Aave V4’s hub and spoke reset of DeFi lending and yields

Aave V4 overhauls DeFi lending with a liquidity hub-and-spoke design, share-based accounting, and an optional reinvestment module. Here is how it could concentrate volume on a few networks, reshape risk, and reset yields as Q4 2025 approaches.

The short version

Aave V4 is set to arrive in Q4 with a clean architectural break from V3. The new version introduces a hub-and-spoke liquidity model, shifts balances to an ERC-4626-style shares system, and ships a strategy-agnostic reinvestment module. The aim is to simplify accounting, centralize liquidity inside configurable hubs, and let governance route idle capital to yield while keeping risk controls tight. Layered on top are a revamped liquidation engine, position managers, multicall, and dynamic risk configuration. Together, these choices could end the spray-and-pray multichain era, push more volume back to a few high-signal networks, and reset how blue-chip lending operates across Ethereum L2s and real world assets.

What actually changes in V4

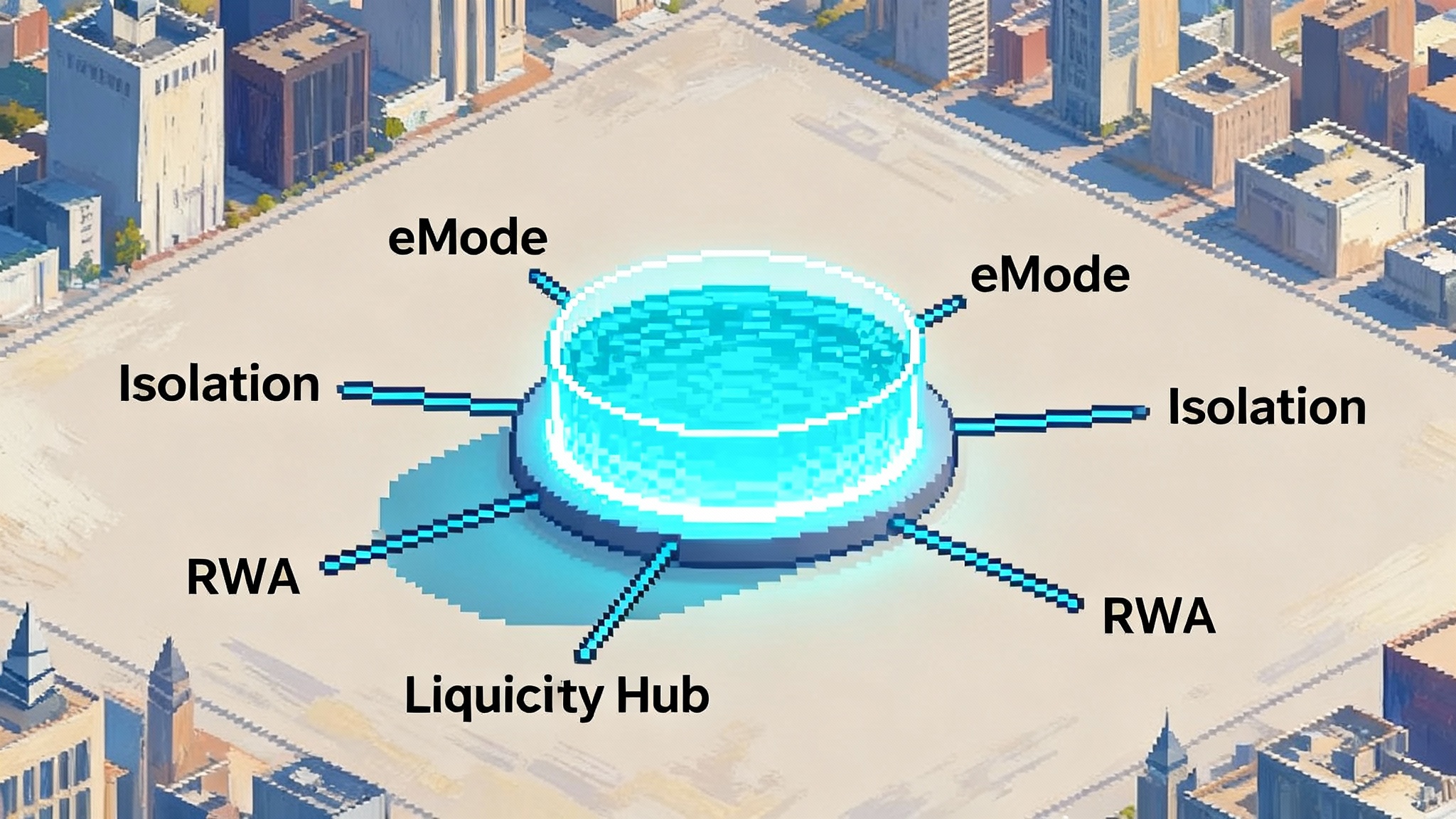

Aave is trading the monolithic, market-per-chain pattern of V3 for a modular architecture built around a Liquidity Hub that coordinates a set of Spokes. The Hub acts as the canonical source of truth for accounting and risk, while Spokes implement specific behaviors and market rules. Positions across modes map back to the same Hub so the system can present a unified view and apply consistent math. Aave Labs declared the codebase feature complete in early September and detailed the launch feature set in a public update. See the official Aave V4 development update for scope and status.

From aTokens to shares

Since Aave V2, depositors received aTokens that tracked principal and accrued interest through indices. V4 replaces that with shares similar in spirit to ERC-4626 vaults. Users own a pro rata number of shares in each reserve, and the exchange rate between shares and underlying captures growth. This removes the complexity of rebase-like mechanics and rate indices, improves downstream compatibility for integrators and accountants, and reduces storage touches. For users, the experience is simpler: balances do not jump from rebases, portfolio tools can reason about shares, and the math works like the standard most DeFi vaults already support.

The Liquidity Hub and its Spokes

The Liquidity Hub is the general pool of capital and the place where premiums and fees accrue. Spokes are purpose-built extensions that plug into the Hub and define how positions behave. Think of familiar modes, such as eMode or Isolation, as Spokes with tailor-made parameters. In V4, Spokes can also represent new markets that use the shared liquidity but carry their own risk configuration. This cuts duplication while preserving isolation where needed. A multi-hub pattern also exists, which means different hubs can be deployed for different chains or special purposes, yet still keep a consistent mental model for users and builders.

Dynamic risk and liquidity premiums

V4 formalizes the idea of pricing risk through a premium that the system can adapt. Instead of static governance settings that lag market conditions, V4 introduces a dynamic framework that blends a base borrow fee with a liquidity premium that responds to utilization and market stress. The aim is to keep utilization in healthier bands, reduce cliff effects from parameter changes, and align the yield paid to suppliers with the true opportunity cost of their liquidity. Over time, this can smooth volatility in APY and make rates more predictable for longer-horizon borrowers.

A new liquidation engine

Liquidations are a key stress path for any lending protocol. V4 upgrades the engine to reduce slippage, batch more work per transaction, and better contain bad-debt risk. The design anticipates parallel processing across collateral types, clearer incentive alignment for liquidators, and safer handling of edge cases. For users, that should translate into fewer surprise liquidations during volatile episodes and faster clearing when markets break.

Position managers and multicall

Managing positions gets less clicky. Position managers help orchestrate common workflows, and native multicall lets users batch steps like supply, enable collateral, and borrow, in one transaction. This should lower gas for complex updates and make integrations simpler for wallets and front ends.

The reinvestment module

The most controversial addition is the reinvestment module. The Hub can allocate a portion of idle liquidity to external strategies under governance control. It is intentionally strategy agnostic. The module provides the rails for deposits, redemptions, accounting, and risk hooks, while the DAO decides if it should be turned on, which strategies qualify, and with what limits. In bull markets, reinvestment can lift base yields without squeezing borrowers. In quiet markets, it can offset inactive capital. Governance also holds the off switch, and the default posture can be conservative while audits and battle testing accrue.

Q4 timing and the consolidation backdrop

As of September 2025, Aave Labs is targeting a Q4 2025 mainnet release with formal verification, multiple external audits, and a public testnet gating the rollout. The roadmap lines up with a broader strategic reset inside the DAO. ACI, one of the most active delegate groups, argued that more than half of deployments on L2s and alt L1s are not economically viable and that over 86 percent of revenue comes from Ethereum mainnet. That post signaled an intent to wind down underperforming networks and concentrate resources where they actually move the needle. The reasoning and data are laid out in the Aave DAO State of the Union.

The consolidation story matters because V4’s architecture plays to it. Hubs and Spokes let Aave curate a smaller set of strategic deployments and still offer differentiated experiences and assets within each one, without cloning the full stack over and over. Service providers can focus audits and incident response on fewer places. Governance can spend time on parameter design rather than maintenance. And integrators get a simpler surface area that looks the same across markets.

How a hub-and-spoke model reshapes risk

Concentration of liquidity is a double-edged sword. Put more capital in a shared Hub, and you get deeper books, smoother rates, and better UX. You also raise the stakes of any bug or oracle disruption that touches the common layer. V4 acknowledges this with layered defenses. The liquidation engine aims to resolve stress faster, dynamic risk lets parameters adapt without governance lag, and Spokes provide isolation where asset profiles diverge. Multi-hub support creates additional firebreaks. If certain riskier assets or experimental modes cannot share the main pool, they can live in a separate hub with stricter guardrails.

Pricing also gets cleaner. Liquidity premiums mean borrowers on scarce books pay more, which can discourage leverage spirals during narrative spikes. Suppliers in that same pool earn more, which keeps capital flowing to where it is actually demanded. Over time, premiums can encode cross-asset and macro signals that are hard to keep current with manual votes. The reserve factor can be tuned to make sure the DAO captures a sustainable slice of that premium without gutting supplier incentives.

The reinvestment module adds a new class of risk. External strategies introduce counterparty, principal loss, and liquidity risks if withdrawals are gated. That is why the module ships with an opt-in posture, clear accounting, and the ability to cap exposure by asset, by strategy, and by time. The test is whether the DAO can define policies that favor simple, liquid, and transparent strategies and turn the dial slowly. The upside is not trivial. Idle capital is a real cost in quiet markets, and diversifying the yield engine beyond borrowers alone can stabilize returns for suppliers.

What happens to yields

Supply APYs in V4 will come from three sources:

- Base borrower interest, still the core engine of any money market

- A liquidity premium that responds to utilization and market stress

- Optional reinvestment returns if the DAO enables them

Borrowers will see rates that adapt more smoothly as conditions change and that price demand more consistently across Spokes tied to the same Hub. Net, expect fewer periods of rock-bottom yields for suppliers on sleepy assets and fewer cliff jumps for borrowers when utilization crosses static thresholds.

Share accounting also changes the flow of yield. With shares, the growth shows up in the exchange rate rather than a token balance increasing. That is friendlier for integrations and can reduce back-office complexity for funds and corporates. It could also make tax reporting clearer in some jurisdictions, since rebasing tokens can confuse cost basis and lot tracking. No one should expect magic yield out of accounting alone, but the friction reduction matters for bringing larger allocators on chain.

L2s, distribution, and the end of sprawl

If you think of V4 as the operating system for Aave’s next cycle, L2s become distribution rather than fragmented products. The DAO appears likely to prioritize a handful of networks where there is either a strong native differentiator, a credible institutional distribution path, or both. That aligns with the multi-hub idea: one or two well-supported Hubs per network, with Spokes that capture the network’s strengths. For perspective on how L2 primitives are evolving, see EigenLayer’s Base debut and AVSs.

The net effect could be a shrink in the number of live deployments and an increase in depth and quality where Aave remains present. Builders on those L2s get a more stable target, and users get the same flows and UI logic no matter which market they enter.

For underperforming networks, a graceful wind down plus clear migration tooling will be key. V4’s modularity should reduce the need for whole protocol migrations in the future, but near term the DAO will still need to help users move positions from V2 or V3 to V4 and between networks if closures happen. Expect incentives and one-click flows to play a role once V4 proves itself in production.

RWAs and the institutional wedge

Real world assets have been the most credible non-crypto-native use case for onchain lending. V4 makes Aave a better fit for that lane. Share accounting lines up with how funds and custodians already manage positions. Spokes can host RWA-specific markets that plug into the same Hub accounting, while enforcing tighter collateral rules, legal wrappers, or whitelists if required by governance. Position managers and multicall reduce operational friction for treasury actions that custodians schedule in batches. And dynamic risk lets Aave adjust as spreads compress or widen without waiting on a vote for every threshold tweak. For context on tokenized cash markets, see Fidelity puts Treasuries on Ethereum and HSBC’s tokenized deposits vs stablecoins.

The reinvestment module is especially relevant here. If the DAO whitelists highly transparent, short-duration strategies in tokenized T-bill or repo markets, it can create a floor yield for suppliers when borrower demand is thin. That does not replace underwriting discipline, and the system still relies on high-quality oracles and conservative LTVs. It does, however, make the product more familiar to institutions that expect idle cash to earn something while awaiting deployment.

For builders and integrators

A standard shares model means ERC-4626 style integrations should feel native. Portfolio trackers, tax software, custody platforms, and DeFi protocols that already speak shares can display and reconcile positions with less custom code. Multicall and position managers cut the number of RPC round trips per action and let front ends compose richer flows. Spokes give integrators a shared base layer and well-scoped differences. That should reduce the surface for bugs and make it easier to ship support for new markets.

Architecturally, the biggest win is cognitive. Instead of every deployment feeling like a separate app with its own quirks, V4 gives builders a consistent spine. If you can integrate one Hub, you can integrate many. If you understand one Spoke contract, you understand the family. That is how ecosystems scale without spraying engineers and auditors across dozens of slightly different stacks.

What to watch as Q4 approaches

- Security track and disclosures. Formal verification and multiple external audits are in motion, and the team plans a public testnet. Watch for audit reports, any hardening changes they drive, and the sequencing of testnet Spokes.

- Governance defaults. The reinvestment module should start disabled, then move through conservative pilots. Expect debates about strategy whitelists, exposure caps, and emergency withdrawal rights.

- Migration tooling. A smooth path from V2 and V3 will matter. Bundled migrations that refinance debt and move collateral in one click will earn goodwill and reduce long tails of stuck liquidity.

- Network rationalization. If the DAO follows through on its consolidation thesis, proposals to wind down underperforming networks should surface, paired with clear timelines and incentives.

- Treasury design. Reserve factor and premium splits will influence the DAO’s net revenue. Expect refinement as real data comes in.

The bet Aave is making

Aave V4 is a statement that depth beats breadth. By unifying liquidity around Hubs, using a share-based accounting model that the rest of DeFi already understands, and giving governance the option to reinvest idle cash, the protocol is choosing concentration, simplicity, and capital efficiency over footprint for its own sake. If execution matches the design, V4 could pull more liquidity back to mainnet and a few high-signal L2s, reduce operational drag, and make blue-chip lending feel institutional grade without losing the permissionless spirit that made Aave what it is.

There is still meaningful work to do. The quality of the reinvestment policies, the discipline to limit the number of live deployments, and the care taken with the new liquidation engine will decide whether V4 is remembered as a tidy refactor or a genuine reset. The architecture gives the DAO the levers. The next few months will show how it chooses to pull them.