A Timely Crypto Reporting Workflow for Policy and Metrics

Build a newsroom workflow that balances policy clocks with market clocks. Use a recency rubric, precise policy snippets, and reproducible on-chain metrics to publish fast, accurate crypto coverage readers trust.

Why crypto reporting needs a tighter workflow

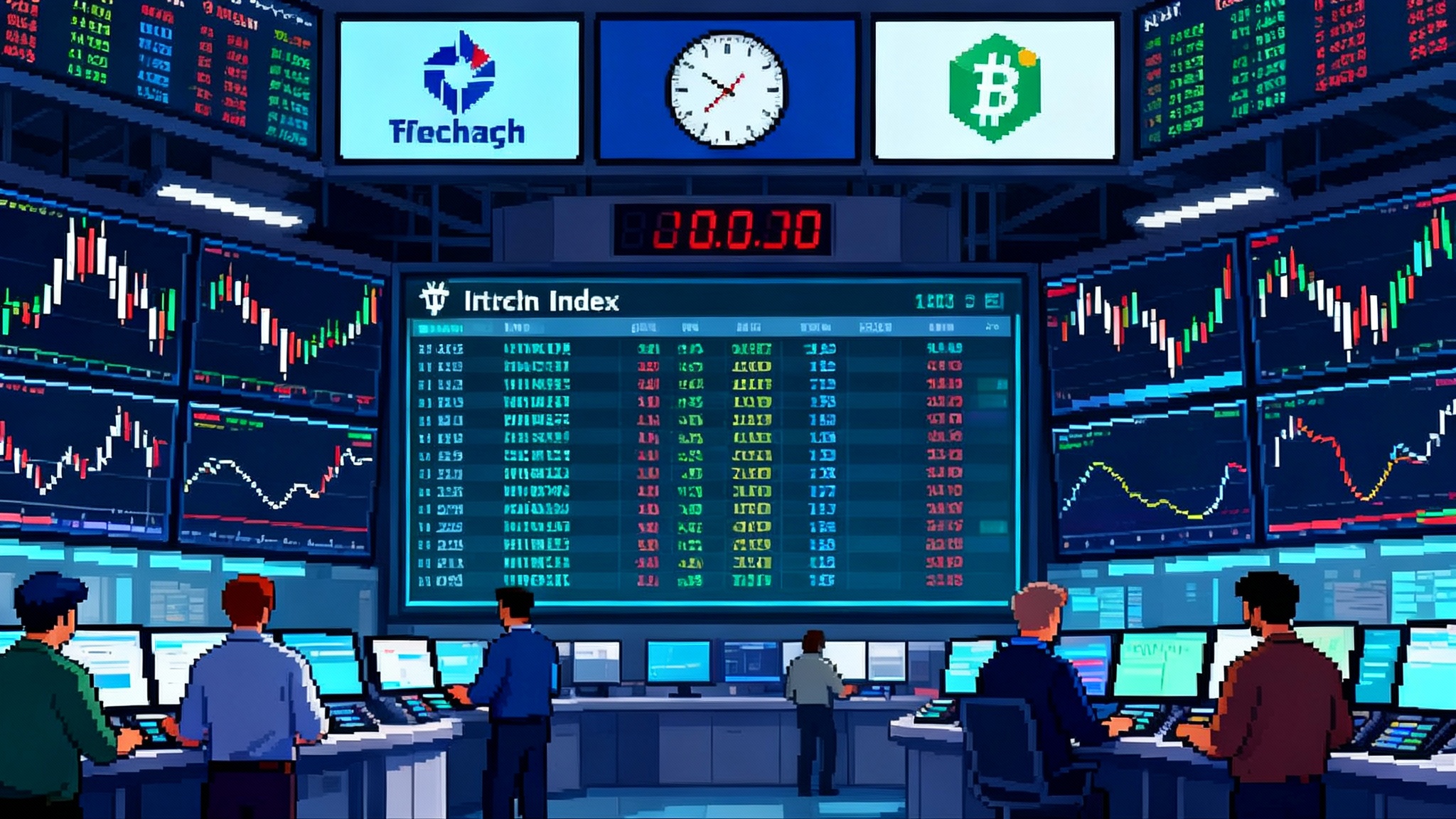

Crypto moves on two clocks at once. Policy clocks tick with filings, comment periods, and enforcement actions. Market clocks race with block times, funding rates, and flows that can flip in minutes. If you want coverage that readers trust and return to, you need an operational workflow that balances both clocks. That means a recency system, a policy lens, and on-chain metrics that are selected for the story, not thrown in after the fact.

This playbook shows how to build that workflow. You will set up a daily runbook, a recency rubric, a compact regulation protocol, and a metrics kit that is reliable, reproducible, and fast. You will also see how to structure articles, visuals, and reviews so the output is accurate and useful under time pressure.

The heartbeat: a recency system that never sleeps

Timeliness is not the same as speed. Timeliness is knowing what matters, how fresh it is, and when it will go stale. Start by defining a freshness window for every recurring input.

- Prices and funding: stale after 5 minutes in fast markets, 15 minutes otherwise.

- Protocol releases and governance votes: stale after 24 hours unless a deadline is imminent.

- Regulatory actions: stale as soon as a newer filing or update arrives.

Back this with an alerting map. Assign every alert to an owner and a response tier.

- Tier 1, immediate: exploits, exchange halts, stablecoin depegs, protocol consensus incidents, high-impact enforcement actions. These are publish-or-hold decisions within minutes.

- Tier 2, same day: major software releases, material governance outcomes, macro data that moves crypto markets.

- Tier 3, next cycle: research notes, incremental ecosystem updates.

Build your Tier 1 sources from primary feeds. For example, the U.S. Securities and Exchange Commission posts frequent updates and enforcement actions on its newsroom; monitor the SEC press releases page with filters and time stamps for context. Set alerts to group by entity and docket, not just keyword, so recurring names do not flood the channel.

A recency rubric you can score in 30 seconds

When an alert fires, score it on four axes. Each axis is 0, 1, or 2.

- Policy impact: Does it change legal risk or operating conditions for a token, issuer, or venue?

- Market structure: Does it affect custody, liquidity, exchange operations, or clearing? For background on regulated derivatives and liquidity, see our take on onshore crypto perps in 2025.

- On-chain immediacy: Can you observe wallet flows, validator behavior, or contract events within an hour?

- Narrative resonance: Will readers care beyond today because it changes a known storyline?

Total 0–8. If 6–8, consider a quick piece within the hour. If 3–5, assemble into a daily note with charts. If 0–2, log it and move on.

Regulation watch, fast and careful

Policy is a minefield for speed. You win by being precise and humble. Anchor to the document, not the discourse.

- Quote the filing name, agency, and exact date, such as “Order Instituting Proceedings, September 26, 2025.”

- Link once to the primary source if available, use a secondary source only if the primary is inaccessible.

- Separate what the text says from what it means. Use a short “What changed” box that states only the new facts.

- For sanctions and cross-border issues, keep a standing feed from the U.S. Treasury’s Office of Foreign Assets Control, which lists Treasury recent sanctions actions that can affect exchange compliance and wallet activity.

- Track deadlines. Post a reminder for the comment close date or compliance effective date. Use a standard label: “Deadline, October 14, 2025, 11:59 p.m. ET.”

A reusable policy snippet

Use this compact structure to write a fast, accurate policy paragraph that slots into any article.

- What happened: The agency, the instrument, and the core action in one sentence.

- Why it matters today: One sentence on immediate risk or relief.

- What to watch: The next dated step, the relevant docket, or the potential extension.

- On-chain angle: One sentence on what you will observe on-chain if impact is real.

Example: “The SEC published a proposed rule on September 26, 2025, expanding custody definitions for digital assets. Immediate market impact is light, but custodians face new reporting duties. Watch the 60-day comment window and subsequent staff guidance. If the rule advances, expect changes in exchange hot wallet management and reduced intraday transfers from certain venues.”

On-chain metrics that move stories forward

Metrics are not decoration. Pick the metric that explains the mechanism your story claims. If your claim is that traders are de-risking after a policy shock, exchange net flows should tell the story. If your claim is that a network is structurally healthier, you might need realized cap, not price.

Core metrics you should keep in a ready kit:

- Active addresses, new addresses, and address reuse: Understand the difference. Active addresses can be spammy during airdrop seasons. New addresses can be artifacts of wallet heuristics.

- Transfer volume, adjusted: Use methods that exclude self-spend and change outputs. If you cannot access adjusted data, clearly state the raw method and its limits.

- Realized capitalization and supply in profit: These add context to price moves by showing where coins last moved, not just where they trade now.

- Exchange reserves and net flows: Track both the level and the direction. Level tells you the inventory on venues. Net flows tell you sentiment.

- Stablecoin issuance, redemptions, and velocity proxies: Stablecoins mediate flows across chains and venues. Watch mint and burn events from issuers, and track large redemptions that can precede market stress. For the policy and scale backdrop, see Tether’s U.S. stablecoin power play.

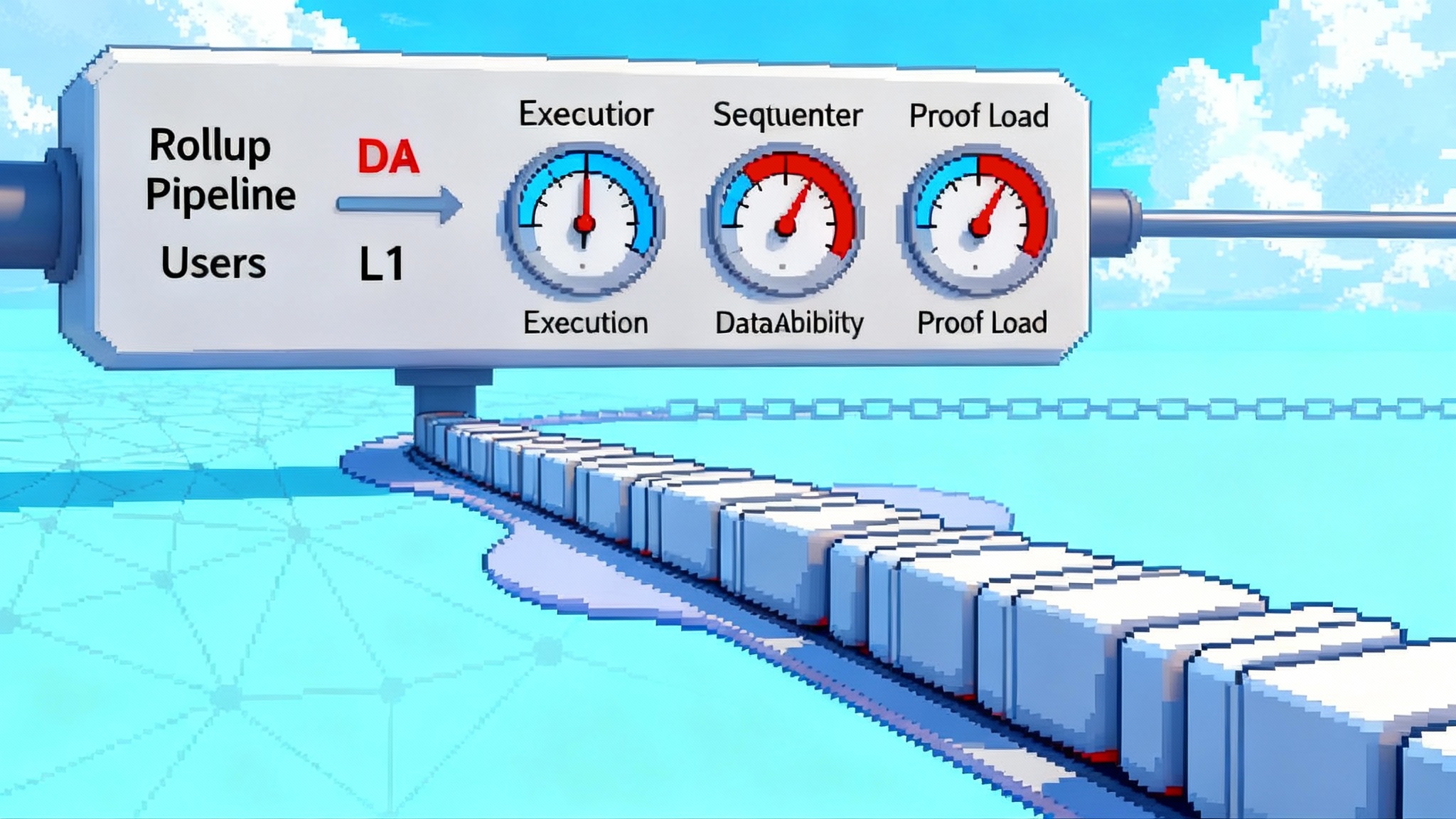

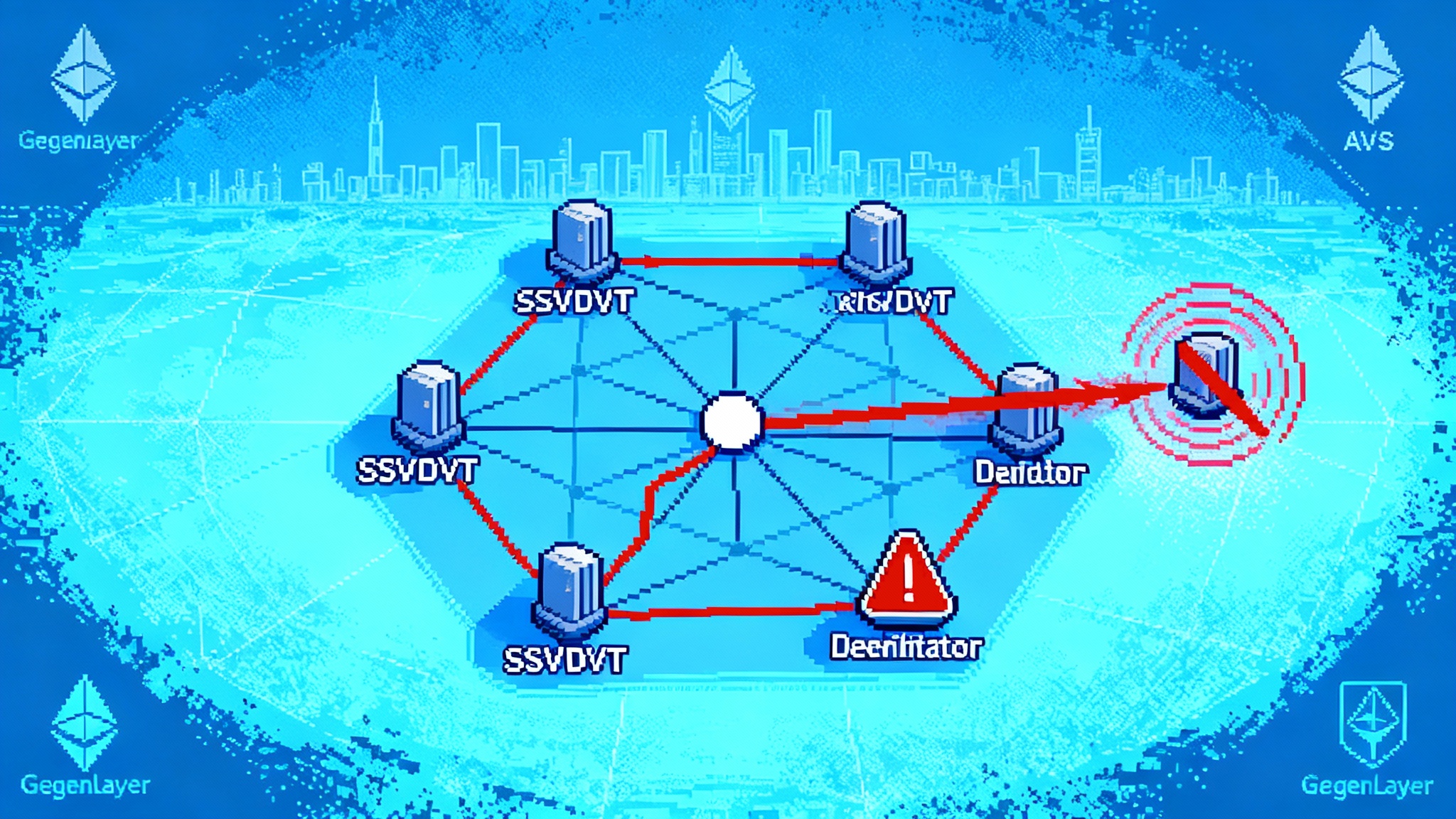

- Staking participation and validator health: For proof-of-stake networks, watch validator churn, effective balance, missed attestations, and penalties. Operational resilience is a reporting angle as well; study how decentralizing L2 sequencers after outages changes incident timelines.

- MEV and fee pressure: If a story claims growing economic security or extractive conditions, show base fees, priority fees, and the distribution of captured value.

- Mempool congestion and confirmation delays: These translate directly to user pain. A rising backlog with steady fees can indicate wallet or relay issues, not demand.

Map metrics to claims

- “Policy shock hit liquidity.” Show exchange net outflows, depth at top of book from reliable market data, and changes in stablecoin redemptions.

- “Network usage is genuine.” Show active addresses alongside median transfer size and fees paid. If fee burn is relevant, show it as a share of issuance.

- “Long-term holders are moving.” Show spent output age bands, realized profit and loss, and flows into custodial clusters.

- “Developers shipped a major upgrade.” Show validator metrics or contract event counts that reflect live use, not just the release notes.

Data hygiene and reproducibility

You gain trust by making your charts and statements reproducible.

- Always log block height or slot number, plus a wall-clock timestamp in UTC and in your local time. Example: “Snapshot at block 18,345,221, 14:05 UTC, 10:05 a.m. ET.”

- Record the query path. If you used a dashboard, note the dashboard name and filter values. If you used a script, store the query in a repository with a date-stamped tag.

- Prefer rolling windows to cherry-picked intervals. If you show a 30-day window, keep it 30 days in every update unless you explain the change.

- State adjustments. If you claim “adjusted volume,” define the adjustment, even briefly.