HSBC’s tokenized deposits vs stablecoins: the 2025 test

HSBC has switched on live cross-border tokenized deposits for corporates, pitting bank-backed tokens against public stablecoins. Here is how the rails differ, what changes for treasurers and merchants, and what to watch in Q4 2025.

The moment bank money went on-chain across borders

HSBC has taken its tokenized deposit service out of the lab and into real client use for cross-border treasury. In September 2025 the bank processed its first live USD transfer between Hong Kong and Singapore for Ant International, extending its earlier domestic rollout and adding 24/7 settlement across regions. HSBC says the service will scale to more currencies and markets as part of its digital money roadmap, with programmability and tokenized asset settlement on the table. The announcement matters because it marks a bank switching on a production rail for corporate payments that runs continuously and is built for automation, not just for demos or closed pilots. HSBC’s cross-border tokenised deposit launch signals that 2026 will not be business as usual for corporate cash management.

Tokenized deposits vs public-chain stablecoins

Before we weigh the implications, it helps to define the two types of digital money now headed for a 2025 showdown.

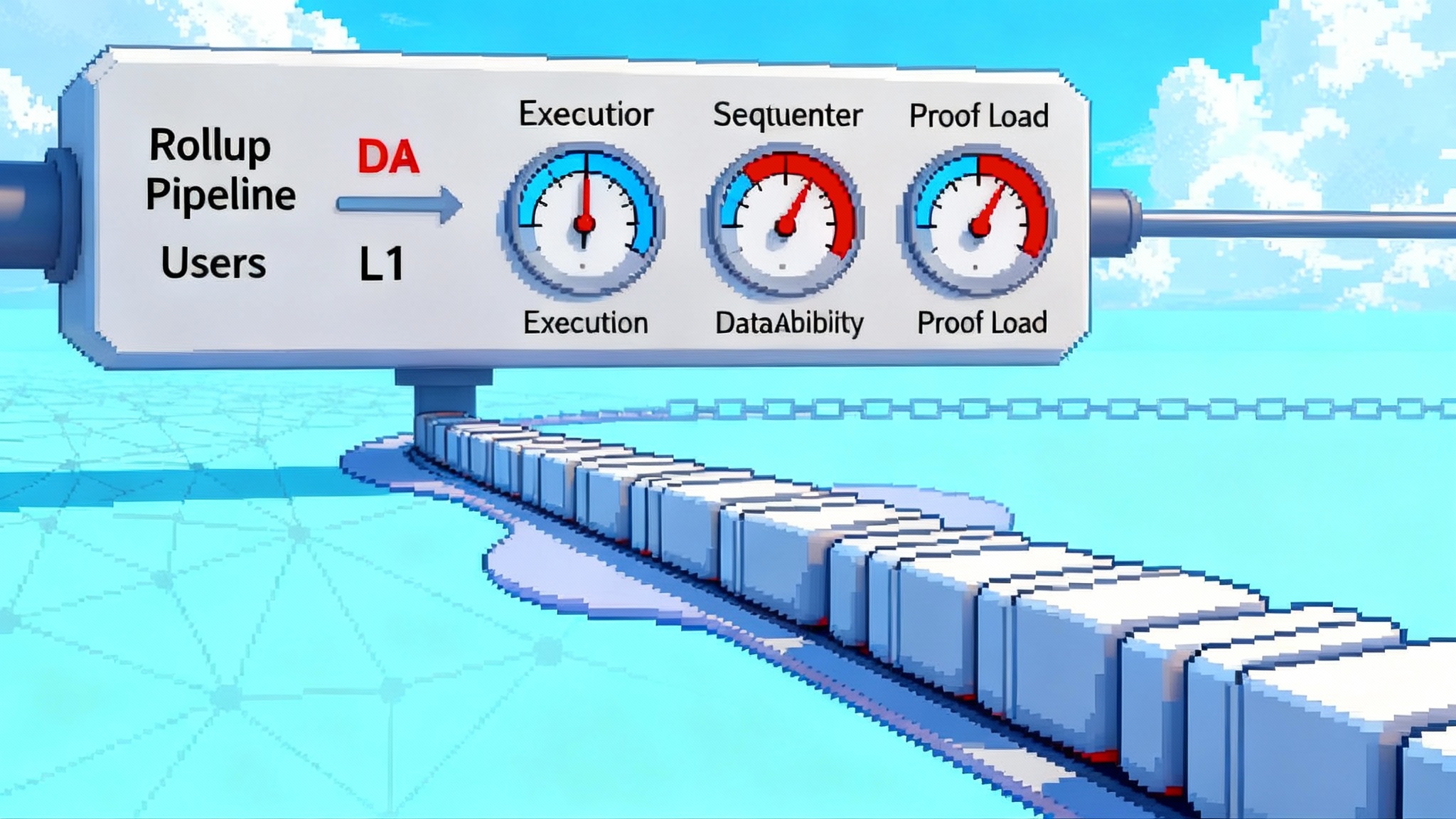

- Tokenized deposits: A tokenized deposit is a claim on a commercial bank. It is the same legal liability as a regular deposit, recorded on a ledger that supports smart contracts. The token sits on a permissioned network where only KYC’d entities participate. Settlement occurs on the bank’s balance sheet. If the bank says you have 10 million dollars in a tokenized wallet, that liability is on the same balance sheet as your operating account. Tokens can be programmable, enabling conditional payments, automated sweeps, and atomic settlement with tokenized assets.

- Public-chain stablecoins: USDC and USDT are digital tokens issued by nonbank or bank-affiliated entities on public blockchains. They are backed one-for-one by reserves like cash and Treasury bills held by the issuer or its custodians. Anyone with a compatible wallet can hold and transfer them globally. Finality is provided by the public chain’s consensus, not a bank ledger. Holders have a redemption claim against the issuer, not against a commercial bank account balance. Stablecoins offer open access and composability with the public crypto ecosystem, from exchanges to DeFi protocols. For market context on issuer ambitions, see Tether’s USAT strategy.

How they differ in practice

- Ledger and access: Tokenized deposits live on permissioned ledgers with gated access. Stablecoins live on public chains with open access.

- Counterparty risk: Tokenized deposits are claims on a specific bank. Stablecoins are claims on the issuer’s reserve pool. In both cases, credit and operational risk profiles differ from traditional card or wire rails.

- Settlement model: Tokenized deposits settle on the bank’s books and can support intraday or instant movements between client wallets. Stablecoins settle on-chain and are final per the chain’s rules, with off-chain redemption needed to exit to bank money.

- Compliance posture: Tokenized deposits are natively KYC’d. Stablecoins rely on issuer policies, on-chain surveillance, and compliance at exchanges and merchant service providers.

- Programmability and composability: Both can be programmable. Stablecoins benefit from wide composability with the public crypto stack. Tokenized deposits are programmable within the bank’s network and any linked permissioned systems, with selective bridges to public chains.

Why HSBC flipping the switch is a step change

Banks have trialed deposit tokens for years. The difference now is production availability for real cross-border flows, with features treasurers actually need.

- 24/7 liquidity and settlement: Tokenized deposit rails remove cutoffs and weekend gaps. A treasury team in London can sweep liquidity from Hong Kong in the local evening and still close books. That compresses working capital cycles and reduces the need for idle buffers.

- KYC’d rails with enterprise controls: Because access is permissioned, corporates can set granular entitlements for who can move funds, embed approval workflows, and automate thresholds with audit trails that speak to internal control requirements.

- Balance-sheet backing and bank integration: The tokens are on the bank’s balance sheet. That means reconciliation, statements, and integration into existing cash pooling and notional structures can be designed to look familiar while gaining real-time features.

- Fit for tokenized capital markets: As tokenized securities, money market funds, and payable-finance instruments gain traction, a bank-issued settlement asset that can do atomic delivery-versus-payment reduces counterparty risk and post-trade friction. For a live example of 24/7 tokenized markets in APAC, see DBS 24/7 tokenized markets.

How HSBC compares with other bank efforts

J.P. Morgan’s JPM Coin pioneered the model for wholesale clients and already supports 24/7 movements on a permissioned ledger, including programmable payments. In 2025, J.P. Morgan extended partnerships that brought anytime USD payments to new markets, giving its corporate clients an alternative to waiting for traditional clearing windows. With HSBC live across Asia and Europe for large corporates, the market now has at least two global banks operating real token rails for clients, not just proofs of concept. That creates a path for network effects and, eventually, interbank interoperability.

Meanwhile, stablecoins hit the checkout line

While banks are turning on deposit tokens for treasurers, stablecoins are moving into retail and platform commerce. Card networks and payment service providers spent 2025 pushing stablecoins into familiar checkout flows. Visa expanded settlement support for multiple stablecoins and blockchains. Mastercard announced partnerships to enable stablecoin settlement and issuance paths for banks and merchants. Most visibly for merchants, Stripe and Shopify said millions of stores can start taking USDC at checkout, with settlement configurable as fiat or as USDC, and with PSP-style risk and reporting. For many businesses this removes the need to build crypto plumbing in-house. See Stripe’s announcement on USDC checkout for Shopify merchants.

The result is two tracks running in parallel. On one track, corporate treasuries move bank money on token rails within KYC perimeters. On the other track, consumers and platforms pay with public-chain stablecoins that settle through PSPs and card networks. These tracks will intersect more often as tokenized commerce grows.

Implications for merchants

- Acceptance and reach: With PSPs and card networks supporting stablecoin payments, merchants can tap global buyers who prefer crypto wallets without changing how they reconcile payouts. Settlement can arrive as fiat in the same merchant account, or as stablecoins to a designated wallet.

- Cost and speed trade-offs: Stablecoin acceptance can reduce FX and cross-border fees in some corridors, but PSP pricing and on-chain network costs still apply. Chargeback policies, dispute rights, and fraud tooling depend on the PSP and network wrapper, not the raw token transfer.

- Treasury and accounting: If you settle in fiat, accounting looks familiar. If you take custody of stablecoins, you add wallet management, safeguarding policies, and valuation controls. Some merchants will blend both, keeping a working balance in stablecoins for supplier payouts while converting the rest.

- Compliance and data: Payments routed through PSPs preserve KYC and AML coverage. Direct wallet-to-wallet sales place more onus on the merchant to screen counterparties and manage sanctions risk.

Implications for treasurers

- Intraday liquidity becomes the default: Tokenized deposits enable automated cash pooling across time zones. You can script sweeps, conditional payments, and just-in-time funding of marketplaces or subsidiaries, including over weekends.

- Operational resilience: Always-on rails need new playbooks. Treasury needs guardrails for after-hours movements, automated approvals, and anomaly detection. Audit and SOX controls must evolve to handle smart contract triggers and machine-initiated postings.

- Counterparty management: You are swapping some correspondent bank dependencies for reliance on a single bank’s token platform. Concentration risk and vendor lock-in should be part of bank selection and contingency planning.

- Interoperability planning: Few treasuries will live entirely on one rail. Expect to maintain traditional wires, instant payment schemes, card settlement, and one or more token rails. That pushes ERP and TMS vendors to ship native connectors and standardized messaging for token instructions.

Implications for DeFi and tokenized markets

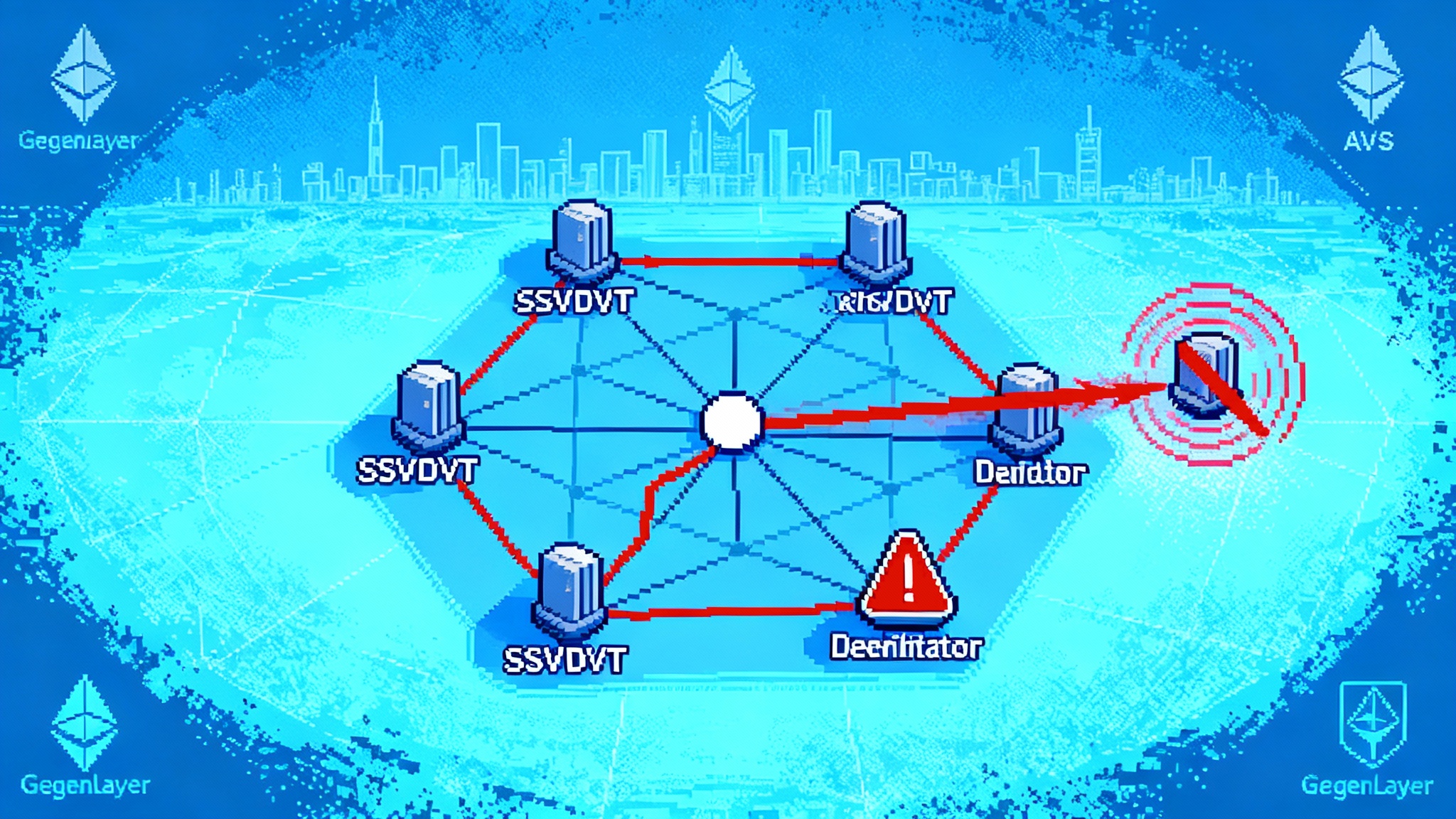

- Settlement asset choice: DeFi today is built around public-chain stablecoins. As banks offer deposit tokens, tokenized securities platforms and permissioned DeFi markets gain a settlement asset that satisfies institutional compliance. The trade-off is reduced open composability.

- Liquidity fragmentation: Liquidity will split between public stablecoins and permissioned bank tokens. Market makers and OTC desks that can arb between these pools, including through compliant bridges, will matter more.

- Programmability meets policy: Smart contracts that trigger cash movements raise questions about reversal rights, dispute handling, and jurisdiction. Bank tokens can encode policy logic up front, but that reduces the plug-and-play flexibility of public DeFi.

Interoperability and programmability

Programmability is the headline feature on both tracks, yet interoperability will decide who wins share.

- Within permissioned networks: Banks will aim for cross-bank interoperability so a deposit token from Bank A can settle with a security token from Platform B. Expect initiatives that resemble messaging standards plus atomic settlement protocols, not open internet composability.

- Between permissioned and public chains: Bridges need to do more than move value. They must carry identity and compliance proofs so that a token leaving a bank perimeter can interact with public contracts under predefined rules. That likely means attestations, allowlists, and revocation hooks, not anonymous free-for-all bridges.

- Developer experience: If issuing a programmable payment looks like creating an invoice in a familiar API, adoption will accelerate. If it feels like deploying and auditing smart contracts from scratch, adoption will stall outside crypto-native teams.

Regulation in 2025: clearer lanes for each rail

The United States now has a federal framework for payment stablecoins that sets reserve, disclosure, and supervisory requirements and clarifies that permitted payment stablecoins are not securities. The law also codifies AML obligations for issuers and restricts misleading claims about deposit insurance or government backing. This clarity reduces legal friction for PSPs, card networks, and exchanges that want to offer stablecoin checkout and settlement.

Bank-issued tokenized deposits remain subject to existing bank rules on capital, liquidity, risk, reporting, and data protection, plus any jurisdiction-specific guidance for digital money and tokenization. That difference matters. Stablecoin issuers manage investment and operational risk in a reserve fund. Banks manage prudential risk across a balance sheet. Treasurers and merchants should evaluate each option’s protections and obligations in that light.

Outside the U.S., policy makers are moving as well. Hong Kong’s central bank is testing interoperability for tokenized money settlement. The U.K. is nudging banks toward tokenized deposits while it finalizes stablecoin regulations. The EU’s MiCA regime is coming online in phases. For a regional snapshot, see EU banks test euro stablecoin.

What to watch in Q4 2025

- Volumes on bank token rails: The single best tell will be actual transaction value and count on the new deposit token platforms. Watch for monthly throughput, number of active corporate wallets, and cross-border share of flows. Also watch currency coverage beyond USD, EUR, and GBP.

- Merchant stablecoin settlement: Track what share of PSP and card network settlement shifts to stablecoins and how often merchants opt to retain stablecoins rather than convert to fiat. Watch for reductions in payout latency for marketplaces and gig platforms.

- Bridges and interoperability: Look for production links between permissioned ledgers and public chains that carry identity proofs and policy controls. Expect the first atomic DvP deals in tokenized securities that settle against deposit tokens rather than cash on legacy rails.

- Pricing and spreads: If stablecoin settlement reduces acquirer or cross-border fees, adoption will accelerate. If banks price tokenized deposit services as premium features, treasurers will selectively deploy them where liquidity benefits are clearest.

- New participants: Additional global banks lighting up token rails, PSPs expanding stablecoin checkout beyond pilots, and major merchants publicly reporting crypto tender volumes.

A simple decision framework

- If you need open access and composability with crypto ecosystems, stablecoins are the natural fit. Pair them with a PSP if you want fiat settlement and familiar risk tooling.

- If you need KYC’d counterparties, enterprise controls, and native links into bank services like pooling and credit, tokenized deposits are likely the better rail.

- For cross-border treasury, use tokenized deposits for continuous sweeps and intraday funding, and keep stablecoins in the toolkit for supplier payouts or customer refunds in crypto-heavy markets.

- For tokenized asset settlement, use whichever side your counterparties can hold. Expect a mix in early deals, with bridges and intermediaries doing the heavy lifting.

The real contest in 2025

This is not a winner-take-all fight. It is a sorting of use cases by trust, access, and programmability. HSBC’s live rollout shows that banks can ship real-time, programmable cash rails that corporates will actually use. Card networks and PSPs are making stablecoins feel like a normal way to pay online. The market will reward the rail that removes the most friction for a given job while satisfying regulators and auditors. By early 2026 we will know if corporate volumes on bank token rails are compounding and whether stablecoin checkout has moved from novelty to routine. If both curves bend up, the world will have two strong digital money tracks and a growing number of bridges between them. That is a good outcome for merchants, treasurers, and developers who want money that moves at the speed of the internet and obeys the rules of the jurisdictions they operate in.