Stacks lifts sBTC cap: open minting and real BTC withdrawals

Stacks removed the sBTC cap in mid September 2025, opening permissionless minting and live L1 withdrawals. Here is why that shift matters for BTCFi, how it compares to wBTC, what the early data shows, and the risks to watch.

The week Bitcoin liquidity went open on a Bitcoin L2

In mid September 2025, Stacks removed the issuance ceiling on sBTC, the network’s Bitcoin‑backed asset. The change sounds technical, but the effect is simple: Bitcoin can now move into and out of Stacks without a program‑level limit. Open minting plus live withdrawals turns BTC from a mostly idle asset into programmable fuel for lending, AMMs, and yield strategies on a Bitcoin‑aligned L2.

The cap removal landed on September 16, 2025, alongside a minimum deposit cut. Together, these decisions opened the top of the funnel for users and exchanges that were waiting on supply headroom and cleaner onramps. See the official cap removal update.

What exactly changed

Before September, sBTC ran under a phased rollout with hard ceilings that filled almost immediately. Deposits launched in December 2024, and the second cap lifted the limit to 3,000 BTC in February 2025. Withdrawals went live in the spring. The September change removed the remaining issuance ceiling and dropped the minimum deposit from 0.01 BTC to 0.001 BTC, which makes testing and small deposits practical.

A quick refresher on the UX:

- Peg in: You send BTC on mainnet to a deposit address and receive sBTC on Stacks within a few Bitcoin blocks. The design aims to complete peg ins in minutes, not days.

- Peg out: You burn sBTC on Stacks and receive native BTC on L1 a few Bitcoin blocks later. Withdrawals are live, so users are not stuck in a one‑way bridge.

Put simply, Stacks made the door bigger and unlocked it in both directions.

Early flows: supply, TVL, and volumes

The best snapshot of flows comes from the sBTC token page in the Stacks explorer. As of September 27, 2025, it shows:

- Circulating supply: about 4,406 sBTC

- Market value of sBTC on chain: about $483 million

- 24‑hour trading volume visible on the page: roughly $178 thousand

These numbers tell a straightforward story. Supply jumped beyond the old caps and kept climbing once minting went open, while volumes are still small compared to CEX markets but growing from a low base as liquidity finds venues and arbitrage paths. You can verify live figures on the Hiro sBTC explorer token page.

How should we interpret this mix? The supply number is the headline because it represents BTC that can now work inside apps. Volume will lag at first while liquidity programs, routing, and listings catch up. Expect DEX routing to thicken first, followed by market‑maker inventory and, over time, exchange Earn‑style integrations. For consistent data hygiene, teams can adapt a timely crypto reporting workflow.

Why this is a step change for BTCFi

A cap is more than a number. It is a coordination limiter. Builders hesitate to ship products that can run into a hard wall. Exchanges resist listing assets that may not have enough float to satisfy market makers and client demand. Funds cannot size positions. Removing the cap and enabling small deposits changes each of those constraints.

- Builders can assume replenishable liquidity. That makes it rational to ship vaults, perps margins, or structured yield that use sBTC as base collateral.

- Exchanges and onramps can integrate sBTC pairs without worrying about hitting an issuance ceiling or unexpected pauses.

- Users can start small, test, and scale. The 0.001 BTC minimum is the difference between a roll of the dice and a real lock‑in path for many retail users.

The result is a more reliable pipeline from passive BTC into on‑chain flow.

What it already powers on Stacks

- Lending: Bitcoin‑native lenders such as Zest are designed for BTC collateral and BTC yields. sBTC collateral makes non‑custodial BTC loans feasible without handing coins to a centralized desk.

- AMMs: Stacks‑based AMMs like ALEX and Bitflow run sBTC pools against STX, stablecoins, or wrapped assets. As float grows, LPs get lower slippage and better fee capture.

- Mint and borrow: Protocols like Arkadiko let users deposit sBTC to mint a USD stablecoin against it, freeing up liquidity while keeping BTC exposure.

- Yield vaults: With two‑way flows and more float, basis trades, covered calls, or liquidity mining become accessible to a wider set of BTC holders.

sBTC vs wBTC and other custodial bridges

-

Custody model: wBTC relies on a centralized custodian and a network of merchants. sBTC replaces that single custodian with a signer network on Stacks that coordinates peg ins and peg outs. The initial signer set is community‑elected and is designed to decentralize further over time.

-

User experience: wBTC minting typically involves a merchant workflow, KYC, and off‑chain settlement windows. With sBTC, users initiate a deposit from their own wallet, wait for a few L1 confirmations, and receive sBTC programmatically. Withdrawals follow the mirror path.

-

Settlement and finality: wBTC lives on EVM chains with their own security assumptions. sBTC settles to Bitcoin through Stacks. After the Nakamoto‑era upgrades, Stacks finalizes to L1 Bitcoin, anchoring sBTC state to the most secure blockchain. For broader context on L2 security evolution, see Ethereum‑grade AVSs on L2.

-

Transparency: Both wBTC and sBTC publish on‑chain proofs of supply. The difference is where trust concentrates: custodian and merchant processes versus signer set behavior and bridge logic.

In short, sBTC trades custodian risk for protocol and signer risk, and it delivers a very different UX in return.

What this unlocks, concretely

-

Healthier lending markets: The ability to mint and redeem sBTC freely allows lenders to support revolving credit against BTC without liquidity crunch fears. Overcollateralized loans, credit lines for market makers, and treasury borrowing become more straightforward.

-

Deeper AMM books: AMM pools need float. A capless sBTC with inflows tied to Bitcoin liquidity can support tighter spreads and larger trades, making it practical to route BTC pairs on Stacks first before bridging elsewhere.

-

Simpler BTC yield: Users can pursue BTC‑denominated yields without moving coins into centralized Earn products. Vaults, LP fees, and basis strategies can all settle to Bitcoin via sBTC.

-

Cross‑chain portability: With sBTC contracts identified on Stacks and a growing set of bridges and custodians integrating it, developers can move sBTC representations to other chains while keeping the base mint on Stacks.

The remaining risks you should not ignore

-

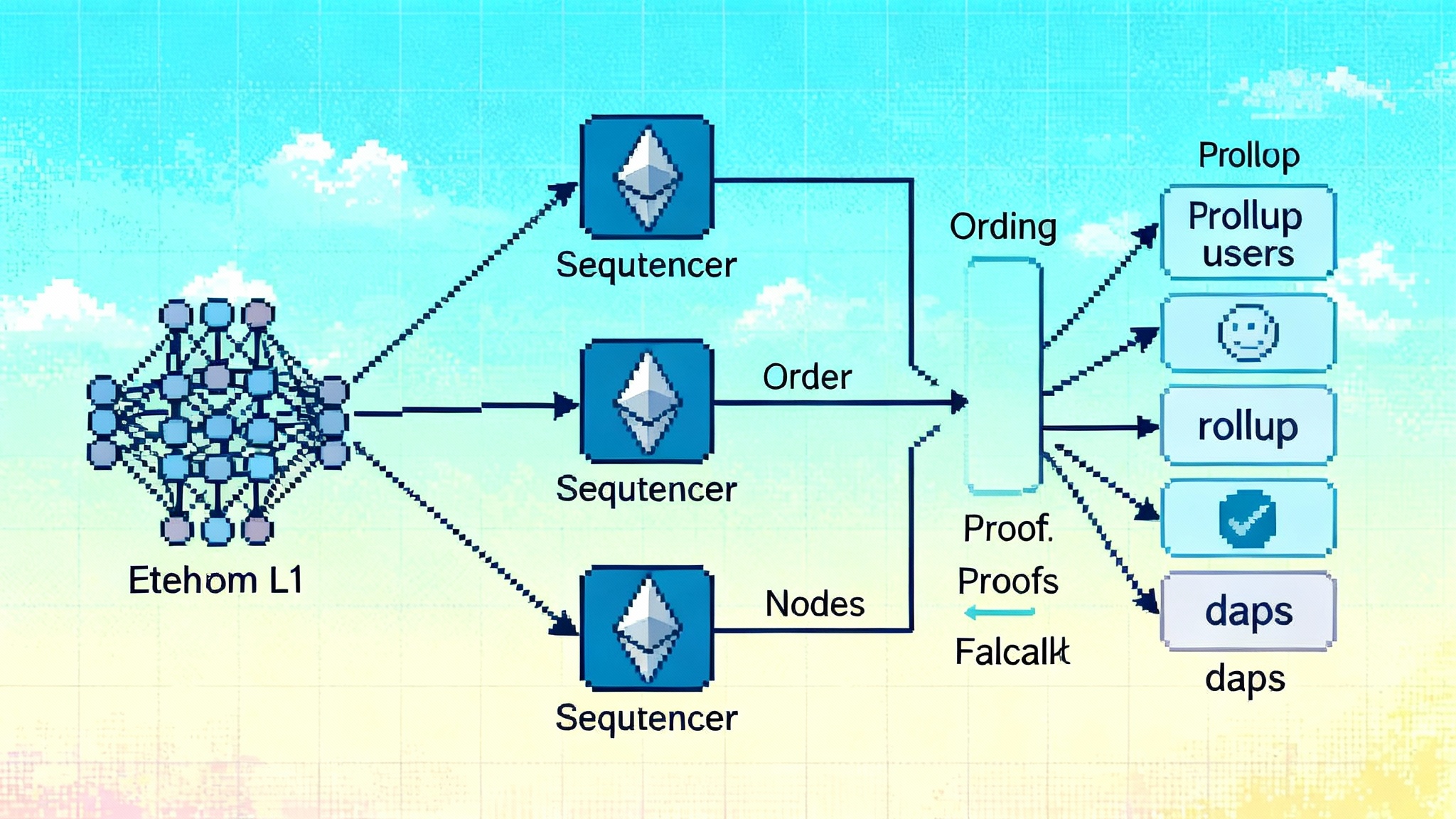

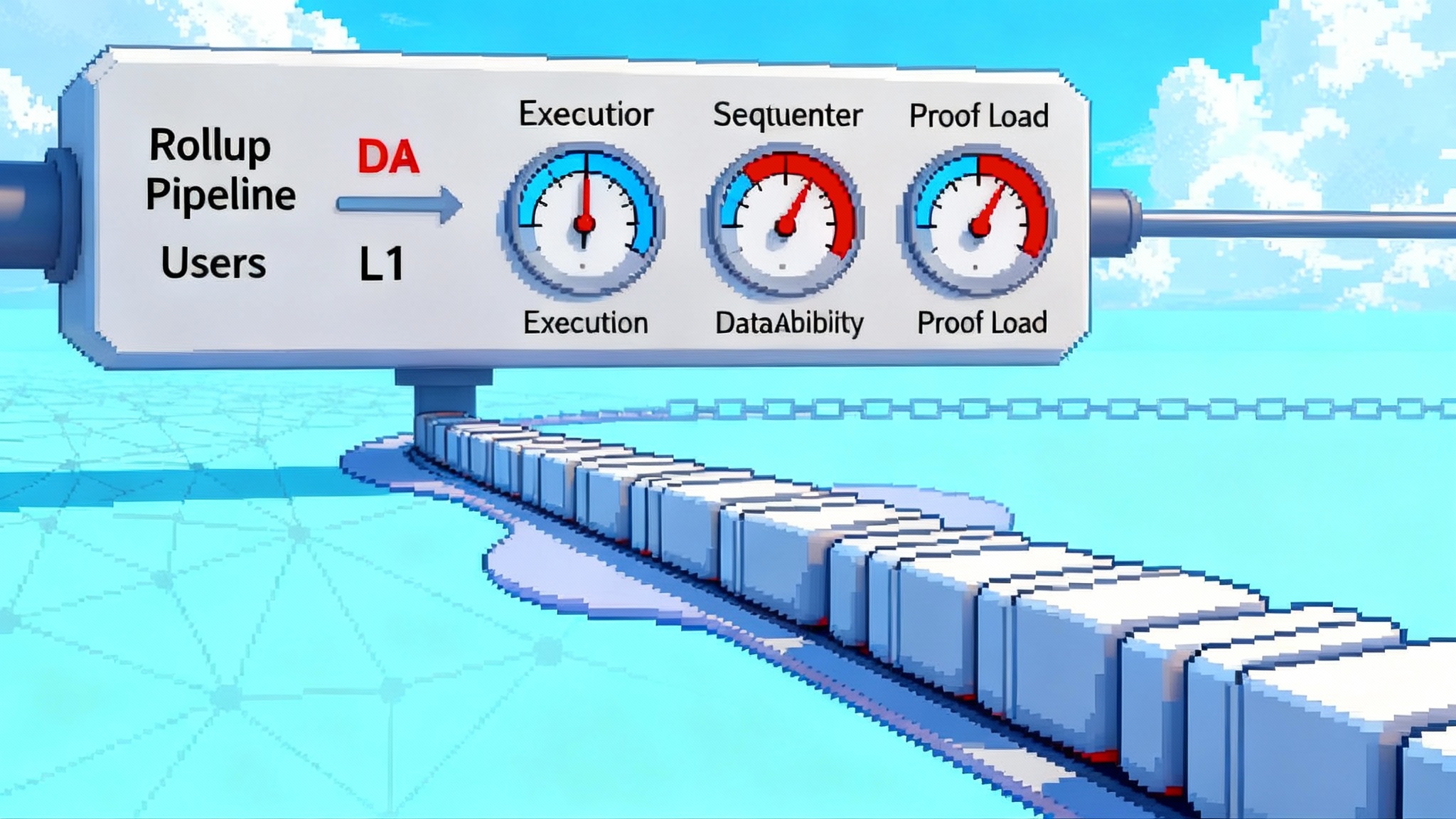

Signer decentralization: Today’s signer network is not yet as decentralized as it aims to be. The number of signers, their independence, and the threshold required to move the reserve UTXO determine both safety and liveness. Concentration or correlated downtime could stall withdrawals or, in a worst case, threaten backing if governance fails. For parallels, study decentralizing L2 sequencers lessons.

-

Bridge and implementation risk: sBTC is code. Bugs in deposit address derivation, threshold signing, or state reconciliation would be serious. Independent audits help, but the best defense is layered safety: limited signer powers, on‑chain monitoring, and clear incident recovery paths.

-

Liquidity fragmentation: As sBTC moves cross‑chain, wrapped representations may proliferate. Without careful registry and routing, this can split liquidity and confuse users. The fix is shared standards, clear naming, and native routing that prefers the canonical mint on Stacks.

-

Market structure risk: Early 24‑hour volumes are still modest compared to mature markets. Thin books can exaggerate price moves and make liquidations spiky in lending protocols. Conservative parameters and guarded launch phases are prudent.

-

Policy and custodial integrations: The promise of exchange Earn programs and institutional onramps depends on compliance reviews and custody readiness. Expect timelines, not instant availability.

How to read the next phase

If you want a simple dashboard for momentum, track three lines through October 2025:

-

Minted supply on chain. A steady climb from roughly 4,400 sBTC would indicate new users arriving and existing users allocating more BTC.

-

DEX depth in the sBTC pairs that matter to you. Watch pool TVL and 1 percent price impact sizes for sBTC against stablecoins and STX. That shows how tradable the asset is becoming.

-

Borrow usage and rates. Rising utilization at stable rates suggests lenders and arbitrageurs trust the bridge and the liquidation engines.

Secondary indicators include the number of unique sBTC holders, deposit count per day, and the share of Stacks fees driven by sBTC activity. Each of these can be monitored in explorers and public analytics as integrations roll out.

Data appendix

-

As of September 27, 2025, the sBTC token page shows a circulating supply near 4,406, market value around $483 million, and roughly $178 thousand in 24‑hour trading volume. These numbers move with BTC price and on‑chain activity and should be checked live before use.

-

The cap removal on September 16, 2025, opened permissionless minting. Minimum deposits dropped to 0.001 BTC. Withdrawals are live and complete within a few Bitcoin blocks in normal conditions.

-

Pre‑removal history for context: deposits first opened in December 2024, the cap expanded in February 2025, and withdrawals went live in the spring. The September change removed the remaining issuance ceiling so builders and exchanges can plan around unbounded float rather than a hard limit.

Bottom line

Bitcoin now has a practical, non‑custodial way to circulate through DeFi while remaining anchored to L1 security. By lifting the sBTC cap and keeping withdrawals live, Stacks turned BTC into a permissionless, two‑way asset on a Bitcoin‑aligned L2. The early numbers show supply marching higher and activity starting to follow. If the signer set decentralizes as planned and liquidity thickens, sBTC can become a standard route for BTC to earn, trade, and borrow on‑chain while staying tied to Bitcoin finality.