Ethereum-Grade AVSs on L2: EigenLayer’s Base Debut

Between July 24 and 28, 2025, EigenLayer began rolling out Multi-Chain Verification, letting AVSs run on L2s like Base while inheriting Ethereum-grade security. Explore how cross-chain restaking works, what it unlocks, the new risks to plan for, and a practical builder checklist.

The moment L2s borrow Ethereum security

Between July 24 and 28, 2025, EigenLayer’s Multi-Chain Verification rollout put a stake in the ground for Base-first deployments. The goal for Q3 2025 is simple to state and hard to deliver: let Actively Validated Services live on L2s and still inherit Ethereum-grade security, including real slashing. That means oracles, data layers, and shared sequencers can scale with L2 throughput while keeping the economic guarantees of Ethereum.

If you care about performance without compromising on safety, this is the hinge point. In this article we unpack how cross-chain restaking works, why it matters for critical infrastructure, who stands to gain or lose among L2s, the new risks this design introduces, and a practical checklist for going live as mainnet support lands.

What Multi-Chain Verification actually is

At a high level, Multi-Chain Verification separates where an AVS executes from where its security is enforced.

- Execution home: the AVS runs on an L2 environment like Base. Its contracts, jobs, and fee flows live there.

- Security home: the slashing commitments and stake accounting live on Ethereum L1. When operators misbehave, the penalty is enforced against L1 stake.

Think of this as a security umbilical cord. The AVS can enjoy the cost and UX profile of an L2, but the hard consequences are anchored on Ethereum. A minimal message path connects the two homes so that evidence of misbehavior observed on the L2 can be finalized and acted upon at L1.

Under the hood, several roles coordinate:

- Delegators restake ETH or LSTs into EigenLayer on L1.

- Operators receive delegations and register for specific AVSs.

- The AVS defines tasks and verification logic, and specifies slashable faults.

- A cross-domain relay carries signed outcomes or fault proofs from the L2 to an L1 slashing contract.

The punchline: the cost of lying is priced in L1 stake. The throughput and latency of serving are priced in L2 gas. That is the Multi-Chain Verification promise. For a deeper primer on participants and lifecycle, the EigenLayer restaking documentation is a solid starting point and stays current on terminology and interfaces.

How cross-chain restaking works, step by step

Here is a simplified flow for an AVS running on Base while enforcing security at L1:

- Registration and stake binding at L1

- The AVS deploys a registration contract on Ethereum that defines its slashing conditions and operator registry. Operators opt in at L1, signaling their keys and agreeing to conditions.

- AVS control plane on Base

- The AVS contracts on Base assign jobs, collect operator attestations, and produce outcomes. This is the hot path where the AVS earns fees and users interact.

- Attestation aggregation

- An aggregator on Base collects operator signatures over results or over detected faults. When a quorum is reached, it posts a compact commitment to a bridging contract.

- Finality alignment

- The commitment is held until Base finality conditions are satisfied. The design must respect Base’s bridge semantics and any challenge windows. Only then is the commitment relayed to Ethereum. For reference on primitives and timing, see the Base developer documentation.

- L1 verification and enforcement

- The L1 contract verifies the commitment and signature set against the registered operator set and thresholds. If the message encodes a fault, it triggers slashing. If it encodes a checkpoint, it might release rewards or update metadata.

- Slashing and distribution

- Penalties reduce operator stake at L1. Rewards are either withdrawn to the AVS treasury or routed to operators and delegators per policy.

The path from Base to Ethereum must be unambiguous and robust. It is the lifeline that converts L2 observations into L1 consequences.

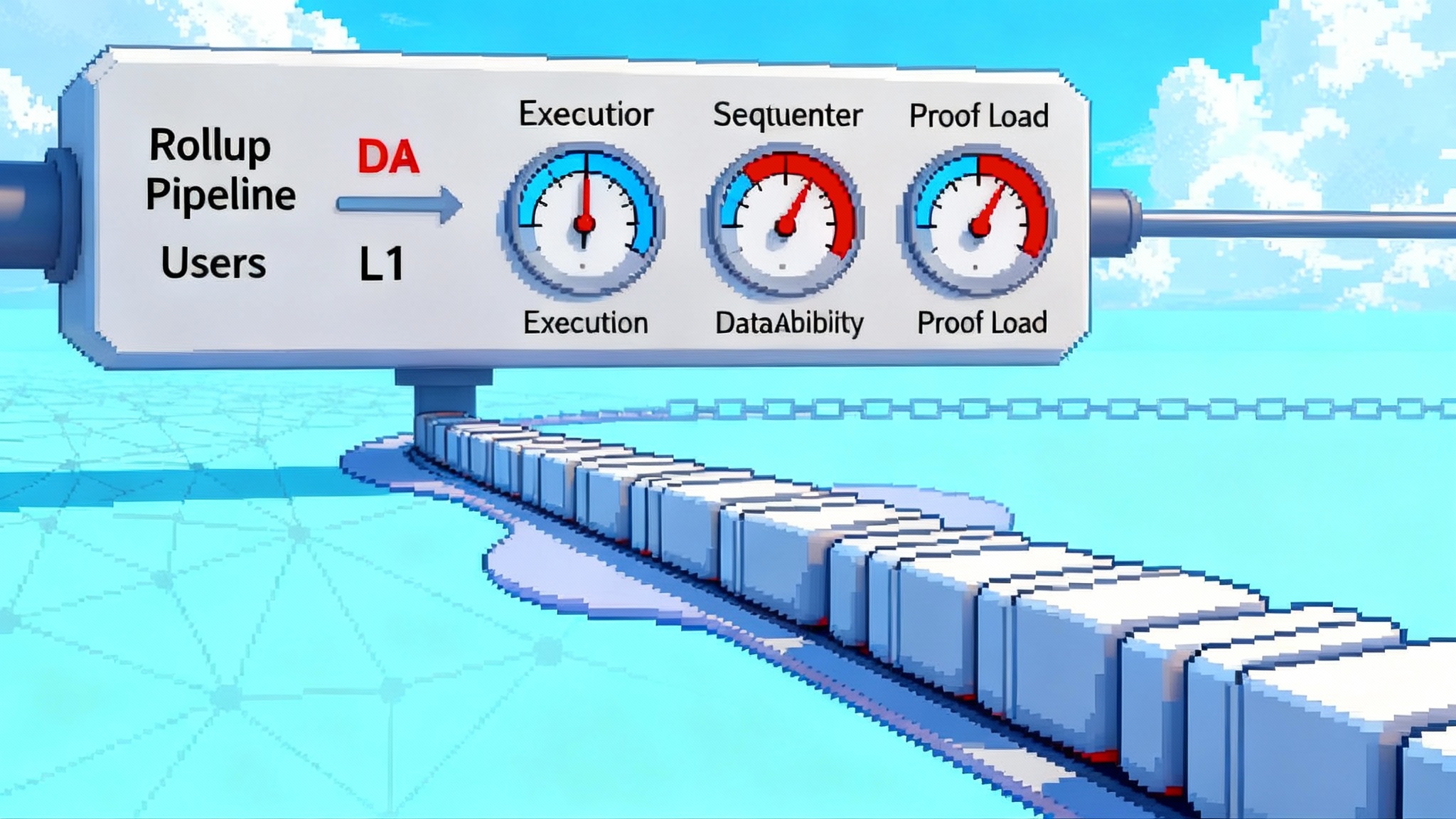

Why this matters for oracles, data availability, and shared sequencers

Some infrastructure cannot afford weak security, yet needs L2 speed and cost.

-

Oracles: Price and data feeds crave low latency and predictable fees. Running on an L2 reduces gas costs and enables faster updates. With Multi-Chain Verification, an oracle can sign on L2 and still face L1 slashing if it deviates from its specification. That aligns incentives without sacrificing responsiveness.

-

Data availability committees and blobs: DA providers or committees want to post commitments cheaply while ensuring operators are accountable. An L2 execution home allows frequent commitments, while L1 slashing keeps committee members honest if they withhold or equivocate.

-

Shared sequencers: Cross-rollup sequencing needs low-latency coordination and high throughput. Placing the sequencer logic on an L2 minimizes cost and allows rich scheduling. Making the operator set slashable at L1 deters censorship and reordering attacks beyond cosmetic penalties. For context on outages and design patterns, see our take on decentralizing L2 sequencers lessons.

The net effect is better user UX with stronger guarantees. Builders get flexibility without asking users to trust unpunished promises.

Who wins and who loses among L2s

A Base-first rollout sends a clear signal about what helps Multi-Chain Verification thrive.

Likely winners:

-

L2s with tight Ethereum alignment: If an L2 uses Ethereum as settlement and offers a battle tested canonical bridge, finality and message semantics are easier to reason about. The simpler the path to L1 enforcement, the lower the integration risk.

-

EVM compatible stacks with mature tooling: AVSs want to reuse operator code, signature schemes, and dev tools. A familiar EVM surface reduces time to market and operator onboarding friction.

-

Ecosystems with healthy operator markets: Where there are many professional node operators already active, AVSs can recruit diverse sets quickly and avoid concentration.

Potential laggards:

-

L2s with complex or slow settlement assumptions: If an L2’s finality or challenge windows are long or bespoke, aligning slashing timelines with user expectations becomes harder.

-

Environments with non standard crypto primitives or limited interoperability: If signature schemes or proving systems diverge, operators face bespoke tooling and higher operational risk, which slows adoption.

-

L2s that rely on external DA without crisp accountability: If data commitments and retrieval guarantees cannot be cleanly mapped into L1 enforceable faults, AVSs will hesitate to rely on them.

This is less about brand and more about the friction between L2 finality and L1 enforcement. Low friction ecosystems will capture more AVS launches. For adjacent risks stemming from economic parameters, review the case for rollup fee mispricing risks.

New risks to understand and mitigate

Cross-chain restaking tightens the coupling between services and operator capital. That opens fresh risk surfaces. Treat the following as non-negotiable design work.

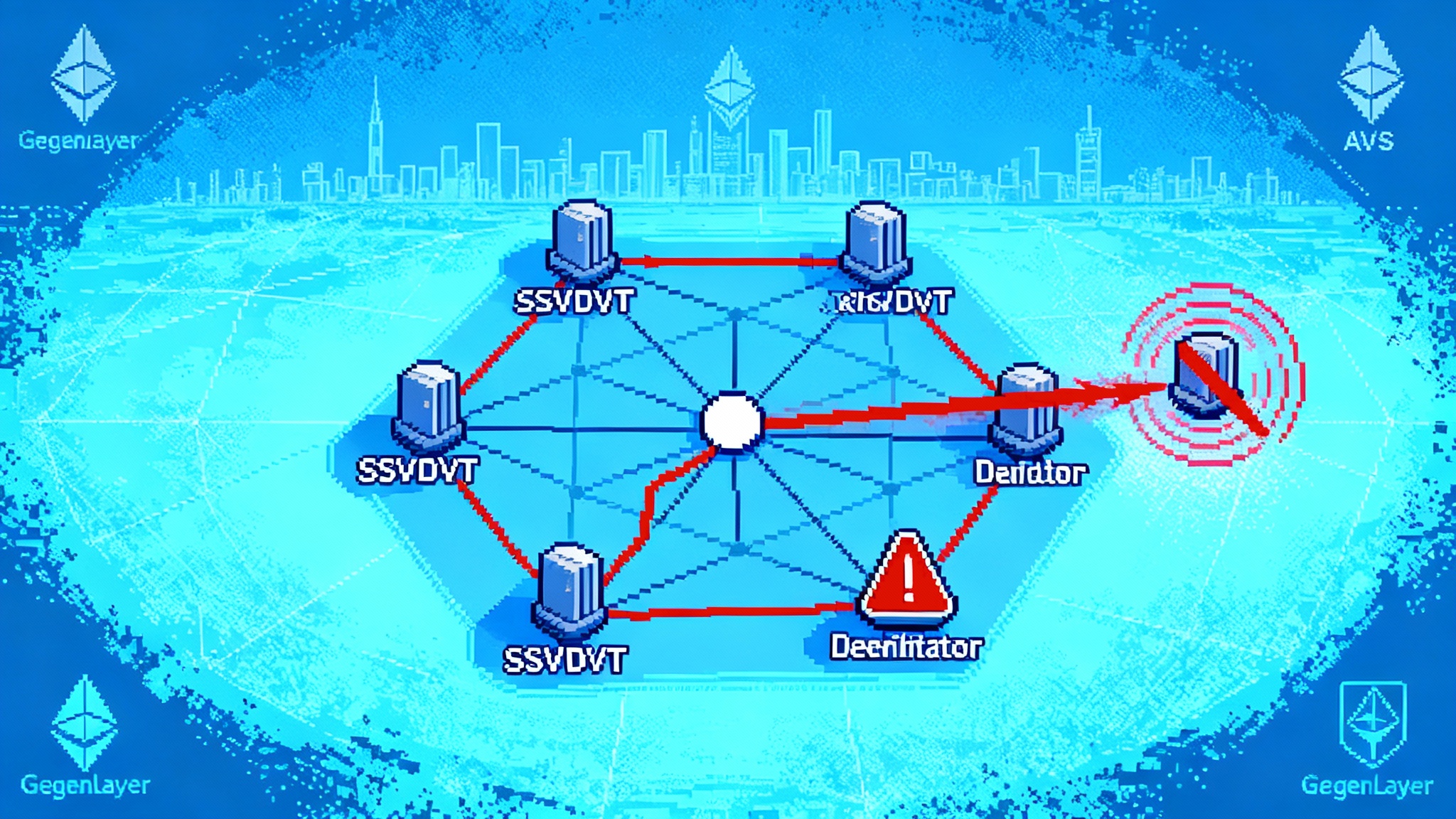

- Slash contagion across AVSs

- If an operator over commits, the same stake can secure multiple AVSs. A major slash in one AVS can shrink the security margin for others. Builders should cap per operator exposure, encourage stake partitioning, and define slashing that is proportional to actual harm.

- Operator concentration

- Early AVSs often rely on a handful of professional operators. Concentration increases the chance of correlated failures and cartel behavior. Require minimum set sizes, random leader selection, and diversity policies. Publish operator performance and churn metrics so delegators can reallocate.

- Governance and upgrade risk

- Upgrades that change faults or thresholds alter risk for operators and delegators. Cross chain governance can create timing gaps where L2 and L1 are out of sync. Use time locked upgrades, explicit version gates, and dual domain governance where L2 changes do not take effect until the L1 contract acknowledges them.

- Finality mismatch and replay

- An L2 commitment relayed too early can be reorged or disputed. Conversely, waiting too long erodes UX. Align your relay with conservative finality that reflects the L2’s bridge model. Include nonces and domain separation in signatures to prevent replay across chains or AVSs.

- Bridge and relay assumptions

- The relay is your single path for slashing evidence. If it stalls or is captured, you miss your enforcement window. Run multiple relayers with different operators, require onchain verifiable commitments, and allow anyone to submit valid evidence without permission.

- Incentive incompatibilities

- AVSs may pay in different tokens or on different schedules. Operators might rationally prioritize one service over another during stress. Align rewards with your reliability SLOs, include performance multipliers, and avoid cliff vesting that encourages short term extraction.

- Monitoring and incident response

- Cross domain systems fail in surprising ways. Without unified observability, you will notice too late. Treat observability as product surface: publish health endpoints, slash proofs, and per operator dashboards. Practice incident playbooks that include L1 and L2 steps.

- Legal and attribution ambiguity

- Slashing requires clear definitions of faults and responsible keys. Ambiguity invites disputes. Specify machine verifiable faults wherever possible, codify signer key rotation and recovery, and define a formal appeal window that does not block safety.

The builder checklist for going live

If you plan to launch on Base with Ethereum enforcement as mainnet support lands, work through this checklist. It is opinionated and tuned for practical execution.

Design and security model

- Define your state machine and list every slashable fault with concrete predicates. Favor objective criteria over subjective judgment.

- Choose your quorum and thresholds. Decide whether signatures are stake weighted, equal weighted, or role weighted. Document why.

- Cap per operator exposure and define stake partitions per AVS. Publish a target Nakamoto coefficient for your operator set.

- Decide on partial slash versus full slash. Map slash sizes to economic harm and recovery costs.

Cross chain architecture

- Document the exact path from Base contracts to the L1 slashing contract. Include message formats, nonces, and replay protection.

- Align with Base finality. Specify the number of confirmations or time you wait before relaying slash evidence.

- Support permissionless submission of valid commitments to L1. A third party should be able to deliver a valid message if your relayer fails.

- Make your L1 contract immutable wherever possible. Where you need upgrade hooks, protect them with time locks and version checks.

Operator lifecycle

- Publish operator requirements: hardware, bandwidth, signing keys, and expected workload. Provide Docker images and IaC templates.

- Implement key rotation and session keys. Avoid long lived hot keys.

- Provide a transparent scoring model that mixes liveness, correctness, latency, and participation. Make rewards sensitive to score.

- Run a canary network or shadow environment that mirrors mainnet settings. Give operators a place to test upgrades.

Testing and game days

- Simulate faults and prove the slash path works end to end. Include late evidence, conflicting evidence, and relayer failure.

- Rehearse a coordinated operator outage and recovery. Measure how quickly the network regains quorum.

- Load test the attestation aggregator and signature verification path with the largest operator set you expect in six months.

Governance and change management

- Publish an upgrade policy. Require public notice and a delay before changes affect slashing.

- Separate configuration that changes economics from configuration that changes safety. Use different approval thresholds.

- Define an appeals window for operators to contest slashes with additional evidence. Keep it short and bounded.

Monitoring and user communication

- Expose live metrics for operator participation, missed rounds, and slash events. Make them easy to consume by wallets and explorers.

- Maintain a status page and an incident log. Postmortems should list user impact and specific fixes.

- Provide client libraries with circuit breakers so integrators can gracefully degrade if your AVS misses SLOs.

Token and fee design

- Pay operators in a liquid asset or with credible buy pressure. If you pay in your own token, create predictable liquidity support.

- Include performance multipliers that reward long term reliability. Penalize churn and late joins that extract value without commitment.

Readiness gates for mainnet

- No critical path multisigs without time locks. If you must use a multisig, publish signers and policies.

- Two independent audits that cover both domains and the relay path. Publicly track remediation.

- A written runbook for freezing L2 contracts and for submitting emergency slashes at L1.

Practical tips specific to Base-first deployments

- Lean on Base’s ecosystem for dev tooling, monitoring, and block explorers. Spend your time on your AVS logic, not on bespoke infra.

- Prefer simple signature schemes with broad library support. Complexity raises operator costs and onboarding time.

- Keep the L2 contract code that handles attestations minimal and deterministic. Complexity belongs offchain in your aggregation pipeline.

- Publish a public test schedule that lines up with Base and Ethereum maintenance windows so operators can plan upgrades. Teams tracking fast-finality roadmaps may also find perspective in the Solana Alpenglow finality push.

What to watch through the end of Q3 2025

As of late September 2025, attention is on how quickly AVSs can reach healthy operator diversity while keeping their cross domain paths robust. A few milestones will matter most:

- The first slashing events that complete cleanly end to end. They prove the model or reveal gaps.

- Evidence that operators can safely serve multiple AVSs without correlated incidents, thanks to stake partitioning and good risk policies.

- Adoption by oracles, DA committees, and shared sequencers that move real user traffic and hold themselves to production SLOs.

If those land, the market will treat Multi-Chain Verification not as a novelty but as the default way to scale critical services. L2s that reduce finality friction will attract the next wave of AVS launches. Builders that ship with clear slashing, strong operator incentives, and disciplined cross chain engineering will set the standard others must match.

The bottom line

Multi-Chain Verification lets you run on L2 speed while paying with L1 steel. For the first time, the path to low cost, high throughput services does not require weak promises. With the July 24 to 28 rollout setting the cadence and Q3 2025 as the target for broad mainnet support, the window is open. If you are building or operating an AVS, the right time to finalize your cross chain design, operator policies, and incident playbooks is today.