Cloudflare’s NET Dollar: Settlement Layer for AI Agents

Cloudflare is proposing NET Dollar, a dollar‑backed stablecoin designed for instant, programmable settlement between software agents. Paired with x402 and the Agent Payments Protocol, it points to a pay‑per‑use internet where crawlers, APIs, and models buy exactly what they need in milliseconds.

A new money primitive for an agentic web

Cloudflare has announced plans for NET Dollar, a U.S. dollar backed stablecoin designed to move at internet speed and plug directly into software that buys, sells, fetches, and negotiates on our behalf. The stated goal is clear: replace ad impressions and monthly subscriptions with instant, programmable settlement that rewards originality and usage rather than clicks. In Cloudflare’s framing, the agentic web needs money that is global, trustworthy, and fast, and it needs that money to be native to the way the web already works. Cloudflare introduced NET Dollar, signaling that payments will be a first‑class primitive alongside caching, security, and compute at the edge.

Why does this matter now? Autonomy is moving from demos to production. Agents that price‑compare flights, renew API keys, schedule deliveries, and negotiate usage rights cannot wait days for settlement or force humans to complete 3D Secure or captcha loops. They need a programmable instrument they can hold, spend, escrow, and reclaim with guardrails. If Cloudflare can pair a low‑latency stablecoin with open protocols for requesting and proving payment, it could shift a meaningful slice of online economics toward pay‑per‑use and pay‑per‑access models.

Why agentic workloads need instant, programmable settlement

Human checkout flows assume attention, patience, and screens. Agents and machines assume none of that. Their payment needs look different:

- Millisecond decision loops: Agents often act inside tight SLAs. A pricing bot cannot hold a reservation for minutes while a card authorization pings legacy rails. Settlement must feel like an API call.

- Deterministic control: Agents need explicit spend rules, time windows, and limits enforced in code. Think allowlists, per‑counterparty ceilings, and auto‑revocation when a mandate expires.

- Atomicity: Access to a resource and the payment for it should be a single logical operation. Either the model weights are returned and the payment posts, or nothing happens.

- Interoperability: Agents will interact with merchants, gateways, and other agents that support different payment methods. A settlement asset must bridge these without brittle custom integrations.

- Micropayments: Agents buy slices of value. A single request might cost a fraction of a cent. Fees and latency that make sense for 40 dollar carts break at 0.004 dollars per call.

Stablecoins fit this profile because they settle near‑instantly, are programmable, and can be held natively by software. A Cloudflare‑issued or Cloudflare‑facilitated stablecoin could further reduce friction by living on a network optimized for small, frequent transactions and by riding Cloudflare’s global presence for verification, fraud checks, and key management. Low‑latency chains pursuing sub‑second finality, such as those where Solana targets sub-150ms finality, illustrate why speed matters for agents.

How NET Dollar could interoperate across rails

Cloudflare has not locked NET Dollar to a specific chain in public materials, which is the right instinct. Agents and merchants will care about finality, cost, and trust, not the logo on a block explorer. Interoperability options include:

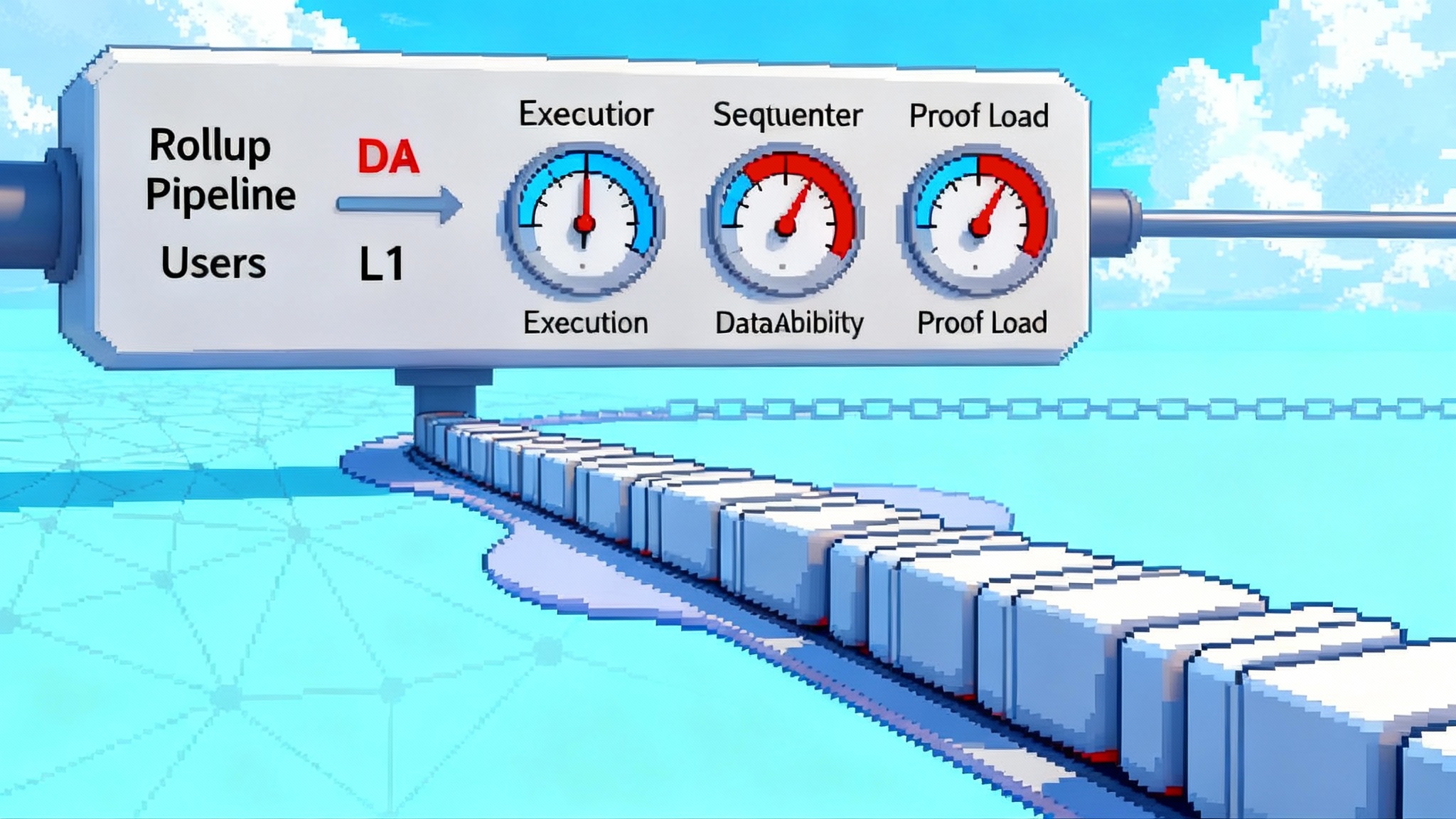

- Stablecoin networks: NET Dollar could circulate on one or more L2s optimized for throughput and low fees. Bridges or native mints on multiple networks would allow agents to pay where the merchant prefers. Settlement could start on a low‑fee domain and hop to other chains as needed.

- Bank and instant rails: A facilitator could offer conversion between NET Dollar and ACH, RTP, or FedNow so merchants can sweep balances to bank accounts with predictable cutoffs. For larger B2B flows, invoicing and netting layers could sit on top.

- Card rails as a fallback: Even in an agentic world, card networks remain ubiquitous. NET Dollar could load a network token behind the scenes for merchants that still prefer card acceptance, while preserving agent‑level guards like spend ceilings and cryptographic mandates.

- Wallet abstraction: Agents should not need to manage per‑chain keys. A hosted or smart‑contract wallet layer can expose a single interface to the agent while spreading actual settlement across chains and custodians.

Interoperability is not just technical. It is contractual and operational. Expect Cloudflare to lean on attestations, risk scores, and merchant registries so that facilitators can decide when to allow a cross‑rail payment, when to require extra proofs, and when to refuse.

The standards that make this programmable: x402 and AP2

Two emerging standards aim to give the web a common language for paid access and agent authorizations.

- x402: This protocol revives the long‑dormant HTTP 402 Payment Required status and wraps it with machine‑readable headers that tell a buyer exactly how to pay and how to prove it on retry. In short, a server can reply with 402 and payment instructions, the client pays programmatically, then resubmits with a proof. It is web native, works with any HTTP stack, and is payment method agnostic. Coinbase’s developer docs offer a clear introduction to how x402 uses HTTP 402.

- Agent Payments Protocol, often abbreviated AP2: This focuses on authority and accountability. Agents transact under cryptographically signed mandates that encode who authorized what, for how much, and for how long. AP2 is payment agnostic and can wrap card pulls, bank pushes, or stablecoin transfers. The emphasis is on verifiable intent and auditability, which matters for disputes and compliance.

Pairing the two gives you both halves of the problem. x402 says how to ask for money and how to prove payment in the request‑response loop. AP2 says the agent was allowed to spend, under what conditions, with evidence everyone can verify later. If Cloudflare bakes support for both into its edge, an origin can speak one standard regardless of which wallet or facilitator the buyer uses.

Pay‑per‑crawl, pay‑per‑token, and licensing that actually fits the web

Large language models thrive on fresh content, and agents are relentless crawlers. But today’s content economy is snarled in scraping battles, robots.txt gray zones, and awkward licensing deals. An instant, programmable settlement layer unlocks alternatives:

- Pay‑per‑crawl: A publisher returns HTTP 402 with a price per page or per kilobyte. The agent pays and retries. Rates can vary by route or freshness. The crawler gets guaranteed access with quality‑of‑service markers, the publisher gets revenue and analytics.

- Pay‑per‑token for LLM use: Rather than wholesale content purchases, publishers meter the use of specific passages or embeddings. An RAG system pays to fetch high‑value snippets with provenance for downstream attribution.

- Tiered licensing: x402 can encode tiered rates and rights in headers. A noncommercial researcher price, a commercial agent price, a real‑time stream price. AP2’s mandates capture the allowed usage so both sides have evidence if terms are breached.

- Dynamic pricing at the edge: Because Cloudflare sits between buyers and origin, a rule can adjust prices in real time based on request patterns, geography, model type, or demand spikes.

The net effect is a path out of the all‑or‑nothing choices that have dominated the past decade: either ads or subscriptions, either scrape for free or sign a giant platform deal. Publishers can start charging pennies for the marginal unit of value that an agent actually needs.

Compliance and fraud controls for autonomous payments

Autonomy changes the risk surface. The controls must be native to the protocol and enforceable without a human in the loop on every transaction.

- Know‑your‑developer: Merchant facilitators can require agent operators to attest identity, jurisdiction, and purpose before granting higher spend limits. Attestations can be cached and checked in milliseconds at the edge.

- Sanctions and blocklists: Facilitators can embed up‑to‑date screening into the payment verification step and return 402 with an alternate flow if a risk flag is triggered.

- Cryptographic mandates: AP2‑style signed intents bind spend to a user, amount, merchant, time, and scope. They can require countersignatures for sensitive actions or larger thresholds.

- Spend guards: Per‑merchant and per‑category ceilings, velocity checks, daypart limits, and one‑time caps reduce the blast radius of prompt‑injection or model hijack events.

- Human‑in‑the‑loop tiers: For small payments everything is fully automated. Above a threshold, a mobile push asks the user to approve the mandate. Above a higher threshold, controls can force a cold‑path verification.

- Dispute evidence: Edge logs plus signed mandates and 402 receipts produce clean artifacts for chargebacks or clawbacks. The evidence is machine‑generated and tamper‑evident, so resolution can be fast.

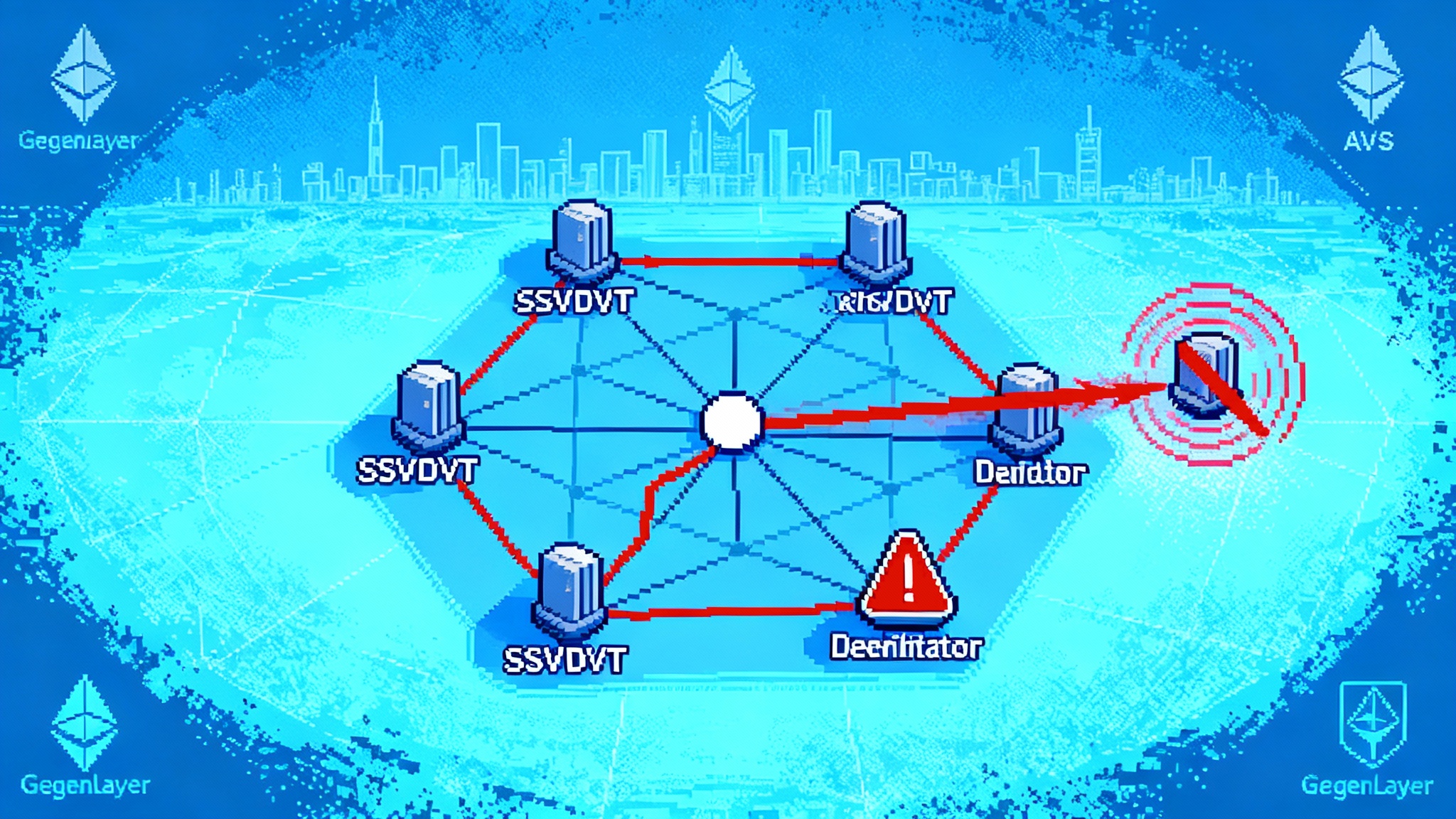

Because Cloudflare already operates at global scale, it can geofence where NET Dollar is offered, adapt to local rules, and apply jurisdictional controls without burdening merchants. Expect a staged rollout where higher‑risk features are enabled behind attestations, not by default. For context on reliability mandates at the infrastructure layer, see how teams are decentralizing L2 sequencers after outages.

Competitive impacts across payments, issuers, CDNs, and creator platforms

- Card networks: If agents drive a rising share of spend, networks will push deeper into agent mandates and network tokenization. They can remain the settlement choice for larger carts and consumer protections, but they risk ceding long‑tail, sub‑1 dollar transactions to x402‑style flows. Networks that certify AP2 and expose mandate signing in wallets will be better positioned.

- Stablecoin issuers: NET Dollar enters a crowded field. The differentiator is distribution and developer surface, not the coin name. If Cloudflare makes it trivial for any API to require NET Dollar at the edge, wallet share could accumulate quickly. Incumbent issuers may court facilitators to ensure their assets are first‑class in x402 flows or offer fee rebates to win default status. For macro context, revisit Tether’s 500B stablecoin strategy.

- CDNs and edge platforms: Turning 402 into a product is a natural extension of caching and WAF rules. Competing CDNs will follow with their own payment headers, rate cards, and developer SDKs. The platform that nails tooling and receipts could become the default meter for machine commerce.

- Creator platforms and data brokers: Pay‑per‑access lets creators sell without joining an ad network or launching a subscription. It also enables data marketplaces to price updates and freshness separately from bulk downloads. Platforms that re‑bundle creators’ x402 endpoints with discovery and analytics can become the new storefronts for agent‑friendly content.

Near‑term adoption scenarios

Expect adoption to start where the value is concentrated and the integration is simple.

- Pay‑per‑API call: Infrastructure and data APIs that already issue keys can add x402 with minimal changes. Agents wrap fetch calls with a tiny client that handles 402 responses and payment retries.

- Retrieval augmented generation: RAG systems pay for fresh references, headlines, or paragraphs at request time. Publishers set per‑route rates and watermark high‑value responses.

- Search and crawl allowances: Search engines and model builders pay publishers for crawl budgets, with dynamic rates based on freshness and canonical tags. The edge enforces robots plus 402.

- Media sampling: Audio and video catalogs allow pay‑per‑minute access for agent summarizers. Rates can spike for premium content and drop for back catalogs.

- IoT and telemetry: Devices publish data streams behind 402. Other devices or agents subscribe in tiny increments. Smart contracts handle group buys and cost sharing.

- Agent marketplaces: Agent‑to‑agent services emerge. A planning agent pays a flight‑search agent that pays multiple data providers, all settling instantly with traceable sub‑transactions.

These scenarios do not require every merchant to switch rails. They require a facilitator that can translate between a small number of payment types at the moment of need, plus standards that make each request unambiguous.

Metrics to watch as this evolves

- Merchant and API integrations: Count of domains and endpoints that reply with HTTP 402 and accept NET Dollar or compatible stablecoins. Look for logos in developer docs and for 402 status share in traffic analytics.

- Protocol support: Which SDKs, frameworks, and clouds ship x402 or AP2 support by default. Pay attention to agents and toolchains that make mandate signing and payment proofs turnkey.

- Developer tooling: Quality of client libraries, 402 debuggers, testnets, and facades that let developers simulate payments locally. Fewer steps means faster adoption.

- Settlement performance: Median and p95 authorization to fulfillment time, fee per transaction at micro amounts, and failure rate under load.

- Compliance posture: Jurisdiction coverage, geofencing accuracy, and documented playbooks for disputes and reversals.

- Interop breadth: Number of supported networks, bank rails, and facilitators. Watch whether merchants can set preferences per route and get paid where they prefer without custom code.

- Content ecosystem: Share of major publishers, forums, and data providers offering pay‑per‑access routes. Track how many crawlers and search providers support proof‑of‑payment in their fetchers.

What could derail the vision

There are real risks. Developers will reject anything that adds fragility to APIs. If payment proofs delay responses or generate flaky retries, usage will stall. Merchants will balk if settlement fragmentation forces them to reconcile multiple ledgers. Consumers will push back if agents spend unpredictably or if disputes feel worse than chargebacks.

The antidote is boring reliability. That means:

- Edge‑first verification that adds negligible latency

- Opinionated defaults for mandates and spend limits

- Clear receipts and evidence bundles for every 402 fulfillment

- Sensible fallbacks when a chain is congested, a facilitator is down, or a merchant prefers traditional rails

If Cloudflare and the broader ecosystem deliver those, the payoff is significant. We get a web where value moves as easily as packets, where creators and developers can price the next unit of value instead of the next page view, and where agents have the money grammar they need to transact safely.

The bottom line

NET Dollar is not just another stablecoin logo. It is a bet that the next phase of the internet moves from ads and subscriptions to usage‑priced, machine‑negotiated access. Pair a Cloudflare‑native settlement asset with x402 for paid requests and AP2 for signed intent, and you have the makings of an internet that can meter and pay for exactly what an agent needs, exactly when it needs it. If the tooling is smooth and the guardrails strong, the world’s most common HTTP error might finally become a feature.