Fidelity puts Treasuries on Ethereum. The cash race begins

Fidelity is rolling out an Ethereum-based share class for its Treasury fund, turning regulated cash into wallet-native collateral. Here is how it reshapes stablecoins, DeFi, and the competition with BlackRock and Franklin Templeton.

Why Fidelity’s move matters now

The idea of cash that lives on public blockchains has been maturing for years. Stablecoins brought always-on settlement and global reach, but they rely on issuers and reserve structures that sit outside traditional fund rules. Franklin Templeton and BlackRock pushed a different path by tokenizing money market fund shares, giving investors cash-like exposure with the guardrails of the Investment Company Act. Now Fidelity is stepping in.

In March 2025, Fidelity filed to create an Ethereum-based “OnChain” share class for the Fidelity Treasury Digital Fund, with the blockchain serving as a secondary record of ownership while the transfer agent keeps the official book of record. That filing set a clear template for how a top asset manager would put a regulated cash vehicle on a public chain, using the tools of the mutual fund world rather than reinventing them. You can read the preliminary prospectus that describes the OnChain class and Ethereum recording of ownership in the preliminary prospectus for an OnChain class.

This is more than a product launch. It is a distribution strategy. By making fund shares legible to smart contracts and wallets, Fidelity is plugging its Treasury cash into a new set of pipes. That has three immediate consequences: competition for the leading position held by BlackRock and Franklin, new collateral options for DeFi and crypto-native trading, and a direct comparison with stablecoins and bank deposit tokens that will influence policy and market standards.

The new map of on-chain cash power

BlackRock’s early lead with BUIDL showed institutions that tokenized fund shares could scale. In March 2025, Securitize announced BUIDL had crossed the one billion dollar mark in assets, a key signal that regulated tokenized cash could attract real flows from treasurers and crypto firms alike. See the announcement that BUIDL surpassed one billion dollars in AUM.

Franklin Templeton built the category’s foundation with its OnChain U.S. Government Money Fund. It pioneered recording share balances on public ledgers and proved that a 2a-7 fund can operate with blockchain as a parallel recordkeeping system. Those two brands have become the default answer when an institution asks for on-chain dollars that sit inside a regulated fund wrapper, a shift echoed by broader efforts like Nasdaq’s plan for tokenized stocks.

Fidelity’s entry changes the conversation in three ways:

- Distribution gravity. Fidelity’s corporate cash and adviser networks are massive. If its on-chain class becomes a standard add-on for treasury accounts, flows can follow without a heavy lift, because investors remain inside familiar KYC and custody relationships.

- Wallet-native UX without leaving the fund world. Fidelity can pipe shares to whitelisted wallets that treasurers already use for digital assets. That makes it easier for a fund or trading desk to hold one instrument for off-exchange settlement, collateral posting, and yield capture.

- Pricing pressure and feature parity. BlackRock set expectations for daily yield accrual and fast transfers. Franklin emphasized accessibility. Fidelity can compete on fees, integration breadth, and settlement tooling, which benefits buyers and increases liquidity across the segment.

From fund shares to programmable cash

Tokenizing money market fund shares sounds like an incremental tweak, yet it unlocks two features that traditional accounts cannot deliver easily.

- Programmability. On-chain fund shares can be locked in smart contracts, split across wallets, or auto-swept between venues based on thresholds and rules. That turns passive cash balances into an active component of risk systems.

- Interoperability with settlement rails. The same instrument can move between a custodian, an exchange, a DeFi protocol, and a counterparty. If transfer rules and whitelists permit, a treasurer can post collateral and receive it back without leaving the fund wrapper.

In the crypto markets, these features become concrete quickly. Market makers, basis traders, and funds need to park dollars, post margin, and settle at any hour. A tokenized 2a-7 fund share provides dollar yield and a path to instant settlement on supported venues. If derivatives platforms, OTC desks, or permissioned DeFi pools accept these shares directly, capital efficiency improves because there is less idle cash and fewer conversions.

How Fidelity could accelerate DeFi collateral design

Most DeFi protocols cannot accept unrestricted retail tokens without creating compliance headaches. They need assets with transfer controls and KYC gates. Tokenized fund shares fit that requirement if contracts restrict transfers to approved addresses, and if the issuer or transfer agent can freeze, redeem, or correct mistakes when needed.

Expect the following adoption path:

-

Permissioned pools. Lending markets with KYC gates will list Fidelity’s on-chain shares as a collateral type once custody and legal opinions line up. This looks similar to how BUIDL and Franklin instruments show up in whitelisted pools.

-

Prime brokerage bridges. Crypto-native prime brokers already integrate tokenized Treasuries for repo-like financing and portfolio margin. Adding Fidelity gives them an alternative source, improves price discovery, and increases negotiation leverage with incumbents.

-

Exchange collateral. Centralized venues that accept tokenized Treasuries reduce funding friction between fiat banking hours and 24x7 trading. They also simplify balance sheet management because collateral remains in a fund wrapper.

-

On-chain settlement for funds and DAOs. Treasury managers for protocols can hold an instrument that satisfies governance rules for safety and yield, while still interacting with smart contracts. Redemptions route through the transfer agent, yet day-to-day operations happen on-chain.

There are still technical chores. Oracles must report a reliable price at or near one dollar. Contracts must handle daily dividends or NAV accounting in a way that does not break collateral calculations. And whitelisting flows need to be smooth, since a slow onboarding can erase the advantages of 24x7 movement.

What changes for institutional treasurers

A treasurer measures success with three yardsticks: safety, liquidity, and operational control. Tokenized fund shares compete on all three.

- Safety. A 2a-7 Treasury fund has a transparent mandate and a record of stress tools such as liquidity fees or gates. The instrument does not depend on a single issuer’s discretionary reserve policy. Governance and disclosure match what treasurers already use.

- Liquidity. Redemptions still move through the fund transfer agent, so there is cutoff-time reality. Yet secondary transfers between whitelisted wallets can be near instant, which solves many operational needs without waiting for a wire.

- Operational control. On-chain settlement shortens the path between counterparties. Instead of wiring to a new exchange account, a treasurer can update an allowlist and move the same instrument into a custody wallet that the exchange accepts.

For a company that already holds digital assets, the case is even stronger. The same custody stack can hold the cash instrument and program its use across venues. That reduces banking dependencies for weekends and holidays, and it makes reconciliations easier because settlement messages and balances are on a shared ledger.

Stablecoins vs tokenized funds vs deposit tokens

Fidelity’s move also sharpens the ongoing debate about on-chain dollars. Each model answers a different set of requirements.

-

Stablecoins. They offer the broadest reach and the best composability. Anyone can hold them, and they move with minimal friction. The tradeoffs are reserve transparency, issuer risk, and regulatory treatment that is still evolving. For fully open DeFi and cross-border retail payments, stablecoins remain unmatched, as seen in ongoing market moves like HSBC’s tokenized deposits test in 2025.

-

Tokenized money market funds. These are built for regulated investors and treasurers. They deliver a yield that tracks front-end rates, sit under SEC rules, and support transfer controls. They are less liquid at the fund level because redemptions follow mutual fund processes, yet secondary on-chain transfers can be fast within the allowlist.

-

Deposit tokens from banks. These promise the legal clarity of a bank deposit and direct connection to payment systems. They are still early outside of closed networks, and they rely on banking hours for some operations. If standardized, deposit tokens could power wholesale settlement and programmable cash management inside and between banks.

The practical upshot: on-chain cash will not converge on a single design. Treasurers will match the instrument to the job. Stablecoins for open settlement and retail-facing flows. Tokenized funds for yield-bearing treasury balances and compliant collateral. Deposit tokens for interbank and corporate cash inside banking networks.

Key regulatory and technical tradeoffs

-

Transfer restrictions. To remain compliant, on-chain share classes typically restrict transfers to approved addresses. That limits viral composability but reduces sanctions and AML risk. Fidelity will need a clear rulebook for exchanges, brokers, and DeFi teams that want to integrate.

-

Recordkeeping hierarchy. The official shareholder register lives off-chain with the transfer agent. The blockchain is a mirror ledger that improves transparency and tooling. This dual-record model aligns with regulation, and it also gives issuers a way to correct errors, which is important for operational risk.

-

Liquidity management. Mutual funds can apply fees or gates during stress. That protects existing shareholders but can create operational surprises for trading desks that treat the instrument like cash. Integrations should surface those states in real time so risk systems can react.

-

Yield mechanics. Most tokenized money funds accrue income daily. Smart contracts that use these tokens as collateral must handle interest distribution cleanly, or else collateralization ratios will drift and trigger noisy liquidations.

-

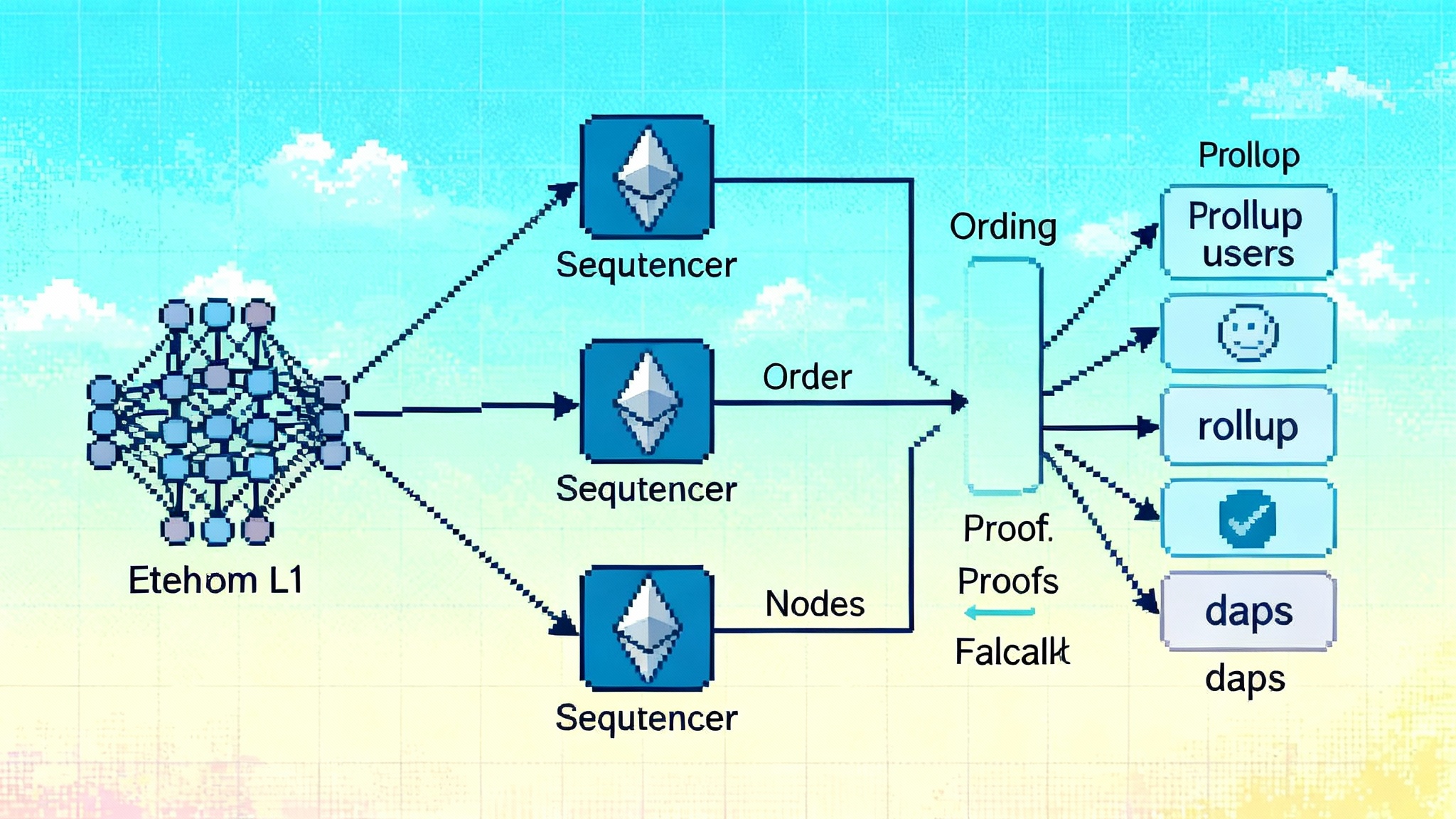

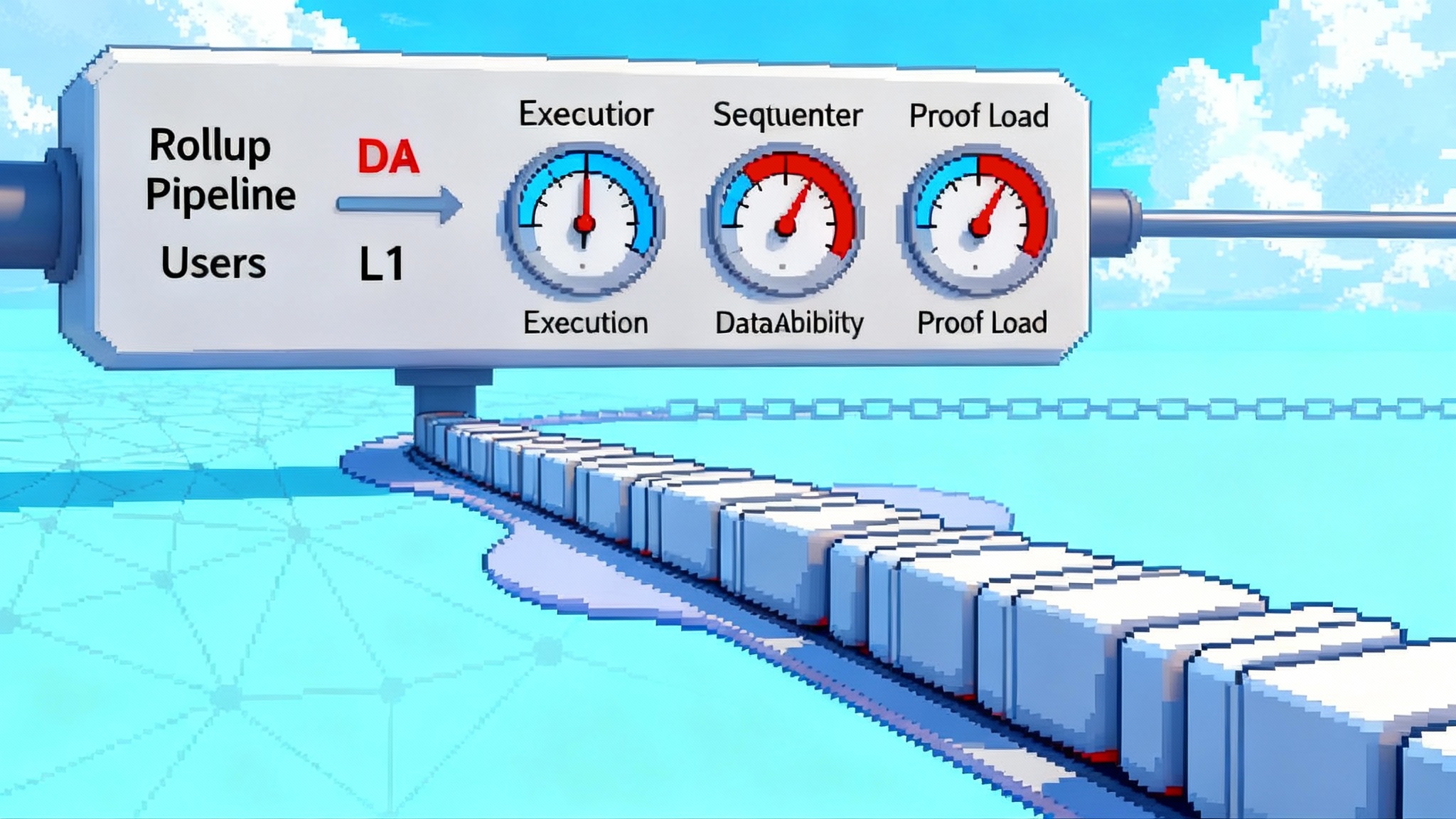

Chain choice and settlement costs. Ethereum offers security and integration depth but has variable fees. Layer 2 networks reduce costs and increase throughput. Over time, expect multi-chain share classes with a common transfer agent and cross-chain messaging, provided settlement guarantees meet compliance requirements, a trend that dovetails with regulatory clarity such as SEC clears generic ETP rules.

What this means for BlackRock and Franklin

BlackRock built a powerful network of custodians, exchanges, and protocol teams around BUIDL. Franklin earned first-mover credibility and a retail-friendly path. Fidelity can compete on three fronts:

-

Fee and flow competition. If Fidelity prices the on-chain class aggressively and bundles it with treasury solutions, it can win wallet share even without the first-mover gloss.

-

Integration velocity. Direct integrations with major custodians, crypto primes, and exchanges will decide early winners. Being the third giant to arrive does not hurt, since counterparties now have a playbook for due diligence and onboarding.

-

Product breadth. Expect sweep features, repo-like financing, and programmatic liquidity tools that make an on-chain fund share behave like cash across venues. If Fidelity pushes standard interfaces for these tools, it can set de facto norms for how tokenized funds plug into DeFi and centralized trading.

In short, Fidelity’s presence should expand the addressable pie. It brings new investors who previously sat on the sidelines, and it encourages venues to support multiple tokenized funds as interchangeable collateral. That, in turn, reduces concentration risk in a single issuer or network.

The adoption checklist that will make or break it

For the on-chain class to become everyday financial plumbing, five things must go right.

- Custody and wallets. Coverage across the big institutional custodians, plus policy controls that mirror what treasurers use for stablecoins today.

- Exchange collateral status. Clear rules for haircut, settlement finality, and intraday movement on the largest derivatives and spot venues.

- DeFi allowlists. A predictable, scalable way for protocols to request allowlisting for their pool contracts and for participants to prove eligibility without paperwork ping-pong.

- Pricing and oracles. A robust price feed that reflects fund NAV and accrued dividend mechanics, with fallback sources and circuit breakers for stress.

- Operational playbooks. Step-by-step guides for corporate treasurers, funds, and trading firms that explain cutoffs, redemptions, freezes, and error resolution.

What to watch next

- Cross-product linkages. Stablecoin issuers will explore using tokenized fund shares as backing, which blurs the line between the two models. This has already started in the market with other issuers and may become a pattern that brings more transparency to reserves.

- Regulatory harmonization. As stablecoin and tokenization bills advance, expect clearer rules for on-chain fund transfers, cross-chain movement, and disclosure. The dual-record model gives regulators comfort, and adoption should accelerate as agencies publish guidance.

- Interoperability standards. If multiple issuers adopt shared schemas for whitelisting and settlement messages, tokenized cash can flow freely between venues without bespoke engineering each time.

The bottom line

Fidelity is not just launching another money fund. It is teaching a familiar instrument a new language, the language of wallets and smart contracts. That makes cash programmable without abandoning the regulatory scaffolding that treasurers rely on. The near term impact will be a faster, safer on-chain collateral market and a broader supply of yield-bearing settlement assets. The longer term effect could be deeper. As more of the world’s cash instruments learn to speak to code, the boundary between banking, markets, and blockchains will keep fading. And the players who master distribution and integrations, not just filings, will write the rules of the next phase of on-chain finance.