EigenCloud’s enterprise pivot: verifiability as a service

In 2025 EigenLayer reframed restaking as a full verifiable cloud. With EigenCloud's June launch, a16z's reported $70M token purchase, a July reorg, and an August EigenPods patch, the company is courting enterprise buyers who want enforceable guarantees.

The setup: a launch and a checkbook

On June 17, 2025, Eigen Labs unveiled EigenCloud, a developer platform that packages the core primitives of the EigenLayer ecosystem into a service surface for building verifiable applications. The announcement landed with a funding signal that enterprises understand: a16z crypto disclosed an additional token purchase to back the rollout, described as a16z’s $70M token deal tied to EigenCloud’s go to market. The combination reframed EigenLayer for a broader audience. It was no longer only about restaking and a high throughput data availability network. It was about selling verifiability as a service to developers and, critically, to buyers inside traditional industries.

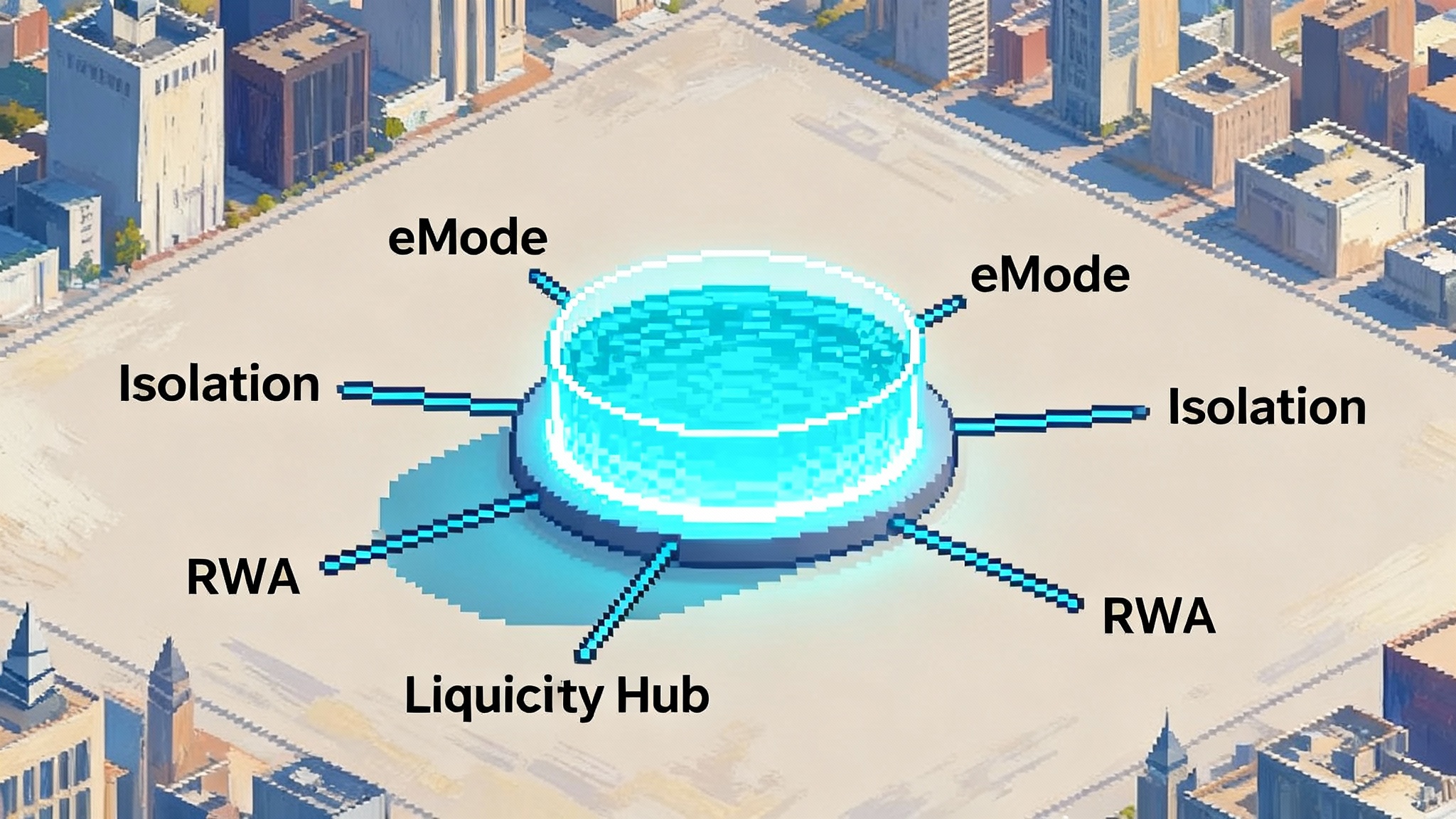

EigenCloud formalized three lanes of capability. First, EigenDA for data availability, now tuned for rollups and high bandwidth publishing. Second, EigenVerify for dispute resolution and settlement style guarantees across different classes of claims. Third, EigenCompute for verifiable offchain execution that can be bound to onchain enforcement. Separate products that once looked like parts of a modular stack started to read like a cloud platform with a clear customer promise.

The pivot becomes real: a restructuring and a patch

The launch by itself could have been a marketing moment. What followed made it a strategic pivot. On July 8 and July 9, 2025, Eigen Labs initiated a restructuring that reduced headcount by roughly a quarter and reoriented the company around EigenCloud delivery. Internally, that meant moving resources from broad protocol experimentation toward productization, documentation, partner enablement, and enterprise support. Externally, it sent an unambiguous message to customers who measure commitment by who is staffed to serve them. An early stage crypto infrastructure team chose to act like an enterprise platform provider.

Then, on August 29, 2025, Eigen Labs executed and disclosed an urgent EigenPods bug fix. Posted to the protocol forum as the work completed, the patch addressed a vulnerability in withdrawal mechanics that could have distorted rewards and slashable stake accounting. No funds were lost and the service remained available, but the timeline and transparency were notable. The update, documented as the EigenPods bug fix on Aug 29, reads like a mature incident process. For enterprise buyers, that is often the difference between an interesting technology and one that can pass procurement.

From EigenDA to EigenCloud: what changed

EigenDA proved there was demand for cryptoeconomic guarantees around data. Rollups wanted bandwidth and durability without central trust, and builders wanted to target a shared operator set rather than stand up bespoke committees. EigenCloud expands that thesis. The platform generalizes the idea of verifiable commitments so it can cover communication, computation, and dispute resolution, not only data.

-

EigenVerify translates different kinds of disagreement into enforceable game rules. A rollup can use deterministic proofs for objective faults. A marketplace can use intersubjective juries for subjective claims. A workflow that mixes algorithmic scoring with expert review can use AI assisted adjudication while still anchoring decisions in slashing backed commitments. The outcome is a low friction way to declare, check, and settle.

-

EigenCompute lets teams run containerized workloads offchain with cryptoeconomic guardrails. Operators opt into task specific rules. AVSs define what constitutes correct behavior and what triggers penalties. That pairing makes it plausible to move heavier or privacy sensitive logic out of blockchains while keeping verifiable results.

-

EigenDA remains the backbone for high throughput publication. Many applications still want the censorship resistance and retrievability properties of DA, but now they can link data events to verification and compute outcomes under the same economic umbrella, which is increasingly relevant as programs like Arbitrum's $40M DRIP targets leverage reshape rollup incentives.

Put differently, EigenCloud tries to give developers one control plane for verifiable IO. Data in, compute out, settle disputes if needed, and tie it all to programmable incentives and penalties.

Slashing and redistribution: why the risk model changed in 2025

Two protocol events in 2025 altered the economics for AVSs and operators.

-

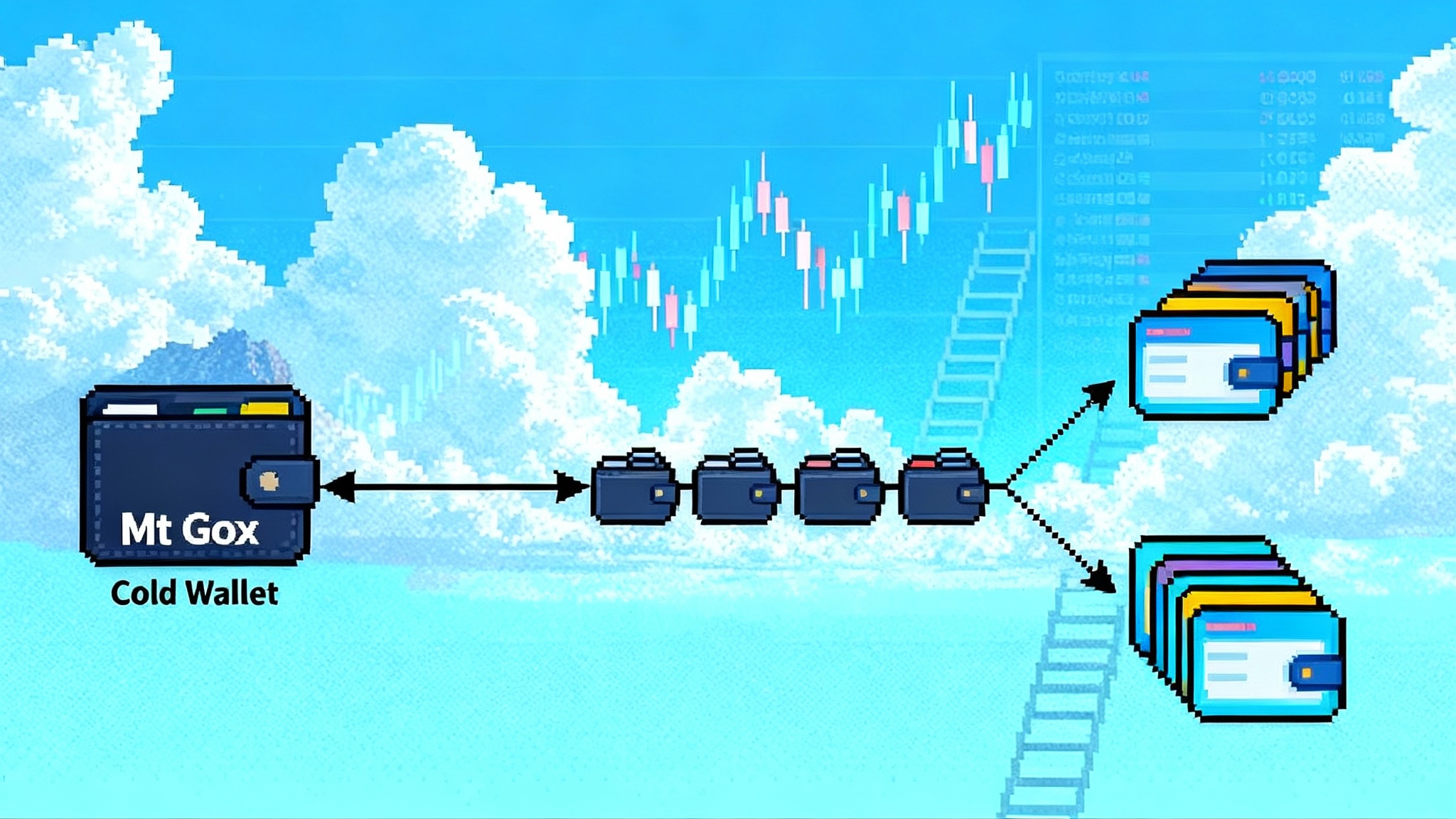

On April 17, 2025, slashing went live on mainnet. That made EigenLayer’s accountability no longer theoretical. Operators and stakers began opting into AVS specific rules with real capital at risk. For AVSs that need to guarantee liveness or correctness, this is the difference between hoping a network behaves well and writing explicit consequences that are enforceable onchain.

-

On July 22, 2025, redistribution went live on mainnet. Before redistribution, slashed assets were effectively burned. With redistribution, an AVS can configure a recipient for slashed funds and redirect value to harmed users, insurance pools, safety modules, or performance reward buckets. That change matters because it turns slashing from a pure deterrent into a programmable remediation tool. It enables business models where service level failures fund user compensation or where late delivery penalties flow to counterparties.

For AVSs, these features push risk pricing to the forefront. If an oracle network wants sub second updates with tight error bounds, it must set strong slashing criteria and pay operators enough to accept the risk. If a compute service runs high variance workloads, it can segment operator sets by specialization and risk tolerance, and offer different reward rates. For operators, it becomes a portfolio problem. They can select AVSs that match their capabilities, diversify across risk classes, and allocate restaked assets to maximize expected return after accounting for correlation between potential slash events.

The opt in nature of operator sets and the presence of safety delays also change behavior. Capital cannot be pulled right before a slash and operators cannot be forced into AVS terms they did not accept. That creates a negotiation dynamic that is closer to traditional vendor relationships, only with automated enforcement.

What this means for tokenized funds, oracles, and AI workloads

- Tokenized funds and capital markets

Asset managers care about audit trails, NAV calculation, and dispute resolution. With EigenVerify, a fund can commit to calculation procedures and reference data sources. If a valuation dispute arises, the protocol can trigger a deterministic check for mechanical errors or escalate to an intersubjective adjudication process governed by rules both parties accepted in advance. Because redistribution exists, the outcome can include automated remediation. This complements the move to real world onchain assets highlighted in Fidelity puts Treasuries on Ethereum.

- Oracles and market data

Oracles can use EigenCompute for pre processing and EigenVerify for settlement of outliers and manipulation claims. Instead of a single network with one size fits all economics, data providers can register AVSs with distinct integrity guarantees and slashing terms. A low latency feed might tolerate higher variance and rely on ex post dispute resolution with redistribution funding user coverage. A high integrity feed might slow slightly and use deterministic checks. In both cases, operators have a clear price for risk and users can select the guarantee they need.

- AI workloads

Enterprises piloting AI in regulated contexts hit two walls: explainability and verifiable process control. EigenCompute allows them to run models in controlled offchain environments while binding outcomes to slashing backed commitments. For example, a claims processor could commit to model version, training dataset hash, and review procedures. If an audit later finds deviations, the service is slashable and users are eligible for redistribution funded remediation. That is not a silver bullet for AI governance, but it is a credible path to operational assurance that standard clouds cannot natively provide.

How EigenCloud compares to Chainlink, Celestia or Avail DA, and rollup as a service

- Chainlink

Chainlink is the leading oracle and cross chain connectivity provider with mature networks for data delivery and messaging. It also offers offchain computation via tools like Functions and secure transport via CCIP. Chainlink’s model centralizes around specialized oracle committees with strong reputation, economic alignment through LINK, and, in some contexts, limited slashing. EigenCloud’s differentiation is scope and enforcement. It frames verification, computation, and settlement as first class services tied to explicit, AVS defined slashing and redistribution. That turns the dispute step into a programmable building block rather than an external process. For users who want a single network to do oracles, compute, and disputes with uniform cryptoeconomic treatment, EigenCloud is more of a platform than a plug in.

- Celestia and Avail DA

Celestia and Avail focus on data availability and consensus as modular base layers. They are excellent at scalable data publication and sampling. EigenCloud uses EigenDA for similar outcomes but continues past DA into verification and compute. That is not better or worse in the abstract. It is a different product boundary. Teams that want neutral DA with their own verification and compute stacks will pick Celestia or Avail. Teams that want DA plus built in dispute tooling and slash based enforcement can reduce integration work by starting with EigenCloud.

- Rollup as a service

RaaS providers package infrastructure and operations for teams that want their own rollups. They excel at developer experience, monitoring, and uptime. EigenCloud does not try to replace that operational layer. Instead, it provides primitives that RaaS providers can compose. A RaaS chain can anchor data to EigenDA, route fraud or validity disputes to EigenVerify, and outsource heavy offchain logic to EigenCompute with slashing attached. The net effect is to give RaaS users a path to enterprise style guarantees without building every cryptoeconomic subsystem themselves.

Why the August EigenPods patch matters beyond security

The August 29, 2025 EigenPods patch is notable not only because it prevented a potential exploit. It showed the company will run a public incident process with concrete timelines, impact statements, and customer guidance. That is the difference between protocols that are interesting to developers and platforms that pass vendor risk reviews. It also sets expectations for AVSs that want to sell into enterprises. If you anchor to EigenCloud’s primitives, you inherit the duty to disclose, patch quickly, and treat remediation as part of product, not only as an emergency response.

Risks and open questions

-

Operator concentration remains a watch item. If the same operators dominate many AVSs, correlation risk can turn a single incident into a multi AVS slash event. Operator set diversification and differentiated risk terms are needed.

-

Governance of intersubjective disputes will be stress tested. Enterprises will want predictable outcomes that map to legal agreements. The design of juries, appeals, and evidence standards will matter as much as cryptography, and policy alignment like the UK and U.S. crypto taskforce will influence adoption.

-

Redistribution is powerful but must be handled carefully. Who controls the redistribution recipient, how it is changed, and how conflicts are resolved will be key design points. Transparent playbooks will help avoid surprises when real money is involved.

-

Token composition risk is rising. As more assets become eligible for restaking, AVSs will need clear rules about what they accept and how they handle assets with different liquidity or legal profiles.

The enterprise read

EigenCloud’s 2025 pattern is what many buyers look for. A platform launch with capital behind it, a company level reorganization that focuses on shipping and support, a security patch executed on fast timelines, and a protocol road map that pushes real world guarantees into programmable form. None of that guarantees product market fit with enterprises, but it removes common blockers and sets the stage for credible pilots.

Q4 2025 metrics to watch

-

AVS launches and revenues

- Count the number of AVSs that go live with paying customers and publish revenue. Track how many anchor to EigenVerify and EigenCompute in addition to EigenDA.

-

Slash and redistribution events

- Monitor the frequency and size of slashes, plus who receives redistributed funds. Early patterns will show how AVSs price risk and how often remediation is used.

-

EIGEN staking share versus ETH and LST restaking

- Measure the composition of slashable security. A rising share of EIGEN staking relative to ETH and LSTs changes risk profiles and incentives.

-

EigenDA throughput in production

- Watch sustained data rates on mainnet deployments, not only benchmarks. Throughput tied to real rollups is a better signal for capacity planning.

-

Early enterprise pilots

- Look for named pilots in finance, data providers, and AI adjacent workloads that specify SLAs, dispute terms, and redistribution mechanics. These will indicate whether the platform’s value proposition survives procurement and legal review.

If these trend in the right direction by the end of the year, EigenCloud will have turned 2025 from a series of protocol milestones into proof that verifiability can be sold as a platform to traditional buyers. That, more than any single technical feature, is the pivot that matters.