Mt. Gox endgame: late September BTC flows and Q4 liquidity

Mt. Gox wallets stirred again in late September as the estate stages final distributions before the October 31, 2025 deadline. Here is how to track exchange inflows, derivatives, and on-chain signals to separate real sell pressure from market absorption across BTC, BCH, and the wider crypto complex.

What changed in late September

Mt. Gox-linked wallets moved again as September draws to a close. These latest movements are smaller and more surgical than the spring batches, but the intent looks similar: stage coins where payouts can be executed, then deliver to creditors in waves. The calendar matters now. The trustee has court approval to complete repayments by October 31, 2025, as spelled out in the official repayment deadline notice. With a fixed date in sight, every inbound to an exchange cluster and every hop between estate wallets takes on new meaning for liquidity.

This explainer focuses on the mechanics that matter over the next few weeks. We outline how to track exchange inflows and outflows, read derivatives positioning, and follow on-chain routing so you can parse what is real sell pressure and what the market can likely absorb. We also cover spillovers to BCH and the broader complex as Q4 begins.

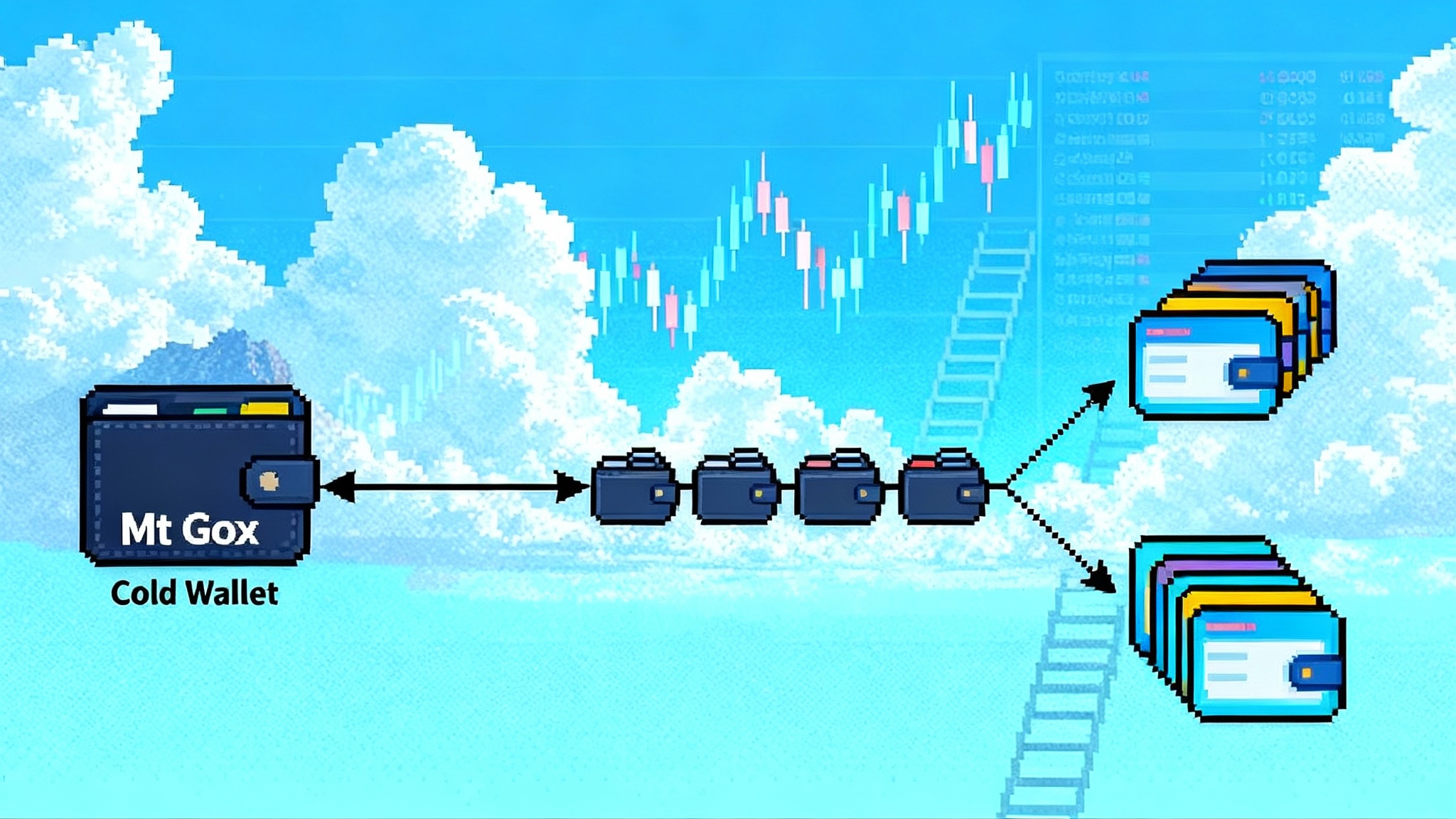

The on-chain trail: how coins move from cold to matching engines

The Mt. Gox estate has followed a consistent pattern when preparing distributions. It starts in deep cold storage, then funds move to intermediate change wallets, and finally to operational or exchange-facing wallets. In late September, on-chain watchers flagged fresh tranches from estate clusters to addresses that have previously interacted with distribution partners. The hops themselves are not proof of imminent selling. They are best viewed as staging: coins get parked where operational teams can batch transactions, run final checks, and align with payee instructions.

A few routing details help interpret the next moves:

- Change wallet loops: If you see coins ping between a small set of labeled wallets before any exchange deposits appear, the estate is likely consolidating UTXOs to a cleaner set. Consolidation is normal before mass payouts.

- Small test sends: Tiny amounts sent to exchange clusters often precede larger movements. These test the path and fee settings.

- Batching cadence: Clusters of similar-sized transactions in a short window suggest automation. If those land at exchange deposit clusters, you can expect follow-through later that day or week.

Through that lens, the late September activity looks like final distribution staging rather than urgent liquidation. The estate has used this playbook before.

A look back at spring for context

In March, the estate executed several large transfers that did not translate into immediate market stress. One batch, reported at the time as the third large movement that month, illustrated how the trustee rotates coins through change wallets and operations addresses before any exchange interaction. For a refresher on that cadence, revisit coverage of the third large March transfer.

The lesson from March was simple. When coins move to staging wallets, price does not need to move much. Price reacts when those coins cross the line into order books, and even then the effect depends on background liquidity, hedging, and demand.

How much sellable supply is this, really

The headline BTC still controlled by the estate is a gross figure. Traders should care about net sellable supply in a given window. To get there, parse three filters:

-

Repayment mix and method: A meaningful share of creditors elected to receive crypto, not just fiat. Coins delivered as BTC or BCH do not need to hit exchange order books if the recipient parks them in self-custody. That path creates no immediate sell pressure.

-

Creditor cohorts: Early claim sellers, funds that bought claims at a discount, and long-time Bitcoiners have different incentives. Claim buyers may monetize faster but are also sensitive to tax treatment and liquidity windows. Native Bitcoiners often hold. Cohort behavior narrows the portion likely to sell at market.

-

Execution rails: Distributions routed through custodial partners and select exchanges can be offset by liquidity providers that plan to take the other side. That turns what looks like gross supply into a negotiated OTC-style transfer that barely touches the public tape.

When you apply these filters, the scary headline stock becomes a much smaller flow. The late September routings are consistent with this. They are designed to convert a large stock into many controlled drips.

Exchange data to watch in October

You do not need proprietary tools to infer whether staged coins are becoming real sell pressure. A simple checklist of public signals will carry most of the load. If you are setting up a dashboard for this, see our timely crypto reporting workflow.

- Netflows and their shape: Track exchange net position change on the largest BTC venues. If you see a sharp, one-day spike in multi-venue net inflows that lines up with known Gox routes, that is a sign distributions are ready to hit books. If netflows rise, then reverse the next day while price holds, that often signals internal crossing or OTC absorbs the flow.

- Taker buy minus sell volume: Rising net taker buy volume into an inflow spike means the market is absorbing. Rising net taker sell volume into the same spike means supply is pushing through bids.

- One percent order book depth: Look at cumulative bids and asks within 1% of mid on top USD and USDT pairs. If bid depth thickens on inflow days, market makers are stepping in. If both sides thin, dealers are defensive.

- Stablecoin creation and destruction: New USDT or USDC issuance around the same time as exchange inflows can signal fresh buying power. For background, review the stablecoin issuance context.

- ETF primary activity and creation baskets: If US spot ETFs see consistent creations while exchange inflows rise, some of the Gox coins can be absorbed indirectly through authorized participants hedging and sourcing supply. For the rulemaking backdrop, see ETF rules and plumbing.

Read these together, not in isolation. A single big inflow is not decisive without context from taker flow and depth.

Derivatives positioning and hedge plumbing

A second layer of signals comes from perps, futures, and options. Here is how to combine them with spot flows:

- Perp funding rates: Neutral or mildly negative funding into spot inflows tells you the market is not aggressively long. That is a healthier backdrop for absorption. Strongly positive funding with high open interest into inflows can force long liquidations if supply actually hits books.

- Open interest distribution: Watch whether BTC open interest is stacked on perps or longer-dated futures. A market dominated by short-dated perps is more fragile when large spot flows arrive. If more OI sits on dated venues like CME, you often see cleaner hedging against expected supply.

- Futures basis: A widening positive basis while netflows rise signals buyers are carrying risk forward. A compressing basis or flips to slight backwardation during inflow windows suggest dealers are leaning short to stay balanced.

- Options skew and vol term structure: A rise in downside skew and a kink in short-dated implieds into inflow days tells you hedgers are paying for protection against near-term sells. If skew normalizes quickly after a transfer day, it means the market believes the flow was handled.

Put simply, friendly funding, moderate basis, and contained skew are your green lights. Stressed funding, flat or negative basis, and jumpy short-dated vol are the yellow lights.

Where BCH fits and why it matters

Repayments include BCH as well as BTC. BCH liquidity is thinner, and order books are more sensitive to large batches. That creates two practical effects:

- Cross impact: If BCH sees sharp exchange inflows around the same time as BTC, the BCH-BTC cross can widen temporarily. Dealers that hedge BCH risk with BTC may sell BTC into strength, creating a small drag on BTC even if BCH is the primary pressure point.

- Venue concentration: BCH books are concentrated on a handful of exchanges. A single venue inflow in BCH can move the market more than the same notional in BTC. Track BCH netflows by venue, not just aggregate, and watch cross-venue arb spreads.

If you trade BCH around these windows, widen your slippage assumptions and watch maker inventory behavior on the books.

Absorption mechanics: who buys and how

Not all buying looks the same. The identity of the absorber shapes the price path:

- Market makers and HFT: They step in first, quoting wider spreads but still providing continuity. Their participation shows up as thicker near-touch depth and mean-reverting microstructure on inflow days.

- OTC desks and principal liquidity: If desks are pre-wired to take coins off exchange deposits, most of the volume gets internalized. You will see high reported exchange inflows with muted prints and steady price.

- Real money and ETF ecosystem: When authorized participants create ETF shares into weakness, they indirectly pull supply off the market. That shows up as ETF creations on or shortly after inflow days, modest basis support on dated futures, and stabilization of price.

- Retail and momentum funds: This cohort is the least reliable absorber during headline events. If they lead the tape, expect more whipsaws.

The late September routing suggests the estate prefers a balanced mix of OTC rails and exchange prints. That keeps execution risk low while still leveraging public venues for transparency.

Practical playbook for the next moves

Use this checklist in October as transfers progress:

- Confirm a wallet hop is distribution-related: Look for repeats of known estate change wallets and operations wallets before any exchange address appears. A new address that quickly receives multiple estate inputs often becomes part of the staging path.

- Map exchange clusters: Identify hot wallets for the likely distribution venues. If a tranche hits those clusters, watch for equal-sized downstream sends to internal deposit schemes. That pattern usually precedes crediting creditor accounts.

- Pair netflows with taker flow and depth: Treat a spike in net inflows as noise until you see taker sell volume rise and bid depth thin at the same time. Only then does it become confirmed sell pressure.

- Cross-check derivatives: If funding flips negative while price holds and netflows are high, the flow is being absorbed. If funding stays positive, basis compresses, and price slips on heavy net inflows, lighten risk.

- Watch BCH separately: A BCH inflow burst can distort BTC for a few hours. Keep an eye on BCH order book depth and the BCH-BTC cross before assuming BTC weakness is Gox-driven.

- Respect time zones: Operational teams often batch during Asian or European hours. If a tranche lands in Asia's morning session, the real impact can arrive when US liquidity wakes up.

Scenarios into the October 31 deadline

Here are the clean scenarios traders should underwrite for Q4:

- Baseline staged absorption: The estate continues late September staging, with periodic exchange cluster inflows that are quickly offset by OTC counterparties and market makers. Spot ETFs see modest creations on down days. Funding is neutral to slightly negative. Price trades choppy but resilient. BCH underperforms on inflow days but recovers between batches.

- Short squeeze on fear: Headlines around a large wallet hop trigger preemptive shorting. Actual exchange prints are smaller than expected, and taker buy volume overwhelms. Funding flips positive to negative in a day, and basis widens afterward. BTC grinds higher as the market realizes absorption outpaces supply.

- Illiquid window shock: A tranche hits during a thin hour or around a macro print. Bid depth is light, funding is already rich, and open interest is heavy in short-dated perps. Price overshoots lower for a session, then stabilizes as desks run inventory into the hole. BCH sees wider relative moves in this case.

- One-and-done batch: The estate executes a larger than expected final batch into a partner venue, then pauses. Exchange netflows show a single day spike followed by negative netflows as coins are pulled back into cold or moved off exchange. Price impact is brief.

The first scenario is the most likely given how the estate managed flows earlier in the year. The late September cadence tracks with staged absorption rather than forced selling.

Reading sentiment without taking the bait

The story writes itself on social platforms whenever a headline says Mt. Gox moved coins. Yet the market has learned to separate wallet shuffles from sell intent. Use these sentiment filters to avoid false alarms:

- Anchor to data, not screenshots: Label quality varies across explorers. Favor addresses that have been confirmed by repeat patterns and prior distribution traces.

- Require two signals: A wallet hop plus exchange net inflow is one signal. Add taker sell dominance or basis compression before you adjust risk.

- Mind the calendar: The final deadline is public. If a wallet hop occurs weeks before a key date, it is probably staging. If it occurs within hours of known payout batches, then it deserves more attention.

- Track realized impact, not imagined: If price is flat and spreads are normal while net inflows appear elevated, the flow is being crossed or offset. Do not front-run a selloff that is not showing up in the tape.

What to expect for BCH and the rest of crypto

BCH will likely experience outsized percentage moves on distribution days because of thinner books and venue concentration. Watch the BCH perpetual funding rate and the BCH-BTC cross for early tells. For the broader market, the key variable is whether BTC absorbs without dragging aggregate liquidity lower. If BTC holds a stable basis and funding stays near flat, altcoin beta should remain intact outside of brief risk-off gusts during headline windows.

A larger takeaway is that controlled supply events can coexist with constructive market structure. March's experience showed that prepositioned liquidity, ETF demand, and options hedging can digest even large tranches without breaking trend. The late September flows point to a similar backdrop heading into Q4.

Bottom line

Mt. Gox is moving closer to the finish line. Late September wallet activity looks like final staging for distributions before the October 31, 2025 deadline, not a scramble to dump coins. The signals that matter are the ones that tie together. Exchange netflows must align with taker flow, depth, and derivatives stress before any move counts as real sell pressure. BCH will wobble more than BTC on inflow days, but the system has handled larger waves already this year.

Keep your eyes on the routing, measure absorption with a simple checklist, and let the market tell you when supply is real. If the data rhyme with spring, Q4 will be a test that the market is ready to pass.