Inside the UK–U.S. Crypto Taskforce and the Road to 2026

London and Washington just stood up a joint taskforce to align crypto rules and capital markets plumbing. Here is what coordinated workstreams could mean for cross-border listings, stablecoin passports, custody recognition, and faster ETP approvals by the 180-day checkpoint.

What just changed

On September 22, 2025, London and Washington launched a joint Transatlantic Taskforce for Markets of the Future with a clear brief: propose ways to deepen capital-markets links and coordinate digital-asset rules, then report back within 180 days. The mandate runs through the existing UK-U.S. Financial Regulatory Working Group channel and explicitly includes near-term collaboration on crypto and longer-term work on wholesale digital markets. You can read the UK announcement of the taskforce.

That single decision set a countdown clock to late March 2026. Between now and then, both countries will test how far they can move together without rewriting each other’s laws. Expect pragmatic bridges, not grand treaties.

Why Q4 2025 to 2026 matters

The calendar is packed with practical catalysts:

- The United States now has a federal stablecoin framework following the July 18, 2025 signing of S. 1582. That creates a national baseline for reserves, disclosures, and supervision of dollar-pegged tokens and helps frame the U.S. stablecoin reset.

- The UK is mid-stream on its own regime. Regulators are moving from discussion papers to formal consultations on stablecoin issuance, custody, prudential rules, and a market-abuse regime for crypto. Most UK rules will phase in through 2026, with an authorization gateway for firms opening next year.

- Market pipes are shifting. The SEC is streamlining crypto ETF approvals, a trend reinforced when SEC clears generic ETP rules. The FCA has signaled an end to its retail ban on crypto ETNs from October 8, 2025. That turns London into a more competitive ETP venue just as U.S. issuers look to broaden offerings.

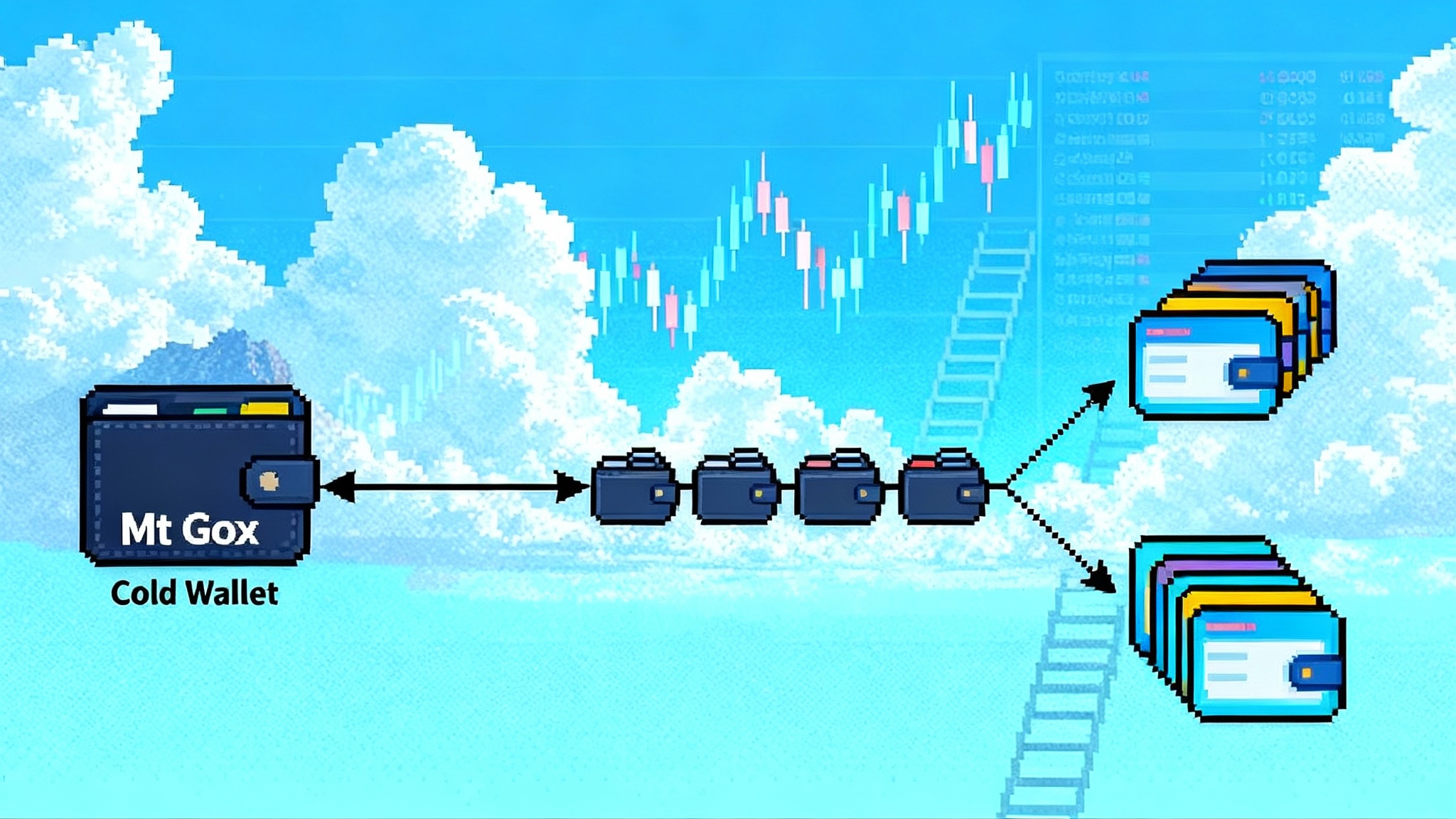

- Banks on both sides are re-entering digital-asset custody and tokenization. U.S. banking agencies have clarified the perimeter for safekeeping and certain blockchain activities, while the UK is drafting CASS-style controls for crypto custody and prudential guardrails for stablecoin issuers. Tokenized cash and securities rails are also accelerating, as seen in the Treasuries on Ethereum move.

Put together, the taskforce arrives at a rare alignment of policy windows. It can turn individual domestic steps into a coherent transatlantic pathway if it tackles the right workstreams first.

The four workstreams that matter most

1) Cross-border listings and secondary trading

The problem

- Companies with crypto exposure and crypto ETP issuers face friction when moving between New York and London. Prospectus formats differ. Audit and continuous-disclosure expectations diverge. For crypto ETPs, custody, valuation, and market-abuse controls are not mapped one-to-one.

What the taskforce could do

- Create a mutual recognition checklist for issuers moving a primary listing or executing a dual-track between U.S. and UK venues. This does not require law changes; it is a mapping tool regulators can endorse through guidance.

- Align market-abuse concepts for crypto markets. The UK’s coming MAR-for-crypto approach and the U.S. anti-fraud and manipulation standards can be made interoperable via a shared taxonomy of abusive behaviors, reporting triggers, and cross-platform surveillance protocols.

- Define a transatlantic playbook for crypto ETPs. That would cover valuation at NAV, basket creation and redemption mechanics, treatment of forks and airdrops, and minimum standards for on-chain surveillance by authorized participants.

Practical outcome by March 2026

- A cross-border listings manual with side-by-side requirements, plus a supervisory MoU that lets exchanges and regulators share surveillance data quickly when a product trades in both markets.

Who benefits first

- U.S. ETF issuers with UK ambitions and UK ETP sponsors seeking U.S. distribution. London also regains relevance for tech and fintech listings that want crypto exposure without regulatory whiplash.

2) Stablecoin passports that travel safely

The problem

- Issuers today navigate two different gateways: a U.S. federal regime for payment stablecoins and a phased UK framework with separate tracks for systemic coins and everything else. A dollar stablecoin that is perfectly fine in the U.S. might still face delays or uncertainty in the UK, and vice versa.

What the taskforce could do

- Build a passport-by-equivalence for payment stablecoins. If an issuer meets the U.S. statutory standards on reserves, disclosure, redemption, and supervision, the UK could permit distribution for specified use cases subject to UK additions such as local safeguarding and complaints handling. The reciprocal path would apply to UK-authorized non-systemic coins.

- Specify reserve asset equivalence. For example, accept U.S. T-bills and overnight reverse repos as high-quality liquid assets on both sides, with consistency on concentration limits and custody segregation.

- Harmonize redemption windows. Converge on T+1 or T+2 cash redemption to reduce basis risk for market makers operating in both markets.

- Pre-agree how to escalate when a coin becomes systemic in the UK. The Bank of England could trigger higher standards and temporary holding limits while preserving cross-border operability.

Practical outcome by March 2026

- A joint policy note that sets the criteria for a basic passport, outlines the application path for issuers, and lists the conditions that void the passport. The U.S. anchor for this work is the GENIUS Act stablecoin law; the UK anchor is the FCA-BoE split between systemic and non-systemic coins and the upcoming custody and prudential rulebooks.

Who benefits first

- Large dollar-pegged issuers with institutional programs. Cross-border commerce platforms and tokenized-securities venues gain a stable settlement rail that works in both jurisdictions without bespoke legal plumbing per client.

3) Onshore custody, clean chains of control

The problem

- Institutions want the simplicity of a single custodian across both markets, but regulators prefer local accountability. Sub-custody chains today create operational risk and slow incident response.

What the taskforce could do

- Publish a shared assurance pack for crypto custody. That would standardize controls around key management, segregation, rehypothecation bans, operational resilience, and incident reporting. It should map to existing bank custodial standards and to UK client-asset protections.

- Enable fast recognition of qualified custodians. A U.S. bank meeting crypto custody standards could rely on that status to serve UK ETPs and exchanges via a UK-regulated sub-custodian, and vice versa, without starting from zero on audits and penetration tests.

- Define a joint approach for staking and protocol interactions. Where staking is not permitted inside a product, set clear prohibitions. Where it is permissible at the protocol level for network security, define consent and disclosure standards so that neither side treats it as hidden activity.

Practical outcome by March 2026

- A model supervisory questionnaire for crypto custody with a transatlantic stamp of approval, plus a fast-track process for recognizing each other’s qualified custodians.

Who benefits first

- U.S. ETFs and London ETPs that want diversified custody outside a single U.S. crypto-native provider. Global banks re-enter the field with clearer rules and scalable vendor frameworks.

4) Exchange and ETP approvals that move at market speed

The problem

- Product approvals and rule changes still take too long relative to crypto’s cycles. Divergent disclosure templates and surveillance expectations add days or weeks to each filing.

What the taskforce could do

- Post a joint template for crypto ETP prospectuses and listing rules. Cover fork policy, wallet segregation, chain reorg handling, oracle dependencies, and emergency delisting criteria.

- Synchronize review clocks. If both sides are working from the same checklist, the agencies can open and close comment windows in parallel, reducing launch gaps that create cross-venue arbitrage.

- Coordinate on index methodologies. Agree what constitutes an investable crypto index for diversified products, including liquidity screens, exchange eligibility, and exclusion policies for sanctioned or high-risk assets.

Practical outcome by March 2026

- A live, public checklist and database of approved methods and control standards. Exchanges and issuers can reference that library to cut iteration cycles.

Who benefits first

- U.S. ETF shelves looking to add new coins or index products in Q4 2025 and London venues targeting professional and now retail flows into ETNs. Tokenized-securities platforms also gain from faster approvals for collateralized on-chain instruments.

Winners in the first wave

- U.S. ETF complexes. They already have distribution and brand. If review clocks shrink and custody recognition improves, they can extend beyond bitcoin and ether and list mirror products abroad with less friction.

- London’s professional and retail ETP market. With the retail ETN gate opening in October 2025 and clearer custody standards, London can recapture some of the flows that migrated to U.S. spot ETFs. Fee competition should intensify.

- Tokenized-securities venues. A shared view on stablecoin reserves and settlement finality makes on-chain T+0 delivery-versus-payment more credible for private credit, funds, and short-term paper. Expect pilots to scale in 2026.

The friction points that will not vanish overnight

- AML harmonization for crypto-native flows. The two countries both apply the Travel Rule and expect robust KYC, but details differ on wallet screening thresholds, sanctions list synchronization, record-keeping, and treatment of privacy-enhancing tools. Bridging those gaps requires joint typologies and safe-harbor testing, not just policy statements.

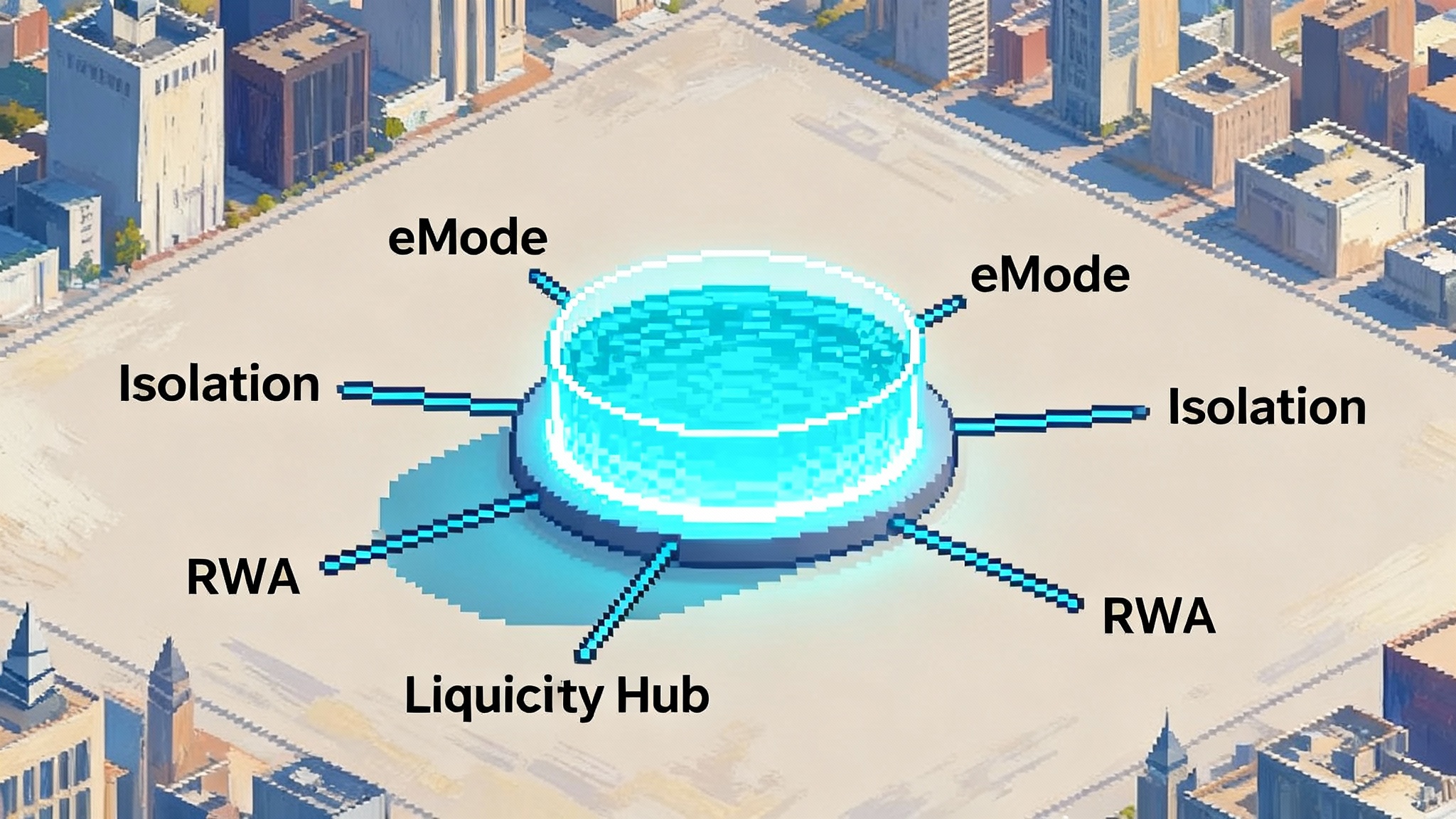

- DeFi treatment. Neither side has fully answered how to supervise activities when there is no centralized intermediary. The taskforce can at least define when front-end operators, sequencers, governance token holders, or key devs are in scope, and when a protocol is sufficiently decentralized to fall outside existing licensing. For broader context on market structure shifts, see Aave V4’s hub and spoke reset.

- Data-sharing and privacy. Real-time cross-border surveillance entails moving sensitive data. The UK’s data-protection regime and the U.S. patchwork of federal and state privacy rules do not align perfectly. Expect phased approaches, with hashed identifiers and verifiable credentials used to minimize personal data transfers.

- Market abuse enforcement across chains. On-chain manipulation often spans multiple venues and bridges. The taskforce should back a shared library of abusive patterns and an encrypted tipline for cross-jurisdiction alerts, but legal evidence standards will still diverge.

- Tax reporting. Differences around the definition of a broker and reporting of cost basis for on-chain events will continue to create compliance complexity for cross-border investors until guidance is updated in both markets.

The 180-day checkpoint: what to watch by March 2026

Set your calendar to the week of March 23 to 27, 2026. By then, look for three things that signal real progress:

- A joint workstreams charter

- A published document listing scope, owners, milestones, and how industry feedback was used. Expect separate annexes on stablecoin passports, custody recognition, and ETP templates.

- Two pilot bridges

- A limited stablecoin passport pilot with at least one U.S. issuer and a UK distribution partner using agreed reserve attestations and T+1 redemption.

- A cross-exchange market-abuse data pilot for a crypto ETP that trades in both countries, with shared alerts and synchronized incident protocols.

- Decision notes on thorny topics

- A short policy note on DeFi scoping and when an interface operator becomes a regulated intermediary.

- A statement on data-sharing safeguards, including the use of verifiable credentials and audit trails for regulator-to-regulator queries.

If all three appear, the taskforce will have moved beyond symbolism into implementation.

How industry should prepare now

-

Issuers and ETP sponsors

- Pre-draft dual-use disclosures. Write fork, airdrop, and oracle policies that satisfy both U.S. and UK reviewers. Include your chain surveillance vendor’s methods and escalation thresholds.

- Align creation and redemption mechanics with custody segregation you can prove on chain. Rehearse emergency procedures for chain halts and reorgs.

-

Stablecoin issuers

- Map reserves to a shared high-quality-asset universe and publish monthly attestations that match both jurisdictions’ expectations. Build T+1 redemption capacity to remove basis risk for cross-border market makers.

- Prepare UK safeguarding and complaints policies even if you are U.S.-based. Assume you will need a UK establishment or supervised agent for consumer-facing activity.

-

Banks and custodians

- Build a transatlantic assurance pack. Combine key-management controls, SOC reports, physical security layouts, and incident-response runbooks into a single dossier that satisfies both sides.

- Design your sub-custody chain to minimize hop count and clarify who controls keys at each step. Contract for data-sharing with exchanges in both markets.

-

Exchanges and trading venues

- Upgrade on-chain surveillance and cross-venue alerting. If you list the same product in both markets, plan for synchronized trading halts and resumption protocols.

- Adopt a common taxonomy for abusive behaviors and share your taxonomy with regulators early to cut approval time.

-

Tokenized-securities platforms

- Pilot with regulated stablecoins for DvP and prove settlement finality with legal opinions in both jurisdictions. Start with short-dated assets where redemption windows match.

Scenarios for Q4 2025 through 2026

-

Baseline

- U.S. ETFs expand cautiously beyond bitcoin and ether. London ETNs attract new retail flows from October. A passport pilot launches for one or two dollar coins with tight conditions. Custody recognition begins via bilateral examiner letters. By March 2026, a charter and two pilots are public, with broader rollout in the second half of 2026.

-

Accelerated

- The SEC and FCA align checklists and synchronize review clocks for crypto ETPs. Multiple altcoin index products debut on both sides before year end. The stablecoin passport extends to more issuers with standardized reserve attestations, and banks re-enter crypto custody at scale. Tokenized repo and short-term credit see real volumes.

-

Dragged feet

- AML disagreements over privacy tools and mixer exposure slow the passport. DeFi scoping remains unresolved. Data-sharing MOUs stall on privacy concerns. Both markets still move, but without the convenience of mutual recognition, leading to duplicated compliance and slower product timelines.

The bottom line

The taskforce has 180 days to prove that the two most important markets for digital assets can align without waiting for perfect global consensus. If it delivers a clean cross-border listings map, a workable stablecoin passport, recognized custody standards, and a synchronized ETP checklist, 2026 will look very different for crypto capital markets. The winners will be the firms that build to those emerging standards now, while the rules are still being written in pencil.