Plasma’s Mainnet Lands: Gasless USDT and a Neobank Inside

Plasma launches its EVM chain with XPL, zero fee USDT transfers, and Plasma One, a built in neobank. If it scales, on chain payments could jump in emerging markets and push wallets, exchanges, and L2s to compete on user experience by 2026.

The breakthrough: dollars that move like messages

Plasma’s mainnet beta is live with its native token XPL, promising something people actually understand and want. You can send digital dollars without paying a network fee, then save, borrow, and spend those dollars through a built in neobank experience. The team calls it a stablecoin native layer 1, and it launched with a war chest of stablecoin liquidity and more than 100 integrations. The first high stakes claim is simple and verifiable: zero fee USDT transfers for simple sends through Plasma’s own interface at launch, plus an EVM compatible chain that aims to feel familiar to anyone who has built on Ethereum. See the project’s announcement for dates, features, and launch mechanics in plain language: Plasma mainnet beta and XPL details.

Think of it like this. If moving money on blockchains has felt like paying a toll at every turnstile, Plasma is trying to open an express lane for the most common trip: send dollars from A to B. Toll booths still exist for complex actions like deploying contracts or using advanced apps, but the day to day transfer of stablecoins is where most people start. Plasma wants that first step to be free, fast, and simple. For a payments focused L2 perspective, see our take on Unichain MEV aware L2.

What “gasless USDT” actually means

Gasless does not mean costless. Someone must pay the network. Plasma covers fees for simple USDT sends made through its official dashboard by sponsoring those transactions. In practice, the chain uses a consensus design that targets very low base fees, then a sponsorship layer handles the rest for eligible transfers. If you do something more complex than a basic send, you still pay gas, typically in XPL or potentially via auto conversion from a supported asset.

For users, the result is straightforward. You open the Plasma app, select a contact or paste an address, enter an amount in USDT, and hit send. The recipient sees dollars arrive in seconds. There is no separate step to top up a little native token just to make the transfer work. That small detail matters. It removes one of the most frustrating roadblocks for first time crypto users who discover that holding a token is not enough. They also need gas. Here they do not, at least for the most common action.

Two constraints are worth noting up front:

- The zero fee experience applies to simple transfers. Power users who want to swap, lend, bridge, or deploy still pay.

- The sponsorship budget is finite. Plasma must sustain it with economics that make sense after the launch moment.

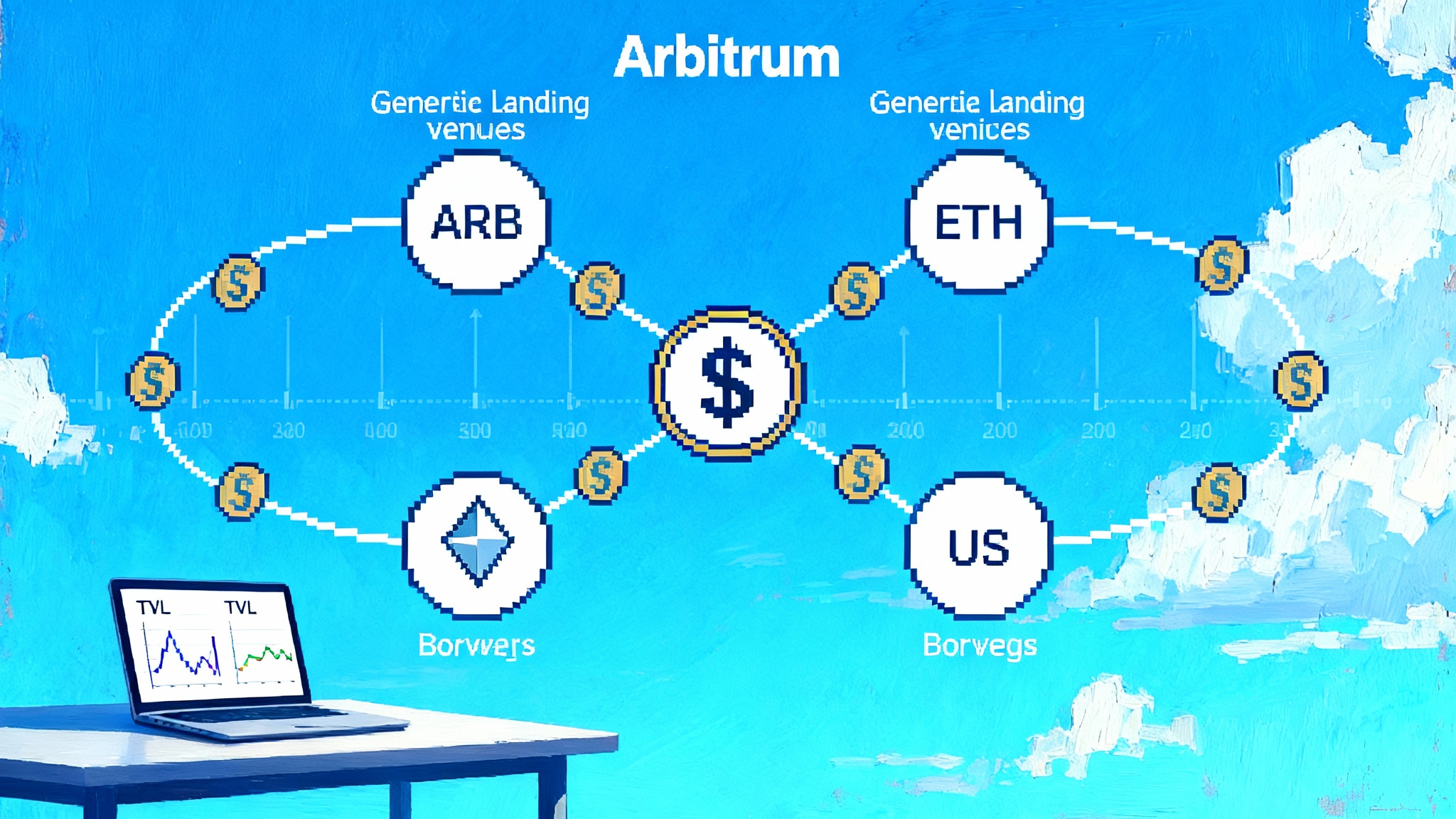

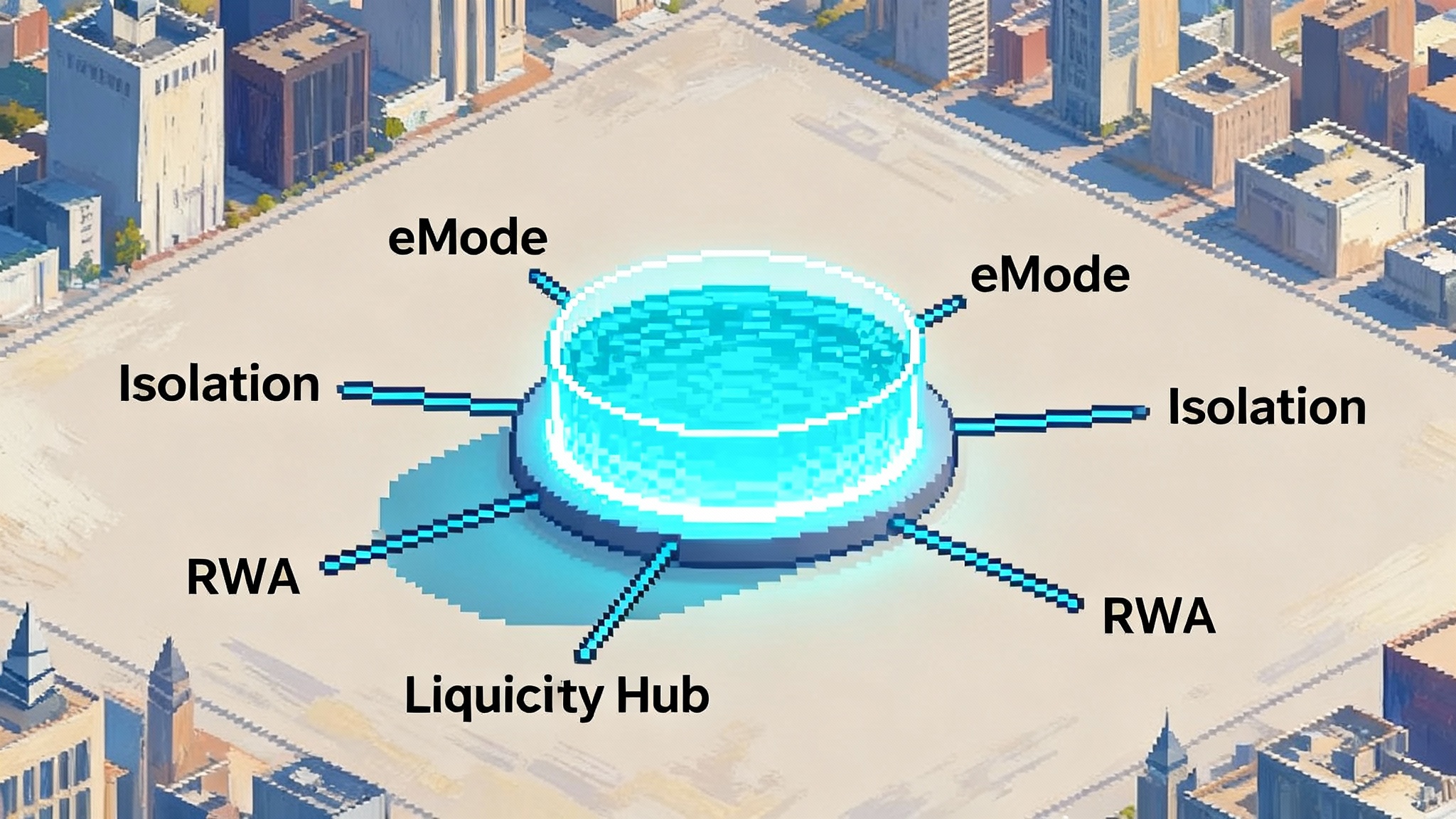

EVM compatibility without translation costs

Plasma is fully compatible with the Ethereum Virtual Machine. That means Solidity contracts port directly. Tooling like MetaMask, Hardhat, Foundry, and common libraries should work with minimal changes. For teams on other chains that already run EVM code, the move is less like a migration and more like adding a new deployment target.

In practical terms, that matters for two groups:

- Consumer apps can chase growth without rewriting their stack. If a wallet or savings app already supports EVM chains, adding Plasma should be a short sprint.

- Liquidity venues can extend stablecoin markets quickly. If market makers and lending protocols can plug in with familiar contracts and infrastructure, depth follows, and depth reduces slippage for everyday payments.

The neobank inside the chain

Alongside the base layer, Plasma introduced Plasma One, a consumer app that functions like a neobank for digital dollars. It promises a few core features: local on and off ramps through partners, card rails where available, rewards to nudge usage, and peer to peer cash networks in markets where cards are rare. The pitch is that you should not need to learn DeFi jargon to save and spend a stablecoin balance. For context and original reporting, see Plasma One neobank rollout.

Why this matters: chains rarely control the full journey from deposit to purchase. Users bounce between a wallet, an exchange, a bridge, and a bank account. Plasma One collapses these hops into a single experience. If the ramps are real and the service is trusted, day one usability improves by an order of magnitude.

The emerging market test

The bold claim is that this product market fits best in places where people want dollars more than they want crypto exposure. Consider three everyday situations:

- A freelancer in Lagos gets paid in USDT by a client in London. Today she faces volatile fees and confusing steps before she can spend locally. A gasless dollar send lowers the friction at the point of receipt. If Plasma One’s local partners can provide fiat cash out or a merchant card, the last mile is in reach.

- A shop owner in Buenos Aires keeps pesos for rent but prefers to save in dollars. If stablecoin savings pay a modest yield and card acceptance improves, he can hold dollars and still run the business without constant currency conversion.

- A remittance sender in Manila needs predictable costs and fast settlement. A zero fee stablecoin transfer plus a low spread off ramp can beat both wire delays and high retail remittance fees, especially for smaller ticket sizes where fixed costs are painful.

These examples rely on two prerequisites: reliable cash out and merchant acceptance. Plasma’s integrations and Plasma One’s local infrastructure will be the decisive factor. Without them, a free on chain send solves the first mile but strands value at the edge.

Why wallets, exchanges, and L2s should care

A network that normalizes free dollar sends reframes user expectations almost overnight. If Plasma’s approach sticks, it pressures incumbents to change three things by 2026.

- Gas and fees become invisible

- Wallets will need to sponsor routine transactions or let users pay fees in the asset they already hold. Account abstraction paymasters and trusted relays are not optional if someone else can make transfers feel free.

- Exchanges and custodians will need low friction internal USDT transfers and free withdrawals to preferred networks for verified users. If Plasma offers this at the network layer, centralized platforms will face a choice: eat the fee or risk churn.

- On chain identity and contacts replace addresses

- If sending money is as common as messaging, people expect names, not hex strings. Wallets will need simple naming systems, safe address books, and fraud flags. If Plasma’s native app sets that norm, third party wallets will copy it or get left behind.

- Ramps and merchant tools become core features

- Plasma One ships with ramps and card support where available. Competing wallets and layer 2 networks will need to meet the user where they are. That means local fiat partners, simple invoicing, and merchant settlement that lands as dollars, not volatile tokens.

The accelerationist case

Stablecoins are already the most used crypto product for everyday finance. If you remove gas requirements for the most common action and ship a consumer app that feels like a bank account, adoption can jump quickly. The network effect is straightforward: more users bring more merchants, more merchants justify deeper on chain dollar markets, and deeper markets lower borrowing costs for working capital and pay later products. This flywheel can move faster on a chain that is designed for the job rather than retrofitted through complex adapters. Related developments in fiat linked rails, like our note on USDC refunds and Arc analysis, point in the same direction.

There is also a capital allocation angle. Developers often spend months smoothing over rough edges in fee handling, token approvals, and bridging. An EVM chain with a subsidized first action and native ramps lets teams move budget from plumbing to product. That accelerates iteration and often results in better consumer features.

The risks you cannot hand wave away

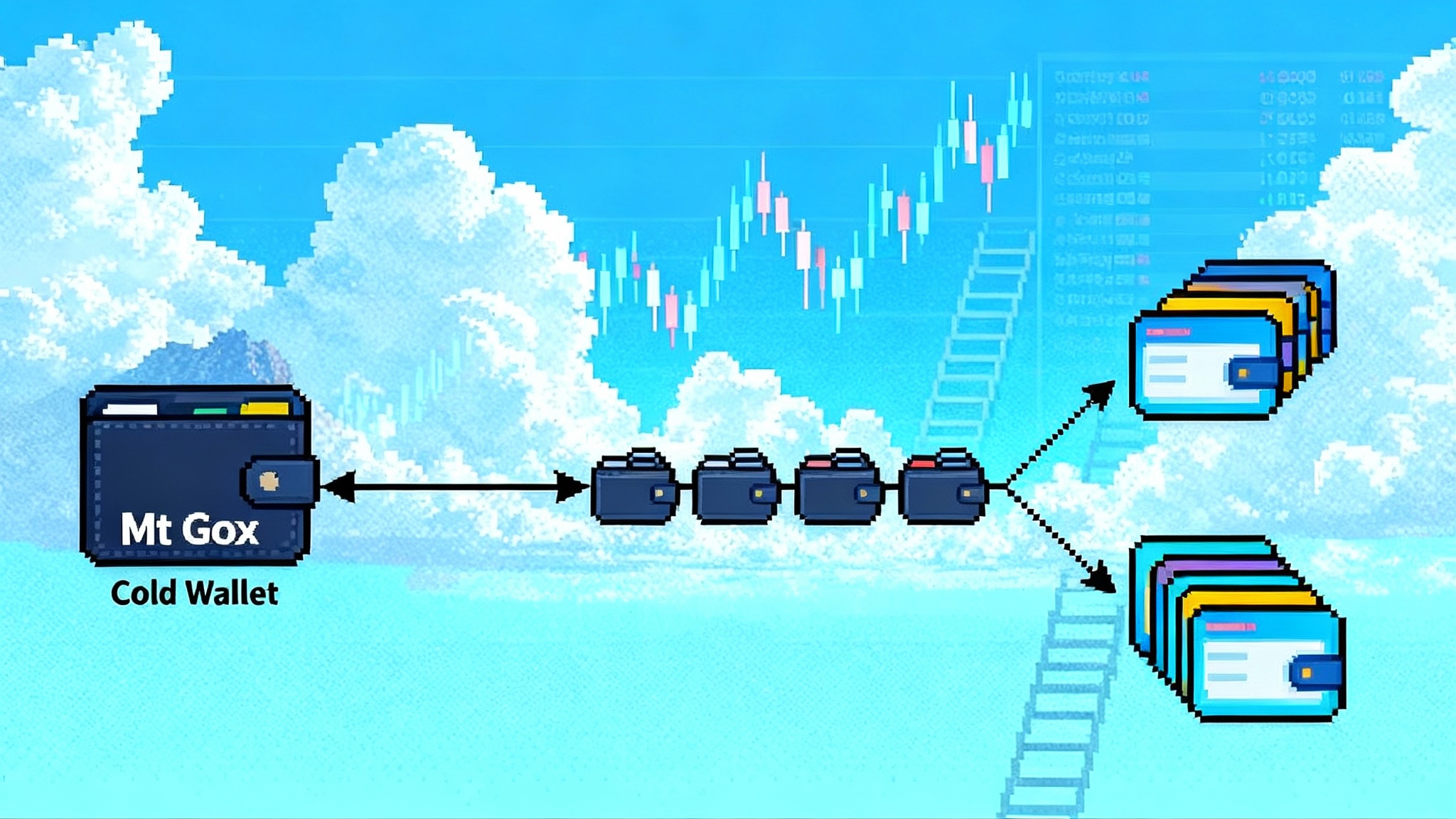

- Tokenomics and sustainability

- A sponsorship budget must be funded by durable revenue. If zero fee transfers depend on emissions or short term marketing funds, the free lane turns into a toll road when the campaign ends. Watch whether XPL incentives are used to mask true costs, and whether value accrues to the gas token in a way that outpaces dilution.

- Centralization and governance

- If validators are concentrated or controlled by a small group, gasless sends can be switched off or throttled. Likewise, adding or removing sponsored assets becomes a policy decision. The governance process, the distribution of stake, and the presence of independent operators matter as much as throughput numbers.

- Regulation and bank like obligations

- A neobank experience invites bank like scrutiny. Know Your Customer and Anti Money Laundering controls will shape where Plasma One can operate and which features arrive in which countries. Partnerships with regulated ramps are a strength, but also a bottleneck if counterparties pull back or rules change. Recent policy moves such as the UK U.S. crypto taskforce illustrate the direction of travel.

- Security and abuse

- If sending is free, abuse is cheap. Systems must detect spam, dusting, and fraud. Rate limits, behavioral thresholds, and challenge mechanisms need to be visible and accountable. Users will not forgive a free transfer that never arrives because an automated filter flagged it incorrectly.

The 90 day scoreboard that will tell us if it sticks

To cut through the noise, track these metrics from day 1 to day 90.

- Active users that actually transact: Daily and monthly actives for non custodial addresses that send or receive USDT, not just wallets that connect. Growth should be steady after the first airdrop week.

- Stablecoin velocity on Plasma: Daily USDT transfer volume divided by average USDT balance on the chain. A higher ratio indicates money is moving, not just parked for points.

- Off ramp coverage by country: Count the number of live cash out or card partners per market, plus average spread to mid market FX. Without coverage in key corridors, activity will cluster among traders rather than households.

- Fee sustainability: The sponsorship burn rate versus protocol revenue. How many gasless transfers are funded per dollar of network income. Ideally this trend improves as scale grows.

- Developer adoption: Number of unique contracts deployed by external teams, plus share of transactions initiated by third party apps. If Plasma One is the only driver, the ecosystem is fragile.

- Reliability: Median time to finality, transaction inclusion failure rate, and customer support response times for Plasma One. Payments are judged on consistency more than peak speed.

What competitors should do now

Wallet teams

- Ship fee abstraction. Let users pay with what they hold and sponsor common actions like first send and first swap. Use per user budgets and abuse detection so the model does not get gamed.

- Build contact lists with verification. Names, profile signals, and risk warnings must sit one tap away from send.

- Integrate local ramps deeply. Partner with providers that can settle to bank accounts, mobile money, and card top ups. A seamless last mile beats a slick on chain experience that ends at the cash out step.

Exchanges and custodians

- Offer free or low fee USDT withdrawals to at least one fast network and make it the default for small transfers. People will notice the difference.

- List and support Plasma if demand materializes, but gate that on objective metrics: off ramp coverage, security reviews, and sponsor program transparency.

Layer 2 networks

- Treat payments as a product, not a side effect. Add stablecoin paymasters, reduce signature and approval steps, and consider partial sponsorships for verified users.

- Focus on merchant tools. Instant settlement in dollars, low risk working capital lines, and automated reconciliation can defend against specialized payment chains.

How builders can use Plasma without betting the farm

- Add Plasma as an additional deployment target for USDT flows while keeping settlement and analytics cross chain.

- Use the gasless rail for onboarding and day one activation, then route complex actions where your app already has depth and liquidity.

- Watch the 90 day metrics before committing roadmaps. If off ramps are thin, prioritize markets where infrastructure exists rather than chasing headlines.

What success looks like by early 2026

If the model works, USDT on Plasma will feel like a real digital checking account in a handful of countries. Transfers will be free at the edge, merchants will see dollars settle in seconds, and card or cash out options will be visible to ordinary users. Competing wallets will have copied the sponsor model. Layer 2 networks will have simplified fees for stablecoin transfers and pitched their own consumer apps. Exchanges will route small withdrawals to sponsored networks by default.

If it stalls, the tell will be obvious. Flat active users after the launch quarter. Low stablecoin velocity. Limited off ramp coverage. Sponsor budgets quietly reduced. In that case, pressure will shift back to general purpose chains and layer 2s that can subsidize fees temporarily but rely on diverse activity to pay the bills long term.

The bottom line

Plasma’s launch is a clear attempt to set a new standard for everyday on chain money. The combination of gasless USDT sends, full EVM compatibility, and a bundled neobank could make stablecoins usable for people who simply want dollars that move like messages. The test is not whether the demo works. It is whether the economics, governance, and local partnerships can carry the weight of real payments at scale.

If you build for consumers, plan for a world where free stablecoin transfers are normal and fees hide behind better design. If you run infrastructure, measure what matters, not just hype. The next 90 days will show whether Plasma’s model is a one time promotion or the blueprint that pushes everyone else to compete on user experience by 2026.