Uniswap’s Unichain: 200ms blocks and an MEV-aware L2

Uniswap’s app-native Layer 2 now touts ~200ms confirmations, TEE-based ordering, and revert protection. Here is how Unichain could recentralize liquidity, reshape MEV, and pressure Base, Arbitrum, and OP while raising the bar for fair, fast execution.

The chain that wants to be home for liquidity

On February 11, 2025, Uniswap turned a long rumored strategy into reality and shipped its own Layer 2. The move was not a simple brand extension. It was a statement about what trading on Ethereum should feel like: faster, fairer, and less leaky for the people who supply liquidity. The team framed Unichain as a new home for DeFi, with lower fees, one second blocks at launch, and a roadmap designed around Uniswap’s product needs rather than generic throughput targets. That vision crystallized with the official Unichain mainnet announcement.

By summer 2025 the chain began to look very different from the average OP Stack rollup. Uniswap and Flashbots moved block building into a trusted execution environment, introduced verifiable priority ordering, and enabled revert protection for transactions in supported apps. In August, Unichain started confirming transactions in roughly 200 milliseconds using sub blocks, bringing L2 latency closer to the limit of human patience.

This is the story of how an app native L2, tightly coupled to Uniswap v4 hooks, could pull liquidity gravity back toward Uniswap, change how MEV is created and shared, and pressure Base, Arbitrum, and OP. It is also a look at the risks that come with new trust assumptions, a still evolving sequencer, and the possibility of fresh fragmentation in a market already split across many chains.

What changed this summer

Unichain’s mainnet launch was the opening act. The plot twist arrived in two steps between May and August 2025.

First, the chain turned on TEE based block building and fair ordering. In practical terms, user transactions flow into a private encrypted mempool and are ordered inside a secure enclave according to clear rules. Priority fees determine order, and the builder is designed to publish attestations so that the ordering can be verified rather than asserted. This reduces opportunistic reordering and makes it harder to extract value through classic sandwich behavior. It also adds a foundation for internalizing a slice of MEV for the protocol and its liquidity providers.

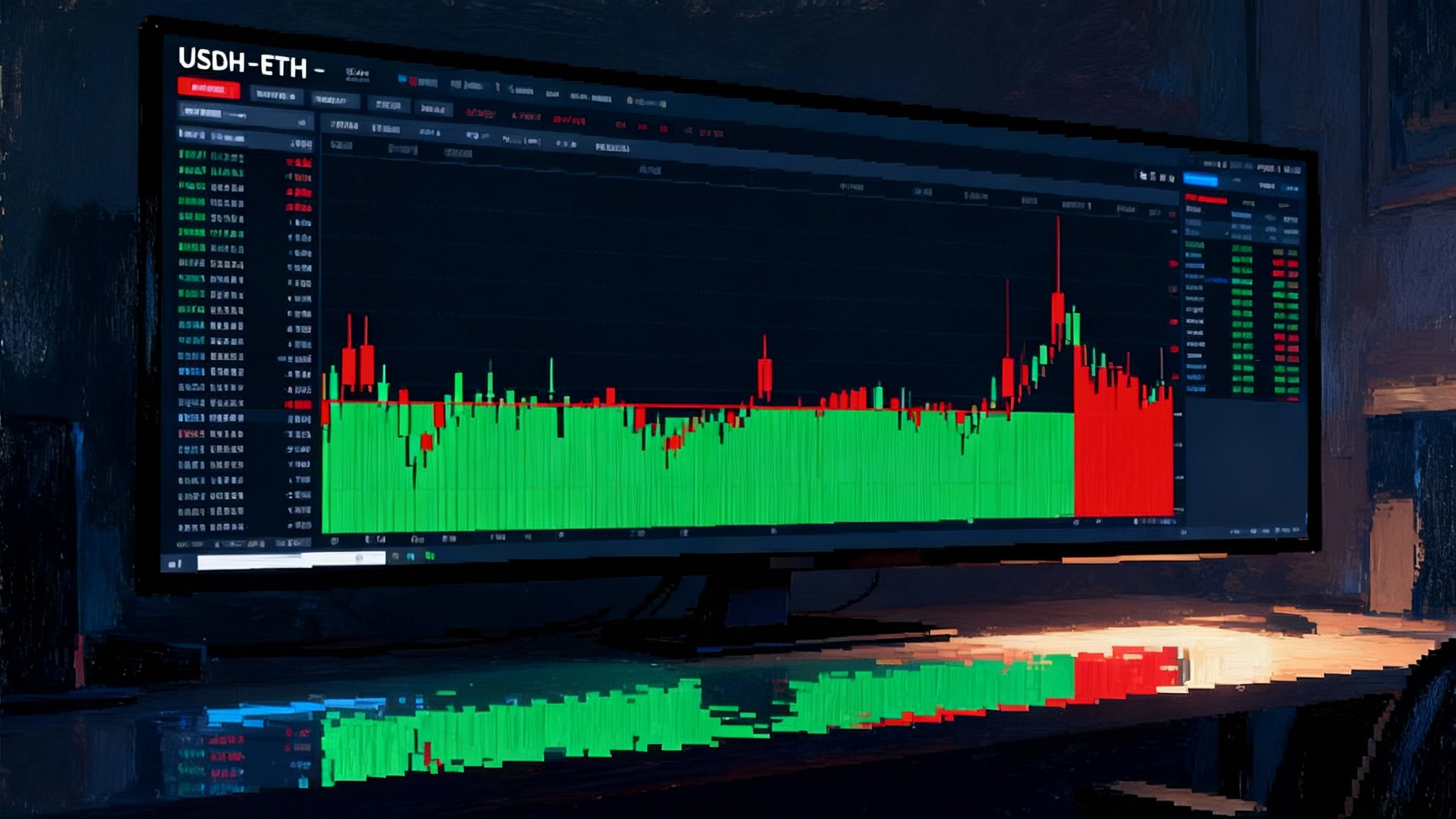

Second, Unichain took aim at latency with sub blocks. Instead of waiting a second for inclusion, the network splits time into smaller slices and confirms in about 200 milliseconds. That is important for more than user snappiness. Market microstructure responds to latency. Faster confirmation compresses the window in which arbitrageurs and backrunners can operate. It should reduce wasted gas on failed transactions and lower price impact for takers in pools where revert protection and fair ordering are active.

Both steps are documented in Uniswap’s public materials, including the running log of releases in the Unichain status updates.

Hooks meet an app native L2

Uniswap v4 introduced hooks, a modular way to attach custom logic to pools. Hooks can implement dynamic fees, time weighted market making, limit orders, anti sandwich protections, and other behaviors that affect the path of a swap. On a general purpose L2, hooks are powerful but still constrained by the chain’s scheduling, mempool rules, and MEV plumbing. On Unichain, hooks live next to a block builder that Uniswap helped design. That pairing changes incentives.

Consider three examples:

- LP friendly auctions. A hook can require order flow to pass through a short batch auction inside the 200ms cadence. The TEE can enforce priority ordering and publish attestations about how the batch was executed. LPs get tighter spreads because less value leaks to external searchers, and takers get more predictable pricing.

- Revert protected intents. A hook can pre simulate a trade and only allow inclusion if the expected execution price remains inside bounds. Since revert protected transactions do not charge gas on failure where enabled, users avoid paying to learn that they missed a fill. Market makers can quote tighter because they do not budget for as many failed attempts.

- Protocol MEV capture. A hook can direct a portion of captured backrun value to LPs or a treasury. The builder’s attestations and ordering rule commitment make this auditable, and the 200ms schedule keeps the opportunity slices small and predictable.

The net effect is a flywheel. If Unichain offers order flow that is both fast and more predictable, LPs have a reason to concentrate capital there. Concentrated capital lowers slippage, which draws more takers and more volume, which improves LP earnings.

MEV in a 200ms world

Traditional L2s leak value through a few familiar paths. Sandwiches exploit mempool transparency and subjectivity in ordering. Backruns capture price corrections in the few seconds after a market moving trade. Liquidation races reward low latency and private connectivity rather than protocol design. Unichain’s model shifts each of these.

- Sandwiching becomes much harder when transactions enter a private encrypted mempool and when inclusion order follows a verifiable priority rule. Attestation based ordering does not eliminate sandwiches in every case, but it removes the easiest forms and raises the cost of more sophisticated attempts.

- Backruns shrink in value when time slices are 200 milliseconds long. The price that LPs quote has less time to diverge from the true price after a large swap, and the next sub block can hold the rebalancing order with less slippage.

- Liquidations become less of a speed race and more of a rules race. If a perps protocol or lending market uses hooks that batch and prioritize liquidations with pre sets, competition happens in the open and on the same time grid.

None of this makes MEV vanish. It channels where value accrues. In an app native chain aligned with Uniswap, more of that value can flow to LPs and to the protocol that accepts responsibility for building the rails.

Will Unichain recentralize DeFi liquidity

We should be honest about gravity. If Unichain pairs ultra low latency with fair ordering and wallets default to routing across it, liquidity will consolidate. LPs will prefer pools that experience fewer toxic fills and fewer failed transactions. Traders will prefer the path with the tightest spreads. Market makers will prefer a venue where policy is clear and verifiable.

There are two reasons this may be healthier than it sounds. First, Unichain still posts data to Ethereum and inherits security from Ethereum. Applications can exit, redeploy, and keep keys portable. Second, Uniswap has a strong incentive to keep routing across chains because a significant share of its user base does not live on one network. The chain is designed to be interoperable.

The counter risk is new fragmentation at the application layer. If major perps, stablecoin issuers, and vault managers follow the liquidity and deploy first class versions on Unichain, other L2s could see thinned out order books. The guardrail is cross chain routing that feels invisible to the user and that shares economic gains with the venues that originate flow.

Base, Arbitrum, OP: who feels the pressure

- Base has distribution and a clear onramp story. It is integrated into a large consumer funnel and has a strong developer pipeline. What Unichain challenges is not user acquisition but execution quality. If routing engines start to prefer Unichain for price discovery and settlement speed, Base will need to show comparable fairness and latency guarantees or differentiate with a product surface that users cannot get elsewhere.

- Arbitrum leads in generalized throughput and has a deep ecosystem. Unichain does not need to match Arbitrum on every dimension. It only needs to dominate the exchange domain with rules and attestations that traders trust. If 200ms confirmation becomes the new expectation for swaps and limit orders, Arbitrum protocols will either integrate similar builders or offer explicit reasons to tolerate slower blocks. For context on Arbitrum’s playbook, see Arbitrum’s $40M DRIP initiative.

- OP is the upstream stack for Unichain and many peers. Improvements that Uniswap co designs with Flashbots can flow into the OP Stack over time. If OP secures a credible path to shared decentralization and to multiple builders that can attest to ordering rules, OP chains as a class will blunt Unichain’s advantage.

The common theme is that Unichain makes fairness and latency product features, not background properties.

New trust, new responsibilities

Trusted execution environments are not magic. They reduce attack surface by isolating code and data, but they introduce a hardware assumption and a dependency on the integrity of attestation infrastructure. If the TEE degrades or is compromised, Unichain’s builder falls back to best effort priority fee ordering without verifiability.

There is also the matter of centralization pressure around a powerful builder. If one team controls policy and implementation, the ecosystem must trust that rule changes will be predictable and conservative. Publishing public attestations, documenting ordering rules, and inviting third party verification are good starts. Opening the door for alternative builders that can plug into the same attestation framework would be better.

Sequencer decentralization remains a key milestone. The Unichain roadmap points to a validation network that can independently verify state and reduce reliance on a single sequencer.

Finally, revert protection shifts some responsibility to app developers. Users benefit when failed transactions do not burn gas, but a sloppy configuration can hide real execution risk. Protocols should publish exactly when revert protection applies and what happens under extreme volatility.

How this changes building onchain

- If you are a market maker, 200ms blocks and verifiable priority ordering change the calculus of quoting. You can run tighter spreads because stale quote exposure is smaller.

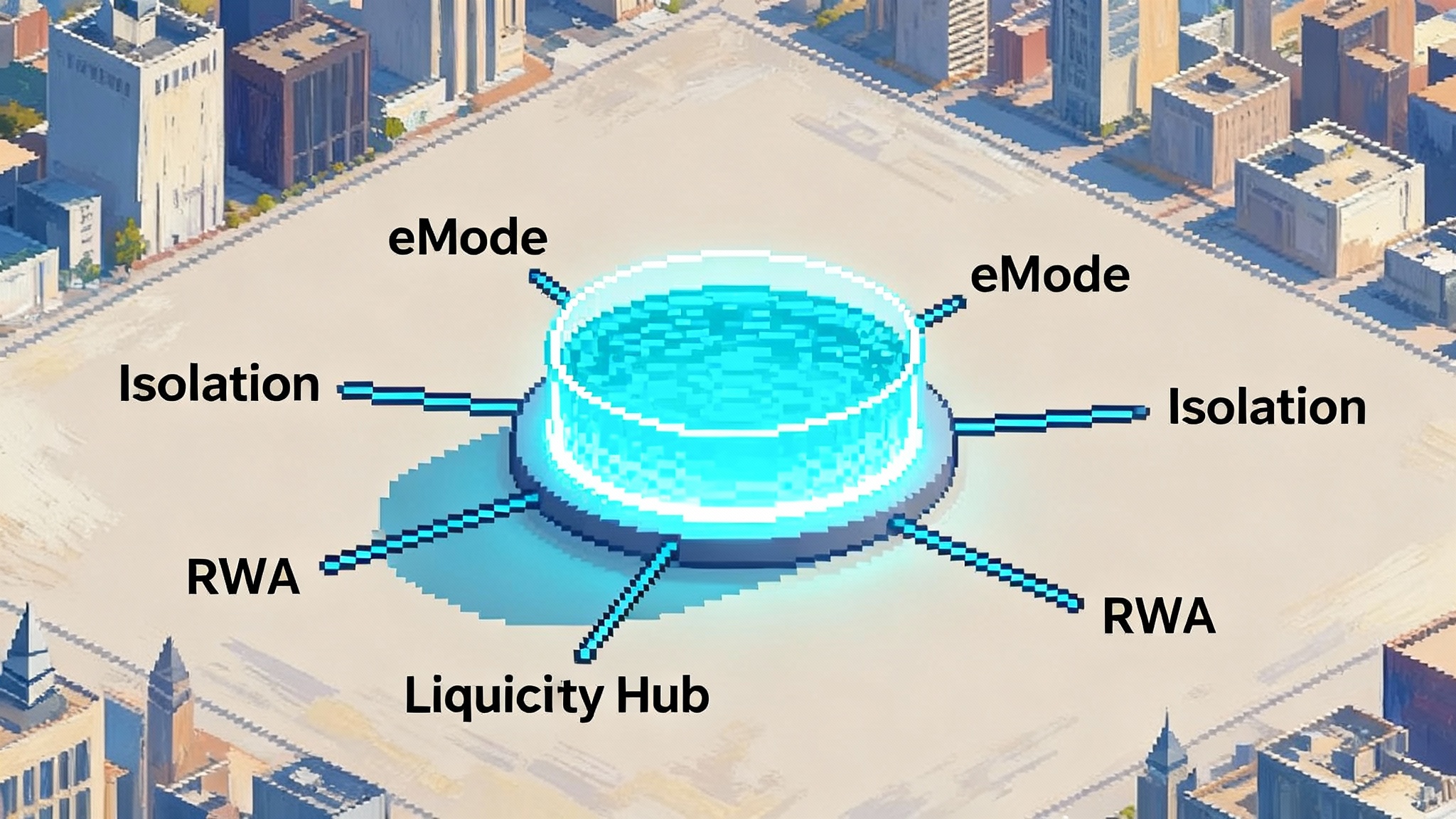

- If you are a perps protocol, you can rethink liquidation. A liquidation queue can be processed inside the sub block schedule with rules that share value between insurers and LPs. For where lending is headed, study Aave V4 hub and spoke reset.

- If you are a wallet, you can explain predictability. Users care that a swap will either fill within bounds or not cost gas. A simple UI toggle that shows protections in effect for a given pool on Unichain will feel like safety.

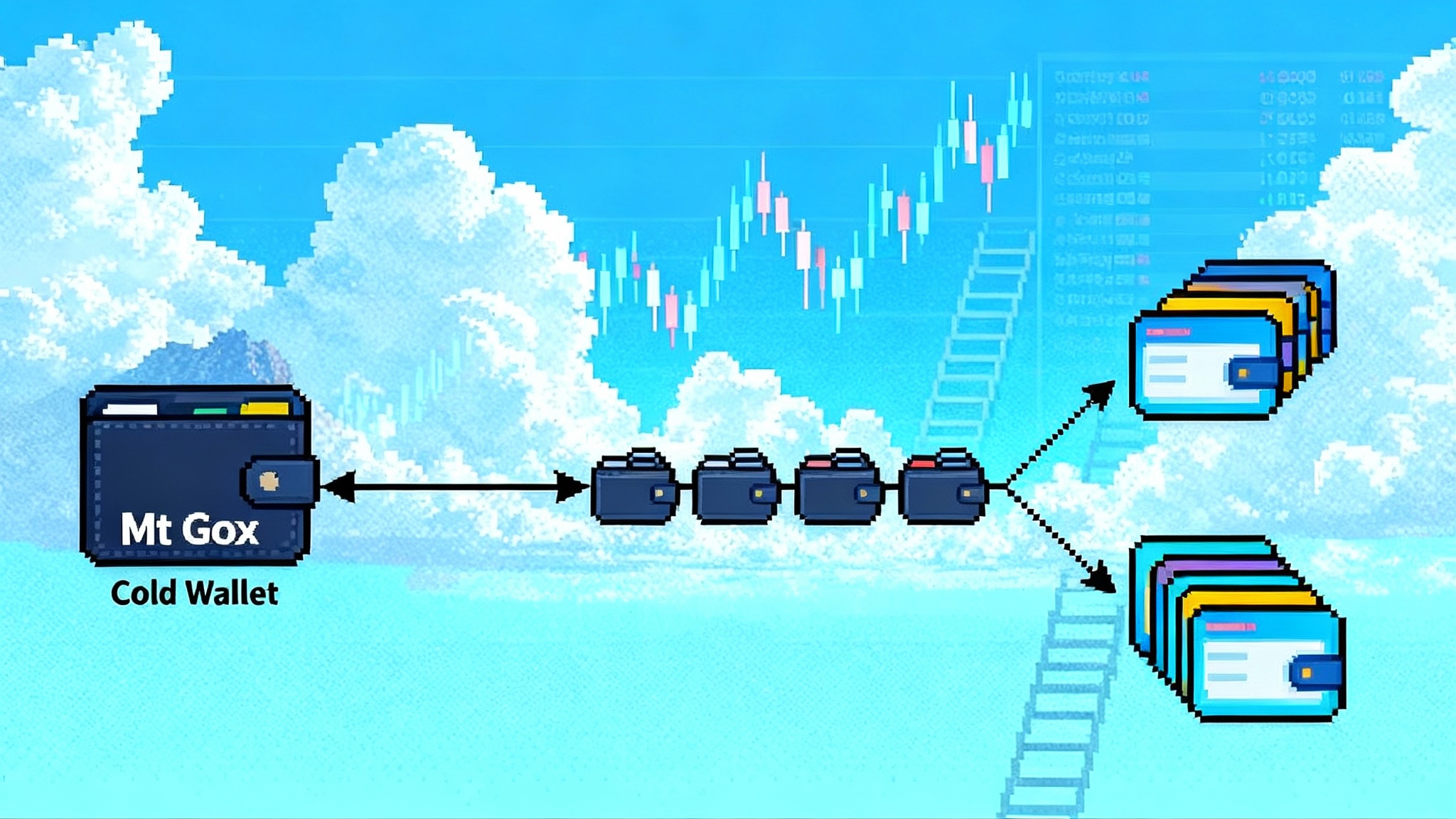

- If you are a stablecoin issuer or bridge, you can lean on attestations. Fast confirmation and verifiable ordering make cross chain exits and entries more reliable. See how PYUSD goes omnichain with LayerZero to understand user expectations for movement across networks.

What to watch next

- Attestation APIs. When these are widely available, independent teams can verify that blocks were built according to rule.

- Alternative builders. A second or third TEE builder that speaks the same attestation language would signal healthy competition.

- Validation network progress. A functioning validation network that verifies state and participates in fault proofs would move Unichain closer to rollup ideals.

- Cross chain routing defaults. If wallets start routing more of their default swaps through Unichain, expect a pull on liquidity that competitors will feel.

- Policy stability. The ordering rules and revert protection parameters should evolve slowly and predictably.

Bottom line

Unichain’s launch set the stage. The summer upgrades moved the spotlight. By pairing a TEE based builder with verifiable priority ordering, revert protection, and ~200ms confirmations, Uniswap reshaped the trading surface of an L2. That changes who captures MEV, how LPs get paid, and where traders find best execution. If Unichain can keep the UX gains while proving out sequencer decentralization and a healthy builder market, it will force Base, Arbitrum, and OP to compete on fairness and verifiability as product features. Either way, the bar for what a trading chain should feel like has moved to 200 milliseconds and it is not going back.