USDC Gets Refunds: Circle’s Arc and the New Payments Era

Circle is pushing USDC into credit card style refunds via Arc, a programmable settlement chain for institutions. With the GENIUS Act now law and Visa expanding stablecoin settlement, onchain payments are set for a reset.

Breaking: stablecoins just learned how to refund

A quiet but radical shift is underway in stablecoins. Circle has signaled that Arc, its new enterprise Layer 1, will support a refund mechanism that looks and feels like a credit card chargeback. Rather than rewriting history, the model uses a counter‑payment that offsets the original transfer, enabling disputes and customer remediation without mutating the chain’s ledger. It is a departure from the industry’s comfort with irreversible transactions and a direct response to what enterprises have asked for since the first pilot accepting crypto at a checkout page: an operationally safe way to undo a mistake. The Financial Times first reported Circle’s explorations of reversible outcomes via Arc’s policy layer for refunds and disputes, underscoring how a counter‑payment could bring stablecoins into mainstream finance. Circle is exploring reversible transactions on Arc.

This is happening as the legal and commercial environment tilts in favor of regulated stablecoins. The GENIUS Act, signed into law on July 18, 2025 after Senate passage on June 17 and House passage on July 17, creates a national framework for payment stablecoins. It sets one‑to‑one reserve requirements, carves payment stablecoins out of securities and commodities classifications, and assigns oversight to bank‑style regulators. It also gives service providers a multi‑year transition to support only compliant payment stablecoins inside the United States. Meanwhile Visa said on July 31, 2025 that it would expand stablecoin settlement to more coins, more chains, and the euro‑denominated EURC, signaling that card networks are building real stablecoin plumbing. PayPal’s consumer push offers a parallel data point; see PYUSD’s omnichain expansion roadmap for how retail rails are evolving. And Tether moved to launch a U.S.-regulated token called USA₮ for domestic institutions, a strategic complement to its global USD₮ footprint.

Put together, the incentives are clear. Stablecoins are graduating from rails built for crypto trading to rails fit for commerce, payroll, and capital markets. Arc’s refund layer is the missing feature that makes finance teams comfortable with onchain settlement.

How a counter‑payment layer works in practice

Think of a refund as a clean counter‑move rather than a rewrite. Here is a simplified flow for a typical dispute:

-

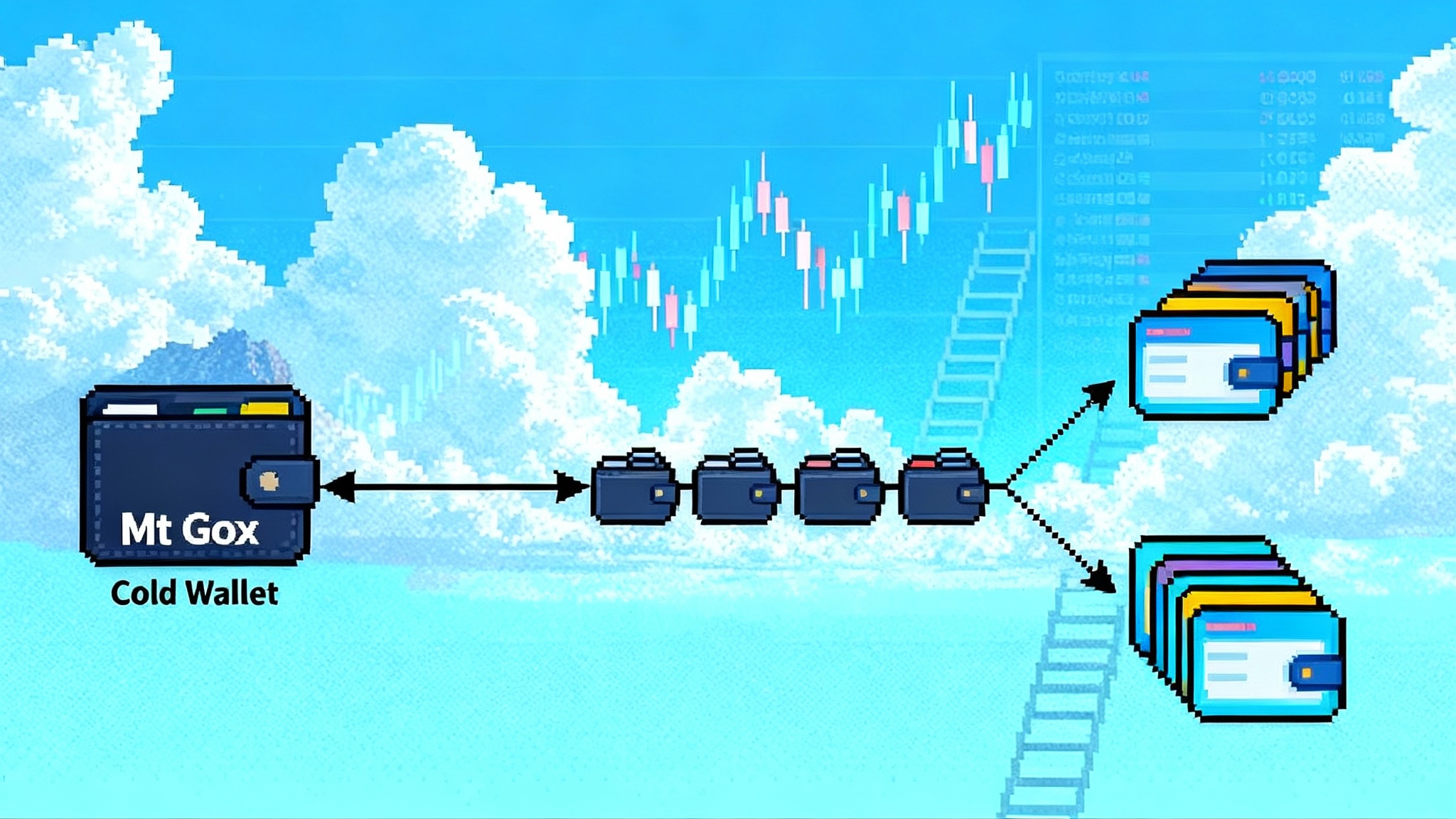

Payment: A buyer pays 120 USDC to a merchant. The transfer finalizes onchain.

-

Dispute opened: The buyer files "item not received" within a defined window. The claim is lodged via the wallet or the merchant’s payment processor. The dispute includes a cause code, evidence packet hash, and the original transaction reference.

-

Review and decision: The merchant or an authorized dispute arbiter reviews evidence. That could be a processor, a bank partner, or an accredited third‑party service. If the decision favors the buyer, a refund authorization is signed by the relevant policy actor.

-

Counter‑payment: A programmable refund contract issues a 120 USDC payment back to the buyer’s wallet, referencing the original transaction, the cause code, and the decision signature. The original transaction is not reversed. The ledger remains immutable; the refund is an explicit offset with a cryptographic paper trail.

-

Clearing and reporting: Both legs are linked at the data layer. Wallets and accounting systems show the net effect and expose dispute metadata for audits and risk analytics.

This model is familiar to every finance team. It relies on auditability, not mutability. In card networks, a chargeback rides the network’s rules. On Arc, a refund rides programmable contracts and policy keys. The enforcement happens in business logic above the settlement layer, but it anchors to onchain facts: who paid whom, when, and why the offset was issued.

Why enterprises asked for this

-

Operational safety: Irreversibility is efficient until something goes wrong. Errors happen. The absence of a standardized refund path pushes enterprises into ad hoc reimbursements and off‑ledger fixes. A common refund primitive reduces exceptions and reconciliations.

-

Compliance and customer protection: The GENIUS Act raises expectations for disclosures, audits, and consumer redress. A structured refund and dispute process helps issuers, processors, and merchants meet those expectations.

-

Accounting clarity: Counter‑payments tie out cleanly in enterprise resource planning systems. A refund reference in the memo field is more understandable than a bespoke outflow with no canonical linkage.

-

Risk analytics: Cause codes and decision attestations provide data for loss modeling. Fraud and abuse can be fought with classification, not guesswork.

Arc’s thesis: programmable settlement, not bare immutability

Circle’s design goal with Arc is to make dollars programmable at the base layer without sacrificing auditability or institutional requirements. The chain orients around USDC as native gas with low, predictable fees; near‑instant finality; and opt‑in privacy for amounts, while keeping addresses observable so compliance teams can meet obligations. Refunds do not rewrite history. They are new, linked transactions with explicit authorizations and standardized metadata. This emphasis on provable records mirrors the enterprise shift toward verifiability as a service.

That distinction matters for builders:

-

Contracts can treat the original payment as settled for inventory release, while maintaining a separate path for post‑settlement remediation.

-

Merchants can automate partial refunds and planned returns without custom code per wallet.

-

Processors can standardize dispute windows, evidence formats, and authorization roles across merchants, cutting integration time.

The post‑GENIUS Act reset, in plain English

The GENIUS Act made three practical changes that affect adoption:

-

Who watches stablecoin issuers: It places permitted issuers under bank‑style supervisors and away from securities or commodities rules for payment use. Finance leaders know which regulators to engage.

-

What backs the coin: It limits reserves to cash and cash‑equivalent instruments and mandates one‑to‑one backing with disclosures and audits. That reduces headline risk for corporate treasurers.

-

When the industry must comply: The law is in effect as of July 18, 2025, with execution timelines tied to rulemaking and transition windows. Exchanges, custodians, wallets, and payment apps get a long runway, but they eventually must support only permitted payment stablecoins for U.S. users. That forces product roadmaps to converge on compliant assets and standardized processes, like refunds.

Result: Enterprises can adopt with clearer rules of the road. Developers can build toward an eventual steady state rather than a moving target.

The trade‑offs: immutability, maximal extractable value, and DeFi composability

A refund layer introduces new dynamics. Builders should plan for them upfront.

-

Immutability culture: Some will argue that any post‑payment remediation dilutes crypto’s ethos. In practice, the ledger stays immutable. The layer above it grows more expressive. The trade is not between ethics and efficiency. It is between ad hoc off‑ledger fixes and onchain, auditable counter‑payments.

-

Maximal extractable value risk: With dispute windows, there is a theoretical risk of sophisticated actors front‑running refund‑linked transfers or rearranging state to influence who holds funds at decision time. Three mitigations help: a brief soft settlement flag that marks funds as refund‑eligible without freezing them, a commit‑reveal scheme for refund authorization to reduce signaling, and per‑transaction refund limits that bound attack surface. For broader context on MEV‑aware design, see MEV‑aware L2 design tradeoffs.

-

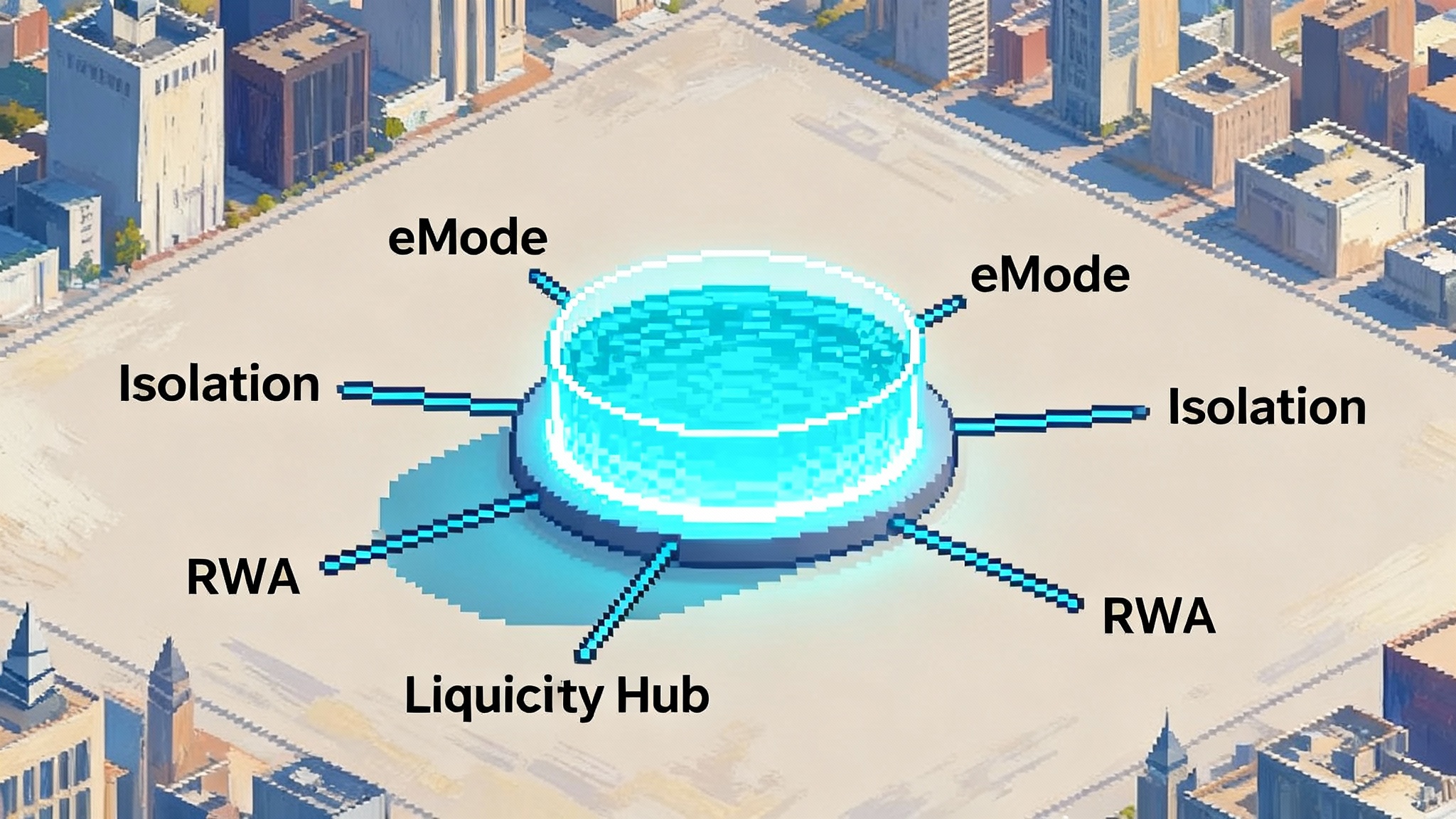

DeFi composability: If a payment is instantly rehypothecated as collateral in lending markets, a later refund could cascade bad debt. One answer is a settlement status bit that protocols can optionally respect. Assets marked refund‑eligible for a limited window might face higher haircuts or ineligibility until the window closes. This mirrors how finance already treats uncleared or pending funds.

-

Abuse and friendly fraud: Refund rails invite gaming. Cause codes and thresholds matter. Merchants need evidence templates. Wallets should hold back a tiny refundable service reserve to deter spam disputes. Processors should rate‑limit serial abusers and share anonymized fraud intelligence.

How this differs from Tether’s USA₮ and Visa’s model

-

Circle’s Arc: Product‑led infrastructure with refunds as a programmable primitive, USDC as gas, and an enterprise policy layer. It aims to upgrade the settlement fabric itself.

-

Tether’s USA₮: A governance‑first move to operate a U.S.-regulated stablecoin for domestic institutions. It answers the who‑can‑issue and under‑what‑rules questions in the United States and complements USD₮ abroad. It does not, by itself, define network‑level refund mechanics. Processors and banks built on top will likely shape those.

-

Visa’s stablecoin settlement: A network overlay that accepts multiple stablecoins across multiple chains for settlement to issuers and acquirers. That expands acceptance and treasury options. Refund logic still lives with merchants, processors, and card network rules. Visa’s expansion tells enterprises that stablecoins can settle at scale. Arc’s refund layer tells them refunds can be standardized onchain.

What this means for builders right now

If you build wallets, checkout flows, or onchain commerce, you can design for refunds today without waiting for Arc’s general availability.

-

Add refund‑ready metadata: When initiating a payment, include an optional refund reference field and a hashed descriptor of goods or services. This gives any counter‑payment a canonical link.

-

Use cause codes: Adopt a structured set of dispute reasons. Start simple: item not received, not as described, duplicate, merchant error, other.

-

Adopt authorization roles: Separate who can authorize refunds from who can submit disputes. For small teams, this can be a second key or a processor role. For larger teams, use policy engines that require multiple signatures.

-

Set windows and thresholds: Define a standard dispute window and a maximum refund percentage without escalations. Automate partial refunds for returns.

-

Expose status to DeFi: If your app touches lending or staking, publish a signal that an asset sits within a dispute window. Let protocols decide how to treat it.

-

Build evidence flows: Ship a template for photos, delivery confirmations, or chat logs. Hash the packet and anchor it to the refund request so reviewers can verify integrity.

-

Simulate attacks: Red‑team friendly‑fraud scenarios and refund loops. Put circuit breakers on repeated disputes from the same wallet across merchants.

Wallets: a new path to trust by default

Wallets are the user interface for refunds. Here is a pragmatic roadmap:

-

One‑tap refund requests: A simple flow for opening a dispute from the payment receipt view, with a default evidence checklist and cause codes.

-

Clear timers and expectations: Show the dispute window, typical decision times, and the path to escalation. Set expectations as clearly as card statements do.

-

Refund notifications: When a counter‑payment arrives, display it as a linked refund that nets out the original transaction, not as a random inflow.

-

Identity and trust: Offer optional identity verification for users who want the highest success rates in disputes. Merchants will reward traceable buyers.

CEX‑L2s and exchanges: the fast lane to adoption

Centralized exchanges running Layer 2 networks are where enterprise traffic will arrive first. That is why Kraken’s Ink adding native USDC matters. Circle has confirmed availability of USDC and its cross‑chain transfer protocol on Ink, which gives builders a compliant, liquid dollar from day one. USDC and CCTP on Ink.

Here is a crisp to‑do list for CEX‑L2 operators:

-

Refund‑aware token support: Surface settlement status bits in your token indexer. If you add Arc later, map its refund metadata one‑to‑one into your explorer and APIs.

-

Processor integrations: Partner with payment processors that can authorize refunds with proper keys and audit trails. Expose a standard refund endpoint for merchants.

-

Treasury hooks: Build fast paths for corporate treasurers to sweep USDC across your L2 and supported chains using circle‑native transfer protocols. This reduces stranded balances during dispute windows.

-

Merchant accounts: Offer merchant‑class accounts with higher default refund limits and reporting. Bundle analytics on dispute rates by cause code.

-

Risk policies: Publish your refund risk schedule. For example, set higher haircuts on lending collateral that is in a dispute window, and show that policy in the UI.

Developers: reference architecture for a refund‑capable checkout

Drop this blueprint into your backlog and iterate:

-

Payments contract: Emits a PaymentSettled event with fields for tx reference, payer, payee, amount, and optional order hash.

-

Refund registry: A separate contract that accepts a signed RefundAuthorization with a reference to the original payment, a cause code, a refund amount, and an arbiter signature. It emits RefundIssued and links to hashed evidence.

-

Policy engine: Off‑chain service that validates evidence and produces RefundAuthorization objects. It maintains allowlists of who can sign and configurable thresholds.

-

Analytics sink: Indexes linked payments and refunds for finance and fraud teams. Provides per‑merchant dashboards and cohort metrics.

-

DeFi signal: Optional oracle feed that publishes whether a given payment sits inside a dispute window. Protocols can weight or ignore the signal.

This is not theory. It is the same pattern modern card processors use, translated to an onchain, auditable substrate.

What could go wrong and how to counter it

-

Serial refunders: Detect repeated disputes with the same cause code and merchant pattern. Add friction such as additional evidence or identity verification.

-

Merchant abuse: Merchants who deny valid refunds face penalties. Processors can downgrade limits or withhold settlement for high‑risk accounts.

-

Collusion: Buyer and merchant collude to drain incentive programs via fake disputes. Randomized audits and rolling limits help, as does liability that sticks to both sides.

-

MEV games: If attackers try to position assets before a refund, require refund authorizations to be valid for a narrow block interval and use commit‑reveal to mask targets until execution.

The new equilibrium

Refunds are not a step backward for crypto. They are a step forward for commerce. An immutable ledger with programmable counter‑payments is closer to how the real world works than an absolutist no‑takebacks rule. The GENIUS Act provides the legal scaffolding. Visa’s settlement expansion shows there is serious demand. Tether’s U.S. push will bring more regulated dollars into U.S. venues. Arc’s refund layer ties it together by turning settlement into software. That is how onchain dollars become business‑grade.

The practical takeaway is simple. If you accept or move stablecoins professionally, design for refunds now. Use linked transactions, cause codes, and policy signatures. Publish your dispute windows. Mark assets that sit inside them. Make it obvious to users what will happen when things go wrong. When the refund button works as reliably as the pay button, onchain money will stop being a novelty and start being infrastructure.