Tether’s mega-raise and USAT pivot reset the stablecoin race

Reports in late September indicate Tether is lining up a multibillion private raise and a U.S.-focused stablecoin, USAT. This analysis explains what that signals for compliance and institutions, how market share could shift, and how builders should prepare through Q4 2025.

The headline that changes the map

Tether is reportedly in early talks to raise a massive private round that could total tens of billions of dollars and imply a valuation in the hundreds of billions. The round, according to multiple briefings, would be advised by Cantor Fitzgerald and would position Tether as one of the most valuable private companies anywhere, not just in crypto. The immediate takeaway is simple. Capital of that scale is a strategic weapon. It can buy distribution, compliance, and time. It can also buy credibility if it is matched with governance upgrades, stronger audits, and disciplined disclosures. The first claim worth anchoring to is the reported size and setup of the raise, which has been covered by top tier outlets including a Reuters report on mega raise.

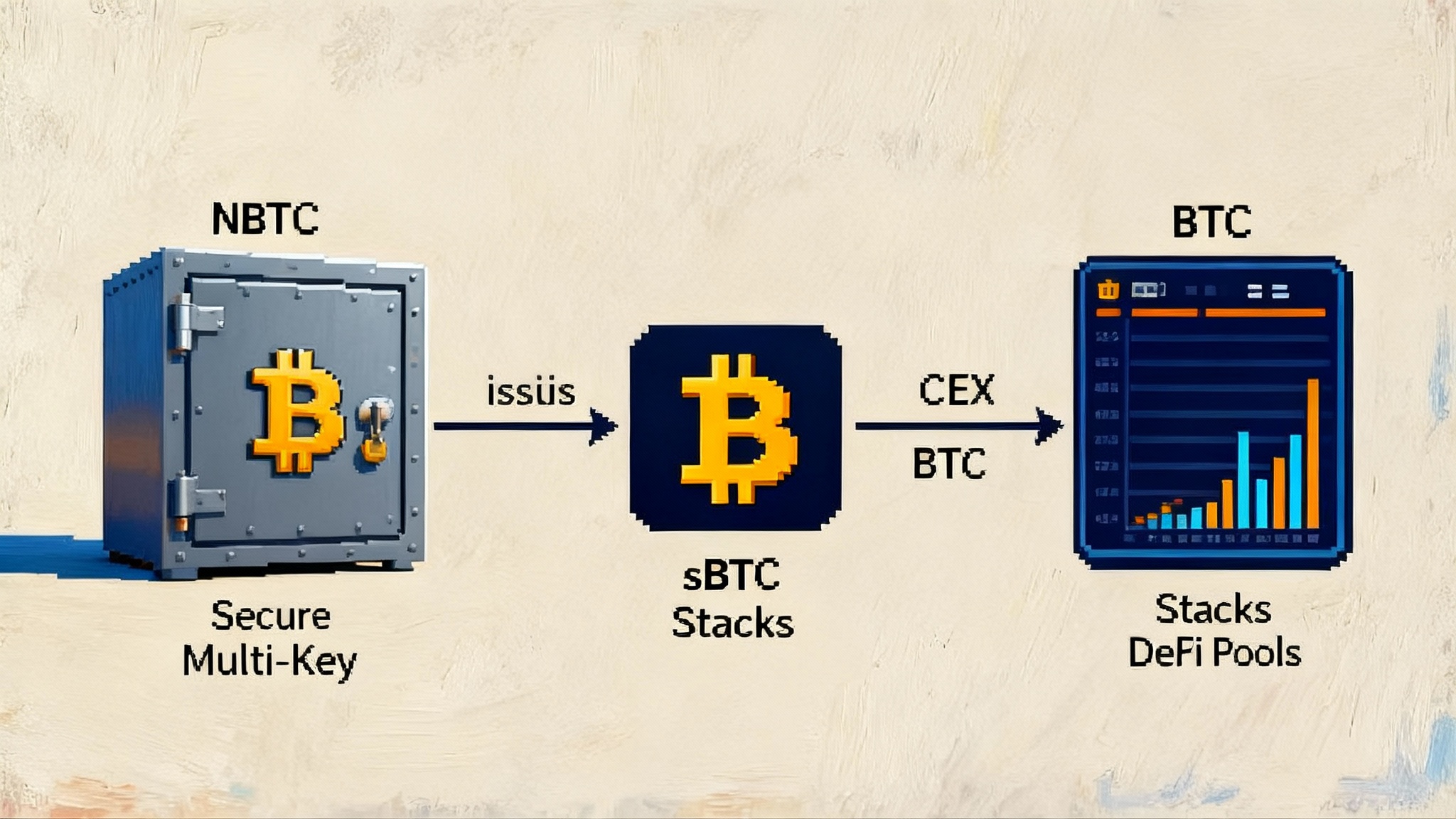

At nearly the same time, Tether previewed a second move with outsized consequences. The firm announced a U.S.-oriented stablecoin named USAT, framed as a product designed for American institutions and businesses operating under a new federal stablecoin regime. USAT would be issued through Anchorage Digital Bank and use Cantor Fitzgerald for reserves custody and primary dealer services. If USDT is the global export version of the on-chain dollar, USAT reads like the domestic, seat-belt-and-airbags trim. Reuters also reported that Tether expects to launch the U.S. token under the new legal framework and that former White House crypto advisor Bo Hines will lead the venture, per Reuters on USAT launch and leadership.

Both moves point to the same destination. The on-chain dollar is exiting its frontier phase and entering the rules-and-railroads era. Money is getting permits. The result will be more conservative structures, tighter controls, and more direct connections to banks, card networks, and enterprise treasury systems.

Why Tether’s pivot matters now

For years Tether built an international dollar network outside the U.S. perimeter while U.S.-regulated rivals like Circle’s USDC led inside large banks and fintechs. The policy picture in 2025 is different. Congress passed a federal stablecoin framework and the major card networks, processors, and banks are piloting settlement with dollar tokens in controlled programs. This is the opening Tether wanted. A U.S.-compliant instrument offers the firm a way to pursue domestic distribution without changing USDT’s role abroad. For background on how compliant rails change merchant operations, see our take on the new payments era for USDC.

Think of USDT and USAT as two chassis on a shared engine. The engine is the reserve portfolio that drives redeemability and confidence. The chassis is the compliance perimeter and distribution channel. USDT emphasizes global liquidity and cost. USAT emphasizes rulebook alignment, bank-grade partners, and integration into regulated payment flows. One does not replace the other. They specialize.

If Tether pairs a record raise with a U.S.-ready product, it can do three things quickly.

- Pay the cost of compliance at scale. That means more staff who speak regulator, more in-house monitoring, and faster responses to lawful requests. It also means funding the operational overhead of monthly attestations, chain analytics, and program audits for enterprise clients.

- Pre-fund distribution. Money follows rails. Tether can help fintechs, exchanges, and processors seed USAT liquidity across chains and venues, absorb initial operational friction, and co-market institutional features like whitelisted transfers and predictable settlement windows.

- Harden governance. A veteran board, a high-quality auditor, and clear reserve policies are not nice-to-haves for a domestic instrument. They are the table stakes to win bank, card, and retailer programs. Capital lets you hire and retain the people who deliver this with credibility.

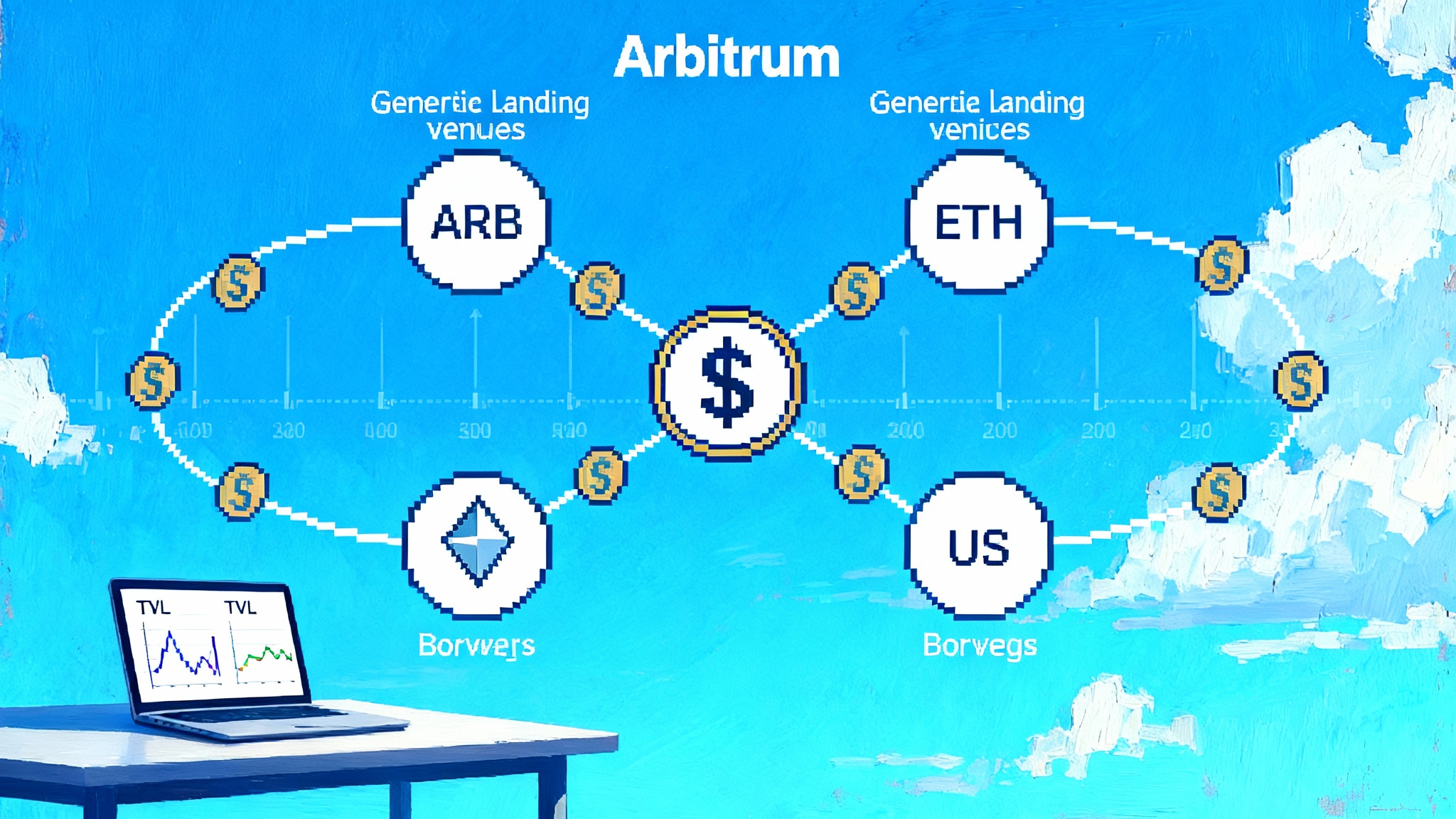

Market share math: USDT vs USDC vs PYUSD

Right now the stablecoin market is concentrated. USDT is still out in front with a market capitalization in the neighborhood of the 170 billion range. USDC is the clear number two and has accelerated through new chain deployments and enterprise deals. PayPal’s PYUSD is smaller by orders of magnitude but strategically important because it rides along an enormous consumer network and a global payouts franchise.

What happens if USAT succeeds? The simplest picture is a barbell. USDT remains the default quote currency for global trading, peer to peer flows, and low fee settlement. USAT becomes the default for U.S. corporates who want the benefits of on-chain dollars without worrying that a future policy change will strand their treasury. USDC keeps its bank and fintech lead through middleware support and a compliance reputation that is already strong with Fortune 500 treasurers. PYUSD focuses on the checkout and payouts layers where PayPal and Venmo already operate. The competitive lines are therefore less about logos and more about use cases. Trading and remittances. Working capital and settlement. Consumer checkout and creator payouts.

The bigger shift comes from distribution. A domestic instrument with Anchorage as issuer and Cantor as custodian is easier for U.S. banks and programs to diligence. If you run treasury at a Fortune 100 retailer or a top five card issuer, your vendor risk committee cares about exactly those names and those controls. That alone nudges wallet providers, processors, and exchanges to offer USAT order books and balances alongside USDT and USDC. Choice begets liquidity, and liquidity begets choice.

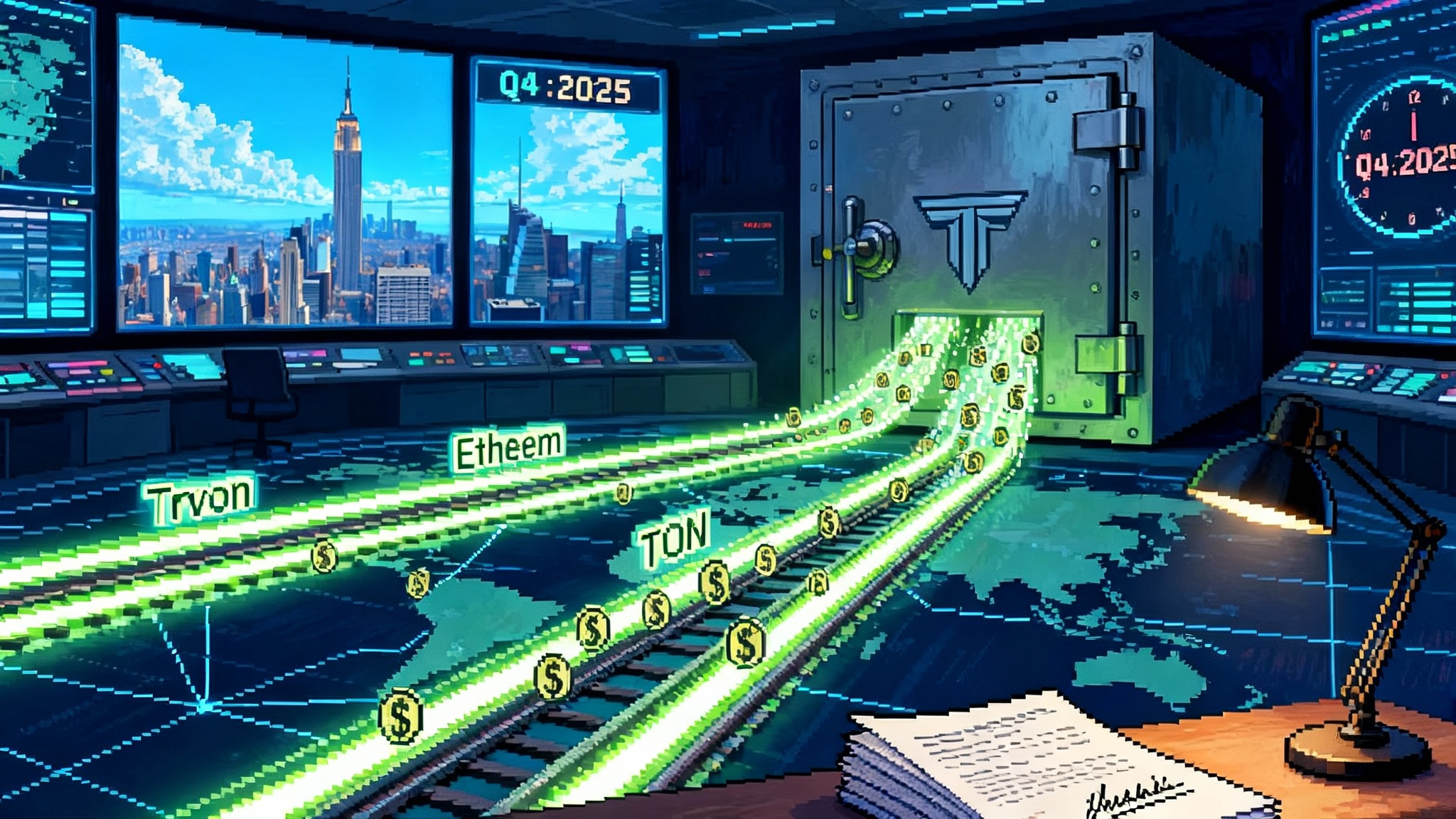

Chains and channels: where settlement moves next

Follow the fees and the user experience. That is how stablecoin settlement spreads.

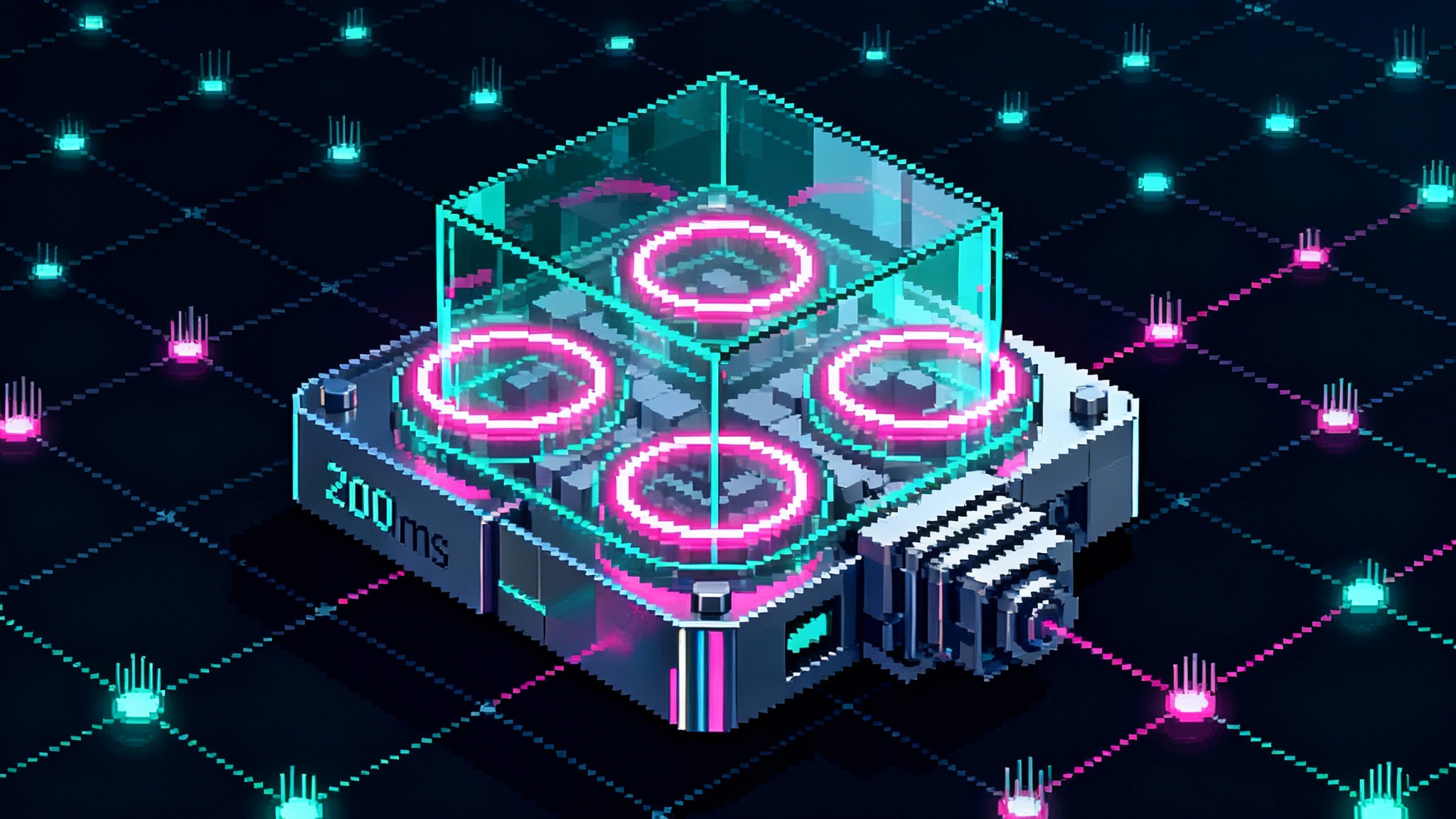

- Tron is still the workhorse for USDT settlement because it is fast, cheap, and ubiquitous across exchanges and peer wallets. It has become the default for cross border flows in regions where cost per transfer determines adoption. Expect that to continue for USDT, especially if the mega-raise helps Tether co-fund better risk controls on chains with heavy retail flows.

- Ethereum remains the deep liquidity home for institutions and DeFi. It is where credit markets, tokenized treasuries, and settlement-grade middleware live. USAT is likely to prioritize Ethereum first because it offers the cleanest compliance story and the richest set of institutional tools. Layer 2 networks then absorb retail and high velocity use cases once bank and card programs demand cheaper rails with the same controls.

- TON is the sleeper. Telegram’s distribution turns mini apps and wallet flows into real settlement traffic. As USDT supply on TON has grown, retail peer to peer and creator payouts have grown with it. If USAT wants instant reach for American creators and small businesses without asking them to change habits, supporting TON is a rational next step, especially in partnership with Telegram-facing processors. For a related look at distribution plays, see how gasless USDT on Plasma changes onboarding.

The result is a tri-polar map. Tron for high volume low fee flows. Ethereum and its scaling networks for institutional programs and DeFi. TON for social commerce and micro businesses. Liquidity will move toward the path of least resistance that still clears compliance. That is the fulcrum USAT changes.

Reserves, yields, and what a rate cut does to your unit economics

Stablecoin issuers make money on the reserve portfolio. Most hold short term United States Treasury bills, repos, and cash equivalents. When the Federal Reserve cuts rates, revenue slips. When it hikes, revenue climbs. Analysts estimate that the September rate cut shaved hundreds of millions of dollars in annualized revenue from top issuers. That is not fatal, but it tightens margins on promotions, partner rebates, and ecosystem grants.

USAT adds another layer. A domestic instrument carries additional costs. Independent audits, bank grade controls, and program certifications are line items. If USAT is designed as a payment stablecoin without yield to holders, then Tether will rely on reserve returns and scale to pay for those controls. That is feasible at size, but it discourages experiments that require heavy subsidies to bootstrap.

Expect Tether to keep its reserve book conservative for USAT. That reads as more Treasury bills, cleaner cash, and limited credit exposure. It also points to thoughtful tokenization of real world assets that do not add liquidity or price risk to the reserve. The optics matter as much as the mechanics. Builders should assume that USAT will be managed to pass a skeptical bank’s diligence checklist without debate.

Payments and payouts: the distribution wars

The next phase of the on-chain dollar is not about winning crypto exchanges. It is about colonizing the payout file and the settlement batch. That is payroll in emerging markets. That is creator economics inside messaging apps. That is card settlement between acquirers and issuers. That is marketplace disbursements to sellers. In each case, the buyer is a payment operations team that cares about reconciliation, reversals, and compliance more than on-chain cleverness. For how this lands at the point of sale, see why onchain checkout finally feels real.

Card networks and large processors are now piloting stablecoin settlement for exactly these reasons. Once those pilots cross the line into limited production, the incentives for merchants and platforms to accept a compliant token grow. If a merchant acquirer can settle funds in minutes instead of days and can pre-fund multi-currency flows with a single wallet, the working capital math changes. USAT’s design signals that Tether wants to be in those conversations, not just the cross border corridor chats on Telegram and WeChat.

For PayPal’s PYUSD, the lesson is clear. Commit to the rails where users already live and offer strong buyer and seller protections. For Circle’s USDC, the lesson is to keep compounding on bank, cloud, and compliance integrations so that USDC remains the safe default in enterprise stacks. For Tether, the USAT bet is that a domestic product with bank grade partners can open doors that USDT could not, even while USDT keeps growing everywhere else.

Q4 2025 watchlist: what to track, chain by chain

- Rulemaking under the federal stablecoin framework. The law is passed, but the details come in the implementing rules. Timelines for issuer registration, custodial guardrails, and reporting formats are the milestones. Builders should budget engineering time for new attestation schemas and sanctions controls that map to those rules.

- Which chains USAT launches on first. An Ethereum first approach is likely for compliance and tooling reasons. Watch for support on layer 2 networks that offer lower fees without sacrificing security. A TON listing would be a tell that USAT is targeting social commerce and creator payouts aggressively.

- Bank and card integrations. The first real distribution wins for USAT will arrive when a major acquirer, processor, or bank offers native support. Look for announcements that use language like settlement window compression, pre-funding reduction, or treasury netting. Those are the unlocks.

- Fintech partnerships. Expect early pilots with payroll platforms, remittance specialists, and cross border marketplace processors. The question is whether those partners default to USDC because of its existing compliance footprint or choose USAT for cost, speed, or co-marketing reasons.

- Exchange market structure. If exchanges add USAT pairs next to USDT and USDC, liquidity will fragment initially. Market makers will care about redemption friction, custody arrangements, and banking lines. Deep and reliable liquidity on a few pairs is more valuable than long tail listings. Incentives that reduce inventory cost for designated market makers will matter.

- Reserve disclosures and audits. USAT will be judged on the quality and cadence of its disclosures. Independent auditors with strong reputations and clear, readable reports will do more for adoption than any marketing campaign.

A positioning guide for builders

- Payments companies and acquirers: prepare for token settlement alongside card and automated clearing house rails. Add treasury rules that allow you to hold stablecoins for short windows with risk limits and automatic conversion triggers. Build reconciliation that treats wallet addresses as account numbers with clear mapping back to customer identifiers.

- Exchanges and brokers: list USAT if your customer base includes U.S. corporates or fintechs that have procurement policies aligned to domestic regulatory standards. Add inventory and risk limits that account for redemption pathways through Anchorage and custody at Cantor. Offer simple conversion flows between USDT, USDC, and USAT so treasurers can pick by use case, not by ticker.

- DeFi protocols: if you operate on Ethereum or a major layer 2, plan for USAT support with permissioning where required. Build compliance toggles so permissioned pools can accept USAT in whitelisted vaults without contaminating open pools. Publish clear disclosures about how you ring fence compliant assets.

- Wallets and super apps: add network smarts that route a payment over Tron, Ethereum, or TON based on fee, speed, and counterparty requirements. If a counterparty requires a domestic token, default to USAT. If the flow is a cross border remittance with strict fee constraints, default to USDT on Tron. If it is a creator payout inside Telegram, detect TON support and route accordingly.

- Market makers and liquidity providers: request clear, written procedures from Tether and Anchorage for large redemptions, including cutoff times and settlement instructions. Model the impact of rate shifts on issuer incentives. If reserve returns compress, expect fewer rebates and adjust your quoting accordingly.

- Treasurers at corporates and fintechs: run a pilot with a small but real working capital slice. Define success as fewer days sales outstanding, lower pre-funding, and cleaner reconciliation. Decide chain preferences up front based on your risk and controls. Negotiate service level agreements for freezes and lawful order compliance so your legal team is comfortable before you scale.

The bottom line

The on-chain dollar is entering its regulated phase. Tether’s reported mega-raise is about scale and staying power. USAT is about permission to operate in the U.S. at enterprise grade. Together they show a company that wants to win both the frontier and the home market. That does not end the race. It changes the lanes.

If you build or allocate in this space, the signal is clear. Choose the right chassis for the job. Use USDT where global liquidity and cost lead. Use USAT where domestic controls and bank partners rule. Keep USDC and PYUSD in your mix when the buyer is a bank, a public company, or a consumer network with strict guardrails. Then route flows across Tron, Ethereum, and TON according to the job to be done.

In the next ninety days the winners will not be the loudest. They will be the teams that wire their treasury, compliance, and product maps to a world where dollars live on multiple ledgers and follow different rulebooks. That world is no longer hypothetical. It is here. The only question is how fast you plug it in.