Tempo’s testnet makes onchain checkout finally feel real

On September 4, 2025, Stripe and Paradigm unveiled Tempo, a payments-first blockchain in private testnet. With sub-second finality, stablecoin-native fees, and issuer-neutral conversion, it pushes onchain checkout and payouts toward mainstream scale.

Tempo’s private testnet is a payments shot across the bow

On September 4, 2025, Stripe and Paradigm introduced Tempo, a payments-first blockchain that starts life in private testnet with an eye-popping roster of design partners across banking, fintech, e-commerce, and artificial intelligence. The companies say Tempo aims to handle checkout, global payouts, and what they call agentic payments at the kind of scale mainstream finance expects. That makes this more than another chain announcement. It is a clear bid to pull core payment flows onchain. The launch details, including the partner list and technical goals, were reported by CoinDesk in early September in a piece that set the tone for the industry reaction, see the CoinDesk launch coverage.

Tempo’s pitch is simple and bold. Build a chain that can do the practical things Stripe has learned to do offchain and bring them onchain: predictable low fees, sub-second finality, and the flexibility to pay fees in the same stablecoins consumers and businesses already use. Add an issuer-neutral automated market maker at the protocol layer so that any compliant dollar or euro token can move and convert without lock-in. Make it familiar for developers by running an Ethereum Virtual Machine on Reth, a high-performance execution client. Then invite heavyweight operators like Visa, Deutsche Bank, OpenAI, Shopify, Revolut, and Nubank to shape how it works for real volumes and real reconciliation.

Why this matters now

The last decade of crypto promised quick, cheap payments, yet most consumer checkout and enterprise payouts still ride card networks and correspondent banks. Two things have changed in 2025, and other experiments like gasless USDT and a neobank show rising demand for simpler fee UX.

First, stablecoins have crossed from niche to normal in many markets. For businesses, stablecoins function like internet cash that settles fast, stays price-stable, and can move twenty-four hours a day. For consumers, they behave like digital dollars inside the apps they already use. That makes them natural tender for ecommerce, creator payouts, and cross-border marketplaces.

Second, the bar for reliability is higher than ever. A checkout button cannot be a science project. It must clear in under a second, reconcile across currencies and issuers, and plug into enterprise finance systems. Tempo positions itself for that bar. If it works, it could reduce the friction that has kept onchain payments mostly in pilot mode.

The core design, explained simply

Think of Tempo as a payments highway designed with real toll booths and exit ramps from day one.

- Fees in stablecoins: Instead of buying a special gas token, a wallet can pay fees in the same stablecoin it is sending. That removes a classic support ticket at checkout where a user has funds but cannot pay gas. For a seller, it removes a treasury headache and reduces slippage from converting back and forth.

- Issuer-neutral automated market maker: Tempo bakes a market into the road. If a buyer pays with one dollar-token and a seller prefers another, the protocol can route and convert automatically at competitive rates. No one issuer gets privileged. This matters for compliance and procurement, since large merchants and banks often must support multiple issuers or specific currencies.

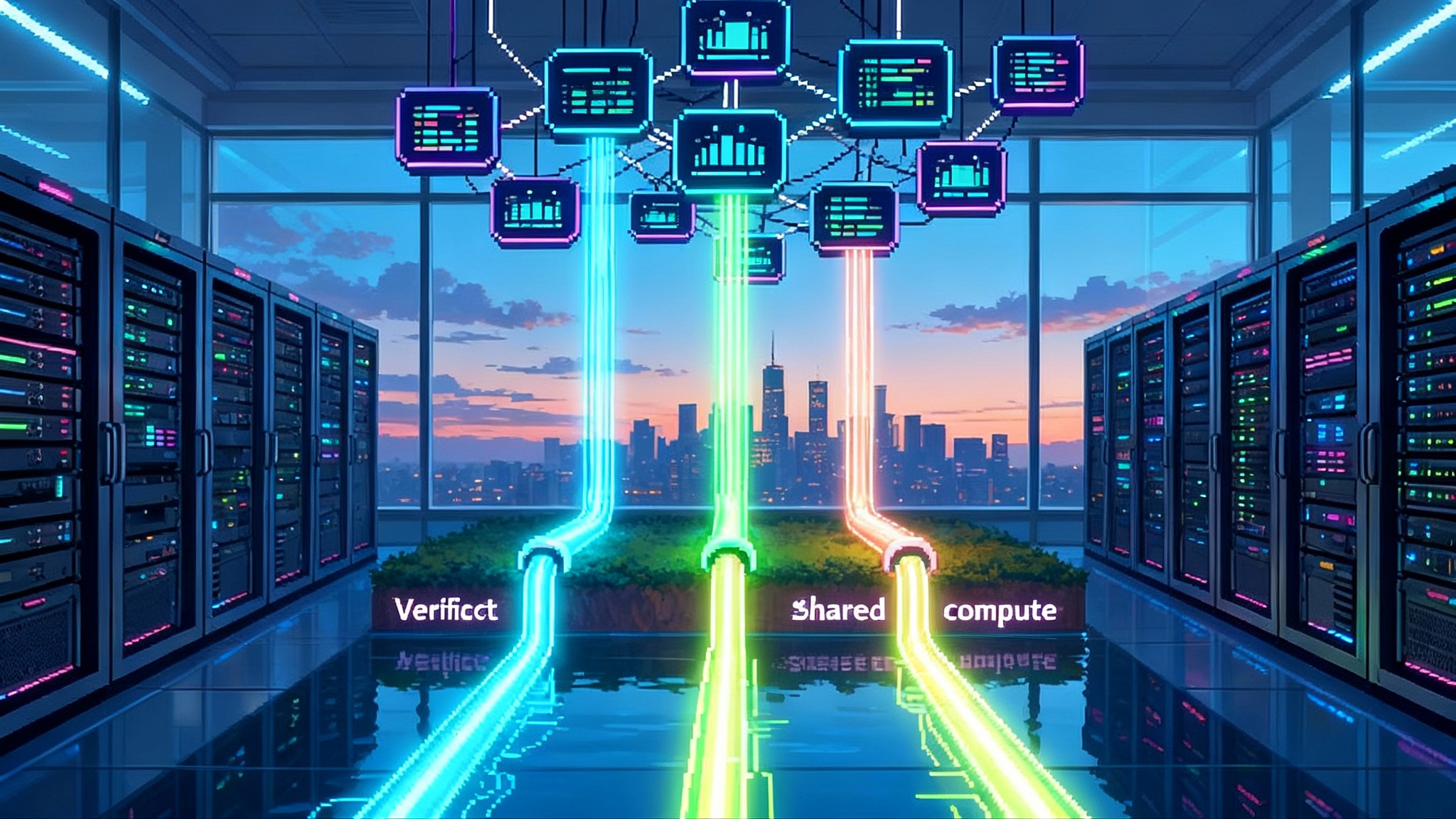

- Scale and finality targets: Tempo targets roughly one hundred thousand transactions per second and sub-second finality. That is the territory needed for busy shopping peaks, high-volume payouts, and a future where autonomous agents do many small transactions in the background. For performance context, compare efforts like 200 ms blocks and MEV-aware L2.

- EVM on Reth: Developers can use the Ethereum toolchain they already know. Reth is a fast, modern execution client built for Ethereum compatibility. For teams with existing smart contracts, this eases portability and reduces onboarding friction.

Tempo’s own summary of these choices is crisp and public. For a deeper technical snapshot straight from the builders, see the Tempo launch announcement.

Three product lanes: checkout, payouts, and agents

- Checkout: A buyer scans a QR code or authorizes in a wallet, pays in a familiar dollar-token, and both the merchant and the acquirer see the transaction finalize in under a second. No separate gas token. No confusing pre-funding. The issuer-neutral market maker moves value into the merchant’s preferred token behind the scenes.

- Payouts: A platform pays thousands of creators or drivers, across currencies, overnight or instantly. Tempo’s routing can consolidate and convert without touching external venues. The accounting team receives memos and access lists that match transfers to invoices and payees. That reduces reconciliation time.

- Agentic payments: Imagine a travel agent bot that books city transit, luggage storage, and Wi-Fi as your flight lands. That bot needs sub-cent fees, high throughput, and predictable settlement. An environment where gas can be paid in a stablecoin and where conversions are neutral by design is more suitable than one that requires preloading a native token.

What this means for wallets

Wallets have lived in a world where a user often needs a native token for gas. Tempo shifts the default. The practical implications:

- Product simplification: Remove on-ramp steps that only exist to buy gas. A single user balance can power both payments and fees. That reduces drop-off at the moment of truth.

- Smarter routing: Integrate the issuer-neutral automated market maker at the protocol layer. A wallet can present a single pay button, handle currency and issuer differences automatically, and still expose clear receipts and rates to the user.

- Enterprise readiness: Support memos, access lists, and payment-specific metadata so finance and risk teams can reconcile and audit. Build explicit support for allow-lists, spending limits by merchant category, and role-based controls so corporate wallets can deploy at scale.

- Compliance hooks: Wallets should plan for address-screening, Travel Rule messaging where applicable, and standardized attestations that counterparties can verify on chain. Build this into the pay flow, not as a separate step.

- Developer motion: Because Tempo is Ethereum-compatible, wallets can reuse a large portion of their existing code and libraries. The lift is in payments features, not in relearning the stack.

What this means for merchants and platforms

Merchants care about acceptance, cost, and reconciliation. Platforms care about scale and reliability. Tempo’s design choices translate into concrete actions for both.

- Pilot a stablecoin-native checkout: Identify one or two high-margin categories or geographies where card fees or cross-border costs are painful. Offer a stablecoin checkout alongside existing options. Because fees can be paid in the tender itself, you do not need to expose your operations team to a second token. Start with a limited set of stablecoin issuers and expand as you gain comfort.

- Rework payout flows: Creator platforms, marketplaces, and gig networks can consolidate global payouts on a single rail. Use the protocol’s built-in routing to pay in the recipient’s preferred stablecoin or currency. Integrate memos so accounting and support can match disbursements to user IDs.

- Treasury simplification: Settle customer balances in the stablecoin that aligns with your reporting currency, then convert periodically for corporate needs. The issuer-neutral automated market maker can be part of that conversion plan without sending funds to external venues on every cycle.

- Risk and refunds: Map chargeback and refund policies up front. Stablecoin payments do not behave like card authorizations. Design a clear refund flow that customers can trigger in your support portal. Provide instant partial refunds when possible, which onchain settlement makes easier to track. For context on refund design, see USDC refunds and the new payments era.

- Vendor onboarding: Ask payment processors and wallet partners for Tempo support timelines. Because the chain runs EVM, many integrations should look like familiar Ethereum work with new payment primitives.

How Tempo reshapes competition with Solana Pay, TON, and Base

- Solana Pay: Solana Pay proved that QR-based checkout with stablecoins can feel slick on mobile. Solana the network already boasts fast block times and low fees. But gas is paid in Solana’s native token, and Solana Pay is a protocol more than a full payment stack with issuer-neutral conversion baked into the base layer. Tempo’s stablecoin-native fees and enshrined market maker reduce two common points of friction at the cash register and in treasury. The contest will come down to how quickly each can deliver merchant tools, wallet support, and consistent settlement behavior across issuers.

- TON: The Open Network benefits from distribution inside Telegram and an ecosystem of mini-apps. For consumer payments in chat, that is powerful. Tempo lacks that built-in audience, but it aims for bank-grade settlement predictability and enterprise features that large merchants and financial institutions require. If Tempo’s pilots land, expect a period where TON dominates in-app social commerce while Tempo targets enterprise payouts and large-ticket checkout, with overlap increasing as both push into mainstream retail.

- Base: Coinbase’s Base has momentum in onchain consumer apps and access to a large user base. It is Ethereum Layer 2 infrastructure with tight exchange and wallet ties. For pure payments, Tempo’s native ability to pay fees in stablecoins and its issuer-neutral market maker could reduce friction for non-crypto users who do not want to juggle Ether for gas. Base’s advantage is distribution and developer energy. Tempo’s bet is that payments need a chain that treats stablecoins as first-class citizens, not as application-level patches on a trading-centric stack.

In simple terms, Tempo is not trying to win the most decentralized finance apps. It is trying to win the receipts. That clarifies the product race.

Near-term milestones to watch

- Validator decentralization: The launch speaks of an independent and diverse validator set with a path to permissionless participation. Watch for published criteria to join, minimum stake or requirements, the presence of neutral custodians, and how quickly the set expands beyond insiders. Decentralization here is not ideology. It is an operational guarantee against single-party downtime and policy capture.

- Merchant pilots: Expect early pilots in cross-border marketplaces, digital goods, and creator platforms where low-value, high-frequency payments matter. The key signal will be end-to-end time from button click to ledger update in the merchant’s back office, measured at scale during peak traffic. A handful of recognizable merchant case studies by mid-2026 would be proof of product-market fit.

- Compliance hooks: Look for standardized invoice memos, onchain references to invoice numbers, and clear Travel Rule message support where rules apply. Watch for built-in screening interfaces, attestations for compliant stablecoin issuers, and audit trails that finance teams can export. These are the rails that let a bank treat onchain money like any other settlement rail.

- Wallet integrations: The first wave of consumer and enterprise wallets that support stablecoin-native gas will set the tone. The tighter the pay flow and the clearer the receipts, the faster adoption will move beyond crypto-native users.

- Stablecoin issuer coverage: A payments chain lives and dies by the breadth and quality of its tender. Coverage of major dollar and euro stablecoins, plus seamless conversion, will be a leading indicator of mainstream usability.

Practical risks and open questions

- Throughput in the wild: Lab targets of one hundred thousand transactions per second are useful, but sustained real-world loads with noisy internet and uneven wallet behavior are the only proof that matters. Benchmark disclosures and third-party measurements will be telling.

- Neutrality under pressure: An issuer-neutral market maker is a strong idea. In practice, neutrality requires governance that resists pressure from any single issuer or partner. Clear policies for listing, delisting, and circuit breakers will matter during market stress.

- Fee predictability: Paying fees in any stablecoin is elegant. At scale, the system needs to keep conversion spreads and fee volatility low, even during liquidity crunches. Watch for transparent fee bands and liquidity commitments by market participants.

- Custody and keys: For enterprises, smart custody with role-based controls is table stakes. The quality of custody integrations, from multi-user approval flows to hardware support, will shape early adoption.

- Regulatory drift: Rules vary by market and change fast. Tempo’s compliance surface must evolve without breaking developer expectations. Shipping versioned compliance primitives will help.

The forward bet

If Tempo’s pilots land in 2025 and 2026, a slice of checkout and a growing share of global payouts will begin to migrate to stablecoin rails. The shift will not be a light switch. It will look like merchants adding a new button next to card, platforms moving a percentage of payouts to stablecoins where fees are lowest, and wallets making the pay experience feel like a normal app purchase. At the margin, that takes volume away from card networks and correspondent banks and gives developers programmable money that settles in seconds.

The second-order effects could be larger. Once stablecoin settlement is routine, autonomous agents can reliably pay for data, compute, and micro-services without human intervention. That is not a science fiction future. It is an operational one, unlocked by cheap, predictable, and instantly final settlement.

So what should teams do today

- Wallets: Build stablecoin-native fee support, integrate issuer-neutral routing, and ship finance-grade receipts. Start a design review with your fraud and compliance partners this quarter so you are ready for pilot merchants in early 2026.

- Merchants and platforms: Pick one market or business line where onchain settlement could obviously cut costs or speed up payouts. Stand up a pilot with a small set of stablecoins and a clear refund policy. Measure settlement time end to end, including reconciliation.

- Payment processors and acquirers: Publish a Tempo roadmap that explains gateway support, token coverage, and refund semantics. Your customers will ask.

- Developers: Treat Tempo like an Ethereum-compatible chain with payments-specific primitives. Reuse what you can. Focus on payment states, retries, and reporting. Build demos that show non-crypto teams the operational payoff, not just the technical novelty.

The bottom line

Tempo’s private testnet is the clearest statement yet that onchain payments are moving from slide decks to shipping software. The combination of stablecoin-native fees, an issuer-neutral market maker, EVM compatibility on Reth, and a bench of design partners that actually move money makes this a credible attempt to bring checkout, payouts, and agentic payments onchain. The next twelve months will determine whether those choices hold up under the heat of real traffic. If they do, 2026 will be the year stablecoin rails quietly start to displace card rails at the margin, one receipt at a time.