SEC generic listing rules spark a rush for SOL and XRP ETFs

A September 2025 rule change gives U.S. exchanges a standing pathway to list qualifying spot commodity ETPs without bespoke 19b-4 approvals. That unlocks a faster, broader lineup of crypto ETFs, with Solana and XRP poised to lead.

The rule that changed everything

On September 17, 2025 the SEC approved generic listing standards that let exchanges list spot commodity ETPs that meet predefined criteria without filing separate 19b-4 rule changes for each product. In plain English, exchanges now have a standing greenlight to list qualifying spot products. That single decision removes the procedural chokepoint that kept every new crypto ETP in a slow approval queue and replaces it with a rules based pathway. The first effect is speed. The second effect is breadth. As a result, the first wave of non bitcoin and non ether spot ETFs can arrive quickly, led by Solana and XRP. For the underlying policy shift, see Reuters’ coverage of the SEC’s approval of generic standards across Nasdaq, NYSE, and Cboe, which outlines the shorter path to market for spot crypto products, including Solana and XRP, under exchange rules that no longer need case by case sign off for each new ETP SEC approval of generic listing standards.

From 19b-4 chokepoint to generic greenlight

Before this change, every spot crypto ETF required two parallel approvals. First, the exchange had to win approval of its listing rule for that specific product via a 19b-4 filing. Second, the issuer had to clear the registration statement. The 19b-4 leg was the unpredictable long pole, with public comment rounds and a timeline that could stretch to the statutory limit. Under the new regime, if a product fits the exchange’s pre approved generic standards for Commodity Based Trust Shares, the exchange can list it without a fresh 19b-4 order. The issuer still must get its registration declared effective, and the exchange still has ongoing surveillance and disclosure obligations, but the procedural bottleneck is gone.

What faster actually means

A generic standard does not mean no review. It means the exchange’s rulebook already covers the product type. In practice, the gating item becomes the issuer’s registration effectiveness and operational readiness. That is a faster and more predictable process than the old one two punch because the exchange no longer waits on a bespoke rulemaking. Several issuers already have draft documents and service providers in place from earlier filings, so time to market compresses from many months to a timeline measured in weeks once documents are aligned. A reasonable base case is first listings in October or November 2025, with the door open to even earlier launches if paperwork is already seasoned.

Who gets out of the gate first

Why Solana looks first in line

Solana checks boxes that matter for early ETF viability. It has deep spot liquidity across major U.S. accessible venues, a thick derivatives complex offshore that market makers can use to hedge, and robust custodial coverage with multiple qualified custodians. The token has a large free float, active validator base, and measurable on chain throughput that institutions can diligence. Just as important, exchanges and issuers have already done the homework. Cboe BZX’s docket this year includes Solana and XRP trust proposals that foreshadow creation and redemption mechanics, basket protocols, and surveillance language. That groundwork should translate into a faster sprint from approval to bell. You can see the exchange’s public history in BZX rule filings referencing Solana and XRP.

Why XRP is a near term candidate

XRP brings long lived liquidity, years of settlement activity with identifiable counterparties, and multiple institutional grade custodians. The regulatory overhang that once clouded issuance has largely been clarified, which makes documentation simpler. XRP also tends to demonstrate strong U.S. trading hours volume relative to its global mix, a trait that helps authorized participants hedge creation or redemption flows during the U.S. session.

Others on deck

After Solana and XRP, the next tier likely includes large cap, high turnover assets with clear custody and pricing infrastructure. Candidates are those that can support consistent reference pricing, robust market surveillance sharing, and institutional hedging. Issuers may also attempt multi asset baskets, but single asset products with clean operational plumbing should move first.

How the timelines compress

Think about the old path as two serial doors. Door one was the exchange specific 19b-4 filing, often the pacing item. Door two was the issuer’s registration. Generic standards remove door one entirely for qualifying products. That has concrete effects:

- Filing strategy changes. Issuers can prioritize the quality of the registration statement, risk disclosures, pricing windows, and operational exhibits instead of negotiating novel exchange rule text.

- Vendor readiness pulls forward. Custodians, administrators, index providers, and market makers can finalize service agreements earlier because the exchange listing rule is already settled.

- Marketing ramps sooner. Issuers can launch roadshows and seed capital commitments in parallel with the last SEC comments on the registration.

With the procedural path simplified, trading desks will anchor their readiness to a public effective date rather than speculate about 19b-4 timing. That leads to better inventory planning and cleaner day one markets.

The market structure fallout in the first 30 days

The first month after launch is where the plumbing reveals itself. Here is what to expect, and what to watch, in five specific arenas.

1) Liquidity migration

- Spot venue to ETF drift. A portion of retail and advisory flow will migrate from offshore exchanges and U.S. crypto platforms into ETFs. The share of U.S. hours volume that settles on exchange will rise as brokerage channels capture passive and model based demand. Expect spot exchange order books to show slightly wider spreads in the first week, then tighten as market makers arbitrage ETF NAV to underlying.

- Concentration in primary dealers. A few large authorized participants and liquidity providers will dominate creations and redemptions early. Their hedging footprint will appear in the underlying as synchronized bursts of buying or selling near the ETF NAV calculation window.

- U.S. hours premium. In the first two weeks, the U.S. session may carry a small liquidity premium in SOL and XRP as APs hedge baskets in real time. Watch quotes and depth during 3:45 to 4:00 p.m. ET as indicative flows cluster around closing prints used by administrators.

2) Basis and arbitrage flows

- Cash and carry without regulated U.S. futures. Unlike bitcoin and ether, Solana and XRP do not yet have deep regulated U.S. futures for simple basis trades. APs will lean on offshore perpetuals, total return swaps, or spot borrow to hedge creation units. That creates cross venue basis relationships that can be volatile during U.S. news events.

- Live NAV arbitrage. The ETF shares will oscillate around indicative NAV. When shares trade at a premium, APs can short the ETF, buy the underlying basket, and deliver for creation. When shares trade at a discount, they can buy ETF shares and redeem for underlying. Early discounts tend to be short lived when creation baskets are easy to source and borrow is available at scale.

- Watch the perps funding rate. Spikes in funding on major venues are often the tell that APs are lifting underlying to hedge. Sustained positive funding paired with rising ETF shares outstanding usually signals net creations. The reverse can signal redemptions.

3) Custody and authorized participant dynamics

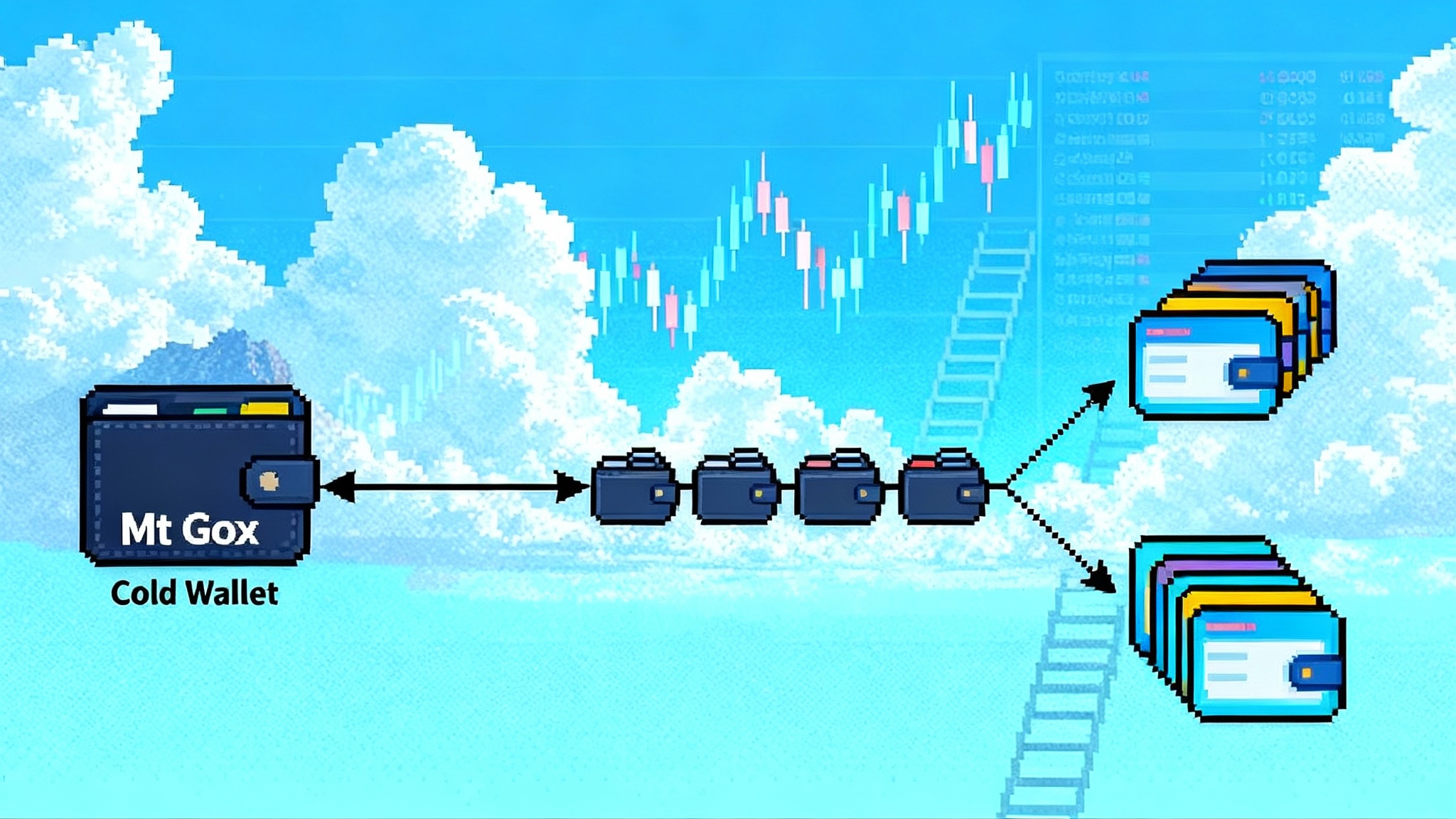

- Cold storage cadence. Creation units will move from exchange wallets to qualified custody quickly, often same day. Expect visible outflows from exchange tagged addresses into well known custodian clusters. That movement is a positive sign that primary markets are functioning.

- AP roster concentration. Early on, a short list of APs with digital asset experience will carry the load. Their risk limits, credit lines, and wallet operations will shape intraday spreads. As more APs join and lines expand, spreads should compress.

- Staking policy clarity for Solana. Most spot commodity ETPs will not stake the underlying. That creates a yield differential between on chain holdings and ETF shares. If large amounts of SOL move from staking pools to ETF custody, the active stake ratio can dip. That may modestly change on chain yields and validator economics. Issuers will disclose whether staking is permitted or prohibited. The market will price any foregone staking yield into the ETF’s fair value over time.

4) Index and model rebalances

- Crypto indices. Multi asset crypto indices that serve as benchmarks for funds and structured products will rebalance once ETF shares hit minimum trading history thresholds. Some indices may also prefer ETF proxies for operational reasons. That can increase ETF secondary volumes during month end windows.

- Equity indices and model portfolios. Direct inclusion in broad equity indices is unlikely, but broker model portfolios and thematic equity baskets that track listed crypto exposure can shift weight from BTC and ETH ETFs into new SOL and XRP ETFs. Expect day five to day ten flows as models update and RIA platforms turn on access. For a broader policy backdrop that influences platform access, see our look at the UK and U.S. taskforce roadmap.

- Options and structured notes. As listed options arrive on the new ETFs, dealers will run delta neutral hedges in the underlying, adding another layer of basis trading. Expect options market makers to quote wider initially, then tighten as borrow improves and realized volatility stabilizes.

5) On chain signals to watch in the first 30 days

- Exchange reserves. Track exchange balances of SOL and XRP. Sustained outflows into custody addresses tied to ETF administrators usually coincide with net creations and rising shares outstanding.

- Large holder flows. Monitor whale transfers from long dormant wallets to exchange and custodian clusters. Transfers into custodians that service ETFs often signal seed capital moving into trust.

- U.S. hours share of volume. If the U.S. share of 24 hour volume rises, that is consistent with ETF driven demand concentrating during the trading day when creations and redemptions occur.

- Funding and perp open interest. Elevated perp open interest and stable funding suggests steady hedging. Sharp funding flips often map to large AP activity.

- Solana validator metrics. Watch changes in active stake, validator churn, and stake pool flows. If ETF custody attracts large amounts of SOL away from staking, on chain yields can move and fee markets can shift slightly.

- XRP ledger activity. Observe on ledger DEX volumes, AMM pool depth if enabled, and flows through known corridor operators. A rise in non exchange settlement paired with ETF creations can indicate institutional positioning.

A day by day playbook

- Days 1 to 3. Price discovery and plumbing tests. ETF spreads are widest on day one, then compress steadily. Creation and redemption mechanics are validated. Look for prints near iNAV during the U.S. afternoon and for the first meaningful AP hedging footprints in spot markets.

- Days 4 to 10. Borrow markets adjust. Spot borrow rates on major venues settle as market makers size hedges. Offshore perp basis becomes the primary hedge lane. If shares outstanding grow steadily, exchange reserves should decline while custodian addresses fill. For context on broader Q4 flows, see Q4 liquidity cross-currents.

- Days 11 to 20. Options quotes appear. With more data, options markets begin to form, which gives APs and dealers alternative hedges. Index and model based flows start to show up near rebalancing dates. If discounts persist, redemptions will shrink shares outstanding and push coins back toward exchanges.

- Days 21 to 30. Spreads normalize. More APs join, seed capital reallocates, and research coverage ramps. ETF ownership begins to diversify across advisors and platforms. On chain flows stabilize at a new baseline where a larger slice of supply sits in qualified custody.

Practical implications for each corner of the market

- For traders. Treat the new ETFs as a live window into institutional demand. Use the premium or discount to iNAV as a timing tool, and hedge risk with perp basis where U.S. regulated futures are absent while minding funding costs.

- For advisors and wealth platforms. The compliance path is simpler. These ETFs can fit models that require 40 Act like wrappers and exchange traded liquidity even though they are commodity trusts. Expect better portfolio integration and lower operational friction than direct token access.

- For issuers. Speed favors those with finished service provider stacks and pre wired AP relationships. Clear distribution, transparent fee schedules, and sharp tax language will matter as much as brand.

- For custodians. Prepare for real time settlement windows around U.S. market close, predictable end of day netting, and heavier reconciliation loads. Cold storage cadence and reporting responsiveness will be a competitive differentiator. For cash management flows intersecting stablecoins and treasury operations, see the U.S. stablecoin reset debate.

Risks and unknowns

- Registration timing. The exchange rule hurdle is cleared, but the registration still drives the go live date. Unexpected comments can add days.

- AP bandwidth. A concentrated AP roster can become a single point of failure on busy days. Diversification of APs and lines is an early watch item.

- Hedging frictions. Without deep U.S. regulated futures, APs will rely on offshore derivatives and spot borrow, which introduces cross venue risks and potential slippage during stress.

- Policy drift. Generic standards reduce procedural friction, not substantive oversight. If surveillance flags anomalies, exchanges can still pause trading, and the SEC can still intervene on non generic products.

The bigger arc

Bitcoin and ether ETFs proved that ETF rails can broaden access while keeping market quality intact. Generic listing standards take the next logical step. They convert a bespoke permissioning regime into a rulebook that scales. If Solana and XRP list in the coming weeks, crypto market structure will tilt further toward exchange traded wrappers. Liquidity will migrate from crypto native venues into ETFs during U.S. hours, APs will knit together on chain inventory with equity market demand, and a new cycle of product innovation will follow. The first 30 days will look busy. The next 300 could reshape the entire trading stack from custody to cash management.