sBTC uncapped and listed: Stacks’ Bitcoin liquidity unlock

In September 2025, Stacks removed the sBTC supply cap and landed its first centralized exchange listing, opening mint and redeem flows to a wider audience. Learn what changes for BTC-native DeFi, how the peg works, what early data shows, and the risks to watch.

The September catalyst: an open faucet for BTC liquidity

Stacks sBTC just crossed a structural threshold. On September 16, 2025, the hard issuance ceiling was lifted, turning a throttled pilot into an open system for mint and redeem flows. The minimum deposit size dropped to 0.001 BTC and the program’s incentive design shifted toward more sustainable rates, a package meant to broaden access for both retail and institutions. The uncapping followed a phased rollout that previously enforced 1,000, then 3,000, then 5,000 BTC supply caps. At the time the cap came off, the team reported roughly $545 million in TVL, over 7,400 holders, and more than 62 BTC distributed to participants since launch, signaling meaningful demand even before the gates opened more widely. These changes were announced and confirmed publicly as the cap was removed on September 16, 2025; see the summary in this post on sBTC uncapping and parameters for the new phase: cap removed on September 16, 2025.

A few days later, sBTC began appearing on centralized exchanges. Gate listed sBTC for spot trading on September 22, 2025, creating a first CEX on-ramp and off-ramp between BTC, sBTC, and Stacks apps for a broad retail audience. That step matters as it connects BTC liquidity with exchange users who do not yet run Stacks wallets or bridge flows themselves. Listing details: Gate lists sBTC for spot trading.

How sBTC actually works

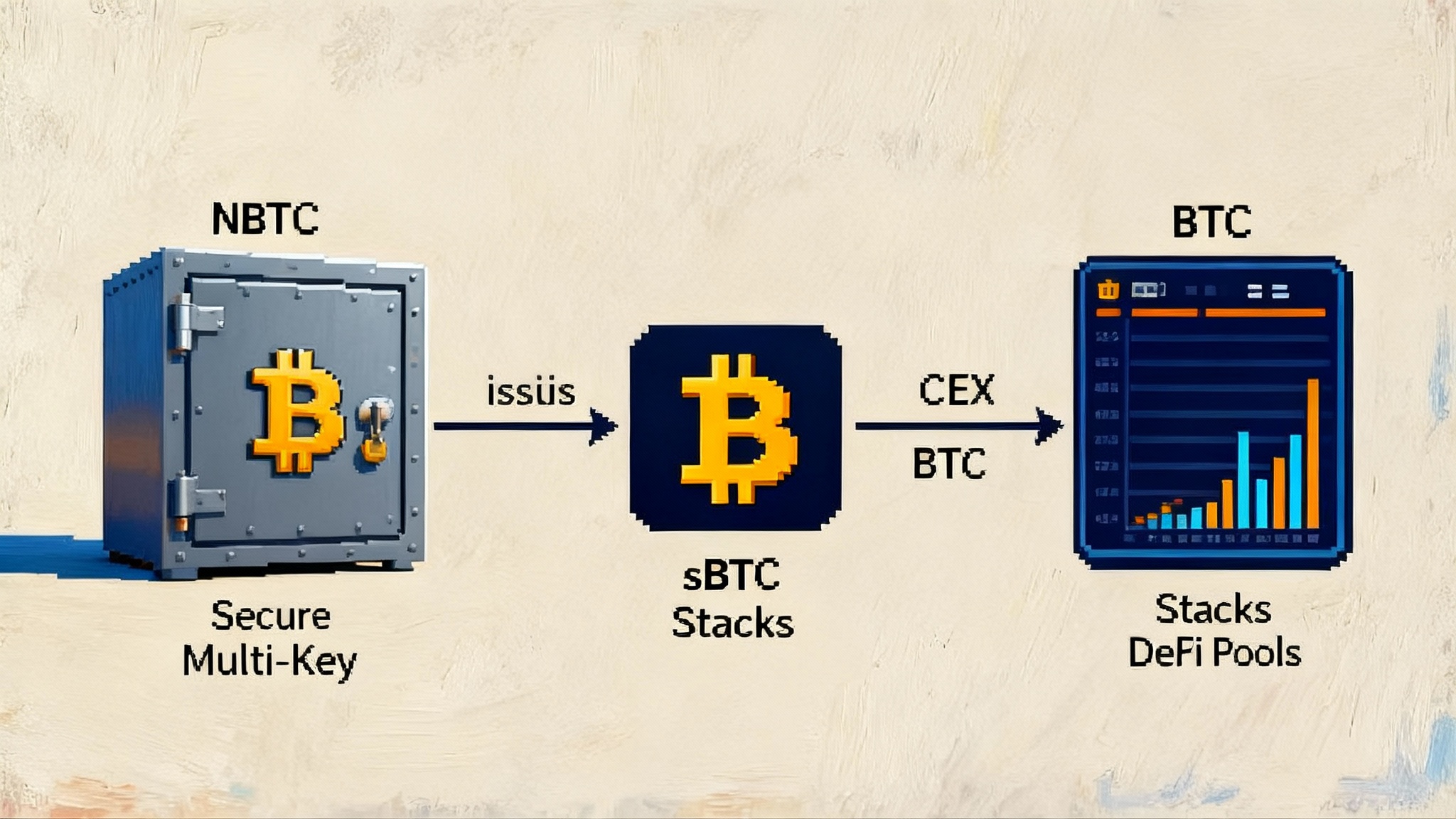

sBTC is a Bitcoin-backed asset that lives on Stacks, a Bitcoin Layer 2 that settles to Bitcoin and inherits Bitcoin finality. The peg model is simple in concept and careful in practice.

- Mint: A user deposits BTC on the Bitcoin mainnet to an address controlled by a threshold set of independent signers. When the signers attest to the deposit, the protocol mints an equivalent amount of sBTC on Stacks to the user’s address. sBTC becomes a programmable BTC proxy the user can send, lend, trade, or pool in Stacks apps.

- Redeem: To exit back to native BTC, the user burns sBTC on Stacks and the signers release BTC from the Bitcoin address to the user’s chosen destination. Minting and redeeming target parity and are designed to be routine flows rather than exceptional events.

- Signer set: In the current phase, a community-elected group operates the threshold signatures that authorize mints and withdrawals, with a supermajority required. The design intent is progressive decentralization and wider participation over time. The set can be rotated and expanded, and its parameters are governed by SIP processes and on-chain coordination.

Two elements make sBTC distinct from older custodian bridges. First, signers operate with explicit thresholds, audits, and transparency, and are meant to grow in number and diversity. Second, Stacks settlement anchors to Bitcoin. That gives sBTC a path to Bitcoin finality while keeping user experience close to what DeFi users expect on an L2.

What changes when you remove the cap

The removal of the supply ceiling turns sBTC from a scarce pilot into a standard piece of infrastructure. That matters in several ways:

- Exchange support becomes viable. Hard caps complicate listings, liquidity programs, and Earn products because circulating supply cannot grow with demand. With uncapping, exchanges can list, market makers can inventory, and programs can scale without artificial ceilings.

- On-ramps get simpler. The minimum deposit lowering to 0.001 BTC reduces the barrier for new users and for developers who need many small test flows. It also improves the fit for retail users who dollar-cost average.

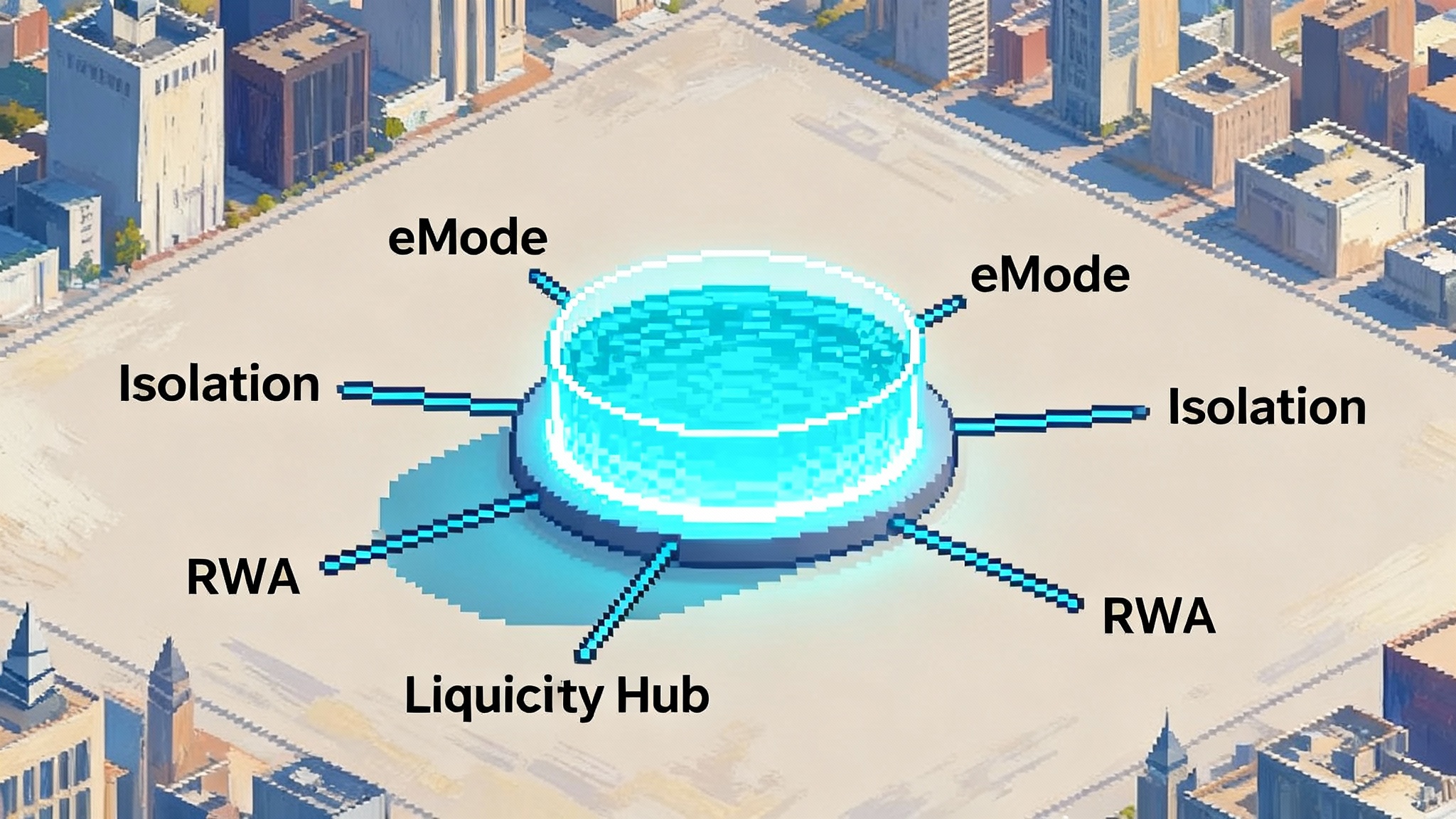

- Builders can plan. Protocol designers can now assume liquidity is elastic. That is crucial for AMMs, lending markets, perps venues, and liquid staking derivatives that need a minimum viable depth to perform. For a cross-ecosystem lens on lending design, see how Aave V4 resets DeFi lending.

- Institutions can size positions. Caps deter allocators because they create access risk. With uncapping, mandates that require scalable entry and exit have a clearer path.

Together, these levers change the narrative from scarcity to throughput. sBTC’s role shifts from a limited beta asset to a default BTC rail on Stacks.

Early data: flows, TVL, and app uptake

Numbers are still settling in the first two weeks after the change, but we already have enough signal to sketch the contour.

- Pre-uncap footprint: As noted in public updates around the change, sBTC sat near the mid nine figures in TVL with thousands of unique holders and tens of BTC in cumulative rewards paid. That suggests not just speculative minting under caps, but recurring participation in DeFi loops.

- Holder breadth: The reported holder count above seven thousand indicates broad distribution, a positive for market depth and for stable fee generation across apps.

- Throughput readiness: Withdrawals went live earlier in 2025, and lowering the minimum deposit to 0.001 BTC improves operational throughput. That matters for market makers arbitraging CEX spot against Stacks DEX pairs and for routing between BTC, sBTC, and stablecoin legs.

- Exchange ignition: Gate’s listing provides the first obvious liquidity sink and source outside native bridges. Even a single liquid venue changes routing math because users can buy sBTC directly, then take it into DeFi, or exit strategies back through a book rather than waiting on redemptions.

Across DeFi categories on Stacks, sBTC is already turning wheels:

- AMMs and DEXs: Pairs with sBTC deepen routing and allow BTC-denominated LP strategies. Traders get tighter spreads once market makers can source sBTC on a CEX and recycle inventory on-chain.

- Lending: Collateralizing with sBTC allows borrowing stablecoins or STX for basis trades and hedged yield loops. Rates should compress toward the marginal cost of sourcing BTC on a CEX plus bridge latency and risk premiums.

- Structured yield: Programs that layer sBTC rewards with protocol incentives can offer stacked yields. With caps gone, these programs can scale toward organic equilibrium rather than cap-driven rushes. For a parallel on incentive design, see DRIP lessons on incentives.

Expect some volatility in the first month as supply expands and arbitrage relationships settle. Price-relative moves in BTC will also move headline TVL since sBTC is pegged one to one.

How sBTC differs from wrapped BTC models

It helps to situate sBTC among familiar BTC-on-other-chain designs.

- Centralized custodial wraps rely on a single custodian or a tight intermediary set. They scale well and integrate easily on large venues, but require trust in specific institutions.

- Fully trust-minimized constructions push custody risk down but often trade off speed, capital efficiency, or user experience.

- sBTC splits the difference. It uses threshold signers with supermajority approval, diverse operators, and Bitcoin finality via Stacks. That is more decentralized than a single custodian and more practical than pure cryptographic pegs that still struggle with UX and liquidity. It also bakes in an incentive layer for signers and participants through Stacks’ Proof of Transfer economy and programmatic rewards paid out to users who hold sBTC or deploy it in specific pools.

Functionally, what differentiates sBTC is the combination of operational clarity and L2 programmability. Deposits are quick to acknowledge, redemptions are routine, and once minted, sBTC behaves like a native asset across Stacks apps with deterministic settlement to Bitcoin.

Yield mechanics: what pays and what fades

For months, the headline was a simple value proposition: hold sBTC and claim Bitcoin rewards that drip to your address on a fixed cadence. Under the hood, those payouts flow from Stackers who point their PoX BTC rewards into pools that feed the sBTC program.

As caps fall away and supply can grow, rewards should normalize. Expect base yields to compress toward organic equilibrium, with the spread over BTC’s risk-free hold explained by signer and bridge risk, plus any additional protocol incentives. The program is still expected to operate, but it will sit alongside organic fees from AMMs, borrow rates from lending, and optional protocol incentives from individual apps. The path from promotional APYs to naturally clearing rates is a sign of maturation.

For users, the practical questions remain constant: what risk are you underwriting to earn a given return, how liquid is your exit, and how correlated are your strategies to BTC drawdowns. With exchange access now present, more users can assemble spreads that hedge exposure with CEX perps or spot, tightening risk-adjusted returns.

Risk assessment: bridges, signers, regulation, and liquidity

- Bridge and protocol security: Threshold-signer systems concentrate risk in coordination and key management. A 70 percent style threshold deters unilateral action but still requires that signers maintain uptime, rotate keys carefully, and avoid correlated failures. Operators need robust operations, and users should watch for independent audits, incident reports, and stress tests on mint and redeem throughput.

- Signer decentralization: The roadmap points to expanding and diversifying the set, with rotation and transparent governance. A larger, more distributed cohort hardens the peg but can slow coordination.

- Market structure: With first CEX support online, new liquidity routes exist. That is a double advantage because CEX depth can absorb redemptions during on-chain volatility, and on-chain yields can attract idle CEX inventory. It also introduces exchange risk and market-maker behavior into peg dynamics.

- Regulatory treatment: sBTC is a claim on BTC managed by a distributed signer set, not an IOU from a single issuer. Teams and signers will need clear terms, transparent operations, and jurisdiction-aware compliance. CEX listings raise the bar for disclosures and asset integrity checks.

None of these risks are unique to sBTC. They are the standard questions for any Bitcoin bridge. The difference is that Stacks has a clear path to L2 finality, an active governance process, and growing app demand that can put sBTC to work.

Second-order effects through Q4 2025

- App design moves from rationing to scaling. Under caps, protocols rationed allocations and gated pools. With supply elastic, builders can set parameters for depth rather than scarcity and can experiment with new vaults, perps collateral, or BTC-settled payment flows.

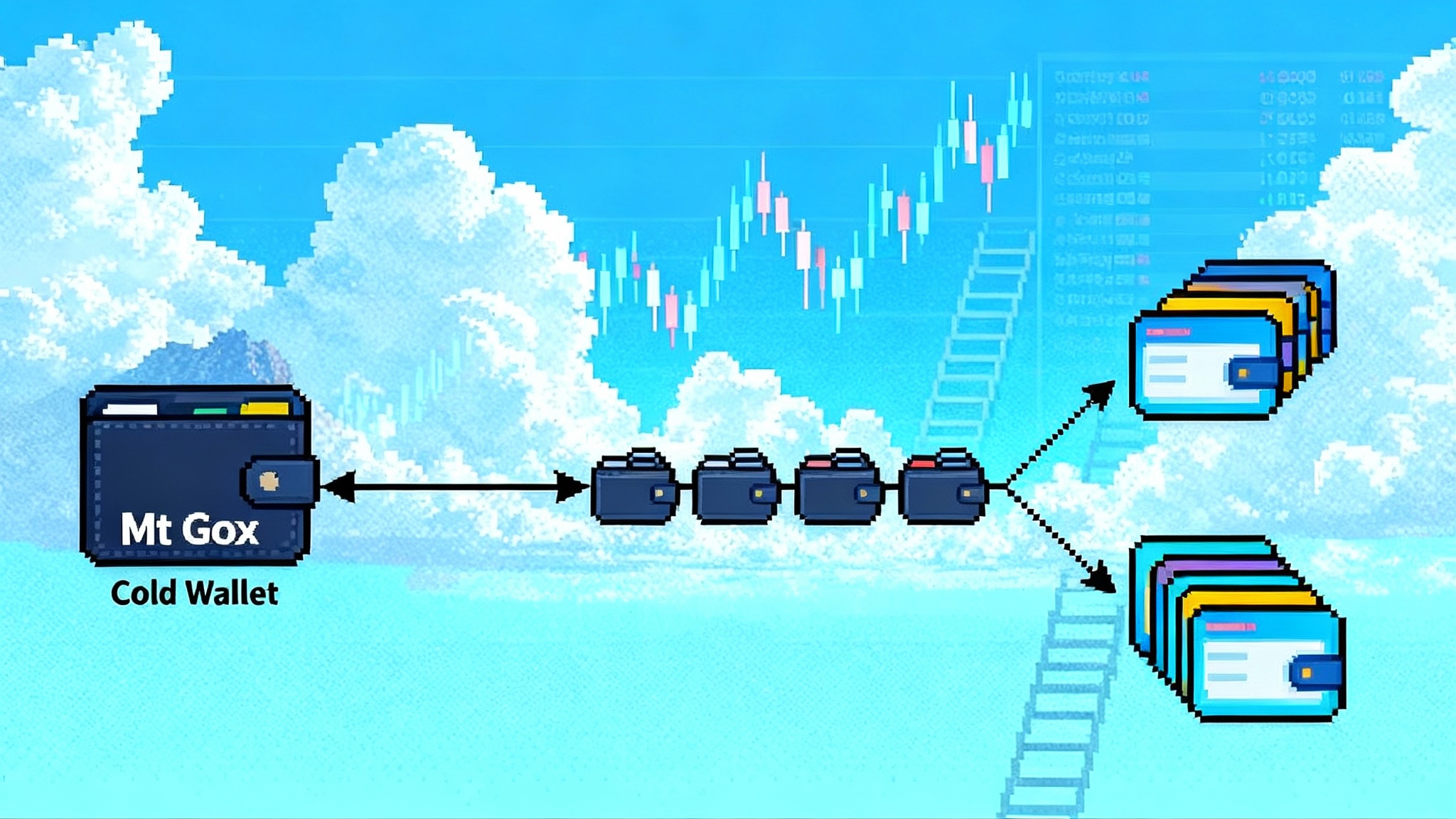

- Cross-ecosystem routes open up. With a CEX pair, more cross-chain bridges and messaging layers have a canonical price and inventory source. Macro BTC flows, including Mt. Gox late September flows, can influence liquidity conditions.

- Institutional strategies get testable. Open mint and redeem flows, plus a CEX exit, enable low-friction operational pilots for funds that want BTC basis trades or conservative yield overlays.

- Competition among Bitcoin L2s sharpens. Other L2s and sidechains are courting BTC liquidity with their own pegs and incentives. An uncapped, exchange-listed sBTC raises the bar.

- Pricing spreads compress. As market makers arbitrage CEX and DEX, spreads in sBTC pairs should narrow. That benefits end users who swap or LP and reduces the hidden cost of moving between BTC and sBTC strategies.

What to watch next

- Redemption latency and throughput under stress. The first real test is a volatile BTC day that drives many users to redeem at once. Time to BTC arrival is the metric.

- Signer set expansion and rotations. Track how often the set rotates, the geographic and organizational diversity, and whether the threshold or quorum rules evolve.

- Wallet UX polish. Lower minimums are only useful if wallets and apps make deposits and redemptions clear and safe.

- Exchange depth and additional listings. Watch order book depth, maker incentives, and borrow rates for sBTC on listed venues.

- TVL quality. Headline TVL moves with BTC price. The better metric is how much sBTC sits in productive strategies and how evenly it is distributed across apps.

Bottom line

September’s uncapping of sBTC and the first exchange listing changed the system’s posture from a carefully rationed pilot to a live liquidity rail. The mechanics are simple to use and transparent to audit, the yield model is normalizing, and the early data suggests there is real demand for programmable Bitcoin on Stacks. If signer decentralization stays on track and redemption performance holds under stress, Q4 2025 is set to be the quarter when sBTC moves from scarcity to scale and BTC-native DeFi on Stacks becomes part of the standard Bitcoin toolbox.