PeerDAS Is Live: Fusaka Triggers the L2 Fee Freefall

On December 3, 2025, Ethereum activates PeerDAS in the Fusaka upgrade, opening the door to bigger blob capacity and cheaper data for rollups. Here is how it could push L2 fees toward sub-cent and what teams should ship in the next 90 days.

The switch flips on December 3

Ethereum’s next act arrives on December 3, 2025. The Fusaka upgrade lights up Peer Data Availability Sampling, better known as PeerDAS, and clears a path for rapid increases in blob capacity. Together they push Ethereum into a larger, cheaper data bus for rollups. If Dencun gave rollups their first dedicated truck lane, Fusaka opens more lanes and teaches the network to check cargo faster without unloading the truck. As detailed in the Fusaka mainnet announcement, these changes are designed to scale data while protecting home stakers.

What just changed, in one sentence

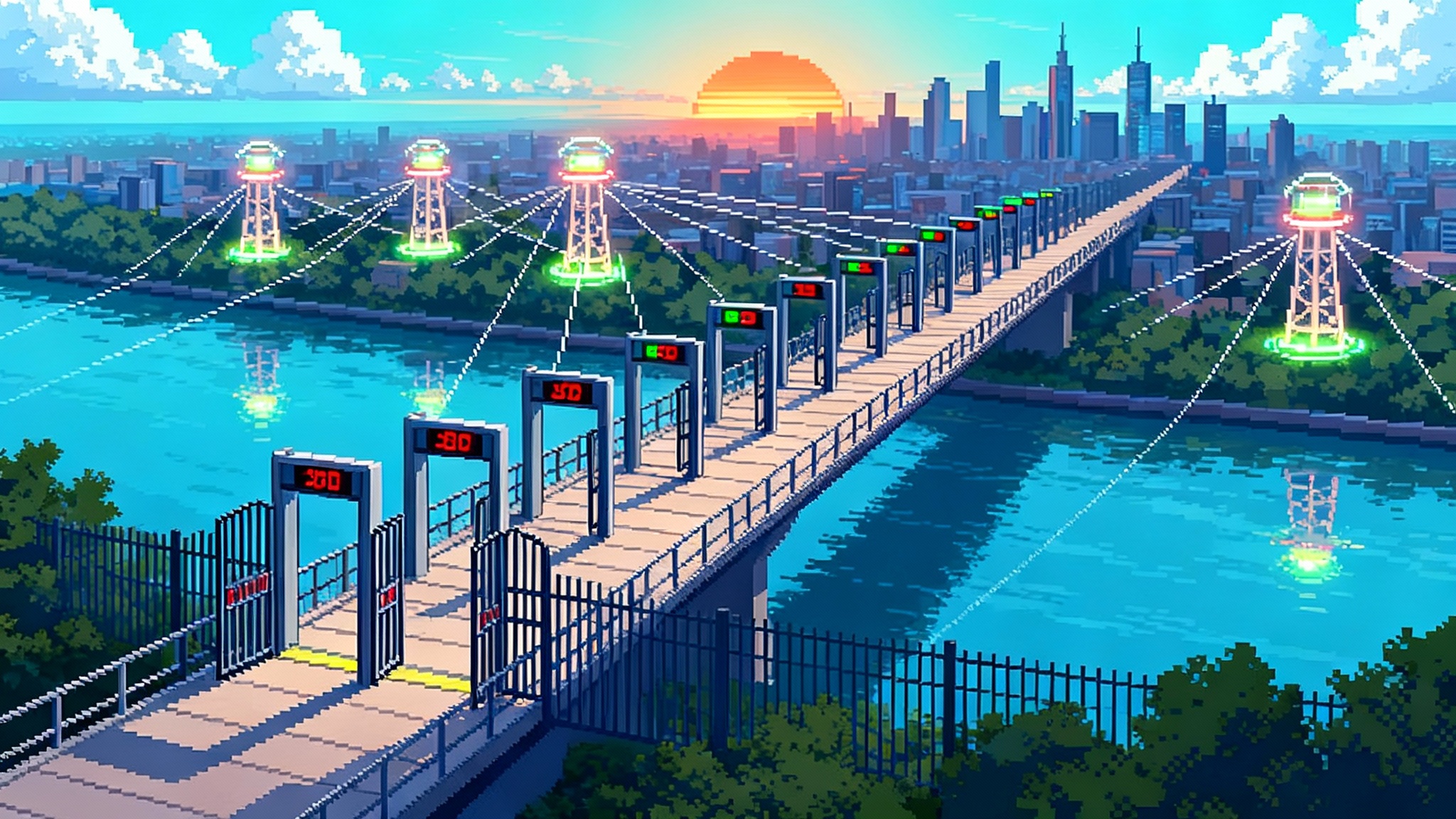

PeerDAS lets Ethereum nodes verify that rollup data is available by sampling small pieces from peers instead of downloading everything, which means the network can safely carry far more data per block. Think of a stadium check where ushers scan random seats rather than re-checking every ticket at the exit. The security comes from math that makes it astronomically unlikely to fake availability across many independent checks, as specified in the EIP-7594 PeerDAS spec.

How sampling unlocks more blobs

Blobs are big attachments that rollups post to Ethereum so the network can verify and reconstruct their state. Before PeerDAS, every node had to handle a heavy share of each blob’s data. That limited how many blobs could fit in a block without overloading home stakers and low-spec servers.

PeerDAS changes the workflow. The blob data is arranged into a grid. Nodes keep custody of specific columns and sample a tiny fraction each slot. Because the grid is built with erasure codes and authenticated with polynomial commitments, any small piece can be verified and the whole can be reconstructed if enough columns are present. In plain English, the network trades full downloads for many lightweight spot checks spread across thousands of peers, which cuts per-node bandwidth while preserving security. This is the ingredient that makes higher blob limits practical.

The throttle that turns up twice

Fusaka enables PeerDAS, and the bigger throughput jump arrives through blob-parameter-only forks that adjust just three numbers: the target blobs per block, the maximum, and the fee adjustment speed. This lets developers dial capacity up on short timelines based on observed network health. The current plan is to raise limits in stages after December 3, moving from today’s target and max toward higher levels with two scheduled increases between mid December and early January. The intent is a more than twofold jump, with intermediate ceilings to monitor node performance and keep the fee market stable.

Why it matters: blob capacity is the toll booth for rollups. When capacity rises faster than demand, the blob base fee drops. With PeerDAS in place, Ethereum can raise the ceiling without making ordinary nodes download unreasonable amounts.

Why Layer 2 fees are set to collapse

For most popular rollups, the largest cost component is data availability on Ethereum. Execution costs on the rollup are already cheap. Every megabyte of blob data amortizes across thousands to millions of transactions depending on compression and batching. When blob supply increases, the per-transaction share of that cost falls quickly.

Here is a concrete mental model. Imagine a rollup that currently fits 100,000 simple transfers into one blob and pays a blob base fee that works out to 1 dollar per blob. The data cost per transfer is one cent. If the network doubles blob capacity and the base fee halves because supply is less scarce, that same rollup now pays roughly 50 cents per blob and still fits 100,000 transfers. Data cost per transfer drops to half a cent. Add better compression or larger batches, and you approach tenths of a cent.

This is why the industry expects a visible fee step down on leading rollups after the parameter increases land. The effect will vary by chain and workload, but the direction is the same: lower data prices in the fee market push real user fees toward sub-cent, assuming sequencers pass savings through.

What this unlocks at consumer scale

Lower fees do not just make existing use cases cheaper. They change what is possible.

- Payments with loyalty logic. When an action costs fractions of a cent, merchants can attach points, receipts, refunds, and split settlements without users noticing fees.

- Gaming loops that are fully onchain. Crafting, trading, and stateful worlds become viable when the cost of a move is less than a push notification.

- Social networks with rich media anchors. Hashes of short videos, comment trees, and follows can live in blobs rather than overloading calldata budgets.

- Machine to machine markets. Internet-connected devices can settle micro-purchases for energy, bandwidth, or data samples continuously.

- Ad auctions onchain. Impression-level accounting becomes practical when a bid and a proof cost far less than a cent.

Expect new consumer apps to default to batched, blob-based writes, with the chain fading into the interface the way cloud servers faded behind mobile apps.

Who wins first: a quick map

- Major rollups. Arbitrum and Optimism ecosystems should see immediate gains on high volume applications. Base and other Optimism Stack chains can move fast by inheriting fee market improvements at the framework level. For background on governance and security dynamics, see OP fault proofs and Arbitrum BoLD. Recent progress such as EigenLayer hits Base L2 shows how shared security will compose with cheaper data.

- Shared sequencers. Networks such as Astria and Espresso that offer neutral sequencing across many rollups gain leverage. As blob capacity rises, more chains can share the same sequencer without running into data bottlenecks. That makes cross-rollup atomicity and fair ordering practical for mainstream apps.

- Data availability layers. Systems like EigenDA, Celestia, and Avail face a more interesting competitive landscape. On the one hand, cheaper Ethereum blobs narrow the cost gap. On the other hand, PeerDAS makes Ethereum more comfortable as the primary data bus, which can expand the overall market. Expect these providers to specialize in non-Ethereum settlement, regional clusters, or archival guarantees that complement Ethereum’s blob lane.

- Wallets and payment companies. When costs become negligible, fee abstraction and recurring payments matter more than gas micromanagement. As stablecoin rails expand, watch USDC at checkout adoption. The winners will handle batching and chain selection behind the scenes and surface a single balance to the user.

The 90-day builder playbook

This is a concrete plan for teams that want to ship into the post-Fusaka environment. Adjust timelines if your stack has custom constraints, but keep the sequence.

Days 0 to 7: prepare and observe

- Upgrade clients and dependencies to Fusaka-compatible versions. Make sure your dev and staging networks match mainnet parameters.

- Turn on detailed blob telemetry. Track blobs per batch, bytes per user action, base fee sensitivity, and inclusion latency.

- Run a canary release with a small percentage of production flow routed to blob writes. Verify end to end integrity and settlement assumptions under PeerDAS.

Days 7 to 21: refactor for blob economics

- Rework batching logic. Target larger batches with steady cadence, and design backpressure to avoid fee spikes. Use multiple priority levels so urgent actions can still pay up during brief congestion.

- Optimize compression. Test delta encoding for lists, dictionary compression for repetitive data, and canonical ordering to improve deduplication across users.

- Pass savings through. If you run a sequencer, update your fee algorithm so lower blob base fees translate into lower user fees quickly. Publish the formula so integrators can predict costs.

Days 21 to 60: ship new user stories

- Add features that were marginal before. Examples include per-transaction loyalty, free trial periods paid by the app, and onchain receipts for high-volume events.

- Integrate a shared sequencer if you need cross-rollup atomicity. Start with a small set of actions that benefit from fair ordering, like cross-game item swaps or shared order books.

- Build a payment rail that hides chains. Offer a single stablecoin pay button that routes to the cheapest compatible rollup at the moment of payment. Keep a shadow ledger to smooth switching.

Days 60 to 90: harden and scale

- Chaos test your data pipeline. Simulate partial data withholding or delayed blobs. Ensure your indexers tolerate missing columns and recover gracefully.

- Prepare a multi-rollup strategy. With more capacity, liquidity and users may fragment. Decide which chains you will support and how you will bridge value and identity across them without user friction.

- Benchmark cost per transaction at target volumes. Share the results in public and push them into your pricing or rebate logic.

Metrics to watch after activation

Markets will try to front-run the story. Instead, watch the plumbing. These are the numbers that tell you if the fee collapse is durable.

- Realized blobs per block. If the network sits near the new target for long stretches, the base fee has room to settle downward.

- Blob base fee and excess blob gas. Track the trend and the variance. Sustained low base fees with mild variance are the best signal for planning promotions or free mints.

- Inclusion latency for blob transactions. Measure median and tail. If tails shrink after PeerDAS, batching strategies can be more aggressive.

- Node resource usage. Peer counts, bandwidth, and disk growth across a representative set of home stakers. Healthy stats indicate headroom for the next parameter bump.

- Rollup fee pass-through. Compare sequencer revenue against blob costs. If the spread widens while blobs get cheaper, users are not receiving full benefits and competitors will arbitrage.

- L2 utilization mix. Watch how volume shifts among Arbitrum, Optimism Stack chains like Base, and zero knowledge rollups. If high volume apps concentrate on the cheapest lanes, follow them with your integrations.

- Shared sequencer adoption. Monitor the number of chains connected to Astria and Espresso and the percentage of cross-chain atomic transactions. Rising adoption suggests new design space for multi-app experiences.

Practical risks and how to hedge

- Misconfigured clients or out-of-date dependencies. Hedge by pinning image versions and automating health checks that validate PeerDAS custody and sampling routines.

- Fee snapbacks during spikes. Hedge by implementing a surge buffer that holds batches for a few slots when base fees jump, with escape hatches for urgent actions.

- Indexing drift. Hedge by building indexers that verify reconstructed data against blob commitments rather than assuming full row downloads.

- User confusion across chains. Hedge by integrating intent routing and a single balance abstraction so users never choose a chain. Let the app pick the cheapest compatible rollup at the moment of action.

The bigger arc

Fusaka is not a one-off moment. It is the start of an operational rhythm where Ethereum raises blob capacity through focused parameter forks, watches how the network behaves, and repeats. PeerDAS makes that rhythm safe because each node does less heavy lifting while the system as a whole checks more often from more angles. The result is a chain that feels less like a single computer and more like a city with smarter traffic controls and wider avenues.

This new scale will not instantly transform every experience. It will, however, remove the most stubborn tax on consumer apps built on rollups. Payments under a cent, games that sync often, social with richer anchors, and ad markets onchain become practical defaults. Builders who arrive with real user stories, disciplined telemetry, and a bias for passing savings through will capture the upside first.

On December 3, the protocol sets the table. In the weeks after, the forks turn the knobs. The builders decide what people taste.