Visa Switches On Stablecoins as GENIUS Act Reshapes Payouts

Visa is piloting stablecoin payouts just weeks after the US GENIUS Act set federal rules for payment stablecoins. Here is how this shifts settlement, compliance, and treasury over the next six months.

The switch flips: stablecoins enter the payout mainstream

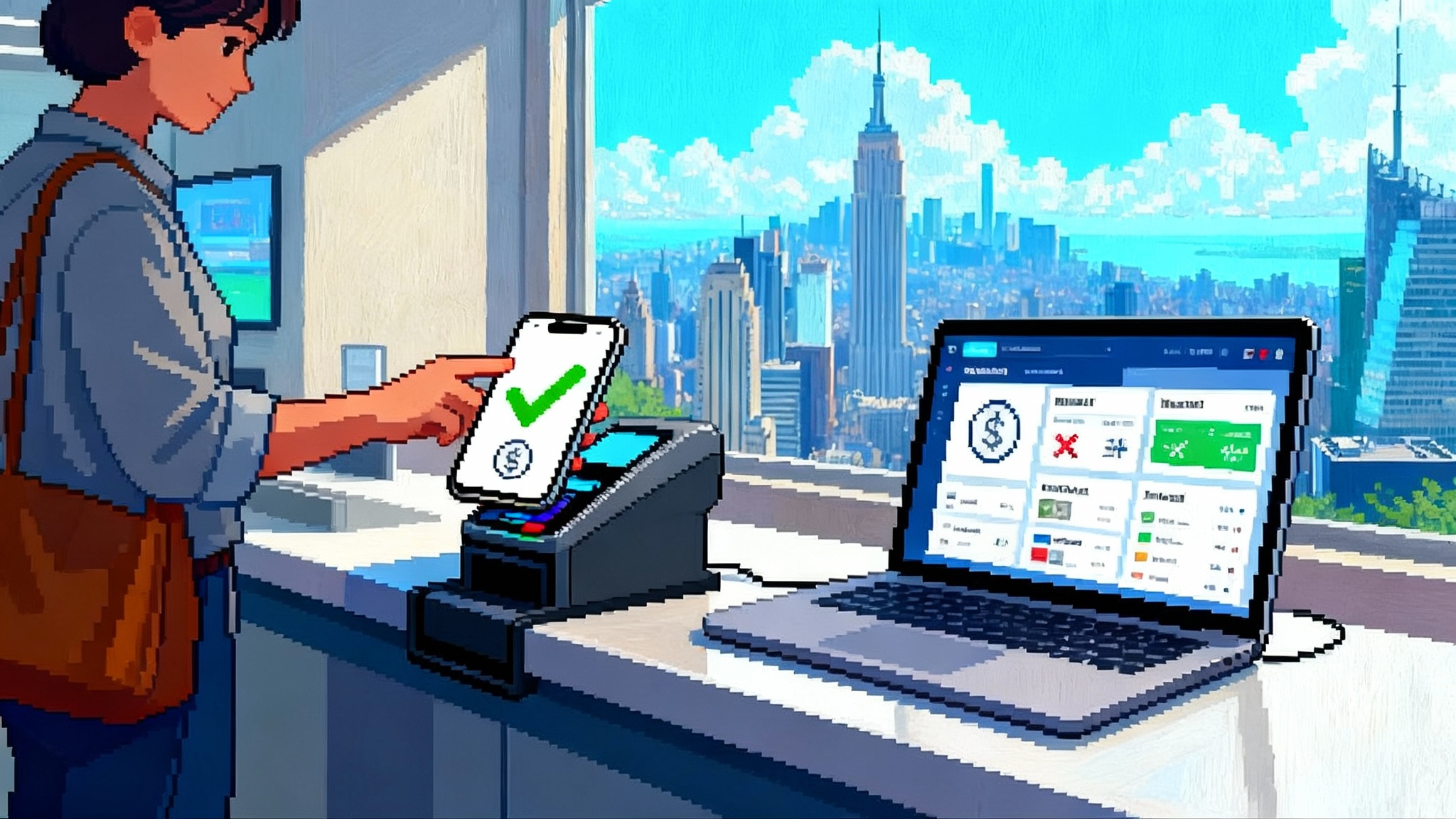

Visa just pulled a quiet lever that could be felt around the world. The company began piloting stablecoin-based cross-border payouts, letting businesses pre-fund with tokenized dollars and push money across borders with near-instant settlement finality and lower fees. The timing is not an accident. In July 2025, the United States enacted the GENIUS Act, the first federal framework for payment stablecoins, which clarified who can issue them, how reserves must be held, and what compliance looks like. That clarity turns stablecoins from a crypto curiosity into a regulated building block for payments. For the first time, the network effect of a global card brand meets a clear national rulebook for tokenized dollars. You can think of it like shifting from shipping cash in sealed envelopes to sending certified wire-grade parcels that move at internet speed.

The new law matters because it moves stablecoins out of a gray area and into a supervised perimeter. Permitted issuers must hold one-to-one reserves in cash and short-dated Treasuries, submit to audits, and meet anti-money-laundering rules. If you are a fintech that has waited for the compliance fog to lift, this is the moment. For a concise official snapshot, start with the GENIUS Act summary on Congress.gov.

Visa’s pilot is a turning point for operations, not just headlines. The company is wiring stablecoins into its existing payout stack rather than inventing a new one. That means speed and scale land at once. Reuters captured the pivot plainly in its report on the pilot and its cross-border focus. See the Reuters report on Visa’s pilot for the high-level picture.

What changed with the GENIUS Act

The law sets the guardrails that large firms need to move from experiments to production:

- Who can issue: bank-affiliated issuers, federally qualified nonbank issuers, and state-qualified issuers under explicit supervision.

- How reserves work: one dollar of high-quality liquid assets for every dollar of tokens outstanding, with narrow, transparent reserve menus and monthly disclosures.

- Safety rails: built-in compliance obligations for sanctions screening, suspicious activity reporting, and recordkeeping.

- Consumer protection: redemption rights at par, clear attestations, and fast remediation when things go wrong.

The net effect is simple. Dollars can now exist as tokens that behave like cash for settlement and like a regulated instrument for compliance. That combination is the unlock for mainstream payouts.

From pre-funded tokens to instant payouts

Cross-border payouts have always had a problem hiding in plain sight: prefunding. Companies keep cash idling in local accounts so a payment in Mexico, Nigeria, or the Philippines can land quickly. That fragmented working capital is expensive and slow to rebalance.

Pre-funded stablecoins change the shape of the problem. Instead of keeping idle balances in many countries, a payout operator can hold a single pool of regulated tokens, then push value to the right endpoint in seconds. Picture a global treasury as a reservoir on a hill. Gravity (the network) carries water through pipes to any town below. Tokens are the water, and the chain is the pipe. You do not need a separate tank in every town.

The operational loop looks like this:

- The payer tops up a corporate wallet with regulated stablecoins from a permitted issuer.

- The payout processor instructs an on-chain transfer to a local partner or wallet.

- The local partner converts to local currency when needed, or passes through tokens to end users who want to hold them.

- The system auto-sweeps residual balances back to centralized treasury at the end of the day.

No more multi-day correspondent ladders. No more guessing how much to leave in far-flung accounts. You pre-fund once, then move value as needed.

What changes for fintechs: settlement, compliance, treasury

For fintech operators, three departments feel the shift first.

- Settlement: You move from batch windows to continuous settlement. Tokens settle at the speed of the chain, often seconds. Cutoff times shrink and reconciliation simplifies because on-chain transfers are atomic and timestamped.

- Compliance: Your scope changes, not your responsibility. You still perform know your customer checks, travel rule data exchange where applicable, sanctions screening, and suspicious activity monitoring. The difference is modern screening tools can evaluate addresses and flows before and after each transfer, not just at onboarding. You also inherit issuer-level hygiene. Work only with permitted issuers that publish attestation reports and have clear blacklisting procedures.

- Treasury: Working capital centralizes. Instead of ten local accounts, you manage one or two token pools plus conversion partners at the edge. Treasury policies need explicit rules for reserve selection, sweep schedules, counterparties, and intraday liquidity limits on chain.

A practical example: a marketplace that pays out to cross-border sellers can pre-fund in tokens at the start of each day, send payouts on demand, then sweep back to fiat before markets close. Intraday cash drag shrinks, and forecasting improves because every transfer is visible and final on chain.

What changes for merchants

Large merchants may not touch the chain directly, but they will feel the downstream effects in lower payout costs and faster funds availability from platforms that do. If you are a merchant of record paying thousands of creators or gig workers across borders, your platform can push funds faster with fewer correspondent fees. Refunds and chargeback-related disbursements can also move faster where tokens act as the settlement bridge while consumer refunds still land in local fiat.

Merchants that also run gift cards or stored value can test tokenized float without forcing customers to manage crypto. The platform can hold tokens for settlement while the consumer experience stays familiar: a card on file, a balance in an app, local currency in the bank the next morning.

What changes for wallets and neobanks

Wallets gain a new wholesale rail. They can accept stablecoin payout inflows on chain and convert to local currency, or let users hold tokens as dollars if regulation permits. Two practical feature unlocks arrive quickly:

- Earn on float: with permitted reserve assets held by the issuer, users may receive pass-through yield models in the future if regulators and product design allow. In the near term, wallets benefit through lower costs and faster settlement. For how gasless experiences show up in production, see our look at gasless USDT and a neobank inside.

- Global reach: freelancers can invoice in dollars and get paid into a compliant wallet, then convert to local fiat or keep a dollar balance that spends via a card.

Wallets must invest in address hygiene, private key management, fraud detection, and gas abstraction. The upside is sticky deposits and cross-border reach without building a correspondent network.

Why users will not touch gas

If you are picturing users juggling token fees, do not. Gasless patterns already exist. A payout platform can sponsor fees through meta-transactions or paymaster services so the receiver never sees a chain or signs a cryptic transaction. To the end user, a payment arrives in an app, shows as dollars, and spends on a card. The chain is the settlement backplane, not the interface.

This is the same magic you experience when you use a streaming service. You do not think about content delivery networks or codecs. You press play. Stablecoin payouts should feel like that. The infrastructure is complex, but the product is simple because the platform eats the complexity.

Competitive impact: banks, PayPal and Stripe, and remittance rails

- Banks: Treasury teams at global banks will not disappear, but their role shifts. Corporate clients will ask for token custody, on-chain liquidity management, and intraday credit lines against token collateral. Banks with strong transaction banking will integrate with token rails and offer deposit and sweep services that straddle fiat and on-chain liquidity. Banks that wait may see working capital and cross-border fee pools erode first in small and medium business segments.

- PayPal and Stripe: Both already speak stablecoin. They will be fast followers with gateway-level support for on-chain settlement behind familiar checkout and payout surfaces. Expect them to bundle compliance tooling and gas abstraction so developers keep existing integrations. Their advantage is distribution. Their risk is margin compression if stablecoin settlement undercuts foreign exchange spreads and correspondent fees they currently capture.

- Remittance networks: Consumer remitters face the clearest pressure. If a neobank can deliver dollars to a compliant wallet in seconds and a local partner can cash out at market rates, the classic cash-in cash-out corridor loses its captive audience. The winners will pivot to become endpoints for cash conversion and domestic bill pay. The losers will cling to cash windows while digital corridors soak up volume.

The 3 to 6 month outlook: who is likely to win first

Chains: Expect early volume to concentrate where performance meets integration maturity. Ethereum will remain the institutional anchor, especially via high-throughput layer 2 networks that support account abstraction and sponsor-paid fees. Solana is positioned for high-volume, low-latency payouts that need fast finality and low costs, helped by prior enterprise pilots and a developer ecosystem focused on throughput. For what Solana’s roadmap means for block space, see Firedancer's plan to uncap Solana blocks. You will also see selective tests on application-specific networks that optimize for payments rather than generalized computing.

Stablecoins: Issuers that meet the new permitted categories and already operate at scale will move first. Circle’s dollar token is the default for many institutions because of its compliance posture and broad chain coverage. We recently examined Circle’s Arc and the new payments era, which foreshadows features merchants and wallets will expect. PayPal’s dollar token, issued by a regulated trust company, is a natural fit inside its ecosystem and attractive for merchant-facing flows that start or end in PayPal. Bank-issued tokens could appear as closed-loop settlement assets for specific corporate clients, especially where a bank extends intraday credit secured by token collateral. Offshore tokens will remain popular in crypto-native contexts but will be harder to justify for regulated payouts into the United States.

Geographies and corridors: The first corridors to light up are the ones with strong local partners, predictable regulation, and demand for dollar flows. Think payout-heavy markets with large freelancer or creator economies and well-developed wallet infrastructure. The gating factor will be stablecoin on- and off-ramps that meet local rules.

The real risks to watch

- Liquidity concentration: If most volume aggregates in one or two issuers, a technical or legal issue could ripple across many payout programs at once. Mitigate with multi-issuer support, daily redemption tests, and automated failover.

- Depeg risk: Even with high-quality reserves, market stress or operational missteps can move a token off par. Your runbook should include price oracles, guardrails that halt payouts beyond a threshold, and instant redemption routes.

- Blacklisting and reversals: Regulated tokens can be frozen under certain conditions. You need clear customer terms, automated exposure tracking for tainted funds, and operational paths to unwind or reissue payouts if an address is frozen.

- Counterparty and custody risk: Do not assume a wallet or crypto service provider is a commodity. Assess their capitalization, insurance, key management model, and incident history. Treat them like critical payments vendors, because they are.

- Operational complexity: On-chain systems add new failure modes. Build staging environments that simulate network congestion, chain reorganizations, and oracle outages. Monitor mempools, not just finality.

Integration checklist for teams that want to ship now

- Define the use case: payroll, marketplace payouts, supplier remittances, or refunds. Each has different timing and compliance needs.

- Pick permitted issuers and a backup: document redemption windows, reserve composition, attestation cadence, and blacklisting policy.

- Choose chains for the first 90 days: prioritize low cost, fast finality, enterprise tooling, and the ability to sponsor gas. Start with one primary and one fallback.

- Decide on custody: self-custody with hardware security modules, a qualified custodian, or a hybrid. Specify key ceremonies, access controls, and disaster recovery.

- Build compliance into the flow: address screening before transfer, sanctions checks, travel rule data exchange, and transaction monitoring tuned to on-chain heuristics.

- Implement gas abstraction: meta-transactions or paymasters so receivers never handle gas. Pre-fund relayer accounts and alert on balance thresholds.

- Treasury policy: target balances for token pools, intraday sweep schedules, and triggers to convert to fiat. Include circuit breakers tied to depeg tolerances.

- Reconciliation and reporting: map on-chain events to journal entries, create daily proof-of-reserves checks for your own holdings, and automate statement generation for finance.

- Incident runbooks: depeg, blacklist, contract upgrade, chain outage. Prewrite customer communications and escalation paths.

- Pilot with a narrow corridor: measure landed cost per payout, delivery time, failure rates, and user satisfaction. Only then scale to additional corridors.

The takeaway

The GENIUS Act gives dollar tokens a supervised home and a predictable set of rules. Visa’s pilot plugs that clarity into a global payout network that businesses already use. Put together, they transform pre-funded tokens from a curiosity into a pragmatic way to move money across borders. The prize is speed, working capital efficiency, and a cleaner audit trail. The cost is the work required to treat on-chain rails like mission-critical infrastructure. If you are a fintech, merchant platform, or wallet, the next three months are for careful pilots. The next six months are for turning pilots into products. The companies that win will hide the complexity, make gas invisible, and design for failure before it happens. The money will move at internet speed either way. Your choice is whether your product moves with it.