Tech-Neutral Credits Are Live: 45Y and 48E Reprice U.S. Power

Treasury and the IRS have finalized the tech-neutral clean electricity credits. The first Annual Table sets a practical GHG threshold of not greater than zero. See what qualifies now, what is pending, and how to move first in 2025–2028.

A new price signal just switched on

Think of the power sector as a crowded auction where every electron is trying to win the cheapest financing. On January 7, 2025, Treasury and the Internal Revenue Service finalized the technology neutral clean electricity credits that set the new rules of that auction. These are the Clean Electricity Production Credit under section 45Y and the Clean Electricity Investment Credit under section 48E, and they now determine who qualifies, how projects pencil, and how rapidly supply can scale. The rules apply to facilities placed in service after December 31, 2024 and are designed to run until the power sector hits a statutory emissions target or through 2032. See Treasury’s announcement of the final rules for 45Y and 48E.

Eight days later, the government published the first Annual Table of greenhouse gas emissions rates. This is the operational heartbeat of the program. It tells you which technologies categorically clear the emissions screen and which must seek a custom determination. The Internal Revenue Service’s Revenue Procedure sets out that initial list in the first Annual Table of emissions rates.

The bottom line: clean power now competes on the same field, by the same test, with a simpler rulebook and new financing levers.

What “GHG ≤ 0” means in plain English

Eligibility turns on a lifecycle greenhouse gas number. For 45Y and 48E, a qualified facility must have a greenhouse gas emissions rate that is not greater than zero. In practice, here is how to read that rule:

- It is lifecycle based. The government is considering cradle-to-gate impacts associated with producing a kilowatt hour, not just what comes out of a smokestack.

- It is determined by category unless you ask for a facility specific value. The Annual Table assigns a default emissions rate by technology category. If your project fits a listed category, you do not need a bespoke lifecycle study to prove you are clean enough.

- It is a threshold, not a bragging contest. You do not get a bigger credit by being more negative. The test is pass or fail. The value of the credit depends on the option you elect, either the per kilowatt hour production credit or the investment percentage.

One point that matters for developers and lenders: the Annual Table is an eligibility instrument, not a global scientific statement about the precise grams of carbon per kilowatt hour for every project. If your technology is listed as "not greater than zero", you are in for credit purposes. If your technology is not listed, you may still qualify, but you must petition for an emissions rate and your schedule then depends on that process.

Who qualifies today, and who is waiting

Treasury’s first Annual Table confirms that the following technologies meet the "not greater than zero" test as categories:

- Wind, including onshore and offshore

- Solar, including photovoltaic and thermal electric

- Hydropower, including uprates at existing dams

- Marine and hydrokinetic, such as tidal and wave

- Geothermal electricity

- Nuclear fission

- Fusion energy

- Certain waste energy recovery property where the energy source itself is a qualifying category

Combustion and gasification pathways are still pending. Treasury has signaled that certain biomass, waste combustion, and related technologies will be evaluated through lifecycle analysis led by Department of Energy national laboratories. Developers in these categories should assume a petition timeline and design flexible schedules that can accommodate a determination later in 2025 or 2026.

The pivotal choice: 45Y Production Credit or 48E Investment Credit

For most utility scale projects, the first strategic decision is whether to take the per kilowatt hour production credit for 10 years (45Y) or the one time investment credit as a percentage of basis (48E). The decision changes bids, returns, and offtake structures. Here is a practical way to decide:

- If your project has a high capacity factor and relatively moderate upfront cost per kilowatt, the Production Credit typically wins. Think high wind resource sites, geothermal with strong steam, and nuclear uprates. Ten years of inflation adjusted payments can beat a one time percent of basis.

- If your project is capital intensive or faces early year cash constraints, the Investment Credit often wins. Think offshore wind with expensive balance of plant, storage that does not produce power for PTC purposes, or distributed projects where immediate monetization lowers delivered prices.

- If you are stacking large bonuses that scale as a percentage of basis, that tilts toward 48E. The domestic content and energy community adders increase the percentage for the Investment Credit. For a Production Credit, they raise the credit amount but do not amplify the capital base in the same way.

- Model both options using conservative inflation paths and realistic curtailment. Developers frequently overlook grid constraints that clip output, which weakens the case for a Production Credit. For interconnection realities and deliverability trends, see Order 2023’s first results.

A quick mental model: at 40 percent capacity factor and healthy interconnection, Production Credit value builds quickly. At 20 percent capacity factor or for storage heavy designs, Investment Credit dominance shows up early. The smart move in 2025 request for proposal responses is to offer both cases and make the election only when you lock in a lender or a credit transfer buyer.

Bonus stacks that move projects from no to go

Three bonuses shape the next four years.

- Domestic content. If you meet the steel, iron, and manufactured product thresholds, the Production Credit increases by 10 percent and the Investment Credit increases by up to 10 percentage points if prevailing wage and apprenticeship rules are satisfied or a small project exception applies. Plan for a documentation burden. You cannot wish your way into this bonus. Build a bill of materials early, use the safe harbors where available, and require suppliers to certify country of origin.

- Energy communities. Locate in a qualifying energy community and you generally add 10 percent to the Production Credit or 10 percentage points to the Investment Credit if prevailing wage and apprenticeship rules are satisfied. Developers should map eligible census tracts and mine data updates since zones shift with employment statistics. Bid schedules should include a fallback location in case boundaries move between bid submission and notice to proceed.

- Low income communities. For smaller projects under section 48E, there is an annual allocation program that can add 10 or 20 percentage points to the Investment Credit for projects that meet low income community or economic benefit tests. Category and capacity caps matter. Developers should pre assemble documentation with property records, benefit sharing agreements, and building affordability covenants, then file during the initial window each year.

The lesson: document once, reuse often. Build a shared data room for country of origin certificates, wage and apprenticeship evidence, energy community mapping, and low income program files. Most of the analysis is portable across similar projects.

Monetization has a new playbook: transferability and direct pay

The transferability market will define the 2025 to 2028 buildout. Private developers that cannot use the full credit internally can sell it for cash to an unrelated taxpayer. Prices reflect three things: credit certainty, recapture risk, and the buyer’s own tax planning. Well structured projects with clear bonus eligibility and stable offtake draw better bids and tighter discounts. Best practices include quality control reporting, conservative credit sizing, and indemnities that clearly allocate recapture risk.

Tax exempt entities and public power have another path. Direct pay converts the credit into a cash refund from the Internal Revenue Service. This option applies broadly for applicable entities and is especially powerful for municipal utilities, rural electric cooperatives, tribes, and similar owners of generation or storage. Some joint ownership structures can be organized so that the public power partner claims direct pay while a private partner uses transferability for its share. That mix lowers overall capital cost and can beat a classic tax equity partnership on speed and fees.

A caution: direct pay has domestic content based phaseout rules for larger projects. If you cannot make the domestic content showing, the direct pay amount can be reduced depending on when construction starts. Plan your supply chain and documentation early to protect the full benefit.

RFP design for the 45Y and 48E world

Utilities and corporate buyers will rewrite their procurement in three ways.

-

Require dual credit cases. Ask bidders to present both Production Credit and Investment Credit economics, with a standard set of inflation and curtailment assumptions. Keep the election open until financing is committed.

-

Score bonus eligibility as a hard criterion. Points for certified domestic content plans, energy community siting, and low income program allocations should be explicit, not left to narrative. Bonus certainty lowers your power price.

-

Make credit monetization part of the bid. Require bidders to specify whether they will use transferability or direct pay, provide letters of intent from credit buyers where possible, and disclose indemnity and recapture terms. Treat credit sale certainty the same way you evaluate interconnection risk.

For corporate buyers, add one more lever. Storage paired designs can deliver firmed clean power blocks that match your load and reduce shape and imbalance charges. Storage does not earn a Production Credit, but it does qualify for the Investment Credit and can materially lower your effective price. Expect demand from data center growth to shape procurement, as outlined in AI’s power land rush.

Near term winners

- Geothermal. High capacity factor geothermal now has a clear pathway to Production Credits or Investment Credits, and it benefits from domestic content where U.S. drilling and field equipment are used. For utilities in the West, geothermal fills night hours without forcing long duration storage procurement in the first phase.

- Hydropower uprates. Small efficiency improvements at existing dams clear the emissions test and can be executed quickly. Capacity factors are high, so the Production Credit is often attractive. These projects also tend to sidestep long permitting fights since the footprint is already in place.

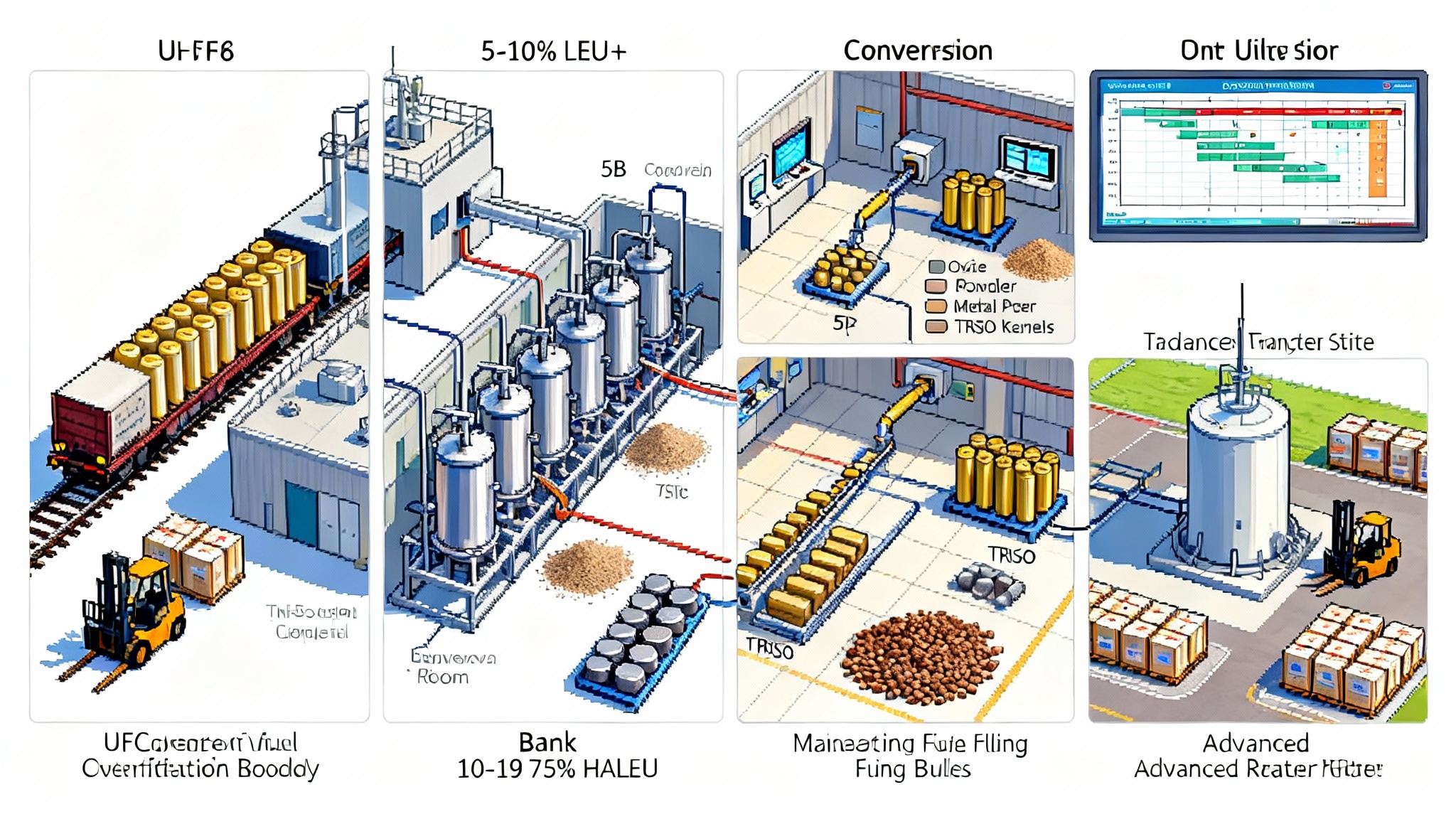

- Nuclear uprates and life extensions. Incremental power from an uprate at a nuclear plant is now clearly eligible. The economics work because incremental capital per additional megawatt is relatively low and output is steady. Owners can also layer domestic content if qualifying equipment is sourced domestically. For fuel dynamics that affect uprate economics, see the LEU and HALEU fuel pivot.

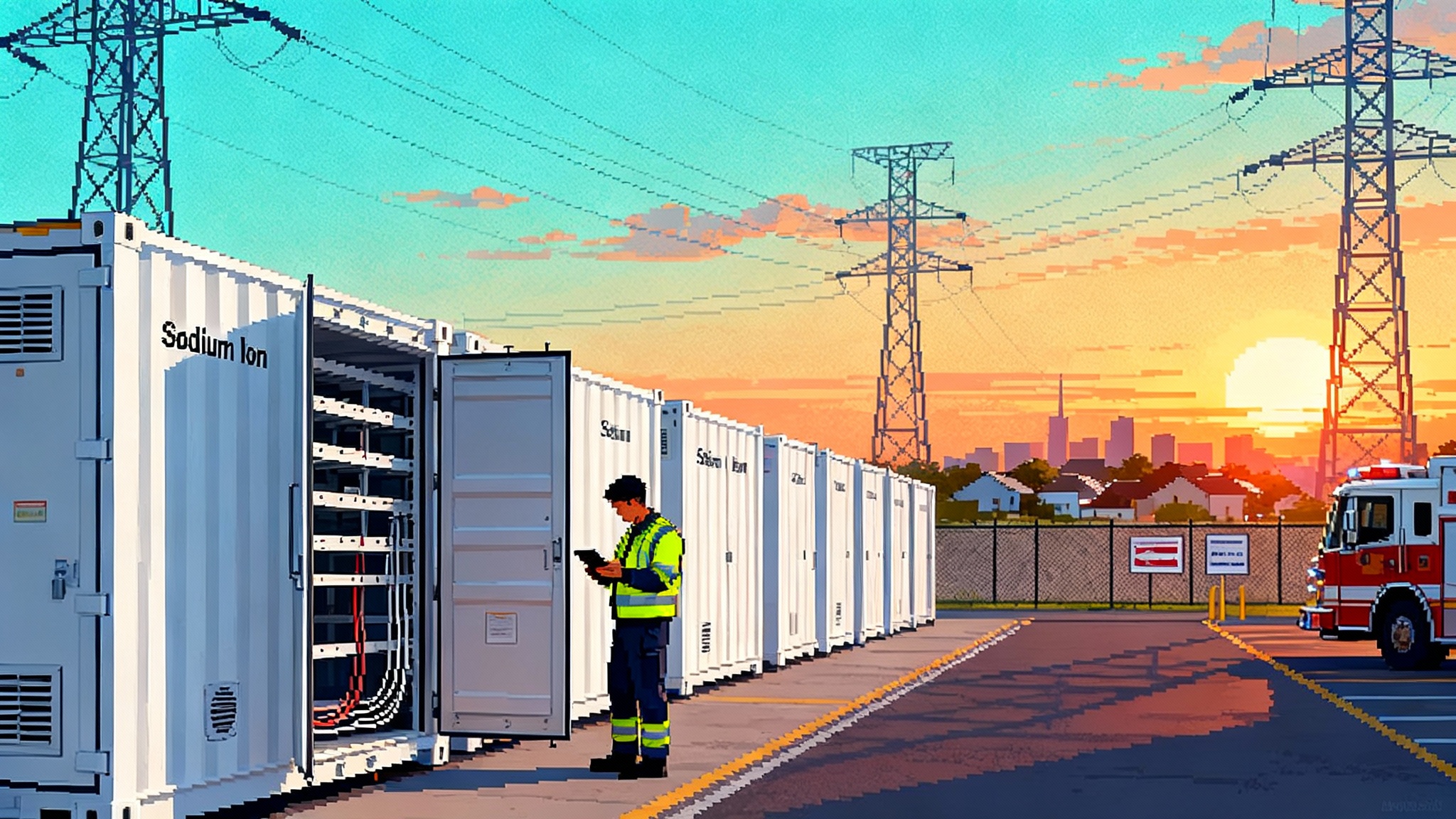

- Storage paired projects. Standalone and paired storage qualify under 48E. When paired with solar or wind, storage smooths delivery and raises the value of the renewable’s production, which can tilt the 45Y versus 48E choice. Storage also helps corporate buyers match hourly targets without overbuying renewable energy credits.

Key risks to manage in 2025 to 2028

- Petition for Emissions Rate queue. If you are in a combustion or gasification pathway, you will need a facility specific emissions determination unless and until a category is added to the table. Budget time for Department of Energy analysis and Internal Revenue Service processing. Build your financing with a petition contingency and a plan B.

- Annual Table updates. The table can change. That is an opportunity if your technology is newly listed, but it is a risk if definitions tighten. Lock in eligibility by aligning your design with a listed category and avoid optional features that could push you into a petition.

- Supply chain choke points. Domestic content bonuses require documentary proof that suppliers cannot always provide on quick turnaround. Engage early with manufacturers, use safe harbors where available, and write purchase agreements that pass through data obligations and penalties for non compliance.

- Interconnection and curtailment. Production Credits reward energy delivered. Queue delays and curtailment risk cut value in half faster than any spreadsheet error. Prioritize nodes with proven deliverability and require curtailment modeling in bids. Our breakdown of reforms and capacity headroom in Order 2023’s first results remains a useful guide.

- Policy durability. Credits are in final rule status today. Future legislation could adjust timing or eligibility. The best hedge is to move quickly, reach notice to proceed, and secure a credit transfer agreement with robust recapture protections.

A playbook for each stakeholder

- Developers. Build a single source of truth for labor compliance, domestic content, and energy community mapping. Price both credit paths in every bid. Line up at least two credible credit buyers well before mechanical completion, and do a dry run on pre filing registration.

- Utilities. Standardize bid forms to expose how bidders will monetize credits. Reward bonus certainty. Consider pay for performance contracts where the seller elects 45Y so that you share the upside of high capacity factors while protecting against curtailment.

- Corporate buyers. Use storage pairing to turn intermittent megawatt hours into fixed clean power blocks aligned with your load. Ask for credit transfer price pass throughs. You do not need to buy the credits yourself to benefit from their monetization.

- Public power and cooperatives. Use direct pay to own, not rent, your transition. If you co develop, structure ownership to keep your direct pay election clean. Combine energy community locations with storage to lower system peaks and reduce wholesale purchases.

The accelerationist conclusion

The switch is on. With tech neutral credits live and an initial Annual Table in place, the lowest cost capital will chase the earliest, cleanest, and most straightforward projects. Speed now lowers your cost of capital, which in turn widens the price gap you can bid and still win. The inverse is also true. Hesitation raises financing spreads, pushes you into riskier petition timelines, and narrows the very window you are trying to evaluate.

Treat the new rulebook as a price signal, not a reading assignment. Decide your 45Y versus 48E path early, stack bonuses you can prove, choose a monetization route you can execute, and move. The power market is about to reward the builders who do their homework this quarter and bring steel to site next.