America’s 2025 Fuel Pivot: LEU+ and HALEU Reset SMRs

With NRC approval for LEU+ production and the first domestic HALEU output, the U.S. nuclear fuel chain just changed. See who is producing what, where deconversion and transport will pinch, and how the next 24 to 36 months reshape refueling cycles, SMR timelines, and project finance.

Breaking moment: the United States moves up the fuel ladder

On September 30, 2025, the U.S. Nuclear Regulatory Commission authorized Urenco USA in Eunice, New Mexico, to produce low enriched uranium plus, fuel with uranium 235 between 5 and 10 percent. Two days later the company announced it publicly. That green light matters because it lets the only commercial U.S. enricher make the higher enrichment feed that existing reactors and many near term designs actually want. See the announcement: NRC authorized Urenco USA.

Three months earlier, on June 25, 2025, a separate milestone quietly landed. Centrus Energy’s 16 machine cascade in Piketon, Ohio delivered 900 kilograms of high assay low enriched uranium to the Department of Energy, completing a first production target and proving domestic HALEU enrichment at industrial quality. Read DOE’s summary: Centrus reached 900 kilograms.

Those two steps reset the U.S. fuel supply chain. One widens the spigot for LEU+, the other proves HALEU is no longer a purely imported product. Combined with the U.S. ban on Russian enriched uranium that took effect on August 11, 2024, with limited waivers through January 1, 2028, utilities and developers now must plan around a domestic system that is still forming. This shift intersects with changing project incentives as tech neutral credits upend project finance and with rising demand pressure from the AI power land rush.

Plain language: what LEU+ and HALEU actually are

Think of enrichment like adding more active ingredient to the same medicine. Standard low enriched uranium for today’s light water reactors is 3 to 5 percent uranium 235. LEU+ is 5 to 10 percent. HALEU is above that, up to 19.75 percent. These are still far below weapons grade material and they let designers do useful things:

- With LEU+, an existing plant can run longer between refueling outages or carry a little more power on the same core design once it is licensed to do so.

- With HALEU, many advanced reactors can be smaller and operate for longer stretches on one core. Some fast reactors need HALEU in metallic form. Pebble and particle fuels need HALEU kernels wrapped in graphite.

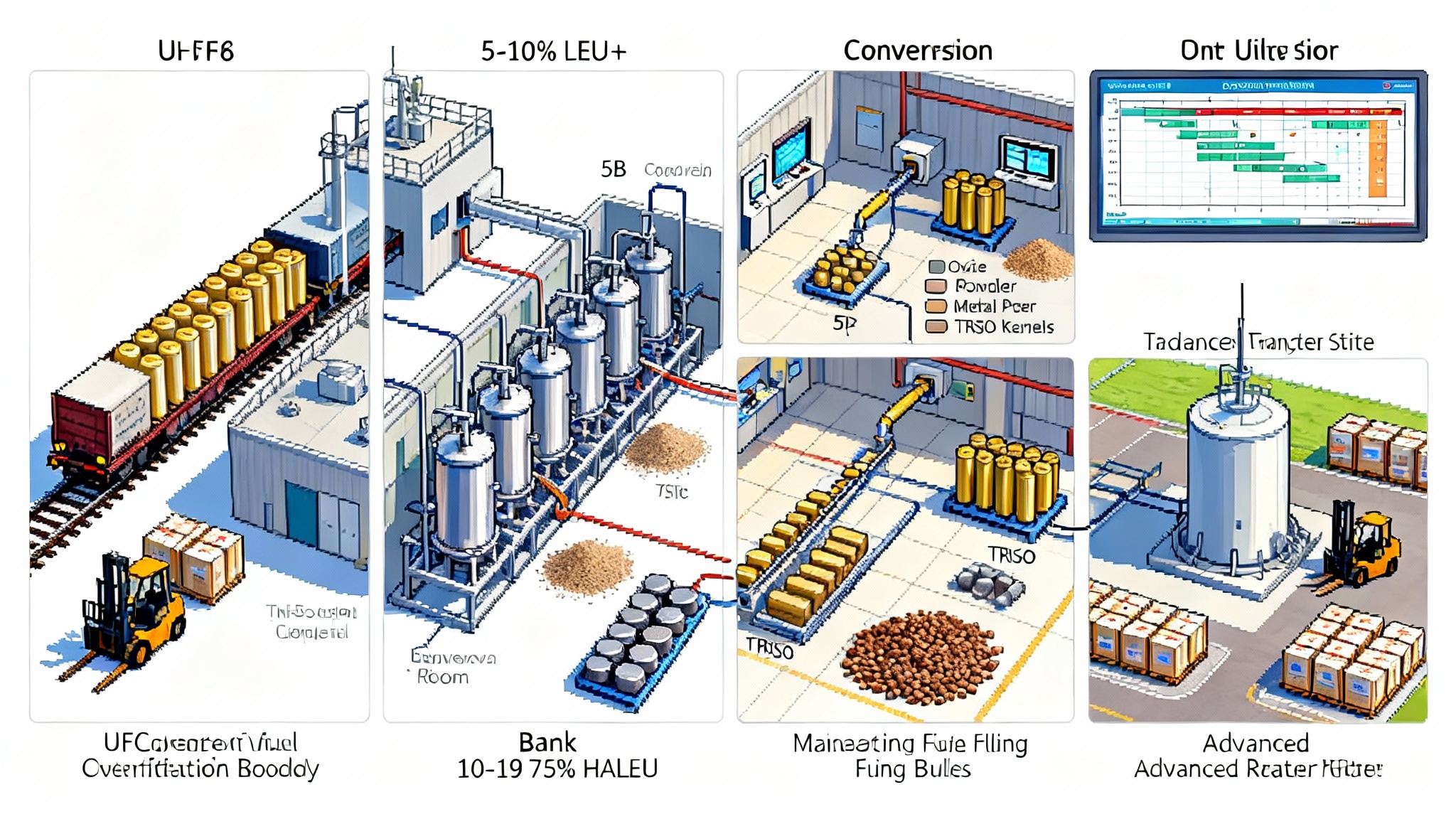

The new map: from rock to rod, step by step

A nuclear fuel reload is not a single factory. It is a chain with specialized links:

-

Mining and conversion. Uranium ore becomes uranium hexafluoride gas, known as UF6. The United States regained domestic conversion capacity at Metropolis, Illinois in 2023, and North American conversion is expanding elsewhere.

-

Enrichment. UF6 is fed into centrifuges that raise uranium 235 to the target level. Urenco USA now has authority to produce LEU+. Centrus currently produces HALEU in a demonstration cascade. Other enrichers are pursuing U.S. contracts and sites, but they are not yet producing domestically.

-

Deconversion. Enriched UF6 is converted into the chemistry a reactor needs: uranium dioxide powder for most light water reactor fuel; uranium metal for some fast reactors; uranium oxycarbide kernels for tristructural isotropic, or TRISO, fuels. For HALEU, these steps must be performed in higher security facilities with new equipment and stricter criticality controls.

-

Fuel fabrication. Powder is pressed into pellets and loaded into tubes to build assemblies. Metal fuel is cast into pins or plates. TRISO kernels are coated and formed into pebbles. Several U.S. fabrication sites are adding the equipment and approvals required for higher enrichment work.

-

Transport and packaging. Cylinders and shipping packages must be licensed for the enrichment level and form. At enrichments above 5 percent, many existing approvals do not apply and new criticality analyses are required.

Each link must exist at the right scale and be licensed to handle the right enrichment. Today, the chokepoints are not where headlines suggest.

Who is producing what in late 2025

Here is the practical scorecard as of November 2025:

-

Urenco USA, Eunice, New Mexico. Authorized to enrich up to 10 percent uranium 235. Initial LEU+ production slated before year end 2025 with first deliveries to a fuel fabricator in 2026. The plant’s current capacity is several million separative work units per year, with expansion potential.

-

Centrus Energy, Piketon, Ohio. Delivered 900 kilograms of HALEU to the Department of Energy by June 25, 2025, and continues at roughly 900 kilograms per year under its current contract period. The cascade is small, but the site and design are expandable once long lead equipment, cylinders, and financing are in place.

-

Framatome, Richland, Washington. Transport approvals now allow shipping fresh pressurized water reactor and boiling water reactor assemblies up to 8 percent enrichment. Framatome has applied to increase plant enrichment limits for fabrication steps at Richland and is developing pilot processes to make HALEU metal for customers that need it.

-

GE Vernova’s Global Nuclear Fuel, Wilmington, North Carolina. Holds an NRC license amendment to fabricate fuel up to 8 percent enrichment and an updated certificate to ship those assemblies. This is key for getting LEU+ from an enricher to an operating light water reactor.

-

TRISO X, Oak Ridge, Tennessee. X energy’s fuel subsidiary is building its NRC licensed TRISO fuel fabrication facility. TRISO pebbles will ultimately require HALEU kernels, so the facility’s timeline is tied to HALEU deconversion and kernel production coming online.

-

Advanced demonstrators. TerraPower’s Natrium project in Kemmerer, Wyoming progressed through state and federal milestones in 2025 and will need HALEU metal for its first core. Kairos Power’s Hermes program in Tennessee is on an aggressive path to operate a low power test reactor in the middle of this decade and is using that program to de risk supply chain steps for later commercial units.

The real bottlenecks and why they matter

Bottleneck 1: Deconversion to the right chemistry

For light water reactors, enriched UF6 must be converted to uranium dioxide. For fast reactors like Natrium, UF6 must be converted to uranium metal. For TRISO, enriched material must become uniform HALEU kernels, then be coated and formed into pebbles. These are very different production lines with different security categories, criticality configurations, and licensing bases. The United States has decades of experience converting standard low enriched UF6 to oxide at large scale. What is new is doing those steps at HALEU levels and at industrial volumes.

What to do: Fabricators and developers should place long lead orders for deconversion equipment now and secure site layouts that maintain favorable criticality geometries. They should align deconversion schedules with the first fuel qualification campaigns for their specific designs. Missing this alignment by a quarter can slide an entire core load by a year because the upstream steps are batch based.

Bottleneck 2: Specialty cylinders and transport packages

To move enriched UF6, you need licensed cylinders. For HALEU, that means small, criticality safe cylinders such as so called 5B units and compatible overpacks. There has been a documented shortage of those cylinders, which forced schedule changes for a U.S. HALEU producer in 2024 and early 2025. On the fresh fuel side, shipping containers for assemblies at enrichments above 5 percent needed updated analyses, and several vendors have obtained those approvals to 8 percent for both pressurized and boiling water reactor packages. For UF6 transport above 5 percent, additional criticality evaluations are required because historical testing, standards, and certificates focused on the 5 percent world.

What to do: Utilities and developers should treat cylinders and shipping packages like turbine generator long leads. Place framework orders with vendors, accept earlier delivery to a secure laydown yard, and pool spare assets across multiple sites under shared custody agreements to maximize utilization. This is a logistics problem more than a physics problem. The pattern echoes other hardware tight spots such as the HVDC cable bottleneck.

Bottleneck 3: The last mile of licensing

Higher enrichment touches many licenses. Enrichers needed amendments to make LEU+. Fabricators required amendments to receive, process, and ship higher enrichment. Utilities will need license amendments and vendor topical approvals to actually load LEU+ into reactor cores and, in some cases, to pursue longer operating cycles or modest power uprates. For HALEU in new designs, developers must match fuel form licensing, transport packages, and deconversion security categories to the first core schedule on the regulator’s visible timeline.

What to do: Build a single integrated licensing Gantt that includes the utility, the fabricator, the enricher, and the shipper. Put the shipping certificates on the same page as the core design reports. The critical path is often not the reactor analysis itself but the package certificate or the plant’s updated security plan to handle a different enrichment stream.

How the next 24 to 36 months likely unfold

The timelines below are based on public approvals and announced production plans as of November 10, 2025. Adjustments will come, but the sequence is what counts.

-

Late 2025 to mid 2026: LEU+ begins to flow. Urenco USA brings up initial LEU+ campaigns and delivers first product to at least one U.S. fuel fabricator in 2026. Fabricators produce lead fuel assemblies and demonstration bundles at up to 8 percent enrichment for selected boiling water and pressurized water reactors. Utilities file and receive license amendments to load those bundles alongside standard 4.9 percent assemblies. Expect lead use programs to target spring and fall 2027 outages.

-

2026: HALEU continues at demonstration scale. Centrus operates under its current one year extension through June 30, 2026, with options on the table for further production if funding and hardware arrive. DOE allocates initial quantities to a handful of developers for qualification and demonstration runs. Because 900 kilograms per year is a fraction of expected demand, HALEU remains the gating item for most first of a kind cores.

-

2026 to 2027: Deconversion lines come online in stages. Pilot oxide and metallization lines validate processes, train operators, and collect data for full scale systems. Security category changes and new criticality configurations drive modifications at existing sites and underpin license amendments. TRISO kernel lines begin low rate initial production, feeding early non nuclear or low power testing and stocking material ahead of first cores.

-

2027 to 2028: First full LEU+ reloads and longer cycles. With two years of lead use data, several utilities move from 18 month cycles to 24 month cycles on units with compatible equipment and market positions. LEU+ helps reduce the number of bundles per reload, and for some plants it enables small power uprates once analyses and plant equipment allow. Outage planning and contract strategies shift: longer cycles mean fewer outages over the same time horizon, which changes cash flow and working capital patterns in predictable ways.

-

Late 2020s: SMR fuel readiness converges with licensing. As federal and state licensing milestones stack up, project finance teams can point to concrete fuel schedules. Where HALEU remains thin, developers pair supply contracts with take or pay terms and milestone based public funding. When an offtaker contract hinges on the first core date, lenders will insist that HALEU supply and deconversion contracts have remedies tied to those same dates.

Utility playbook: how to turn LEU+ into dollars and certainty

-

Lock in LEU+ now. In negotiating the next multi year fuel cycle contract, add a tranche for 6 to 8 percent enrichment with options on volume. Make deliveries conditional on receiving the plant’s license amendment and the vendor’s topical approvals. This gives the supplier a demand signal without exposing the utility to take fuel it cannot yet load.

-

Align licensing and outage strategy. Submit license amendments on a schedule that lands approval at least one refueling before the planned transition to longer cycles. That gives you a safety valve if reviews slip.

-

Buy logistics early. Treat 5B cylinders, assembly shipping packages, and on site storage containers as long lead. The cost of carrying inventory is small compared with the cost of missing a fuel in date.

-

Model refueling cash flows. A move from 18 month cycles to 24 month cycles reduces outage frequency. That is fewer refueling outages over a decade and a different working capital profile for fuel. Put those savings in front of the board with the assumptions and a clear risk register for licensing and supply.

Developer and lender playbook: how to make HALEU bankable

-

Build a three contract stack. First, enrichment to a specified assay and schedule. Second, deconversion into the correct fuel chemistry. Third, fabrication and initial core assembly. Tie remedies and liquidated damages to the first criticality window, not to individual factory milestones.

-

Hedge with LEU+. For designs that can start life on LEU+ and shift to HALEU later, write a fallback path with the reactor vendor and the regulator now. That contingency has real value in a financing model, even if it is never used.

-

Use public allocations to crowd in private capital. Where DOE allocates initial HALEU or provides offtake credit, embed those volumes in the financing case as an availability bridge rather than a long term crutch.

-

Share hardware. Coordinate with other developers to co fund cylinder orders, overpacks, and deconversion skids with shared custody. The throughput risk is lower together than alone, and the NRC accepts shared arrangements when responsibilities are clear.

What changes if Russian supply fully unwinds by 2028

The import ban already caps volumes and ends waivers on January 1, 2028. As those volumes ratchet down, three effects compound:

-

Price discipline. Enrichment and conversion prices remain firm because new capacity arrives in stages and must earn a return. Utilities that lock in LEU+ now reduce exposure to a late decade squeeze.

-

Logistics scarcity. The industry will not just be short of enriched product; it will be short of the hardware and certificates to move it. Early orders for cylinders and packages will look prescient.

-

Schedule realism. Demonstration schedules survive if fuel contracts match the licensing plan and include remedies. Projects without that alignment will slide to the right. Lenders will increasingly treat fuel readiness as a first order condition for releasing construction debt.

The bottom line

The fuel conversation in the United States has finally moved from aspiration to allocation. LEU+ production authority in New Mexico and proven HALEU output in Ohio are not the end of the story; they are the start of a supply chain that matches the decade’s reactor ambitions. If you want to change the nuclear timeline, you do not start at the plant gate. You start at the cylinder, the deconversion line, and the shipping certificate. The winners over the next 24 to 36 months will be the teams that plan those quiet steps as if the project depends on them, because it does.