FERC 881 Slips, the AAR and DLR Race to Free Capacity

A missed mid-2025 milestone for FERC Order 881 exposed how thin the grid’s software and vendor capacity has become. Here is a practical 2026 to 2028 playbook for ambient adjusted and dynamic line ratings, where the action is now, and how to move first.

The miss that set the race

In late January 2025, the reality landed. Most regional grid operators signaled they would miss the July 2025 compliance target for FERC Order 881, the rule that requires hourly ambient adjusted ratings on transmission lines. Reporters tallied delay requests across the country and highlighted a shortage of market software and integration capacity as a core culprit. The headline was simple, the nation had a proven way to move more power on the wires it already owns, and the industry could not roll it out fast enough. See early coverage that set the tone in 2025: operators seek more time to meet 881.

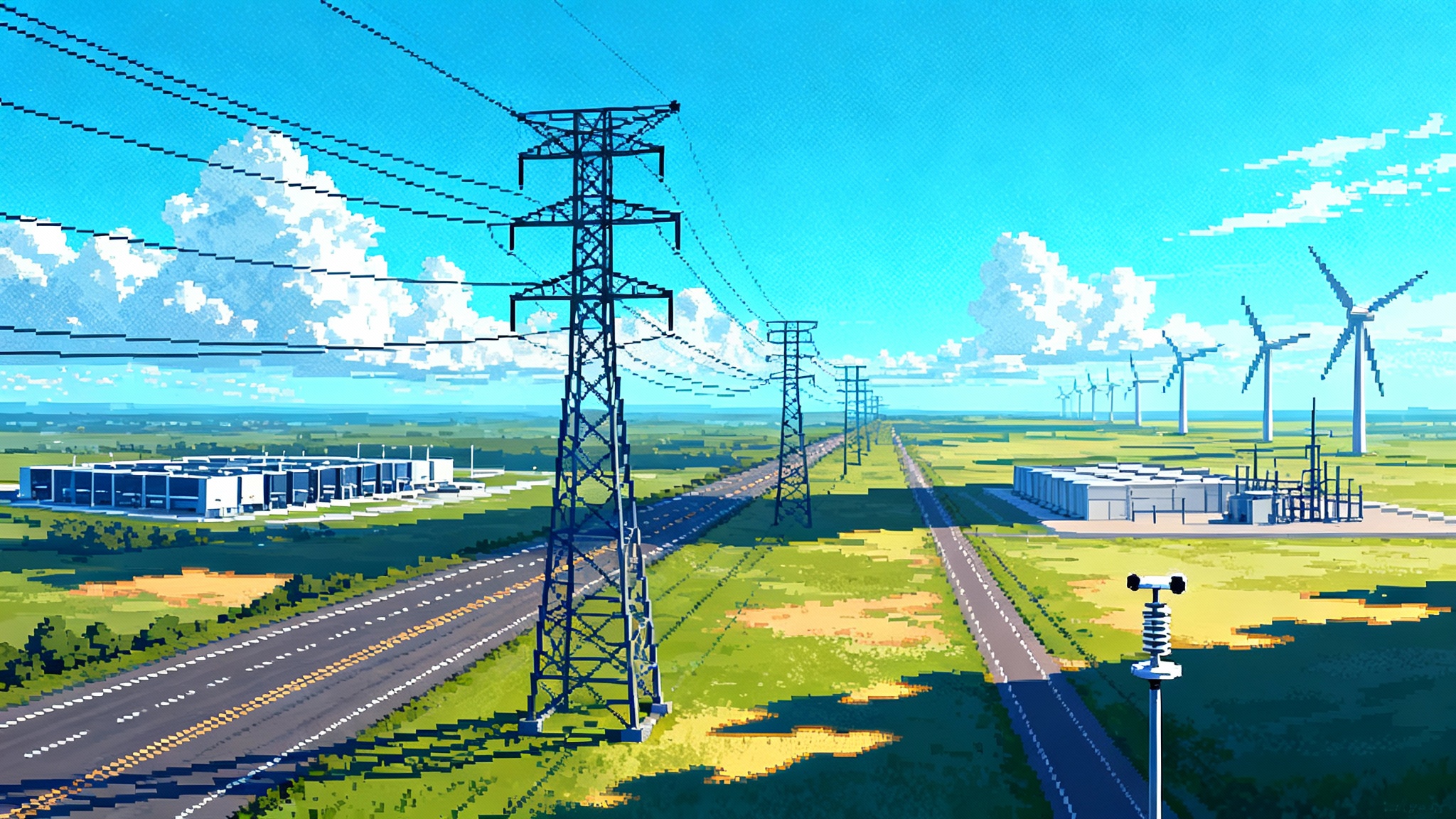

It was not a policy failure. It was a delivery bottleneck. And it created a new race for 2026 through 2028, a sprint to scale two different but related tools for unlocking hidden capacity: ambient adjusted ratings and dynamic line ratings.

A quick primer: AAR versus DLR

Think of a highway with a speed limit sign that never changes. That is a static line rating, a single number set for worst case heat, wind, and sun. Ambient adjusted ratings (AAR) replace the fixed sign with one that updates every hour using forecast temperature and solar heating. When the air is cooler, the conductor sheds heat more easily, so the safe current and transfer limit rises. Dynamic line ratings (DLR) go a step further by measuring more of what actually cools or warms the conductor, including wind, cloud cover, and real line sag and tension. AAR relies on weather forecasts and physics models. DLR adds sensors or non‑contact monitors to feed the model with precise local conditions.

AAR is the floor that Order 881 requires. DLR is the ceiling that many grid operators and utilities are now planning, since it can unlock additional headroom on the windiest and coldest days, and it can also flag true risk sooner when cooling fades.

Why the slip happened

The 2025 miss did not stem from a lack of math. Transmission operators and vendors know how to compute ratings. The failure points were pragmatic and cumulative:

- Market and energy management systems already had full backlogs. Updating state estimator pipelines, interchange scheduling, outage planning, and available transfer capability calculators to ingest hourly ratings requires code, testing, and cutovers. The same engineering teams were finishing reliability projects, cyber upgrades, and long‑standing market changes.

- Data plumbing was not ready everywhere. AAR requires clean conductor libraries, segmenting long circuits into weather zones, ingesting hourly weather forecasts, and keeping a consistent record of emergency, short‑term, and long‑term ratings in databases that dispatchers trust.

- Vendor capacity is finite. A handful of platform providers dominate the critical layers, from energy management systems to open access scheduling and tagging. Utility and regional transmission organization queues formed, and even well funded teams found that testing windows and change freezes pushed go‑live dates into 2026.

- Governance and training needed time. Dispatchers and reliability coordinators have to understand when ratings change, what to do if a feed fails, and which fallback applies. That means new procedures, drills, and human factors reviews.

The result, more time requests, each with its own path to compliance.

Where the action is now

By fall 2025, several regional organizations had formal extensions to implement Order 881 tariff and system changes. A notable concurrence from a FERC commissioner summarized dates publicly granted across markets, including requests by MISO for an outside date of December 31, 2028, extensions for ISO New England into 2026, Southwest Power Pool into 2026, California ISO into late 2026, and PJM into spring 2026. See the commission record that put numbers on the scoreboard: concurrence on MISO extension and peer timelines.

On the vendor side, software firms that serve scheduling and rating workflows became the pacing items. Companies offering integrated AAR engines and market gateways won early deployments. Sensor providers positioned themselves for the next phase. Names you will hear often include OATI, GE Vernova Grid Solutions, Siemens, Hitachi Energy, and a set of DLR specialists like Ampacimon, LineVision, and Heimdall Power.

Utilities that operate outside the organized markets, and a few with simpler footprints, managed earlier AAR rollouts. Their lesson is clear, start with data hygiene and a narrow cut that puts hourly ratings into operator tools, then expand steadily as the teams build confidence.

The 2026 to 2028 playbook

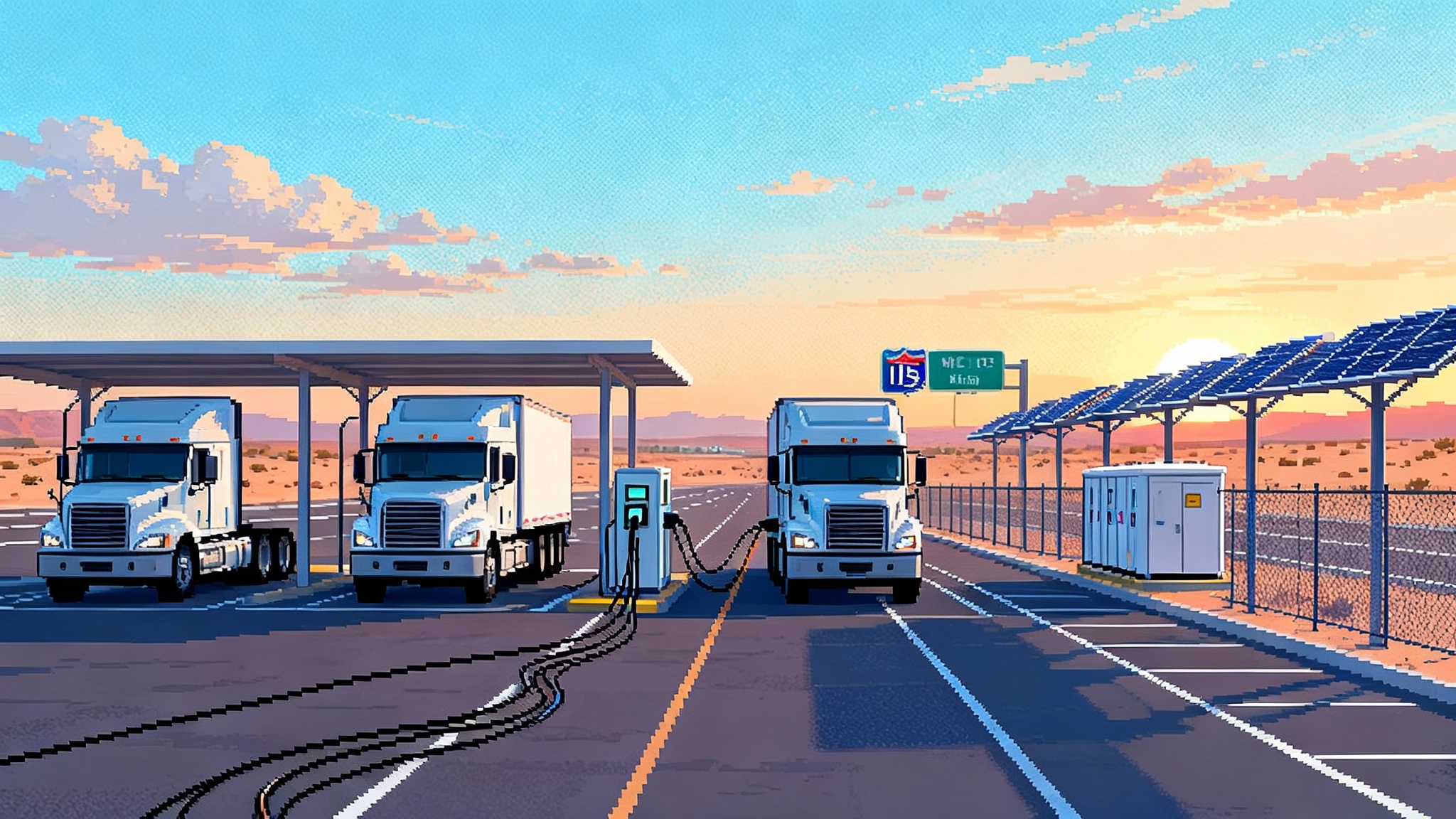

This is a deployment plan designed for results, not just compliance. It assumes you must free capacity for three urgent needs, interconnecting new wind and solar, serving fast growing data center load amid the AI power land rush reshaping utility plans, and building reliability margin for extreme weather. The plan divides the work into three waves.

2026: Build the AAR backbone everywhere

- Lock the data foundation. Finalize a conductor parameter library that covers at least 95 percent of flow on peak‑congestion paths. Segment long lines into weather zones of 10 to 30 miles where forecast differences matter. Document normal, short‑term, and emergency assumptions so operators have a common language.

- Stand up the rating engine. Choose a platform that computes hourly ambient adjusted ratings with a 72‑hour forecast horizon and rolls to real time once per hour. It must create synchronized outputs for operating limits, available transfer capability, and the market system. Build a fallback that reverts to conservative static ratings if any feed fails.

- Integrate across the control room. Feed the energy management system, the market engine, the interchange scheduling and tagging system, and the outage planning tool with one source of ratings truth. Update alarms and displays so dispatchers see when and why a rating changed, and what to do next.

- Deploy emergency and short‑term ratings. Emergency ratings are a material portion of the near‑term benefit. Ensure the market engine can call them when needed and that operators have clear criteria for the duration of the rating.

- Publish the new ratings to customers. External visibility builds trust and improves scheduling. Post hourly ratings for key interfaces and tie them to curtailment decisions in your open access environment.

- Target the first bottlenecks. Apply AAR on the top 20 constraints by congestion cost or curtailment hours. Measure the effect and roll those lessons into the next 50 lines.

What to expect in 2026, a 3 to 8 percent increase in transfer capability on many lines in typical weather, with occasional double digit gains during cool or windy spells. Operators also gain higher emergency headroom, which translates into fewer load management calls when a plant trips.

2027: Scale DLR where it pays

Ambient adjustments carry you most of the way, and dynamic line ratings close the gap on the very highest value corridors. In 2027, pick your DLR targets with a hard nose and a spreadsheet.

- Create a DLR short list. Rank lines by a weighted mix of congestion cost, curtailment hours, interconnection queue impact, and proximity to fast growing load like data centers. Look for corridors where wind and ambient conditions are highly variable and favorable.

- Choose your sensor stack with intent. You have three major options. Conductor‑mounted sensors measure temperature, sag, or tension from the line itself. Non‑contact monitors such as LiDAR or camera systems watch for sway and sag from below the line. Weather stations and microwave links estimate wind and cooling along a corridor. Many operators start with a hybrid, a few conductor sensors on the most constrained span, plus weather stations for coverage, plus non‑contact on segments where crews cannot easily mount devices.

- Close the cyber and reliability loop. Ensure that sensor data routes through secure gateways, that there is a local buffer if communications fail, and that every DLR‑derived rating includes a conservative fallback. Operators must be able to see the last good data time and the precise span on which the rating is based.

- Put DLR into the market and into operations. A DLR that sits in a stand‑alone dashboard does not reduce congestion. Feed the ratings to the state estimator, constraint calculators, and the market dispatch engine.

- Tie DLR to interconnection relief. When a cluster of renewables waits on one corridor, use DLR to raise the interim limit and allow staged energization. Document the conditions under which the additional capacity applies so that developers and customers understand availability risk.

A well chosen DLR project can raise limits by another 5 to 20 percent during favorable conditions. In wind‑rich plains or winter peaking regions the effect can be larger. The average benefit depends on local weather patterns and sensor coverage.

2028: Operate at scale, treat ratings as code

- Establish a ratings change control board. Ratings are now software artifacts. Use version control, code review, and test environments. Require that any change to the calculation, the weather model, or the circuit segmentation ships with a test plan and rollback procedure.

- Move to automated exception handling. When a feed is stale or inconsistent, automatically flag and apply a defined fallback, then notify operators and support teams.

- Expand to interfaces and seams. Apply AAR and DLR across interties between regions so that transfer limits increase in both directions with symmetric logic and shared data.

- Keep training fresh. Operators need regular drills that blend real weather events and hypothetical failures. Add DLR‑specific scenario training for high wind days and rapid cooling changes.

By the end of 2028, a balanced region can have AAR on nearly all major lines and DLR on the highest value corridors, with results flowing directly into dispatch and interchange.

State PUC levers that work

State commissions have direct tools that accelerate results without overprescribing technology choices.

- Make ratings a performance objective. Tie a share of utility earnings or incentives to congestion cost reduction, renewable curtailment reduction, and interface limit increases that can be traced to AAR and DLR deployment.

- Pre‑authorize recovery for rating systems and sensors. Create a rider or tracker so utilities can move quickly on the software and devices that feed the ratings engine, subject to caps and reporting.

- Require transparent reporting. Ask for quarterly dashboards that list the circuits with hourly AAR enabled, the lines with DLR active, and the measured effect on transfer capacity and curtailments.

- Align interconnection reforms with ratings rollout. When a grid bottleneck is slated for DLR, allow interim interconnection service at a level consistent with expected DLR availability, with contingency rules.

- Standardize minimum capabilities. Specify that hourly ratings must be forecast and published, that emergency ratings must be callable in the market, and that fallback logic must be clear to operators and customers.

- Encourage joint procurement across utilities. Shared contracts for sensors, weather services, and software integrations cut delays and costs.

What to buy in 2026, a procurement checklist

You do not need to guess. A well written request for proposals will specify outcomes and integration points.

- A rating engine that computes hourly AAR with forecast and real time values, produces emergency and short‑term ratings, and supports multiple conductor models.

- Integration adaptors for the energy management system, market engine, interchange scheduling, outage planning, and data historian, with clear application programming interfaces.

- Weather inputs with redundancy. Forecasts from at least two sources, local weather stations where needed, and a clear model for how forecast error maps to rating margins.

- Security and resilience. Role based access, logging, encryption in transit, and a documented failover for every data feed.

- Operator tooling. Displays that show current ratings, the reason for the last change, the weather drivers, and the fallback state.

- DLR‑ready design. The ability to ingest conductor‑mounted or non‑contact sensor data later without replacing the core platform.

- Test harness and sandbox. A way to replay past weather and flows to validate logic and train dispatchers.

For a DLR‑specific buy, specify the sensor types, desired accuracy, the spans or segments of interest, the data latency and availability, and the process by which field crews will mount, maintain, or relocate the devices. Require that field photos and as‑built diagrams are stored with the data stream.

Sensor stacks, what works where

- Conductor‑mounted sensors. These clamp to the line and report temperature, sag, or tension. They give you the most direct view of the conductor and can be deployed in a matter of hours by trained crews. They require line outages for installation and regular inspection.

- Non‑contact monitors. These sit below the line and watch with lidar or optical systems. They avoid line work and reduce safety risks but need clear sight lines and periodic calibration.

- Corridor weather. Tall masts or compact stations measure wind, temperature, and solar loading. They are invaluable for AAR accuracy and provide a fallback for DLR when line sensors fail.

- Fiber sensing. Where optical ground wire exists, distributed temperature sensing can create a detailed thermal map. It is powerful but not universal and can be costly to retrofit.

The winning pattern in 2027 and 2028 is mixed. Use conductor sensors on the single span that limits a corridor, non‑contact on spans you cannot touch easily, and corridor weather to cover the rest.

What this unlocks for renewables, data centers, and reliability

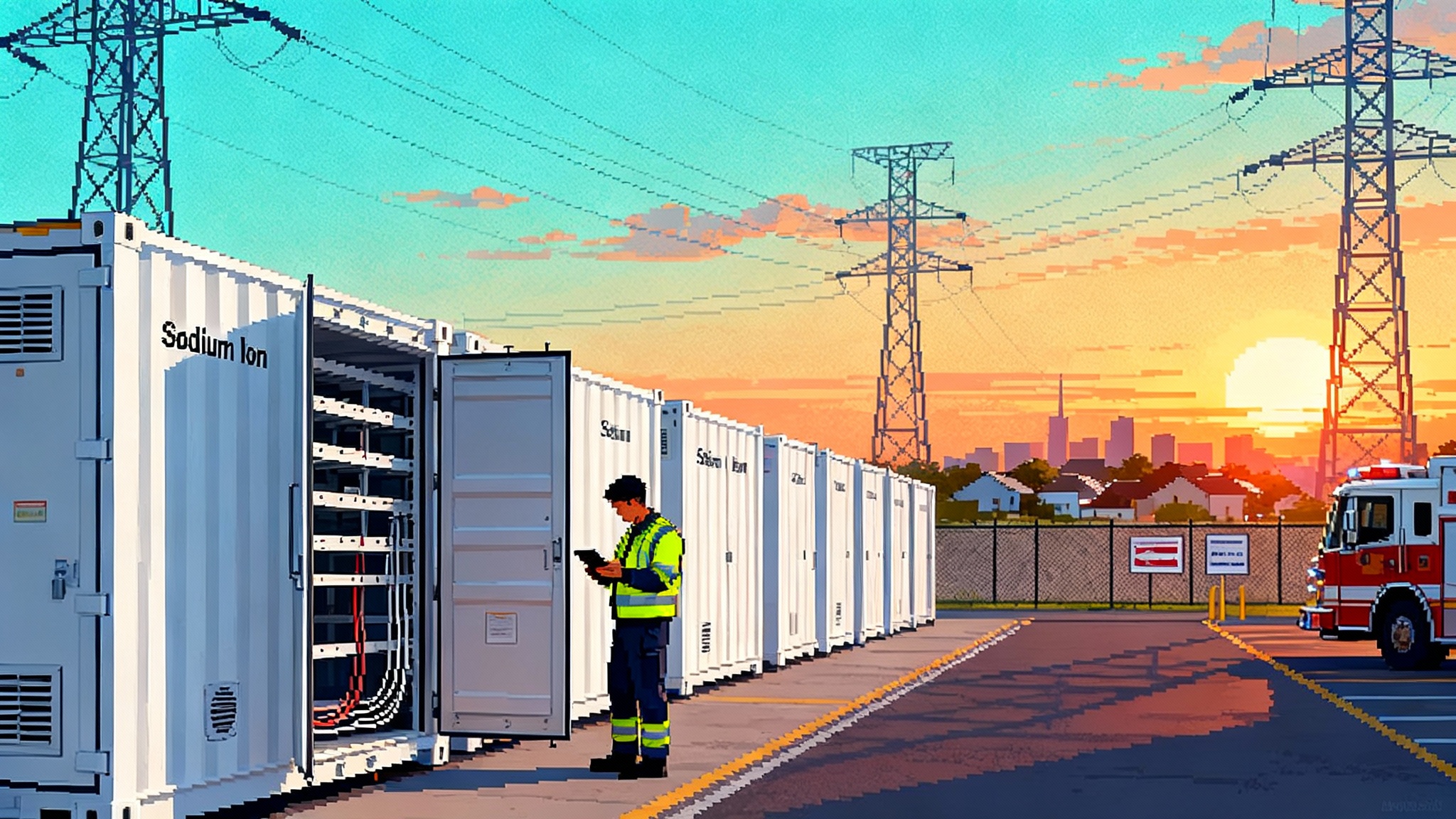

Ambient adjustments offer consistent gains. In a typical year, operators can expect 3 to 8 percent more capacity on many lines, with larger increases in cooler months. Dynamic ratings are episodic but potent, raising limits by 5 to 20 percent in the right wind and temperature. Paired with innovations like sodium ion storage's 2025 debut, emergency ratings and more accurate limits can keep generators online during a cold snap and serve peak data center load without tripping constraints.

For renewables, AAR and DLR reduce curtailment and allow earlier interconnection. A wind farm that is waiting on a reconductor project can often inject more during cold, windy hours if the corridor applies DLR on the limiting span. For data centers, especially in Virginia, Ohio, and Georgia, hourly ratings raise the odds that a new campus can be served within existing substation footprints during the first few years while long lead projects proceed. For reliability, emergency ratings and more accurate limits reduce the chance that conservative assumptions trigger unnecessary load management.

None of this replaces new lines or high voltage direct current corridors. It is the bridge while FERC Order 1920 transmission planning runs its course. When 1920 projects complete, ratings remain useful because they keep those new assets fully utilized when the weather allows and protect them when it does not. See how this complements America's HVDC cable bottleneck.

How to avoid getting stuck again

The lesson of 2025 is that the bottleneck was delivery, not intent. Here is how to keep 2026 to 2028 on track.

- Treat ratings as a first‑class market input. If the dispatch engine cannot use them, you will not see the value.

- Limit bespoke code. Use standard adaptors from your platform vendors and keep customizations minimal so upgrades do not stall.

- Fund the test environment. You need a sandbox with realistic weather and system playback, and you need time on the calendar for cutovers outside peak season.

- Publish metrics. Track and share the percent of flow under hourly AAR, the number of circuits with DLR, and the measured transfer gains and curtailment reductions.

- Plan for people. Train dispatchers, planners, and field crews, and rotate a few engineers through short stints with the vendor teams so you keep know‑how in house.

The scoreboard to watch through 2028

- Percent of congested flow under hourly AAR. Aim for 90 percent by late 2027.

- DLR coverage on top corridors. A target of 30 to 60 of the highest value line segments in a large region is reasonable by 2028.

- Reduction in renewable curtailment hours traceable to ratings changes. Set a numeric goal and publish progress quarterly.

- Interface limit increases across regional seams. Document winter and shoulder season gains, not just summer peaks.

- Emergency rating usage and duration. Measure how often emergency ratings averted redispatch or load management.

- Customer savings from lower congestion rents and uplift. Tie the dollars to the deployments.

A closing thought, steel and software need each other

Transmission planning under FERC Order 1920 will map and finance the big projects. Those projects are necessary. But the years between now and their in‑service dates are not dead time. They are the proving ground for AAR and DLR. The early slip in 2025 set a clear agenda, finish the ambient backbone, then add dynamic sensors where they matter most. The teams that treat ratings as code, publish their metrics, and pair software with field reality will free real capacity for renewables, keep data center growth on the rails, and buy reliability when it counts. That is the race worth winning.