Inside AI’s Power Land Rush Rewriting U.S. Grid Plans

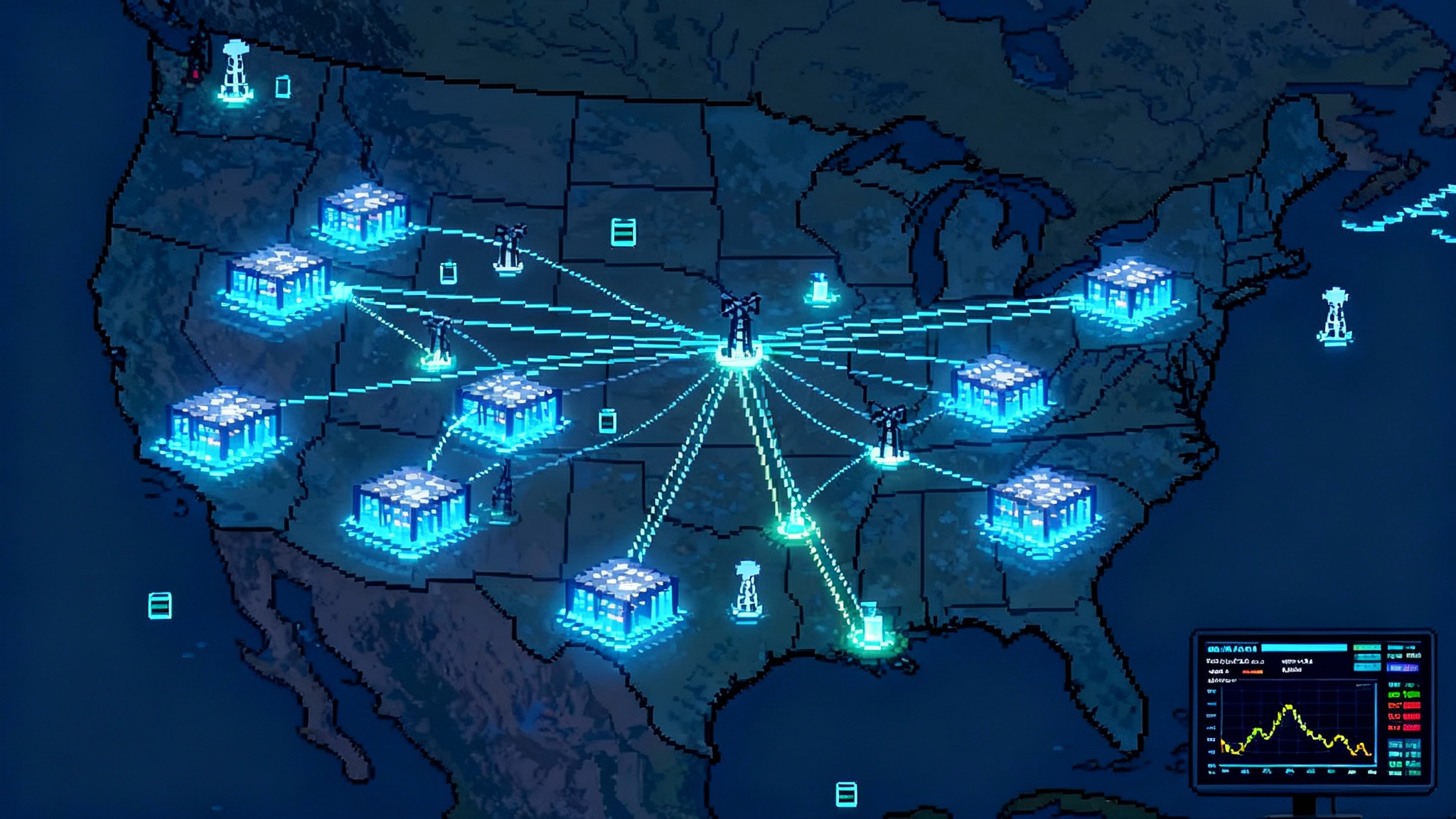

Record U.S. electricity demand in 2025, PJM fast-track approvals, and utilities racing to fund new load are reshaping where and how data centers get built. See the hotspots, the mechanics, and a 2025 to 2028 playbook to win.

Breaking signals from the grid

If you want to understand the next chapter of artificial intelligence, do not start with models or chips. Start with megawatts. The United States is on pace to set new records for electricity consumption in 2025 as data centers absorb power at a scale the grid has not planned around in decades. The Energy Information Administration projects fresh highs for 2025 and 2026, with data centers a leading driver of growth. See the agency outlook summarized in EIA projects record 2025 electricity use.

This is not a small bump on a chart. For nearly 15 years, national demand was mostly flat. In 2025 the trend line bends up, and it is bending fastest in the same places where data centers, fiber, and cloud teams are staking land. That is why utilities are rewriting capital plans, why state commissions are revisiting siting rules, and why developers are drawing new circles on the map for where to place the next wave of artificial intelligence clusters.

Where the growth is hottest

Think of the grid as a set of overlapping neighborhoods. Each has its own rules and congestion. In 2025 three neighborhoods matter most for artificial intelligence power buyers and builders: PJM in the Mid-Atlantic and Midwest, ERCOT in Texas, and California within the broader Western grid.

-

PJM Interconnection: From Northern Virginia up through Maryland and Pennsylvania, across to Ohio and down into parts of Kentucky, PJM operates the nation’s largest wholesale market. Northern Virginia remains the densest data center cluster in the world. But growth has fanned out to Central Ohio near Columbus, to western Pennsylvania, and to New Jersey locations with strong substation access. The appeal is proximity to fiber routes and to talent, plus a mature market for capacity and ancillary services. The constraint is network headroom. Substations and 230 kilovolt lines are crowded, and interconnection studies are gating projects that looked shovel ready on paper.

-

ERCOT in Texas: Dallas–Fort Worth, San Antonio, Austin, and the I-35 corridor have become launchpads for new facilities. ERCOT clears projects faster than most peers, and Texas maintains a business-friendly siting climate with fewer layers of review. The tradeoff is weather risk and scarcity pricing. When conditions tighten, prices can spike and availability can shrink. Many builders respond with bigger on-site backup and more storage to protect service level agreements, but those choices influence total cost of ownership.

-

California and the Western markets: California Independent System Operator has pockets of grid capacity near the Central Valley and desert regions that attract large campuses. The Bay Area still draws builds for latency-sensitive workloads, but land and permitting push many megawatts inland. Beyond California, the West’s fastest risers include Phoenix, Salt Lake City, and parts of Nevada and Oregon where transmission access and cooler nights help operating costs. Water availability and wildfire-related reliability planning are now first-round screening items for new sites.

These hotspots matter for more than geography. They set the rules for timing and for the cost stack. Where queues are long, the all-in price of a megawatt is not just the energy price. It is also the carrying cost of time.

The grid is rewriting its playbook

In early 2025, regulators approved a plan for PJM to fast track certain power plant connections to keep reliability intact as load grows. The move drew praise from reliability hawks and criticism from clean energy developers who argue it advantages gas projects ahead of solar, wind, and storage. See the regulatory action reported in FERC approves PJM fast track plan.

What does fast track mean on the ground? It means some projects that can come online quickly and contribute firm capacity will get priority. That helps near-term reliability and allows the region to serve new data center load without brownouts. It also means many clean energy projects remain in cluster studies that are still working through backlogs. As a buyer, your procurement strategy must assume two realities at once. Near-term megawatts will often come from existing fleets and quick-to-build resources. Medium-term megawatts will depend on the pace of transmission upgrades and the throughput of interconnection queues. For background on freeing capacity with operating ratings, see FERC 881 and dynamic line ratings.

Interconnection and siting, 2025 edition

Interconnection is the process of studying how a new load or generator affects the grid and what upgrades are needed to operate safely. Siting is where the facility physically goes, along with water, cooling, and local permits. In 2025 both sets of rules are tightening.

-

Cluster studies and material readiness: Regional operators increasingly require site control, equipment evidence, and higher deposits before studies begin. This screens out speculative queue positions, but it pushes developers to invest earlier.

-

Substation saturation: In Northern Virginia and parts of Ohio, the best-located substations are fully committed. A new campus may require a brand-new substation or a long-lead transformer. Delivery windows are measured in years, not months, and large transformers have become a global supply chain choke point. Teams that pre-order critical gear, or that partner with utilities on standard designs, are moving faster.

-

Transmission upgrades: Upgrades determine timelines. A site that seems perfect can carry a hidden price tag if it triggers reconductoring on a long stretch of line. The earliest engineering screens and a willingness to adjust site boundaries by a few miles can decide whether a campus delivers in 24 months or 48. Related constraints show up in America's HVDC cable bottleneck.

-

Water and heat: New artificial intelligence clusters have high rack densities. That changes cooling and water math. Many localities are imposing water-efficiency conditions. Dry cooling, heat reuse into district systems, and carefully selected aquifer rights are no longer nice to have. They are gate criteria.

-

Air permits and backup: Gigawatt-scale clusters rely on significant on-site backup. In air quality constrained basins, stacks and runtime limits add complexity. Some operators are experimenting with battery-backed spinning reserves and dual-fuel microgrids to meet both reliability and permit conditions.

Utility capital plans are shifting to new load

Utilities are changing their spending plans because the load is changing. In 2025 many investor-owned utilities aimed more capital at three buckets. First, new transmission lines that loop around growing data center hubs. Second, new or rebuilt substations, including high-voltage yards dedicated to campus districts. Third, fast-to-market firm resources, often modern gas turbines paired with storage, that can be built within a two to three year window while longer-lead clean projects advance. Regulators are flagging cost recovery conditions tied to reliability benefits and to evidence that upgrades serve shared needs, not single customers. For builders, the implication is practical. Tie projects to regional reliability benefits, offer flexible load commitments, and you will often move to the front of the line.

The 2025 to 2028 playbook to win

Here is a concrete plan for buyers and builders who want megawatts that are reliable, affordable, and verifiably clean.

- Lock in 24 by 7 clean power purchase agreements with hourly matching

-

What to do: Move from annual renewable energy credits to hourly matched supply that mirrors your facility’s load shape every hour of the year. Build a portfolio that combines in-region wind and solar with storage and clean firm supply where available.

-

Why it works: Annual matching lets gaps hide behind averages. Hourly matching exposes when you lean on fossil generators and tells you where to add storage or shift load.

-

How to execute: Use two contract tranches. Tranche A is a financial swap for energy shaped to your expected hourly profile with storage firming. Tranche B is a clean capacity strip that covers your worst-case hour. In PJM and California, structure Tranche B to qualify for capacity market or resource adequacy credits. In ERCOT, align it with ancillary services revenue and on-site reliability targets.

- Pair storage with every new offtake

-

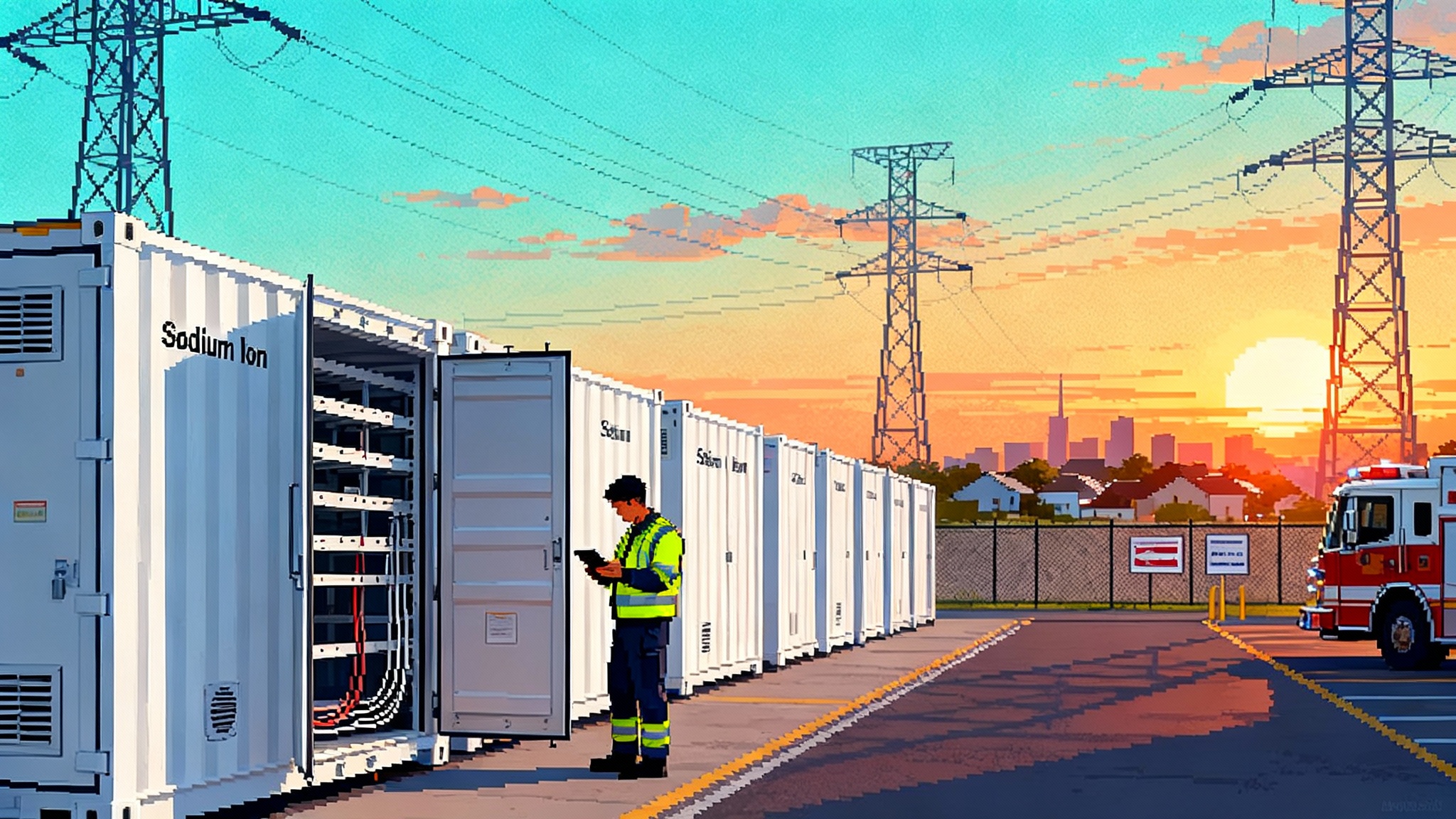

What to do: Make storage a default companion to each solar or wind contract. Target a portfolio duration that covers your driver problem, not a generic number. For a campus that peaks in the late afternoon and early evening, four to six hours can be the sweet spot. For training jobs that run overnight, longer duration or seasonal pairing with wind helps.

-

Why it works: Storage turns variable supply into a product that can hit hourly targets. It can also provide on-site ride-through to protect racks from short disturbances and can monetize grid services when prices spike.

-

How to execute: In PJM, make the storage dispatch rights contractually available for you to shape hourly performance. In ERCOT, enroll the same asset in ancillary service markets when not needed for load, and set a cap on state of charge to preserve reliability. In California, ensure the asset is deliverable to your node and qualifies for resource adequacy counting rules. For emerging chemistries that may change cost curves, see how the 2025 storage shake up begins.

- Build flexible demand into your workloads

-

What to do: Treat compute like an industrial process you can schedule. Training and batch analytics can be shifted by hours or days. Create a policy engine that listens to price, carbon intensity, and grid stress signals and moves work accordingly.

-

Why it works: Operators will prioritize interconnections for loads that can reduce during system peaks. You also cut your average cost of energy, and you free up scarce capacity during heat waves or cold snaps.

-

How to execute: Write service level agreements that define two tiers. Tier 1 is latency-sensitive inferencing that always runs. Tier 2 is shiftable training that can pause for a defined number of hours per month. Back the policy with automation at the orchestrator level and give the utility the right to call a small number of events for compensation. Document this flexibility in your interconnection application, which can help with queue position and upgrade cost allocation.

- Choose your Western markets with precision

-

What to do: In the West, start with transmission maps and water. Favor nodes with spare capacity on 230 kilovolt or 500 kilovolt lines and with access to recycled water or low-impact aquifers. Balance California market depth against the speed and land options available in Arizona, Nevada, and Utah.

-

Why it works: Western permitting can be slower, but well targeted sites avoid the longest bottlenecks. Proximity to new solar and storage hubs reduces deliverability risk. Water planning keeps you out of late-stage surprises.

-

How to execute: Pre-negotiate recycled water supply, specify air-cooled or hybrid systems upfront, and reserve parcels near planned substations rather than only near existing ones. In California, stack resource adequacy contracts with clean energy offtakes to anchor your hourly match. In non-California Western markets, secure long-term transmission service ahead of site purchase to avoid being trapped behind a congested path.

- Finance to the milestone that unlocks speed

-

What to do: Arrange capital in two tranches tied to interconnection status. The first tranche funds site control, early engineering, and long-lead equipment orders. The second tranche closes after your interconnection agreement is executed and major permits clear.

-

Why it works: Your rate of progress depends on the first 90 to 180 days of engineering and procurement. Early deposits for transformers and switchgear can move delivery by months. Investors are more willing to back that spend if there is a clean path to full notice to proceed.

-

How to execute: Use a development capital facility with automatic upsizing when you hit defined milestones. Pair it with a supply agreement that locks pricing on critical components. Offer your utility partner a cost share on equipment that can be repurposed to future customers. This de-risks their position and shortens their review cycle.

- Make your project a reliability solution, not just a load

-

What to do: Offer a package that includes flexible demand, on-site storage capable of islanding, and participation in local emergency programs. Consider heat reuse into district systems or nearby buildings.

-

Why it works: Utilities and regulators are more likely to approve projects that improve local reliability, not just consume it. Heat reuse can turn waste into a community benefit, easing local approvals.

-

How to execute: Commit a minimum megawatt quantity of controllable load for emergencies, documented in your interconnection agreement. Size batteries to both cover ride-through and to export during peak events. Build heat capture into the initial design, not as a retrofit.

The siting checklist that separates winners

-

Fiber first, but power tied for first: Proximity to major fiber routes matters, yet the decisive factor is the combination of power headroom and upgrade timing. Map both before spending on land.

-

Water plan in the pro forma: Assume local authorities will ask for water efficiency, heat reuse, or both. Budget for hybrid cooling and for recycled water hookups.

-

Transformer and breaker lead times: Order early or partner on utility standard specs. Treat long-lead equipment as a critical path item like land.

-

Backup that satisfies air permits: Choose configurations that minimize local emissions. Batteries that cover regular blips plus limited generator runtime for rare events can pass permitting more easily in constrained basins.

-

Community benefits you can publish: Put numbers on jobs, tax base, emergency response support, and heat reuse. Share them before the first hearing.

What changes if PJM and peers truly accelerate

If PJM’s fast track model becomes a template, near-term capacity additions will rise in regions where load is growing fastest. Expect more hybrid projects that pair quick-start thermal units with storage to meet reliability rules while larger grid reinforcements proceed. For clean developers, the implication is to pitch projects as congestion relief with measurable local benefits. For buyers, the actionable response is to secure hourly matched clean supply that can ride alongside this evolution rather than waiting for a perfect long-term portfolio that may not reach commercial operation by 2027. For system constraints outside AC upgrades, revisit America's HVDC cable bottleneck.

A note on cost and risk

Artificial intelligence builders often ask one question: what is the cheapest path to reliable power at scale. The better question is which portfolio keeps you building when the grid is stressed. The cheapest path that stalls for lack of deliverability is not cheap. A diversified mix that combines day-one megawatts from existing fleets, near-term storage, and a pipeline of new clean projects timed to interconnection upgrades is the portfolio that wins in 2025 to 2028.

The bottom line

The United States grid is being redrawn by the geography of data centers. Record demand, fast track approvals, and utility capital shifts are the headlines. The deeper story is operational. The winners in the artificial intelligence power land rush will be the teams that treat interconnection as a product design constraint, that buy clean power in the same hourly cadence that they consume it, and that convert flexibility into a permitting and reliability asset. Move first on the map, buy time with storage, and turn your load into a solution that regulators want to approve. That is how to turn the power land rush into durable advantage.