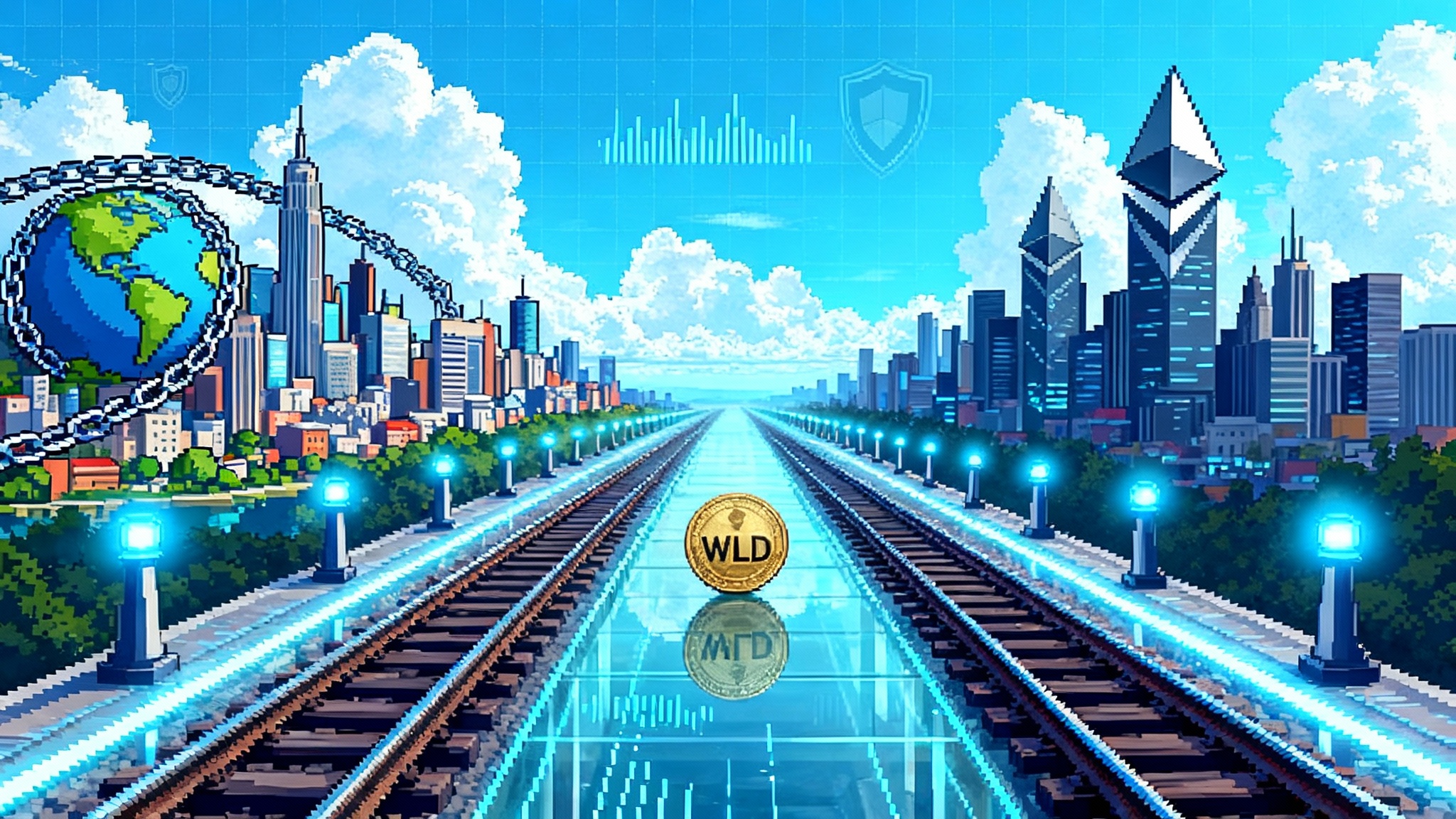

World Chain uses Chainlink CCIP to make WLD natively cross chain

On September 25, 2025, World Chain enabled native WLD transfers between Ethereum and World Chain using Chainlink CCIP and the Cross-Chain Token standard. The move replaces fragile custom bridges with audited rails and pushes cross-chain toward enterprise-grade interoperability.

Breaking: WLD goes natively cross chain

On September 25, 2025, World Chain said it is using Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and the Cross-Chain Token (CCT) standard to let users transfer WLD between World Chain and Ethereum. The integration also brings Chainlink Data Streams for high quality market data to the network that powers World Network’s thirty five million plus users. The announcement makes the path for WLD clear, from a single chain token to a cross chain asset secured by a common standard, and it removes a major source of risk for everyday users and developers who want portability without fragile custom bridges. You can read the primary details in the official release, which states that users can now move WLD between World Chain and Ethereum using the new setup: World Chain adopts Chainlink CCIP and CCT.

This is more than a convenience feature. It is a sign that cross chain token standards are starting to become the default for consumer scale apps. If you run a wallet, an exchange, or a payments app, you do not want to maintain bespoke bridges for every token. You want a standard interface, predictable security guarantees, and a way to plug into many chains without rewriting core logic each time. That is the shift taking place here, the same one that makes onchain checkout that feels real a practical product goal.

Why this matters

Custom bridges are like private ferry boats that each project has to build and operate. Some ferries are excellent, some cut corners, and every ferry has separate rules. This leads to failures that strand passengers on one side and fragment liquidity into isolated pools. A cross chain token standard is closer to a public rail system. Trains follow common signals, stations are predictable, and you can transfer lines without rebuilding the tracks for every trip.

Chainlink’s Cross-Chain Token standard, often shortened to CCT, is the rail gauge that keeps the tracks the same across networks. It sets how tokens are moved between chains, who can mint or burn, and how rate limits and checks are enforced. In practice, WLD can now use audited token pool contracts to lock or burn on the source chain and mint or unlock on the destination chain. The movement is zero slippage by design, which means the amount you send is the amount you receive. Developers get the ability to set transfer rate limits per lane, which operate as circuit breakers if anything looks abnormal.

For users, the main point is simple. You can move WLD between World Chain and Ethereum inside a wallet or app without being asked to pick an obscure bridge, copy long addresses, and sign a chain of risky steps. The app can call a standard interface that is already supported by infrastructure across multiple chains. That is what makes cross chain usable at consumer scale.

Under the hood, in plain language

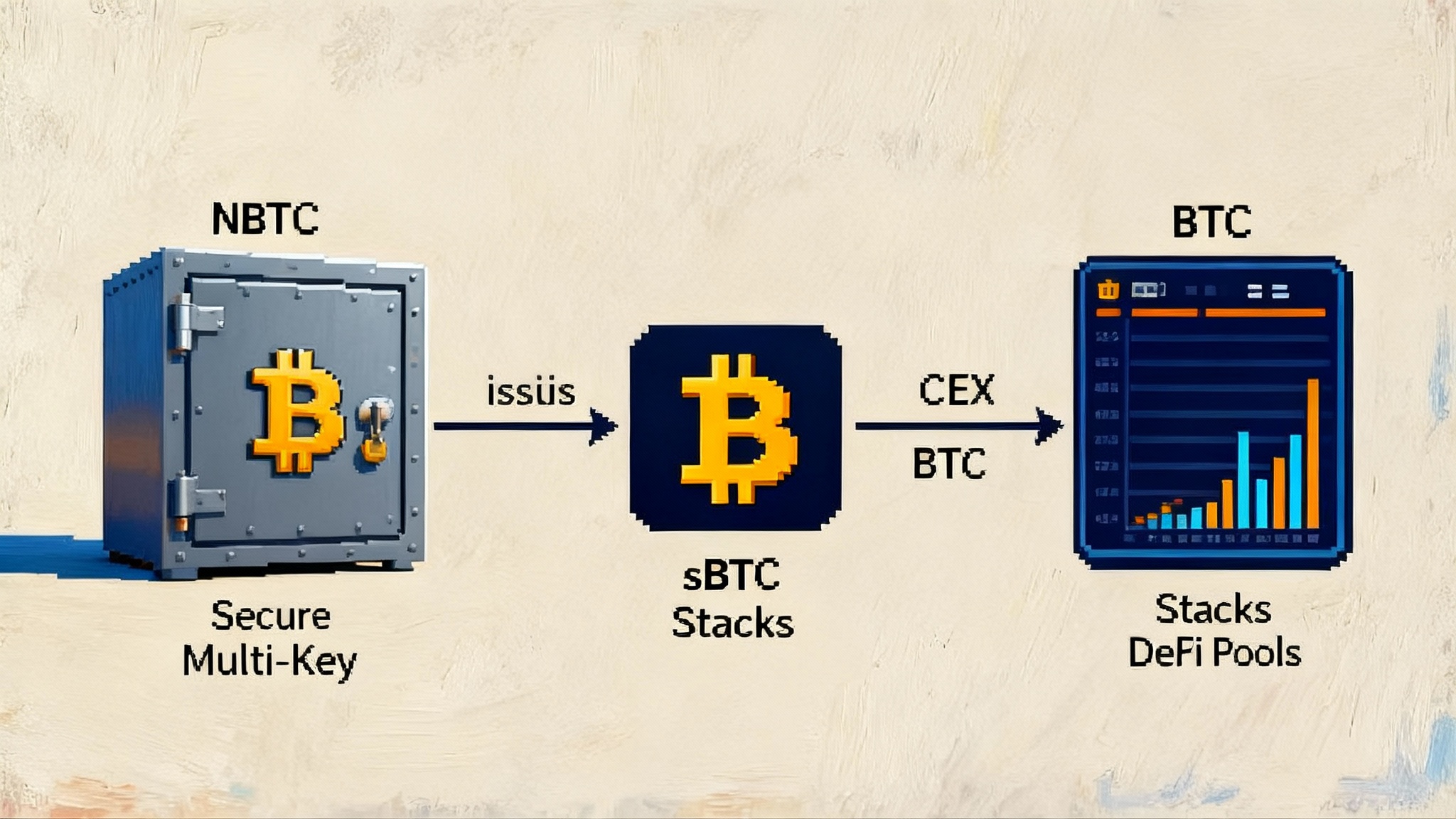

Here is a simple picture of what happens when you move WLD from World Chain to Ethereum:

-

Your wallet or app sends a transfer instruction to CCIP on World Chain. Think of this as buying a train ticket and specifying the destination station.

-

The token pool on World Chain locks or burns the WLD you are sending. This is how the system keeps total supply consistent without needing fragmented liquidity pools.

-

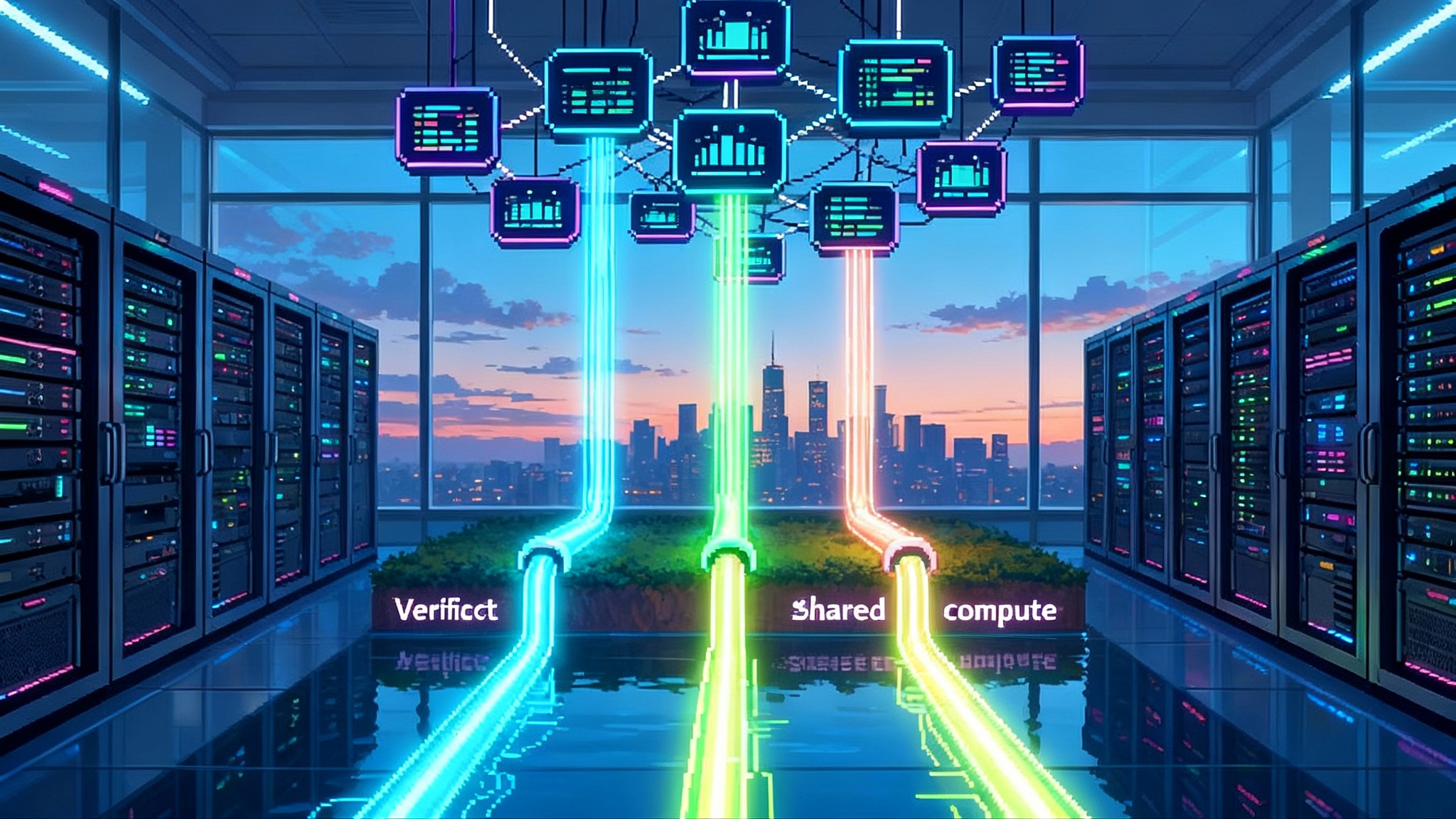

Chainlink’s offchain network reaches agreement that the transfer instruction is valid and safe, then delivers a message to the destination chain.

-

The token pool on Ethereum mints or unlocks the exact amount of WLD on your destination address.

This process avoids the common pitfalls of pooled liquidity bridges that depend on market makers, variable pricing, and the hope that there are enough tokens waiting on the other side. It is deterministic. The security model has multiple lines of defense, including independent risk checks and configurable rate limits that act like speed limits when market conditions are chaotic.

A turning point for enterprise grade interoperability

Two trends make this more than a one off integration.

First, Chainlink has been expanding CCIP beyond Ethereum Virtual Machine chains. Support for non EVM networks such as Solana means the same token standard can reach ecosystems that run on different virtual machines. That opens a path for WLD and other consumer tokens to move into places where the users already are, without asking everyone to switch wallets or mental models.

Second, Chainlink recently announced ISO 27001 certification and a SOC 2 Type 1 attestation. These are the compliance standards large enterprises look for before trusting core infrastructure. Banks, payment processors, and regulated fintechs do not move without audit trails and controls. The certifications cover CCIP and Chainlink’s data services, which is exactly the stack that underpins a cross chain token like WLD. See the company’s summary here: ISO 27001 and SOC 2 compliance.

Put those together and you get a credible path for cross chain to move from clever demos to enterprise programs. A payments app can offer chain abstracted transfers and know that the underlying rails meet recognized security standards. A tokenization platform can route redemptions across chains and still meet internal audit requirements. A wallet can hide chain boundaries for new users and still keep a clear, verifiable record of what happened under the hood, supported by patterns like verifiability as a service.

What changes for users, today and soon

-

Transfers get simpler. If your WLD sits on World Chain but a service you need operates on Ethereum, you can move it directly inside your wallet flow. No hunting for unofficial bridges, no jangling between tabs.

-

Fees get more predictable. Because the transfer is not a swap against a liquidity pool, you do not pay hidden slippage. Cost becomes a function of execution fees and a known service fee, which apps can quote upfront.

-

Risk is easier to reason about. The failure modes are documented. If a transfer exceeds a rate limit, it waits instead of breaking. If a chain is congested, the system retries according to a clear policy rather than leaving a user to guess where funds went.

-

App experiences can become chain abstracted. A wallet can present WLD as a single balance and let you spend on either chain, initiating the cross chain move only when necessary. That is how you start to make blockchains disappear from the user interface.

What changes for developers

-

You build once, then extend. The CCT standard lets teams turn existing tokens into cross chain tokens without rewriting token contracts. You configure token pools, choose a mechanism such as burn and mint, and set transfer controls.

-

You get knobs and gauges. Rate limits per lane give you a way to manage risk during busy periods, and you can adjust them without redeploying contracts. Programmed transfers let you bundle token movement with an action, for example move WLD then stake, or move WLD then settle an invoice.

-

You do not need to run a bridge. The operating burden is lower. You rely on a standard interface that many chains can support, and you can connect to new networks as CCIP brings them online.

-

You have a path to non EVM ecosystems. As CCIP adds more non EVM chains, the same integration work can reach new user bases. If your customers use a Solana wallet, you can plan for them without inventing a separate bridge stack. Momentum from efforts like PYUSD goes omnichain with LayerZero shows how fast issuer led standards can spread.

Liquidity, price discovery, and safer markets

World Chain is also adopting Chainlink Data Streams for market prices. That matters because cross chain tokens need reliable reference data to power lending, trading, and payments. Sub second price updates reduce the window for stale quotes and let apps design smaller safety buffers. The combination of a standard for token movement and a standard for data delivery means developers can build markets that behave the same way across chains.

For WLD, expect liquidity to rationalize. Instead of breaking into two separate pools, one per chain, the token can move to where demand is, then move back when conditions change. That supports tighter spreads and fewer incentives to chase minor price gaps across bridges.

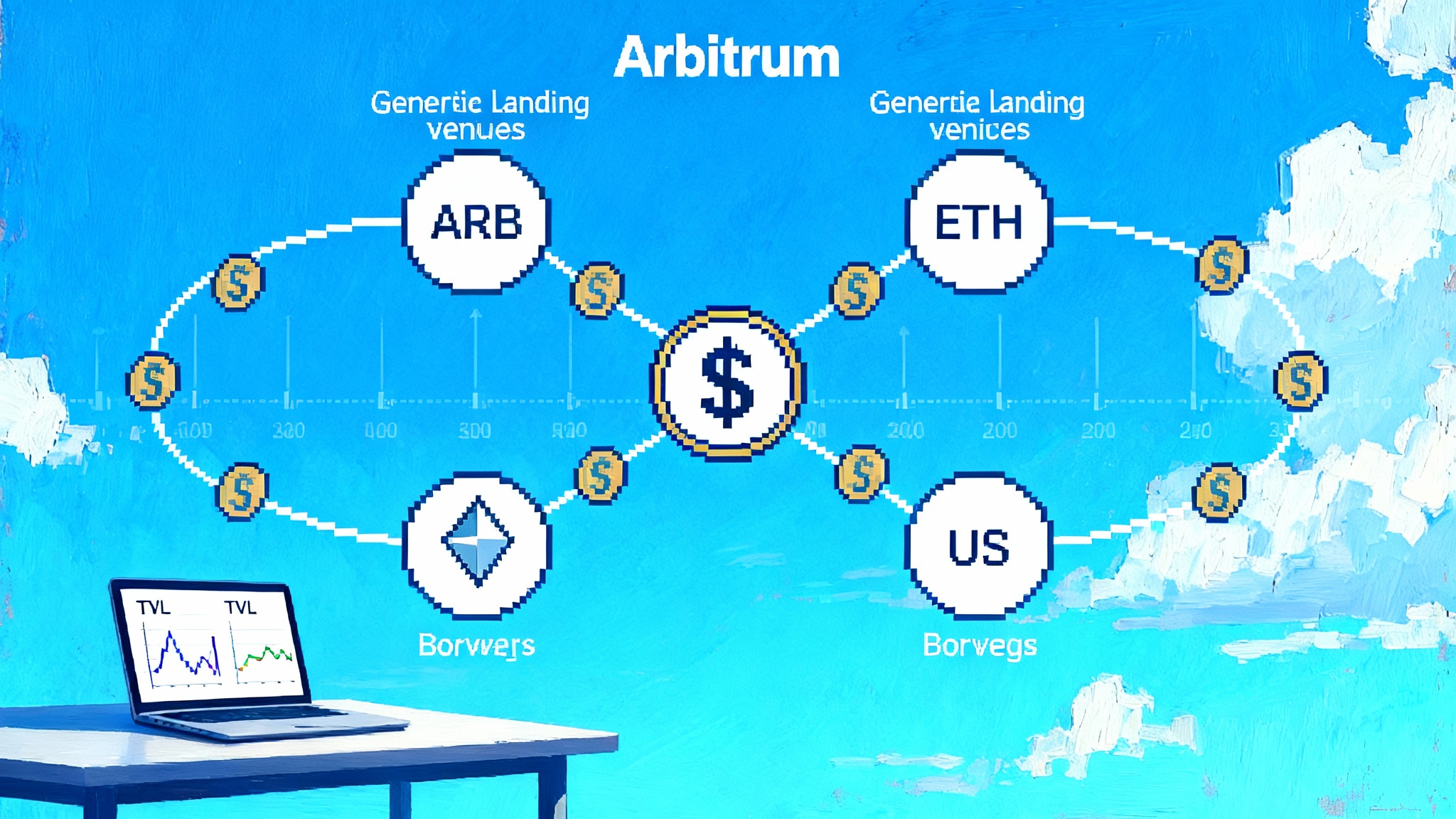

How this compares to common alternatives

-

Bespoke bridges: Powerful for special cases, but each one is a new codebase, a new operational process, and a new set of risks. Standards reduce that surface area and make monitoring and governance repeatable.

-

Liquidity pool bridges: Useful when you need instant settlement without mint permissions, but they introduce slippage and liquidity fragmentation. CCT avoids that by locking or burning on one side and minting or unlocking on the other side, so the token’s supply stays coherent.

-

Custodial wrapping: Fast to launch, but custody risk sits with a single operator and it can be hard to scale across many chains without central points of failure. CCT keeps control with the token issuer and relies on a decentralized network for message delivery and verification.

The common thread is control and auditability. Token teams retain ownership of their token contracts and the permissioning that governs mint and burn. Moves are not market trades, they are supply changes that can be audited chain by chain.

What to watch next

-

More chains: Watch for additional destination and source chains beyond Ethereum and World Chain. CCIP’s expansion into non EVM networks suggests a roadmap where consumer apps can reach different ecosystems without changing user experience.

-

Better wallet flows: Expect wallets to unify balances across chains and to ask users a simpler question, such as how much to pay and to whom, not which chain to select. Behind the scenes, the wallet will route the transfer and only prompt when a signature is needed.

-

Exchange and merchant support: As more venues treat WLD as a single asset across chains, deposits and withdrawals should become faster and less confusing. That is usually the moment when usage spikes, because the onboarding friction drops.

-

Real world asset rails: Compliance friendly interoperability is useful for tokenized treasuries, invoices, and payments that touch traditional finance. When an issuer can show that the cross chain layer meets known security standards and provides clear rate limits and logs, internal sign off gets easier.

Practical steps for builders and product teams

-

If you issue a token, review your mint and burn permissions. Decide who grants and revokes privileges to token pools, and document your process for rate limit changes. Treat this like change management, not ad hoc ops.

-

If you run a wallet, plan for chain abstraction in your user interface. Collapse cross chain movement behind a single action. Show fees and timing in plain language and warn early if a rate limit might delay settlement.

-

If you build trading or lending markets, align your oracles and your token movement. Use a consistent data standard, and test your liquidations and health checks across paths where tokens move between chains in stressful conditions.

-

If you work in a regulated environment, map the certifications and controls to your risk framework. Tie ISO 27001 and SOC 2 controls to your vendor review, then document how CCIP messages are verified and how transfer limits will be governed.

The bigger picture

World Chain’s move puts a large consumer token on rails that are designed for scale and audit. It is hard to overstate the value of boring, predictable infrastructure in a fast moving market. Standards that reduce edge cases and operational variance become invisible over time, and that is the point. When users stop thinking about which bridge to trust, and when teams stop writing bespoke transfer code, the space can focus on product features instead of plumbing.

There are still open questions. Governance around token pool upgrades needs clear procedures. Rate limits must be tuned to balance throughput and safety. Non EVM integrations will require careful wallet support so that the user experience stays clean. Yet these are the kinds of problems that institutions know how to manage, because they look like change management and capacity planning, not heroics.

Conclusion

A token standard only becomes a standard when the biggest consumer apps adopt it. With World Chain moving WLD onto CCIP and the Cross-Chain Token standard, the industry is one step closer to a world where wallets hide chains, liquidity flows to where it is needed, and compliance is addressed in the infrastructure rather than bolted on later. The rails are finally aligning with the ambition. Now we get to see what builders do when they do not have to reinvent them.