Transmission 2.0 Goes Live: 2025 Compliance and Court Fights

First compliance filings under FERC Order 1920 arrive on December 12, 2025 as petitions for review hit the courts. Here is how 20-year planning, scenario rules, and new cost-allocation choices will reshape who builds and who pays for big lines and storage.

The filings are here. The fight is on.

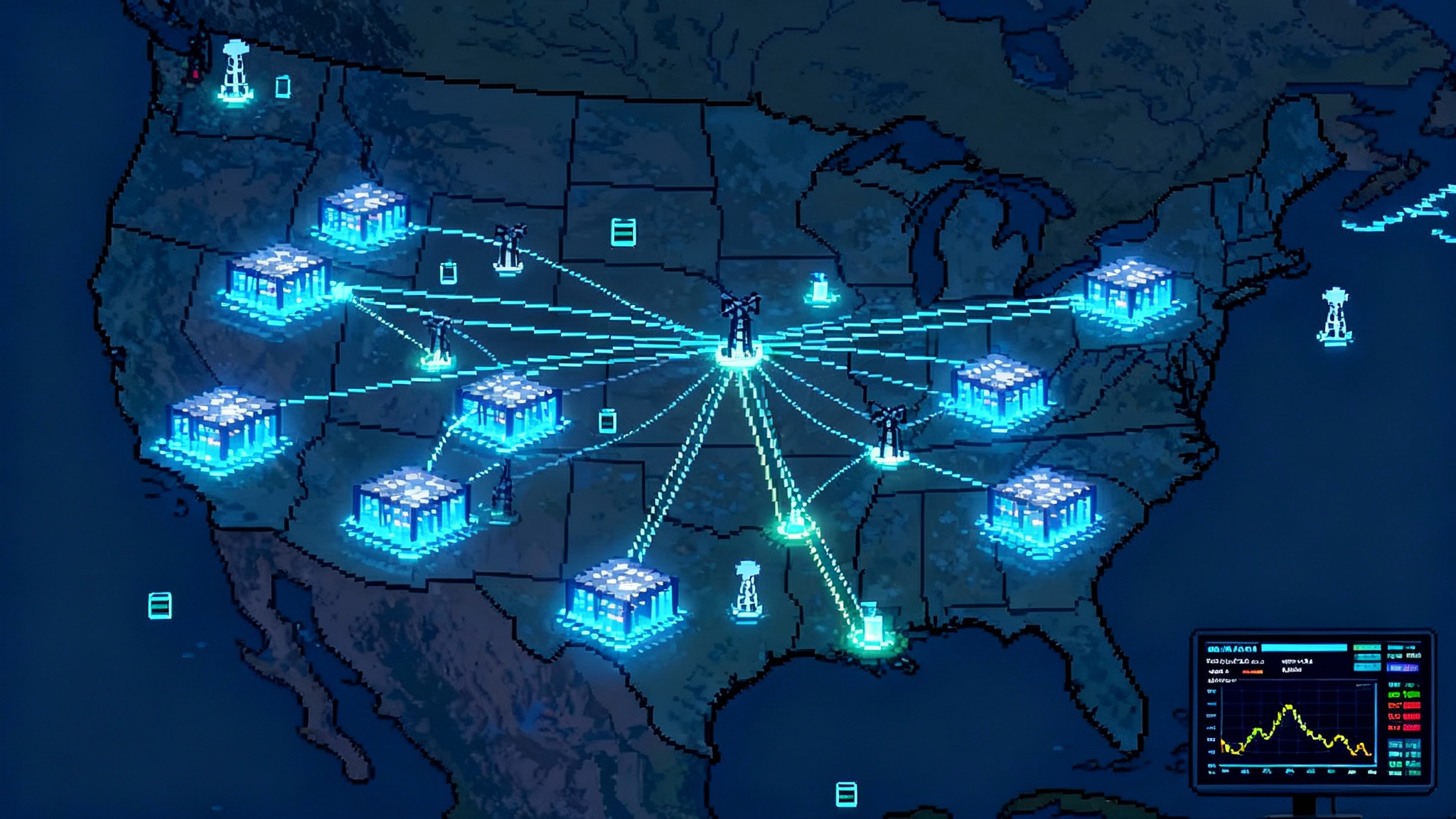

On December 12, 2025, the first wave of compliance plans under Order 1920 land at the Federal Energy Regulatory Commission. California ISO, PJM, NorthernGrid, and WestConnect are up first, with the rest of the country following through 2026 and ISO New England in 2027. This is the moment Transmission 2.0 moves from theory to filings. If you care about who builds the next set of high‑voltage lines, how costs are split, and whether storage can be treated as a transmission solution, the next six months will set the playbook. The agency’s own summary shows the staggered deadlines and the regions on the clock, including the six‑month state engagement windows that accompany them. See the dates on FERC’s compliance schedule.

At nearly the same time, a coalition of merchant developers and generators has taken Order 1920 to court. Multiple petitions have been consolidated in the Fifth Circuit, with a marquee case caption that includes NextEra Energy Resources, LS Power, RWE Clean Energy, Invenergy, Vistra, Electric Power Supply Association, and others in Leeward v. FERC. You can follow the consolidated Leeward v. FERC docket.

The filings will define the new planning rules in each region. The court cases will define the legal boundaries. Together, they will determine what gets built in the 2027 to 2030 in‑service window and who pays for it.

What Order 1920 actually changes

Think of Order 1920 as moving from short road repairs to a 20‑year highway map. Transmission providers must:

- Plan at a 20‑year horizon and refresh long‑term plans at least every five years.

- Build at least three forward‑looking scenarios and stress‑test them for uncertainties, such as extreme weather.

- Measure a common set of seven benefits when selecting long‑term regional facilities. These include avoided reliability upgrades and aging replacements, reduced loss‑of‑load risk or reserve margins, production cost savings, reduced energy losses, lower outage‑related congestion, mitigation of extreme conditions, and capacity cost benefits from reduced peak losses.

- Propose ex ante cost‑allocation methods for long‑term regional facilities, and hold a formal six‑month state engagement period where states can negotiate a method or a state agreement process. If states agree, the transmission provider must file the states’ proposal alongside its own.

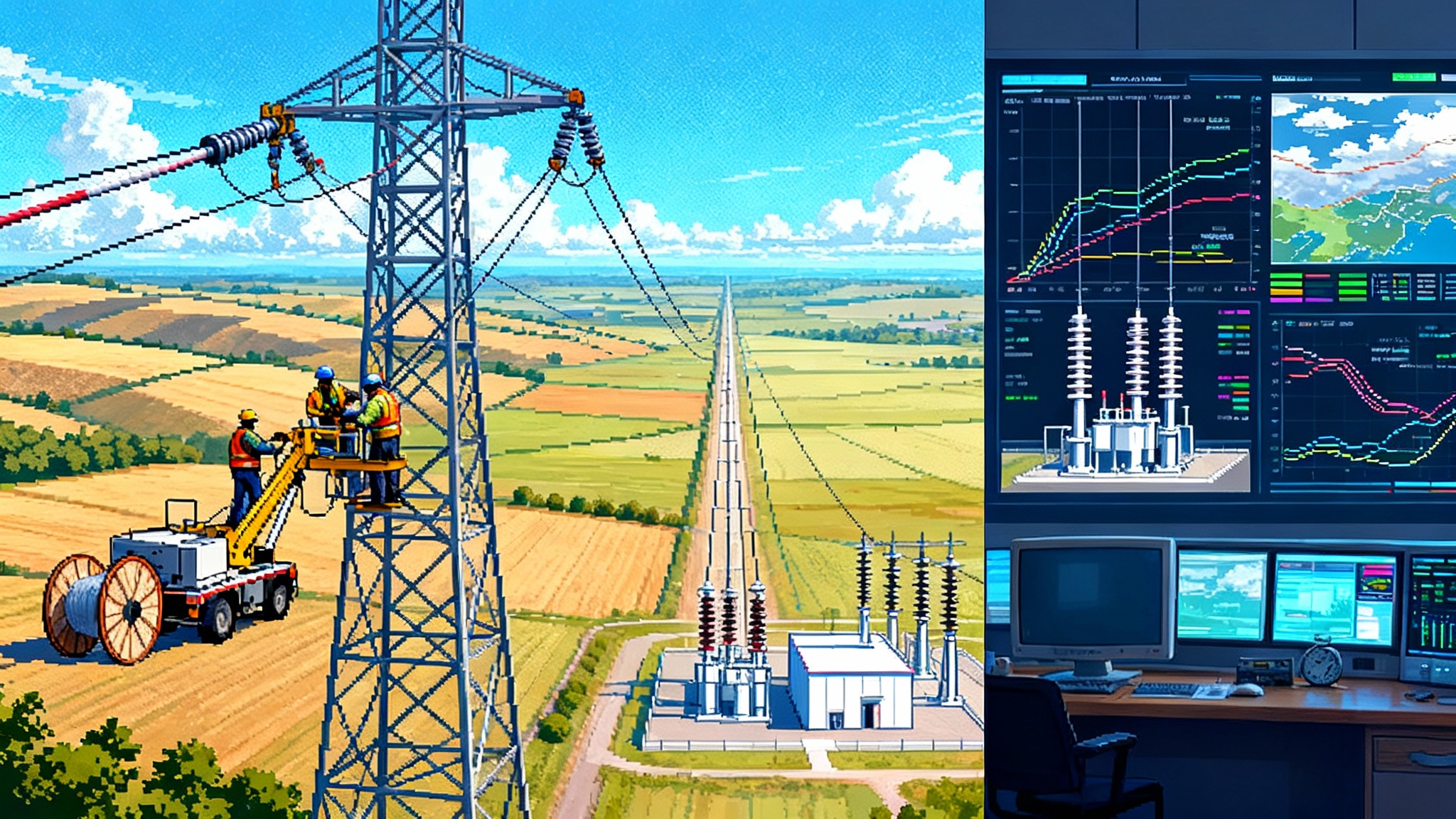

- Consider alternative transmission technologies in both near‑term and long‑term planning, including dynamic line ratings, advanced power‑flow controllers, advanced conductors, and transmission switching.

Order 1920‑A also gave regions more runway to start the first long‑term cycle. Instead of kicking off within one year of compliance, the first long‑term planning cycle must start no later than two years after the initial compliance filing. That extra year matters for staffing, modeling, and sequencing portfolios. For queue context and deliverability pressures, see Order 2023’s first results.

The filings that matter in late 2025

Four planning regions have December 12, 2025 deadlines for their first compliance filings: CAISO, PJM, NorthernGrid, and WestConnect. Two practical implications follow.

First, these regions will set the opening precedent for how to build 20‑year scenarios, what benefit metrics are actually used in practice, and how transparent the selection criteria are. If PJM includes a co‑optimized model that weighs generation, storage, and transmission together, that will ripple into neighboring regions as a benchmark. If CAISO defines clean, repeatable methods for quantifying extreme‑weather benefits, that will become a template elsewhere.

Second, the six‑month state engagement periods tied to these filings can make or break cost allocation. In PJM, for example, states can use the engagement period to reach agreement on a method that shares reliability and economic benefits region‑wide while allocating additional policy‑driven costs only to states that adopt the policies driving those costs. That kind of two‑tier method can hold a diverse coalition together long enough to move a multi‑value portfolio.

The court challenges you should actually watch

Petitions for review challenge three themes.

- Federalism and state roles. Petitioners argue the rule tilts planning toward distant resources and shifts costs to unwilling states. Expect the court to probe whether FERC tied the planning reforms tightly enough to ensuring just and reasonable rates under Section 206 of the Federal Power Act.

- Competition and the right of first refusal. The rule maintains an incumbent right to build certain right‑sized replacements and does not impose a broad federal right to build new regional lines. Petitioners on both sides argue FERC either went too far or not far enough. The outcome will shape whether independent transmission developers can compete for more projects in the next decade.

- Cost allocation. The question is whether FERC adequately justified requiring ex ante regional methods and the state agreement process. If the court narrows those tools, the path to region‑wide portfolios gets steeper.

Do not expect a final judicial answer in 2025. Do expect interim procedural orders, briefing schedules, and possibly stays on specific sub‑issues. Developers should plan for both outcomes: a broad affirmation that lets filings proceed largely intact, and a narrower ruling that trims back parts of cost allocation or state process design.

Who builds and who pays in Transmission 2.0

Order 1920 tries to align project selection with measurable benefits and pre‑negotiated cost shares. That shifts the old argument from “should we build a line” to “which portfolio delivers the most benefits per dollar, and how do we assign the bill.”

- Incumbent transmission owners will remain the default builders of right‑sized replacements and many upgrades. They also retain advantages around siting, rights‑of‑way, and local cost recovery.

- Independent transmission companies and merchant developers gain when regions select multi‑value portfolios and when competition is used for new greenfield facilities. Look for opportunities where a high‑voltage direct current segment or advanced reconductoring converts a scattered set of queue upgrades into one regional solution that clears multiple bottlenecks at once.

- Storage‑as‑transmission becomes a practical option when a battery is selected to solve a transmission need and is paid through transmission rates. The 2017 policy on cost recovery for storage that does both market and cost‑based services set the foundation; Order 1920 brings storage into the long‑term planning conversation as a selectable solution when it is the most efficient fix.

- States gain real leverage. The engagement period, the requirement to file any state agreement alongside the transmission provider’s proposal, and the expectation that planners consult states before changing cost‑allocation methods all move decisions closer to governors’ offices and public utility commissions. States that come to the table with a concrete cost‑allocation design can steer portfolios; states that sit out will cede that steering wheel.

Near‑term openings for developers

This is where the next 90 to 180 days matter.

- Multi‑value portfolios. The seven required benefits are an invitation to stack value. Package a backbone line that reduces outages, cuts production costs, and mitigates extreme weather risks with local reconductoring and targeted storage that shrink losses and reduce peak capacity needs. The more boxes a portfolio checks, the more defensible it becomes in selection and cost allocation.

- HVDC spines across seams. High‑voltage direct current lines excel at moving large blocks of power between regions while limiting loop flows. If you can document reduced loss‑of‑load risk and major production cost savings, an HVDC segment that bridges two fatigue points is competitive in a 20‑year plan. Tie it to interregional coordination requirements coming due in 2026 to 2027.

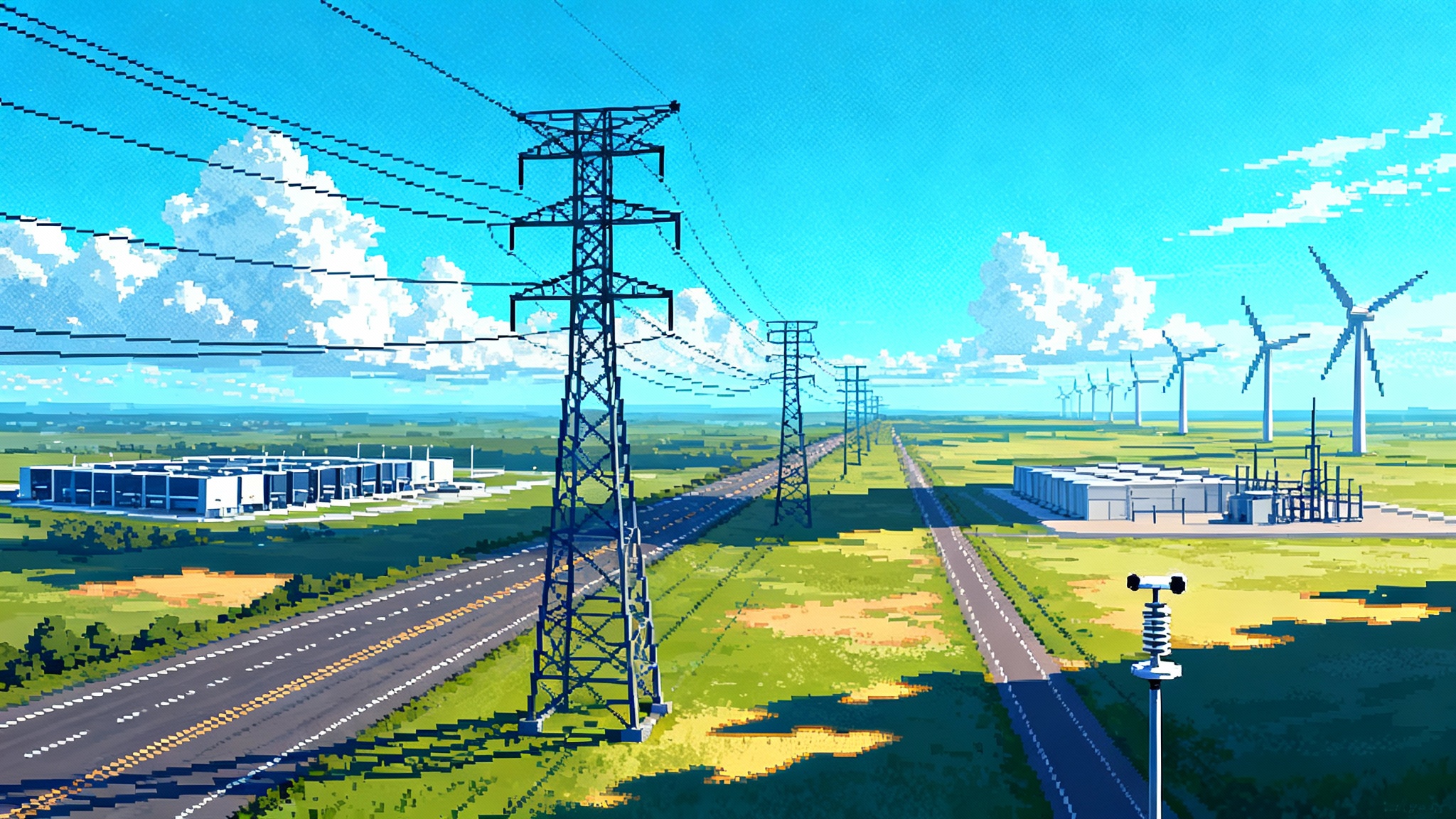

- Advanced reconductoring. High‑temperature low‑sag and advanced composite conductors can triple capacity on existing corridors without new rights‑of‑way. Order 1920 requires planners to consider advanced conductors in long‑term planning. Bring reconductoring forward as the fast first phase of a larger corridor upgrade so ratepayers see early relief while a new greenfield segment moves through siting. For day‑one headroom from software and sensors, see the AAR and DLR race.

- Storage‑as‑transmission. Target places where storage can avoid or defer a 200 kilovolt network upgrade measured in tens of millions of dollars. The case is strongest where a battery can cut outage‑related congestion, improve extreme‑weather resilience, and reduce peak losses. Clarify dispatch priority and market revenue crediting so the transmission ratepayers are protected.

- Grid‑enhancing technologies as the glue. Dynamic line ratings and power‑flow control are not side notes. They turn a good portfolio into a great one by unlocking headroom on day one and by reducing curtailments that erode production cost savings.

How states can accelerate or stall 2027–2030 in‑service dates

- Use the engagement period. States that present a clear cost‑allocation proposal aligned with the measured benefits will see it filed alongside the transmission provider’s tariff changes. That alone shortens the runway by avoiding a post‑selection scramble.

- Ask planners to set a 2026 start date. Order 1920‑A lets regions begin the first long‑term cycle any time up to two years after compliance. Regions that choose 2026 rather than 2027 keep 2029–2030 in play for big projects. Governors and commissions can push for that calendar now.

- Tie portfolios to reliability and affordability. The seven benefits were designed to reach beyond policy labels. If a package delivers reliability and production cost savings that outweigh policy‑driven elements, it is more likely to hold together politically.

- Decide on who pays for the extras. States with specific policy goals can volunteer to pay incremental costs above a region‑wide baseline that already covers reliability and economic benefits. That keeps coalitions intact and limits litigation exposure.

What to watch by region

- PJM. Watch for a scenario framework that co‑optimizes generation, storage, and transmission and for a cost‑allocation method that mixes region‑wide and state‑specific benefits. Expect independent developers to pitch multi‑value backbones that relieve the Mid‑Atlantic and Midwest congestion tangle. For the load side of the story, see AI’s power land rush.

- CAISO. Look for a long‑term process that formalizes how extreme‑weather risk and wildfire constraints enter the benefit calculus. Advanced reconductoring and storage‑as‑transmission are likely to feature because rights‑of‑way are scarce.

- NorthernGrid and WestConnect. These non‑RTO Western regions can move fast if states coalesce around a portfolio that focuses on reliability and production cost savings first, with optional policy adders carved out for volunteer states.

- MISO and SPP. With compliance dates in mid‑to‑late 2026, both have time to stitch interregional seams together. HVDC concepts that connect wind and storage to load centers with measurable benefits will test well under the seven‑benefit framework.

- NYISO and ISO‑NE. The long extension into 2026 and 2027 suggests deeper coordination with state agencies. Expect more explicit ties between planning scenarios and binding state laws, and sharp debates over who pays for policy‑specific benefits.

A practical checklist for developers and financiers

- Map projects to the seven benefits. Put numbers on each benefit over a 20‑year horizon. Use credible production cost modeling and loss estimates. If you cannot measure it, it will not carry weight in selection or cost allocation.

- Pre‑negotiate state support. Engage governors’ energy advisors and consumer advocates with a cost‑allocation straw model that protects non‑participating states from policy‑specific costs. Offer a region‑wide baseline, with volunteers paying for incremental policy benefits.

- Stage projects for early wins. Lead with reconductoring and grid‑enhancing technologies that produce benefits in one to two years, while long‑lead siting proceeds on a parallel track. Early results build political cover.

- Clarify who builds. Where competition is permitted, assemble teams that de‑risk execution: experienced constructors, equipment suppliers with delivery certainty, and operations partners with a track record in the region. Where incumbents retain the build, position as a partner with rights‑of‑way or specialty technology that fills a gap.

- Design storage‑as‑transmission for clean accounting. Set priority rules, telemetry, and revenue crediting so the battery’s market activity never creates double recovery for ratepayers. Simpler is better when you head into stakeholder review.

- Keep interregional on the radar. The second compliance wave in 2026 is about coordination across regions. If your 2025 filing references interregional ties and benefits, you will be ready to convert in the next docket.

The bottom line

Transmission 2.0 is no longer a debate. It is a calendar. December 12, 2025 filings will show how regions intend to plan 20 years ahead, measure common benefits, and split costs in ways that can survive both state politics and federal court review. Developers who arrive with measurable multi‑value portfolios, early wins from reconductoring and grid‑enhancing technologies, and cost‑allocation proposals that let states opt into policy extras will find doors opening. States that use their engagement windows to anchor clear methods will pull projects into the 2027–2030 window rather than watch them slip.

The next grid will not be one big bet. It will be a portfolio that moves power like freeways, squeezes more capacity from the lanes we already have, and uses storage as intelligent on‑ramps. Plan for that portfolio now, or get ready to read someone else’s map.