Coinbase’s POL auto-swap makes Polygon’s AggLayer default

Coinbase will pause MATIC activity and automatically convert balances to POL between October 14 and 17. Here is what changes for holders, builders, and liquidity as Polygon’s AggLayer becomes the default path.

Breaking: Coinbase sets the clock on MATIC to POL

Coinbase has started the countdown that will make POL, not MATIC, the default face of Polygon for most users. According to Coinbase’s migration notice, new staking and unstaking requests for MATIC pause on October 7, MATIC order books are disabled on October 14, sends and receives pause October 14 to 17, and all MATIC balances are automatically converted to POL between October 14 and 17. Staked MATIC converts to staked POL during the window, and trading in POL continues uninterrupted. Read Coinbase’s own summary of the steps and dates in this notice: Polygon migration on Coinbase.

This is not just a ticker change. Coinbase is the largest consumer on-ramp in the United States. When it turns MATIC into POL by default, the practical center of gravity for Polygon’s next phase, the AggLayer, shifts from road map to reality. For context on U.S. exchange dynamics, see our analysis of America’s spot crypto pivot.

Why POL replaces MATIC

POL is the token built for Polygon’s multichain design. MATIC did one job well: secure and pay for the Proof of Stake chain. POL is designed to secure many chains at once and to coordinate them. In Polygon 2.0, validators stake POL to help secure multiple networks, including Polygon PoS, Polygon zkEVM, and future app-specific chains. Think of MATIC as a bus pass for a single route; POL is a passport that gets stamped across many connected networks.

The economics also change. After the legacy MATIC rewards schedule finished in June 2025, POL began a predictable emissions cycle that expands supply by about 2 percent per year, with roughly half directed to validator rewards and half to the community treasury. Polygon’s technical docs explain that governance controls the rate through the EmissionManager contract and that the post June 2025 intent is 1 percent to validators and 1 percent to treasury each year, compounded annually: POL emissions and governance details.

Two takeaways follow:

- For holders: POL is inflationary by design. Your slice of the pie will shrink unless you stake or otherwise earn yield that keeps pace.

- For builders: there is a standing budget to reward validation and to fund ecosystem growth. That is dry powder for chains and applications that plug into the AggLayer.

AggLayer, made default by on-ramps

AggLayer is Polygon’s system for making many chains feel like one network. Instead of relying on dozens of separate bridges, it provides a common bridge and a zero knowledge safety layer so that assets can move natively between chains. In plain language, that means moving a token from chain A to chain B does not wrap it in new paper each time. It is more like walking through a hallway that connects rooms, not boxing your belongings and shipping them across town. For the broader technical backdrop, compare with the Ethereum L1 zkEVM plan that rewrites L2s.

Coinbase’s migration compresses the adoption curve. When deposits, balances, and staking positions on a major exchange become POL, the average user’s first interaction with Polygon’s world is POL. Wallets and custodians follow the liquidity. Market data providers label pairs in POL. New users show up with POL in hand, and the path of least resistance for builders is to connect their chain or app where that default liquidity lives. That is the point where AggLayer stops being optional plumbing and becomes the standard hallway.

The practical checklists: opt out or ride the swap

You have two clean options. Pick one and stick to it.

If you plan to ride the swap on Coinbase

- Do nothing before October 14. Your MATIC and staked MATIC will turn into POL and staked POL during October 14 to 17.

- Expect a pause in send and receive between October 14 and 17. Bills and bridges that rely on transfers during that interval will fail. Reschedule anything time sensitive.

- Staking rewards do not accrue during the migration window. Plan cash flows accordingly.

- After conversion, update your personal spreadsheet or accounting tool so that MATIC positions are labeled POL at a 1 to 1 rate on the conversion date of record.

- If you use automated trading tools or price alerts, change the instrument from MATIC pairs to POL pairs.

This option is for people who value simplicity, are fine with Coinbase custody, and want uninterrupted access to exchange liquidity after October 17.

If you want to opt out of the auto-conversion

- Move MATIC to self-custody before October 14. If your MATIC is staked on Coinbase, unstake before October 7 so you have time to withdraw.

- Use a reputable on-chain migration contract to upgrade to POL at your own pace. Confirm contract addresses from official docs and avoid ad hoc migration helpers.

- If your tax profile benefits from realizing the swap later, the opt-out path gives you control over timing. Keep meticulous records of the date you manually upgrade.

- Prepare for more friction. Some exchanges will delist MATIC pairs around October 14, so your off-ramp may narrow. You will likely bridge or swap on chain when you are ready to convert.

This option is for people who want control over timing, run their own wallets, or have smart contracts that must be tested against POL before they accept it.

What POL’s emissions and staking mean for holders

Inflation cuts two ways. It dilutes passive holders. It pays active participants.

Here is how to reason about it without spreadsheets. Imagine the network prints 2 new apples for every 100 apples in existence each year. One apple goes to farmers who maintain the orchard. One apple goes to plant new trees and run the market stall. If you just keep apples in a box, you own less of the orchard over time.

For holders, the basic playbook looks like this:

- Stake to offset dilution. If validator rewards near 1 percent of supply flow to stakers, your goal is to capture a fair share of that 1 percent, net of operator or exchange fees. The more middlemen you use, the more of that apple you hand away.

- Do not overfit to headline yields. Validator returns vary with participation rates, validator commissions, and how many people stake. If staking participation rises, the yield per staker often falls, even if the total pie stays the same size.

- Diversify how you earn POL. Some chains and programs built around the AggLayer plan to direct a portion of their token supply to POL stakers or cross-chain participants. Treat these as real but variable bonuses rather than guaranteed income.

For planners, the practical implication is clear: update your long-term return assumptions from “MATIC’s hard-ish supply with burns” to “POL’s moderate inflation with staking and ecosystem rewards.” If you measure everything in unit count, you may feel richer. If you measure in percentage of the network, you will only keep pace by contributing.

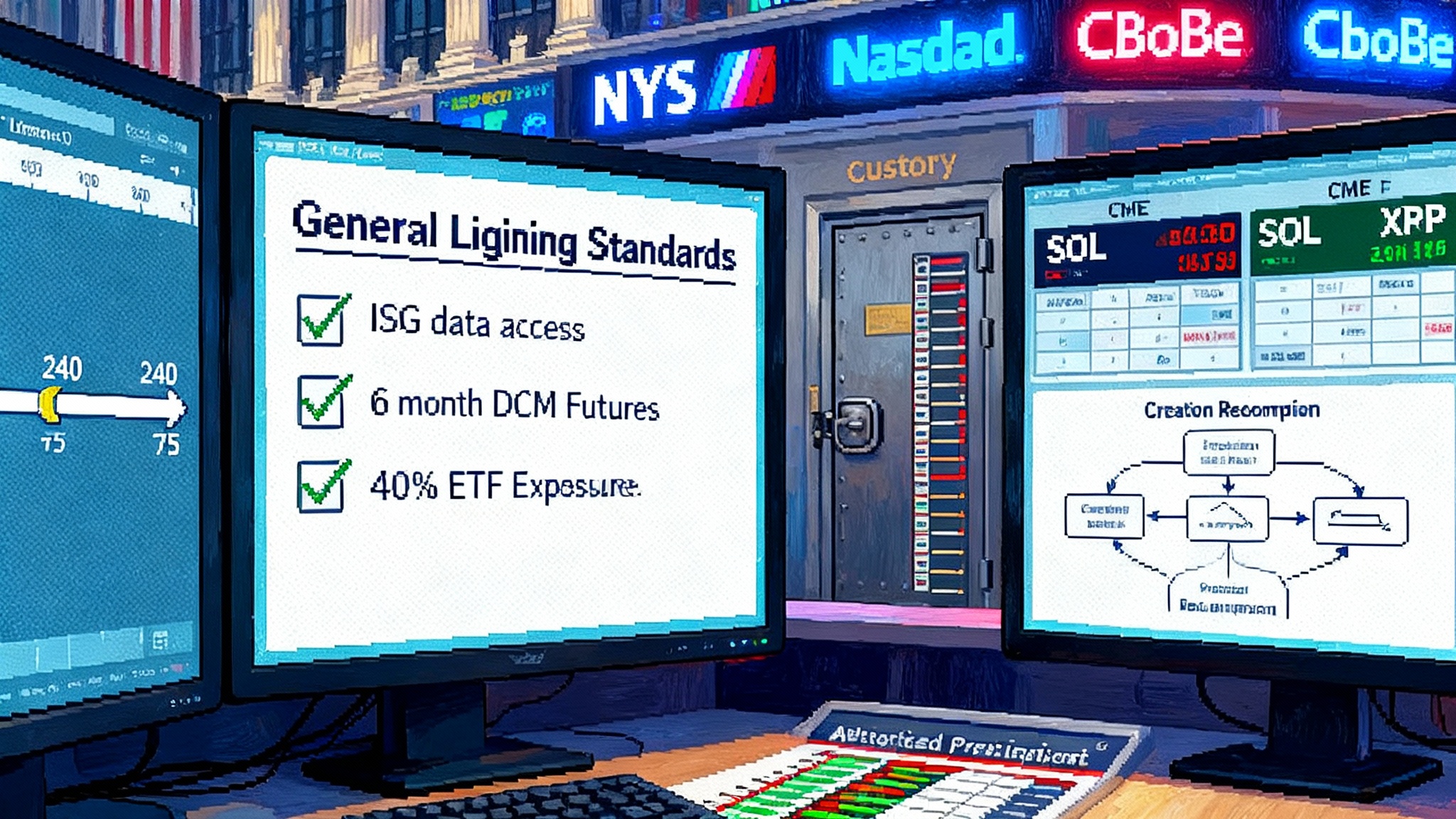

Liquidity shifts to watch as exchanges converge on POL

When Coinbase disables MATIC order books on October 14, the market will do what it always does around migrations. Expect spreads to widen on last-day MATIC pairs, sudden dust balances to remain on delisted tickers, and a short period where arbitrageurs shuffle between on-chain pools and the first POL books that fill.

What typically happens next:

- Spot volume consolidates into POL pairs. Index providers and market trackers point new retail flows to POL as the canonical ticker.

- Derivatives lag. Some venues will take time to relabel perpetuals or list POL contracts. If you hedge with futures, check instrument codes well before the window.

- On-chain pools flip gradually. Major automated market maker pools will list POL base pairs, but long-tail MATIC pools may linger. If you are a liquidity provider, look for concentrated opportunities created by the shift and expect short-lived impermanent loss as prices and routing adapt.

For teams managing treasury, update custody policies so that exchange deposits default to POL and that any remaining MATIC sitting idle is scheduled for migration. For financial controllers, align chart of accounts, oracle feeds, and position limits so that references to MATIC are retired after conversion.

Builders: position now for AggLayer-linked upside through 2026

The window created by Coinbase’s migration is short. The upside for builders is large because liquidity and users will funnel into the same hallway.

Here is a focused plan:

-

Connect to the AggLayer early. If you are launching a new chain, use a stack that integrates with the AggLayer from day one so that your token moves natively across connected networks. Users should be able to arrive with POL and travel without learning a new bridge.

-

Design a bridge-and-call path in your app. Treat cross-chain calls as a first-class feature, not a compromise. A user who starts execution on chain A should be able to complete on chain B with native assets and familiar wallets.

-

Align with staking incentives. Programs around the AggLayer increasingly direct part of their token supply to POL stakers. If you plan a token, budget a clear share of supply to reward POL stakers who help validate or route activity that touches your app. Make the rules explicit and verifiable.

-

Target exchange-liquidity rails. Because Coinbase is making POL the default for the average user, make POL the native settlement asset in your app. Show balances, fees, and cross-chain quotes in POL by default. This reduces cognitive friction and taps the aggregation effect of shared liquidity.

-

Ship intent-centric flows. The AggLayer’s value shows up when users state what they want and the system finds the best path across chains. Build intents, not menus of networks. For example, swap 500 POL for stablecoins at the best all-in cost rather than bridge here, then swap there.

-

Prepare for audits across chains. Cross-chain systems fail at the edges. Inventory every approval, message, and assumption in your cross-chain path. Add replay protection, rate limits, and circuit breakers so that a problem on one chain does not cascade.

-

Plan for 2026 token distribution. If you are chasing airdrops tied to POL staking or cross-chain usage, map the qualifying actions now and automate tracking. If you are running a project, publish criteria early to attract the right users rather than opportunistic wash activity.

A user-first action plan for the next two weeks

- Put the dates on your calendar. October 7 for staking requests. October 14 for order book shutdown. October 14 to 17 for send and receive pause. Plan around them.

- If you need self-custody, move before October 14. If you are staked on Coinbase and want out, start before October 7 to leave time for settlement.

- After conversion, check addresses. Update any payroll, vendor, or treasury systems that reference MATIC deposit addresses or tickers.

- Restake on your terms. If you want to earn emissions, choose a validator with a transparent commission and a history of uptime. Avoid chasing temporary headline yields if they rely on large token incentives that end next quarter.

- Rotate liquidity. If you provide liquidity on chain, reallocate from MATIC pools to POL pools you expect will hold depth. Do it while spreads are still compressing rather than after everyone moves.

What this means for Polygon’s multi-chain vision

Polygon’s pitch has always been that the internet will need many chains, but they should feel like one network to the user. The AggLayer tries to make that true by reducing the cost and cognitive burden of moving between chains. When a major exchange like Coinbase enforces a single token across consumer balances, that experience gets an accelerant.

A default token concentrates distribution. Concentrated distribution attracts builders. Builders, in turn, create more places to use POL and more reasons for new chains to connect. The flywheel is not magical; it is mechanical. It is a pattern we have seen before, similar to the Tether rail switch case study. Now the rail is POL.

The risk is also mechanical. More activity flows through shared infrastructure. A bug in a common bridge or a flawed upgrade can pause many things at once. This is why builders should insist on auditable, rate-limited cross-chain paths and why users should diversify custody.

The bottom line

October 14 to 17 is not a marketing moment. It is the week the on-ramp becomes the standard, POL becomes the label most people see, and AggLayer moves from whiteboard to default pathway. If you are a user, align your calendar, staking plan, and liquidity so you do not miss a beat. If you are a builder, align your stack, incentives, and user flows so you meet the liquidity where it lands.

The network effect will not wait. Coinbase flipped the switch. The hallway is open. Walk through it while it is still quiet.