After Sept 1: Tether’s Rail Switch Is Remaking Payments

On September 1, 2025, Tether ended support for five legacy networks and pushed USDT flows to a few dominant rails. Here is what changed, who benefits, and how teams should migrate without breaking payments.

Breaking: the rail switch that moved the money

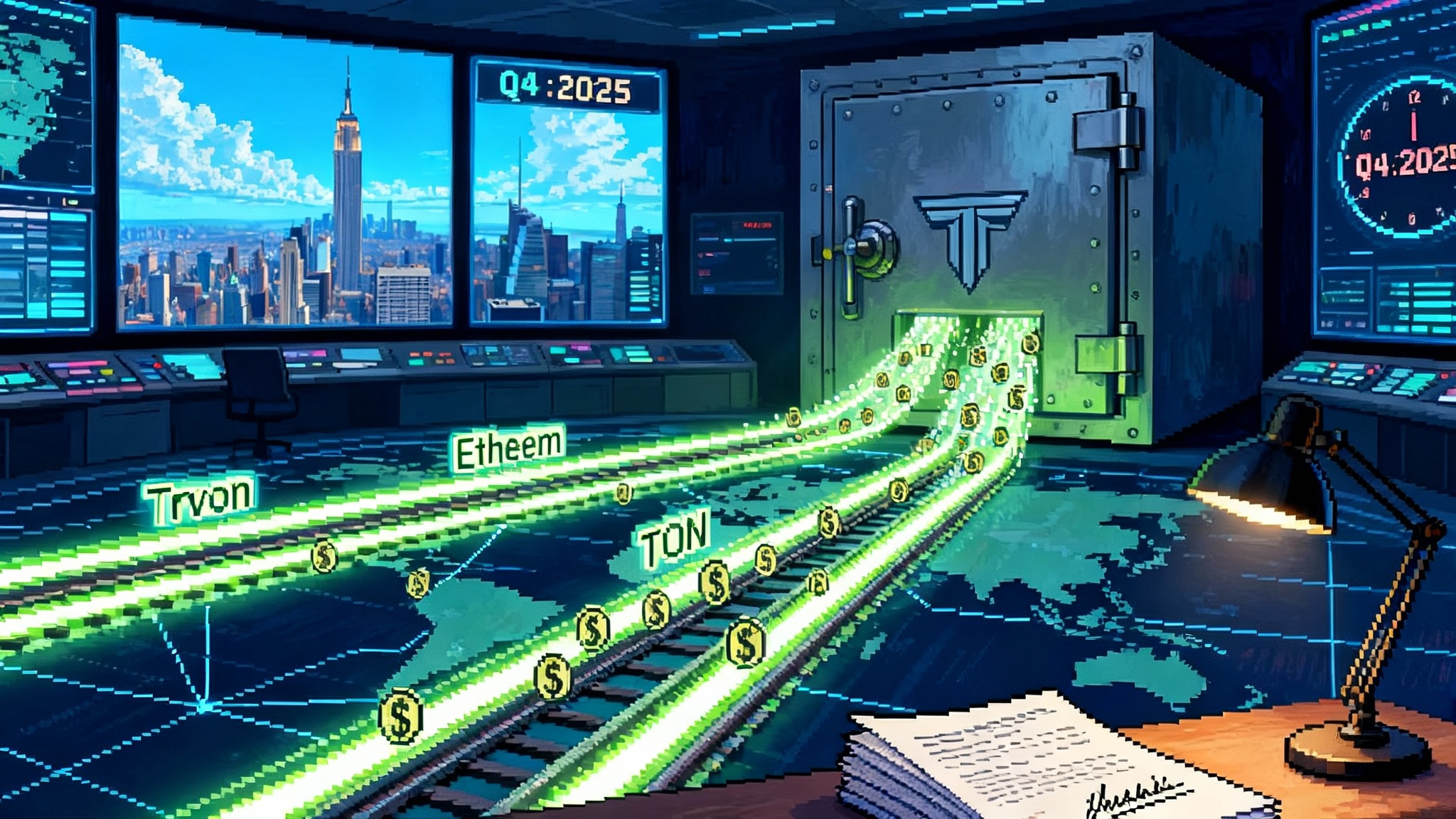

On September 1, 2025, the world’s largest stablecoin finished a major track change. Tether confirmed the end of support for five legacy networks: Omni, Bitcoin Cash SLP, Kusama, EOS, and Algorand, and told users to migrate to active rails, chiefly Ethereum and Tron, with Solana as a distant but rising third. The company laid out the discontinuation plan in mid July, setting the date and the list of affected chains in a public note that captivated every exchange and wallet operator who touches stablecoin deposits and withdrawals. Tether’s July announcement made one thing explicit: the dollar liquidity map was about to be redrawn.

Then, in a late August update, Tether changed how the transition would work. Rather than freezing smart contracts on the sunset chains, Tether said it would stop issuance and redemption there but leave tokens transferable, classifying them as unsupported assets rather than frozen ones. In practical terms, that means holders can still move those tokens between wallets on those chains, but they cannot redeem with Tether or expect first-class operational support. This revision softened the technical risk of funds becoming stuck while still funneling fresh liquidity to the active rails. The August 29 update finalized the playbook.

The result is a visible consolidation of dollar liquidity. Most new issuance and transactional gravity sit on Ethereum and Tron. Solana, while smaller for Tether flows, is now the third rail many consumer apps want to support because of its speed and low fees, and the Firedancer plan to uncap Solana only reinforces that trajectory.

The new map of USD liquidity

Think of stablecoin networks like freight lines. For years, the cargo moved across many tracks: some busy, some sparsely used but still maintained. Tether’s sunset bundled five low-traffic spurs into maintenance mode and redirected trains to three mainlines. That shift has three immediate effects:

- Depth concentrates where the most trading and settlement already occur. Exchange hot wallets, market maker inventories, and onchain treasuries now standardize around Ethereum and Tron for issuance and redemption, with Solana gaining share for retail transfers and point of sale.

- Operational overhead falls. Fewer full nodes to run, fewer chain-specific bugs or deposit memo quirks, and fewer reconciliation paths in accounting systems.

- Routing gets simpler. Cross-chain bridges still matter, but the default path for deposits, withdrawals, and merchant payouts is now on a smaller set of rails.

Winners

- Ethereum and its rollups: Dollar depth accumulates where liquidity providers already hedge, lend, and trade. DeFi venues that settle stablecoin pairs on Ethereum and on major layer 2 networks benefit from larger pools and tighter spreads.

- Tron: For high-frequency transfers and exchange withdrawals, Tron’s low fees and fast confirmations keep it a favored rail for retail users and offshore venues. Many exchanges default to Tron withdrawals when users pick the cheapest route.

- Solana: Not the biggest gainer in absolute USDT supply yet, but a clear winner in product experience. Solana’s combination of speed and low cost makes it attractive for consumer wallets and merchant processors that need instant authorizations and sub-cent fees.

- Exchanges and processors with auto-conversion: Platforms with robust credit lines and internal inventory can accept deprecated-chain deposits for a limited time, sweep them to active rails, and credit users instantly.

Losers

- Ecosystems on the sunset chains: DeFi protocols and wallets centered on Omni, BCH SLP, Kusama, EOS, or Algorand lose native USDT issuance and redemption. Even with transfers still possible, liquidity thins, front ends de-prioritize these networks, and market makers reduce activity.

- Bridge services in long-tail corridors: When official flows concentrate, the business case for niche bridges shrinks.

- Smaller exchanges without auto-conversion: If a venue cannot accept deposits from deprecated chains and map balances to supported rails, it faces user churn and higher manual support costs.

Fees, depth, and speed: what actually changes

For stablecoin users, three variables drive day-to-day experience: the fee to move funds, the depth available at the destination, and the time to finality.

- Fees: Tron transfers usually cost cents, often less than ten cents depending on contract calls. Solana transfers range from fractions of a cent to a few cents. Ethereum mainnet fees vary with congestion; a simple transfer can be under one dollar during quiet periods and several dollars during busy windows. Layer 2 networks on Ethereum compress fees again, commonly to under ten cents for a transfer, and the Ethereum zkEVM plan that rewrites L2s should keep that trend intact.

- Depth: Centralized exchanges, major DeFi pools, and money market protocols concentrate on Ethereum with mirrored liquidity on Tron. Depth dictates slippage. Tighter spreads on these rails reduce the hidden cost of moving size.

- Settlement speed: Solana and Tron post confirmations in seconds and are widely considered usable after one or two blocks for retail flows. Ethereum mainnet targets near twelve seconds per block, but many venues wait for several confirmations. Layer 2s batch post to mainnet, but user-visible finality is typically seconds.

The net effect is that retail and high-velocity commerce increasingly routes to Tron or Solana for low cost and speed, while treasury operations, lending, and institution-scale trading cluster on Ethereum and its rollups, where composability and risk tooling are richest.

Exchanges, wallets, and merchants: operational playbook

The wind-down is more than a headline. It forces process change in how platforms accept, credit, and move stablecoins.

- Addressing and symbols: Deprecate deposit addresses on sunset chains in user interfaces. Make the network selector default to Ethereum, Tron, or Solana and warn proactively if a deprecated chain is chosen.

- Auto-conversions: If you can hold inventory on multiple rails, accept deprecated deposits temporarily, then sweep and credit on supported rails. Publish limits and cut-off times.

- Treasury routing: Standardize corporate wallets and payout flows on two rails, not five. Run health checks on signer infrastructure and onchain allowlists. Document contingency paths if one rail degrades.

- Support workflows: Write deadline-driven scripts for cases where users have tokens on unsupported chains. Offer a paid recovery service if you must, but set expectations clearly that redemption is not available on those networks.

Why Q3 inflows point to a few dominant rails

The third quarter of 2025 set new records for net stablecoin issuance and onchain transfer volumes. This is not just a cyclical bump. It is a sign that dollar settlement is moving further onchain, and that users are choosing certainty over optionality.

Three drivers explain the acceleration:

- Fewer choices, less friction: When issuers prioritize a handful of networks, product teams can build fewer code paths that work better. That lowers the barrier for merchants, apps, and fintechs who integrate stablecoin payments, aligning with the broader arc of stablecoin payouts under the GENIUS Act.

- Yield discipline: As interest rates and issuer reserve strategies evolve, onchain dollars have become a clearer cash management tool for desks and businesses. That drives more balances onto rails with the tightest markets and best credit perception.

- UX leapfrogs: Payment experiences have improved. Wallets now hide the chain unless the user insists. Developers are shipping one tap sends with sponsored gas, creating a feeling that resembles familiar web payments.

The shape of inflows matters as much as the size. Most new supply now mints to Ethereum and Tron, and a rising share of consumer transfers runs on Solana. That concentration feeds a feedback loop: deeper pools make pricing better, which attracts more flows, which makes integrations more straightforward.

The next 6 to 12 months: what changes in practice

- Layer 2 native stablecoin UX

- Gas abstraction becomes normal: Users will send and receive stablecoins on Ethereum rollups without needing to hold the native gas token. Paymasters will sponsor fees or allow fees in stablecoins, which removes the last confusing step for first-time users.

- Account abstraction crosses the chasm: Smart accounts let wallets bundle actions like approvals, swaps, and transfers into one transaction and recover accounts with social or hardware keys. Teams will ship consumer flows where the app pays a few cents to finalize the action. For merchants, this means fewer failed checkouts.

- Onchain foreign exchange corridors

- Dollars to local currency without a bank: We will see corridors where businesses in Latin America, Africa, and Southeast Asia convert US dollar stablecoins to local money through onchain pools with licensed off-ramps on the edge. The starting point will be Ethereum and Tron for depth, with settlement to consumer wallets on Solana or a rollup for speed.

- Treasury to treasury: Corporate treasurers will use onchain swaps to rebalance between dollar stablecoins and tokenized cash equivalents. The rails with the most predictable liquidity and compliance tooling will dominate these flows.

- Risk markets mature

- Depeg hedges: Options and futures that pay out when a stablecoin deviates from par will list deeper order books and standardized terms. Expect baskets that hedge multiple issuers at once.

- Issuer rate hedges: Because issuer revenue depends on short-term interest rates, onchain markets will list swaps where desks can hedge or express views on the rate implied by a stablecoin’s reserve yield or distribution policy. That, in turn, will influence how wallets and processors choose default rails and default stablecoins.

A practical migration checklist for teams still on deprecated networks

If you still have users on Omni, BCH SLP, Kusama, EOS, or Algorand, here is a simple plan you can execute in a week and refine over a month.

- Inventory and exposure

- Pull a chain-by-chain balance report for user deposits, corporate wallets, and pending withdrawals. Identify whales and high-risk balances first.

- Check your vendor list. Which custodians, wallet services, or payment processors still expose deprecated chains by default?

- Communicate the policy

- Publish a clear cut-off timeline for deposits on deprecated chains. Offer a grace period but be explicit that credits after the deadline are manual, slow, and may incur a fee.

- Send direct messages to affected users with step-by-step migration instructions, including screenshots. Offer a test transfer walkthrough.

- Configure rails and routing

- Disable deprecated chain addresses in your interface. Add network detection to block mis-sends.

- For a limited window, accept deprecated deposits to a quarantine wallet. Sweep to active rails and credit users net of costs. Document the conversion rate you use and where it comes from.

- Strengthen treasury controls

- Consolidate to two primary rails, one backup. Keep signer policies and monitoring simple. Set up alerts for stuck transactions and gas sponsorship depletion on rollups.

- Pre-approve counterparties on those rails for redemptions, swaps, and lending. Eliminate ad hoc routing that creates reconciliation risk.

- Close the loop with customers

- Update your help center, bot scripts, and email templates with the new policies. Include a concise explanation of unsupported assets so your team can answer in one message, not ten.

- Offer a one click migration option where possible. If you cannot automate, schedule white glove sessions for your top customers and absorb a portion of their network fees to accelerate the switch.

The deeper takeaway

This is not just a company decision. It is a sign that stablecoin payments are maturing from an experimental web of side tracks into a small set of highways. The sunset chains are not technically dead, but they are no longer where new money wants to live. Dollars now prefer the places with the best liquidity, the clearest compliance posture, the strongest developer roadmaps, and the fewest surprises at checkout.

For teams that build on payments, the lesson is specific. Reduce the number of chains you support, design your flows to be chain-agnostic for users, and invest in risk tooling that assumes you will be moving size on a small set of rails. If you do that, you will spend less time firefighting and more time shipping features that matter.

In a year, few will remember which chain an old deposit address referenced. They will remember which app let them pay, get paid, and reconcile in seconds without thinking about what is under the hood. The great rail switch put the tracks in place. The next phase rewards the operators who learn to run faster trains on them.