Aave V4’s modular turn: Q4 plan to rewire DeFi liquidity

Aave V4 shifts to a hub and spoke architecture and ERC-4626 vaults, aiming to compress rates, simplify cross-chain UX, and concentrate liquidity in Q4. Here is what changes, who benefits, and how to prepare.

The breakthrough in plain English

Aave, one of the largest lending protocols in crypto, is preparing a V4 redesign that trades a single, all purpose system for a modular network of parts that fit together. The big goals are simple to say and hard to pull off. Put more liquidity where users actually borrow. Make rates fairer and tighter. Cut the clicks and the guesswork from moving across chains. Turn the protocol into a flexible base for real world assets and cross margin.

Think of today’s multichain Aave like a dozen neighborhood banks that all share the same logo but keep separate vaults. Each branch sets rates based on who walked in that day. Some branches are busy, others sit half empty, and you do not get the benefit of deposits sitting somewhere else. V4 wants to act more like a modern payments network. There is a central hub that tracks the money and rules, connected to specialized spokes that can adapt to each chain and asset type. The experience should feel like one bank with many counters, not many banks with many rules.

Why Aave is rewiring itself now

The last cycle left every major protocol spread across many chains. That brought growth, but also sprawl. Liquidity is sliced thin. Rates bounce around. Integrations break or lag. Every deployment needs separate governance time, audits, oracles, and upgrades. The result is higher costs and worse user experience. V4 tackles this by concentrating decision making and accounting in a hub, then letting per chain spokes become lighter, faster, and more replaceable.

The redesign is not just about code architecture. It is a strategy shift. Instead of chasing every new chain with a full copy of the system, Aave can plug in a spoke where there is demand, retire a spoke that underperforms, and route flow to the best venue in real time. That is how you compress rates and pull liquidity back onchain without forcing users to guess where to go. For context on cross ecosystem routing, see how Polygon’s AggLayer default changes where flows aggregate and how Arbitrum’s Timeboost auctions shape blockspace priority.

From monolith to hub and spokes

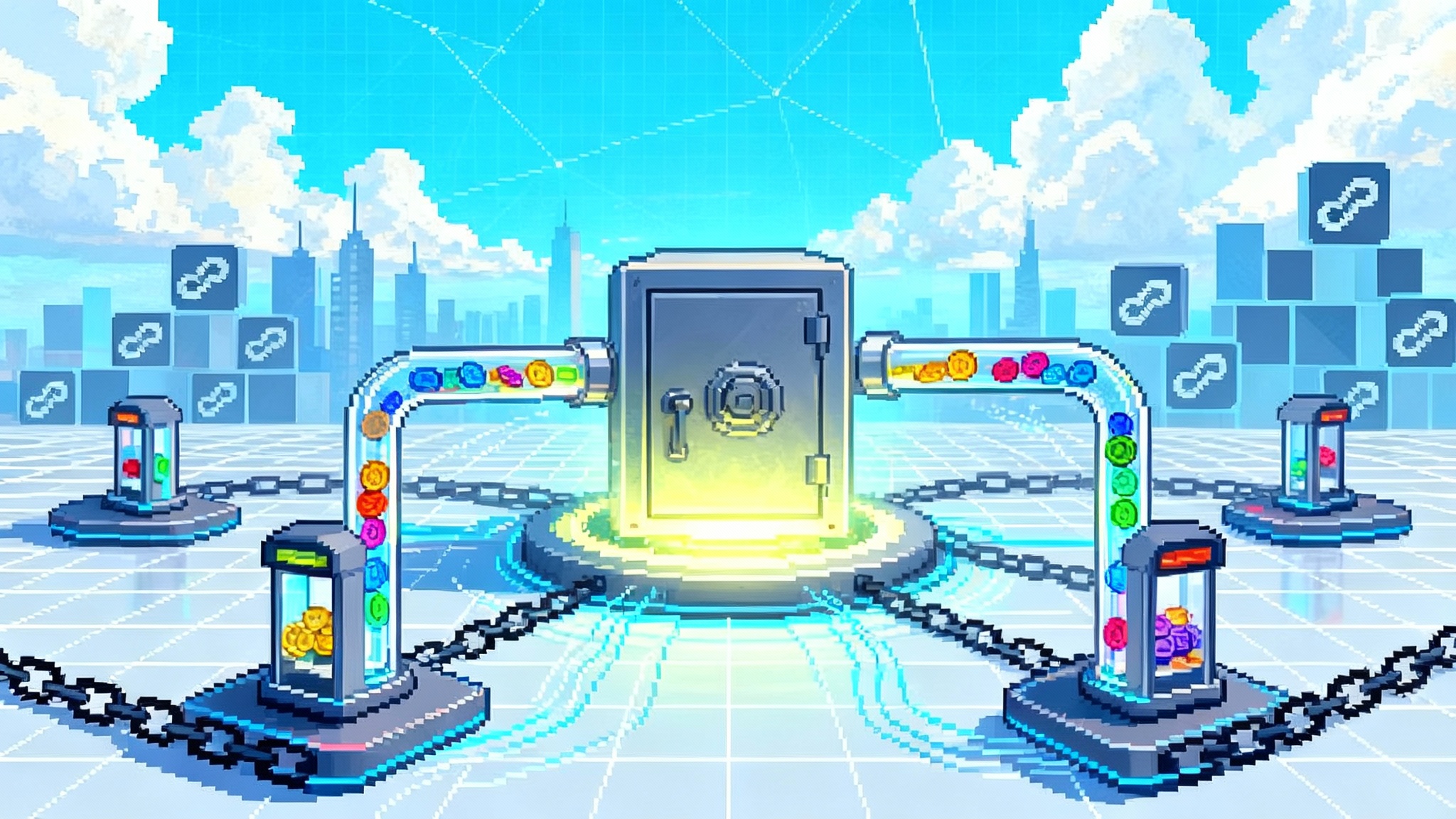

Today, most users pick a chain, pick an Aave market on that chain, then hope the pool is deep enough. In V4, deposits and borrows point to a network where a hub coordinates positions and risk parameters. The spokes are per chain markets with slimmer logic and standard interfaces. The hub is not about custody; it is about unified accounting, risk limits, and policy that spokes must obey.

What a hub means in practice

Imagine you deposit stablecoins on Base, but the cheapest place to borrow ether today is on Arbitrum. In the current world, you either bridge over, deposit again, and borrow there, or you accept a worse rate. In a hub and spoke model, the protocol can expose one borrow quote that reflects pooled depth and policy. Under the hood, the spoke can tap the deepest venue that meets the same risk rules. Your wallet sees one market. The protocol handles the routing.

This is not magic. It relies on standardized messaging, common risk constraints, and clear settlement paths. But the payoff is cleaner markets. When more liquidity is visible to more borrowers, supply and demand meet in a tighter band. That is how rate compression happens.

Spokes as specialized markets

Spokes can be tuned for what a chain is good at. If a particular chain is where liquid staking tokens thrive, its spoke can list those assets with parameters optimized for their behavior. Another chain might be the home of active derivatives and needs tighter oracle updates. The hub enforces consistency on critical rules, while the spoke handles local execution and integrates the chain’s best features. For broader Ethereum roadmap context, compare to the Ethereum L1 zkEVM plan.

ERC-4626 is the new accounting core

The other pillar of V4 is ERC-4626, the tokenized vault standard for deposits that mint shares. If you have used a money market or a yield vault, you have seen versions of this. You deposit an asset, the vault gives you shares, and the share price reflects accrued yield or losses. ERC-4626 makes this consistent across assets and integrators. Read the specification at the ERC-4626 vault standard.

Why does that matter? First, integrators get predictable behavior. Aave deposit tokens become true vault shares with common methods for deposit, withdraw, and accounting. That keeps front ends, bridges, and automated strategies simpler and safer. Second, accounting gets clearer for cross chain positions. A share is a claim on the pool regardless of where it sits. That makes it easier for the hub to know exactly who owns what.

There is a user benefit too. Shares reduce the need to track many moving parts. Instead of juggling deposit balances, interest rate changes, and separate reward accruals, you hold a single share token that grows in value as the pool earns. That reduces room for confusion and mispriced liquidations.

Consolidating underperforming deployments

In the last bull market, protocols rushed to new chains. Some Aave deployments never reached critical mass. Thin pools lead to jumpy rates, wider spreads, and higher slippage when a single whale moves. They also add overhead for oracles and governance.

V4 turns this into a feature. If a spoke does not reach healthy usage, it can be sunset, and its liquidity can migrate toward deeper venues. A smaller number of spoke markets with more standardized assets will share risk parameters set by the hub. That should pull liquidity into thicker books and compress both supply and borrow rates toward a tighter range. It also reduces the need for users to guess which chain has the best deal today.

Consolidation sounds harsh, but the goal is better markets, not fewer choices. Chains with strong native demand and unique assets should thrive as spokes. Chains that cannot sustain depth will not force users to pay for their empty seats.

Near term catalysts to watch in Q4

A modular rewrite touches every part of a lending protocol. The following milestones are the ones that matter for users, integrators, and tokenholders.

- Public audits. Expect code freezes, full audit reports, and a period for the community to review findings and remediations. Watch for final audit sign offs on the hub modules, spoke adapters, and migration tooling.

- Governance rollout. Look for temperature checks to formalize the V4 scope, then formal proposals to deploy the hub, authorize the first spokes, and set initial risk parameters. Track progress via the Aave governance forum.

- Migration path. The most important user facing tool is a safe way to move from V3 to V4. Expect a migrator that repays and reopens positions atomically, with support for popular collateral pairs and permit signatures. The second critical tool is analytics that show your before and after risk profile.

- Integrator readiness. Large front ends and smart account platforms need time to adapt to ERC-4626 shares and new events. Watch for public testnets, beta rollouts, and guarded mainnet releases that prove deposits and borrows flow as one market.

None of these on their own make the upgrade a success. Together, they tell you whether the network is ready to behave like one market with many counters.

Who stands to win, and who may lose

Every redesign shifts incentives. Here is a grounded view of likely outcomes.

- Deep liquidity chains win. Ethereum mainnet and the leading layer twos with established Aave usage should benefit. If the hub can route to the best venue, these chains become the default liquidity backbone and see steadier rates.

- Niche but active chains win. A spoke focused on a chain with clear product market fit, such as liquid staking tokens or onchain derivatives, can offer tailored assets and still tap the wider pool through the hub. That is a strong combo.

- Thin deployments lose. Chains that never reached critical mass will struggle to justify a spoke. Without depth, they add noise and cost. Consolidation will likely redirect incentives to venues where spreads are tight and usage is real.

- Integrators with strong routing win. Wallets and protocol routers that can request a single quote and handle share tokens cleanly will deliver the best user experience. Cross chain smart accounts should shine when the protocol does more of the heavy lifting under the hood.

- One off wrappers lose. If ERC-4626 standardizes deposit tokens and rewards, ad hoc wrappers become less useful. The market will favor clean, standard share tokens over bespoke derivatives that fragment liquidity.

What this unlocks for real world assets and cross margin

Real world asset issuers need predictable interfaces and transparent accounting. ERC-4626 makes both easier. A tokenized treasury bill fund or private credit pool can expose itself as a standard vault. The hub can whitelist it with tailored risk parameters and caps. Spokes can list the share tokens where demand is strongest without redefining the accounting each time.

The practical benefit is simple. Treasurers and corporate users can treat these vault shares as clear collateral with known behavior. They can borrow stablecoins against them with fewer surprises, and they can do it in the same wallet they already use for crypto native assets.

Cross margin gets a lift too. When positions are shares with consistent pricing and accrual rules, a margin engine can evaluate portfolio risk more cleanly. The hub can see total exposure across spokes and apply circuit breakers when needed. That enables safer netting across assets and chains. It also opens the door to advanced features like unified health scores and cross chain liquidations that do not require clunky manual bridging.

How rate compression and better UX actually happen

Tighter markets do not appear by decree. Here are the mechanics that matter.

- Shared depth reduces outliers. When borrowers can access a larger pool indirectly, a single venue with a temporary imbalance does not set the market. That narrows the gap between the best and worst rates seen by users.

- Faster parameter updates. Centralizing key risk and interest rate curves in the hub means governance can change them once, then push consistent settings to all spokes. That keeps markets aligned and reduces stale configurations that cause mispriced loans.

- Standard tokens reduce integration friction. When deposits, rewards, and accounting follow the same pattern, integrators can spend time on better routing and risk checks instead of custom adapters. Users see this as fewer clicks and fewer prompts.

- Migration tools lower switching costs. If moving from V3 to V4 takes one transaction and preserves your health factor, more liquidity moves early. Early mass moves create the depth that compresses rates for everyone.

A pragmatic checklist for Q4 preparation

Here is a practical, non hype list for each group.

For users

- Review your open variable rate borrows and collateral types. If you plan to migrate, pay down volatile debt first to avoid surprises during the switch.

- Snapshot your current health factor and loan to value. Know your before state so you can verify the after state matches expectations.

- Check that your wallet and account abstraction provider support ERC-4626 shares. If not, pick a front end that does, or be ready to hold share tokens directly.

- Plan for a guarded launch period. Early spokes may have caps. Queue orders or set alerts for when limits rise.

- Avoid last minute migrations near market volatility events. Give yourself time to test a small position before moving size.

For developers and integrators

- Implement ERC-4626 flows end to end. Handle deposit and withdraw previews, share accounting, and reward accrual methods. Test rounding behavior and slippage bounds.

- Update event indexing and analytics. V4 will emit different events for deposits, borrows, and migrations. Ensure your dashboards track shares, not raw balances.

- Build quote and routing logic for a hub and spoke world. Request quotes at the network level, not per deployment, and design for fallback if a spoke is rate limited.

- Add cross chain safety checks. If you rely on messages between spokes, include timeouts, replay protection, and clear user prompts when settlement is pending.

- Coordinate audits early. Even if you are only integrating, changes to routing and accounting touch customer funds. Book external reviews for your adapters.

For DAOs and risk teams

- Decide which deployments deserve a spoke on day one. Use clear metrics: average daily liquidity, utilization stability, oracle quality, integrator coverage.

- Set interest rate curves and caps to favor healthy depth. Prevent a thin spoke from offering eye catching teaser rates that drain liquidity from the hub.

- Publish a migration incentive plan. Small, time bound rewards tied to successful V3 to V4 moves can accelerate the flywheel when it matters most.

- Clarify liquidation and oracle policies for the new architecture. Document how cross chain liquidations work, who can trigger them, and what backstops exist.

- Communicate deprecations early. If a legacy market will be offboarded, announce timelines and provide step by step guides well before deadlines.

Risks and open questions to watch

No redesign removes risk. It shifts and hopefully reduces it.

- Cross chain messaging. The hub and spokes need a secure way to coordinate. Even with multiple routes and delays, messaging risk is real. Watch for circuit breakers and staged activation.

- Oracle consistency. Spokes must read trustworthy prices that match the hub’s risk settings. Inconsistent oracles can create cross market arbitrage and liquidation cascades.

- Governance load. A central hub concentrates power and responsibility. The community must resist the temptation to micromanage every spoke. Clear thresholds and automation can help.

- Migration friction. Even the best tool cannot predict every edge case. Complex positions with multiple collateral types and rewards may require manual steps. Plan for customer support and generous buffers.

- Economic attacks. Tighter routing can reduce rate outliers, but it also creates new surfaces, such as attacking a spoke to influence hub level parameters. Stress testing and gamed simulations are essential.

How to know if V4 worked

You do not need a PhD to tell if the redesign is doing its job. Track a few simple metrics.

- Depth at the hub. Total deposits accessible across spokes should grow faster than the sum of isolated markets it replaces.

- Rate dispersion. The gap between the 25th and 75th percentile borrow rates for the same asset across spokes should shrink over time.

- Migration adoption. The share of top collateral that has moved to V4 within 30 to 60 days after launch is a real signal that users trust the new stack.

- Integrator fill quality. Measure the share of routed borrows that execute at or better than the quoted network rate.

- Incident count and time to remediation. Fewer severity one issues, faster fixes, and clear post mortems mean the modular approach is paying off.

The bottom line

Aave V4 is not a coat of paint. It is a decision to be one protocol again across many chains. The hub and spoke design makes depth portable, which is how rates compress. ERC-4626 makes positions legible, which is how integrators and real world asset issuers plug in with less friction. Consolidation sheds weight where usage is thin, which is how user experience improves without hiding complexity behind higher fees.

If the public audits land cleanly, governance prioritizes the right spokes, and the migration tools feel safe enough for cautious capital, V4 can pull liquidity back onchain and make lending feel less like chain shopping and more like market making. That is a healthier future for users and a sturdier base for builders.