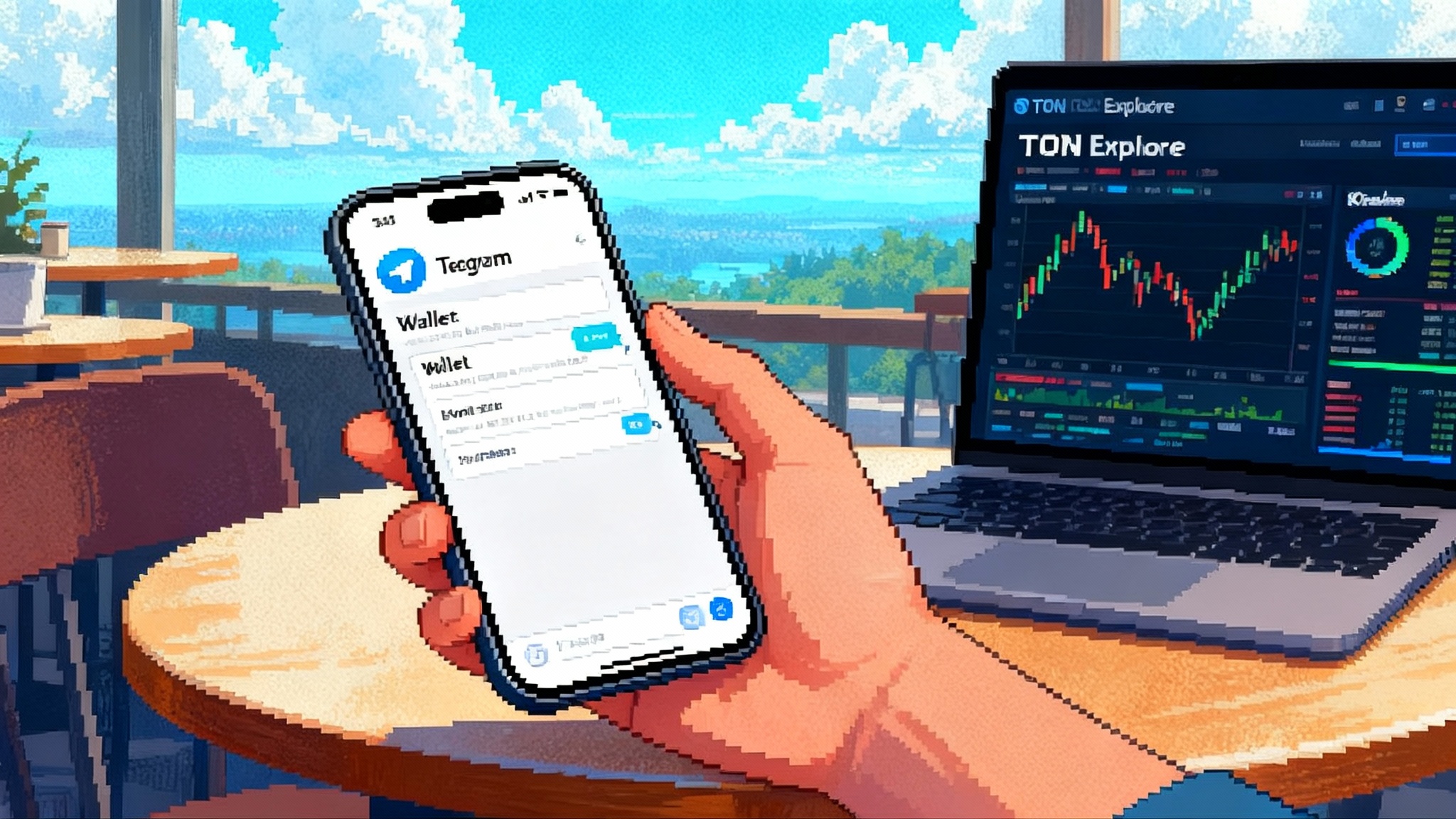

Telegram Wallet puts tokenized U.S. stocks in chat via Kraken

In October 2025, Telegram’s built-in Wallet begins rolling out tokenized US stocks and ETFs powered by Kraken and Backed. Custodial first, then self-custodial via TON Wallet, this shift could compress onboarding, speed settlement, and turn RWAs into everyday chat balances.

The moment US stocks walk into chat

The news is simple to say and big to digest. Starting in October 2025, Wallet in Telegram is rolling out tokenized US stocks and exchange-traded funds inside the messaging app. The initial launch is custodial inside Wallet. A self-custodial option in TON Wallet is planned next, with the team prioritizing emerging markets during the first wave. The integration relies on xStocks, a tokenized equities product by Backed with listing on Kraken. The companies say the first tranche includes roughly three dozen assets, growing to around sixty by year end. That puts a brokerage-like experience next to your contact list and group chats, not a separate app tab on your phone’s third screen. Cointelegraph detailed the rollout and timeline.

Why this matters is not just convenience. It brings real-world assets into the place where people already orchestrate their financial lives: the chat thread. That is Telegram’s consumer real-world-asset moment on The Open Network. A tap in chat can now route you to an order ticket for Nvidia or Apple, collateralized on chain, and settled at crypto speed.

What xStocks change under the hood

xStocks package familiar public equities into on-chain tokens that can move between venues. Kraken lists and provides primary liquidity. Backed handles issuance and the claim that each token is backed one for one with the underlying security. The program runs on public blockchains, with tokens designed for exchange withdrawal and wallet transfer. Kraken’s own materials note who can participate, how collateralization works, and the key guardrails such as regional access limits. Kraken xStocks availability and backing.

For a user, the model looks like this:

- You pass verification inside Wallet in Telegram. Your region determines whether you can see or trade the Stocks and ETFs section.

- You fund with stablecoins or fiat through existing ramps. The app abstracts the route to xStocks liquidity on Kraken.

- When you buy one tokenized share, a corresponding unit is locked against real shares held by the issuer’s custodian. Your balance shows up immediately. You can hold inside the custodial wallet or withdraw to a supported self-custody wallet once that path is enabled.

Two design choices deserve attention:

- 1:1 backing with redemption. This is not a synthetic contract. The issuer asserts that a token can be redeemed into cash proceeds equal to the underlying share value, less any fees. That promise anchors price to the real market.

- On-chain portability. Withdrawal turns a messaging app position into a network asset that can flow into mini-apps, lending pools, or other protocols that whitelist the token.

Why putting stocks in chat changes onboarding

Onboarding is where most brokers lose people. New users face an identity check, a bank link, a fund transfer, a ticker search, then a wait. Telegram shortens that chain because the user and the wallet already live where the conversation starts. A friend posts a chart in a group, another sends a tip, and the call to action sits one tap away. The app can prefill identity data, reuse a payment method you already trust for peer-to-peer transfers, and show a simple order box with fractional amounts. Think of it like a country store that also sells stamps: you were going there anyway.

Settlement also changes character. Traditional brokers batch orders to market makers. Finality can take days. Tokenized shares unlock near-instant portfolio updates with programmable transfers. If the issuer allows it, you can send a stock token to a friend as easily as you send a photo. That does not replace the underlying market’s opening hours or halt rules, but it compresses the handoff from order to usable position. On payments rails, see Tether rail switch remakes payments for context on instant wallet funding.

The TON angle: from chat balance to collateral

The second phase matters as much as the launch. Self-custodial support in TON Wallet means tokenized equities can leave the fenced garden and enter The Open Network’s application layer. Once tokens sit in a user-controlled address, TON mini-apps can recognize them as inputs. A developer can accept Apple-token deposits to unlock a premium bot, or a lender can take Nvidia-tokens as collateral for a loan in dollar stablecoins. For another consumer RWA example, see MMFs tradable on XRPL.

This is where real-world asset liquidity meets consumer use. In a TON mini-app, a user could:

- Pledge two tokenized shares of a blue-chip stock, borrow 100 USDT to pay a vendor in chat, and repay the loan next payday.

- Park tokenized S&P exposure as an earn bucket inside a wallet-embedded savings mini-app, with automated risk checks on loan-to-value.

- Grant temporary viewing rights over a portfolio to a financial helper bot that explains exposure and corporate actions with plain language.

The more these flows feel like everyday chat actions, the more they can pressure the default behavior of tapping a separate broker app.

Pressure on neobrokers and why it will be felt fast

Neobrokers built their edge on simple interfaces, zero-commission trades, and fast account opening. They still ask users to leave the place where attention lives. A brokerage icon sits far from a group chat. Telegram’s move tightens that distance to zero. That can force a rethink in three areas:

- Acquisition. A messaging-native order ticket can piggyback on viral loops inside groups. Brokers without a chat surface lose share of mind.

- Funding costs. On-chain settlement avoids some legacy money-movement costs. Neobrokers may need to match instant wallet top-ups to keep pace.

- Product breadth. If stock tokens become acceptable collateral in consumer DeFi, the surrounding bundle grows: spend against collateral, sweep into savings, send assets as gifts. Neobrokers will either build similar rails or integrate with them.

Pressure is likely to concentrate first in markets where bank rails are weaker, foreign exchange frictions are higher, and messaging apps serve as daily commerce hubs. Those are also the markets the Wallet team says it will prioritize.

Regulatory map: who can actually use this and where

Regulation decides the real footprint. The headline rules to watch are straightforward.

- United States. xStocks are not available to US persons. Kraken’s own materials call this out, along with similar restrictions for Canada, the United Kingdom, and Australia. Wallet in Telegram is therefore expected to geofence US users from the Stocks and ETFs section. US crypto users can still hold Toncoin or stablecoins, but not tokenized equities, inside the Wallet product.

- European Union. The Markets in Crypto-Assets Regulation, known as MiCA, is now in force. It sets obligations for crypto issuers and service providers, including disclosures and, for certain stablecoins, authorization. Tokenized equities often fall under securities law first and crypto rules second, which means issuers may lean on prospectuses and national regimes. The practical read is simple: in the European Union, distribution requires the right licensing stack and clear investor documents. Expect staggered availability.

- Emerging markets. Many of the jurisdictions Wallet plans to prioritize do not have comprehensive tokenization regimes, but they do enforce general securities law and foreign exchange rules. Expect conservative country lists at first, with explicit exclusion of sanctioned markets and a slow expansion as local counsel signs off.

The operator mix matters too. A messaging app can host a user interface without being the securities distributor. Kraken can handle listing and liquidity. Backed can handle issuance and custody arrangements. Those separations help each party comply within its role.

Key risks and how to read them

The surface is friendly. The risk stack is not trivial. Here is what to watch and how to mitigate each point.

- Custody and redemption. The claim of 1:1 backing lives or dies on custody. Who holds the underlying shares, how segregated are they, and what is the redemption path during stress. Action: read the issuer’s disclosures and look for named custodians, audit coverage, and time-bound redemption service levels.

- Price parity. Tokenized shares shadow their underlying, but they trade in crypto venues with their own demand and funding cycles. If the token price drifts from the stock price after fees, arbitrage should close the gap; if redemption gates tighten, gaps can persist. Action: watch the spread between the token and the native stock during market opens, halts, and earnings.

- Disclosures and corporate actions. Dividends, stock splits, voting, and spin-offs need to flow through to token holders in a clear way. Action: review how the issuer credits dividends, whether tokens carry voting rights, and how off-chain events are reflected on chain; see our deeper dive on the corporate actions onchain record.

- Chain risk and interoperability. If tokens live on a specific chain first, bridges and wrappers introduce additional risk. Action: prefer native withdrawals supported by the listing venue, and treat cross-chain representations as separate assets with their own risk.

- Country enforcement. Users may rely on virtual private networks to bypass country blocks. That raises enforcement and consumer protection issues. Action: platforms should combine geofencing, identity checks, and on-chain controls to ensure distribution stays inside approved markets.

- Tax treatment. Owning a tokenized share is still exposure to a security. Jurisdictions may treat gains, dividends, and transfers differently than crypto. Action: expect a tax form trail similar to a traditional broker in supported markets, and do not assume anonymous treatment.

None of these risks are new to tokenization. What is new is their arrival inside a consumer messaging app where the default action is a tap, not a signature on a brokerage packet. That puts a premium on crisp, in-product explanations and on disclosures that a first-time investor will actually read.

How it might feel in practice

Picture a user in Lagos in late October. She opens Telegram, taps Wallet, and sees a new Stocks and ETFs tile. She searches for an ETF that tracks the S&P 500 and chooses a fractional amount. She funds with her existing wallet balance and confirms. The position lands in seconds. Her friend asks in chat what she bought, and she shares a mini-app card that shows a simple exposure pie. A week later she needs 50 dollars for a vendor payment. She collateralizes part of her stock token position in a TON mini-app, borrows USDT, pays inside the same chat thread, and repays when her paycheck arrives. The app shows the loan-to-value meter and the liquidation threshold in plain English.

Traditional brokers can replicate most of that with app-to-app links and fast funding partners. It still requires a context switch. Messaging removes that switch and turns investment into a native chat action.

2026 scenarios to watch

Here are three concrete paths, each with signals to track.

- Base case: embedded stocks become a standard mini-app component. By mid-2026, Wallet in Telegram supports over one hundred tokenized equities and ETFs for non-US users. TON Wallet users routinely withdraw to self-custody and pledge stock tokens as collateral in whitelisted lending pools. Merchant mini-apps begin accepting stock tokens as a funding source that is auto-converted at checkout. Signals: steady country expansion, on-chain supply tracked by block explorers, rising collateral usage in top TON protocols, and regular corporate action processing without drama.

- Bull case: chat becomes the retail fintech rail. Neobrokers integrate Telegram Login and embed chat widgets to keep up. Tokenized stocks achieve deep liquidity on exchanges and in on-chain pools, tightening spreads against the underlying. Users in emerging markets treat Telegram as their combined bank, broker, and remittance rail. TON adds native financial primitives that treat stock tokens like high quality collateral alongside stablecoins, with conservative risk parameters. Signals: multiple regulated market makers streaming quotes into mini-apps, credit products that price stock-token risk cleanly, and measurable user migration away from standalone broker apps.

- Bear case: regulation squeezes and liquidity fragments. A large jurisdiction tightens rules on tokenized securities distribution. An issuer pauses redemptions during a market shock. Price gaps widen and confidence erodes. Neobrokers pull back from integrations. Signals: abrupt geofencing, long redemption delays, and chain-specific incidents that freeze wrapped tokens.

These scenarios are not abstract. Developers can prepare now by building with circuit breakers: conservative collateral factors, oracle checks against native market prices, and automatic position unwinds that respect both market hours and user experience. They can also design audits into the interface. Show where collateral sits, who the custodian is, and how to redeem. If a user needs to hunt for a PDF, the design has failed.

What to do now if you are a builder or a fintech

- Build the mini-app bridge. Treat stock tokens as another payment method and another collateral type. Start with read-only portfolio cards, then add opt-in actions.

- Align with the compliance perimeter. Map where your users are, then filter features accordingly. If you rely on Wallet’s geofencing, add your own checks.

- Design for explainability. Replace jargon with plain language. A good rule: every risky button has a one-sentence why and a two-sentence how.

- Plan for resolution. If a token diverges from its underlying, what do you show, when do you halt, and what do you tell the user. Put those rules in code and in the help center.

The bottom line

Stocks in chat is not a gimmick. It is a serious distribution shift. Kraken and Backed bring the plumbing. Telegram brings the audience. TON brings the programmable rail. If the disclosures are strong, the geofencing holds, and redemption stays smooth, tokenized equities will stop being a niche and start being an everyday balance type next to USDT and Toncoin. That is how consumer real-world assets get real.