Post-Pectra Ethereum: smart accounts, bigger validators

Ethereum’s Pectra upgrade is live. EIP‑7702 turns every address into a wallet‑native smart account, EIP‑7251 streamlines staking with larger validators and faster deposits, and bigger blob capacity pressures L2 fees while opening new consumer use cases.

Pectra flipped the script

On May 7, 2025 Ethereum activated Pectra on mainnet, the umbrella upgrade that bundled Prague on the execution layer and Electra on the consensus layer. It brought a trio of changes that matter to builders over the next year: wallet‑native programmability, simpler staking operations at larger validator sizes, and more blob capacity for rollups. For dates, scope, and official client releases, see the Foundation’s mainnet announcement.

Think of Pectra as a new playbook rather than a patch. Two of its star plays are already reshaping decisions teams make this quarter.

- Smart accounts for everyone via EIP‑7702

- Bigger and fewer validators via EIP‑7251, plus faster, cleaner deposit and exit plumbing

The third play, a higher blob throughput target, does not grab headlines, but it quietly shifts how Layer 2s set fees and design growth strategies.

EIP‑7702: the wallet becomes the app

Until now, most users lived with externally owned accounts, a fancy term for private key controlled addresses with limited features. EIP‑7702 lets those addresses point to audited smart wallet code and execute it without forcing users to migrate funds or switch to a new contract address. The EIP defines a new transaction type with an authorization list that says, in effect, “for this account, temporarily use that code.” For the specification and security notes, see the EIP‑7702 specification and notes.

What this unlocks in practice:

- Gasless onboarding: a user can install a wallet, receive a link, and sign once. A relayer or the app itself sponsors the first actions like claim, approve, and swap. No more “first buy ether” dead end.

- Passkeys as first class security: wallets can bind WebAuthn passkeys on phones and laptops to an account that now behaves like a smart wallet. Recovery flows become familiar, closer to how people secure email or a password manager.

- Session keys: games and consumer apps can request a narrow permission that expires, for example spend up to 5 dollars worth of tokens in the next 30 minutes with a whitelist of contracts. Users get one prompt at session start, not a click for every move.

- One‑tap bundles: the classic two‑step approve then spend becomes a single atomic action. That is a cleaner checkout for payments and a faster path to first action for new users.

Concrete example: a mobile wallet integrates a “Try now” button for a new onchain game. Tapping it signs a 7702 authorization that delegates to a battle‑tested wallet module. The app opens, creates a session key limited to the game’s contracts and small spend limits, and a relayer sponsors the first five transactions. From install to first match takes 15 seconds and zero ether.

This is not a replacement for full smart wallets that use separate account abstraction frameworks. It is a bridge. Teams like Coinbase Wallet, MetaMask, Safe, and Privy can converge on lighter flows without forcing every user to migrate assets. For app developers, the near‑term win is fewer abandoned sessions and fewer support tickets about gas on day one.

What to build next with 7702

- Wallet‑native onboarding: build a single button that handles install, account initialization, and a sponsored starter action. Measure drop‑off between install and first onchain action and aim to cut it in half.

- Session key scaffolds: ship a library that lets apps request, renew, and revoke time‑boxed keys with human‑readable scopes. Include defaults for gaming, media streaming, and payments.

- Safer delegation registries: publish a curated allowlist of audited delegation targets and expose it in wallet UIs. Make risky delegations visually loud with clear warnings.

- Paymaster marketplaces: let apps choose among competing gas sponsors based on reliability, geographic latency, and token acceptance.

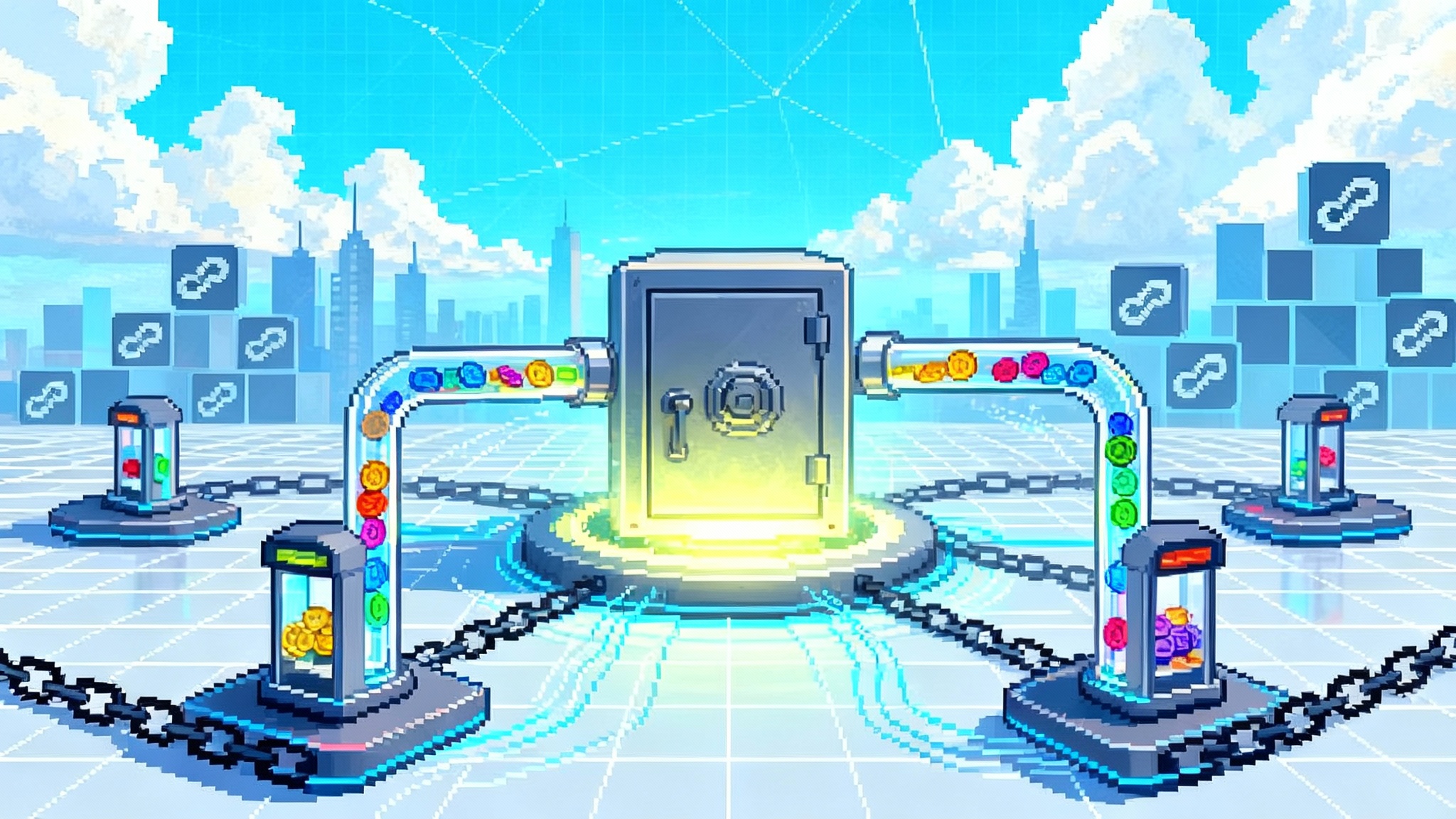

EIP‑7251 and friends: bigger validators, calmer ops

Before Pectra, every validator’s effective balance capped at 32 ether. That cap created a huge validator set because large operators split stakes across many keys and machines. EIP‑7251 raises the effective balance ceiling to 2,048 ether while keeping the 32 ether minimum intact. The result is fewer validators per operator, fewer signatures to aggregate per epoch, and a smaller networking footprint for the same economic stake.

For operators, this is more than a constant change. It introduces compounding and flexible top‑ups. A solo staker with 40 ether no longer needs to assemble two full 32 ether lots to put all funds to work. A professional operator can consolidate hundreds of micro validators into a handful of large ones without reentering queues. Client teams also benefit from smaller state and less gossip overhead.

Two other plumbing fixes round out the experience:

- Faster deposits: deposits are now supplied directly on chain to the consensus layer. The practical effect is a drop in activation latency from roughly half a day to around one epoch range, near 13 minutes under normal conditions. New validators can join and begin duties faster, and client logic is simpler and less fragile.

- Execution‑layer exits: a withdrawal credential can trigger a validator exit from the execution layer, not only from the consensus side. This matters for custodial setups, pooled staking, and distributed validator technology arrangements. It reduces the need for pre‑signed exits and tightens the trust loop between the party that owns the stake and the party that runs the node.

What to build next for stakers and node operators

- Consolidation tooling: a safe, well‑documented path to combine many 32 ether validators into larger ones, with preflight checks, fee estimates, and roll‑back plans. Integrate with Grafana and Prometheus dashboards so teams can watch consolidation queues.

- Solo staker kits: a one‑click upgrade that recommends a target effective balance based on hardware, internet link, and slashing risk tolerance. Add automatic partial withdrawal settings so compounding is not manual.

- Exit controls: user interfaces that let withdrawal credential owners initiate exits, with safeguards for grace periods and multi‑party approvals in pooled setups.

- Custody‑aware policies: for entities like exchanges or custodians, codify when to consolidate, when to disperse, and how to handle emergency exits if a data center fails.

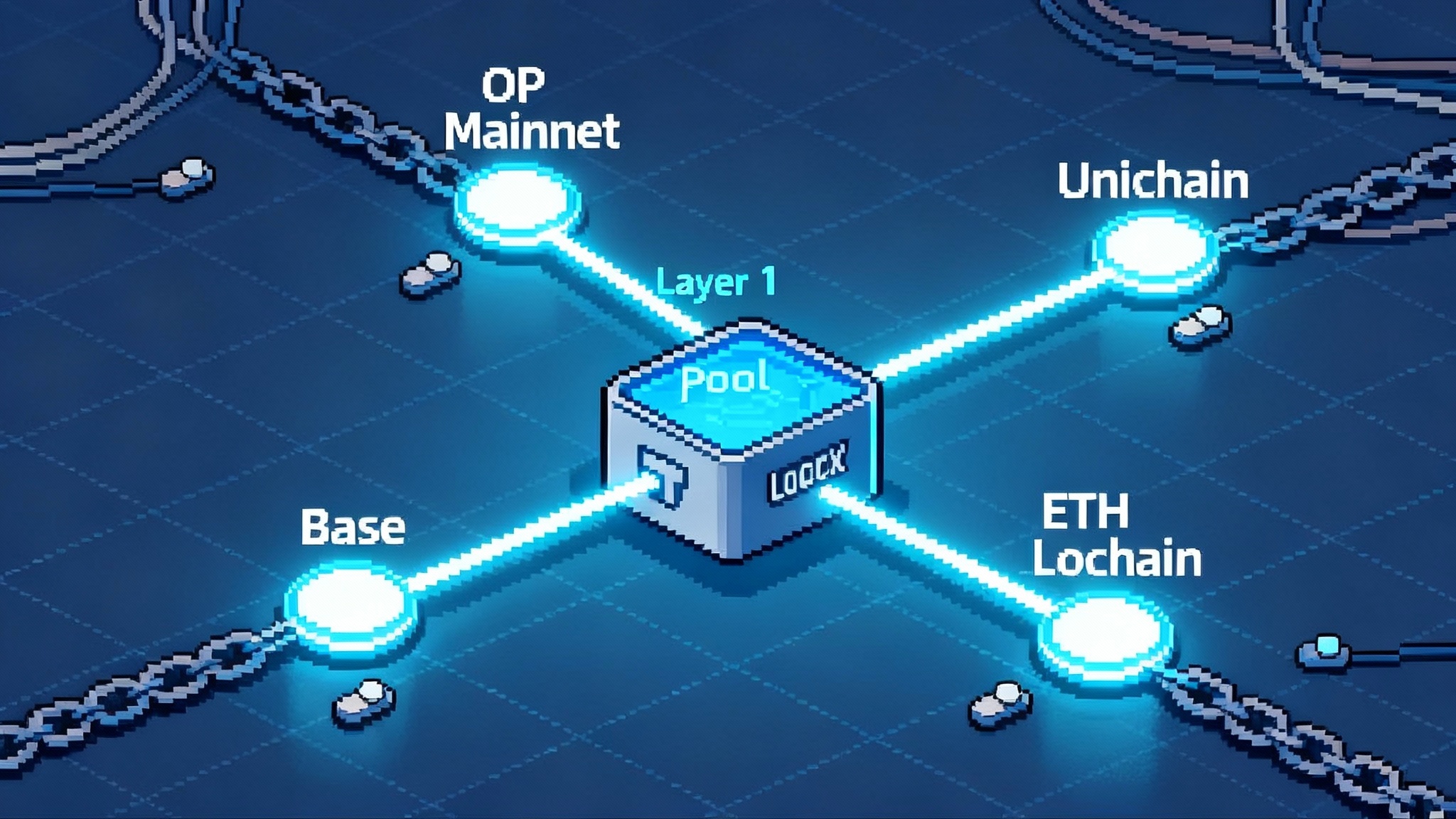

More blobs, tougher L2 pricing games

Pectra increased blob throughput targets, growing the supply of data availability capacity for rollups. This is the next step after proto‑danksharding introduced blobs in early 2024. More blob capacity reduces the blob base fee when demand is unchanged. For a Layer 2 sequencer, that lowers input costs for publishing batches. In competitive markets, lower input costs push downstream transaction fees lower, even if only to defend market share. As coordination improves across ecosystems, see how builders approach interop in safer rollouts on the Superchain.

This pressure will show up first where elasticity is highest:

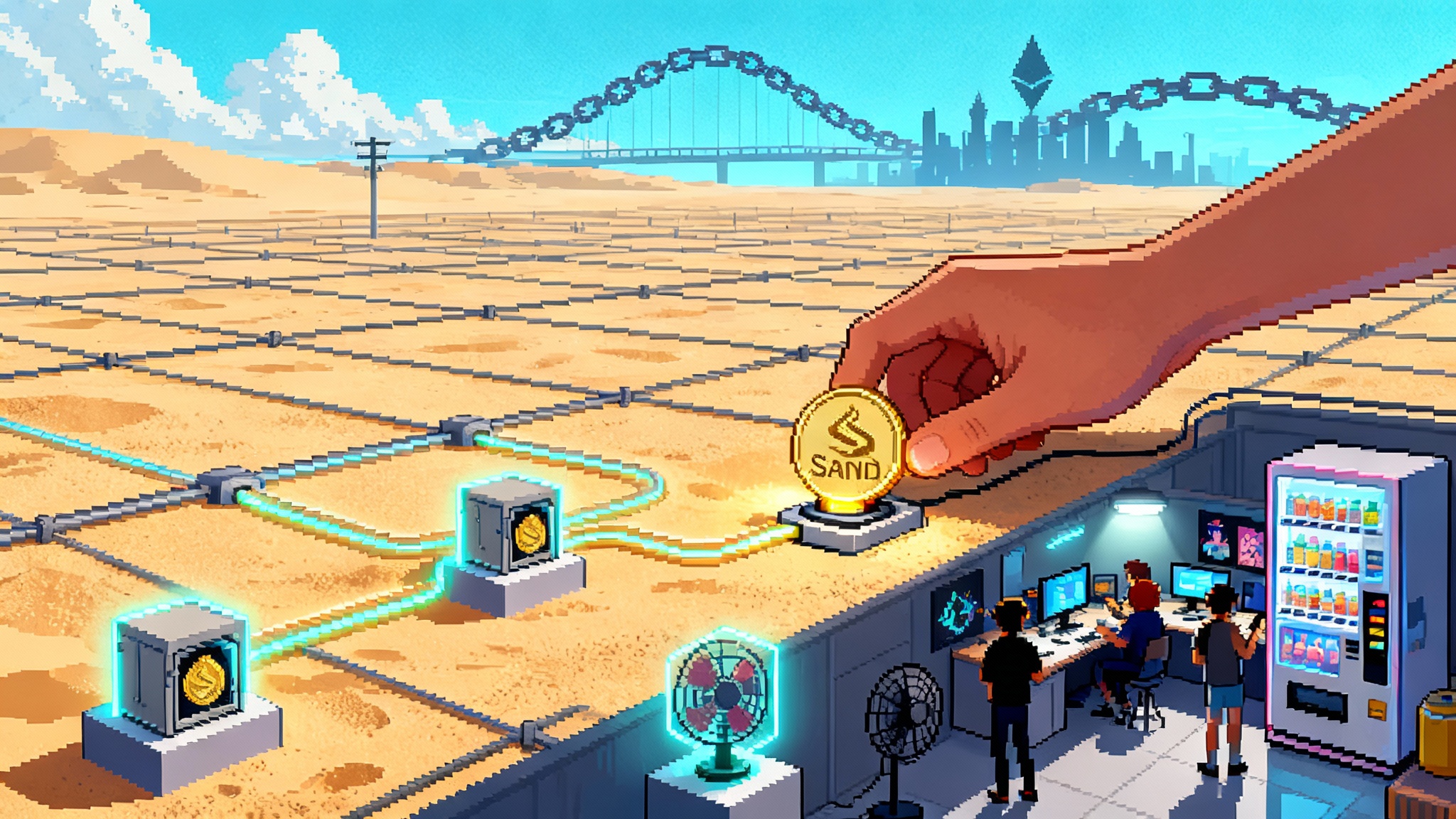

- Consumer apps: social posts, collectibles, and casual auctions move toward near zero fees at the edges. If your app charges 10 cents per action today, expect margin pressure, especially as creator ecosystems expand with a creator chain on ZK Stack.

- Payments: stablecoin and point‑of‑sale flows get closer to card‑like pricing. The winning wallets will pre‑quote final price, bundle approvals, and hide bridges.

- Gaming: session keys plus cheaper data make mid‑game onchain moves viable. Expect more titles to keep state on a rollup by default rather than only settle rewards.

The corollary is that designs relying on calldata for data availability get taxed. Pectra raised calldata cost to create room for blobs and to reduce worst‑case block sizes. Teams still posting big batches as calldata will feel it. Migrate to blob‑based posting if you have not already, and plan for the next increase when peer data availability sampling arrives.

Playbook for Layer 2 teams

- Price discipline: publish a transparent formula that ties your fee schedule to blob base fee bands. If input costs fall 30 percent, pass through most of it to users within a week to stay ahead of rivals.

- Batch strategy: tune batch sizes to target the new blob economics. In thin periods, keep latency promises by sponsoring more frequent small batches.

- Sequencer routing: build intent routers that can choose among multiple settlement lanes when blob fees spike, including alternative times of day or different rollups for cross‑app actions.

Six to twelve months: what likely ships

- Intent routers go mainstream: wallets embed routers that translate a user’s goal into the cheapest, safest path across rollups and bridges. Many will start with limited scopes such as token swaps or bill payment, then add complex flows with refund guarantees. Expect tighter wallet‑L2 tie‑ins similar to how Polygon’s AggLayer goes default.

- Account‑abstracted wallets default on: at least two major retail wallets will make smart features the default for new users, with passkeys and session keys switched on and clear recovery paths. The day one experience will look like a modern consumer app, not a developer tool.

- Solo staker growth at the margin: with simpler deposits and compounding, a portion of technically inclined ether holders will return to self custody staking. Expect new managed home‑staking kits to appear, with safer exit levers and consolidation wizards.

- Rollup fee competition intensifies: consumer‑facing networks lean into promotions that offset residual gas for first‑time users. Some will partner directly with large wallets to sponsor the first thousand onchain actions per user per month.

Risks and second‑order effects to watch

- MEV dynamics: as more flows bundle via wallets, intent routers, and paymasters, order flow may concentrate. Builders should publish auction rules and latency guarantees, integrate multiple builders, and support fallback direct send paths. Validators should continue to diversify relays and monitor missed slot rates to avoid reliance on any single builder.

- Validator centralization: larger maximum effective balances improve ergonomics but can increase concentration. Track effective balance distributions and encourage policies that cap per‑operator stake within staking pools. Solo staker grants or fee rebates can counterbalance consolidation.

- 7702 phishing and unsafe delegations: the new power to delegate execution invites scammers. Wallets should default to known, audited code templates, show full human‑readable scopes, and rate‑limit how often a new delegation can be installed. App developers should never prompt users to paste a raw delegation target.

- Calldata price shocks: apps that still rely on calldata could see sudden cost spikes during busy periods. Budget for the migration to blob publishing and simulate worst‑case blocks.

- Operational risk during consolidation: combining validators introduces queues and novel failure modes. Stage dry runs on testnets, and avoid consolidating all validators in a single maintenance window.

A concrete build list for right now

- Intent routers: start with a narrow domain like swaps or bill pay. Offer a refund guarantee if the router misses its quoted price. Integrate two builders and two bridges by default, and log every decision for postmortems.

- Wallets: add passkey onboarding with a clear fallback to seed‑based recovery, ship session keys with pre‑set spend caps, and surface a delegation registry with green checks for audited modules.

- Staking tools: release a consolidation advisor that computes optimal validator sizes given your hardware and revenue targets. Add exit‑from‑execution flows guarded by time locks and multi‑sig policies.

- Monitoring: extend dashboards to track blob fee bands, 7702 authorization events, validator effective balances, and deposit throughput. Alert when blob fees or effective balances cross thresholds.

The upshot

Pectra did not just add features. It changed default choices. Wallets can offer a real consumer experience without making users juggle ether first. Node operators can do more with fewer validators and simpler deposit and exit flows. Rollups have more room to grow and more reason to cut prices. The next six to twelve months favor teams that ship session keys, passkey onboarding, intent routing, and consolidation tooling early. Build for the new equilibrium now, while the cost curves and user expectations are moving in your favor.