SANDchain is live, a creator chain built on zkSync’s ZK Stack

The Sandbox has launched SANDchain, a ZK Layer 2 built on zkSync’s ZK Stack that uses SAND for gas and governance. Here is how branded ZK chains could reset creator funding, distribution, and ownership at scale.

The Sandbox lights up SANDchain, a creator-first Layer 2

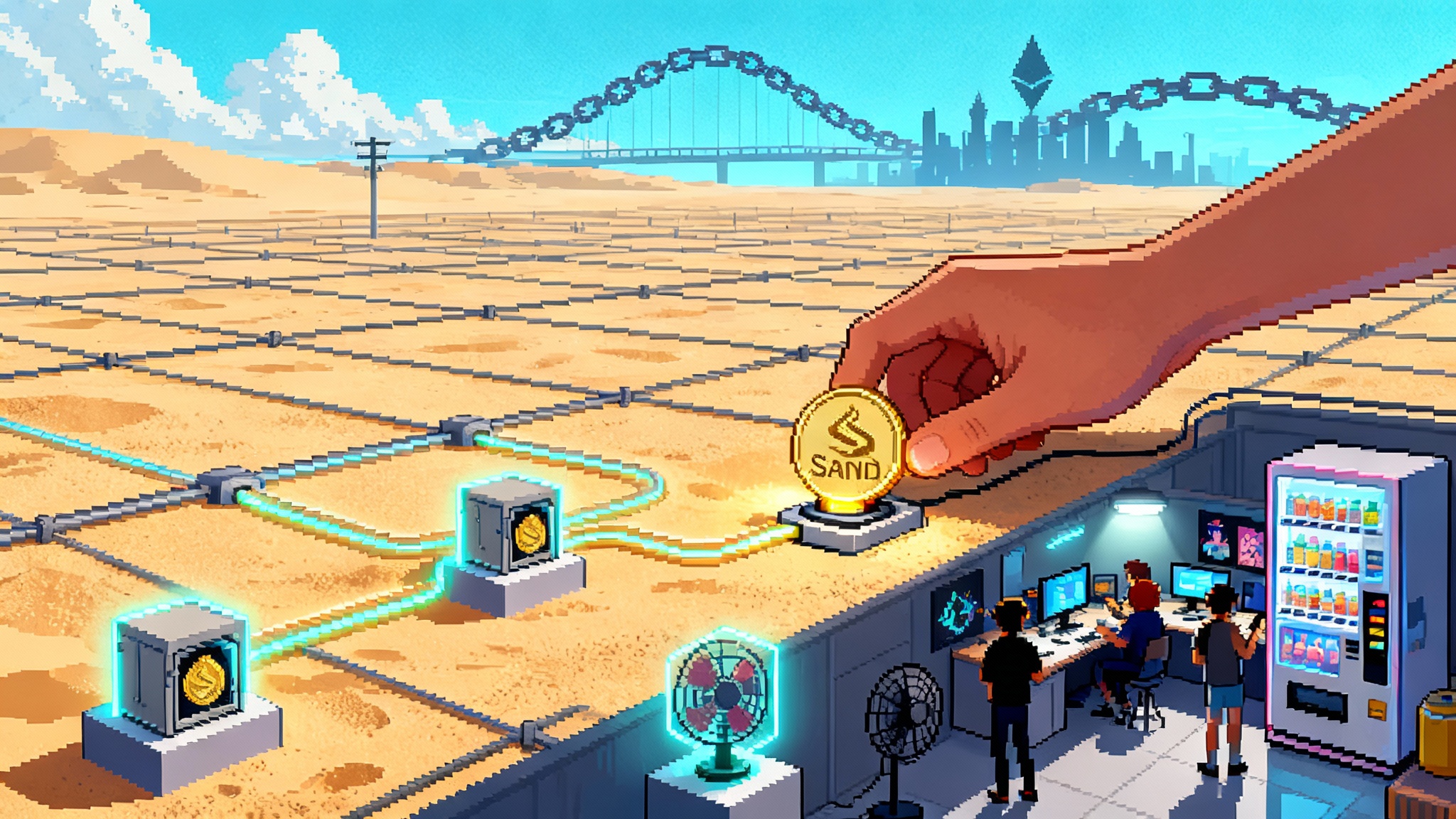

A new kind of blockchain just went live for creators. The Sandbox has spun up SANDchain, a branded Layer 2 network that runs on zkSync’s ZK Stack. In practical terms, The Sandbox is not just publishing games and tools anymore. It now operates a programmable financial layer where creators can issue tokens, route income, and share upside with fans. ZK means zero knowledge, a cryptographic system that lets the network prove transactions are valid without revealing unnecessary information. ZK systems are popular because they can be fast and private while inheriting the security of Ethereum. zkSync’s ZK Stack is the build kit that lets teams launch their own ZK chains with custom gas tokens, interoperability, and an upgrade path as Ethereum evolves. If you care about the economics of digital culture, this is a fresh turning point, not another chain announcement. For context on how the stack works, see zkSync’s overview of the framework in its documentation on ZK Stack capabilities and design. For where ZK roadmaps are heading at L1, see our analysis of the Ethereum L1 zkEVM roadmap.

Why a branded ZK chain matters now

Creators have learned the hard way that distribution platforms own the checkout line. Social feeds rent reach. App stores clip margins. Payment rails see every dollar before the artist does. A branded chain flips that relationship. It makes the platform a shared settlement layer, not the toll booth. SANDchain is a clear example of a consumer brand taking that role seriously and wiring it with purpose-built features for creators.

Here is the simple mental model. Think of The Sandbox as a city where people build worlds and games. SANDchain is the electric grid beneath that city. Every light switch, from a cosmetic skin to a live event ticket, can draw power from the same grid and pay its bill in the same currency. That currency is SAND, which now steps into a larger role as the gas token that powers the chain and the governance token that coordinates the network.

SAND as gas and governance, explained

SAND started life as a utility token for The Sandbox’s metaverse. On SANDchain, it becomes the base currency for computation, the way ether is on Ethereum. Paying gas in the same token that a creator’s community already knows compresses friction at checkout. No juggling of multiple tokens. No conversion tax every time a fan wants to support a creator or mint an asset. When the cost model is simple, creators can price content more cleanly and fans can support more often.

Governance is the other half. SAND gives holders a say in how core settings evolve, from fee schedules to the list of official bridges. The value of governance is not abstract. In a creator economy, small policy choices affect livelihoods. Do microtransactions need fee rebates below a threshold to encourage tipping? Should creator tokens qualify for gas discounts on specific actions such as in-game purchases or ticketing? Having one token that sits in both the engine room and the town hall lets changes propagate quickly.

Patron Vaults and Creator Vaults, the new funding rails

A funding system is only useful if it matches how income actually flows for creators. SANDchain’s early product set proposes two concrete primitives.

-

Patron Vaults: think of these as community-funded credit lines. A creator issues a Patron Vault that fans can deposit into, in SAND or supported stablecoins. The creator draws from this pool to finance production, with terms that can be as simple as a revenue share or a capped payback with a small yield. Because the vault is on chain, every deposit, draw, and repayment is visible, programmable, and enforceable in code.

-

Creator Vaults: these act like programmable treasuries that can receive both on-chain revenue and off-chain payouts from Web2 platforms such as video ad shares, music streaming, or app store royalties. The vault aggregates those flows and routes them according to transparent rules. For example, 70 percent to the creator’s wallet, 20 percent to Patron Vault repayments until complete, 10 percent to a community grant that funds modders. When income hits the vault, the split happens automatically.

These two vault types stitch together the messy mix of subscription payments, tips, sponsorships, and platform payouts that creators juggle. The punchline is not yield farming. It is workflow. Vaults turn an audience into a balance sheet that can be financed, audited, and improved.

Creator tokens as distribution rails

If Patron Vaults and Creator Vaults handle financing and cash management, creator tokens handle distribution. A creator token is a brand-linked digital asset that confers rights: access to drops, early looks at drafts, backstage chats, or even the right to vote on a tour city. On SANDchain, those tokens can be recognized across experiences inside The Sandbox and beyond through standard token interfaces. The more consistent these rights become across the network, the more tokens function like daily passes rather than one-off collectibles.

Mechanically, a creator can choose to issue a fixed-supply token that fans earn through actions such as playtime, attendance, or sharing, then sell a fraction to fund production. Or they can run a time-boxed mint that opens during a season and closes when the season ends. Because SANDchain is ZK based, the chain can keep costs low while batching validation to Ethereum for final settlement. That gives creators the speed of a consumer app with the security of a public ledger.

The near-term catalysts to watch

SANDchain has a roadmap that matters in weeks, not quarters. The team introduced the network during Token2049 in Singapore on October 1, 2025, with early access signups and a testnet slated for October 14, 2025. The SAND token is the native gas, and the initiative is backed by The Sandbox’s existing ecosystem and partners, according to an official SANDchain announcement and dates.

Here is what that means for the next few months:

-

Testnet adoption curve: the testnet will show whether creators and studios actually mint, fund, and ship assets on SANDchain. Watch for daily active wallets on testnet, not just raw transactions. A healthy signal would be creators running recurring vault disbursements and publishing token-gated updates.

-

Partner rollouts: expect the first wave to include game studios, virtual event hosts, and creator tool vendors already inside The Sandbox. The proof point is not a logo slide. It is whether partners commit to make SAND the payment and gas rail for a visible feature such as season passes or marketplace fees. For a sense of how major consumer stacks are shifting, see how Coinbase’s AggLayer auto-swap shift reframes cross-chain distribution.

-

Liquidity and bridge design: the chain needs clean on-ramps. At minimum, a native bridge to Ethereum with predictable settlement windows and a stablecoin strategy that favors circulating assets over wrapped isolates. The zkSync Elastic Chain architecture supports in-cluster interoperability. That means SANDchain can talk to sister chains within the zkSync family through shared routers and vaults, while still offering a canonical route to Ethereum for assets that need broad liquidity. The most practical early design is a routing layer that favors SAND and one major stablecoin, paired with market makers that commit to tight spreads on day one. As payments rails evolve, note how Tether’s rail switch is remaking payments across multiple networks.

-

Compliance guardrails: fan funding touches securities law. The safest defaults are simple. Patron Vaults should favor capped, non-transferable payback streams rather than open-ended promises. Creator tokens should map to access and utility, not revenue share, unless the issuer is prepared to comply with the relevant exemptions and disclosure rules in their jurisdiction. A permissioned gate for qualified backers can coexist with a permissionless network. ZK tooling can also support selective disclosure for audits while preserving user privacy.

How SANDchain stacks up against OP Stack chains and Web2 platforms

When a brand launches a chain today, the competitive set spans two worlds. On one side, optimistic rollup ecosystems like the Optimism Stack power large consumer chains such as Base. On the other, Web2 platforms like YouTube and TikTok monetize distribution and take a platform fee. SANDchain must compete with both.

-

Performance and finality: ZK chains prove validity and submit proofs to Ethereum for final settlement in minutes. Optimistic systems assume transactions are valid and allow a challenge window. For creators, that difference shows up in faster withdrawals to Ethereum and in the ability to do small, frequent payouts without clogging the bridge. In plain English, ZK feels closer to real time for the user, which is critical for tipping, ticketing, and in-game markets.

-

Interoperability: the ZK Stack’s Elastic Chain design aims to enable native, trust-minimized messaging among sibling chains. That gives SANDchain a path to a network effect with other entertainment chains without relying on third-party bridges for every hop. OP Stack chains benefit from the Superchain vision and shared standards as well. The race will come down to which cluster ships the developer experience that makes cross-chain actions feel invisible.

-

Custom gas and brand alignment: ZK Stack chains can choose a custom gas token. SAND is the gas on SANDchain, so every transaction reinforces the brand and the token’s role. Many OP Stack chains use ether or their own tokens, but consumer chains that want one currency to do everything will prefer a stack that makes custom gas straightforward. The practical edge is marketing plus mechanics. Fans do not need to remember which token powers what.

-

Business model fit: Web2 platforms are still the best distribution megaphones. But their economics cap how much value creators can keep and share. A creator who uses SANDchain can keep building on YouTube or TikTok for discovery while settling membership perks, drops, and tips on chain to improve margins and give fans portable access. The winning stack is the one that lets creators blend Web2 reach with on-chain ownership without thinking about it.

What this unlocks for onchain media, AI-made assets, and social monetization

The story is not just lower fees or faster bridges. It is new content loops that were not feasible when every action cost dollars and every experiment required a custom contract.

-

AI-made assets at scale: generative tools inside and around The Sandbox already churn out avatars, items, and scenes. With near-zero transaction costs and instant minting, those assets can ship as on-chain objects with revenue splits baked in. A 3D model that includes someone else’s rigging can automatically split income between both creators when it sells. Training data attribution can be formalized as a tiny ongoing reward into a vault. The marginal cost of honoring provenance falls close to zero when the network can handle thousands of micro splits per minute.

-

Social monetization that feels native: creators can issue a seasonal token that acts like a digital wristband. Holders get entry to live streams, private worlds, and priority queues. Tips become instant, gas-subsidized microtransactions instead of a clunky checkout flow. Fans stop being just viewers. They become contributors whose tokens carry forward across experiences and seasons.

-

Onchain media formats: think of a music video whose rights graph lives in a Creator Vault. Remixes are allowed by design. Each derivative triggers a split to the original vault. A patron who seeded the production recoups their advance, then yields drop to zero and fan perks take over. The vault codifies what used to be a handshake and a spreadsheet.

Concrete actions for three groups

-

Creators and studios: start by mapping your income flows into a Creator Vault diagram. List your Web2 payouts, on-chain sales, sponsorships, and tips. Then decide what you want to automate. Second, run a testnet pilot on October’s public network with a simple token-gated experience and one Patron Vault. Measure conversion rate from free fans to token holders and track how many paybacks complete without manual intervention. Third, design perks that are spendable, not collectible. Perks that expire or unlock utility drive repeat engagement.

-

Brands and IP holders: prototype a loyalty layer that sits above your existing app and marketplaces. Use SAND for gas and settle rewards to a brand vault with a clear weekly budget. Pick one partner studio to ship a limited-run item where revenue splits are enforced on chain and redeemed in your existing storefront. The first pilot should be boring and measurable.

-

Exchanges and market makers: help seed liquidity in SAND and one stablecoin on day one of mainnet. Commit to narrow spreads, predictable withdrawal times, and a clear route from bank rails to SAND. The minute tipping feels as easy as swiping a debit card, the flywheel turns.

What could go wrong, and how to mitigate it

-

Fragmented liquidity: a branded chain can strand assets. Reduce that risk with a conservative bridging policy. One default bridge to Ethereum, clear withdrawal windows, and delayed listings for experimental wrapped assets until volumes justify it.

-

Regulatory uncertainty: if Patron Vaults creep into revenue-share territory, treat them like investment contracts and either exclude unqualified participants or provide the appropriate disclosures. If the intent is utility and access, design token terms that reflect that and avoid implied returns.

-

Cost drift and reliability: creators cannot budget around variable gas costs. Mitigate with gas credits funded from ecosystem grants and with fee rebates for microtransactions. Run public reliability dashboards so creators can see uptime and queue depth before a premiere.

The competitive stakes

Base showed that branded L2s can reach mainstream scale. SANDchain shows that a consumer brand with a live creation platform can use a ZK-based stack to wire creator economics into the network from the start. The prize is not only economic. It is narrative. If creators and fans discover that the most rewarding place to fund, make, and celebrate culture is a chain with clear economics and low friction, the center of gravity of digital media moves. Distribution remains omnichannel. Ownership, funding, and settlement consolidate.

The acceleration point

SANDchain launches into a world where creators already build inside The Sandbox, where the SAND token already circulates, and where zero knowledge systems already power fast, low-cost transactions. The next two weeks deliver the first checkpoints: early access and testnet. The next two quarters determine whether the vault model, token rails, and SAND-first economics add up to a habit. If they do, the creator economy gains what it has lacked: a network that treats fan energy as capital and turns creative output into programmable cash flows rather than static products.

The city was already buzzing. The grid just came online. Now we see which neighborhoods light up first.