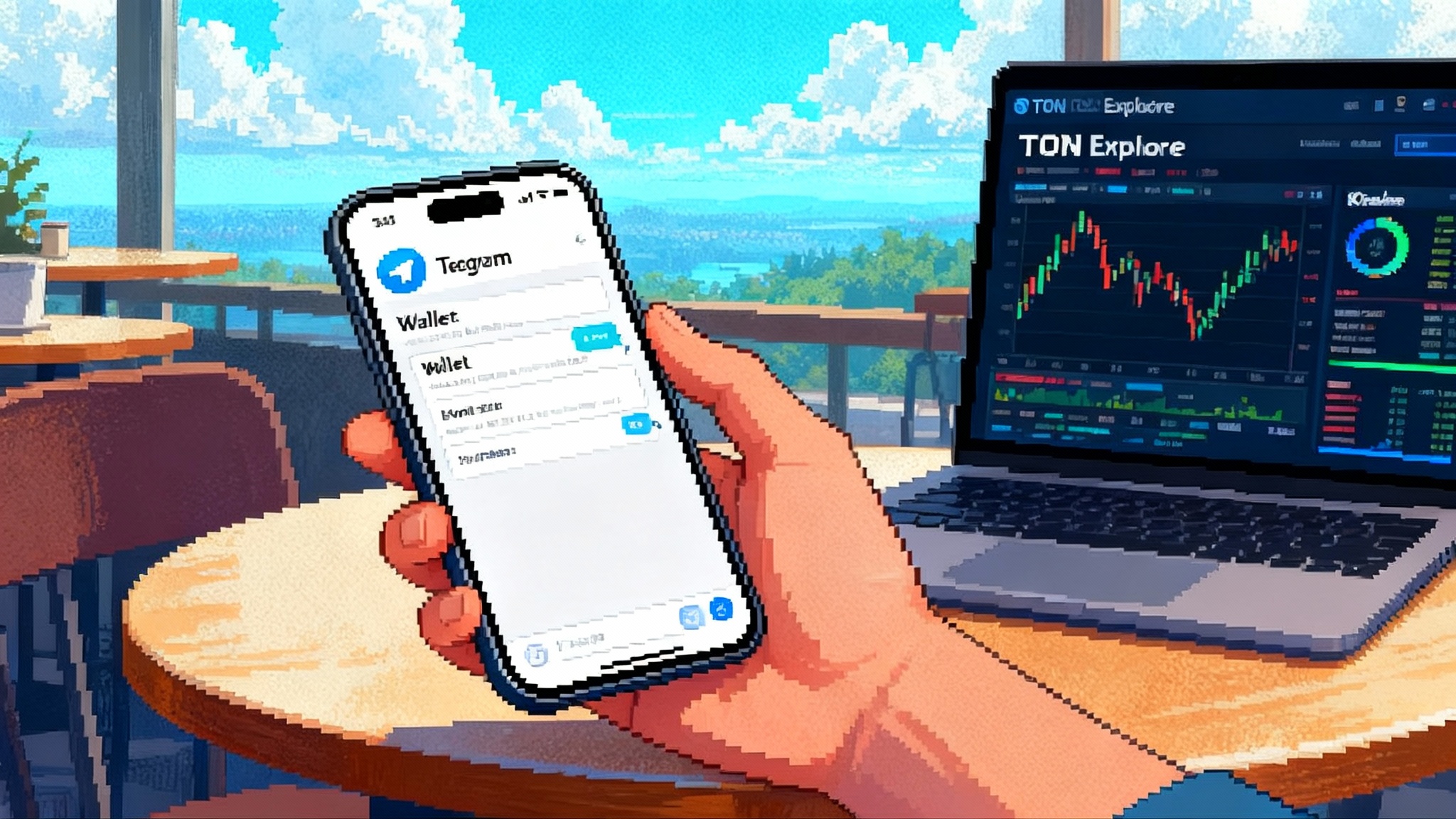

Telegram crowns TON and ships TON Wallet to the U.S.

Telegram set TON as the exclusive blockchain for Mini Apps and began rolling out its built-in TON Wallet in the United States. This move turns chats into one‑tap dollar payments, in‑app dApps, and direct creator payouts across a near‑billion user base.

Breaking: Telegram makes TON the home field for Web3

On January 21, 2025, The Open Network Foundation announced that TON would become Telegram’s exclusive blockchain for Mini Apps, with TON Connect required for wallet actions and Toncoin supporting pay‑ins and payouts tied to Stars and Ads. This is the first time a mainstream messenger consolidated its on‑chain stack behind a single network across a near‑billion user platform. See the announcement: TON named exclusive Mini Apps chain.

On July 22, 2025, Telegram began rolling out its built‑in TON Wallet to users in the United States. The self‑custody wallet sits inside the messenger, supports peer‑to‑peer transfers, swaps, and ramps via licensed partners. Coverage: Telegram starts U.S. TON Wallet rollout. For deeper context on where this can go, revisit our look at tokenized U.S. stocks in chat.

Two moves. One battle plan. Telegram is turning the chat box into the checkout button. The implication is direct: chat‑native wallets and stablecoins are on track to become default on‑ramps for mainstream consumers.

Why chat‑native beats app installs

Think about the last time you sent a photo. You did not open a new app and register an account. You tapped the paperclip and it just went. Payments that feel like attachments are the bar. Chat‑native wallets remove classic frictions of crypto onboarding: seed phrases, address copying, network selection, and juggling multiple apps.

Telegram’s approach offers three practical advantages:

- Distribution already solved. Mini Apps and bots run where people already spend time. Instead of fighting for home screen real estate, builders can live inside existing chats, channels, and communities.

- One‑tap intent. The action starts inside a conversation. A creator posts a paywalled video, a game drops a limited item, or a local seller issues an invoice. The wallet is one tap away, not a separate app and sign‑in.

- Stablecoin first. Consumers want dollars they can send instantly. USDT on TON is live across wallets and Mini Apps, with faster settlement and lower fees than most cards. As U.S. policy evolves in 2025, expect more compliant stablecoins to reach these flows. For a wider backdrop, see our stablecoins hit $300B overview.

In short, chats beat home screens, and dollars beat tokens for everyday spend.

What is live right now

- TON Connect as the wallet bridge. For Mini Apps that touch blockchain, TON Connect is the required way to request signatures and link a user’s wallet identity. Users get consistency; developers get a single integration surface instead of a plugin zoo.

- Mini Apps 2.0 features. Full‑screen experiences, subscriptions, device capabilities like gyro, and deep sharing to chats let Mini Apps behave more like real mobile apps without the cost of a native rebuild. A user can discover, authorize, pay, and share in the same flow.

- TON Wallet inside Telegram. The U.S. rollout brings self‑custody to an app Americans already use. The wallet supports stablecoin transfers, swaps, and ramps via licensed partners. For creators, that means smoother payouts; for users, it means receiving and spending digital dollars without leaving a chat. Related context: tokenized U.S. stocks in chat.

- Pay‑ins and payouts tied to Telegram economics. Telegram’s internal economic surfaces, such as Stars and advertising revenue shares, connect to Toncoin‑based settlement. For developers, that means less fragmentation in how money enters and exits the system.

These building blocks convert social reach into spend and settlement. The leap is not a feature. It is a distribution model.

What this unlocks at near billion‑user scale

- One‑tap stablecoin payments. Settling a group order or paying a freelancer becomes as simple as pinging a contact. A Mini App can embed a pay button for USDT on TON, removing card fees and delays. For cross‑border families, remittances can move at chat speed.

- In‑chat applications with real money. Games can sell time‑limited items. Media teams can gate premium content. Local services can invoice and receive payment without building a full storefront. Because the wallet is the substrate, every chat becomes a potential point of sale.

- Direct creator payouts. Channel owners and bot developers can see earnings flow straight to their wallets. No extra dashboards, no complex withdrawal schedules. That creates tighter feedback loops for pricing, offers, and retention.

- Viral distribution for financial apps. Mini Apps ride on Telegram’s sharing primitives. A referral link or a sticker can convert a reader into a payer within the same session. When money moves at the speed of memes, the top of funnel and the checkout live in one place.

Who loses if this sticks

- Centralized exchanges’ retail flows. If an everyday user can buy dollars in‑wallet, send to friends, and use them in apps, exchanges lose casual volume and future habits. Traders will still need advanced products, but retail inflows will increasingly start elsewhere.

- Web2 app stores’ rents. If Mini Apps monetize with Stars, Toncoin, or stablecoins, a meaningful portion of gross value bypasses 30 percent platform fees. App stores still matter for Telegram’s distribution, but transaction taxes shrink as more spend moves inside chats.

- Standalone wallets that only do transfers. Utility consolidates where network effects live. A wallet that is not on the user’s daily path to content and conversation will struggle to stay top of mind.

The next 6 to 12 months: patterns to watch

- Chat‑native commerce. Expect Shopify‑like builders for Telegram that let brands ship catalogs, invoices, and subscriptions as Mini Apps. Winners will nail tax handling, refunds, and customer support inside chat.

- Micro‑work and creator bounties. Channels will spin up task feeds that pay in stablecoins for clipping videos, translating posts, moderating comments, or labeling data for AI. Fast payouts drive supply; reputation systems and escrow reduce fraud.

- Remittances and local off‑ramps. Mini Apps that plug into regional cash‑out partners will grow fast in emerging markets. Think QR vouchers, mobile money connectors, and agent networks, all triggered from Telegram chats.

- Games with real economies. Time‑limited drops, team events funded by pooled stakes, and creator‑run tournaments will treat stablecoins as entry fees and prize pools. The Mini App format solves discovery; wallet in chat solves payout.

- Loyalty and memberships. Creators will sell tiered access, drops, and meetups via token‑gated chats. The hard part is not the token. It is the toolkit for upgrades, downgrades, and disputes without breaking chat UX.

Compliance friction to plan around

- App store policy drift. Apple and Google change rules. Telegram has navigated this by keeping payments inside its own economics and by working with licensed processors for fiat conversions. Design for policy switches. If external payment links are temporarily restricted, can your Mini App fall back to Stars or on‑chain flows without a redesign?

- Know your customer and sanctions screening. If you touch fiat ramps, require identity checks. Rely on providers that offer transaction monitoring and travel rule support. Build KYC status into your Mini App’s state so you can degrade gracefully. Let users browse and simulate, then unlock money features once checks clear.

- U.S. stablecoin rules. With federal proposals and rulemaking advancing in 2025, issuers and on‑ramps are tightening controls. That raises compliance costs for builders, but also expands the supply of regulated dollars that users and merchants are comfortable holding. Design treasury around stablecoin diversification so you can adapt to issuer or jurisdiction changes. For broader plumbing trends, see ISO 20022 onchain fund flows.

- Data privacy and consumer protection. Treat chats as sensitive. Keep payment details minimal. Store only what you need for refunds and audit. Build opt‑in logs and simple export tools so users can take their records elsewhere.

Platform risk and how to hedge it

- Single‑chain dependency. Telegram picked TON. That gives speed, tooling, and distribution, but concentrates risk. Keep data models and business logic portable. Encapsulate on‑chain interactions behind adapters so you can redeploy to other environments if policies or fees change.

- Telegram policy and discovery. You benefit from Telegram’s reach and are exposed to its moderation and ranking decisions. Build direct relationships with your audience through channels and email. Offer web fallbacks for mission‑critical flows.

- Wallet changes. The in‑app wallet will evolve. New assets appear, fee models adjust, and default surfaces move. Avoid hardcoding assumptions about send or swap screens. Use documented interfaces and test weekly on new builds.

A concrete builder playbook for TON today

- Choose your model early. Are you a bot, a Mini App, or both? Bots are fast to ship and great for notifications. Mini Apps unlock full‑screen experiences, device capabilities, and better merchandising.

- Integrate TON Connect from day one. Treat wallet linking like sign‑in. Ask for the minimum permissions to confirm ownership and only request signatures when a user is in a pay flow. Cache nothing sensitive. Display human‑readable transaction summaries.

- Default to stablecoins for money flows. Start with USDT on TON for pay‑ins, tips, and payouts. If your users are U.S. heavy, work with a ramp partner that supports compliant dollar purchases via card or bank transfer. Offer automatic conversion to the assets your app needs behind the scenes so the user sees dollars throughout.

- Offer two surface areas in the wallet. Support both the self‑custodial surface that advanced users expect and the simplified custodial surface where permitted. Always disclose custody status with clear labels.

- Build a clean receipts layer. Users need proofs for refunds, disputes, and accounting. After every payment, write a compact, signed receipt to your database with the transaction hash, item name, price in dollars, and counterparty. Expose a shareable link to the receipt so support can resolve issues inside a chat.

- Support refunds and chargeback analogues. Crypto has finality. Your product needs policies to simulate a chargeback where appropriate. Hold funds in escrow for a short window before releasing to sellers. Offer voluntary refunds and reputation penalties for abuse.

- Price for the chat. Keep offers simple. Use round dollar amounts. Bundle digital items and community access. Build a meter that lets users preview what a subscription unlocks before the first payment.

- Embrace Telegram‑native growth. Use channels for announcements, reply‑ready posts for support, and refer‑a‑friend programs with in‑chat deep links. Plan giveaways that require simple in‑wallet actions. Optimize onboarding for shares from creators and communities.

- Monitor policy and add toggles. Keep flags in your code for alternative payment flows, extra KYC steps, and region‑specific restrictions. When a policy shifts, flip a toggle and keep shipping.

- Keep your money map portable. Maintain treasury across two or more regulated stablecoins where possible, and design a simple operator panel to shift float when an issuer changes terms. Where you hold Toncoin for fees or promos, document top‑up and unwind procedures.

How this changes the competitive map

- Messaging super apps. WeChat showed that chat plus payments can power everything from taxis to taxes. Outside China, platform policies and banking rules slowed that model. Telegram’s decision to go all‑in on one chain and integrate a self‑custodial wallet gives Western consumers a credible version of the super app idea, starting with digital goods and creator economies.

- Exchanges and neobanks. Onboarding will migrate toward wherever users already are and where conversion is lowest friction. For a new cohort, that is the chat box. Exchanges will retain traders and listing‑driven traffic, but will need to partner at the wallet layer or risk losing first touch on mainstream users.

- Issuers and ramps. Stablecoin issuers with strong compliance footprints will compete to become the default dollar inside chats. Ramps that handle KYC, fraud, and card acceptance will be the unsung winners behind the scenes.

The bottom line

Telegram’s 2025 shift is less about one app and more about a change in defaults. If the wallet lives in chat and the dollar lives on‑chain, payments become a feature of conversation rather than a destination in a browser. That is the power of making TON the exclusive chain for Mini Apps and bringing the wallet to the United States. It removes a layer of distance between intent and action. For builders, the play is to ship where the user already is, price in dollars, and let the chat do the distribution. For users, it feels like sending a photo. Except this time the file is money.

The race is on for the first breakout Mini Apps that make this obvious. They will be the ones that treat chat like the operating system, the wallet like a browser tab, and stablecoins like cash. When that happens, onboarding to crypto will feel less like a tutorial and more like a tap.