Stablecoins hit $300B as Europe warns of new risks

On October 2, 2025 stablecoin supply crossed $300 billion just as Europe’s ESRB called for urgent safeguards under MiCA. Here is how that combo will reshape redemption, liquidity, and routing for builders, treasuries, and traders.

A week that resets the map

Two headlines in the same week tell one story. First, the stablecoin market crossed a symbolic line. By Thursday, the total supply of fiat-pegged tokens stood above 300 billion dollars, an all-time high that turns a crypto niche into systemically relevant plumbing for payments and markets. That figure is not a projection. Based on public dashboards and mainstream coverage, stablecoin supply passed $300 billion as of October 2, 2025.

Second, Europe’s risk referee spoke up. On October 2, the European Systemic Risk Board called for urgent safeguards on stablecoins, flagging weaknesses in cross-border and multi-issuer models where a token is minted by affiliated entities inside and outside the European Union. The message was clear. Europe wants a level set of rules, consistent oversight, and predictable redemption under its Markets in Crypto-Assets Regulation. Reuters summarized the signal as a call for urgent safeguards on stablecoins.

These two events are not random. Together they mark a regime shift. A market this large will not be allowed to run on soft norms. As MiCA hardens the rules in the European Union and the United States consolidates around dollar-stablecoin dominance, on-chain money is about to split along currency and compliance lines. Builders, treasuries, and traders should prepare for a world where euro tokens and dollar tokens live by different operational playbooks. For context on how rails are evolving, see our take on Tether rail switch remaking payments.

The two headlines, one story

The new scale means stablecoins now matter to payment networks, broker-dealers, and treasury desks that need instant finality without settlement windows. Volume attracts scrutiny. Scrutiny changes rules. The European Systemic Risk Board does not write law, but it influences the European Banking Authority, securities regulators, and central banks that will interpret MiCA’s stablecoin chapters in practice. DeFi markets are already rewiring around modular architectures like Aave V4 modular liquidity.

Why the ESRB warning matters

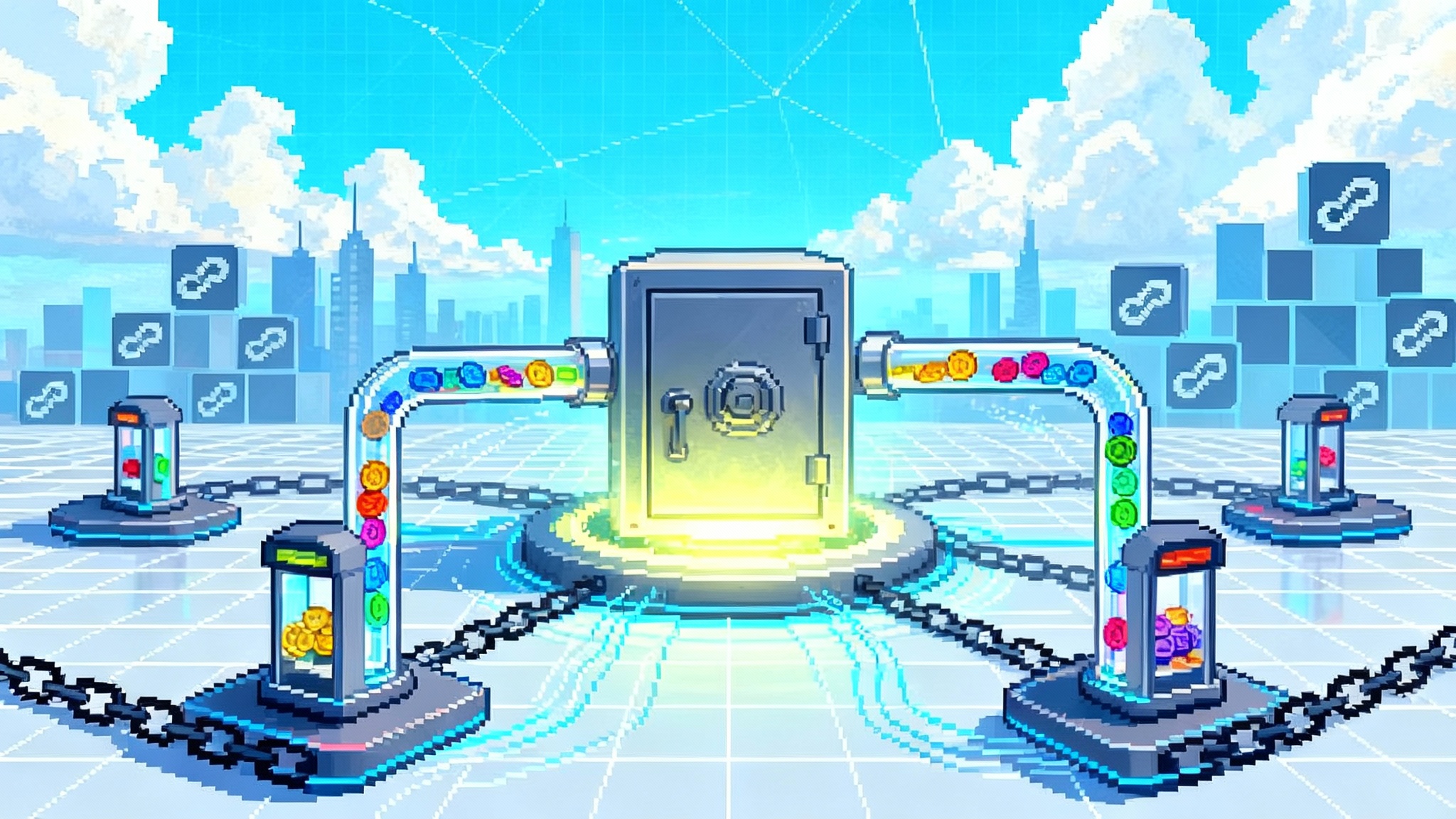

Think about a stablecoin as a digital claim on a reserve bucket. If a token can be minted by one entity in Paris and another in New York, both under one brand, and the claims are fungible on exchanges, where do users run for cash in a stress event. The European Systemic Risk Board is worried that if European rules are stricter and safer, holders will prefer redeeming with the European entity. That could drain reserves located inside the European Union first, create a local squeeze, and force European supervisors to choose between limiting redemptions or providing emergency liquidity to a privately issued token. Neither is attractive.

The most likely policy response is coordination. Expect guidance that ties together group-level issuance policies, harmonized redemption windows, shared transparency on where reserves sit, and operational firebreaks that prevent a run from sloshing risk from one jurisdiction to another. The goal is simple. If a token trades as one unit globally, the safeguards must bind globally too.

MiCA’s new ground rules in plain English

MiCA divides stablecoins into two buckets that matter for issuers and integrators.

- E-money tokens. These are single-currency tokens like a euro coin or a dollar coin. They must be issued by a licensed electronic money institution or a bank, fully backed by liquid assets, redeemable for fiat at par on demand, and supervised for conduct and prudential risk.

- Asset-referenced tokens. These mimic a value by referencing a basket of assets. They face stricter constraints in the European Union because they can wobble in stress and are less suitable as payment instruments.

Across both buckets, significant tokens can face limits and extra obligations if they cross size thresholds. That can include higher reserve quality, reporting frequency, and crisis playbooks. None of this bans innovation. It does force enterprise-grade discipline into a market that historically relied on best efforts and quarterly attestations.

The practical changes that matter for operators in the next four quarters are more specific.

- Issuance. Minting to unverified addresses will be discouraged for European supply. Issuers will tighten know-your-customer onboarding, whitelisting, and travel rule compliance.

- Redemption. Expect clearer cutoffs, shorter settlement windows, and standardized fees. European supervisors will press for auditable logs that prove same-day processing for reasonable sizes, with playbooks for queueing in stress.

- Disclosures. More granular breakdowns of reserve composition by geography, custodian, and maturity ladder. The European side will push for visibility into intraday liquidity usage and concentration by banking partner.

Where liquidity could fragment

Liquidity fragmentation is not an abstraction. It shows up in spreads and in routing. Here are three concrete places to watch.

- Euro vs dollar pools on public chains. If a euro token becomes the default for European wallets and on-ramps, but most decentralized exchanges, perpetuals, and non-fungible token markets remain dollar-denominated, then builders face a choice. Either they back every pool with both currencies or they accept a thin euro lane that widens slippage during volatility. A visible symptom will be more frequent basis between euro-stablecoin prices on centralized exchanges and their on-chain counterparts during European trading hours.

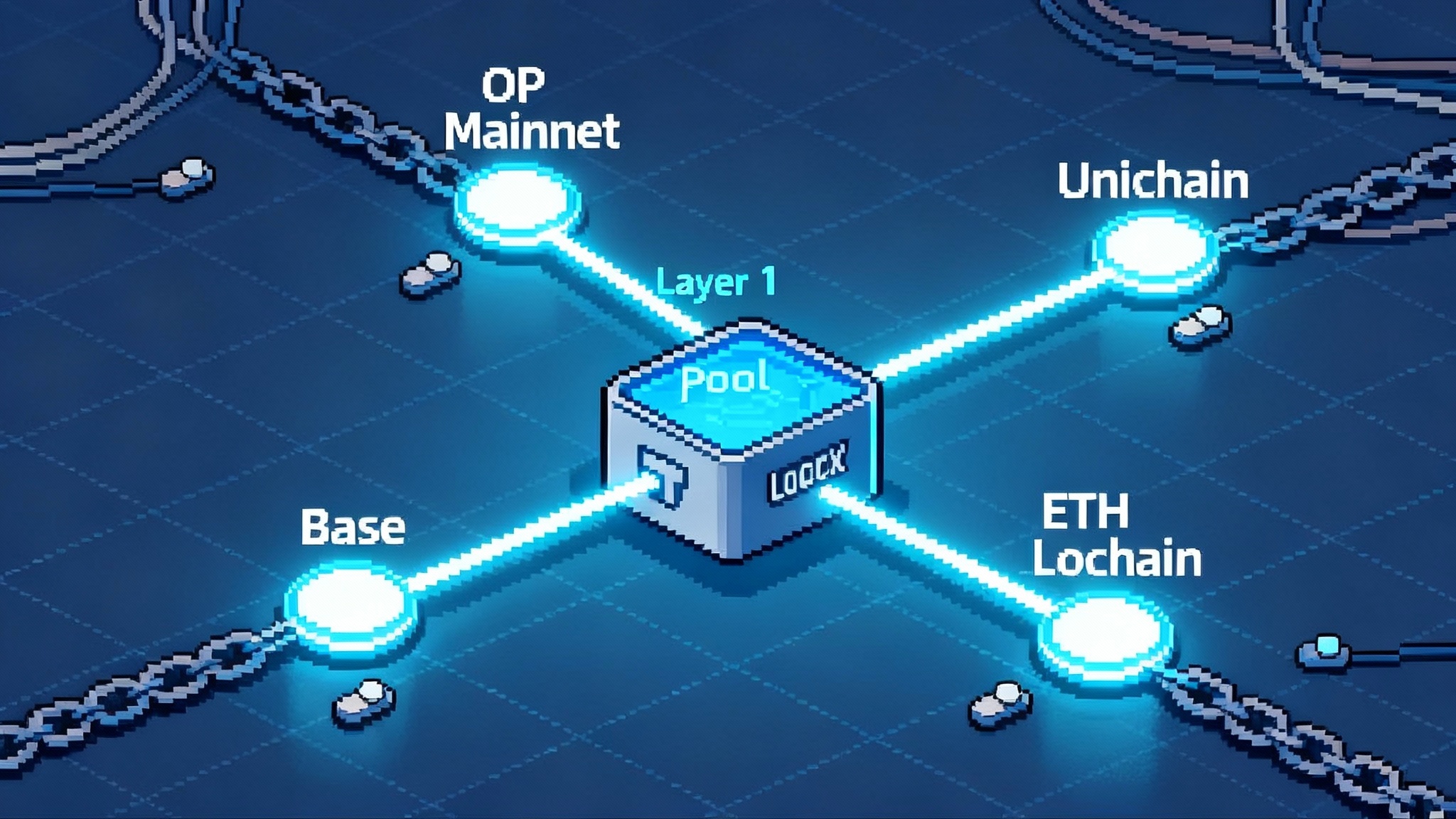

- Permissioned vs open pools. Some Layer 2 networks are experimenting with identity hooks and allowlists. If MiCA-compliant issuers prefer minting to permissioned environments for European users, liquidity splits into two ponds. For developers this means bridging volume between ponds is not just a technical question. It is a policy and monitoring question. Cross-pond arbitrage will exist, but it will rely on regulated market makers with access to both sides.

- Redemption queues by region. In stress, European entities will follow prescriptive redemption queues. Non-European entities may be looser. When spreads blow out, the redemption path that clears first becomes the reference price. If that is European-only, the rest of the world trades at a discount for a period. This is how fragmentation starts: identical tokens with different real-world access to cash.

Who stands to win right now

-

MiCA-licensed euro issuers. Teams that complete licensing and can mint euro tokens to verified counterparties gain a first-mover advantage in European banking relationships and merchant acceptance. Examples include the firms behind EURC, EURe, and EURCV. Their pitch to treasurers is clean. You get a euro claim, under European rules, with auditable redemption.

-

Compliant on-ramps and off-ramps. Exchanges and brokers that secure European authorization under MiCA become the default endpoints for Europe-bound flows. They will be the safest place to convert between bank deposits and on-chain euros, and they will win institutional clients that cannot touch gray-area rails.

-

Layer 2 networks that integrate identity-aware stablecoins. Rollups that support allowlists, compliance hooks, and native travel rule messaging will onboard fiat gateways faster. Expect momentum on Base, Polygon CDK-based chains, Arbitrum Orbit instances, zkEVM and zkSync variants, Linea, and Avalanche Evergreen subnets that can run permissioned enterprise lanes alongside public liquidity. This trend accelerated after POL auto-swap AggLayer default.

-

U.S. dollar stablecoin ecosystems. In the United States, legal clarity has tilted the field toward regulated dollar tokens. Even as Europe pushes euro issuance, most global crypto liquidity remains dollar-denominated. U.S. dollar stablecoins will continue to dominate margining for derivatives, collateral in lending markets, and settlement on exchanges serving international clients.

Who is at risk

-

Non-compliant or lightly documented issuers. The cost of capital rises when supervisors question redemption controls or reserve transparency. Tokens that cannot show clean audit trails and real-time risk metrics will see lists of prohibited venues grow.

-

DeFi applications reliant on gray-area liquidity. Protocols that depend on anonymous minting and redemption will find their European volumes curtailed. Without compliant euro pools, routing gets longer and costlier, which erodes yields that relied on quick loops.

-

Cross-border multi-issuer brands without tight governance. If a token relies on separate legal entities in the European Union and elsewhere but treats supply as one, it will need group-level controls. Without them, the Board’s warning will translate into supervisory actions that limit fungibility, throttle minting, or force disclosures that expose operational gaps.

How this changes routing and settlement

Here is what changes on the ground for payments, trading, and treasury ops.

-

For European payouts. If you are paying contractors in Berlin or suppliers in Warsaw, a MiCA-aligned euro token will reduce off-ramp risk and accounting confusion. Your accounts payable workflow should add a euro lane with KYC-approved wallets on permitted networks. Expect better acceptance by banks and auditors for these flows compared with dollar tokens.

-

For global settlement. Dollar tokens still clear the deepest pools. If you need to settle a trade on a non-European venue, start with U.S. dollar stablecoins, then convert to euros only at the edge where European invoices must be paid. This concentrates your slippage risk into fewer legs and exploits the deepest liquidity.

-

For on-chain commerce. Marketplaces serving European consumers will lean into euro pricing and euro stablecoin checkouts. The checkout stack changes slightly. Identity at sign-up, whitelisted wallets, and clearer refunds through on-chain redemption rather than exchange transfers.

-

For cross-chain transfers. Native issuers will favor official bridging like burn-and-mint schemes over wrapped assets. Integrate with official connectors that preserve redemption rights across chains. Avoid wrapping that strands you on a network where the issuer will not redeem.

Yield mechanics in the new split

Yield depends on reserve assets and on your route to those assets. Three implications matter through 2026.

-

The reserve ladder. Euro tokens will hold more euro Treasury bills, repo, and bank deposits. Dollar tokens will hold U.S. Treasury bills and repo. Interest differentials will show up in on-chain yields. If euro policy rates fall faster than U.S. rates, euro stablecoin yields will compress first. Treasurers who chase extra basis points by holding dollar tokens to pay European invoices later should model foreign exchange and policy risk, not just the headline yield.

-

Share-class creep. Issuers may introduce institutional share classes with higher transparency and lower fees for large balances. If that happens, retail pools and professional pools will trade at subtly different implied yields. Arbitrage is not free. Redemption windows and KYC constraints will keep some gaps open longer than before.

-

Risk-aware staking and rehypothecation. Expect new rules of the road for how stablecoins can be used as collateral in lending protocols and tokenized money market funds. For European treasurers, policies will favor tri-party custody, segregation, and no rehypothecation unless explicitly approved.

Actionable outlook for Q4 2025 through 2026

Here is a concrete plan by role, with what to do, why, and how.

Builders

-

Add euro rails on purpose. If you have European users, integrate a MiCA-aligned euro token with address whitelisting and travel rule messaging. Why: smoother bank connections and lower chargeback friction. How: work with issuers that support allowlists and provide per-mint provenance data you can log.

-

Design for jurisdiction-aware routing. Build a routing layer that picks currency and chain based on user location, counterparty preferences, and compliance flags. Why: lower failure rates and better spreads. How: keep a matrix of preferred networks per currency and user type, then auto-select.

-

Separate pools and analytics. Maintain separate treasury wallets and dashboards for euro and dollar tokens. Why: simpler audits and faster responses in stress. How: segment custody, track basis, and alert when redemption queues deviate by more than a set threshold.

-

Choose identity-friendly Layer 2s. Prioritize rollups that support fine-grained access controls and official issuer bridges. Why: faster listings by regulated on-ramps. How: pilot on networks with allowlist modules and audit logs you can export. The Polygon ecosystem’s direction after POL auto-swap AggLayer default is a useful signal.

Treasuries

-

Run a two-currency cash book. Allocate working capital between euro tokens for European payables and dollar tokens for global settlements. Why: currency alignment reduces foreign exchange noise and speeds reconciliation. How: set policy bands, for example 60 percent dollar tokens, 40 percent euro tokens, with monthly rebalancing.

-

Install a redemption ladder. Do not rely on exchanges for emergency exits. Why: exchanges can halt withdrawals. How: open direct redemption accounts with at least two issuers per currency, test small redemptions weekly, and track cutoffs.

-

Capture safe yield. Use tokenized Treasury bill funds or issuer yield-sharing where permitted, but avoid stacking protocols for a few extra basis points. Why: compounded smart contract risk hurts when policies tighten. How: restrict to two layers of exposure max, document your look-through to underlying assets, and monitor share-class differences.

-

Negotiate reporting. Ask issuers for reserve breakdowns by geography, maturity, and custodian. Why: you need to see if your redemption path depends on a single banking hub. How: add those fields to your vendor due diligence checklist.

Traders

-

Watch euro-dollar basis on chain. Track spreads between euro tokens and dollar tokens during European hours on major rollups. Why: fragmentation premiums will show first where pools are shallow. How: set alerts for deviations above historical averages and build routes that natively cross the currency when spreads justify it.

-

Use official bridges. Prefer burn-and-mint pathways supported by issuers over wrapped routes. Why: wrapped assets can break redemption. How: code your routers to treat issuer bridges as first class and wrapped routes as last resort.

-

Price permission. Add a premium for routing through permissioned pools even when the quoted spread looks tight. Why: you need eligibility, operational contracts, and sometimes pre-funding. How: include a compliance latency factor in your execution engine.

-

Arbitrage the queue. In stress, redemption queues will diverge by region. Watch for European queues clearing faster. Why: exits in Europe can reset reference prices. How: hold accounts with both issuers in advance and automate small, frequent test redemptions so large tickets do not fail when you need them.

What to watch next

-

Licensing tape. Track which euro issuers complete MiCA authorization and which on-ramps receive European approvals. Each approval is a green light for liquidity to concentrate.

-

Policy harmonization. Look for joint statements from the European Banking Authority, national supervisors, and central banks on coordinated treatment of group issuers. This will define whether a euro token minted in one country behaves the same when redeemed from another.

-

Network preferences. Follow where issuers choose to mint by default. If European issuers favor permissioned rollups, public pools will thin out in European time zones.

-

U.S. implementation timeline. As U.S. stablecoin rules settle, bank partnerships for dollar tokens will deepen. This will reinforce dollar dominance in global crypto markets even as Europe builds a strong euro lane for domestic commerce.

The upshot

A big market attracts big rules. Crossing 300 billion dollars puts stablecoins on the radar of every serious supervisor, and the European Systemic Risk Board’s call shows where the European Union intends to steer this market in the MiCA era. Expect tighter redemption, more identity at the edge, and a split liquidity picture that follows currency lines. The winners will be the teams that treat compliance as a feature and routing as a product, not an afterthought. If you build now for a two-pool future, you will not have to rebuild when the tide goes out.