Uniswap v4 hooks: DEX pools become app platforms on L2

Uniswap v4 makes liquidity programmable with hooks. Here’s how dynamic fees, protected orderflow, and in-path automation are reshaping markets and pulling activity to layer 2.

The DEX becomes a platform

On January 31, 2025, Uniswap v4 went live and moved the center of gravity in decentralized trading from static pools to programmable ones. The headline feature is hooks, small smart contracts that attach to a pool and change how it behaves at each step of a swap or liquidity action. Think of a hook as an app installed on a trading pair. That app can set fees, run risk checks, shield orderflow, or automate liquidity moves while the trade is executing. In a very real sense, the decentralized exchange just became a platform for apps built on top of liquidity. See the launch post, Uniswap v4 is here.

Hooks 101: what they actually do

A v4 pool exposes well defined points in its lifecycle. Before a swap. After a swap. Before liquidity is added or removed. A hook can plug into those moments and run its own code. That is the difference between a fixed venue and a programmable one:

- Fee logic can be static or dynamic and can change per trade.

- Orderflow can be routed through protection or auction logic before it hits the pool.

- Liquidity provider strategies can rebalance, hedge, or even lend and borrow in the same transaction path.

- Any pool can add guardrails: slippage caps, price band checks, or allowlists and identity proofs.

The mechanism matters. v4’s singleton architecture puts every pool behind a single manager contract, which lowers gas for multi hop routes and lets hooks compose without the old copy paste pattern of deploying a new contract per pool. That is why hooks are not a bolt on. They are the operating system for v4 pools.

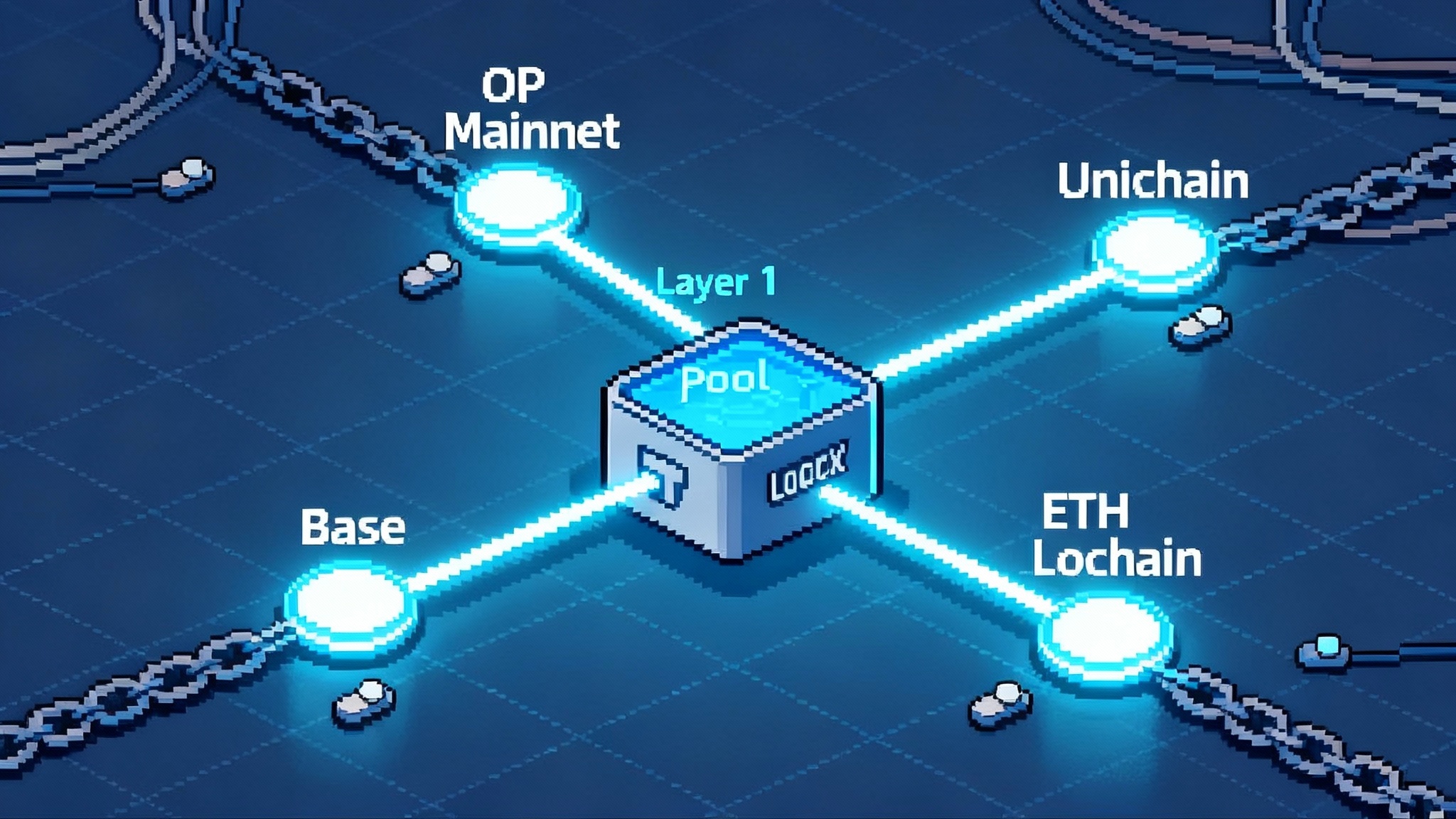

Why the hook era pushes liquidity to layer 2

Hooks do more work per swap. That favors cheaper, faster chains. In the first months after launch, a material share of v4 activity moved to rollups where block space is plentiful and ordering is fair by design. Uniswap’s own layer 2, Unichain, became a leading venue for v4 as incentives and sub second block targets met a hook heavy workload. On May 9, 2025, coverage showed Unichain surpassing Ethereum by transaction share for v4 activity, a clear signal that programmable pools prefer low cost, high throughput environments. See reporting that Unichain surpasses Ethereum on v4.

Lower fees alone do not explain it. Two architectural shifts amplify the pull:

- Fair ordering upgrades and revert protection on rollups reduce maximum extractable value, so hooks that depend on predictable ordering or failure handling work better. For context on rollup evolution, see how U16a lands on the Superchain.

- Faster confirmation and cheaper calls let per swap logic, like dynamic fees or hedging routines, run without pricing out retail trades.

The result is a new baseline: the default venue for complex DeFi logic is a layer 2, and the default DeFi app is a hook enhanced pool.

The four superpowers hooks unlock

Hooks are not an abstract toggle. They deliver four capabilities that change how liquidity is managed.

- Dynamic fees that breathe with the market

In v3, fees were tied to fixed tiers. In v4, a pool can set its liquidity provider fee dynamically per swap and can also charge an optional hook fee to fund extra logic. That lets fees react to volatility and flow quality. A simple example is a volatility sensitive schedule: raise fees when the price whipsaws or when trade size spikes; relax them when markets are quiet to tighten spreads.

Why this matters: predictable fees are easy to game. When fees can be raised at the exact moment toxic flow arrives, liquidity providers finally charge the right price for risk. Token issuers can also use dynamic fees to defend against launch day arbitrage, and safer fees make it easier for teams to list assets without heavy incentives.

Practical pattern: projects are shipping volatility or oracle driven hooks that update the fee in the beforeSwap step. Some combine a slow moving base fee with a short lived surge fee that decays within blocks. The goal is not to guess the perfect number. It is to move the fee quickly enough that the pool does not become a sitting duck.

- Protected orderflow instead of wishful routing

Most sandwich and backrun losses happen because a user broadcasts a transaction into a dark forest and hopes. Hooks let a pool demand a safer path. A pool can require that incoming swaps arrive from a designated order flow auction, an encrypted mempool, or a fair ordering builder. The hook checks provenance before allowing the swap to proceed.

Why this matters: with protected orderflow, price improvement is not an accident. It is a policy. A pool can commit to auction off its flow, share any auction rebates with liquidity providers or traders, and reject flows that do not meet the rule. That turns order handling into a programmable revenue source instead of a tax.

Practical pattern: hooks that verify a signed receipt from an auction or a protector, then credit a portion of the rebate to the pool’s fee pot. On rollups with fair ordering, hooks can add revert protection so a failed attempt to sandwich does not leave the trader paying for wasted gas.

- Automated liquidity provider strategies without a separate vault protocol

Active management used to require a separate product. Now the pool can do it. Hooks can rebalance ranges, shift inventory, or hedge delta in response to price. They can even integrate with lending so the same collateral can earn interest while backing swaps.

Why this matters: moving logic into the pool cuts latency and avoids fragmented liquidity. Instead of waiting for a keeper to poll prices and pay a second gas bill, the hook reacts in the swap’s execution path. That shrinks the gap between intent and execution and makes automation viable for smaller positions.

Practical pattern: rebalance on price band exits, adjust range width during spikes, and convert single sided deposits into balanced ranges on the fly. On lending integrated designs, a pool’s hook borrows and repays within the swap, so depth expands just in time without idle capital. The broader shift to modular liquidity mirrors Aave V4's modular turn.

- On chain risk controls that meet institutional checklists

Hooks can require an identity proof, apply sanctions screening, or enforce per address risk budgets. They can cap slippage, pause pools on oracle divergence, and save audit friendly logs of every decision. For institutions, that means a pool can be both permissioned and open source, with clear policies baked into code.

Why this matters: compliance ready liquidity is no longer a separate venue. It is a policy set attached to a pool. That pushes more volume on chain and lowers the barrier for traditional desks to provide liquidity next to crypto native teams.

Practical pattern: zero knowledge checks for know your customer and anti money laundering that reveal as little as possible, combined with circuit breakers, oracle windows, and per wallet limits enforced in beforeSwap.

The new attack surface and how teams are responding

Programmable liquidity is powerful and dangerous. Teams are converging on a risk model that assumes the hook is as risky as a new protocol. Here is the short version.

New failure modes to model:

- Malicious reverts. A hook can revert to block actions. If it is upstream in a route, one bad hook can poison multiple pools.

- Fee siphons. A hook can route tiny fees to itself or a partner, especially if the math is nonstandard or the accounting is custom.

- Cross hook timing. Two hooks that both rely on timing or on the same oracle can interfere with each other.

- Hidden state and grief. Transient storage and custom accounting can produce state that is hard to audit. Attackers can push a pool into rare branches to drain fees or stall execution.

- Governance drift. If a policy hook or an orchestrator can be upgraded, the upgrade path is a central point of failure.

Mitigations that are becoming standard practice:

- Hook warnings and allowlists in interfaces so retail users see flags before they deposit liquidity. Teams are starting to rely on these cues the way they once relied on token lists.

- Canonical templates. Security teams and auditors are publishing base hook libraries that enforce safe patterns for fee math, event emission, and revert handling.

- Registry first distribution. Instead of copy pasting addresses into chats, teams submit hooks to a registry with metadata, audits, and versioning. Interfaces and wallets pull from those lists by default.

- Orchestrators and pause first upgrades. When policies must change, orchestration layers pause, upgrade a module, and resume, with on chain logs that a wallet or a compliance desk can review.

The main lesson: treat a hook like a product, not a snippet. Give it docs, audits, a change log, and a deprecation plan.

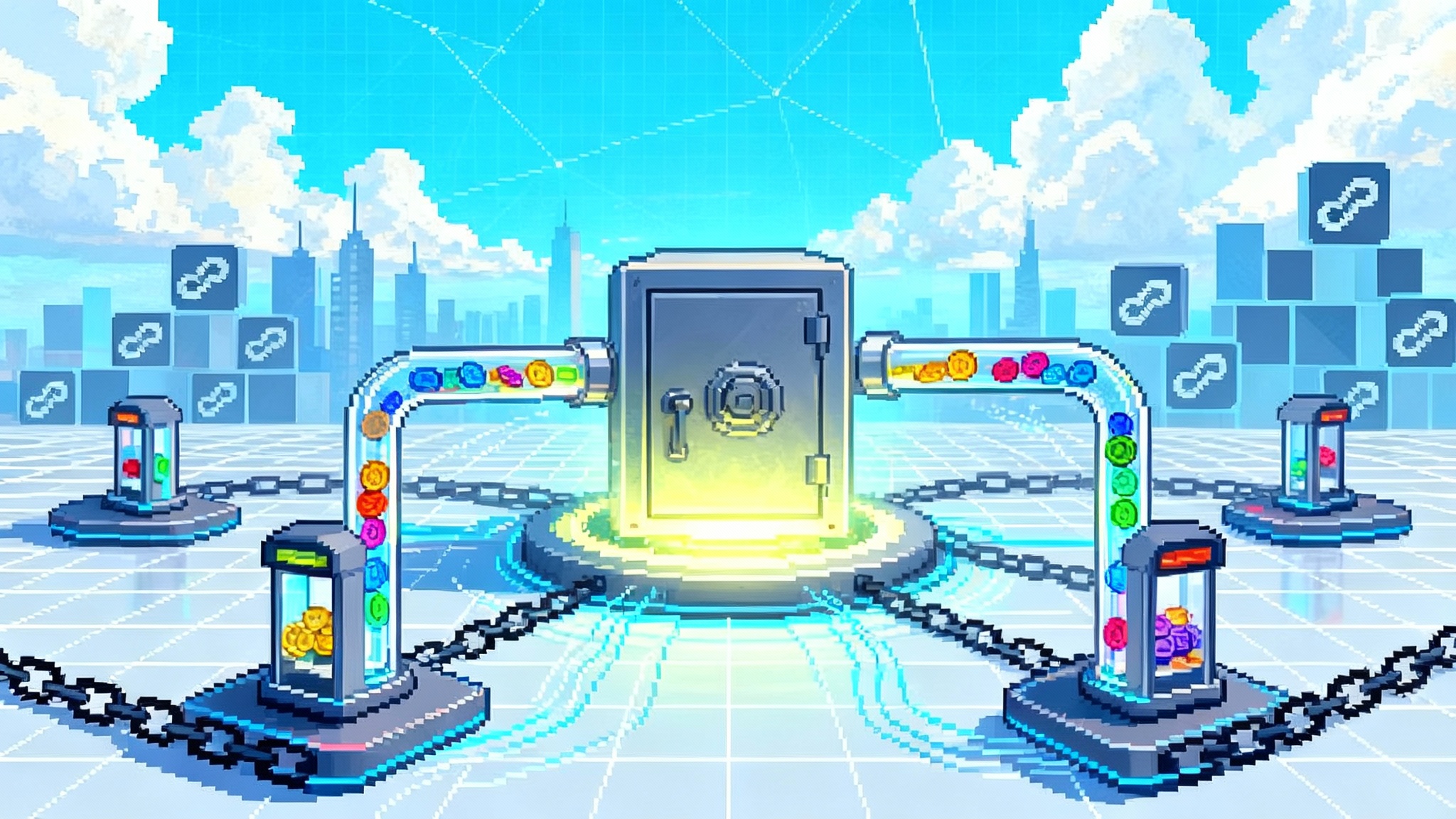

Standards are forming: registries and managers

Two standards are emerging as volume concentrates on layer 2s and teams repeat the same patterns.

- Hook registries, also called hook lists. These are structured lists of known hook contracts with metadata, risk flags, and version history. They mirror the token list model that made token discovery safer in 2020. A registry makes it easier for a wallet to show a warning, for an indexer to decode events, and for an interface to route through only vetted hooks by default.

- Hook managers and policy orchestration. This pattern is a thin layer installed when a pool is created. It coordinates which policy hooks run and in what order, so a pool can combine, for example, a dynamic fee module, a protected orderflow module, and a compliance module without writing a bespoke mega hook. The manager can also manage controlled upgrades with pausing and explicit governance, which reduces migration churn and centralizes audit focus.

Neither standard locks the protocol. They are opt in, open, and minimize the work for integrators who otherwise face a zoo of one off hooks.

Who wins and who loses

- Liquidity providers: Active providers win. Dynamic fees and in path automation raise net returns by charging appropriately for volatility and by cutting the cost of rebalancing. Passive providers on older versions may see flow drift to pools that react faster.

- Traders: Retail traders benefit when spreads tighten in calm markets and when routes include protection. They can also face higher fees during spikes and permissioned pools that exclude some wallets. Net outcome depends on the router choosing the right mix of vanilla and hooked pools.

- Wallets: Smart wallets become policy routers. They need registry support, clear warnings, and intent flows that let users express constraints. Wallets that leverage Post Pectra Ethereum smart accounts will be better positioned to execute complex policies.

- Market makers: The bar to run sophisticated strategies on chain drops. Makers who bring their models into hooks can control their own policy stack and stop leaking edge to external keepers. The flip side is more competition on equal footing.

- Institutions: This is the moment they asked for. They can deploy compliance ready pools and trade against them without building new venues. The risk is overfitting to one chain or one manager and missing the broader hook market where most retail flow lives.

The deeper reason volume is moving

v4 collapses the distance between policy and execution. Instead of sending orders to a venue that may or may not honor preferences, users and liquidity providers can encode those preferences into the pool itself. The more specific the policy, the more it needs cheap, fair blockspace. That is why layer 2s, and especially rollups with fair ordering and fast confirms, are capturing the first wave of hook volume.

What to do now

- If you are a token team: start with a guarded pool on a layer 2. Combine a dynamic fee hook with a basic protection policy and a simple circuit breaker. Use a registry entry with audits before inviting liquidity providers. Expand to mainnet once behavior is stable.

- If you are a liquidity provider: select venues with fair ordering and clear hook metadata. Prefer pools where the fee schedule and risk controls are transparent and adjustable without migrations.

- If you build wallets: integrate hook lists, show flags at deposit and swap time, and support allowlists. Add intent style trade tickets that can target hooked pools with constraints like fee caps and provenance checks.

- If you run a desk: pilot policy controlled pools that mirror internal compliance rules. Use on chain logs to satisfy audit and reporting. Treat hook upgrades like change managed software releases.

Accelerationist roadmap for 2026

Three trajectories are converging over the next four quarters.

- Intents native trading on v4. Routers will let users specify outcomes instead of paths. Solvers will compete to satisfy those intents by composing vanilla and hooked pools, protected orderflow, and cross chain settlement. Hooks will verify that provenance and policy constraints were respected before releasing funds.

- Policy orchestration layers. Hook managers will become a common dependency. Expect standard interfaces for sequencing policy modules, pausing, upgrading, and logging. Governance will move from monolithic pool settings to modular policy bundles that can be swapped without migrating liquidity.

- Compliance ready liquidity that blurs centralized and decentralized boundaries. With audited policy stacks, identity proofs, and granular limits, institutions can trade directly on programmable pools while preserving self custody. Centralized venues will mirror this by offering access to policy compatible on chain liquidity as part of their order books.

By the end of 2026, the line between a decentralized exchange and a marketplace of pool apps will be thin. The winners will be teams that treat liquidity as software and chains that offer the cheapest, fairest compute for that software to run.

The bottom line

Uniswap v4 turned pools into platforms. Hooks are the modules that make those platforms useful. They price risk in real time, protect users from predatory ordering, automate the hard parts of liquidity provision, and put risk policy on chain. That is why volume is gathering on layer 2s. The next step is to make this programmable liquidity safe by default with registries, managers, and transparent policy logs. Do that, and decentralized markets will feel less like a venue and more like a toolkit. That is a good place to build from.