After the DeFi rule repeal: building U.S. onchain compliance

Congress nullified the IRS’s DeFi broker rule in April 2025, pausing noncustodial 1099-DA reporting while custodial brokers move ahead. This practical playbook shows exchanges, wallets, DAOs, and payment firms what to build next for private, user-first onchain compliance.

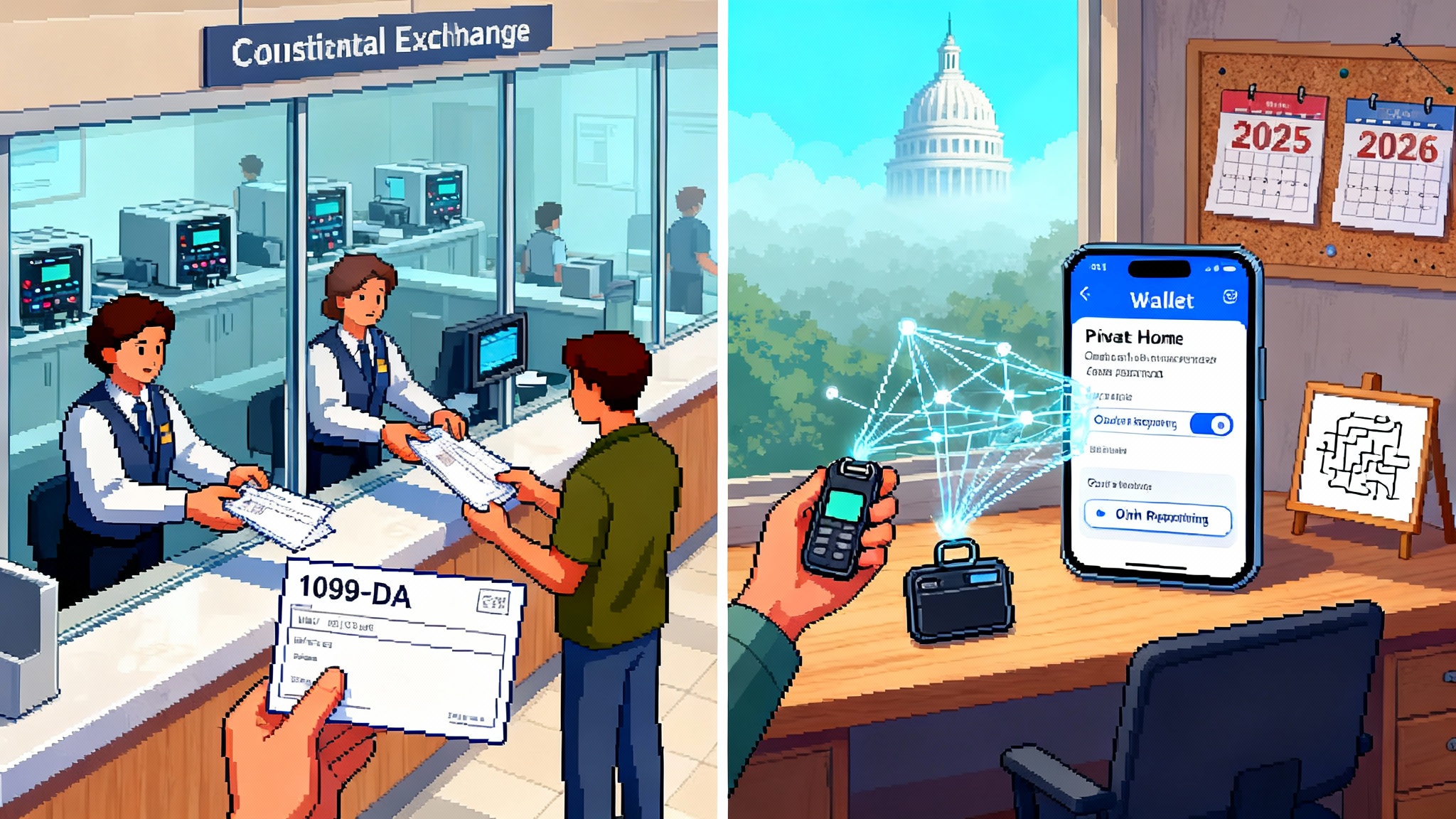

The reset: what Congress changed in April 2025

In April 2025 Congress used the Congressional Review Act to nullify the Internal Revenue Service rule that would have treated many decentralized finance participants as brokers. The joint resolution became law on April 10, 2025 and disapproved the rule titled Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales. You can read the short law text on Congress.gov under Public Law 119-5 text.

This matters because the nullified rule would have brought some noncustodial operators into the information reporting regime for digital assets through Form 1099-DA. The repeal removes that requirement for now. It does not erase the 2021 statute that created digital asset reporting. It does not undo the already issued final regulations that focus on custodial intermediaries. It simply knocks out the late 2024 expansion that aimed at decentralized finance and other noncustodial actors.

The Congressional Review Act has a second effect. It bars an agency from reissuing a new rule that is substantially the same as the disapproved rule unless Congress passes a new law. In practice that creates a window. Treasury and the IRS will need time to draft a narrower approach and may seek input. Builders now have a rare chance to influence the shape of onchain compliance by shipping credible solutions before any new proposal lands.

What still applies in 2025 and 2026

The June 2024 final regulations remain in force. They cover brokers that take possession of customers’ digital assets, including operators of custodial trading platforms, hosted wallet providers, digital asset kiosks, and some payment processors that actually hold customer coins for settlement. The IRS summarizes the scope and the phase in under the IRS final regulations for custodial brokers.

Here is what those rules require, in plain language:

- 2025: custodial brokers must report gross proceeds on Form 1099-DA for customer sales and exchanges that occur in the calendar year 2025. Many brokers received transition relief from penalties while systems catch up, but the general obligation to furnish payee statements and report gross proceeds begins with 2025 activity.

- 2026: basis reporting begins for covered assets. That means a custodial broker must include the customer’s cost basis and gain or loss for covered assets and furnish that to both the customer and the IRS. The rules include optional aggregate reporting methods for some stablecoins and certain nonfungible tokens. Where a broker chooses an optional method, basis reporting may be limited. The details vary by asset type and thresholds.

- Backup withholding and payee statements: the usual information reporting machinery applies. Collect taxpayer identification numbers. Send recipient statements. Withhold when the law requires. Transition relief may ease penalties during the first year, but brokers still need to build to the rules.

What sits outside scope after the April repeal:

- Protocol developers that do not take possession of customer assets. Publishing or maintaining smart contracts without custody is out of scope under the remaining rules.

- Noncustodial wallet software where the user holds the keys. A wallet that never takes possession is not a broker under the 2024 final regulations.

- Pure liquidity pool participants who never custody a third party’s assets. A user supplying their own assets directly from self-custody is not a broker.

Gray areas do not disappear. Some actors blend noncustodial design with significant control over user choices, routing, or matching. Treasury can pursue narrower rules that target those control points. The smart move is to design now for a world where certain noncustodial facilitators may still have limited obligations, for example to furnish transaction summaries to users who opt in.

The next 18 months by persona

To understand what actually changes on the ground in 2025 and 2026, start with who you are in the transaction.

- Custodial exchanges and brokers such as Coinbase, Kraken, Bitstamp, and Gemini: you must file Form 1099-DA for 2025 transactions with gross proceeds. In 2026 you must file with basis for covered assets. You need a plan for historical cost ingestion, corporate actions, NFT handling, and optional methods for stablecoins where relevant. Your roadmap should include customer interfaces for tax lots, lot selection, and corrections.

- Hosted wallet providers such as BitGo, Anchorage Digital, and some institutional custodians: you are in scope where you stand ready to effect sales for customers and hold assets. You need the same 1099-DA capabilities as exchanges. You also need coordination features for external venues if you route client orders.

- Noncustodial wallet developers such as MetaMask and Phantom: you are out of scope, but your users will still ask for cost basis, gain and loss, and year end reports. This is an opportunity to create wallet-native tax features that users control and to partner with 1099 providers through explicit opt in. As account abstraction advances, keep an eye on smart accounts after Pectra.

- Payment companies that custody stablecoins for merchants: you are likely in scope for sales and exchanges you effect for customers when you hold the tokens. Aggregate reporting methods may apply in 2026 depending on volumes and thresholds. You will need merchant dashboards and refund logic for corrected statements.

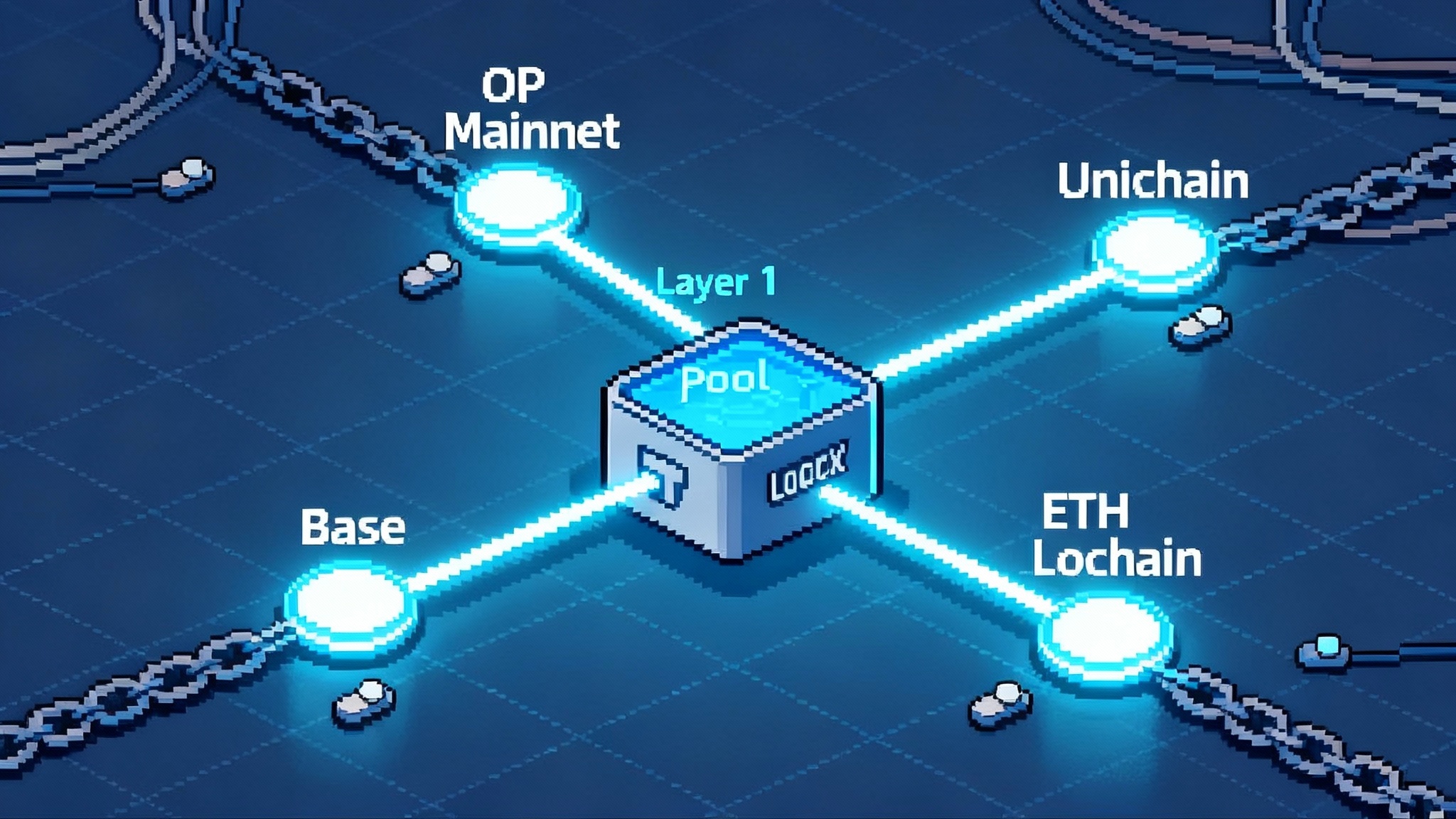

- Protocol teams and decentralized autonomous organizations, often called DAOs: you are not brokers under the surviving rules if you do not custody user assets. You do need a governance playbook to manage optional reporting features and user education, and to prepare for future agency proposals. For DEX teams, see how Uniswap v4 hooks as platforms change what a front end can do without custody.

A builder’s roadmap for the new onchain compliance architecture

The repeal created time. It did not erase the need for usable, privacy respecting tax tools. If builders seize the moment, the next proposal from Treasury can meet a market that already solves most problems without forcing awkward rules on software developers. Here is the roadmap.

1) Wallet native cost basis that actually works

User pain is simple to describe and hard to fix. People trade across many venues, bridge between chains, stake, and interact with hundreds of contracts. They want a simple number at tax time. A wallet can assemble that number without becoming a broker or sending anything to the IRS.

Product design:

- Local ledger at the wallet level. Each wallet keeps a private ledger of sends, receives, swaps, mint and burn events, and cost basis for every lot. Use a deterministic format keyed to transaction hashes and token identifiers.

- Portable, privacy first export. Build a standard export called Tax-Lot File Version 1. It is a signed, compressed file that summarizes lots without revealing addresses beyond the ones the user selects. Include a redaction layer so a user can share only what a tax preparer needs.

- Multi venue basis rules. Implement first in first out, specific identification, and average cost where allowed. Show the user the rule applied for each asset and let them override where the law permits.

- Chain scanning and heuristics. Wallets should detect wraps, bridges, and liquid staking derivatives. When the source basis is missing, mark unknown with a bright warning and suggest steps to reconcile using exchange exports or prior year files.

Business model:

- Free core, paid reconciliation. Offer the local ledger free. Charge for automated exchange import connectors, historical chain scans, and prior year reconciliation.

- Enterprise add ons. Let custodial brokers purchase in wallet basis visibility for their customers through secure APIs. The wallet remains in control. The broker can validate but not edit user lots.

Execution detail:

- Publish an open schema with a short specification. Invite tax software providers to support import and validation. Host a public conformance test that anyone can run against their implementation.

2) Opt in 1099 providers for self custody users

Users who want help will choose it. Create a provider network that furnishes Form 1099 style statements only when the user says so and only for the assets and addresses they select.

How it works:

- Permissioned relay. The user connects a wallet to a reporting provider. The wallet signs a message that authorizes read only access to selected addresses and time ranges. The wallet can revoke at any time.

- Synthetic 1099. The provider ingests the wallet’s Tax-Lot File Version 1 and produces a 1099 style statement with gross proceeds, basis where available, and a reconciliation log. It is not filed with the IRS by default. It is a user artifact that can be shared with an accountant.

- Optional filing. Add a single, very explicit toggle that allows filing with the IRS for a subset of transactions. This is meant for pilots where users ask for help with centralized exchange activity that did not receive a 1099 or for future regimes if Treasury creates a narrow opt in path for certain facilitators.

Market structure:

- Compete on accuracy. Providers differentiate on chain coverage, NFT handling, and staking rewards classification. Price on a per address or per transaction basis.

- Consumer protections. Place every consent, scope, and retention term inside the wallet flow in human readable language. Make expiry clear. Use a countdown and a bright revoke button.

3) Zero knowledge tax receipts that prove what really matters

Today a user must either overshare every wallet and every trade with a preparer or hand enter summaries and hope for the best. We can do better. Use zero knowledge proofs to show tax relevant facts without exposing raw transaction data. This can dovetail with institutional rails as ISO 20022 onchain fund flows mature.

Design goal:

- Produce a ZK Tax Receipt. It is a compact proof that the total net capital gain for a wallet over a period equals a number and that the set of transactions used to compute that number meets defined rules. The receipt does not reveal individual trades.

How to build it:

- Commitments. Inside the wallet, commit to each transaction’s key fields using a collision resistant commitment. Store commitments and a Merkle tree that indexes them by time.

- Circuits. Write circuits that compute gains and losses under specific tax lot methods. Start with first in first out for fungible tokens, then add specific identification with constraints that match IRS rules for lot selection. For nonfungible tokens, treat each token as its own lot.

- Selective inclusion. Let the user choose the addresses and the date range. The circuit accepts only those commitments and proves that the reported summary equals the computed result.

- Public reference. Publish the circuits and hash them. Include the circuit hash in every receipt so preparers and, one day, the IRS can verify which rule set was used.

Real world use:

- Preparers accept a ZK Tax Receipt along with a short reconciliation report for out of scope items like centralized exchange trades already covered by a Form 1099-DA. Over time, custodial brokers could ingest receipts to reconcile with their own statements.

- Privacy preserving audits. If the IRS ever offers a pilot, a taxpayer could authorize a verifier to check a receipt on a secure portal without uploading raw wallet histories.

4) DAO governance playbooks that separate code from compliance choices

Decentralized autonomous organizations should write down how they engage with tax reporting, even if they are out of scope as brokers today.

Practical playbook items:

- User communication. Publish a one page explainer that clarifies the protocol does not take possession of user assets, does not issue tax forms, and points to wallet native cost basis features and opt in providers.

- Optional reporting toggles. If the protocol offers a front end that aggregates user activity, add an opt in export that produces the Tax-Lot File Version 1 and a simple gains summary. The front end does not store any personal data. Everything is generated on the client.

- Vendor policy. If a DAO funds a 1099 provider integration for its users, specify that the vendor cannot file anything with the IRS without explicit user consent at the wallet layer.

- Governance alignment. Include a standard clause in the governance process that any future change that touches user data must be reviewed by a privacy working group and presented in clear language for token holder votes.

5) Exchange to wallet cooperation that reduces mismatches

A big source of pain is mismatched lots between what a user sees in a wallet and what a custodial broker reports. Fix that with simple handshakes.

- Receipt of transfer. When a user withdraws to self custody, the broker creates a signed transfer receipt that includes asset, quantity, and the basis lots depleted. The wallet can import the receipt to update its local ledger.

- Proof of origin. When a user deposits from self custody, the wallet can provide a signed proof of origin. It lists the local basis lots and their identifiers. The broker can choose to accept that as a hint and flag inconsistencies for the user to resolve.

- Correction flow. Add a standard correction flow that lets a user request an amended 1099-DA. Use the same signed receipts to ground the correction.

What to build first, and when

The repeal bought time, but deadlines remain. Here is a realistic sequence for the next 12 months.

- By December 2025: ship wallet native cost basis with the Tax-Lot File Version 1 export. Start with one chain and the assets your users hold. Add a simple gains summary. Ship a revoke friendly permission screen for any data sharing.

- By March 2026: launch an opt in 1099 provider network in beta. Focus on accurate imports from the largest custodial venues and on a clean reconciliation report that shows what was included and what remains unknown.

- By June 2026: deliver the first ZK Tax Receipt that covers fungible tokens with first in first out. Publish the circuits and a verifier in the open. Invite tax software vendors to verify receipts in their tools.

- Year round: work with custodial brokers on transfer receipts and proof of origin handshakes. The mutual goal is fewer mismatches when 1099-DA forms include basis in 2026 for covered assets.

Risks to anticipate, and how to de risk them

- A narrower future rule: the agency could revisit facilitators who route orders or set transaction rules without custody. If you operate a noncustodial interface with significant control, design an opt in reporting feature now. Keep all personal data on the client side. Make any server side analytics anonymous or aggregate only.

- Bad data in, bad taxes out: the hardest problem is missing history. Solve it with strong warnings, bright unknown labels, and backup flows that import exchange CSVs or scan known addresses for historical context.

- Privacy surprises: do not create silent data exhaust. Every export and every third party connection should be obvious to the user, easy to revoke, and off by default.

- Stablecoin and NFT edge cases: 2026 methods allow some special handling. Build unit tests for these cases early and expose the logic to users in plain language.

Why this is a real chance for American leadership

The market has been asking for clarity. The April law reset shifts the burden back to builders. If wallets can give users accurate cost basis and private summaries, and if custodial brokers can reconcile those summaries with clean, signed transfer receipts, the agency’s next proposal can be modest. It can focus on true intermediaries and on bad actors, not on software.

Companies already have pieces of the puzzle. Exchanges have years of cost basis engines. Wallet teams have great user experiences. Tax software firms have import connectors and reconciliation logic. Protocol teams understand zero knowledge technology. The job now is to stitch those strengths into a coherent onchain reporting fabric that puts the user in control and gives the IRS the numbers it needs when a user chooses to share them.

The bottom line

The DeFi broker rule is gone, but custodial broker reporting is here and expanding. That split defines 2025 and 2026. Treat it as a design brief. Build wallet native cost basis that is private by default. Offer opt in 1099 providers for users who want help. Ship zero knowledge receipts that prove gains without revealing a life story. Write DAO playbooks that keep compliance choices separate from code. If the industry does these things before the next rulemaking arrives, the United States can set a model where onchain finance stays open, tax compliance gets easier, and privacy is a feature, not a casualty.