EigenLayer Goes Multichain: Portable AVSs Land First on Base

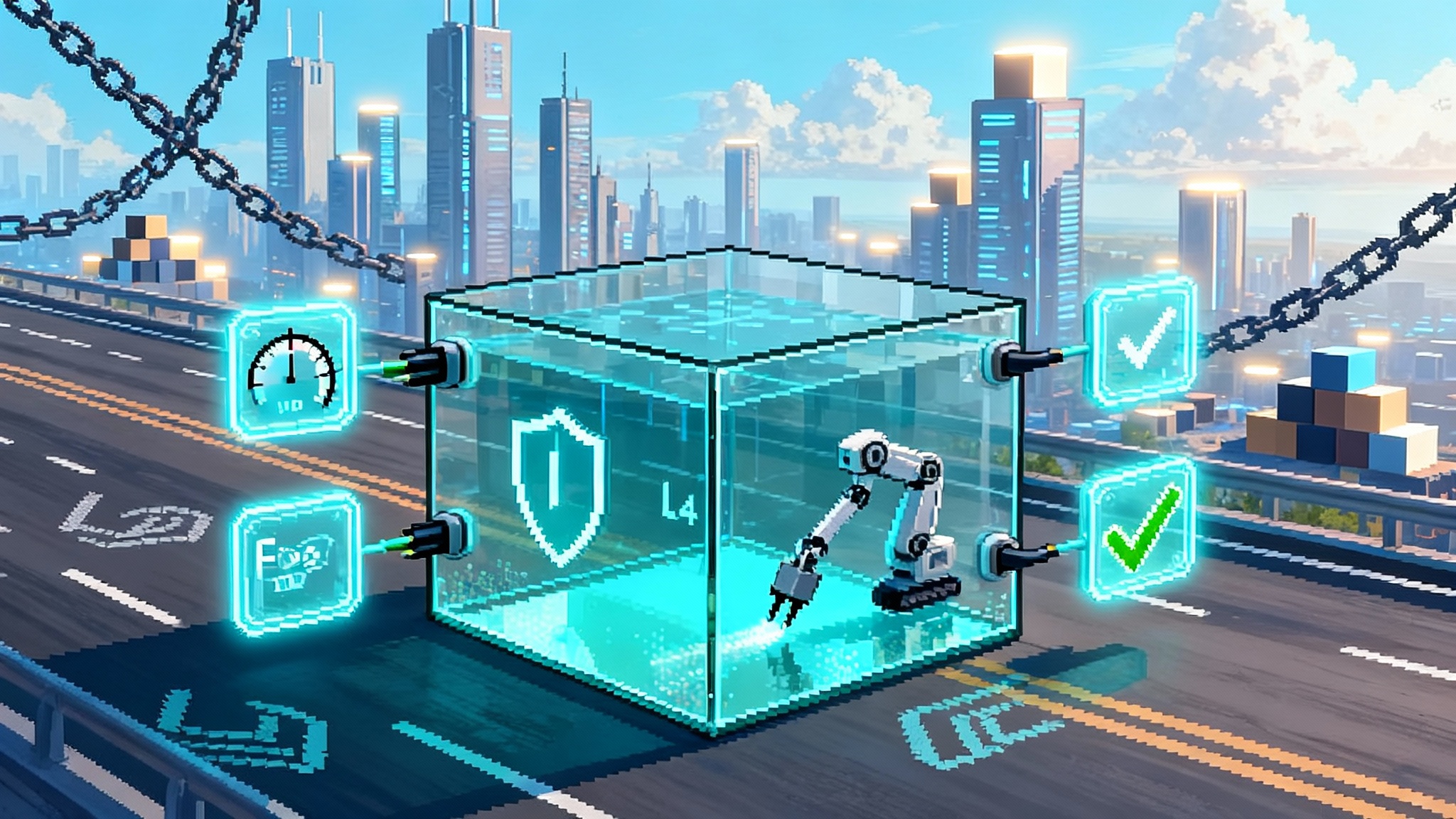

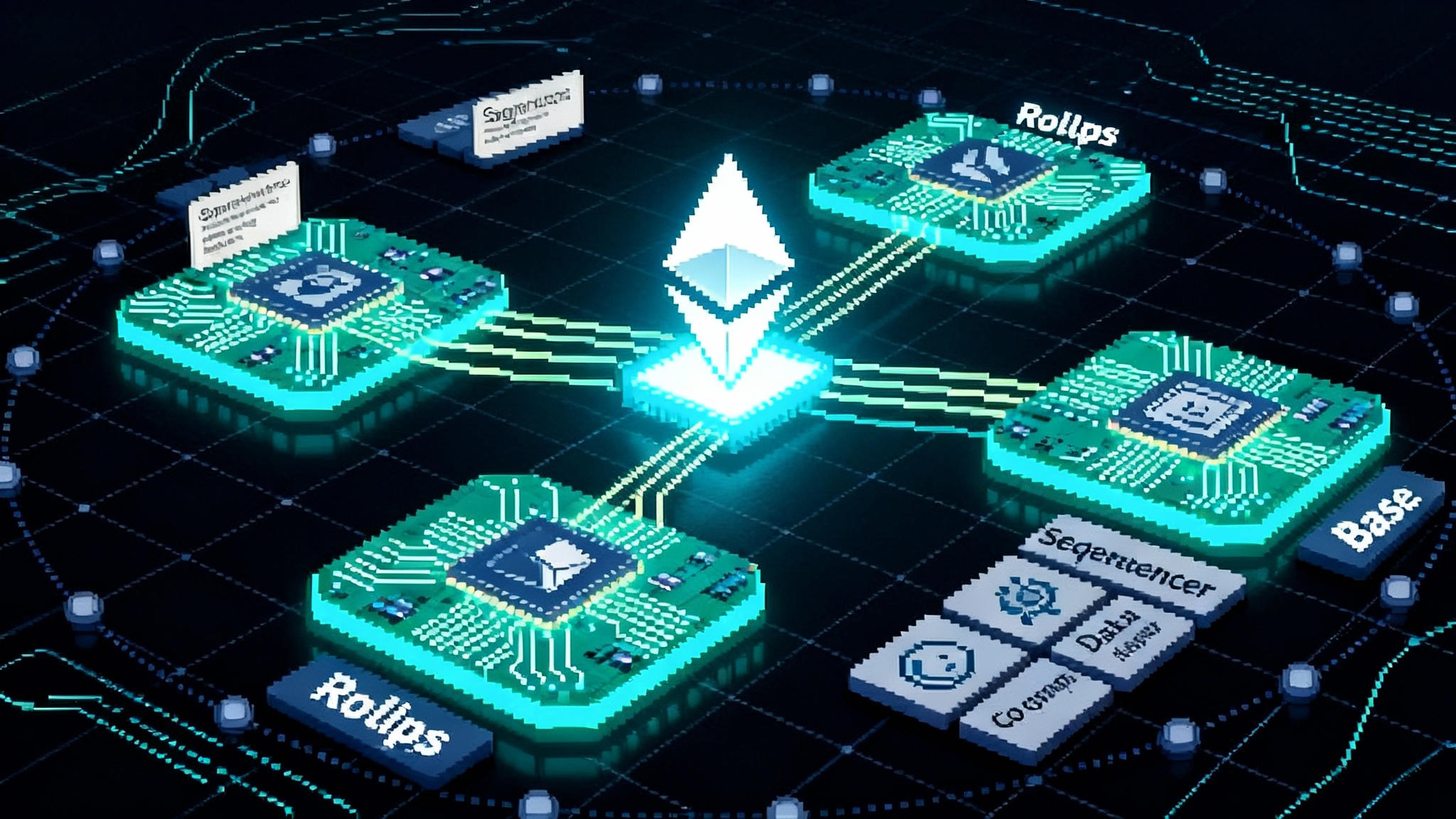

EigenLayer has switched on multichain verification, starting with Base, allowing AVSs like oracles, data layers, sequencers, and co-processors to run on L2s while staying secured by Ethereum. Here is how this could reshape L2s, MEV, fees, and cross-chain app design.

Breaking: restaking just left Ethereum’s walled garden

On July 25, 2025, EigenLayer introduced multichain verification and named Base as the first integration partner. The initial rollout went live on Base Sepolia with mainnet environments targeted for the third quarter of 2025, a step that lets Actively Validated Services move off Ethereum Layer 1 for execution while inheriting Ethereum-grade security for verification and slashing. The result is simple to say and big in impact: Ethereum-secured services can now run where users are, not only where the security anchor lives. The Block covers multichain launch.

If restaking on EigenLayer was the power outlet, multichain verification is the travel adapter. An oracle, data layer, shared sequencer, or co-processor can plug into the same pooled security and light up on different chains without re-engineering trust from scratch. This is a concrete step toward a cloud of crypto security that reaches across rollups.

What changed under the hood

Multichain verification standardizes how AVSs consume operator sets, stake weights, and slashing signals across chains. Instead of every chain needing its own full copy of EigenLayer’s accounting, the system transports the essential facts operators need to attest to work and the rules needed to punish misbehavior. Think of it as syncing a directory of trusted workers and their commitments, then letting those workers perform on any stage that supports the format.

The design is outlined in EigenLayer’s ELIP-008, which specifies standardized operator key registration, operator weighting, and cross-chain certificates for task verification. In short, verification and accountability are portable while chains keep their execution advantages. For the technical blueprint, see ELIP-008 on the EigenLayer forum.

A few pieces of context matter:

- Slashing went live in April 2025. Misbehavior can be penalized on-chain, and multichain verification reuses those guarantees across L2s.

- EigenCloud arrived in June 2025. It signals a broader direction: data availability, dispute resolution, and verifiable compute that any chain can consume while settlement and penalties remain anchored to Ethereum.

Why Base was first

Base has a large and fast-growing builder community, low fees, and a culture of pragmatic integrations. Launching on Base Sepolia let AVSs test real multichain flows without taking early production risk. For developers, it was the smoothest runway to try portable verification while keeping Ethereum’s trust anchor.

The next 6 to 12 months: five shifts to watch

1) L2 competition tilts to who hosts the best security-backed services

Until now, L2s mostly competed on speed, fees, and incentive programs. With portable AVSs, they will compete on which high-value services show up first. A rollup that hosts the richest menu of Ethereum-secured infrastructure wins developer attention. Expect a race to integrate or co-market with leading AVSs: oracles, shared sequencers, fast finality layers, co-processors for AI inference or zero-knowledge proving, and indexing or search services.

Practical implication: the first rollups to support easy AVS onboarding and to advertise clear revenue paths for operators will attract the most portable security. Base is early. Others will follow quickly to avoid app fragmentation.

To see how L2s become app platforms, compare with Uniswap v4 hooks on L2.

2) Fees bend down and flatten across chains

When verification and slashing live in a shared Ethereum-backed layer, AVSs can execute on an L2 at L2 gas prices while paying only a fraction of verification overhead per task. That allows more frequent service calls. Oracles can post more granular updates. Data layers can chunk proofs more aggressively. Shared sequencers can offer preconfirmations without forcing every verification step through Layer 1.

Expect visible effects:

- More apps choose L2-first deployments for heavy service usage while keeping Ethereum as the security and settlement root.

- Service pricing shifts from per-chain monopolies to cross-chain menus. If an oracle posts the same update across chains with a single security budget, the unit cost per chain falls.

3) MEV markets start to bridge for real

Portable AVSs make it easier to coordinate cross-domain ordering, preconfirmation, and censorship resistance. A shared sequencer or intent network can anchor its slashing to Ethereum while offering per-chain execution lanes. That opens three paths:

- Cross-chain order flow aggregation with better price discovery as quotes propagate across rollups with consistent verification rules.

- Richer preconfirmation markets where apps buy latency guarantees from a sequencer AVS that faces real penalties if it fails.

- Lower leakage to opaque intermediaries as standardized slashing and operator sets enable open designs for cross-chain MEV capture.

Winners will be the teams that turn MEV management into a productized service with clear penalties and revenue sharing. Losers are bridges and order routers that relied on trust over verification.

4) Cross-chain app design changes shape

Portable verification invites new architectures:

- Split brain apps. Keep business logic on a low-cost L2 like Base. Consume a secured oracle and dispute layer from EigenLayer. Finalize to Ethereum only when needed.

- Any-chain co-processors. Run compute-heavy tasks like AI inference or proof generation on a co-processor AVS and deliver results across multiple chains with the same security assumptions.

- Shared state light clients. A storage AVS can expose a consistent snapshot to many rollups. Apps no longer build chain-specific integrations for the same dataset.

The design pattern to remember: execute where it is cheap, verify where it is safest. As Ethereum evolves, align with the Post-Pectra Ethereum roadmap.

5) Governance, audits, and risk move cross-chain

The biggest cultural shift is operational. When an AVS opts into slashing and redistribution, penalties and rewards affect stakers, operators, and users across chains. That means governance and incident response must be synchronized. AVS builders will need clear documentation, real-time dashboards, and a crisis playbook that works across multiple rollups at once. For oracle-centric teams, lessons from Swift and Chainlink integrations can inform reliability and disclosure norms.

Concrete plays for builders

You asked for actionable guidance. Here it is, step by step.

Where to deploy first

- Start on Base. The developer tooling is strong, the community is primed, and multichain verification began there. You will get early support and a faster feedback loop.

- Choose a second home thoughtfully. If you are latency sensitive or order flow heavy, target a rollup with a credible shared sequencing roadmap. If you are data intensive, target chains with cheap blob space and robust archival infrastructure.

- Avoid overextension. Two chains are enough to prove cross-chain value. Add more only when metrics show you can support them.

How to route security and slashing risk

- Define slashing conditions per service action. For an oracle, punish missed updates beyond a threshold and provable manipulation against reference feeds. For a sequencer, punish delivery failures and provable reorderings that violate preconfirmation terms.

- Use redistributable slashing where appropriate. Direct a portion of penalties to harmed counterparties or to reliability pools. Leave room for discretionary grants only if the policy is on-chain and transparent.

- Separate operator sets for different risk tiers. High availability work can use larger, more diverse sets with smaller per-operator stakes. High corruption-resistance work should use smaller, heavily collateralized sets.

- Denominate obligations in stable units when possible. Pay operators in a stablecoin or in a staked asset with a hedge plan, rather than exposing them to price risk that could ruin incentives during market stress.

- Budget for Ethereum finality. Design your dispute windows and slash proofs to account for L1 finality and L2 confirmation rules. Test worst-case latencies before you promise service-level agreements.

Operational setup that saves headaches later

- Write a cross-chain incident playbook. Specify who can pause which contracts, on which chain, with what timelocks. Define an on-call rotation that includes operators and AVS maintainers.

- Instrument everything. Expose dashboards for missed tasks, delayed attestations, and slashable events. Alert when operator weights drift or when a chain falls behind in certificate updates.

- Pre-negotiate operator exits. Define minimum notice periods and automatic rebalancing when a large operator withdraws. Make sure the offboarding path does not leak slashing power or create gaps in coverage.

- Keep upgrade keys simple and safe. Put the real authority on Ethereum with timelocks. Mirror minimal proxies on L2s that cannot unilaterally change slashing or operator sets.

Gotchas to avoid

- Slashing UX is unforgiving. A sloppy on-chain condition can accidentally penalize operators for events caused by external chain failures. Dry-run on testnets with fault injection. Simulate timestamp drift, reorgs, and oracle stalls.

- Cross-chain state sync can fail. Build a second data-transport path for operator weights and certificates. Even if you never use it in production, it is your airbag during an outage.

- Incentives can invert across chains. An operator’s cost base differs per rollup. If your rewards do not reflect this, operators will silently prioritize some chains over others. Publish per-chain rewards and penalties so expectations are unambiguous.

- Governance sprawl is real. If you add a new chain, do not create a new governance surface. Route control to the same Ethereum-rooted process and mirror only what is necessary.

Winners and losers in a multichain restaking world

-

Likely winners

- L2s that court AVSs with clear paths for revenue and predictable operations. Base is first. The next to ship credible integrations will see a developer influx.

- AVS categories that benefit most from frequent calls: oracles, indexing, storage proofs, preconfirmation layers, and verification marketplaces. Expect new entrants to compete with incumbents in oracles and MEV management by anchoring stronger slashing to Ethereum.

- Professional operators who can run fleets across chains and manage slash exposure. Their edge is process and monitoring more than raw hardware.

-

Likely losers

- Single-chain middleware that relied on isolation for pricing power. Once an Ethereum-secured alternative becomes portable, payers will push for cross-chain pricing and accountability.

- Bridges and brokers that monetize opacity. With portable verification and standardized slashing, open designs will replace closed ones.

- L2s that treat AVSs as afterthoughts. If your rollup makes it hard to deploy and measure service performance, builders will launch elsewhere first.

How this changes MEV, order flow, and user experience

Cross-chain preconfirmation becomes a product. A sequencer AVS can sell soft commitments to users and apps across several L2s while pointing to a single Ethereum-based penalty contract. Arbitrage becomes more efficient because the same intent network can police itself with slashing that everyone recognizes. Users will not see the machinery. They will see fewer failed transactions, more predictable inclusion, and tighter spreads.

For wallets and frontends, portable AVSs remove a decision burden. Instead of supporting one oracle vendor on each chain, a wallet can integrate one Ethereum-secured oracle that publishes to several chains under one service contract. The same is true for data availability and co-processors. This consolidates security assumptions and simplifies audits.

What to watch next

- Which L2s announce native support for multichain verification certificates. Expect at least two more large rollups to follow Base so they are not left out of the service menus that matter to apps.

- Which AVSs treat redistribution as a core feature. If slashed funds compensate harmed users reliably, trust in service-level guarantees will increase and adoption will accelerate.

- The first portable shared sequencer with meaningful penalties. This will be a watershed because it translates cross-chain MEV talk into enforceable guarantees.

- Tooling for operator selection, simulation, and hedging. The easier it is to model slash risk, the faster professional operators will scale across chains.

The bottom line

Restaking has crossed a threshold. In July through Q3 2025, EigenLayer turned Ethereum’s security into a portable good that AVSs can take to where users and throughput live. The strategic lever is not only yield for stakers. It is the ability to sell verification and accountability as a shared product across chains. If you build, launch where onboarding is smooth and your users are concentrated. If you run infrastructure, professionalize your operations and your risk book. If you run a rollup, make your chain the easiest place for portable AVSs to plug in. The cloud of crypto security is here. The first movers will set the defaults everyone else has to live with.