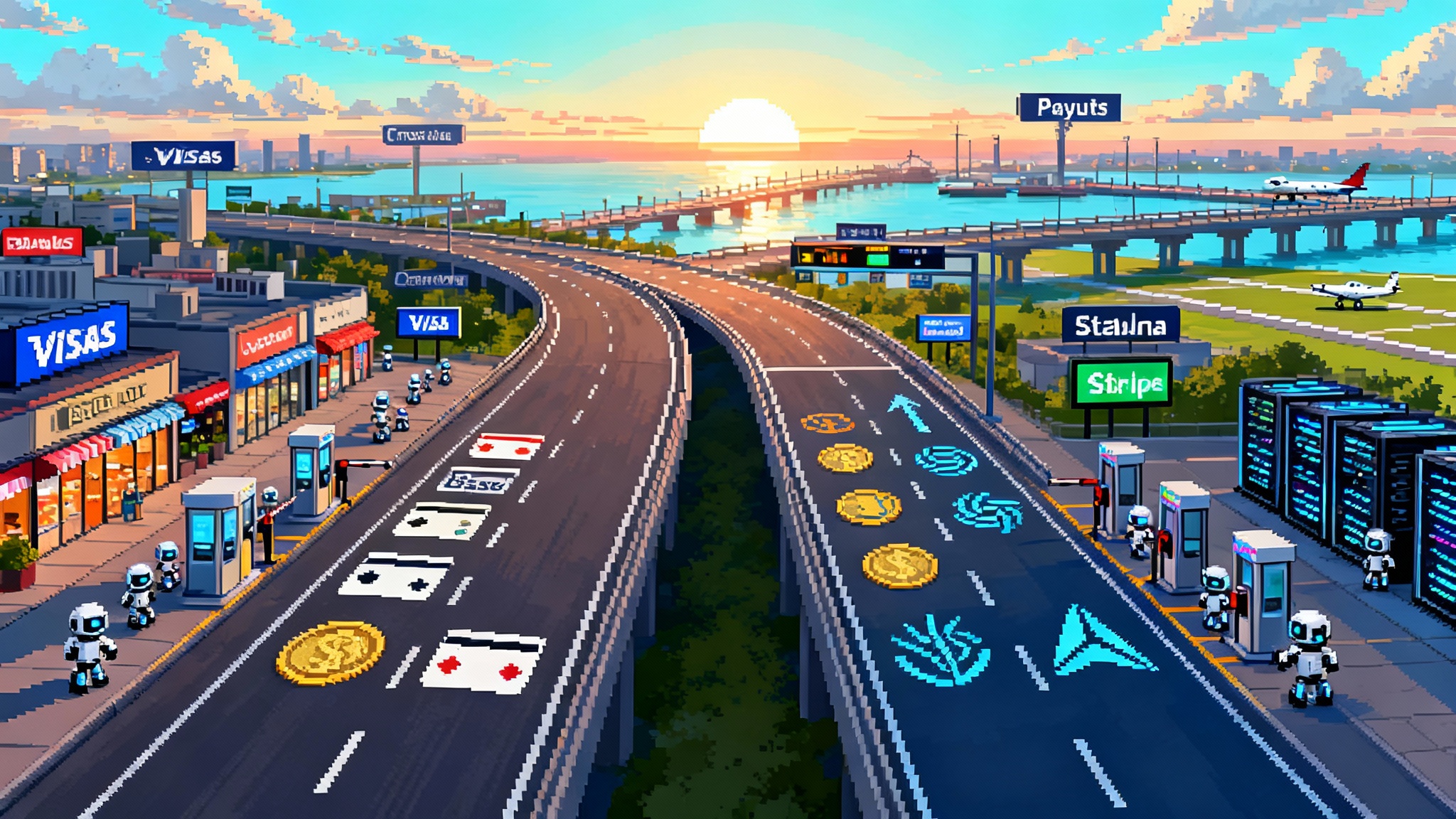

Stablecoin Rail Wars: Visa and Stripe Go Mainstream

Clear rules just unlocked prime time for stablecoins. After the GENIUS Act became law in July 2025, Visa expanded multi coin, multi chain settlement while Stripe rolled out USDC checkout and a coin issuance platform. Here is what it means for builders, merchants, and finance teams—and how to act now.

Breaking: Stablecoins are graduating to prime time

On July 18, 2025, the GENIUS Act became law in the United States, setting clear ground rules for payment stablecoins, from one to one reserve backing to bank secrecy obligations and issuer supervision. It is the moment stablecoin builders have waited for, because it removes the fog that kept mainstream payment companies on the sidelines. The policy signal is now visible from orbit, and the biggest brands in payments are moving fast. See the official confirmation in this White House fact sheet.

Within weeks, Visa said it would support more stablecoins, more blockchains, and even the euro backed EURC in its settlement stack. The company named PayPal USD and Global Dollar alongside existing USDC support, and added Stellar and Avalanche to Ethereum and Solana. The announcement on July 31, 2025 underlined a simple point: settlement is going multi coin and multi chain, attached to the rails merchants already use every day. Read Visa’s details here: Visa expands stablecoin settlement support.

Stripe is pushing from the other side of the funnel. In June 2025, Stripe and Shopify began enabling USDC checkout on Base for millions of merchants, with funds auto settled to local currency by default or paid out in USDC to a wallet if a merchant prefers. In September 2025, Stripe unveiled Open Issuance, a platform for companies to launch their own branded stablecoins with reserve management, interoperability, and compliance pre wired. The message from both giants is unmistakable. Stablecoins are not a side quest. They are the next default for internet money.

What a stablecoin rail actually is

Think of a rail as a two layer highway. The first layer is the blockchain that carries value packets all day and night. The second layer is the adapter that makes those packets usable inside existing commerce workflows. That adapter includes issuer controls, know your customer checks, fraud tooling, treasury settlement, dispute operations, and reporting. Crypto had the first layer years ago. What it lacked at scale was the second layer that card networks, processors, wallets, acquirers, and enterprise resource planning systems recognize. Visa and Stripe are building that adapter into places where commerce already lives, a theme that rhymes with how banks are mapping ISO 20022 into onchain fund flows.

A practical example: a marketplace in Mexico wants to pay a creator in Nigeria in near real time with low fees and predictable settlement. On a pure blockchain path, that means juggling token liquidity, wallet support, compliance checks, and local off ramps. On a stablecoin rail, the marketplace triggers a payout in USDC, Stripe or a partner handles the compliance and conversion logic, and the creator receives value in a wallet or a connected bank account, often within minutes. The merchant never touches a private key or worries about which chain has the best throughput today.

Visa’s move turns stablecoins into a settlement currency, not a novelty

Visa’s July expansion matters for three reasons:

-

Supply diversification. Supporting PayPal USD and Global Dollar, alongside USDC, and adding euro backed EURC, reduces single issuer exposure. That lowers operational risk for acquirers and wallets that do not want all flows dependent on one company’s coin.

-

Network optionality. Settlement over Ethereum, Solana, Stellar, and Avalanche gives treasury teams knobs to turn. They can pick a chain with the fee and finality profile that matches their risk appetite and cash management needs.

-

Treasury integration. Visa positions stablecoins as another currency in its settlement layer. That means an acquirer can pre fund or settle obligations in a digital dollar the same way it uses a fiat currency account today. It moves stablecoins from the experimentation lab into the boring, business critical function that closes the books.

If you run payments at scale, boring is beautiful. Boring means predictable accounting entries, familiar reconciliation, and standard payment operations. Visa is aiming exactly at that outcome.

Stripe’s play: default checkout plus a coin factory

Stripe’s USDC checkout on Base with Shopify is a distribution win. Millions of merchants get a new tender type without implementing a crypto gateway, and shoppers can pay from many popular wallets. For most merchants, the default setting converts funds to local currency in their bank accounts with no additional reconciliation work. For crypto native shops, leaving funds in USDC keeps them on chain for treasury or on chain payouts.

Open Issuance is the second shoe. A stablecoin issuance stack with reserve management, audit ready controls, and interoperability is a power tool for platforms with large user bases or closed loop economies. A gaming platform can mint a branded dollar that is swappable one for one with other Open Issuance coins, while fine tuning which chains it supports and how reserves are allocated between cash and short term treasuries, a trend reinforced by the growth of tokenized Treasuries. A ride hailing network could use a branded coin to pay drivers instantly after a trip, then let drivers swap to any major coin, or cash out to their bank by the end of the day. You get the user experience of store credit with the spendability of cash and the portability of a stablecoin.

Crucially, Open Issuance leans into GENIUS ready compliance. That term will become a buying criterion. Merchants, platforms, and banks will ask a simple question: does this stablecoin program meet the law’s reserve, disclosure, and control requirements today, and are the obligations portable if we switch issuers or processors tomorrow. Stripe’s answer is to make compliance a feature of the platform rather than an afterthought, aligned with a practical U.S. onchain compliance playbook.

Near term impact forecast

Cross border commerce

- Settlement speed and working capital. Expect settlement windows to compress from days to hours for many corridors. A Latin American merchant that receives weekend sales in USDC can settle through a processor on Sunday, freeing cash on Monday morning, rather than waiting for midweek bank wires. That reduces the need for expensive cross border prefunding.

- Fee compression. Stablecoin settlement shifts volume from closed correspondent banking loops to open rails. Processors can share savings with merchants without changing the checkout experience. Expect early discounts for stablecoin settlement in high fee corridors, since the economics are easiest to prove there.

- Local currency choice. Merchants can choose to hold a portion of receivables in USDC as a working capital buffer, then convert to local currency on demand. This is a hedge against local currency volatility without opening a new bank account.

Creator and marketplace payouts

- Instant, small value payouts. Paying out ten dollars to a creator after a live stream is not economical on wires, and is slow on card rails. Stablecoins make micro payouts and daily sweeps trivial, which will change creator expectations. If one platform pays daily, rivals that pay weekly will see churn.

- Lower failure rates. Bank account and name mismatches are a common cause of payout failures. A wallet address or a hosted wallet account reduces data entry errors. Expect marketplaces to see fewer support tickets about missing funds.

AI agents and machine commerce

- Always on clearing. Agents do not sleep. Stablecoins clear around the clock. That lets agents buy compute, data, or microservices at any hour without batching payments for banking windows.

- Pre authorized spending. Merchants can create spending allowances for agents with revocable limits. That aligns with how developers already manage application programming interface keys and budgets. Expect new commerce patterns like agents paying per second for application programming interface calls, with refunds on unused allowances.

- Interchange free machine to machine payments. For commodity machine transactions under a dollar, stablecoins often beat card economics. Expect pilots for vending, charging, and connected devices to shift to stablecoins, especially in developer heavy markets.

Integration playbooks for builders and merchants

Merchants on Shopify and Stripe

- Turn on USDC checkout. Start with a limited offer, such as international orders above one hundred dollars, where fee savings and fraud controls are clearest. Monitor conversion, chargeback rates, and customer support load.

- Pick a treasury policy. Decide whether to auto convert to local currency or retain a portion in USDC for supplier payments or cross border refunds. Write a one page policy and share it with finance and support teams.

- Enable on chain refunds. Add logic to automatically return USDC to the sending wallet where available. This reduces refund processing time, which improves customer trust for first time crypto payers.

Marketplaces and platforms

- Add stablecoin payouts as a first class option. Offer daily and on demand sweeps. Provide a simple wallet experience for users without wallets, and a bring your own wallet option for crypto native users.

- Route by corridor. For cross border payouts, pick chains by corridor based on latency, fee, and liquidity. A rule of thumb: default to Base or Solana for retail sized payouts, fall back to Ethereum for larger settlements, and use Stellar for remittance heavy routes if your processor supports it.

- Compliance by design. Bake know your customer and sanctions checks into user onboarding for payout recipients. Reuse your existing card payout risk framework. Most of the review logic is the same, but add wallet address screening and chain analysis alerts.

Financial apps and wallets

- Build gas abstraction. Let users pay fees in the same stablecoin they hold, even when the underlying chain requires its native token for gas. This removes a top three source of first payment failure.

- Make chain choice invisible. Present a human label at checkout such as Fast or Low fee instead of chain names. Power users can override, but most consumers should not be asked to choose a chain.

- Add spending controls. Support per transaction limits, daily caps, and virtual sub wallets. These controls help consumers feel safe, and they make enterprise adoption possible.

Enterprises and global brands

- Pilot with internal use cases. Start with contractor payouts, travel reimbursements, or digital gift cards. These are contained flows with clear savings and low external dependencies.

- Connect accounting. Map stablecoin flows to your chart of accounts. Create reconciliation rules and automate mark to market for any balances you hold intra month.

- Plan for data retention. Decide how long you store address and transaction metadata, and how you will respond to data subject requests. This avoids retroactive privacy work when volumes scale.

The risks worth managing

Issuer fragmentation

There will be more issuers, not fewer. Visa’s expansion and Stripe’s issuance stack invite a Cambrian bloom. The risk is liquidity scatter and inconsistent controls. The mitigation is twofold. First, prefer coins that publish monthly reserve reports, that support attestation by recognized auditors, and that operate under clear GENIUS Act authority. Second, integrate a swap layer that lets you convert among preferred coins at minimal spread. Treat coin conversion as a core treasury function.

Compliance portability

Many teams will start with one processor or issuer and later switch. You want your know your customer and anti money laundering stack to travel with you. Use providers that export decision logs, risk scores, and case notes in a standard format. Write contract language that treats your compliance rules as your intellectual property so they can be reused with a new vendor. If you have platform sub merchants, standardize their due diligence package so they can be re underwritten without repeating document collection.

Wallet user experience

Wallet user experience is still rough for first time users. The practical fixes are known:

- Social and passkey recovery rather than twelve word seed phrases

- Clear fee previews with total cost in local currency

- Address books and human readable payment identifiers

- Built in test mode for a one dollar first payment with a fast refund so users can try before trusting

Chargebacks and buyer protection

Stablecoins do not have card style chargebacks by default. That does not mean less consumer protection. It means merchants must publish clear refund policies and implement fast on chain refunds or off chain credits. Platforms can layer buyer protection on top by escrow, dispute review, and release conditions. Document these flows so support teams know when to refund and when to escalate.

Accounting and tax

Stablecoins introduce new reconciliation rows, not new physics. Treat them like foreign currency subledgers. Automate balance snapshots at month end, capture realized and unrealized gains if you hold inventory intra month, and ensure your auditors can replay wallet activity from chain data. For tax reporting, align payout reporting timelines with your existing payroll or contractor processes to avoid duplicate filings.

On chain risk and sanctions

Chain analysis and address screening are table stakes. More important is response. Practice playbooks for freezing funds when required under law, for rejecting incoming payments from blocked addresses, and for filing suspicious activity reports. The GENIUS Act makes these obligations explicit. Your team should be able to demonstrate how they comply before volumes spike.

How the next year likely unfolds

- Merchant share. A visible minority of large merchants turn on stablecoin checkout as a tender type by default for international buyers. Early signs appear in travel, software, gaming, and high average order value retail.

- Cross border payout share. Marketplaces push daily or near instant stablecoin payouts to contractors and creators in high fee corridors, then expand to mid fee markets as user demand grows.

- AI agent pilots. Developers treat stablecoins as the default balance for agent wallets. Expect an ecosystem of prepaid agent allowlists, spend caps, and refund protocols to standardize in software development kits.

- Issuance diversity. At least a dozen branded stablecoins launch under platforms with large user bases. The winners will be those that are redeemable one for one into a major coin, liquid on day one, and usable for payouts and checkout inside the same platform.

The builders’ checklist to win now

- Ship stablecoin native checkout. Offer it alongside cards and wallets. Start with USDC on Base or Solana. Measure conversion, refund time, and fraud deltas, not just authorization rates.

- Offer stablecoin payouts on day one. If you are a marketplace or platform, make stablecoin payouts a peer to peer foundation, not an add on. Users care more about getting paid fast than paying fast.

- Support two to three chains. Pick based on corridor needs and wallet reach. Keep chain logic behind an abstraction layer.

- Integrate a simple swap. Users will arrive with the coin they have, not the coin you prefer. Smooth conversion prevents checkout drops.

- Make compliance an asset. Build reusable due diligence templates, decision logs, and export tools so you can change vendors or add new issuers without rewiring your risk program.

- Document money movement. Write and share a merchant facing money movement diagram that shows where funds sit at every step, when they settle, and who holds what obligations. Clarity builds trust.

The bottom line

The combination of a clear legal framework and decisive moves by Visa and Stripe changes the center of gravity. Stablecoins are not a speculative sideshow. They are becoming the default internet money for cross border commerce, creator payouts, and machine to machine payments. The winners of the next year will not be those who publish manifestos about what stablecoins might do someday. They will be the teams that put stablecoin checkout and payouts into production, measure the results, and iterate. The rails are being built. The on ramp is open. The only question left is whether you ship before your competitors do.