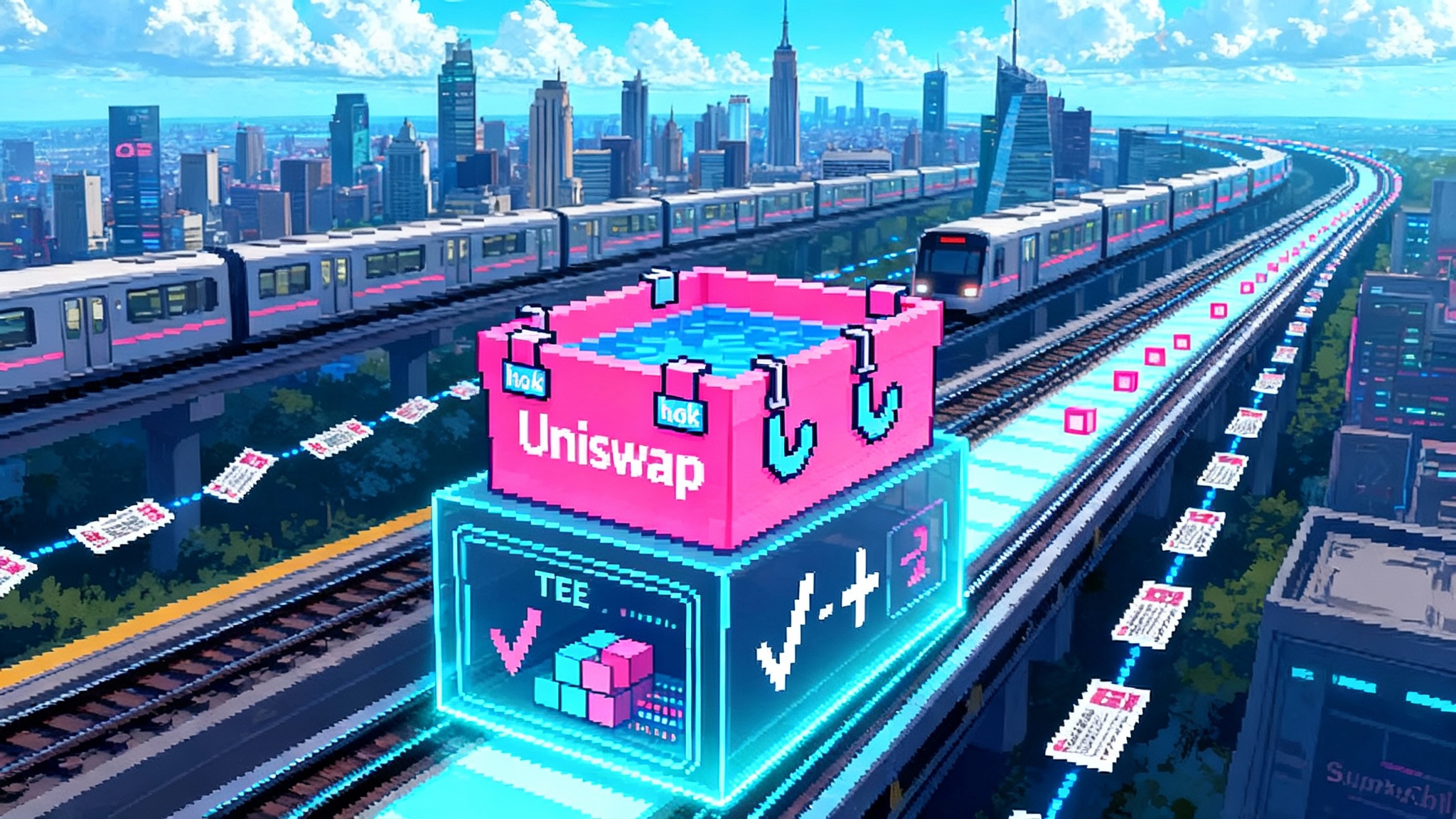

Uniswap v4 hooks + Unichain: a DEX becomes a full‑stack L2

Uniswap’s v4 hooks turned pools into programmable modules, and Unichain added a fast, MEV-hardened home for them. Here is what that platform-plus-chain shift means for traders, LPs, and builders right now.

The day a DEX became a platform and a chain

On January 31, 2025, Uniswap shipped v4 with programmable hooks, turning each liquidity pool from a fixed machine into an extendable module. It was not just a version bump. It was the moment Uniswap stopped being only an application and started acting like a developer platform. The team said it plainly in their launch post: v4 is designed for builders, with custom logic that can be attached to pools as cleanly as a browser extension clips onto your browser bar. Uniswap v4 is here.

Two weeks later, on February 11, 2025, Uniswap launched Unichain mainnet, a layer 2 network built on the OP Stack and aligned with the OP Superchain. Unichain is tuned for markets: one second blocks at launch, and a roadmap that includes sub second confirmations, fair ordering, and revert protection. In one move, Uniswap added the last piece of the stack it did not control. It now owns the app, the liquidity layer, and the chain that optimizes them. Unichain mainnet is here.

What changes when a decentralized exchange becomes both a platform and a chain? You get a programmable marketplace sitting on top of a fast, MEV hardened settlement layer, with native routes across a wider Superchain. Traders see better execution and new order types. Liquidity providers see safer automation and more flexible fees. Developers see primitives they can compose like Lego, instead of monolithic boxes.

Hooks 101: the simple mental model

Imagine every Uniswap pool as a kitchen. Before v4, a chef could choose from a fixed menu: set the fee tier, choose a price range, and serve. With hooks, the kitchen accepts plug in appliances that can turn any recipe into your own signature dish. A hook is a small smart contract that can run code before or after key pool actions: create a pool, add or remove liquidity, execute a swap, or donate fees.

Some concrete examples that developers are already shipping:

- Native limit orders: a hook escrows your tokens, watches the price, and executes a swap only if a target is reached. No need to babysit the screen. The hook handles the if this, then that.

- Time weighted execution: a time weighted average market maker hook slices a large trade into multiple tiny swaps across blocks to reduce price impact, like dripping water rather than dumping a bucket into a pool.

- Dynamic fees: a volatility sensing hook nudges fees up when markets are noisy and down when they are calm, protecting liquidity providers during stress while staying competitive during lulls.

- Sandwich resistance: a pre trade hook moves orders into a private flow or inserts checks that make classic front running unprofitable, then enforces a fair ordering rule at settlement time.

- Compliant or specialized pools: an institution only pool requires an allowlist to add liquidity while still enabling permissionless trading, or a real world asset pool bakes in settlement logic for offchain transfers. For context on the policy backdrop, see how the U.S. onchain compliance landscape is evolving in After the DeFi rule repeal.

Two bits of architecture make this scalable:

- Singleton design: all pools live under one PoolManager contract. That saves gas and lets multi hop routes settle their net token balances at the end of the transaction instead of paying transfer costs hop by hop. Think of it as a highway with one tollbooth at the exit.

- Flash accounting and native Ether: v4 tracks intermediate debits and credits in temporary storage and allows direct Ether trading. That reduces bookkeeping and the overhead of wrapping and unwrapping tokens.

The result is a wide design space. Hooks turn Uniswap from a place where you choose from a list of predefined pools into a platform where you can ship your own pool behaviors. If you are a developer, you can write a weekend hook that automates rebalancing with a simple rule, then graduate to a production ready module after audits and guardrails. If you are a protocol, you can build your next feature directly in the trade path rather than standing up a whole new exchange.

Unichain’s design: speed, fairness, and native interoperability

Building features on the application layer is only half the story. Settlement still decides everything. This is where Unichain matters.

- Fast blocks: Unichain launched with one second blocks. That already reduces latency for routing and rebalancing. The roadmap then introduces sub second confirmations that make trading feel immediate.

- Fair ordering and revert protection: Unichain’s block builder runs inside a trusted execution environment and is designed to order transactions by simple priority fees, while supporting private mempools and revert protection for apps that opt in. For traders, that means fewer failed transactions and less exposure to the classic sandwich pattern. For liquidity providers, less value leaks to extractive strategies during volatile moments.

- OP Superchain alignment: Unichain is part of the OP Superchain. Native interoperability promises single block message passing between participating chains once live. Instead of bridging through mainnet and waiting, an app can send a message from one Superchain network to another and see it confirmed inside the next block. Think of it as turning many cities connected by dirt roads into neighborhoods linked by a subway. The broader multichain trend is already visible as EigenLayer goes multichain on Base.

This has direct consequences for routing:

- Routers can plan across chains as if they were lanes on the same highway. If the best price for leg one is on Base and the best price for leg two is on Unichain, a solver can stitch the steps together with one user intent and settle atomically once interop is enabled.

- Liquidity can concentrate where it earns the best, then be reached through fast cross chain messages. Liquidity mining no longer needs to fork pools across every network. It can favor a hub and route to it.

What traders, LPs, and builders get on day one

Here is what each group can do now, without waiting for distant roadmaps.

-

Traders

- Use native limit orders where hooks make them available. You can place a target, walk away, and let the hook execute when the pool’s price crosses your mark.

- Expect more consistent execution on Unichain when apps opt into fair ordering and revert protection. That removes some of the guesswork around slippage and failed swaps.

- See more routes. UniswapX and other solvers can route across v2, v3, and v4 and, where supported, across chains. As liquidity migrates to v4 hooks, exotic routes will become normal.

-

Liquidity providers

- Choose vault style strategies built as hooks. For example, a vault could widen your range when realized volatility spikes and tighten it when volumes are high. It could skim trading fees into a reserve and dollar cost average into the stronger side of the pair, reducing the sting of divergence loss.

- Pick fee policies that suit your risk. In volatile markets, dynamic fee hooks can raise fees to compensate, then relax when volumes normalize.

- Earn on faster markets. With one second blocks and sub second confirmations on the way, you get more frequent fee accrual events and tighter price discovery.

-

Builders

- Ship features inside the swap lifecycle. Want native referral fees, buffered settlements, or oracle guarded trades? Add them with a hook. Start with templates and standards from the community, then harden with audits.

- Compose across chains. As OP Superchain interop becomes widely available, you can orchestrate cross chain steps without users switching networks or touching risky bridges.

- Integrate with official front ends. v4 was designed to be part of the default route. If your hook aligns with safety and UX requirements, interfaces can discover and surface it. That turns a niche hook into runway for mainstream users.

Intent based order flow meets hook logic

Intents turn a user’s action from a step by step instruction into a goal. Instead of telling the system how to swap, you tell it what you want to end up with and let solvers compete to get you the best outcome. Uniswap’s intent rails can run orders through v2, v3, v4 pools, and external liquidity.

Hooks make those intents richer. A limit order hook can sign the order, escrow funds, and enforce execution conditions without trusting an offchain bot. A time weighted execution hook can guarantee that a whale size intent becomes many small, predictable trades. A sandwich resistant hook can refuse to settle if pre trade conditions that signal manipulation are observed.

Add Unichain’s fast blocks and fair ordering, and you get a market where intents settle quickly, private order flow stays private until settlement, and the rules for inclusion are simple and auditable. The pipeline from user signature to settlement tightens, which reduces opportunities to extract value in the gaps. This also aligns with the industry’s move toward standardized rails such as ISO 20022 onchain fund flows.

Cross chain swaps in practice

Picture a user who wants to move from a stablecoin on an Optimism chain to a governance token on Unichain without thinking about bridges. Here is what a near term experience can look like as native interoperability rolls out across the Superchain:

-

The user signs a swap intent in a wallet. The order expresses the desired destination token on Unichain and the minimum amount they are willing to accept.

-

A solver chooses the route. It might sell the stablecoin on Base, buy Ether on Base where depth is best, send a message to Unichain, and complete the swap into the target token using a v4 pool with a limit order hook that batches fills.

-

The chain to chain message is passed and executed inside a single block once Superchain interop is live. The user sees the final asset on Unichain without clicking a bridge or switching networks.

-

If a step would revert, the solver can pre simulate and avoid inclusion on Unichain, so the user is not charged gas for a failed attempt when apps adopt revert protection.

To the user, this feels like moving money inside one app. Under the hood, it is intents, hooks, and an L2 tuned for predictable, fast settlement.

The new risks you should weigh

Every new capability comes with fresh risk. Here are the main ones and how to manage them.

-

Hook security

- Expanded attack surface: a hook runs code at sensitive points in a pool’s lifecycle. A bug or malicious implementation can siphon value or make a pool unrouteable. Action: only LP into pools with audited, battle tested hooks. Prefer hooks that follow shared interfaces and templates, and check whether the front end you use recognizes the hook class.

- Permission signaling: v4 encodes which callbacks a hook implements in its address and uses granular before and after hooks to limit blast radius. That helps, but it does not replace audits and live safeguards. Action: treat new hooks like new protocols. Start small, read the code or summary, and monitor early behavior.

- Composability hazards: two benign hooks can interact in surprising ways. For example, a dynamic fee hook and a time weighted execution hook could work at cross purposes if not coordinated. Action: look for managers or registries that test combinations and rank safe sets, and for per pool governance that can pause and upgrade when needed.

-

Governance and the fee switch

- The v4 design leaves room for protocol fees. The Uniswap community has already taken steps to formalize governance and build tooling that would support fee activation. That would shift a slice of fees from pools to governance and could change LP returns, market structure, and routing incentives. Action: LPs should track proposals and model how a fee would affect their positions. Builders should write hooks that can adapt fee splits through governance messages rather than forking.

-

L2 trust and operations

- Trusted execution environments introduce a new trust assumption. They raise the bar on fairness and privacy but create a dependency on enclave integrity. Action: use Unichain because of its speed and MEV hardening, but design with fallbacks that do not assume a specific block builder forever. Keep an eye on public attestation and validation network milestones.

What to build next

For founders and dev teams, the opportunity is clear and specific. A short list of products that fit the moment:

- Native limit order and dollar cost average hooks. Simple to understand, immediately useful, and easy to showcase inside interfaces.

- Vault strategies that hedge divergence loss. Combine a volatility aware fee policy with an automated rebalancer and a reserve that drip feeds into the weaker side of a pair.

- Hook managers and registries. Ship a policy engine that composes hooks safely and lets per pool governance upgrade combinations without migrating liquidity.

- Cross chain solvers tuned for the Superchain. Build intent based routers that arbitrage between Unichain and other Superchain networks, then plug into standard interfaces.

- Market risk analytics for hooks. Give LPs and token teams a dashboard that explains how a pool’s custom logic changes fee capture and price impact.

Each of these can start with a clear minimum viable feature and expand as Unichain’s interop, validation network, and sub second confirmations mature.

How to navigate the next twelve months

Expect three shifts:

- A wave of LP automation. As v4 hooks prove themselves, liquidity will migrate into vault like strategies with clearer risk disclosures, dynamic fee policies, and guardrails against toxic flow.

- Intent routers competing on latency and predictability. The winners will use Unichain’s fair ordering and revert protection to deliver fewer failed transactions, then extend across the Superchain as native interop lands.

- Governance maturity. As the path to protocol fees clarifies, DAO proposals will focus less on whether to do it and more on how to split value while keeping liquidity deep and routing competitive.

If you are a builder, pick a small surface area where you can be the best hook on earth, then plug it into a router. If you are an LP, try vaults that publish live stats, not just backtests. If you are a trader, learn to place intents that express your true goal rather than micromanaging every step.

The bottom line

Uniswap v4’s hooks turn every pool into a programmable marketplace. Unichain gives those markets a fast, fair, and interoperable home. Together they make Uniswap feel less like a single venue and more like an operating system for onchain finance. The winning teams will not be the ones that shout the loudest. They will be the ones that quietly tighten the loop between user intent, hook logic, and settlement on a chain built for markets. That is what it means for a DEX to become a full stack L2.