Order 881’s Moment: AAR, DLR and Grid Tech Hit Operations

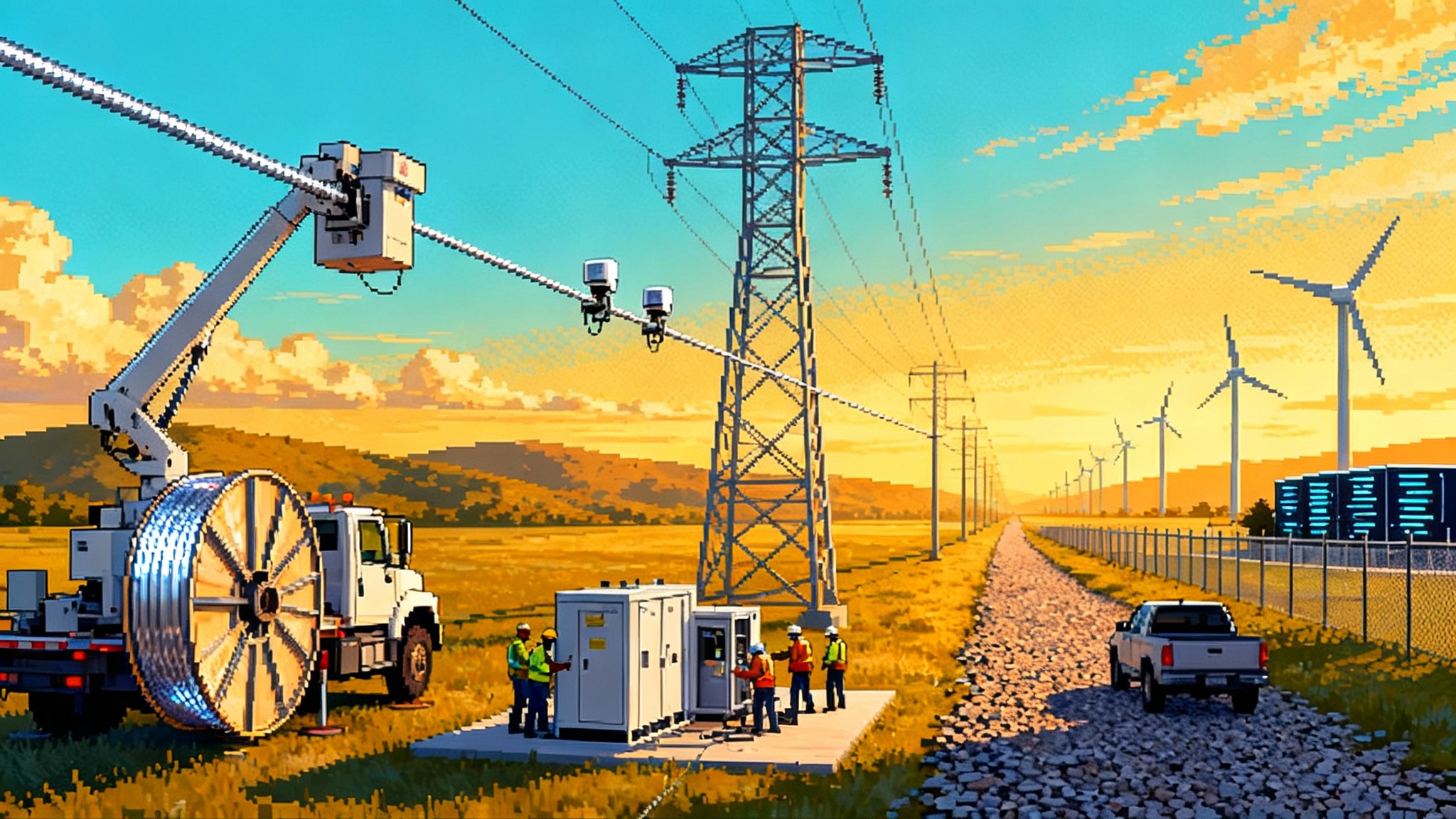

Compliance deadlines are pushing the U.S. grid to refresh line ratings by the hour and bring dynamic sensors and topology tools into daily dispatch. Here is what changes next for operators, developers and investors.

The news: 2025 made pilots give way to operations

The U.S. grid just crossed an inflection point. Order 881, the Federal Energy Regulatory Commission rule that requires hour‑by‑hour ambient‑adjusted line ratings, reached its first big compliance milepost in July 2025. Several regional transmission organizations secured extra time, but the direction of travel is unmistakable. PJM won an extension to April 15, 2026, ISO New England to December 15, 2026, the California Independent System Operator to December 17, 2026, Southwest Power Pool to September 1, 2026, and New York Independent System Operator and Midcontinent Independent System Operator to dates no later than December 31, 2028. FERC’s public record ties those dates together and notes estimates that customers paid hundreds of millions more in 2023 and 2024 without temperature‑adjusted and emergency ratings. See the FERC Order 881 extensions summary.

Extensions do not mean inaction. A growing list of utilities have flipped on hour‑by‑hour ratings in production. By mid‑2025, multiple transmission providers reported live ambient‑adjusted rating software and data exchanges. In parallel, dynamic line ratings that started as pilots are moving into the control room. Operators are beginning to rely on condition‑specific ratings during normal operations, not just in sandbox tests.

For how planning reforms intersect with these operational changes, see Order 1920 transmission reset.

A quick decoder: AAR and DLR without the jargon

Think of a transmission line like a bridge with a posted speed limit. The sign is usually set for a worst‑case day. Order 881 tells grid operators to refresh that sign every hour based on the day’s weather. That is ambient‑adjusted ratings. On cool or windy hours the safe limit rises and the grid can carry more power.

Dynamic line ratings go a step further. Instead of assuming typical wind and sun, DLR uses sensors and analytics to measure how the conductor is actually behaving. If a line is running cool and taut in a stiff breeze, DLR grants additional safe capacity. When heat or low wind make the line sag, DLR can pull ratings back to protect equipment. The result is a more accurate speed limit that moves with the conditions of the road.

Why it matters: every extra megawatt that moves on existing wires reduces reliance on redispatch to avoid constraints. That trims congestion costs, cuts renewable curtailment, and improves reliability because operators can lean on measured capability rather than conservative assumptions.

What just changed in operations

-

Production AAR arrives. Hourly ratings are being calculated and shared with market systems. Even where full integration into security‑constrained economic dispatch is staged, operators are already using more granular ratings in outage coordination and contingency analysis, which reduces false alarms and widens transfer capability on mild days. Several transmission providers are live with commercial AAR tools that feed the data flows Order 881 requires.

-

DLR moves from pilots to practice. In multiple service territories, sensors on key corridors now feed automated ratings to the control room. As dispatchers gain confidence that ratings can move with the wind, asking for more when conditions allow becomes routine, not experimental.

-

Compliance roadmaps get real. Regional operators are building ratings exchange portals and sequencing model changes so hourly and emergency ratings can be used in day‑ahead and real‑time markets. The message to market participants is clear: start producing forecasted hourly ratings and emergency ratings in the formats market models will ingest.

The other two levers: advanced conductors and topology optimization

Order 881 is the software layer. Two complements are multiplying its effect.

-

Advanced conductors. High‑capacity composite‑core wires can double ampacity in some corridors while using the same towers, which avoids years of permitting. Large load customers and utilities are beginning to co‑fund reconductoring where it unlocks capacity near data center clusters and renewable hubs. For context on near‑term grid fixes with material scale, see the DOE Liftoff grid solutions report.

-

Topology optimization. Software can reconfigure existing breakers to route flows around bottlenecks, much like mapping software finds side streets when the freeway clogs. Decision‑support tools propose secure switching actions to mitigate constraints in minutes, often faster than committing expensive generation or curtailing renewables.

How much capacity is really on the table

-

Near‑term transfer capacity. Hours with cool or windy conditions can see 10 to 30 percent more capacity relative to static seasonal ratings, sometimes higher on individual lines. In operating deployments, utilities have reported double‑digit average gains and even larger increments on specific windy corridors.

-

Curtailment cut. Curtailment falls for two reasons. First, more headroom appears during the same hours wind and solar tend to produce. Second, topology optimization can create operational remedies that avoid tripping into market‑driven curtailments.

-

Deferred capital. Reconductoring plus AAR and DLR allows many upgrades to be resized or sequenced. Instead of a single long outage for a rebuild, owners can do targeted structure fixes and swap in advanced conductors, then lean on measured ratings to carry more while a larger project works through siting.

Winners and laggards: a 2025 scorecard

The point of a scorecard is not to cheer or scold. It is to signal where value will show up first in the next 12 to 24 months.

Winners right now

-

PJM. Extension or not, PJM is integrating ratings and congestion solutions into planning and operations. Expect early gains in transfer capacity on cool, high‑load days and faster relief on recurring constraints, with direct impacts on congestion rents in data center corridors. For the demand backdrop, see AI becomes the new baseload.

-

SPP. The operator is overhauling planning and pushing process innovations that aim to shorten interconnection study times. An artificial intelligence partnership announced in June 2025 targets meaningful reductions in study durations, with early milestones expected by winter 2025 to 2026.

-

Utilities that operationalized DLR. Owners with live DLR and a path to share ratings with their regional market operator will capture congestion relief sooner and build the internal muscle memory to use the tools daily.

Gaining ground

-

CAISO and ISO‑NE. Both have staged implementation schedules through 2026. They are building the data exchanges and model changes that make ratings usable in day‑ahead and real‑time markets.

-

ERCOT. Not under FERC jurisdiction for Order 881, but moving quickly on market upgrades that increase the payoff from granular ratings and topology control.

Laggards for now

- MISO and NYISO. Both received extensions to dates no later than the end of 2028. That buys time to sequence major software and market upgrades, but it also postpones savings for customers and delays relief for developers waiting at congested interfaces.

How congestion economics will shift

-

Locational marginal prices flatten on mild days. Expect more hours when a historically binding constraint fails to set price because AAR allows extra flow. Where that happens, day‑ahead and real‑time spreads tighten and congestion revenues get more weather‑sensitive.

-

Renewable basis improves and curtailment shrinks. Projects sited behind a single chokepoint should see fewer zero or negative price hours when conditions are favorable, because AAR and DLR raise the ceiling exactly when output peaks.

-

Redispatch costs fall, but volatility may rise. Operators will redispatch less often to avoid overloads, yet when weather flips, ratings can fall quickly. That will reward fast‑start assets and flexible demand that can move with hourly ratings.

-

Topology becomes a tradable idea. As operators adopt topology optimization, mitigation can arrive as a switching action rather than a unit commitment. Traders and asset owners who anticipate likely switching patterns on recurring constraints will have an edge.

What it means for the interconnection backlog

Near‑term ratings and topology fixes do not replace long‑lead transmission, but they do change how fast projects can progress. Three shifts matter in the next 12 to 24 months:

-

Hosting capacity rises in steps. As AAR and DLR become routine, developers on constrained radials and weak interfaces can advance because the modeled headroom grows. In places with reconductoring plans, interconnection studies can assume higher ampacity in the near term rather than waiting for a rebuild.

-

Study cadence accelerates. Regional operators are investing in tooling and process changes to shrink study timelines. Early milestones from process overhauls are slated by winter 2025 to 2026.

-

Queue triage improves. When ratings and topology tools reduce chronic congestion, clusters no longer fail en masse at the same bottleneck. Operators can approve a cleaner mix of projects instead of pausing whole regions due to a single overloaded span.

What to do now: actions by role

Transmission owners

-

Treat AAR as a data quality program. Build reliable telemetry and forecasting for hourly ratings, including emergency ratings, and align naming, equipment identifiers, and outage codes so the market operator can ingest them with minimal translation.

-

Pick DLR corridors with intent. Start with windy interfaces and long conductor spans where sag limits capacity. Document before‑and‑after curtailment and congestion outcomes to quantify the value.

-

Use reconductoring to right‑size capital plans. Where towers are healthy, pair advanced conductors with targeted structure replacements so AAR and DLR add value immediately after stringing.

Market operators and planners

-

Stage the model changes into production. Integrate hourly ratings first into contingency analysis and post‑contingency simulations, then into real‑time dispatch and day‑ahead commitment. Publish data schemas and testing sandboxes early to reduce back‑and‑forth with transmission owners.

-

Stand up topology optimization in parallel. Start with advisory mode and a narrow menu of secure switching options on recurring constraints, then allow operator‑initiated actions with clear playbooks.

-

Coordinate with planning reforms. Align operational ratings and topology capabilities with the changes outlined in Order 1920 transmission reset.

Developers and large loads

-

Site to the new map. Watch where ratings and reconductoring are scheduled. Projects just behind those lines will see better basis and lower curtailment risk.

-

Bring weather‑aligned cases to studies. Show how your resource produces during hours when AAR and DLR commonly lift ratings. That can reduce required network upgrades.

Investors

-

Lean into picks‑and‑shovels vendors. Sensor makers, conductor suppliers, and topology software firms are positioned for a two to three year adoption curve. For the financing backdrop, review Cheap DOE 1706 loans.

-

Expect congestion trades to get more weather‑sensitive. Strategies that ignore AAR‑driven shoulder season relief will underperform. Methods that pair weather nowcasts with expected ratings will gain an edge.

The bottom line

Order 881 did not build a single new tower, yet it is changing how much power we can move tomorrow morning. Hourly ratings, dynamic sensors, smarter switching, and higher capacity conductors are turning conservative assumptions into measured capability. The timelines vary across regions, and some operators will not be fully integrated until 2026 or 2028. But the shift from pilots to operations is already visible in control rooms and tariffs. The next 12 to 24 months will reward those who treat ratings, topology, and reconductoring as a single toolkit and act accordingly.

As these tools scale, they will cut curtailment and congestion, change the shape of returns for generators and grid investors, unclog parts of the queue, and buy time for the long game of new transmission corridors.