EPA’s 2025 A2L pivot: what it means for heat pumps and HVAC

In late September 2025 the EPA moved to revisit refrigerant rules that underpin America’s switch to mildly flammable A2L gases. Here is how the rethink could reshape heat pumps, codes, training, and the HVAC market through 2028.

The rule rethink that jolted an entire industry

On September 30, 2025 the Environmental Protection Agency proposed a formal reconsideration of its 2023 Technology Transitions rule that governs which refrigerants can be used in new equipment. The notice signaled a willingness to adjust compliance timelines and ease specific subsector limits while keeping the hydrofluorocarbon phasedown required by law. The first signal of the shift arrived via an agency news release previewing longer sell through windows and targeted deadline changes for certain systems and projects. See the details in the EPA’s September 30 proposal, which is now open for public comment.

Two days later, on October 3, 2025 the agency’s Technology Transitions docket showed where stakeholder petitions were concentrated. Refrigerated transport, remote condensing units, supermarkets, cold storage, and certain lab equipment were in the mix. That signaled that while residential and light commercial heat pumps remain central to the transition, the next round of policy tuning will ripple through the full cold chain.

A quick refresher: what A2L really means

A2L refrigerants are lower global warming potential alternatives to legacy blends like R 410A. The A2L classification denotes lower flammability with low toxicity, which brings new safety engineering requirements. The modern safety backbone is the 2022 update to ASHRAE 15 and the fourth edition of UL 60335 2 40, which specify how to size refrigerant charge, add mitigation like leak detection, and design airflow so leaked refrigerant does not pool.

For homeowners the headline is simple. A2L heat pumps and air conditioners look and feel the same. The big changes are under the cabinet. Indoor coils, controls, and line sets are designed and tested for A2L properties. Servicing them requires an updated tool kit and a sharper focus on airflow and leak mitigation.

The 2025 to 2028 timeline just shifted

Even before the late September proposal, EPA had already tweaked several dates to avoid stranded inventory and to give the market more time in complex installations. In December 2023 the agency allowed R 410A residential air conditioning and heat pump systems manufactured or imported before January 1, 2025 to be installed through January 1, 2026. That decision kept countless units out of dumpsters while builders and distributors worked through 2024 stock.

In December 2024 the agency granted additional relief for variable refrigerant flow systems, allowing installations of new systems above the 700 global warming potential threshold until January 1, 2027 if all components were manufactured or imported by January 1, 2026. It also granted an extension to January 1, 2028 for permitted construction projects that had committed to higher GWP refrigerants before October 5, 2023. Those VRF specific allowances recognized the long lead times and multi component nature of large projects.

The September 30, 2025 proposal goes further in select areas, including how long pre 2025 residential and light commercial equipment can be installed and the GWP thresholds for cold storage warehouses. Final contours will depend on the comment record and legal durability, but contractors and distributors should plan on at least a partial extension of their sell through runway into 2026 and 2027. The bottom line for heat pumps is counterintuitive. The A2L era arrives in 2025, yet 2025 and 2026 will also be the last big years for compliant installations of legacy stock in many markets.

OEMs have already retooled, and that matters

Most major manufacturers built 2024 and 2025 product lines around R 454B or R 32. That included re rating coils and compressors, adding leak detection on larger charges, revising service ports, updating control logic, and refreshing labels and training. Commercial portfolios shifted quickly as new chillers, rooftops, and large splits began arriving with A2Ls in North America in late 2023. The strategic question now is less about chemistry and more about channel management: how to balance A2L production with a tail of R 410A install capacity without stranding either.

If you run a factory, your 2025 capital plan likely funded A2L capable brazing, testing, and quality control. Reversing that is neither cheap nor practical. The rational move is to continue leaning into A2L volume while using any extended windows to monetize remaining A1 inventory and to soften the learning curve for contractors.

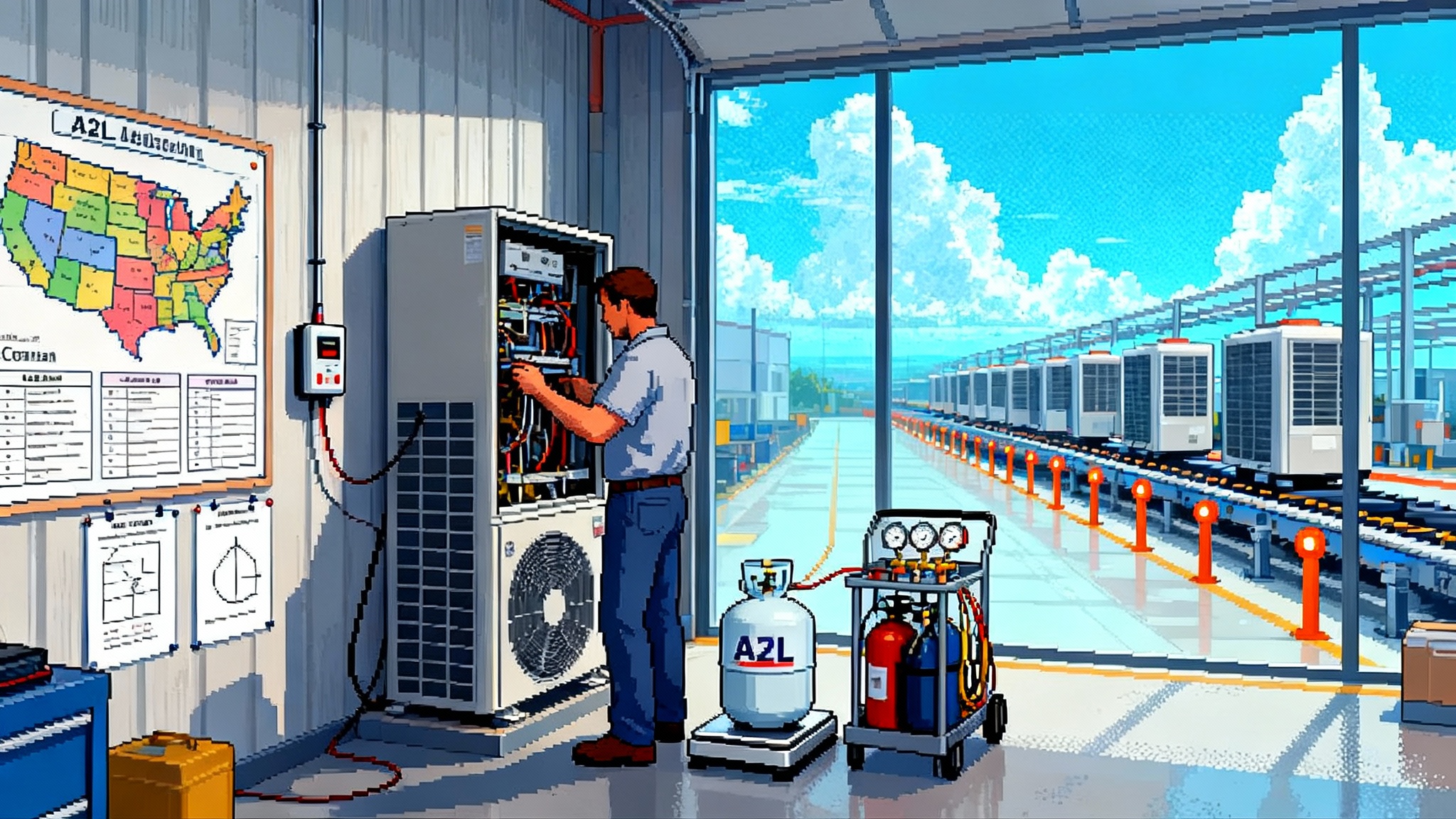

The installer reality: training, tools, and liability

A2Ls do not change the basic physics of heat pumps. They do change the job. Technicians need to know charge limits by room size, how to place and commission leak sensors, and how to ventilate a mechanical room during service. Vacuum pumps, recovery machines, and gauges must be A2L rated. Fire marshals and inspectors may ask new questions. Your best insulation against callbacks and claims is training.

What does good training look like in 2025 and 2026?

- A2L hazard and mitigation fundamentals tied to UL 60335 2 40 and ASHRAE 15. Focus on use cases and thresholds, not just vocabulary.

- Hands on labs that simulate a leak event and walk through sensor placement, control responses, and safe recovery.

- Updated commissioning checklists. Document sensor self tests, label placements, and firmware versions of detection modules.

- A2L specific brazing, evacuation, and charging procedures, including nitrogen purges and cleanliness standards.

- Customer education scripts that explain what changed in plain language and why the home is as safe as ever.

The pitch to a homeowner should be as boring as possible: this is a modern, efficient system using a refrigerant with significantly lower climate impact. It includes sensors that make it safer in edge cases. Utility bills and comfort improve.

The state code patchwork is real, and it can bite

A system can be UL listed and EPA compliant yet still run into code roadblocks. That is because states and cities adopt model code updates on their own timelines, and A2L allowances live in those updates. Before ordering a truckload of A2L equipment, verify the status in your jurisdiction by checking the AHRI A2L code map and conferring with your local authority having jurisdiction.

Contractors can de risk projects by bundling code coordination into proposals. Offer to handle the permit narrative, attach product safety listings, and include a one page explanation of charge limits and leak detection. For large projects, schedule a pre inspection with the authority having jurisdiction.

What this means for heat pump adoption

Heat pump adoption does not hinge on refrigerant class alone. Efficiency, comfort, incentives, and code certainty drive decisions. A2Ls are an enabler because they allow higher efficiency designs without trapping the market on high GWP blends. The near term headwind from the EPA reconsideration is confusion, not capability. Here is how this likely plays out from 2025 to 2028:

- Residential replacement stays busy. The combination of aging R 410A systems, utility rebates, federal incentives, and A2L ready supply keeps installers booked. Extended installation windows for pre 2025 equipment create a two track market in 2025 and 2026, but by 2027 the share of A2L units in new installs dominates.

- New construction normalizes around A2Ls by 2026. Builders value design standardization and fewer surprises with inspection. Early adopters will specify A2Ls now to avoid a mid project refrigerant flip.

- Commercial retrofits continue toward A2Ls where code allows. VRF projects make use of the 2027 or 2028 deadlines when eligible, but most new designs avoid the risk of late stage rule tightening.

The grid and winter peaks

The most common question from grid planners and investors is not about refrigerant safety. It is about winter peaks as more homes heat with electricity. Expect peak impacts to vary by climate and equipment mix, and expect connected controls to matter. For broader system context, see our look at AI becomes the new baseload and our analysis of Transmission Reset Order 1920. Financing tools that accelerate grid upgrades also matter, as covered in our piece on the DOE 1706 loan boom.

Strategy for contractors: play offense, not defense

- Build a two bin inventory plan. Bin A is your A2L core lines, sized to your 2026 run rate. Bin B is your compliant legacy stock with firm installation deadlines. Tag every Bin B unit with a bright deadline and price it to move by the last safe install month.

- Turn training into margin. Offer a premium A2L commissioning package that includes leak sensor diagnostics and a two year safety check. Include it as a clear line item.

- Prewire for demand response. Standardize on thermostats and heat pump water heaters that speak the same language. Ask your utility which programs will pay in 2026 and bake those incentives into your sales flow.

- Keep one eye on code. Assign someone to track A2L related bulletins and maintain a template packet for permits.

Strategy for manufacturers and distributors: keep the pivot, smooth the tail

- Stay the course on A2L production. Factory lines have shifted. Use any extended windows to clear remaining A1 inventory without slowing A2L momentum.

- Manage model transitions with software. You will be juggling serial numbers, refrigerant class, and installation eligibility dates. A simple portal that lets a contractor enter a serial number and get a green light or red light by jurisdiction will reduce returns.

- Protect the service ecosystem. Continue to support R 410A parts and training. Service work on legacy fleets will finance a lot of A2L training time.

The bottom line

America’s A2L pivot is not a U turn. It is an on ramp with a longer merge lane. The EPA’s late September move acknowledges bottlenecks in construction timelines and inventory. It does not change the direction of travel. For heat pumps, the implications are practical. The equipment is ready. The safety standards are in place. The market work now is to clear legacy stock without confusing customers, train every technician who will touch an A2L system, align with local codes, and put connected controls to work on winter peaks.

If you make, sell, install, or finance heat pumps, treat 2025 through 2026 as the transition window and 2027 through 2028 as the consolidation period. Keep your eye on the docket and your hands on the tools. The companies that win will build confidence with inspectors and homeowners, prove out flexible load in real programs, and turn policy turbulence into a smoother coast to coast rollout of better, cleaner comfort.