Sodium‑ion’s U.S. shakeout: Natron collapses, CATL ramps

Natron Energy’s September 3 shutdown and CATL’s December ramp mark a turning point for sodium-ion grid storage. See what 2026 RFPs must require, how US manufacturing could localize by 2027, and where sodium-ion can beat LFP on cost and safety.

The jolt that clarifies the stakes

On September 3, 2025, Natron Energy ceased operations and began closing its Michigan and California sites. The notice, filed under the Worker Adjustment and Retraining Notification Act, marked the first major US shakeout for sodium-ion manufacturing and ended a decade of pioneering work in aqueous sodium-ion cells geared to fast charge and high cycle life for data centers and industry. Reports of the shutdown surfaced the next day, detailing WARN notices and headcount impacts at both locations, a reminder that new chemistries do not get extra time on the balance sheet clock. DataCenterDynamics summarized the closure and timing.

Just nine months earlier, the story looked different. Sodium-ion had momentum, pilots, and a plausible path to domestic lines. Natron’s fall does not erase that groundwork. It sets the boundary conditions for what has to be true for sodium-ion to earn a place as the low cost, safer workhorse for two to six hour grid storage between 2026 and 2028.

Meanwhile, the world’s largest cell maker keeps moving

In April 2025, Contemporary Amperex Technology Company Limited introduced Naxtra, a sodium-ion line that it said would enter mass production in December 2025, with an energy density around 175 watt-hours per kilogram. That is within striking distance of mainstream lithium iron phosphate at the pack level for stationary storage, while promising improved cold weather performance. Reuters covered the Naxtra launch and production schedule.

CATL’s ramp does not guarantee sodium-ion wins the grid. It does guarantee that pricing, supply availability, and safety data will get tested at scale. If a global supplier can ship containers of sodium-ion modules into US projects in 2026, utilities and independent power producers will have real comparative data on degradation, parasitic loads, and failure modes, not just slide decks.

What changed in 2025, and what did not

Three signals frame the next phase.

- Natron’s shutdown shows that a sound chemistry is not enough without bankable customers, multi-year purchase commitments, and a financing stack that bridges the first two or three production years. Aqueous sodium-ion has safety and cycle-life strengths, but the commercial handoff stalled.

- Peak Energy announced and shipped a grid-scale sodium-ion system in July 2025 to a shared pilot for a set of utility and independent power producer partners. That put a stake in the ground for US field data on system-level thermal management, operations, and safety with a non-lithium chemistry.

- The Inflation Reduction Act continued to shape deals. Round 2 allocations of the Section 48C Advanced Energy Project Credit were announced in January 2025. Updated domestic content bonus guidance arrived later that month. Put together, they reward buyers that can demonstrate a clear domestic content plan and suppliers that can document a component-level bill of materials with US cost shares. Low cost federal financing also matters, and DOE 1706 loans are rewiring project economics.

These market shifts intersect with transmission policy, where Order 1920 unlocks capacity that storage can capture.

None of this changes what a grid battery must deliver. The project has to be safe to permit, simple to operate, and predictable in annual energy delivered and availability. What sodium-ion offers is a different way to hit those marks. Lower dependence on lithium, wider temperature operating windows, simpler thermal management for some cell formats, and a safety profile that can cut the tail risk of high energy propagation events.

The sodium-ion value proposition, in plain terms

Think of a grid battery like a refrigerated warehouse. Lithium iron phosphate is the incumbent system that needs a lot of air conditioning to keep everything within a narrow comfort zone. Sodium-ion promises to be the warehouse that holds temperature with a thicker wall, so the compressors work less. If you buy power by the hour, that difference shows up year after year as lower auxiliary load, simpler maintenance, and higher net energy delivered.

Sodium-ion does not win by squeezing more energy into less space. For most two to six hour projects, land use is not the constraint. Cost, safety, ease of siting, and predictable output are. That is where sodium-ion can compete. Energy density matters in cars, ships, and rooftops. It matters less next to a substation.

What US utilities and IPPs should demand in 2026 RFPs

Here is a checklist you can lift into your next solicitation. It is specific because vague language creates expensive change orders later.

Bankability and commercial structure

- Require audited financials for the cell maker and the system integrator, plus a parent guarantee or a performance bond sized to the replacement cost of the battery subsystem.

- Ask for at least two full reference projects at one megawatt hour or larger in commercial operation for six months or longer, with permission to contact the owners. Pilots count only if they include real dispatch and warranty terms.

- Include an escrowed spares package sized for five percent of cells or modules for the first three years, with a defined replenishment schedule and pricing for years four to ten.

Certifications and safety documentation

- UL 1973 certification for cells or modules, UL 9540 for the energy storage system, and a UL 9540A full test stack report with gas composition, peak heat release, and fire propagation outcomes at the cell, module, and unit levels. No summaries. Submit the full test reports.

- A complete NFPA 855 compliance package, including separation distances, detection and suppression system design narratives, and ventilation calculations.

- For inverters and controls, UL 1741 listing with grid support functions tested to IEEE 1547-2018.

- A hazard and operability study and a failure mode and effects analysis that include sodium-ion specific considerations, such as electrolyte composition, moisture tolerance, and end-of-life behavior.

Warranties that actually cover grid duty

- Two warranties, not one. A product warranty that covers defects for at least ten years, and a performance warranty that guarantees net delivered energy and capacity throughputs, not just remaining capacity percentage at the cell terminals.

- Specify the warranted temperature window, the allowable charge and discharge rates, and the calendar plus cycling degradation model. Require curves at 25 degrees Celsius and 40 degrees Celsius, at 80 and 100 percent depth of discharge, and at 0.5C and 1C rates.

- Define minimum round trip efficiency measured AC to AC at the point of interconnection, corrected for auxiliary loads at 25 degrees Celsius, and specify a warranty floor that declines no more than 1 percentage point over ten years unless higher ambient temperatures are allowed.

Degradation transparency and testability

- Require access to cell-level or module-level impedance growth data and a method to map that to available capacity and power capability.

- Ask for a standardized fleet-level degradation report every quarter that includes the empirical fit parameters, not just trend lines, so you can independently model end-of-life energy.

- Include an acceptance test plan that burns in at least 20 cycles under a realistic grid profile, such as an afternoon four hour discharge with midday charging, and captures both auxiliary load and thermal behavior.

Fire safe balance of system

- Require container or enclosure designs that can demonstrate no external flame ejection under worst case failure at the unit level, as evidenced in UL 9540A testing.

- Specify passive fire barriers and deflagration venting sized by test data, not rule of thumb.

- If the supplier claims nonflammable or low flammability behavior for the electrolyte or cell, require third party verification and acceptance testing on delivered units.

Supply chain localization and IRA alignment

- Ask for a costed bill of materials with country of origin for each manufactured product and manufactured component, along with a plan to meet domestic content bonus eligibility using the latest safe harbor tables.

- Require a pass through of federal credits and bonus value to the buyer via fixed price reductions, with a reconciliation mechanism at commercial operation date when domestic content certification is finalized.

- For suppliers that plan to localize by 2027, require milestone pricing that improves as localization thresholds are met, plus termination rights if milestones slip by more than six months.

Low cost capital can accelerate localization. See how DOE 1706 loans are rewiring the grid’s supply chain.

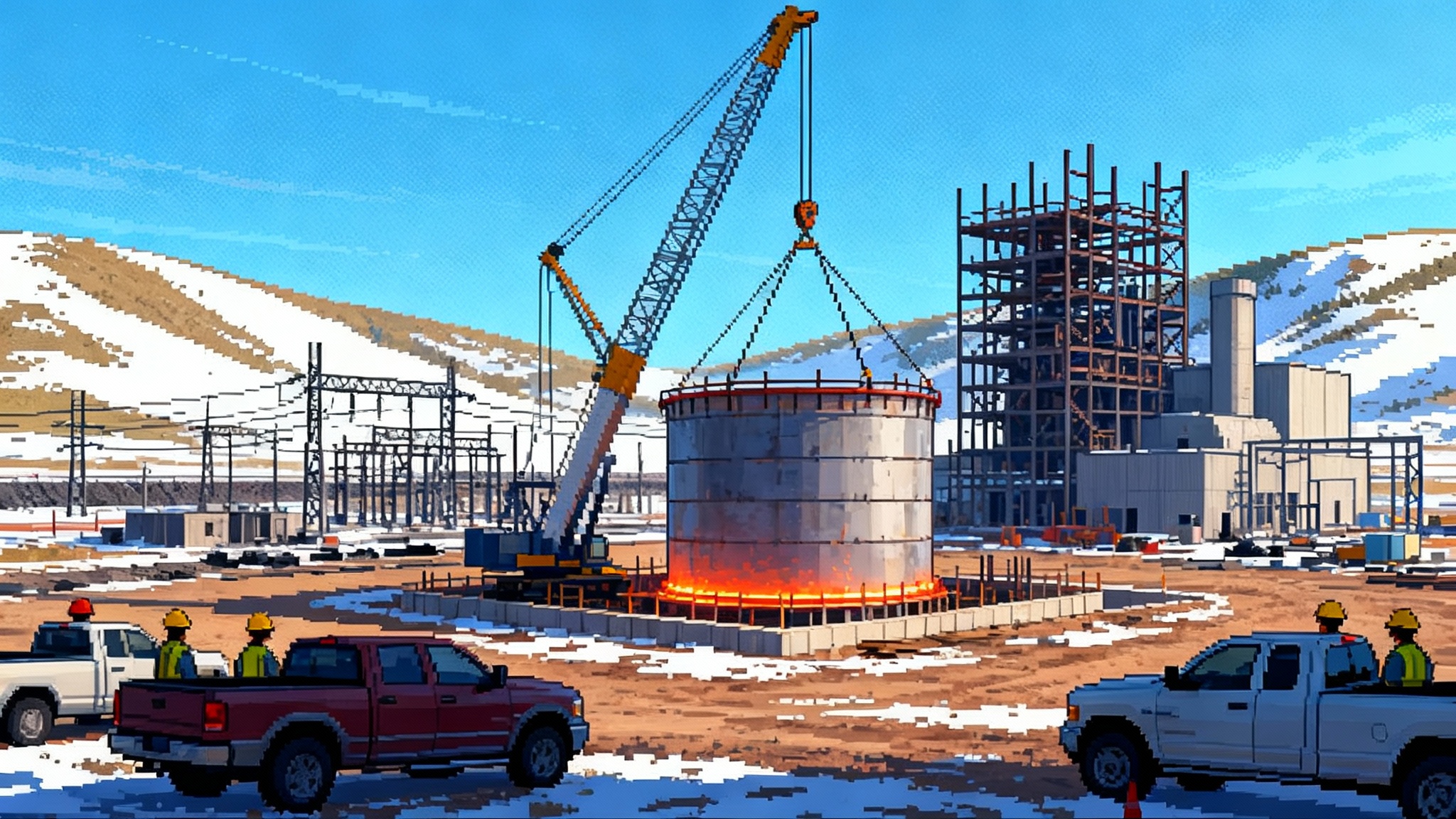

Where US sodium-ion manufacturing could emerge by 2027

The likely path is pragmatic, not heroic. Pack and system integration localize first, then cell assembly, then electrode production. The geographies to watch are the existing battery belt in the Southeast and Great Lakes, energy community tracts that qualify for additional incentives, and port-adjacent sites in the Gulf Coast and Mid Atlantic where imported precursor materials can arrive at scale.

- Southeast battery belt. Georgia, Tennessee, Kentucky, and the Carolinas have workforce, suppliers, and permitting experience for large electrical assembly. If sodium-ion module assembly lines spin up in 2026, these states can host them quickly.

- Great Lakes and Midwest. Michigan, Ohio, and Indiana already host energy storage suppliers and test labs. If cathode precursor production and calendering lines are added, these regions can deliver deeper domestic content shares.

- Gulf Coast and Mid Atlantic. Texas and Louisiana bring chemicals expertise and port logistics suited to electrolyte production and bulk materials handling. Virginia and Maryland ports can support module import, with near-port assembly to begin domestic content on day one.

Round 2 of the Section 48C Advanced Energy Project Credit set the table in January 2025 with another six billion dollars in allocations. Projects that move from allocation to certification by 2027 can anchor US sodium-ion lines. Updated domestic content bonus guidance released that same month added clearer safe harbors for calculating a project’s domestic cost percentage and for classifying what counts as steel, iron, manufactured products, and manufactured product components. Together, these let buyers ask for real documentation instead of promises.

How sodium-ion can undercut LFP on cost and safety

Sodium-ion has three routes to lower total cost of ownership for two to six hour systems.

-

Cell and module cost per kilowatt hour. Sodium precursors are cheaper and more abundant than lithium precursors. If mass production hits its stride, cells can be priced below lithium iron phosphate on a per kilowatt hour basis. The exact spread will depend on nickel and lithium prices, but the structural advantage comes from materials costs and supply diversity.

-

Less thermal babysitting. Many sodium-ion designs operate across wider temperatures without aggressive liquid cooling. This simplifies enclosures and reduces auxiliary power. Over ten to twenty years, lower parasitic load translates to more net megawatt hours delivered to the meter and lower operating expense.

-

Safer failure modes. Aqueous sodium-ion chemistries, like those Natron championed, are inherently nonflammable. Non aqueous formats still require careful engineering and can be flammable, but cell to cell propagation risk may be lower due to different reaction pathways and lower stored energy per cell. The result is a system that, when engineered with passive fire barriers and validated by UL 9540A testing, can reduce the tail risk of catastrophic events that drive insurance and site costs.

A simple project finance example illustrates the point. Consider a four hour system with a twenty year service life and a duty profile that cycles 250 to 300 times per year. If sodium-ion reduces installed cost by even five to ten percent at the start, trims auxiliary load by 0.5 to 1.5 percentage points, and avoids a midlife thermal retrofit or enclosure upgrade, the net present cost of delivered energy decreases. In markets with tight interconnection timelines, simpler thermal systems can also shave weeks off commissioning, which has real value when capacity payments or tax credit deadlines are calendar based.

None of these benefits happen by accident. Buyers have to demand them in contracts and verify them in acceptance tests. Two phrases belong in your 2026 documents: auxiliary load is metered and guaranteed, and UL 9540A full reports are part of the data room before shortlist selection.

A field test plan you can run in 90 days

If you are piloting sodium-ion in 2026, use a fast and fair test that gives your team confidence.

- Phase 1, characterization. Thirty cycles at 25 degrees Celsius on a four hour profile, charging in late morning and discharging into the evening peak. Meter auxiliary load separately. Capture round trip efficiency AC to AC and unit thermal behavior.

- Phase 2, heat. Twenty cycles at 40 degrees Celsius ambient, same profile, to assess degradation acceleration and thermal controls.

- Phase 3, cold. Twenty cycles at 5 degrees Celsius, record charge acceptance and any derates.

- Safety validation. Review UL 9540A results against enclosure design, verify gas detection calibration, and conduct a supervised suppression system test on a spare unit.

- Data access. Require open telemetry through a documented application programming interface so you can stream cell or module data into your analytics stack.

At the end of 90 days, compare net energy to the meter, auxiliary load, operational alarms, and any maintenance events against a recent lithium iron phosphate project on the same feeder. For context on how storage is already operating on the grid, see how grid batteries became America’s new peaker.

What to do now if you buy storage in 2026

- Add sodium-ion as an approved chemistry in your RFPs for two to six hour projects, with the certification and warranty requirements listed above.

- Award at least one pilot per service territory with a two year operations window and contractual rights to publish non confidential performance data.

- Use milestone pricing tied to Section 48C certification or domestic content evidence. Value local assembly and domestic content with explicit points in your scoring rubric, not a vague preference statement.

- Negotiate auxiliary load guarantees and maintenance schedules that reflect simpler thermal designs. Insist on spare parts escrow and minimum on site inventory for the first summer.

The bottom line

Natron’s September 3 shutdown ends a brave US chapter, but it does not end the sodium-ion story. It makes the next chapters clearer. Global suppliers will ship sodium-ion modules at scale. US integrators will prove or disprove the operating and safety advantages in real fleets. Federal policy already favors those who can document domestic content and move quickly from allocation to certification and from pilot to purchase agreement.

Sodium-ion can become the grid’s low cost, safer workhorse for two to six hours if buyers set exacting specifications and hold vendors to them. The chemistry gives you a better warehouse. Your contracts, test plans, and procurement discipline decide whether it is stocked, cooled, and run to deliver lower cost energy every year.