LNG Whiplash 2025: CP2, Commonwealth and Delfin reset the buildout

Washington’s permit restart uncorked a wave of U.S. LNG approvals. Here is what can truly reach FID and first cargo by 2026–2030, and how it will ripple through Henry Hub, Europe, Asia, and shipping.

The year the pause snapped back

America’s liquefied natural gas story did not just resume in 2025. It hit fast forward. The Department of Energy restarted non‑FTA approvals and put fresh ink on long‑delayed export orders, including the big one for Venture Global’s CP2 in March 2025. That decision, and the Federal Energy Regulatory Commission’s subsequent actions, effectively reset the cadence for U.S. export growth after a year of limbo. The signal to developers and buyers was simple and loud: the gate is open again. See the Department of Energy’s CP2 export authorization for the inflection point.

This policy turn did more than unlock paperwork. It re‑sequenced which projects can reach the only milestone that truly matters in this sector, final investment decision, and the one that matters to the market, first cargo. Below is a grounded map of what can realistically move between now and 2030, and the knock‑on effects from Henry Hub to Rotterdam power margins, from Tokyo contract structures to the global LNG carrier fleet.

The new buildout map: who can reach FID and sail by 2030

Think of the 2025 approvals as green flags at different distances from the finish line. Every project must still clear engineering, procurement and construction bottlenecks, lock in offtake, and assemble ships. Some are closer than others.

2026 arrivals: projects already in the slipstream

-

Golden Pass in Texas is back on a visible path after contractor turmoil in 2024. The owner team re‑stacked the contracting bench and kept critical equipment fabrication moving. Expect staged start‑up, with trains phasing in through 2026 as commissioning risk is worked down. The lesson is clear for new sponsors: fixed‑price mega contracts can crack under inflation and labor stress, and recovery plans take quarters, not weeks.

-

Plaquemines Phase 1 in Louisiana is ramping. Early cargoes began late 2024 and volumes should step up through 2025 and 2026. The developer’s modular approach and a deep book of offtakers shorten the path from steel to molecules.

-

Corpus Christi Stage 3 continues to layer volumes. With utilities and portfolio players already on contract, the remaining gating factor is commissioning pace, not paper.

2027 to 2028: the middle wave

-

Port Arthur Phase 1 should deliver in this window. Creditworthy sponsors, a conservative contracting model, and big equipment reserved early point to a smoother mechanical completion than the class of 2019 to 2021.

-

Rio Grande Phase 1 moves into late‑decade deliveries. The site is active, long‑lead equipment is booked, and the ship slate is forming. Expect first cargo toward the back half of this window, then a ramp.

-

Delfin LNG, the offshore entrant, benefits from the 2025 extension and a modular floating architecture. The first floating unit is the milestone to watch. A realistic path is first steel on the hull followed by liquefaction topsides integration at a major Asian yard. If a final investment decision lands in 2025 to 2026 for the first floater, first cargo in 2028 to 2029 is credible. Each additional floater is additive at roughly 3 million tonnes per year.

2029 to 2030: the reset class

-

CP2 LNG is the headline beneficiary of the 2025 regulatory tempo. Full buildout is near 28 million tonnes per year, but the near‑term question is phase one. Venture Global’s track record is speed through modularization and parallelization, but size matters. A first phase reaching first cargo in 2029 to 2030 is a sensible baseline if fabrication yards and heavy‑lift windows are secured in 2025 to 2026.

-

Commonwealth LNG cleared key hurdles in 2025, including a final Department of Energy export authorization and a Federal Energy Regulatory Commission order upholding siting approvals. The company has lined up notable offtakers and a cost‑focused site plan in Cameron Parish. With financial close in late 2025 to early 2026, first cargo around 2029 is plausible, with some schedule buffer prudent given the tightness in Gulf Coast construction labor and specialty equipment.

Add these volumes to capacity already operating and under construction, and the United States remains on course to lift export capability again by the end of the decade. The U.S. Energy Information Administration’s October outlook expects U.S. LNG exports to push higher through 2026 as new trains come online, with Henry Hub firming seasonally as a result. See EIA’s Short Term Energy Outlook for the baseline view.

What this means for prices and power

Henry Hub: volatility with a higher winter floor

New LNG capacity tightens the shoulder‑season surplus and lifts winter draw risk. The pattern to watch is familiar. When a large U.S. train starts sustained pulls, pipeline flows re‑route from storage injections to Gulf feeds. Basis markets in Texas and Louisiana flip from long to tight. The net effect is not a straight line up for Henry Hub, because associated gas from oil drilling and Appalachia productivity keep a ceiling on rally attempts. It is a ratchet. Each tranche of new exports raises the probability that cold snaps or nuclear outages push Henry Hub through prior winter highs, as highlighted in the Palisades restart playbook. The leading indicators that matter are Gulf Coast feedgas nominations, weekly injection deltas versus the five‑year average, and the forward curve’s Jan–Feb spread. If the spread widens and storage undershoots late‑autumn targets, the floor lifts.

Coal‑to‑gas switching is now a smaller shock absorber than it was five years ago, since fewer coal units remain. Power burns will respond, but less elastically. Rising data‑center load makes this even more pronounced, as detailed in AI becomes the new baseload.

Europe: storage, power, and the marginal megawatt

Europe’s gas storage strategy since 2022 has been speed and redundancy. The continent enters winter with high inventories in core hubs, but geography still matters. Eastern bottlenecks and weather outliers can drain regional stocks quickly and pull higher‑priced spot cargoes. The Dutch Title Transfer Facility price sets the marginal megawatt for gas‑fired power in many markets, so swings in LNG arrivals translate into day‑ahead power spreads in Germany, Italy, and Spain. A bigger U.S. export base steadies the global pool and reduces the frequency of extreme price spikes, but it does not eliminate them. When Asian demand pulls hard or the Panama Canal is constrained, ton‑miles and voyage times stretch and Europe pays up. Watch European storage fill rates in September and October, the TTF to JKM spread, and the number of prompt Atlantic Basin reloads. Those three signals tell you how the winter power margin will feel on the ground. Transmission reforms such as the Order 1920 transmission reset will also shape how price signals flow through power markets.

Asia: contracts are getting more flexible, not shorter by default

Buyers in Japan, South Korea, India, and Southeast Asia learned two lessons in 2022. First, spot dependence is expensive during shocks. Second, destination rigidity is a tax during calm periods. The 2025 contract class reflects both. We see more 15‑ to 20‑year sales and purchase agreements tied to U.S. gas plus liquefaction fees, paired with optionality on delivery points and make‑up volumes. Portfolio players assemble these blocks and arbitrage between basins. Utilities and national oil companies anchor the long‑term offtake, then layer seasonal swaps. Expect more hybrid pricing where a tranche floats on TTF or JKM for a few initial years before stepping to Brent slope or Henry Hub plus fees. The headline is not a return to one size fits all. It is fit for purpose, with flexibility provisions doing the heavy lifting.

The bottlenecks that will decide winners

Engineering, procurement and construction capacity and labor

The Gulf Coast now faces a very human constraint. Skilled welders, electricians, instrument techs, and experienced foremen are finite. The bankruptcy of a major contractor on a marquee project in 2024 was not an isolated weather event. It was a sign that fixed‑price mega contracts signed in a low‑inflation era can buckle when supply chains and wage rates move. In 2025, owners shifted toward split packages, early works under reimbursable structures, and stronger owner teams in the field. If a developer cannot point to which craft labor halls they will draw from, which shift patterns they will run, and which camp beds are already blocked, the schedule on paper is fiction.

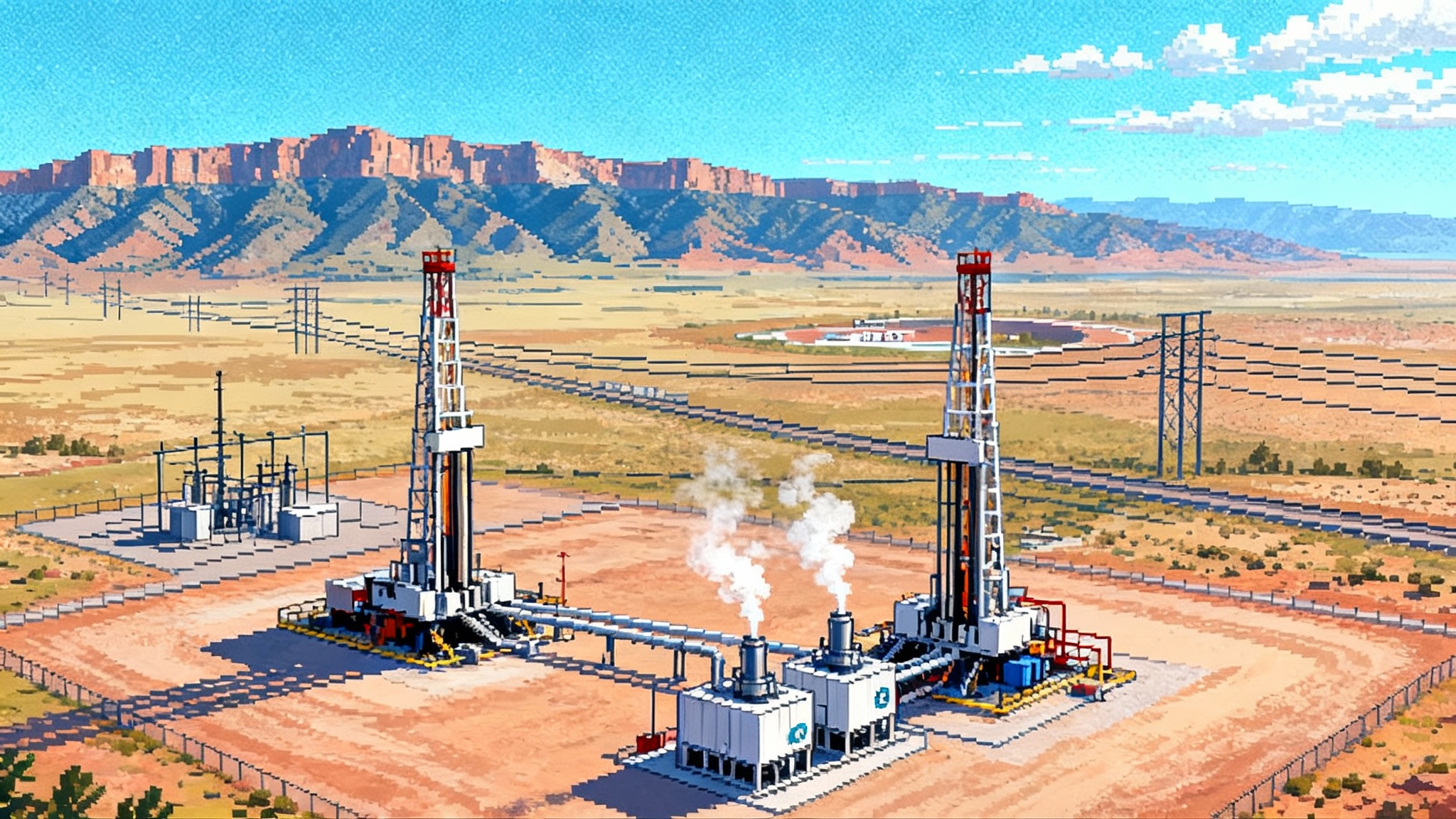

Module yards and long‑lead equipment

The fastest projects will be those that reserved module yard slots and heavy‑lift windows early. Major Chinese yards and Korean heavy fabricators can turn out massive process modules and topsides, but they are booked years ahead. Cold boxes, cryogenic heat exchangers, main refrigeration compressors, and boil‑off gas compressors carry lead times measured in quarters, not months. A sponsor that holds purchase orders for these items owns the real schedule. Others will be held to the right by turbine rotor slots and transport vessel availability.

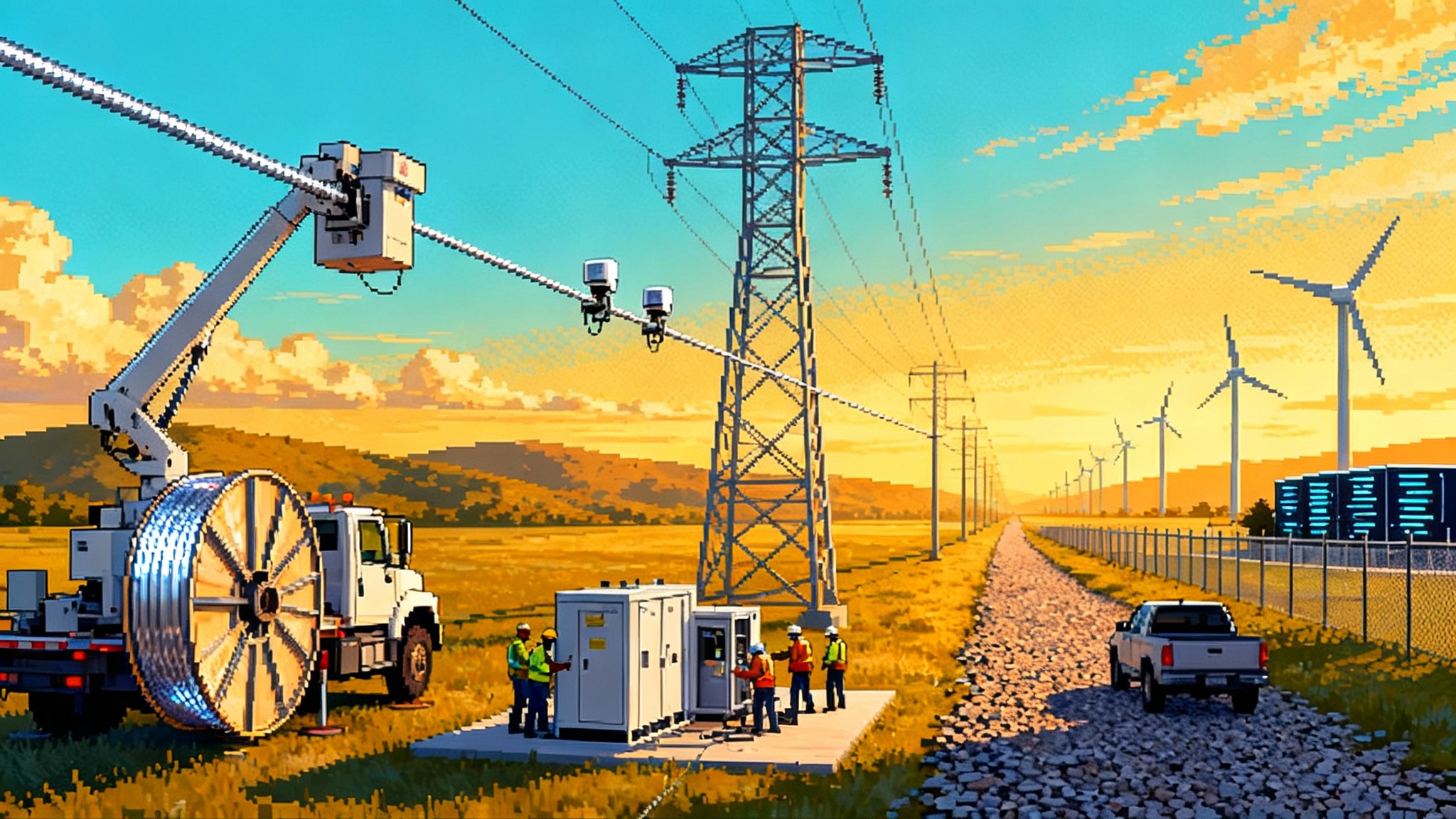

Grid and pipe

New export volumes ride on old constraints. Gulf Coast substations, coastal roads, and last‑mile pipelines need upgrades to move oversize loads and electrons. Projects that bundled utility interconnects and road work into early packages will advance. Those that assumed local governments would sprint on their behalf will wait.

Methane intensity and emissions verification

Two forces are converging. First, U.S. standards for methane performance at oil and gas sites continue to tighten under Clean Air Act rules. Second, the European Union’s methane regulation is moving from policy to procurement. Importers will have to declare and, over time, meet methane intensity limits with credible measurement and reporting. Sellers who can trace upstream gas with site‑level data and satellite‑validated leak detection and repair will find buyers faster and at better terms. Those who cannot will be pushed to the back of the queue or pay a pricing discount.

Shipping: yard slots, routes, and day‑rate whiplash

LNG carrier orderbooks swelled after 2022. Shipyards in South Korea and China are still digesting those bookings, and the best slots now attach to projects that place multi‑vessel series orders. New Gulf capacity adds long‑haul demand. If the Panama Canal again restricts drafts or slots, Atlantic to Pacific voyages stretch around the Cape and absorb more ships. Charter markets will feel like a seesaw through 2027. When several new trains commission at once, spot rates can leap as owners seek commissioning cargo premiums and extra boil‑off cover. When a commissioning wave subsides or a mild winter hits both basins, rates can fall just as fast. Sponsors that sequenced ship deliveries to the mechanical completion curve, rather than the calendar year, will hold the advantage.

Leading indicators: how to separate signal from noise

Use these as your dashboard through 2026 to 2030.

- EPC awards you can timestamp. Bechtel, KBR, Fluor, McDermott, Chiyoda, and Technip Energies all publish meaningful contract wins. A signed lump‑sum notice to proceed with named scope, not a letter of intent, is your true start gun.

- Offtake structures, not just names. Long‑term SPAs with firm volumes, creditworthy buyers, and clear destination flexibility beat aspirational term sheets. Pay attention to whether contracts are free on board or delivered ex ship, and who is on the hook for shipping.

- Module yard bookings. Watch for announcements that lock specific yards and delivery windows for process modules or floating topsides. This is often buried in supplier releases rather than sponsor press statements.

- Turbomachinery and cryo kit purchase orders. Orders for refrigeration compressors, power‑generation turbines, and cold boxes are the critical path. If those are not placed, the schedule is not real.

- Ship orders matched to ramp. Look for series orders of 170‑ to 180‑thousand‑cubic‑meter vessels tied to a project’s commissioning cadence. A scramble for single ships in the spot yard market is a red flag.

- Gulf Coast labor tightness. Monitor construction job openings in Texas and Louisiana, wage trends for skilled crafts, and local housing starts near project sites. Labor scarcity is the hidden schedule killer.

- Feedgas and pipe progress. Final investment decisions without a clear pipeline expansion or interconnect plan are hollow. The permits and compressor orders for lateral lines are your tell.

- Environmental performance data. Public methane measurements, leak detection and repair programs, and third‑party verification will move from nice to have to must have for buyers, especially in Europe.

What to do now: a practical playbook

-

Buyers: secure optionality, not just volume. Blend U.S. Henry Hub‑linked contracts with flexible delivery windows across basins. Negotiate destination flexibility and upward tolerance so you can lean into one basin or the other when spreads move. Align ship charters with commissioning windows and reserve options that avoid paying peak spot rates for a single tight quarter.

-

Developers: fix the critical path before you market the curve. Book module yards, cold boxes, and compressors early, then hire the owner’s engineer and field leadership before you sign the big EPC package. Use reimbursable early works to de‑risk ground conditions and utility tie‑ins. Structure offtake so phase one is fully covered by bankable names, then pursue marketing upside later.

-

Investors: watch for cash discipline in construction. Split packages and milestone payments that reflect real progress will outperform single giant fixed‑price deals without transparency. Insist on contingency that reflects today’s wage and equipment inflation, not 2019’s.

-

Policymakers: keep the docket moving and the metrics clear. Faster, predictable reviews reduce the incentive to sprint toward marginal sites. Pair approvals with unambiguous methane measurement standards and reporting templates so sellers know what to prove and buyers know what to trust.

The bottom line

The 2025 regulatory reset took a crowded queue and reordered it by readiness. CP2, Commonwealth, and Delfin are now on a visible path, joining an under‑construction wave that already has steel in place. The market impact will not wait for 28 million tonnes in one go. It will arrive in pulses as each train, floater, and module hits its commissioning window. For Henry Hub that means firmer winter floors and sharper shoulder‑season pivots. For Europe it means fewer crisis‑level price spikes, but continued sensitivity to shipping and weather. For Asia it means more credible long‑term supply with contracts that finally reflect how buyers actually manage risk.

Acceleration is not bravado in this cycle. It is a function of bookings, bolts, and a believable schedule. The projects that win the decade will be the ones that lock real capacity in the yards, on the decks, and in the craft halls now, while others are still celebrating approvals. The pause is over. The clock is running.