Geothermal’s 2025 inflection: Cape Station sparks oilfield build

Two milestones in 2025 push enhanced geothermal from pilot to program: a September equipment award for Cape Station Phase II and a June appraisal well that hit near 500°F at record depth. Here is how EGS plus ORC can deliver 24/7, fuel-free capacity across the West from 2026 to 2030.

Breaking signals from Utah

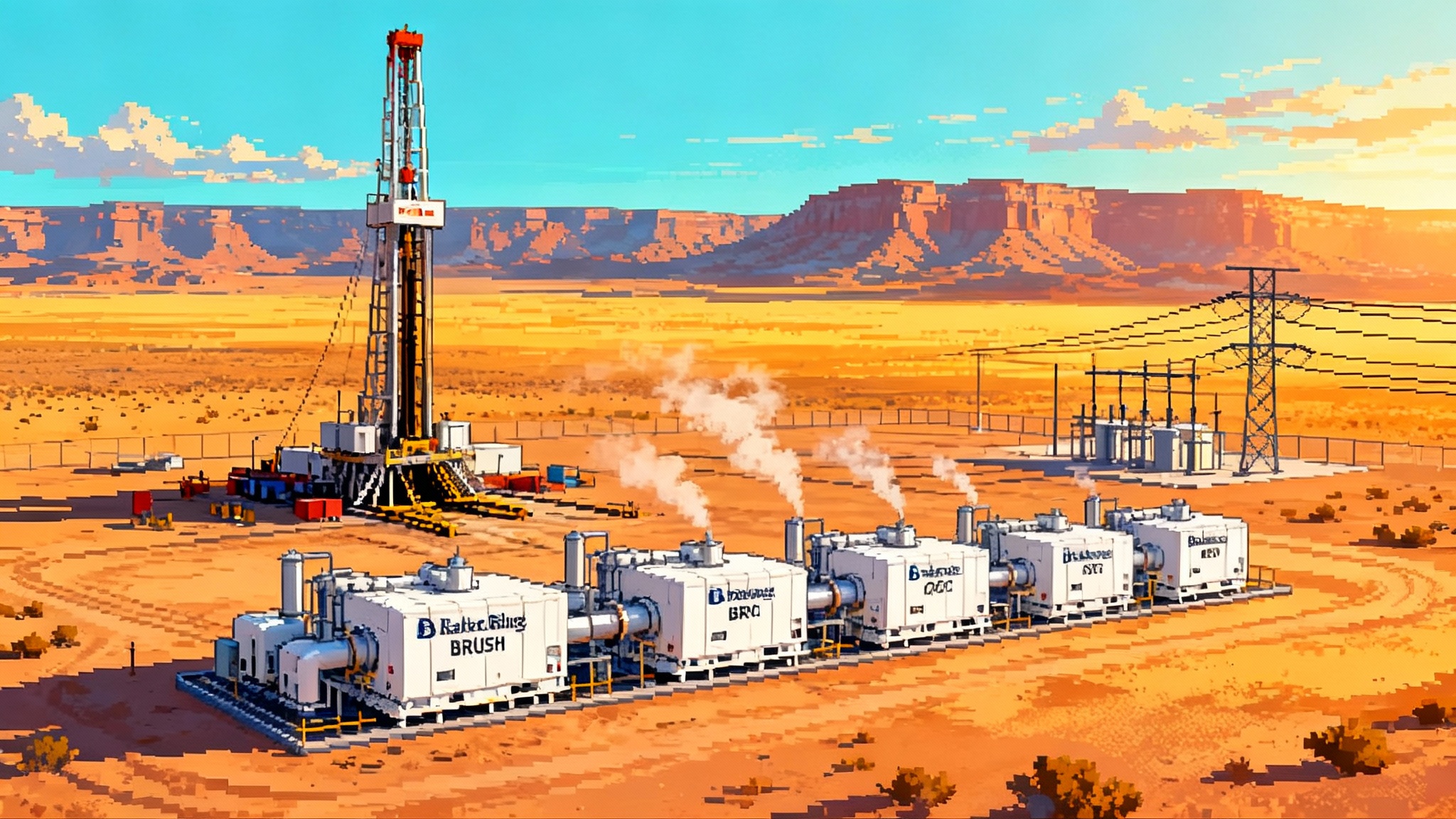

If you work in power procurement or grid interconnection in the Western United States, September and June of 2025 should be circled on your calendar. In September 2025, Baker Hughes won the order to design and deliver five Organic Rankine Cycle power trains for Fervo Energy’s Cape Station Phase II in Utah, including turboexpanders and BRUSH generators. The package totals roughly 300 megawatts across five 60 megawatt units and is part of a developer plan that brings Phase II to 400 megawatts by 2028. It is the first time a major oilfield technology company has taken the lead on the surface power island for an enhanced geothermal project at this scale, and it is the strongest sign yet that geothermal is graduating from bespoke projects to repeatable plants. That milestone is documented in the Baker Hughes Cape Station equipment award.

June 2025 delivered the subsurface confirmation. Fervo announced a Cape Station appraisal well drilled to a true vertical depth of 15,765 feet that will equilibrate near 500 degrees Fahrenheit. The well was completed in 16 drilling days, a speed improvement associated with oilfield tooling and practices. For developers and utilities, that is not just a headline. It shows a path to repeatable costs and cycle times at depths and temperatures that unlock multi‑hundred megawatt fields. See the Fervo Energy appraisal well hits 500°F.

These two events taken together are the hinge. The oilfield is now building both sides of enhanced geothermal systems: the hot reservoir below ground and the power plant above it.

EGS plus ORC, explained simply

Think of enhanced geothermal systems as a closed‑loop radiator planted a few miles underground. You drill two or more wells into hot, hard rock. You create a controlled set of tiny cracks between them so water can circulate through that hot rock and come back up very hot. That is the subsurface half.

On the surface, an Organic Rankine Cycle power plant takes that returning heat and runs it through a working fluid with a low boiling point, something like a refrigerant. The hot fluid boils to vapor, spins a turboexpander connected to a generator, then condenses and repeats. The cycle runs quietly, it does not burn fuel, and it delivers steady power day and night. When the underground radiator gets hotter and the flow increases, the ORC makes more electricity. When it cools slightly, output drops a bit, but the plant still runs around the clock.

This pairing matters because it uses two supply chains that already exist. The oilfield knows how to drill hot, deep, and fast. The ORC industry knows how to turn moderate‑to‑high temperature heat into reliable megawatts with standardized modules. Put them together and you get a new playbook for firm power.

Why 2026 to 2030 looks different for the West

From California to Utah and Nevada, the day‑night shape of electricity demand has forced buyers to stitch together batteries, gas peakers, and imports to meet evening peaks. Enhanced geothermal changes the stitch pattern because the output is flat. A 100 megawatt geothermal block delivers roughly 100 megawatts in the evening too. That profile means high capacity value, low integration cost, and fewer surprises when clouds roll in.

Cape Station Phase I is slated to begin delivering in 2026, with Phase II adding large blocks by 2028. That puts a new kind of product into request‑for‑offers windows between now and 2027. Instead of only solar plus storage, buyers can lock in a tranche of 24 hours by 365 days, no fuel price risk, and a forward schedule that looks more like wind or gas plant construction than like one‑off geothermal science projects. The early offtake with Shell Energy for 2026 delivery suggests these products are already being shaped to meet retail and load‑serving needs.

By 2030, if Cape Station demonstrates repeatable drilling and standardized power trains, several Western load pockets can be served by a portfolio that mixes solar, batteries, and geothermal in fewer contracts with simpler operating rules. That is not just a cost story. It reduces the number of interconnection points you must chase in a crowded queue and it delivers more dependable resource adequacy in the evening and winter. For transmission policy context, see the Order 1920 transmission reset.

The oilfield‑led supply chain is the story

The reason this inflection is real is not a grant or a pilot. It is because the supply chain looks like one the energy industry already knows how to scale:

- Drilling systems: high temperature drill bits, mud motors, measurement while drilling, and telemetry that are proven in ultradeep oil and gas wells.

- Completion and stimulation: engineered fracture designs and zonal isolation to create a controlled heat exchanger between wells.

- Subsurface monitoring: fiber optic sensing to manage flow paths and adjust the field for longevity and output.

- Surface equipment: modular ORC skids, turboexpanders, and generators that can be duplicated and shipped in parallel.

In September, Baker Hughes signaled that the same company that sells the drill bits and the mud pumps can also sell the turboexpander and generator set that sit on the pad. That consolidation reduces interface risk and shortens the punch list between the well and the wire. It also makes it easier for lenders and offtakers to underwrite the entire plant, not just the drilling campaign.

What this means for procurement teams

Utilities, community choice aggregators, data center energy teams, and corporate buyers can start to write new playbooks now. Here are three changes to make between the fourth quarter of 2025 and the end of 2027:

-

Ask for shaped baseload, not just peak coverage. Frame geothermal bids as 24 hours by 365 days blocks that offset both energy and capacity purchases. Require an hourly delivery shape and an expected effective capacity value for your balancing area. For grid‑support expectations on future fleets, review FERC’s 2025 IBR rules.

-

Unbundle subsurface and surface risk in your contracts. Require separate milestone schedules for drilling and for ORC erection, with liquidated damages tied to both. Push for a single point of accountability on integration so that the wellhead conditions you are buying actually match the acceptance test on the turboexpander.

-

Pay for availability and heat, not only megawatt hours. A heat‑supply payment with an availability band can line up incentives between the field team and the power island team. Think of it the way gas pipelines and power plants align around heat content and pressure, then settle on a delivered megawatt hour number.

Buyers who make these changes will find it easier to compare geothermal against storage and gas. You can evaluate the product on three axes: capacity value in your evening peak, energy price stability over 15 years, and the degree to which it reduces your reliance on expensive transmission imports.

Interconnection strategy shifts too

Interconnection queues across the West are congested. Projects that can prove they are both real and ready will move faster. Enhanced geothermal offers three advantages you can use when you enter the queue:

- Smaller footprints per megawatt: a 60 megawatt ORC block needs a compact pad and ties into the grid at a few hundred megavolt amperes, not thousands, which reduces substation rework.

- Fewer swings at the point of interconnection: a flat output profile means simplified studies and less remedial gear for voltage support compared with solar plus storage combinations that ramp sharply.

- Phased energization: five 60 megawatt blocks can be scheduled in a stair‑step that lets transmission owners test protection schemes progressively.

For teams submitting in 2026, the practical move is to match your geothermal block size to available substation bay capacity and to propose phased energization with clear test windows. Attach the drilling and surface equipment milestones to your interconnection schedule so the transmission owner sees the ramp to commercial operation, not just a final in‑service date. You will look real earlier, which can move you up in cluster prioritization. For related grid operations advances, see Order 881’s field moment.

Costs, learning rates, and why they matter

The June appraisal well tells us two things that matter for cost. First, time is coming out of the well schedule. Sixteen days to more than 15,000 feet is not just fast for geothermal. It is approaching commercial speeds seen in deep oil programs. Second, temperature and depth open higher power densities. The hotter the returning fluid, the more net power you get per well pair. That allows the surface equipment to run nearer its nameplate rating and improves field economics.

On the surface, standardized ORC modules accelerate learning. When you install the third and fourth 60 megawatt train in the same field, you are no longer designing a plant. You are replicating with punch‑list discipline. EPC crews can move as a caravan and repeat balance‑of‑plant tasks from one pad to the next. That is the moment when lenders and rating agencies start treating geothermal like wind and utility solar: a known set of tasks with a schedule you can trust.

Data centers and 24 by 7 carbon‑free energy

Large buyers chasing 24 by 7 carbon‑free energy are learning that stacking hourly clean energy certificates from intermittent resources is expensive and operationally complex. Enhanced geothermal offers a simpler path. One 100 megawatt tranche can cover a large fraction of a data center campus’s minimum load. It also reduces the battery duration you must buy to cover the evening. The result is a cleaner portfolio with fewer contracts and lower residual emissions. See how AI becomes the new baseload.

As more artificial intelligence workloads land in the desert Southwest, this is a strategic lever. If you can site a data center within transmission reach of a geothermal field, you can hedge both energy and capacity in a single offtake instead of a mosaic that must be rebalanced every year.

Risks to manage, not reasons to wait

Enhanced geothermal is not without risk. Three deserve attention:

- Subsurface variability. Even with appraisal wells, flow and temperature can surprise you. Mitigation: require a multi‑well production test and a heat‑balance acceptance test before the first ORC block reaches final completion.

- High‑temperature equipment life. Turboexpanders, seals, and heat exchangers work hard at 500 degrees Fahrenheit. Mitigation: negotiate long‑term service agreements with defined overhaul cycles and include spares packages in the financial model.

- Water sourcing and induced seismicity. Stimulation requires water and careful monitoring. Mitigation: plan for non‑potable water sources, recycling of produced water, and a traffic light protocol tied to local seismic networks.

None of these are showstoppers. They are standard engineering problems, and the oilfield has decades of experience managing analogs.

What to do between now and the end of 2027

- If you buy power: issue a request for information that asks developers to price 50 to 150 megawatt geothermal blocks with hourly shapes, availability guarantees, and phased commercial operation dates. Ask for both delivered energy and delivered capacity structures.

- If you interconnect projects: design a cluster study addendum that evaluates flat‑output geothermal blocks with simplified remedial action schemes and phased energization. Identify substations where a 60 to 120 megavolt ampere addition fits without major rebuilds.

- If you finance projects: seek portfolios of three to five identical ORC trains backed by long‑term service agreements and a drilling schedule that exceeds two wells per month at steady state. Favor fields that have already logged high‑temperature returns in appraisal.

These steps turn the Cape Station signals into your own capability. You will shorten negotiations and reduce surprise costs when your project moves from paper to pad.

The road to 2030

By 2026, the first Cape Station megawatts arrive. Through 2027, the field adds more wells and the first Phase II blocks break ground. By the end of 2028, the project’s second phase is scheduled to be online at large scale, and by 2030 we will have three to five years of operational data from high‑temperature, deep enhanced geothermal. That dataset will feed new development in adjacent basins and in states that have heat but historically lacked conventional hydrothermal resources.

If that happens, procurement officers will buy geothermal the way they buy wind today: in standardized blocks, with known service agreements, from vendors that blend oilfield experience with power equipment manufacturing. Interconnection teams will slot in 60 megawatt increments at substations that can accept them, rather than chasing only massive transmission builds. Communities will see fewer generators and more steady jobs per megawatt, since geothermal fields require ongoing drilling over the life of the project.

The bottom line

A single project cannot change a region. A replicable method can. The September equipment award and the June appraisal well are not isolated victories. They are the first proof points that the oilfield can mass produce firm, fuel‑free megawatts. If buyers ask for the right products and if interconnection teams plan for flat geothermal blocks, the Western grid can add dependable capacity without adding fuel risk. That is how an inflection becomes a buildout.

The upshot is simple. The rocks are hot enough, the tools are fast enough, and the equipment is standardized enough. The next move belongs to buyers and grid planners who decide to make geothermal one of their default options, not their last resort.