Texas Energy Fund 2025: Will cheap loans deliver firm power?

Texas has begun approving low‑interest loans for new gas plants under the Texas Energy Fund. We map the 2025 pipeline, flag the projects most likely to hit notice to proceed, and test how added dispatchable megawatts could reshape ERCOT by 2028.

Breaking through the stalemate: Texas starts writing checks

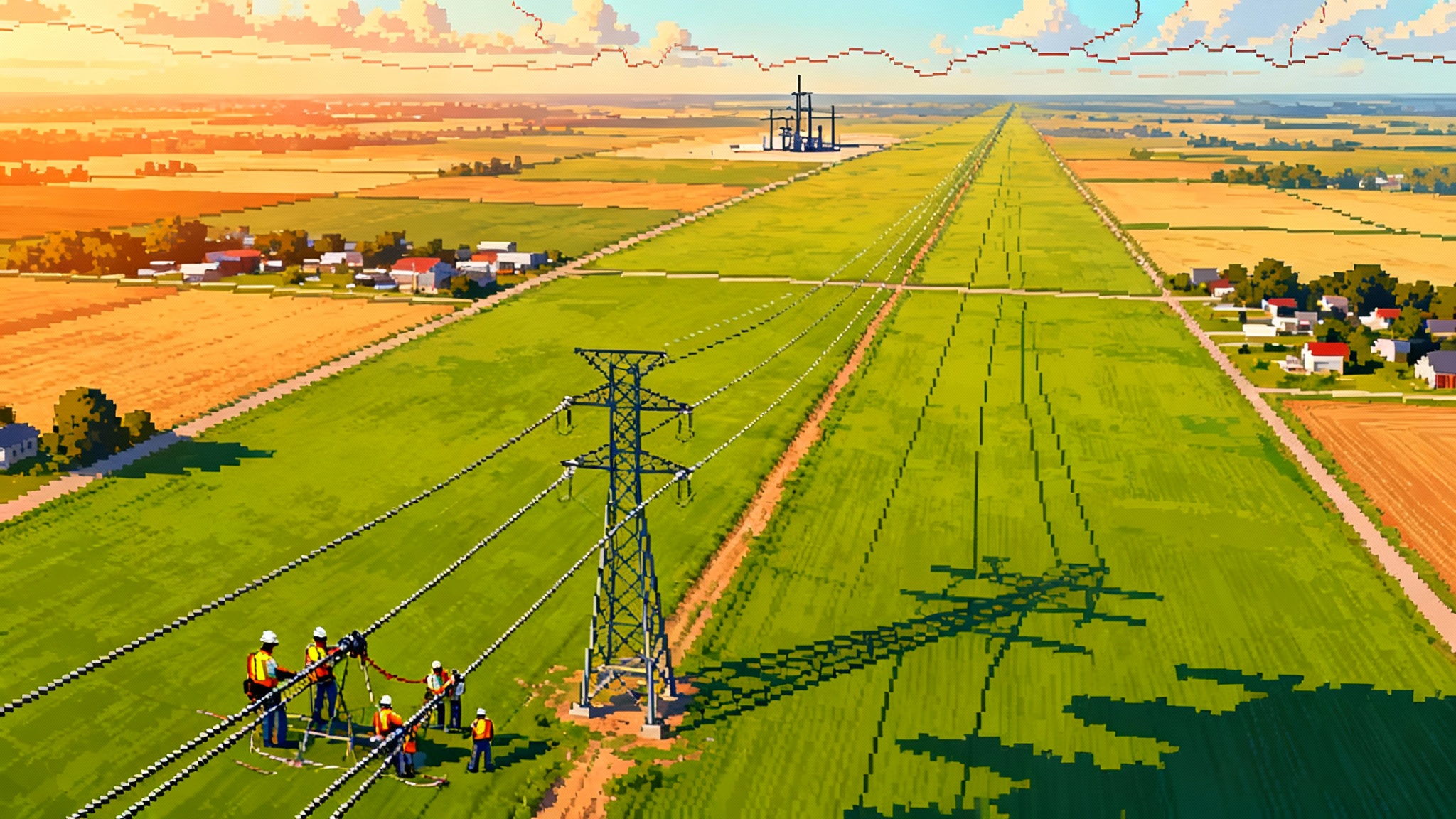

Texas voters created the Texas Energy Fund to add new, controllable power to the ERCOT grid. In 2025 that idea crossed from speeches to signatures. The Public Utility Commission of Texas signed the first loan agreement in June 2025, with more approvals following through late summer. The program is now real money, real deadlines, and real megawatts. The question is whether cheap state capital can turn that momentum into on the ground capacity fast enough to matter before the next wave of demand arrives. Program terms, timing, and geography will decide the answer, and the early evidence is unusually clear: the Houston load zone is the prime landing spot for new gas capacity.

If you want the official playbook for what the fund will and will not finance, the commission maintains an updated overview of rules, timelines, and program milestones, including the date of the first executed loan agreement and the December 31, 2025 deadline for initial disbursements. See the regulator’s summary under The Texas Energy Fund in the PUC summary of Texas Energy Fund.

What the money actually buys

The In‑ERCOT Generation Loan Program offers long‑dated capital at a three percent interest rate, for up to sixty percent of a project’s cost, with a 20‑year term. The money is restricted to new or expanded dispatchable generation of at least 100 megawatts that was not in ERCOT’s planning models before June 2023. Storage does not qualify for these loans, nor for the separate completion bonus grants defined in rule and statute. Loans come with performance standards and reporting, and the statute sets a hard stop for initial disbursements by December 31, 2025 unless the commission grants extensions for market factors that delay schedules.

That design tells you two things. First, the fund is meant to tilt marginal gas projects over the finish line, not to rewrite ERCOT’s market. Second, time is short. Sponsors need sites with gas supply and interconnection steps already underway, because lenders will not wait and the state is not offering construction management services. The winners will be developers with steel, permits, and contracts mostly lined up.

The early winners, by name and location

Three loan agreements are now public and they point to a clear map.

- Houston, TH Wharton: A 456 megawatt simple cycle gas project at NRG’s existing TH Wharton site. The project is under construction and slated to be online as early as summer 2026. Interconnection is in the Houston load zone and leverages an existing brownfield footprint, which reduces schedule risk.

- Chambers County, Cedar Bayou: A 721 megawatt project at NRG’s Cedar Bayou complex near Baytown. The project targets the same Houston zone and is scheduled for summer 2028 operations. Siting next to an existing plant simplifies gas and water logistics, two common bottlenecks for greenfield plants.

- Colorado County, Rock Island: A 122 megawatt gas project sponsored by Kerrville Public Utility Board that will interconnect to the South zone just west of the Houston zone. The sponsor completed a financing stack that includes the state loan and tax‑exempt bonds, a combination that tends to move quickly from approval to notice to proceed.

These three approvals say a lot about what the commission is rewarding: brownfield expansions or add‑ons where gas supply is close, interconnection work is visible, and load relief is targeted to the biggest congestion problems.

The 2025 pipeline that could follow them

The commission has been evaluating a second cohort of applications since late 2024. Public comments and press briefings throughout 2025 indicate that the diligence funnel still contains several gigawatts of gas additions. The mix skews toward two families of projects:

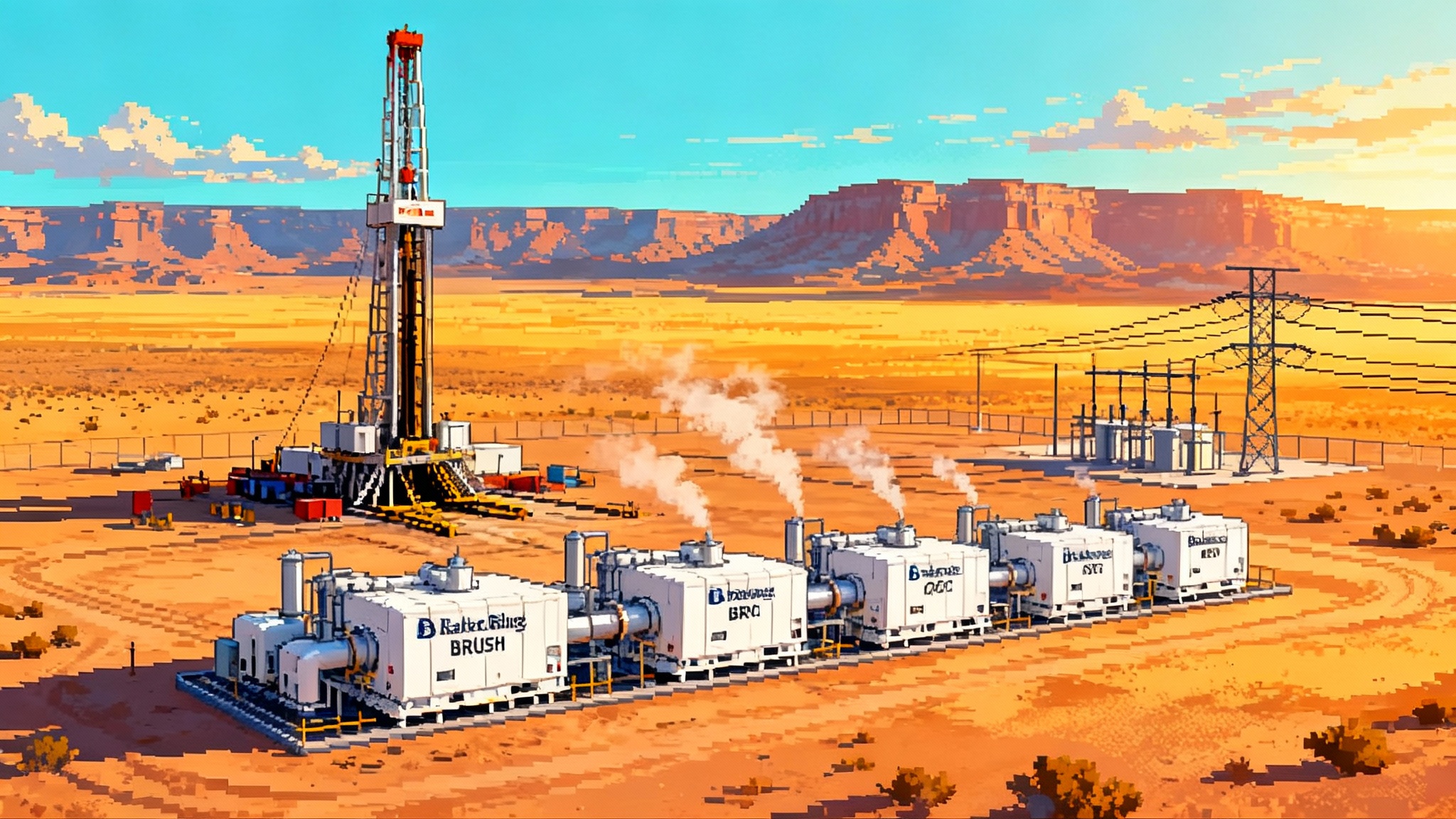

- Large combined cycle builds in West and South Texas that chase baseload economics and balancing needs created by wind and solar growth in those regions. These projects tend to be big single sites that need more construction time and carry higher interconnection upgrade exposure.

- Fast start peakers and expansions around the four major load zones, with Houston and Dallas at the top of the list. These are often aeroderivative or frame simple cycles added at existing stations, and because they align with local reliability planning, they have a clearer path to timely interconnection studies and upgrades.

Based on siting, permits already filed, and the program’s clock, the likeliest 2025 notices to proceed are additional Houston‑centric peakers and one or two expansions in the Dallas area where gas and wires are already present. West Texas combined cycles may reach loan agreements this year but are more likely to hit full construction mobilization in 2026 because of equipment lead times and water supply requirements.

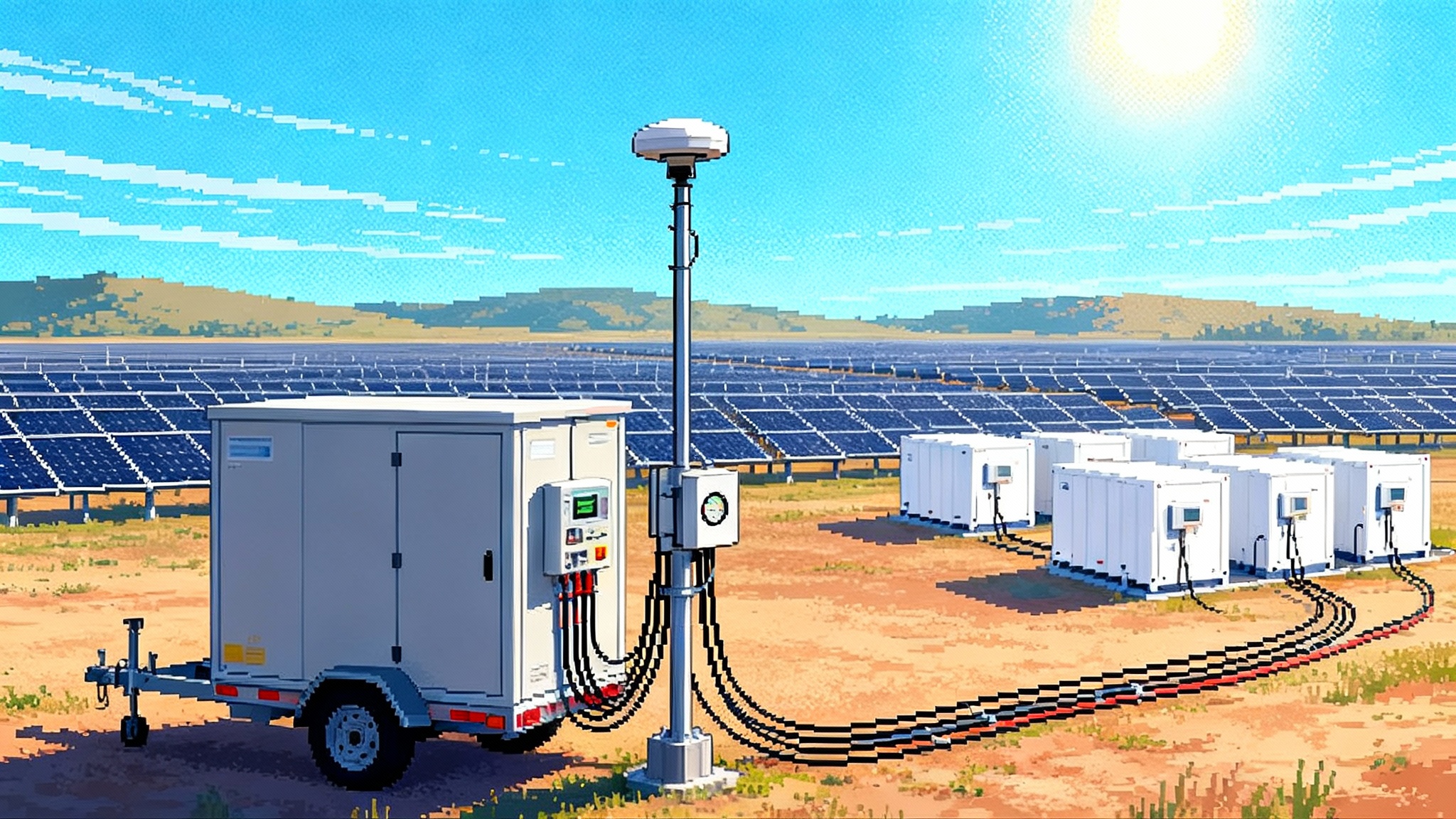

Storage will move with or without the fund

The loan program excludes storage, but batteries are still part of the 2025 picture because private capital is building them to monetize price spreads and ancillary services. Developers are clustering around Houston substations that often separate from the rest of ERCOT on peak days. Several projects have broken ground or reached operation in 2025 in and around the Houston zone, including a 150 megawatt site in Brazoria County and a 160 megawatt, two‑hour system scheduled to finish construction by mid‑2025. Global platforms have also announced roughly 400 megawatts of new storage with construction starts this year split between Houston and Dallas. The draw is simple. Storage captures volatility created by transmission constraints and fast ramps, it soaks up midday solar that might otherwise be curtailed, and it can respond to scarcity signals in seconds. That makes it a natural complement to the new gas peakers that will set the ceiling on prices.

How many megawatts does ERCOT actually need by 2028

ERCOT’s most recent five‑year Capacity, Demand and Reserves update, released in February 2025, describes a system where planning reserves look comfortable on paper in one scenario, then tighten quickly when you layer in contracted new load from data centers, oil and gas electrification, and industrial expansions. The operator’s message was plain: reserves are pressured, and resource and load accounting has been updated to reflect newer realities. See ERCOT’s CDR update and context.

This picture aligns with broader national trends, including rapid server farm growth summarized in AI’s power scramble in 2025.

Against that backdrop, the three approved loans add roughly 1.3 gigawatts of dispatchable capacity by 2028 if schedules hold. Add a few more peakers from the 2025 pipeline and ERCOT could see 2 to 3 gigawatts of new firm gas by late decade that the market would not have financed as quickly without the fund. That does not erase the need for transmission and demand flexibility, but it does change the shape of risk on the tightest hours.

What more firm capacity does to prices and curtailment

Think of the Operating Reserve Demand Curve as a thermostat that raises prices when reserves fall. Extra firm capacity pushes that thermostat to activate less often and for fewer minutes. Here is how that plays out by zone and by hour if the Houston‑area plants arrive on time:

- Houston scarcity events: New peakers at TH Wharton and Cedar Bayou should cut the frequency of low reserve intervals inside the Houston zone, especially on late summer afternoons when load is highest and imports are constrained. That lowers the Houston Hub’s tendency to spike above the system price. The basis between Houston and North Hubs should compress on hot days when both zones are short, because Houston will get local relief while North relies more on imports.

- Evening ramps: Peakers that can start and hit full output in minutes reduce price spikes created by the solar decline after 6 p.m. Batteries compete here too. A more robust fleet of short‑duration storage in Houston and Dallas will cover the first hour or two of the evening ramp, leaving peakers to set prices later in the evening or during long heat events. New market participation details will also be shaped by 2025 inverter‑based resource rules.

- Renewable curtailment: More midday batteries in Houston, the Rio Grande Valley, and West Texas should reduce solar curtailment by absorbing negative price periods and selling into the evening. Additional gas capacity can either reduce or increase curtailment depending on how it runs. When peakers stay idle until scarcity looms, curtailment falls because batteries arbitrage the midday glut. When peakers run for local reliability during line outages, they can depress prices in a pocket and indirectly increase curtailment nearby. On balance, the combination of new storage and targeted peakers should move curtailment down, but the change will be uneven across zones.

Where notice to proceed is most likely in the next 12 months

- Houston zone, existing sites: Brownfield peakers at big multi‑unit plants have the inside track. They use existing gas laterals, water service, and switchyards. They also tend to have neighbors and local officials who already understand what a power plant is, which lowers permitting risk.

- Dallas zone, municipal and cooperative footprints: Public power and cooperatives with load growth and available land inside their footprints are well positioned to blend state loans with tax‑exempt debt. That looks a lot like the Rock Island model shifted north.

- South zone near Houston’s western edge: One or two smaller peakers can slot into existing substation plans to support industrial load growth along the Interstate 10 corridor. Gas supply is strong, and developers can interconnect without major 345 kilovolt upgrades.

Storage notice to proceed will continue to pop where substation capacity, transformer upgrades, and congestion spread values line up. Brazoria, Chambers, and Fort Bend counties are the most likely to see announcements that make 2025 construction windows.

The execution risks that could slow the buildout

- Turbine and balance of plant supply: Lead times for simple cycle units have improved from the 2022 crunch, but specialized components still have year‑plus delivery windows. Developers that locked orders in 2024 will move. Late buyers will slip.

- Gas and interconnection: Even brownfield projects sometimes discover that legacy gas laterals need upgrades or that new pressure commitments require compressor additions. On the electric side, stability studies can trigger unexpected control upgrades, capacitor banks, or breaker replacements that add six to twelve months.

- Permitting and community process: Texas Commission on Environmental Quality air permitting is predictable when applicants reuse existing sites, but greenfield plants can face contested case hearings that alter schedules. Water sourcing and discharge plans can also add time for combined cycles in dry counties.

- Financing terms and market signals: The state loan is cheap, but it is also senior and comes with performance standards. That structure leaves a thinner slice for private lenders and equity. If forward spark spreads soften because batteries and a few peakers take the top off peak prices, marginal projects may struggle to assemble the rest of the stack.

- Federal policy and component sourcing for storage: New rules on domestic content and foreign entity restrictions are tightening the battery supply chain. That will not stop Texas storage, but it can shift delivery months and push some 2025 starts into 2026.

What this means for buyers, sellers, and policymakers

- Retail suppliers and large loads: Expect fewer extreme price spikes in the Houston Hub if the 456 megawatt and 721 megawatt projects arrive on schedule. Options to hedge summer peak risk locally should become slightly cheaper. Shape risk migrates toward long heat waves and long winter mornings when batteries have already discharged.

- Generators: Peakers in Houston will earn more from scarcity avoidance and ancillary services than from pure energy margins. Brownfield optionality is now a financial asset. Projects that can add a second unit at a site later are worth more than they look on paper because they can follow transmission upgrades. Those upgrades will increasingly reflect state‑led transmission planning.

- Storage developers: The Houston congestion story remains intact. Batteries should focus on short to medium duration systems sited where they can relieve transformer and line constraints. Four hour assets will find the best contracts with municipal and cooperative buyers in the Dallas and San Antonio areas that need local capacity.

- Policymakers and the commission: The program is working as written. The next reliability gains will come from making interconnection timelines more predictable and prioritizing transmission upgrades that release the full value of new plants.

By 2028, what will be different

If current schedules hold, ERCOT will have an extra one to three gigawatts of firm gas plants sprinkled across its most stressed load zones, with the largest additions in greater Houston. Storage will have at least doubled from early 2024 levels, with the densest clusters around Houston and Dallas. Planning reserves will look less fragile during the hottest 40 hours of the summer, and nodal volatility in Houston will still be alive, but not the headline risk it was in 2023 and 2024. Renewable curtailment will still happen, especially in the West zone on windy nights, but batteries will shave the worst of it on sunny, shoulder‑season days.

The verdict

Cheap state capital can add firm capacity fast, but only when it chases projects that already solved the slow parts of power development. The Texas Energy Fund has steered early loans to expansion sites in the Houston area where gas, wires, and water already exist. That is the right bet for 2025. To make the program truly shift ERCOT’s risk by 2028, the commission needs two more things to happen in parallel. First, a handful of due diligence projects must lock notice to proceed this year, especially in Houston and Dallas where the nodal payoff is largest. Second, ERCOT and wires companies need to keep pushing the most surgical transmission upgrades that let new plants and batteries actually move power where it is needed. Do those two things, and by 2028 the grid will feel less like a high wire act and more like a sturdy bridge that can handle whatever Texas throws at it.