Solar Tariff Shock 2025: How U.S. Supply Rebuilds by 2027

A field guide for developers and buyers navigating new AD/CVD duties on Southeast Asian solar imports. Learn how to pivot sourcing, win the domestic content bonus, rebase PPAs and schedules, and spot the surprise winners.

What just happened and why it matters

In April 2025, the United States completed yearlong trade investigations with final determinations, followed by orders in June, imposing antidumping and countervailing duties on crystalline silicon solar cells and modules from Cambodia, Malaysia, Thailand, and Vietnam. Rates vary by company and country and are material in every case, with some outliers so high they effectively halt shipments. The orders cover cells whether or not assembled into modules. Read the details in Commerce’s summary of final tariff determinations. This is the biggest jolt to the U.S. solar supply chain since the Section 201 safeguard case and it hits where most U.S. utility scale modules came from in recent years.

For developers and buyers trying to hold schedules and levelized cost of energy targets, this is not just a price story. It is a multiyear sourcing reset that rewires who builds what, where, and when.

The new sourcing map: three lanes, one clock

Think of U.S. module supply between now and the end of 2027 as three parallel lanes feeding the same highway. Your job is to keep your project moving while the lanes merge and widen.

- Lane 1. Domestic silicon ramps. New and expanded U.S. factories for ingots, wafers, cells, and modules are scaling through 2026. Georgia’s integrated cell and module lines and multiple module plants across the Midwest and Southeast are the headliners. The most constrained element is cell output, which is why offtake reservations and take or pay terms are reappearing. Production tax credits for U.S. made cells and modules help close the price gap, and many manufacturers will pass part of that value through in long term supply agreements.

- Lane 2. Near shore bridge supply. India, Indonesia, and Laos can fill part of the gap in 2025 and early 2026 for buyers willing to underwrite origin transparency, supply chain audibility, and tariff risk. Prices will look attractive next to fully loaded Southeast Asia rates, but this lane carries investigation risk. If you use it, build a fallback plan tied to domestic or thin film allocations.

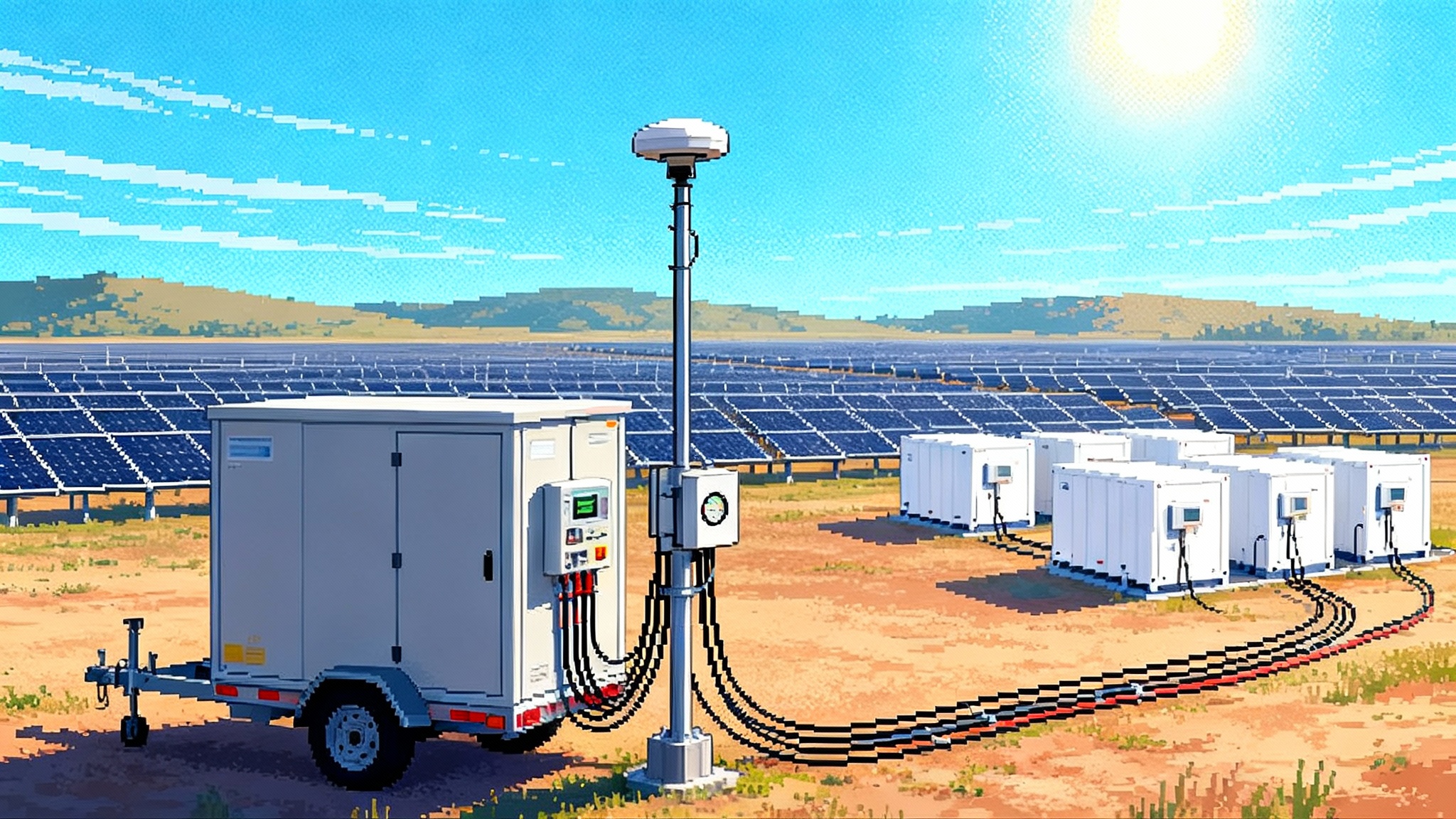

- Lane 3. Thin film independence. Thin film modules such as cadmium telluride are not subject to these crystalline silicon duty orders. U.S. thin film capacity is on track to exceed 14 gigawatts per year by the end of 2026, with additional lines commissioning in 2025. This lane is more predictable on policy and logistics, but you must plan for longer reservation horizons and site designs optimized for larger module formats and different temperature coefficients.

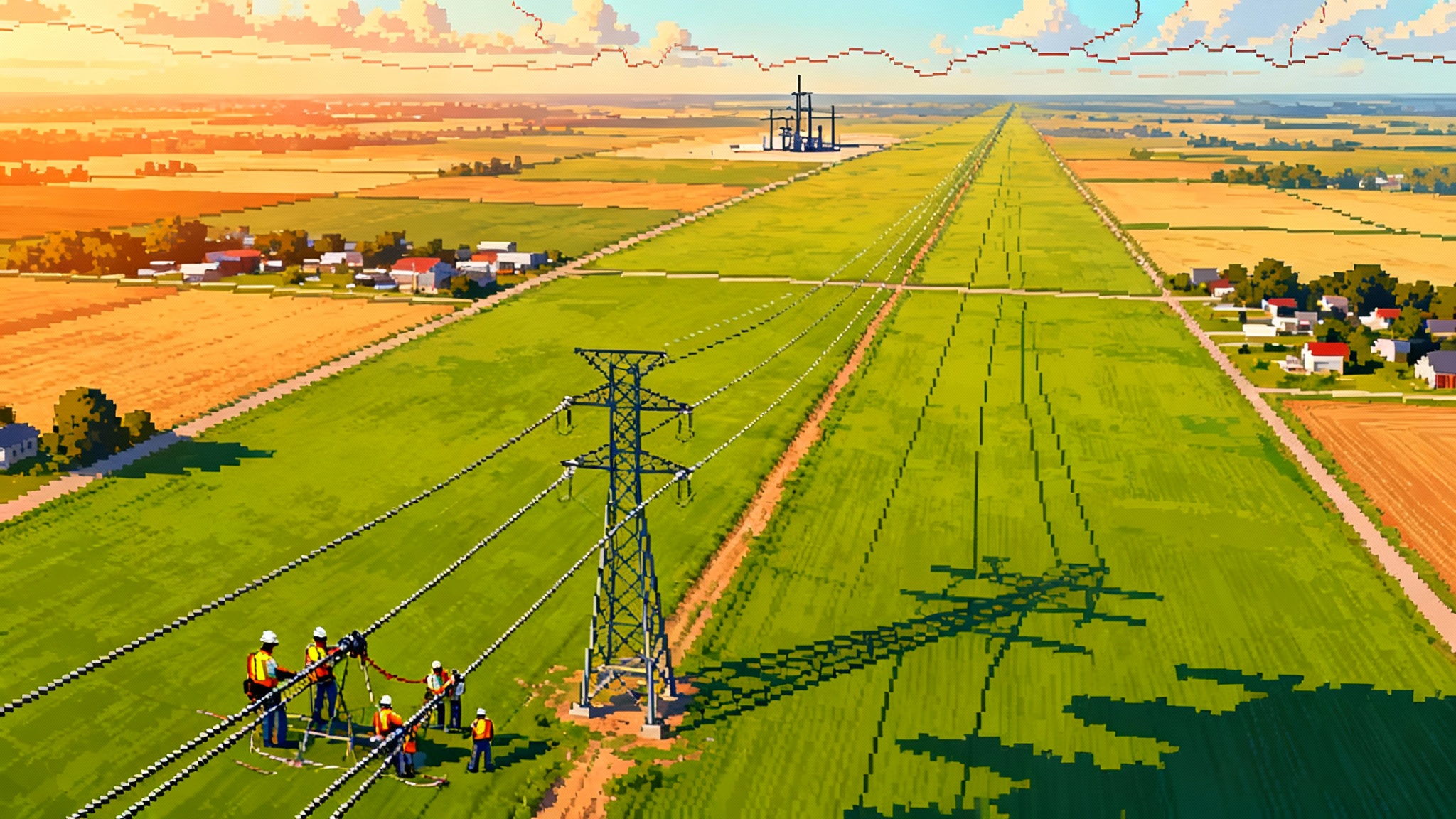

The clock matters. Orders issued in June 2025 mean cash deposits at import start now. That resets delivered pricing and reshuffles the queue. The market will reward buyers who lock timelines and are clear about which incentives they can actually capture. Transmission policy is shifting in parallel, which affects interconnection and delivery risk, so keep an eye on state-led grid expansion under 1920-A.

Project economics in plain numbers

Use a simple stack to rebase your pro forma. Pick one project in your portfolio, say a 200 megawatt alternating current build scheduled for 2026 in an energy community.

-

Start with ex works module price from a tariff exposed source. Add ocean freight and insurance. Then add the applicable antidumping and countervailing duty cash deposit rate. The rate applies to the customs value of cells or modules at the border, not to your final balance of plant. That turns a plausible 18 cents per watt direct module price into something closer to 25 to 30 cents per watt delivered, depending on the rate. The swing will be bigger for companies with higher duty rates.

-

Compare that to a domestic module offer that reflects higher factory costs but no AD or CVD and includes partial pass through of manufacturing credits. Many 2026 deliveries will land in the low to mid 30 cents per watt range before incentives. The gap to a tariff exposed offer shrinks fast once you add the duty deposit and the cost of delay risk.

-

Now layer incentives you can bank. If you meet prevailing wage and apprenticeship requirements, the Investment Tax Credit base is 30 percent. Add 10 percentage points for energy communities if your project qualifies. Add up to 10 percentage points for domestic content if you meet steel and iron rules and the manufactured product threshold using the current safe harbor tables. Treasury’s January 2025 update to domestic content rules includes new default cost percentages that make modeling the bonus more practical. See the government’s summary of Treasury’s 2025 domestic content guidance. A realistic path to 40 to 50 percent total ITC is now common for utility scale projects that secure domestic trackers and inverters and either domestic modules or a verified mix that still clears the manufactured product percentage. The bonus is a credit, not cash at delivery, but the transferability market has matured enough that sponsors can underwrite a discount to par with reasonable confidence.

Also consider demand effects that pull schedules forward. Data center builds are driving new procurement behavior, as detailed in our look at AI-driven load growth reshaping grids.

How to actually qualify for the domestic content bonus

The domestic content bonus sounds simple. In practice it is an exercise in bill of materials discipline.

- Start with the safe harbor tables. Decide if you will use the elective safe harbor or a supplier attestation route. You cannot mix methods on the same project. The safe harbor gives you default cost percentages for major manufactured products and components. That keeps you from chasing proprietary supplier cost breakdowns.

- Build a three tier sourcing plan. Tier 1 is steel and iron for structural components. Trackers and foundations are where you win or lose here. Work with tracker suppliers that can document U.S. steel melt and fabrication. Tier 2 is manufactured products like trackers, inverters, modules, transformers. Tier 3 is manufactured product components inside those products, such as inverter power stages or module junction boxes. Your target is to meet or exceed the adjusted percentage for manufactured products while satisfying the steel and iron requirement.

- Treat modules as the swing factor. If you cannot secure enough domestic modules to hit the threshold, you can still win the bonus by pairing high domestic content trackers and inverters with a share of domestic modules and a share of foreign modules. The safe harbor assigns default weights that can bridge the gap if the rest of your bill is local.

- Document from day one. Put domestic content attestations, serial tracking, and component origin certificates in your contracts. Make a single source of truth folder for the accounting team. If you plan to transfer your credits, the buyer will diligence this file.

Rebase your PPA and your schedule, not just your budget

Most power purchase agreements signed before spring 2025 assumed Southeast Asia pricing and smooth logistics. That world is gone. Three actions will save you months of renegotiation later.

- Add a tariff and tax credit reopener. If your tariff exposure changes because a supplier’s assigned rate changes or a new country is brought into scope, you need a clean mechanism to adjust price or extend schedule. Tie the reopener to specifically defined events and independent public notices.

- Use indexed price floors. Anchor a portion of your price to a transparent index that reflects long term module and steel trends. Floors protect you if policy changes unwind parts of the Inflation Reduction Act. Ceilings protect the offtaker if supply normalizes faster than expected.

- Right size your commercial operation date window. Modules will not be the only constraint. Trackers, medium voltage equipment, and domestic steel can all drive delivery. A six month commercial operation date window that would have sounded conservative in 2023 may not be conservative in 2026.

Procurement plays that work in 2025 and 2026

- Allocate technology risk across the portfolio. Do not bet the year on one module type. Pair thin film blocks with domestic crystalline blocks. That lets your engineering team optimize for bifacial gain and albedo in some sites while leaning on thin film temperature performance in hotter locations.

- Consider tolling where it is real. Some module brands will offer tolling or contract manufacturing in the United States. If you can feed cells to a domestic line under contract and walk away with a domestic module and a domestic content file, you lower tariff exposure. This is only useful if logistics and quality control are mature at the site.

- Pre buy long lead domestic components. Tracker suppliers with domestic steel offtake agreements can lock material. Medium voltage transformers and inverter skids still carry long lead times. Buy them early and store them under warranty if your balance sheet allows.

- Reserve cells, not just modules. The tightest choke point in silicon will be cells. A contract that secures cell quantity for 2026 deliveries gives you optionality to place those cells into domestic module lines or to shift to a backup line if a supplier slips.

- Ask for 45X pass through. The advanced manufacturing production credit for domestic cells and modules adds meaningful value at the factory. In a constrained market, a partial pass through builds a cooperative relationship and can keep your delivered price inside your PPA.

Grid codes are tightening at the same time. When you evaluate inverter options and timelines, factor in IBR rules that mandate grid support.

Unexpected winners and new bottlenecks

Winners. Thin film manufacturers gain share because they are outside the scope of the crystalline duty orders and have been expanding. U.S. cell makers gain pricing power and secure offtake years ahead. Tracker companies that already localized steel and gearboxes become key to unlocking the domestic content bonus. U.S. glass makers that can produce solar grade glass find a durable new customer base. Inverter makers with domestic assembly lines see stronger backlogs as buyers chase bonus eligibility.

Bottlenecks. Solar glass, junction boxes, and some encapsulants are the new squeeze points. The simplest way to blow a domestic content plan is to discover a critical subcomponent is only available offshore. Expect tight labor markets in states with multiple new factories commissioning in 2025 and 2026. Plan crew training and housing ahead of time.

Risk watchlist you should brief your board on

- Country switching risk. Imports pivoting from Southeast Asia to India, Indonesia, or Laos may earn short term savings but carry a clear risk profile. U.S. trade agencies began investigating those lanes in late summer 2025. If you build a 2026 portfolio on that lane, keep a domestic or thin film backup ready.

- Critical circumstances and retroactive exposure. In some trade cases, duties can be applied retroactively if critical circumstances are found. That is rare, but not impossible. Avoid delivery schedules that leave you exposed to large retroactive deposits you did not model.

- Policy volatility. The Inflation Reduction Act framework still anchors utility scale economics, but parts of it can be modified by Congress or in subsequent guidance. That is another reason to lock domestic content and energy community bonuses wherever you can satisfy the rules on the ground.

A 24 month playbook

- Quarter 4 2025. Segment your portfolio by technology and by eligibility. For every site, decide now whether your domestic content path is module led, tracker led, inverter led, or a mix. Set a minimum threshold for the bonus and a stop loss date to switch technology if you cannot reach it.

- Quarter 1 2026. Lock tracker steel commitments and inverter blocks for all 2026 sites. If you need domestic modules, put down refundable deposits tied to factory milestones. If you are using near shore supply, sign a mirror agreement for a domestic or thin film backstop that you can activate at a pre agreed price.

- Quarter 2 2026. Finalize your tax credit transfer plan. Identify buyers and close term sheets before you submit your tax forms. Credit buyers will price better for documented domestic content and clean project files.

- Quarter 3 2026. Start construction on at least 5 percent of costs for late 2026 and 2027 projects to preserve eligibility and reduce risk from future rule changes. Make sure your storage integration plan aligns with domestic content targets. If your battery inverter is domestic but the battery pack is not, model the impact on your manufactured product percentage.

- Quarter 4 2026. Reconcile your actual bills of materials against the safe harbor tables. Fix any gaps while there is still time to swap subcomponents. Perform a cold eyes tax review on domestic content certifications and wage and apprenticeship documentation.

- Quarter 1 2027. Pull forward spares for critical domestic components. Keep at least one spare inverter power stack and a set of tracker drivetrains per site. Domestic content also means domestic warranty and service capacity. Use it to protect availability.

Developer checklist for the next contract you sign

- Does the supply contract spell out the duty rate used for pricing and the adjustment if the rate changes at final determination or due to ministerial corrections?

- Do you have serial number traceability from cell to module for domestic content and for import audits?

- Does the tracker vendor provide certificates of U.S. melt and fabrication for steel and can they document domestic subassemblies?

- If you plan to transfer credits, does your counterpart accept the safe harbor method you chose and the evidence you will provide?

- If you must pivot technology midstream, how will the offtaker be notified and how is price adjusted?

The near term pain that speeds the long term build

No one welcomes a shock to their bill of materials. Yet shocks force clarity. The new duty orders price in risks that were always there. They also pull forward the investments that make a resilient U.S. solar industry possible.

If you are a developer or buyer, the path through 2027 is straightforward. Sequence decisions in the right order, pick partners who can certify what they sell, and write contracts that handle the facts on the ground. The market will reward those who treat domestic content as a design input, not a checkbox. It will reward portfolios that mix technologies and keep a clean tax file. It will reward buyers who rebalance PPAs now instead of waiting for a force majeure letter next summer. The result is a U.S. supply chain that is closer, more auditable, and better able to meet the next surge in demand.

The tariff shock hurts now. It also accelerates the rebuild. Use it to lock the foundations of your next three years, then build on them with speed and confidence.