AI’s Power Crunch Is Forcing A New U.S. Grid Playbook

Federal loan guarantees and sharper load forecasts show the U.S. grid shifting from planning to execution. Hyperscalers and utilities are racing to secure 24 hour supply with dispatchable capacity, big battery hybrids, selective on site generation, and next generation contracts.

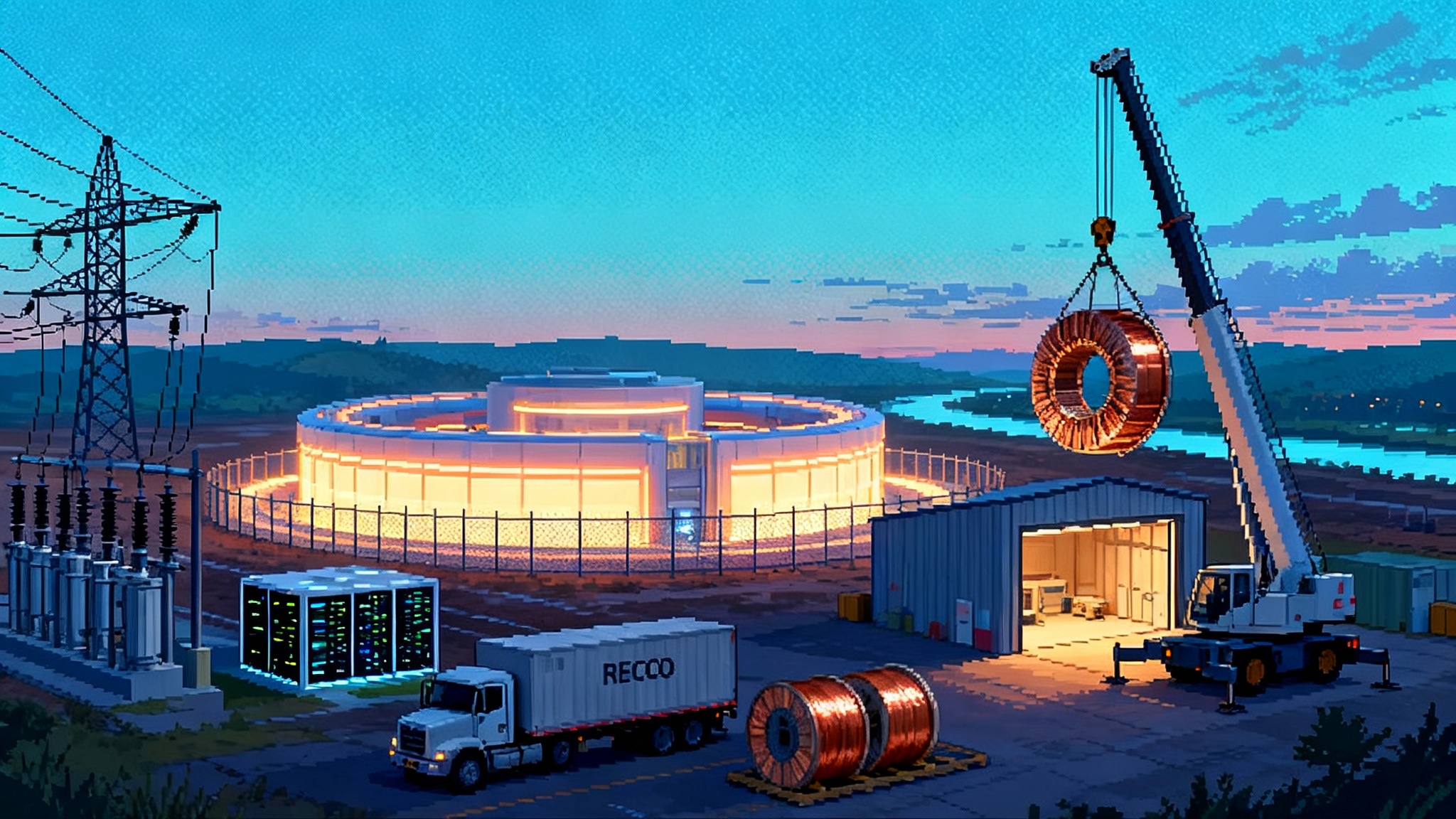

The week the grid went on offense

This week, the United States Department of Energy finalized a loan guarantee that is small in headline dollars yet large in signal. The agency will back American Electric Power as it rebuilds and upgrades thousands of miles of transmission in five states, an early move in what looks like a new federal habit of putting public balance sheets behind grid capacity that can arrive sooner rather than later. This aligns with the momentum behind FERC 1920-A transmission rules that emphasize getting more capacity from existing corridors. The message is clear. More load is coming, and it is not hypothetical anymore. The beneficiaries will include artificial intelligence data centers, which keep arriving faster than most planners expected. The federal line of credit is one way to get steel in the ground in time for the next wave of servers. See DOE backs AEP grid upgrade.

If the last decade was about buying clean electrons in bulk, this decade is about buying time. Data center operators now need power that is not just green on paper but also available every hour, on the dot. That is pushing utilities, grid operators, and hyperscalers to rewrite the playbook for firm supply, siting, and interconnection.

The demand shock gets a number

For years, forecasts tiptoed around the scale of artificial intelligence. Then the models caught up with reality. PJM Interconnection, the regional grid that stretches from Illinois to the Mid Atlantic, says its summer peak could rise toward 220,000 megawatts within 15 years, up roughly 70,000 megawatts from today, with data centers as a prime driver. The winter peak, usually smaller, is closing the gap. PJM extended its planning horizon to match the new normal and warned that timing now matters as much as totals. See the PJM 2025 load forecast.

MISO, the Midcontinent Independent System Operator that runs the grid for much of the Midwest, is seeing large load requests at a pace never tracked before, with staff flagging potential data center demand in the tens of gigawatts by the 2040s. ERCOT, the Electric Reliability Council of Texas, has watched retail sales in its footprint climb faster than the national average, with double digit growth in some near term outlooks and a surge in interconnection requests from so called large flexible loads. Taken together, the signal is not subtle. Consumption growth that once came in tenths of a percent now shows up as a whole percentage point or more, and it clusters in places where fiber, land, and substations align.

Think of the grid as an airport. For a long time, planners assumed a steady increase in regional flights. Now a fleet of wide body jets just appeared on the arrivals board, all asking for gates in the same terminals. That is the kind of scheduling puzzle artificial intelligence has created for system operators.

From annual green to hourly firm

Hyperscalers pioneered the corporate renewable energy contract. The first wave was built with annual accounting that matched a year of consumption with a year of wind and solar output. That helped build a lot of zero marginal cost generation, but it did not change the hourly reality that a server room needs power at 3 a.m. in February when the wind is low or a heat wave hits at 5 p.m. in August. The new target is simple to explain and hard to deliver. Keep the lights on every hour, keep carbon low enough to meet public goals, and keep costs predictable for a business that spends as much on electricity as it does on chips.

To get there, the market is converging around four pillars.

1) Utility built capacity that is dispatchable

Many utilities are preparing to add new natural gas generation that can start quickly and follow load. In parts of PJM and MISO, resource plans now include simple cycle peakers that can cover hours when solar output fades, and combined cycle plants that add efficient, longer duty power. These are not nostalgia projects. They are bridges that let grids absorb fast load growth without losing resilience as coal fleets retire.

Next generation nuclear is back on the whiteboard too. Some utilities and industrials are advancing small modular reactor designs, often on existing nuclear or coal sites so they can reuse transmission and water rights. Timelines are measured in years, not quarters, and fuel supply chains need work, but the motivation is straightforward. A plant that runs day and night, with a long term fuel contract and no variable gas price, is attractive when operations depend on a strict power budget. Even before new reactors arrive, existing nuclear is being paired with data centers through long dated contracts that provide hourly carbon free attributes. Recent deals in the Mid Atlantic show the shape of things to come, including a multi decade nuclear supply agreement that anchors a large data center campus next to an existing plant in Pennsylvania.

2) Big battery hybrids stitched to renewables

Storage is the Swiss Army knife in the new stack. Four hour batteries have become common. Eight hour assets are entering planning models where evening peaks are stubborn. Solar plus storage can shape output to match a data hall’s daily curve. Wind plus storage can firm nighttime supply. Batteries do not add net new energy across a full day, but they do transform when and where energy is useful, which is exactly what operators need to survive the late afternoon ramp without leaning only on gas.

Utilities are pursuing hybrids that put batteries behind the same point of interconnection as a new solar field or a repowered wind farm. That reduces queue risk, shrinks the footprint of grid upgrades, and lets developers deliver a cleaner capacity product. The play is even more potent near data centers, where batteries can provide both bulk shifting and site level backup that takes stress off distribution equipment.

3) Selective on site generation for speed and control

While few hyperscalers want to be power plant owners, more are open to targeted on site assets when they cut timelines or manage risk. The menu ranges from reciprocating engines that can burn natural gas or hydrogen blends, to fuel cells that provide steady baseload in a small footprint, to direct ties to existing plants through retail structures that keep transactions inside the market while delivering the same physical outcome as a private wire.

On site generation is not a free pass. It triggers air permits, interconnection studies, and community scrutiny. But for specific campuses, a modest block of on site firm power can shave the top off peak demand, which lowers grid upgrade costs and smooths the interconnection path. In ERCOT, where the state has tightened rules for very large loads and created new curtailment and study requirements, developers are modeling designs that combine grid supply with on site backup and pre agreed load management. The pattern is spreading.

4) Novel long term contracts that buy time, not just megawatt hours

The contracting toolkit is evolving. The classic virtual power purchase agreement is giving way to structures that deliver hourly performance, not just annual averages. Examples include retail supply with hour by hour carbon matching, tolling agreements that reserve physical capacity at a gas plant, and utility tariffs that bundle new generation and deliverable transmission into a single, regulated price. In the West, Google and NV Energy created a clean transition tariff to underwrite Cape Station 500 MW geothermal, a resource prized because it runs around the clock.

In the Mid Atlantic, nuclear retail supply paired with hourly tracking is becoming a template for data centers that want 24 hour carbon free supply without building their own plants. One large cloud provider and an independent power producer extended a deal this summer that will ramp to nearly two gigawatts of nuclear backed supply through the early 2040s, with options to add new capacity through uprates and advanced reactors. These contracts share two features. They run long enough to justify new steel, and they reward the ability to show up every hour, not just on average.

The fast lane for siting and interconnection

Speed now decides where the next cluster lands. Several tactics have moved from clever to common in the last year.

-

Reuse what exists. The quickest way to get a big load connected is to pick sites with spare transformer bays and stout substations. Retired coal plants and industrial parks with transmission in place are suddenly prime digital real estate. That is why so many projects in PJM and MISO are circling legacy corridors.

-

Co locate with generation. Placing data centers next to existing plants, then routing transactions through the grid instead of around it, delivers the physics of a private wire without losing market transparency. It also keeps the door open to expand later, since the site already fits industrial energy use.

-

Join the expedited queues. Grid operators have begun carving out faster interconnection paths for near term reliability resources and for projects that can energize within a few years. The goal is to align study resources with system needs, rather than hold everything in the same multi year line.

-

Accept curtailment as a feature. In fast growing regions, large loads can get provisional service early if they agree to curtail during grid emergencies and install the controls to make that curtailment certain. For data centers with on site backup and good software, a managed interruption of a few hours a year is better than waiting an extra year for full firm service. The trade is now part of many interconnection conversations.

-

Pre pay for upgrades. Some customers are fronting the money for specific network upgrades in exchange for firm delivery timelines and step up rights if neighboring load grows. Utilities like this because it lowers capital pressure and protects other customers. Developers like it because it buys clarity.

Where the first wave will land

The build out is not uniform. It follows fiber routes, land use rules, and the existing skeleton of the grid.

-

Mid Atlantic anchors. Northern Virginia is still the belly button of the internet. What changes is the radius. With the closest substations saturated, capacity is spreading into adjacent Virginia counties, Maryland, and southern Pennsylvania. The Susquehanna nuclear corridor in Pennsylvania, already paired with a major data center campus, illustrates how legacy generation sites become digital hubs. Expect more of that along the Susquehanna and Potomac river basins where high voltage lines converge.

-

PJM Midwest hotspots. Central Ohio, western Pennsylvania, and northern Indiana are benefiting from substation strength and logistics. Developers are also eyeing brownfield steel and coal sites that can be remade as energy served industrial parks with ready access to interstate highways and fiber.

-

MISO Upper Midwest. Wisconsin and Michigan have a mix of manufacturing, cool climate, and proximity to Great Lakes transmission lines. States that combine clear tax policies with predictable siting rules will leapfrog peers. Expect a tug of war between places that can move permits in under a year and those that cannot.

-

Parts of ERCOT in Texas. Dallas Fort Worth has the fiber, San Antonio has land and a growing battery fleet nearby, and the Houston area is seeing interest tied to pipeline access for on site gas and to the emerging battery cluster. The ERCOT storage pivot is accelerating. ERCOT’s new large load rules will shape who moves first. Operators that can live with curtailment during emergencies, and can verify voltage ride through performance, will get to market sooner.

How utilities are rewriting their plans

Utilities are adjusting in three ways that matter for customers and communities.

-

Planning for hourly need, not just annual growth. Resource plans now stress test against extreme weeks rather than average years. That shifts portfolios toward resources that can respond quickly and toward storage that can bridge the evening ramp.

-

Building hybrid capacity. Transmission that ties a new solar field to a substation is being sized for a co located battery from day one. The hybrid mindset lets utilities add firming without reopening the interconnection from scratch.

-

Bringing customers into the plan. Some utilities are crafting special tariffs that let a data center underwrite a new plant in exchange for a fixed price path. Others are creating queue rules that prioritize projects that serve confirmed large loads. A few are helping city and county partners pre permit energy served industrial sites so that load arrives where the grid can take it.

How hyperscalers are buying certainty

The most successful buyers this year are acting more like industrials and less like buyers of green certificates. Five moves stand out.

-

Lock in a 24 hour supply you can verify. Favor tariffs or retail contracts that provide hourly performance data and allow suppliers to blend nuclear, geothermal, hydro, and storage with renewables for firming. Hourly matching is the new compliance language.

-

Pay for speed with flexibility. Offer provisional service agreements that commit to curtailment during emergencies, and back them with on site backup. This can shave months off energization.

-

Split the feed. Design campuses with two utility feeds from different substations and add a modest on site generation block. The combination can lower the size of the single largest contingency the utility must plan for, which can make the interconnection study pass sooner.

-

Prefund specific upgrades. If a transformer bay, a breaker, or a short line segment is the pacing item, fund that item directly in exchange for a firm date and a clear crediting mechanism. Be explicit about step up rights if neighboring projects stall.

-

Place big bets where policy is stable. Favor regions where state regulators have laid out clear rules for large load interconnection, where permitting timelines are predictable, and where labor and training pipelines exist to build quickly. Time lost to unclear rules rarely comes back.

What to watch next

-

The federal loan pipeline. The AEP loan guarantee may be the first of several grid backed financings that focus on reconductoring and rebuilds rather than new corridors. Replacing steel with higher capacity conductors is faster than siting brand new lines, and it adds megawatts of headroom where data centers need it most.

-

Implementation of new large load rules in Texas. As ERCOT and the Public Utility Commission of Texas finalize standards for very large loads, interconnection study times and curtailment obligations will become more predictable. Projects that design for these rules now will move first.

-

Longer duration storage. Eight to twelve hour batteries will decide how much gas capacity is needed for evening peaks in the late 2020s. Watch for hybrid projects that layer four hour and eight hour assets to deliver a shaped capacity block.

-

Nuclear timelines. Uprates at existing plants are the near term lever. Advanced reactors are a next decade lever. Buyers and utilities that treat uprates and lifetime extensions as supply will have an edge.

-

Data center designs that use less per compute. Chips and cooling matter as much as contracts. The most resilient campuses will bring energy efficiency and power procurement into the same room.

The bottom line

Artificial intelligence is not only changing software. It is changing how and where the United States builds power. Federal financing is nudging transmission forward. Forecasts are finally honest about load. Utilities are adding dispatchable capacity and storage in smarter combinations. Hyperscalers are moving from annual green claims to hourly firm supply. The map is shifting toward Mid Atlantic corridors, PJM and MISO hubs, and selected parts of Texas that can move fast without losing reliability.

The practical takeaway is simple. Speed now rests on certainty. Buyers that can promise flexibility and pay for targeted upgrades will get power sooner. Utilities that design for the hour, not just the year, will keep their systems stable as they grow. Do that, and the grid can absorb the next wave of compute without breaking stride.