Enhanced Geothermal Goes Big: Cape Station’s 500 MW Moment

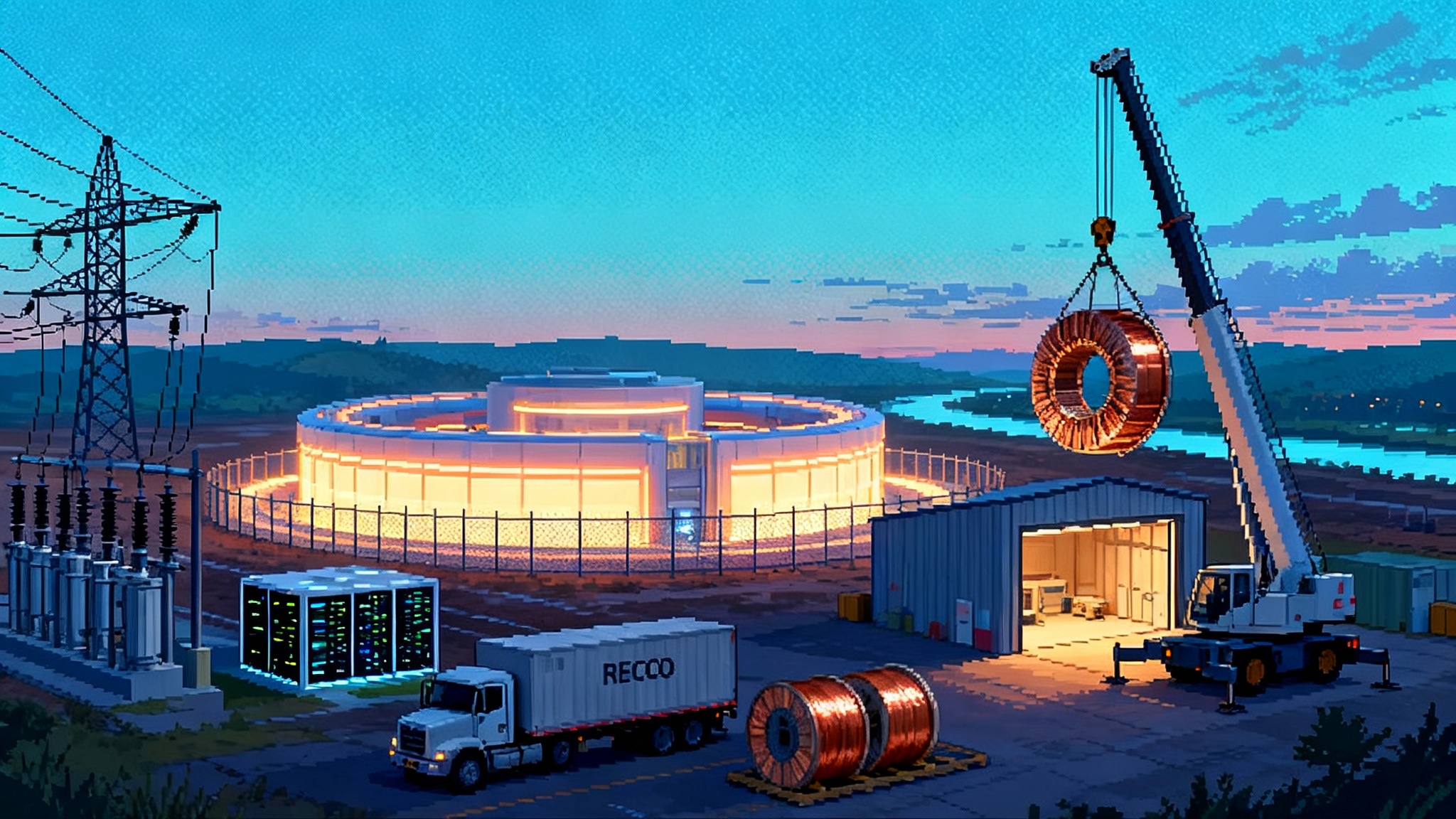

Fervo Energy has upsized Cape Station in Utah to 500 megawatts with real offtakes, named equipment, and first power set for 2026. Here is why engineered geothermal just moved into the firm, bankable core of the Western grid.

2025, the year the Earth's heat went prime time

Enhanced geothermal moved from promise to product this year. The signal was not a vague forecast. It was a contract, a turbine order, a financing close, and a calendar with near-term delivery dates. Fervo Energy's Cape Station in Beaver County, Utah, was upsized to 500 megawatts after a fresh power purchase agreement with Shell Energy North America, a deal that also set first deliveries for 2026. The announcement was a simple sentence with big implications: the resource underneath our feet just joined the utility-scale club with 24 hours a day output. Shell Energy's 31 MW contract made the expansion public and capped a run of agreements that put all of Cape Station's initial capacity under contract.

To appreciate why this moment matters, think of the grid as a diet. Solar is a salad the grid loves at noon, wind is a hearty stew the grid enjoys on breezy nights. Data centers and big cities need protein at every hour. Enhanced geothermal systems provide exactly that, using oil and gas style drilling and fiber optics to turn hot dry rock into a repeatable source of steady heat and power. For a snapshot of demand pressure, see how the AI power scramble in 2025 is reshaping loads and procurement.

A flagship you can track, not a concept you can debate

Cape Station is a useful lens because you can follow it like a stadium build. The site sits near the Department of Energy's research field, FORGE, and the legacy Blundell geothermal plant. Phase I is scheduled to bring about 100 megawatts to the grid in 2026. Phase II is slated to add roughly 400 megawatts by 2028. Contracts already tie the output to West Coast loads that need firm, clean supply in the evening peak.

Here is the milestone map that turned Cape from renderings to resource:

-

The big offtakes. Southern California Edison signed two contracts totaling 320 megawatts in 2024, setting the anchor for long-term utility demand. Clean Power Alliance added to an earlier agreement and now expects 48 megawatts. In 2025, Shell Energy signed for 31 megawatts to start receiving electrons from Phase I. NV Energy's Clean Transition Tariff model unlocked an additional 115 megawatts to serve Google's Nevada data centers, and Nevada regulators approved the tariff in May 2025. These are not pilot purchases; they are multi-decade grid commitments.

-

The hardware orders. Equipment awards decided whether geothermal could scale like wind and solar did a decade ago. Baker Hughes disclosed a September 2025 award to design and supply the turboexpanders and generators for five Organic Rankine Cycle units at Cape Station's Phase II, about 300 megawatts of surface power equipment. Turboden, part of Mitsubishi Heavy Industries, is providing the first tranche of ORC equipment for Phase I and was selected again in October 2025 for additional Phase II units. These packages pull a long supply chain into the sector, from high temperature seals and heat exchangers to generators and controls.

-

The money and schedule. In June 2025, Fervo secured more than two hundred million dollars in additional capital for Phase I construction work, the kind of financing you do not raise on a science project. What investors saw was a drilled, instrumented field with known temperatures and flow rates, a lineup of creditworthy buyers, and equipment slots on order.

If you want a mental picture for pace, imagine a factory-style program rather than a one-off plant. Crews drill standardized well pairs, complete them with modern stimulation techniques, and tie them into modular surface plants. Each block adds dozens of megawatts, and the site grows like a neighborhood of identical buildings that all share the same utility hookups.

How the oil and gas playbook unlocked hot rock

Enhanced geothermal systems do not sit and wait for a perfect natural aquifer. They create one. That is the difference between yesterday's rare hydrothermal fields and today's engineered reservoirs.

-

Drilling geometry. Instead of a single vertical well, developers drill pairs of long-reach wells that jog horizontally through hot rock. Think of two parallel subway tunnels at depth. One sends down cool water, the other brings up hot brine to the surface. The long lateral sections expose far more rock to the circulation loop, which boosts heat pickup without needing boiling water in a natural fracture.

-

Completion and stimulation. Controlled injections open and connect existing micro-fractures in the rock. The aim is not to crack the crust indiscriminately; it is to build a durable radiator underground, with measured connectivity between the two wells. Operators tweak injection rates, pressures, and stages to shape flow paths.

-

Fiber optics and real-time steering. Developers thread fiber optic lines downhole and read temperature and acoustic data as if they were watching the reservoir breathe. That data tells you whether a well pair is communicating properly and how fast the rock is cooling. The result is less guesswork and faster learning from one well to the next.

-

Bigger casing and better materials. Cape Station's upsizing to 500 megawatts reflects design tweaks such as larger well casings and refined well spacing that increased output per well. High temperature cements, packers, and elastomers that once lived only in deep oil and gas wells now find a second home in clean power.

The payoff is capacity factor and dispatchability. A properly engineered reservoir behaves like a giant rechargeable hot plate. It can run at a steady set point or ramp within a band to help the grid during evening peaks. Unlike a battery, it does not need to recharge from the grid; it recharges itself from the heat of the Earth. For context on how firm capacity competes with storage, see the storage pivot and FEOC rules.

The policy gravity that pulled projects across the line

The United States shifted clean power tax credits to a technology neutral format that began in 2025. The Department of the Treasury's final rules confirmed that geothermal electricity qualifies for the new production and investment credits, which now hinge on a simple test: zero or net negative lifecycle emissions. That clarity reduced legal risk and supported bankable models for long-lived assets like engineered geothermal. See Treasury's summary table for qualifying technologies released January 15, 2025. Treasury's clean electricity credits list makes the point plain.

Two other policy moves mattered in practice. First, the Bureau of Land Management's 2024 adoption of categorical exclusions for geothermal exploration helped accelerate early fieldwork. Even when later development required full environmental review, shaving months off the exploration cycle is what allowed Cape and other projects to stack learning and lock in equipment slots. Second, California's resource adequacy rules and new procurement mandates pushed utilities to sign for non-weather dependent, zero emission resources. When utilities had to produce a plan for the worst August evening, engineered geothermal fit the slot better than another midday megawatt.

State-level innovation also played a starring role. Nevada's Clean Transition Tariff is a blueprint for regulated markets where large buyers want hour-by-hour clean energy without shifting costs to other customers. The tariff aligned the utility, the developer, and the data center on price, risk, and delivery timing. That structure is exportable to other states that host data centers and heavy industry.

Costs, contracts, and what the numbers really look like

Enhanced geothermal costs live and die with drilling, just as offshore wind costs live and die with installation vessels and towers. Developers budget around several big line items:

-

Drilling and completions. Each well is a multi-million dollar piece of infrastructure. The learning curve comes from drilling repeated designs, optimizing lateral lengths, and cutting non-productive time. The oil and gas sector already did this in shale basins; geothermal is now harvesting that experience for heat rather than hydrocarbons.

-

Surface power plants. Organic Rankine Cycle units rely on standard modules that convert medium temperature heat into electricity. As orders scale from tens to hundreds of megawatts, suppliers can run true series production, which drops per megawatt costs and shortens delivery times.

-

Interconnection and transmission. Firm power earns premium value only if it reaches the evening peak. Sites sited near existing high voltage lines, like Cape Station, avoid expensive upgrades that kill returns on paper.

-

Finance. Tax credit clarity and long-term contracts with strong counterparties lower the cost of capital. That effect is hard to see in a rendering, but it is the difference between a 2026 delivery and a delayed project.

Power purchase agreements for engineered geothermal look different from solar. They are typically 15 years or longer, include shape or time-of-delivery factors so the developer is paid for the hours that matter, and sometimes include provisions for incremental capacity as the field is optimized. The stack of SCE, Clean Power Alliance, Shell Energy, and NV Energy or Google yields a portfolio that diversifies buyer risk across regulated and competitive markets, which further improves finance terms.

Supply chains snapping into place

If you want to know whether a new energy sector is real, do not just look at press releases. Look for long lead equipment orders and factory expansions. In 2025, unit orders went to global firms with deep benches in high temperature turbomachinery, generators, and controls. That allowed those firms to invest in geothermal specific tooling and service teams. On the subsurface side, high temperature cement blends, corrosion resistant tubulars, and downhole tools are being specced at volumes that move them out of prototype scarcity. The quiet but crucial win is vendor confidence. When a supplier knows the next five units already have a buyer, they assign their A-team and reserve manufacturing slots. That is how new sectors graduate from boutique to backlog.

Enhanced geothermal also benefits from workforce overlap. Drillers, completions engineers, mud loggers, and wireline specialists already exist in oil and gas hubs. Retraining those crews to run geothermal programs is measured in weeks, not years. Western states with both hydrocarbons and heat, such as Utah and Nevada, are already seeing that labor portability reduce hiring risk.

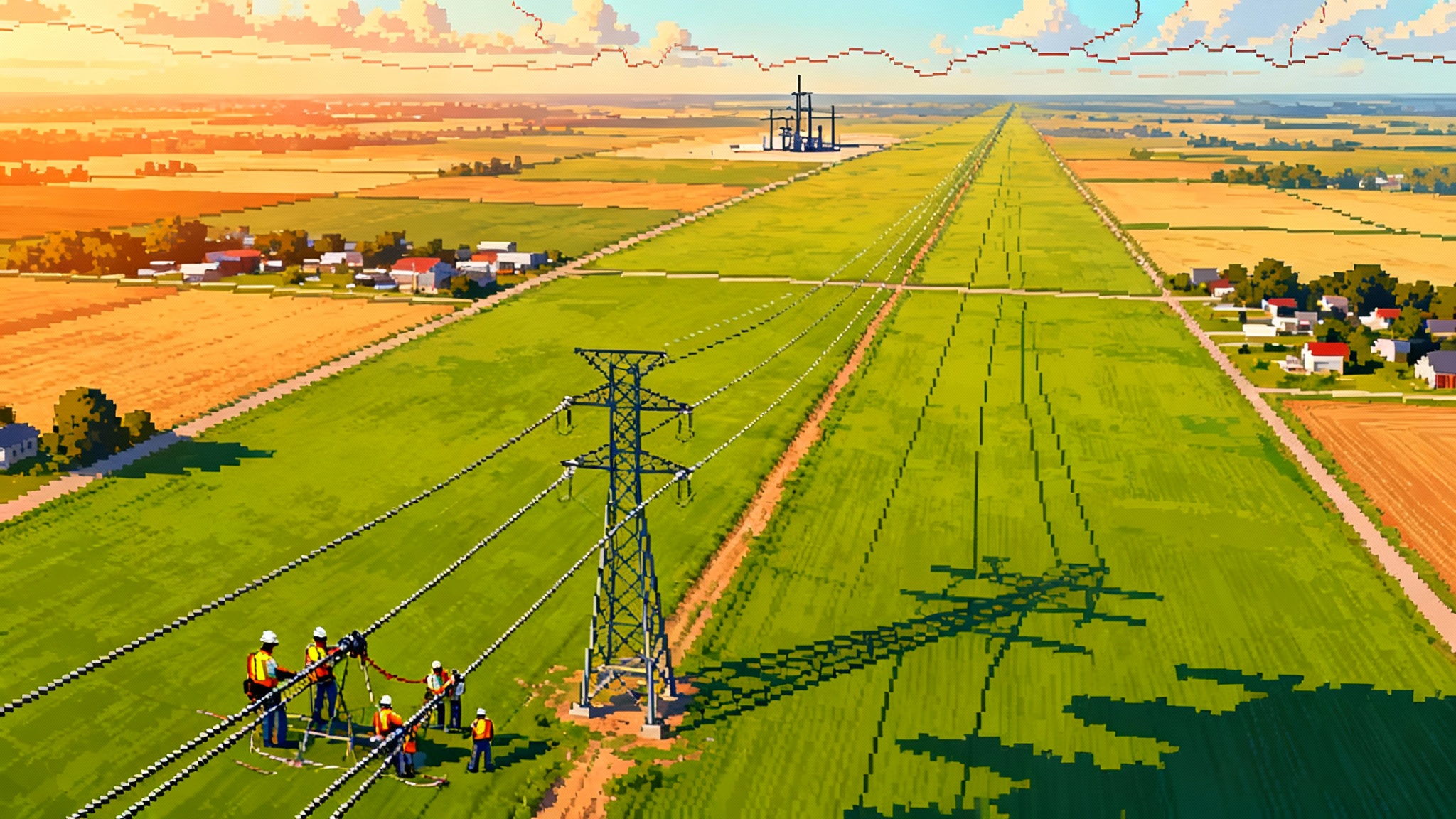

Transmission and siting: the last mile to serve Western loads

The West is building lines again, but not nearly fast enough to meet the demand spike from data centers, electrified industry, and population growth. That mismatch is both a risk and an opportunity for engineered geothermal.

-

Put firm clean in scarce import zones. The most stressed load pockets in California and the Mountain West need megawatts that count on the hottest evening hours. Siting engineered geothermal near existing 230 kilovolt and 345 kilovolt lines, and using reconductoring and dynamic line ratings, can unlock capacity without waiting for decade-long greenfield lines.

-

Use planning that values capacity. Transmission planning often undervalues resources that show up at 7 p.m. A practical fix is to apply capacity accreditation and portfolio modeling that capture evening reliability and seasonal drought resilience. Recent policy like FERC 1920-A on grid expansion is already nudging utilities toward firmer resources.

-

Keep interconnection queues moving. Small process changes matter: standard study assumptions for non-weather dependent plants; dedicated review teams for firm clean resources; and clearer timelines that match drilling schedules so developers can order equipment with confidence.

What would accelerate the next multi-gigawatt wave

If the goal is to have multiple Cape-scale projects serving Western loads by 2028, the roadmap is practical and short.

-

Lock in tax-credit stability through the decade. Treasury's January 2025 rules put geothermal firmly in the clean electricity credits regime. The action now is to keep those rules stable and predictable, with clear guidance on domestic content safe harbors, energy community bonuses, and transferability. Developers can work around rate volatility; they cannot work around rule volatility.

-

Expand replicable tariffs and contracts. The Clean Transition Tariff in Nevada deserves copycat versions in other regulated states. The essential features are hour-by-hour matching, no cost shift to non participating customers, and a defined procurement path for firm clean resources. State commissions can pilot these structures with data center anchors and then open them to large industrials.

-

Make exploration easy, keep development rigorous. Keep using categorical exclusions for low impact exploration on public lands so developers can define the reservoir fast. Then apply full environmental review for development with timelines that agencies commit to and report against. Certainty is as important as speed.

-

Build a geothermal equipment lane. Encourage suppliers to treat engineered geothermal as a distinct product line. That means committing to high temperature material stock, expanding test stands for ORC components, and training field service teams. State manufacturing credits and federal loan guarantees can be tuned to these needs.

-

Design transmission around evening reliability. Use new long-term planning standards to value firm clean in congested corridors. Fund reconductoring and grid enhancing technologies to create near-term carrying capacity while new lines are built. Prioritize interties that move firm clean from the interior West to coastal load centers.

-

Align public power with firm clean. Several Western public power agencies plan big loads for water, transit, and municipal data processing. Federal and state guidance that simplifies transferability or direct pay pathways for those agencies can unlock another tranche of bankable offtake.

The next three summers

Cape Station is not the only engineered geothermal project under way, but it is the first to show a full stack: large offtakes, named equipment suppliers, money in the bank, and near-term delivery. By summer 2026, the first hundred megawatts should be producing around-the-clock clean electricity. By 2028, several hundred more megawatts should be online, and the vendors who cut their teeth at Cape will be ready to replicate.

For grid planners, that means a new tool for the evening peak that does not depend on the weather. For data center developers, it means hour-matched clean power that can scale with campus growth. For Western states, it means a way to keep the lights on during heat waves without leaning on gas peakers.

The Earth's heat is the most patient energy source we have. 2025 is the year we finally matched that patience with a plan. The contracts are signed, the steel is on order, and the drill bits are turning. The remaining work is administrative discipline and grid pragmatism, not scientific breakthrough. If we do that work, enhanced geothermal will not be an alternative. It will be part of the backbone.