Carbon pipelines rerouted as states reshape Corn Belt CCS

State decisions in 2025 reshaped Midwestern CO2 pipeline routes and storage plans. Iowa stayed the trunkline anchor, South Dakota shifted to voluntary easements only, and finance now leans on bankable 45Q while 45Z value settles in.

The week the map changed

In March 2025, South Dakota drew a bright line: no eminent domain for carbon dioxide pipelines. One month later, the state’s Public Utilities Commission rejected a major application from Summit Carbon Solutions, calling the filed route unworkable and the record incomplete. Those decisions did not end carbon capture in the Corn Belt, but they did change its shape. Developers who once plotted long straight shots across county lines now face a world where every state line and county ordinance matters, and where voluntary easements are the only doorway in South Dakota.

Across the Big Sioux River, Iowa moved in the opposite direction. In June 2025, Governor Kim Reynolds vetoed legislation that would have tightened restrictions on carbon dioxide pipelines, preserving earlier approvals and keeping options open for projects that serve the state’s ethanol industry.

Taken together, these moves flipped the risk map for carbon capture and storage. South Dakota became a place where projects must be smaller, voluntary, and carefully routed. Iowa remained a trunkline anchor. As of mid 2025, developers described a narrower scope in South Dakota and a strategy to focus steel, crews, and capital where permits look durable. For a broader look at how state power shapes energy buildouts, see our FERC 1920-A overview.

From a single ribbon to a patchwork

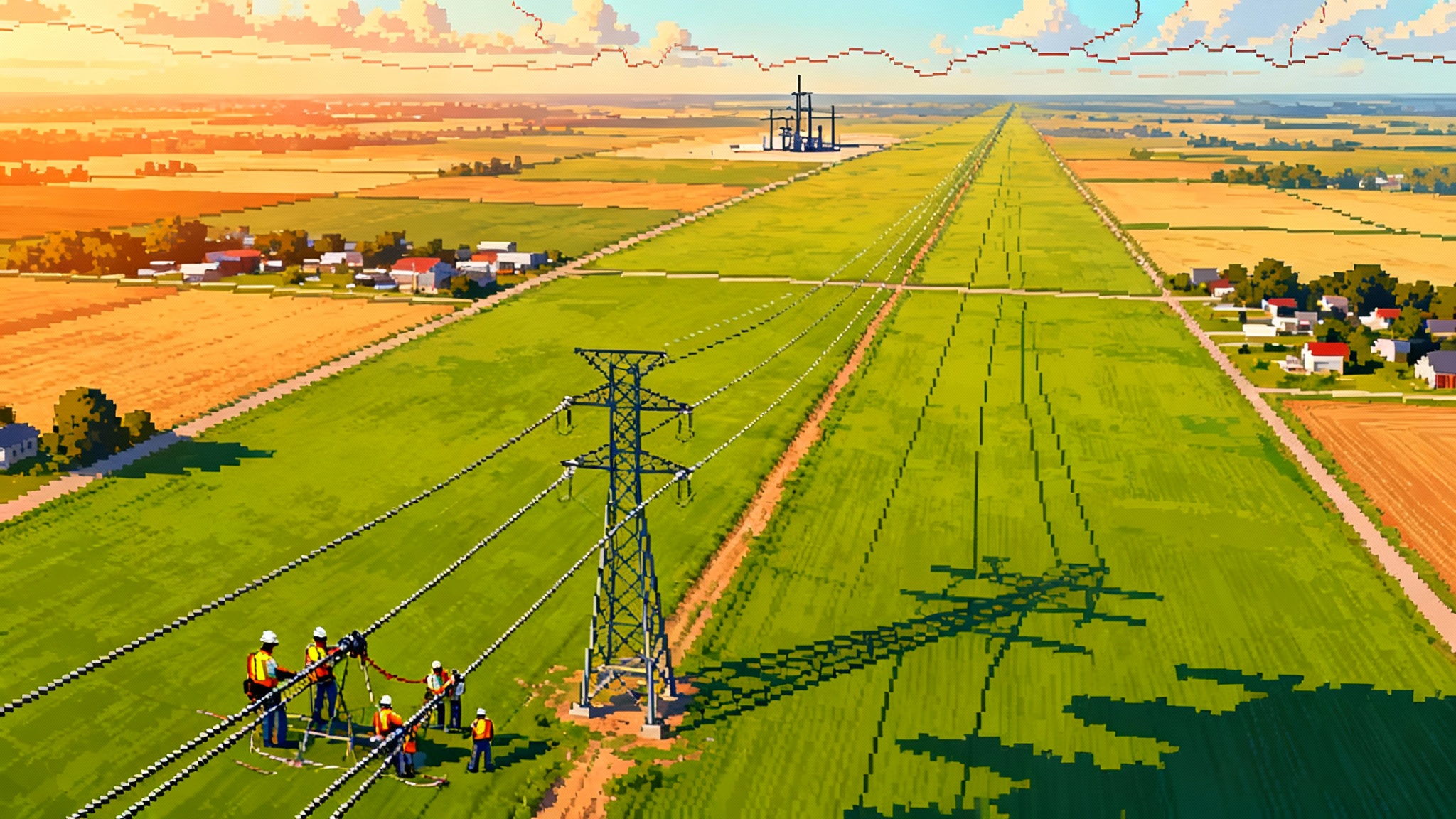

Before 2025’s state actions, the Midwest carbon concept looked like a ribbon: gather fermentation CO2 from dozens of ethanol plants and run it to a shared storage hub in North Dakota. Today it looks more like a quilt.

- Iowa is the main seam. Regulators there approved a hazardous‑liquid pipeline application in 2024 and issued a permit with conditions on insurance and cross‑state coordination. Eminent‑domain authority vests on specific parcels once conditions are met, which is why the state now functions as the project’s backbone.

- Minnesota became a narrow corridor rather than a sprawling grid. In late 2024, regulators granted a routing permit for a short segment from an Otter Tail County ethanol plant to the North Dakota border, with strict conditions on land agreements and financial assurance.

- North Dakota is the anchor, not only for siting a large share of pipe but for the end of the chain: the storage hubs. The state’s primacy over Class VI geologic sequestration permits makes timelines more predictable, and regulators approved storage facilities and the in‑state pipeline segment in late 2024.

- South Dakota is now a set of short, voluntary laterals at best. Developers indicated they would refile with a reduced scope, pruning segments with concentrated landowner opposition and leaning on voluntary easements only.

The net effect is that routes and construction sequencing will change. Expect longer dwell times in counties that host manifold junctions in Iowa and shorter, surgical spurs to border crossings in Minnesota. In South Dakota, expect fewer taps and more trucking or rail bridging to neighboring states until developers rebuild landowner trust.

What PHMSA’s coming rules mean on the ground

The federal safety baseline is also in flux. On January 15, 2025, the Pipeline and Hazardous Materials Safety Administration announced a proposal to strengthen standards for CO2 pipelines, including first‑time rules for gaseous CO2 lines, more detailed vapor dispersion analyses, and requirements for emergency responder training and public communication. See the agency’s summary in the PHMSA proposed CO2 safety rule.

Developers should treat that announcement as a trajectory, not a deadline. In late January 2025, a White House regulatory freeze paused publication in the Federal Register, creating timing uncertainty even as PHMSA advanced other pipeline safety updates. The prudent interpretation is simple: plan designs as if the most conservative parts of the CO2 package will land, even if the effective date slides. That means thicker wall pipe in sensitive segments, more and smarter block valves, better dispersion modeling near population centers, and pre‑funded first responder training and equipment caches. It also means a greater emphasis on route adjustments to avoid terrain that amplifies plume behavior.

Ethanol’s credit math in 2025 to 2026

Carbon capture economics for ethanol hinge on turning a waste stream into a credit stack. Two credits dominate the stack.

- Section 45Q pays a per‑ton incentive for captured CO2 that is permanently stored in deep geologic formations. Under the Inflation Reduction Act, the top rate for industrial sources is 85 dollars per metric ton for projects that meet labor standards, with a 12‑year payout window.

- Section 45Z, the Clean Fuel Production Credit, arrived in 2025 and rewards producers whose finished fuels have lifecycle emissions below a threshold. For ethanol plants, carbon capture lowers the carbon intensity of their product, which can boost 45Z value and also help in low‑carbon fuel markets that use lifecycle scoring. For deeper policy context, see our 45Z Goes Live analysis.

Here is how the math changes through 2026 in plain terms.

- The 45Q side is clearer and more bankable. Final energy credit transferability regulations published in 2024 allow developers to sell the 45Q credit for cash without bringing in a tax equity investor, subject to guardrails such as pre‑filing registration and recapture rules. In practice, that turns 45Q into a revenue line with a known buyer and reduces the need for complex partnership flips. See the IRS transferability regulations 2024-25 IRB.

- The 45Z side is still settling. Treasury and the IRS issued initial 45Z guidance and an emissions rate table on January 10, 2025, directing taxpayers to use a 45Z‑specific GREET model. The guidance sparked debate in the biofuels sector because it did not initially credit certain climate‑smart agriculture practices and left details to future rulemaking. The bottom line for ethanol plants planning carbon capture is that 45Z value may be positive but variable through 2026, and it should be underwritten conservatively unless firm rules and verified plant‑level carbon intensity scores are in hand.

A concrete example helps. Imagine a 100 million gallon per year dry‑mill ethanol plant. Fermentation emits roughly 0.9 to 1.0 million metric tons of CO2 over 12 years. If capture and storage costs, inclusive of compression, transport, and storage fees, net to 35 to 45 dollars per ton, and if 45Q can be sold near face value due to credit scarcity in 2025 to 2026, then 45Q alone can cover capital and operating costs with room for a margin. Any 45Z upside is additive but uncertain and should be treated as a hedge against low carbon fuel standard price swings rather than core debt service. The action item for plant finance teams is to model three cases for 45Z: a conservative case with minimal recognition of farming practices, a mid case that reflects likely near‑term updates, and a high case tied to site‑specific process improvements.

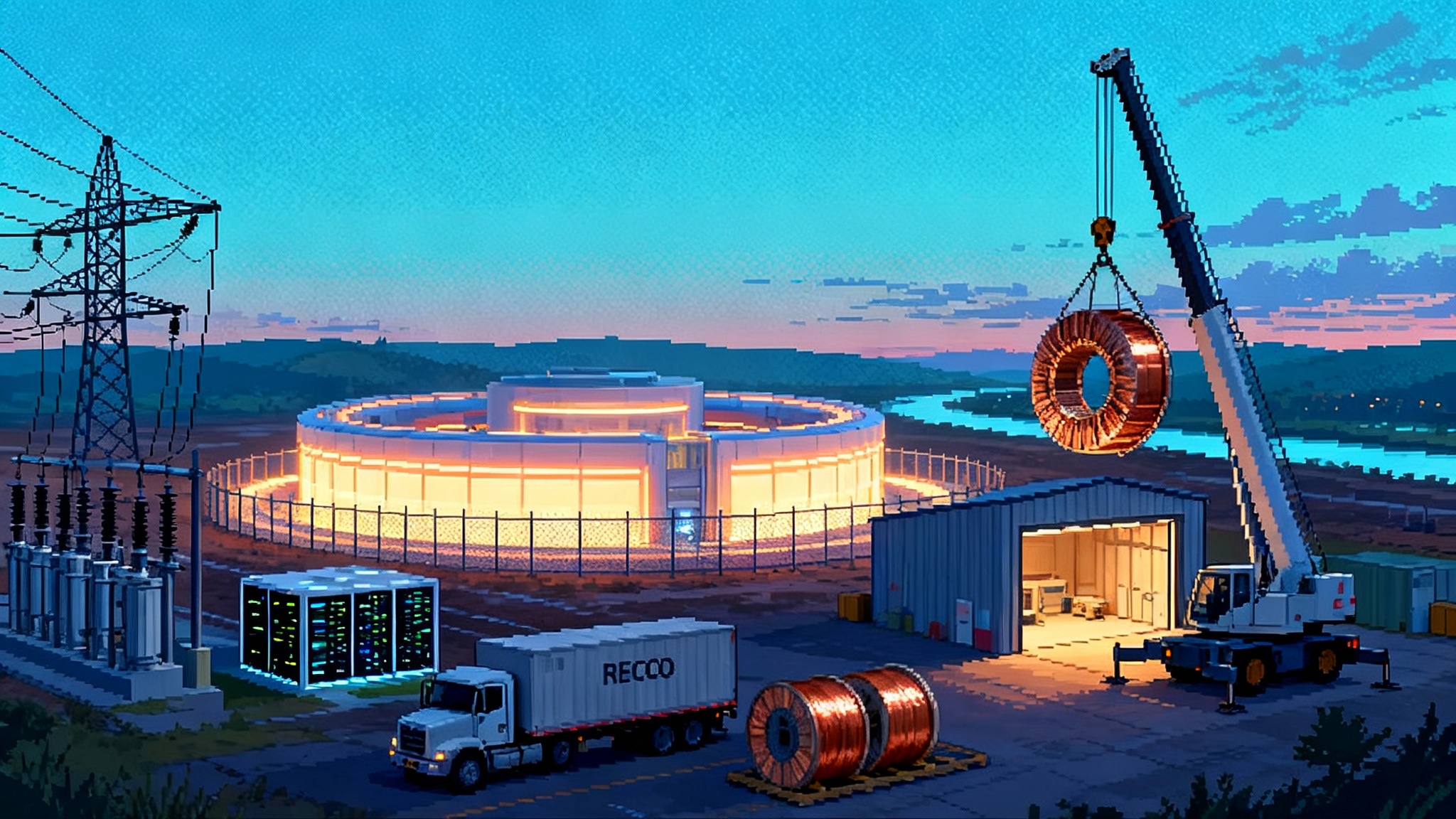

Storage hubs and why North Dakota matters more than ever

Pipeline projects rise or fall on storage certainty. North Dakota has three advantages that make it the Midwest’s gravitational center in 2025 and 2026.

- State primacy for Class VI wells. North Dakota regulates geologic storage with delegated authority, which has proven faster and more predictable than federal permitting. That primacy has already supported approvals for multiple ethanol‑linked storage facilities in the Broom Creek Formation.

- Project clustering. Approvals for storage facilities and the in‑state pipeline segment allow developers to concentrate wells, monitoring, and surface infrastructure. Clustering cuts operating cost per ton and simplifies monitoring, reporting, and verification during the 45Q credit period.

- Cross‑border routing flexibility. Because North Dakota sits at the end of the line, developers can adjust gathering routes in Iowa and Minnesota without changing the storage plan. That flexibility is valuable when a single county ordinance or a set of voluntary easements can reshape a lateral in South Dakota. For broader context on storage economics and siting, see our storage pivot explainer.

For ethanol plants outside easy reach of the North Dakota hubs, expect more interest in on‑site storage where geology allows, or in shorter laterals to in‑state storage partnerships, especially in states that secure Class VI primacy next. The strategic takeaway is simple: storage drives routing, not the other way around.

Safety, siting, and community consent in the new era

Even before any federal CO2 rule is finalized, the direction is clear. Developers that over‑invest in safety before regulators force the issue will move faster through county boards and state commissions. The most effective steps are concrete and visible:

- Design for rapid isolation. Extra block valves, automated detection, and conservative spacing near populated areas shorten release duration and shrink hazard zones in dispersion models.

- Build public safety into the budget. Pre‑fund, in writing, multi‑year training and equipment for local first responders along the route. Put detection gear and supplies where responders actually store and service equipment.

- Choose alignments people can live with. Avoid topography that channels cold heavy gas. Use existing utility corridors and rail rights‑of‑way when possible. Think of the route like a river; the safest flow path matters more than the shortest line.

- Make easements boring. In South Dakota, voluntary agreements are the only tool. Standard terms, transparent payments, clear restoration commitments, and responsive claims handling will keep crews on schedule.

Project finance pivots for 2026 closings

Carbon capture for ethanol used to rely on complex tax equity structures that turned many lenders away. The 2024 transferability regulations changed that. For 2026 financial closes, the practical playbook looks like this:

- Use 45Q transferability as the anchor of the revenue contract. Credit purchase agreements with investment‑grade buyers can sit beside offtake agreements for compression and transport. Keep payment timing inside IRS safe harbor windows and add robust recapture indemnities.

- Stage the capital stack to match state risk. Tranche construction debt by state, releasing proceeds only as easement milestones and state permits are satisfied. Use performance bonds and step‑in rights to protect lenders if a lateral stalls behind county lines.

- Hedge the carbon intensity path. Contract with independent lifecycle modelers to validate plant‑level CI improvements. Treat 45Z as upside until the rules are fully baked and your plant has verified scores.

- Share storage risk wisely. Storage take‑or‑pay contracts should be backed by Class VI permits in hand. Align recapture risk with the party best able to manage monitoring, reporting, and verification for the 12‑year 45Q period.

What about timing? The most likely pattern is late 2025 and 2026 final investment decisions tied to Iowa trunk segments and Minnesota border connections, followed by mobilization in early 2026 where rights‑of‑way are complete and storage is fully permitted. South Dakota laterals will be smaller and slower unless developers prove a voluntary model that communities welcome.

Winners, losers, and smart adaptations

- Likely winners: North Dakota storage operators, Iowa counties along trunk routes that secure durable easements, Minnesota plants that already sit on permitted corridors, and ethanol producers that lock in 45Q transfer agreements while 45Z rules mature.

- Pressured players: South Dakota ethanol plants that expected force‑majeure‑proof schedules from eminent domain. They will need bridge strategies, from temporary trucking of compressed CO2 to participating in scaled‑down, fully voluntary laterals.

- Quiet beneficiaries: Emergency response agencies along routes, as developers begin funding training and equipment repeatedly rather than once.

How the Corn Belt CCS map gets redrawn

The old vision was a straight line. The new one is modular: a backbone through Iowa, small but strategic crossings in Minnesota, and concentrated injection in North Dakota. South Dakota is not off the map, but it is on different terms that prize trust over leverage. Federal safety rules are coming, though on a timeline not entirely under PHMSA’s control. Developers who act like those rules are already real will have fewer surprises. And the economics are not a mystery: 45Q is the workhorse that pays for compression, pipe, and rock, while 45Z is a bonus that rewards cleaner gallons once Treasury finishes its homework.

If you build or finance this infrastructure, the lesson is not to wait. Treat every state as a separate investment case with its own permits, easements, and politics. Design the pipe for the next rulebook, not the last one. And build a storage‑first plan that can absorb route changes without recutting your wells.