45V’s Final Rules Reset Where America Builds Clean Hydrogen

Treasury’s January 2025 rulebook for Section 45V makes the three pillars real. Incrementality, deliverability, and hourly matching by 2030 will shape where electrolyzers get built, how PPAs and certificates are written, and which hubs and industries scale first.

The rulebook arrived. The market just moved.

On January 3, 2025, the U.S. Treasury and Internal Revenue Service finalized how the Section 45V clean hydrogen credit works. The decision ends two years of speculation and turns the industry’s rough sketch into working instructions. The headline for developers is simple. The three pillars are now binding: new clean power, power that can physically reach your plant, and time matching that becomes hourly in 2030. With that certainty, the map of where and how to build hydrogen in the United States has shifted. The announcement also clarifies credit tiers up to 3 dollars per kilogram for the lowest lifecycle emissions, keeps a tight leash on abuses, and gives projects a runway to 2030 to organize their electricity supply. Read Treasury’s summary for the official contours of the final rule in Treasury’s final 45V rules.

This article translates the rule into siting and deal flow. Where projects now make the most sense. How to write power purchase agreements and energy attribute certificate deals that survive the 2030 switch. Which hubs and industries will scale between 2025 and 2030. Who wins, who will need to retool, and where the fast follows in storage and transmission appear.

The three pillars in plain language

Think of making hydrogen like filling a very large water tank with a garden hose. You do not get credit for a full tank unless the water is new to your yard, it actually arrives through your hose, and you can prove the hour it was flowing. The rule codifies that metaphor with three tests for grid-connected electrolysis and other electricity pathways.

Pillar 1: Incrementality

Incrementality means the electricity you claim is adding something real and recent to the grid. Under the final rules, energy attribute certificates, often called EACs, must come from a generating source that is new or newly expanded. The default yardstick is commercial operation or a capacity uprate within 36 months of the hydrogen facility’s in-service date. Uprates can be measured by more than just nameplate capacity, which helps wind and solar plants that gradually degrade or repower.

Two notable carve outs matter in siting decisions:

- Certain state policy environments are treated as incremental. Treasury determined that only Washington and California currently have the combination of a strong greenhouse gas cap and a clean electricity standard that qualifies. Projects that buy EACs in those states can clear the new power test more easily. They still have to pass deliverability and time matching, but the additionality hurdle is lower.

- Nuclear power gets a narrow path. If an existing reactor can show it is at risk of retirement and the hydrogen offtake will keep it running, up to a capped amount of output can count as incremental. That points to selected plants in markets like Illinois or Pennsylvania where merchant nuclear fleets face tightening economics.

If your strategy was to buy cheap, old renewable certificates from distant states, it is stranded. If your plan was to rely on legacy nuclear that is not demonstrably at risk, it needs a redesign.

Pillar 2: Deliverability

Deliverability asks a physical question: could the electrons you claim plausibly reach your electrolyzer without assuming a magical grid? The final rule defines regions using the federal grid maps and balancing authorities. In practice, your EACs must come from the same grid region to which your hydrogen plant is electrically connected, with limited, defined proofs for interregional transfers.

This is the end of cross-country paper matching. A project in Texas cannot count EACs from the Midwest unless it can prove a real transfer across specified interfaces. That pushes developers to co-locate near new wind, solar, hydro, or qualifying nuclear generation, or to ensure their chosen grid actually has the headroom and pathways to deliver clean power at the right times.

Pillar 3: Time matching that turns hourly in 2030

Time matching links when you run the electrolyzer to when your clean power is generated. The rule gives the market time to build the plumbing for hourly tracking. Annual matching is permitted through 2029. Beginning January 1, 2030, EACs must match the same hour as hydrogen production. The rule also creates a useful safety valve. When hourly matching is required, producers may still calculate electricity emissions hour by hour and fall back to the grid’s average emissions for a small number of uncovered hours, as long as the plant’s annual average stays under 4 kilograms of carbon dioxide equivalent per kilogram of hydrogen. The effective date of the final regulations is January 10, 2025, which starts the countdown, as noted in the IRS final regulation publication.

Storage matters here. The final rule confirms that on-site storage that meets the three pillars can shift clean electricity from one hour to another. Batteries beside your electrolyzer become not only a reliability asset but also a compliance tool. Offsite storage is more complex because registries must certify exactly what went in and what came out. For how storage value is evolving in ERCOT and beyond, see our look at the ERCOT storage ascent analysis.

The siting map just redrew itself

With the pillars firm, the best project locations now share three traits: abundant new clean generation, a simple deliverability story, and a path to hourly matching that does not crush utilization.

-

Texas and the ERCOT grid: ERCOT is electrically islanded, which makes deliverability straightforward. The state is rich in new wind and solar and is adding batteries at record pace. Developers can stack a diverse portfolio of EACs inside one region with high coincidence of wind at night and solar by day. Expect Gulf Coast projects to pair grid supply with on-site storage and, in some cases, behind-the-meter solar or wind at industrial sites. Context on ERCOT’s trajectory is in Texas Energy Fund 2025.

-

The Pacific Northwest and California: Hydropower and strong state policies simplify incrementality in Washington and California. The Bonneville Power Administration region can support electrolyzers that flex with spring runoff, and California’s growing battery fleet helps shape hours by 2030. Hydrogen near ports along the West Coast will also align with early demand for ammonia bunkering and heavy-duty transport.

-

The Midwest wind belt and SPP-MISO seam: From the Dakotas through Iowa to Minnesota and Missouri, new wind is plentiful. Direct reduction iron modules for green steel near that resource can combine wind-heavy nights with storage to firm output. Deliverability inside a single region is easier than trying to wheel certificates across multiple transmission operators.

-

Nuclear carve-out candidates: Portions of PJM and the Midcontinent region with merchant nuclear units that can document retirement risk will see niche but material opportunities to anchor electrolyzers near reactors. Expect merchant owners such as Constellation to explore 100 to 200 megawatt pairings where plant economics improve and EACs clear the incrementality test.

Strategies that look stranded:

- REC-only thinking: Annual certificates from old plants outside your grid region no longer solve the problem. Compliance requires new power, right region, then hourly.

- One-resource portfolios: A pure solar or pure wind supply will struggle to hit high electrolyzer capacity factors when hourly matching arrives. Blends of resources plus storage are the new standard.

- Anywhere in the interconnect assumptions: The rule’s deliverability detail means you cannot assume a Western Interconnection certificate automatically covers a plant hundreds of miles away without documented transfer paths.

The new blueprint for PPAs and EACs

The final rules change how offtakers and developers write deals. The days of buying generic annual renewable energy certificates are over. Deal structures now need hour-by-hour thinking.

-

Shape before price: A long-term power purchase agreement, often called a PPA, must be built from resources that complement each other across the day and across seasons. A common stack might combine wind, solar, and a four-hour battery with a reserve of dispatchable clean supply. The mix should be sized to your electrolyzer’s operating profile rather than a round number nameplate.

-

Contract for the certificates, not just electrons: Every PPA needs a parallel schedule for EAC delivery that calls out eligibility under the three pillars. Contracts should specify retirement of qualifying certificates in the right region and, after 2030, in the right hour. Sellers will start offering 8760 EAC delivery schedules, with make-whole provisions if an hour is missed and substitute rules that keep the annual lifecycle emissions below the 4 kilogram threshold.

-

Add storage rights: Include explicit rights to on-site battery control so you can move excess solar into evening hours and meet hourly matching. Settlement should reflect both energy arbitrage and the compliance value of shifting.

-

Build a hedge for 2030: Many developers will run on annual matching through 2029 while designing contracts with an automatic step-up to hourly EACs in 2030. A price collar for hourly certificates will become as common as a floor in a merchant solar hedge. Expect first movers like NextEra Energy Resources, Ørsted, and Invenergy to standardize these terms.

-

Think portfolio, not project: Producers with multiple plants in one grid region can pool resources and allocate EACs hour by hour where they are most needed. That enables higher utilization and lower curtailment risk.

A practical example: a 200 megawatt electrolyzer on the Gulf Coast pairs a 300 megawatt solar PPA, a 200 megawatt wind PPA, and a 100 megawatt four-hour battery. Through 2029, the developer uses annual matching and focuses on commissioning and ramp. By 2030, the battery shifts excess solar into evening peaks while wind covers nights. The EAC schedule matches hours at least 90 percent of the year, and the remaining hours fall back to the grid’s default with enough clean over-coverage elsewhere to keep the annual average below 4 kilograms of carbon dioxide equivalent per kilogram of hydrogen.

Who scales first from 2025 to 2030

With the rules final, the near-term buildout favors sectors that can live with flexible supply in the early years yet move to firmer hourly-matched hydrogen by 2030.

-

Ammonia and methanol: Gulf Coast projects led by companies like CF Industries, OCI Global, Yara, and Methanex can absorb variable supply, use existing ports and pipelines, and sell into export and shipping fuel markets. Co-location with salt cavern storage further smooths hourly matching. For fuel policy linkages, see our overview of 45Z clean fuels rules.

-

Green steel and sponge iron: Nucor and Cleveland-Cliffs have studied direct reduction processes that swap natural gas for hydrogen. Upper Midwest sites near wind and growing storage can hit the hourly test with a diversified PPA stack. Captive hydrogen for ironmaking is a natural early customer because it can anchor long-term PPAs and tolerate staged ramp-up.

-

Heavy road transport and depots: California’s freight corridors and ports will be fertile ground for early hydrogen refueling due to the state policy carve out and dense demand. Fleet operators like Nikola and fuel suppliers such as Air Products and Plug Power can blend on-site production with grid supply and batteries to meet the hourly rule without overbuilding generation.

-

Refining and chemicals: Along the Gulf Coast, refineries and crackers can replace hydrogen from steam methane reformers with low carbon hydrogen. They already buy large volumes and understand long-term offtake. Hourly matching becomes a grid and contracting problem rather than a new customer problem.

-

Data center backup and campus energy: By the late 2020s, firms piloting solid oxide fuel cells and hydrogen turbines may create campus demand that pairs with on-site electrolysis as part of resiliency packages. Hourly matching is manageable when you operate both sides of the meter and control storage.

The H2Hubs selected by the Department of Energy should now sort cleanly into leaders and laggards. Hubs that sit in regions with abundant new clean power and simple deliverability, like California and the Pacific Northwest, will move fastest. Gulf Coast hubs that pair industrial demand with large new renewables and cavern storage will be right behind. Projects that counted on legacy certificates or on moving paper power across regions will have to retool or risk delay.

Grid impacts you should model now

Hydrogen producers are not just new demand. They are a controllable load and, in many cases, a new balancing tool for the grid. Here is what changes between now and 2030.

-

Daytime demand rises: Annual matching favors daytime solar in the near term. Electrolyzers will soak up mid-day surplus and reduce curtailment. That helps market prices and can stabilize operating margins for solar-rich regions.

-

Storage gets a demand partner: Hourly matching makes on-site batteries a must-have compliance asset. It also creates merchant upside. Batteries can earn spreads and deliver the right hour of clean energy to your meter. Long-duration options like pumped hydro and compressed air pair well with seasonal patterns and can lift electrolyzer capacity factors after 2030.

-

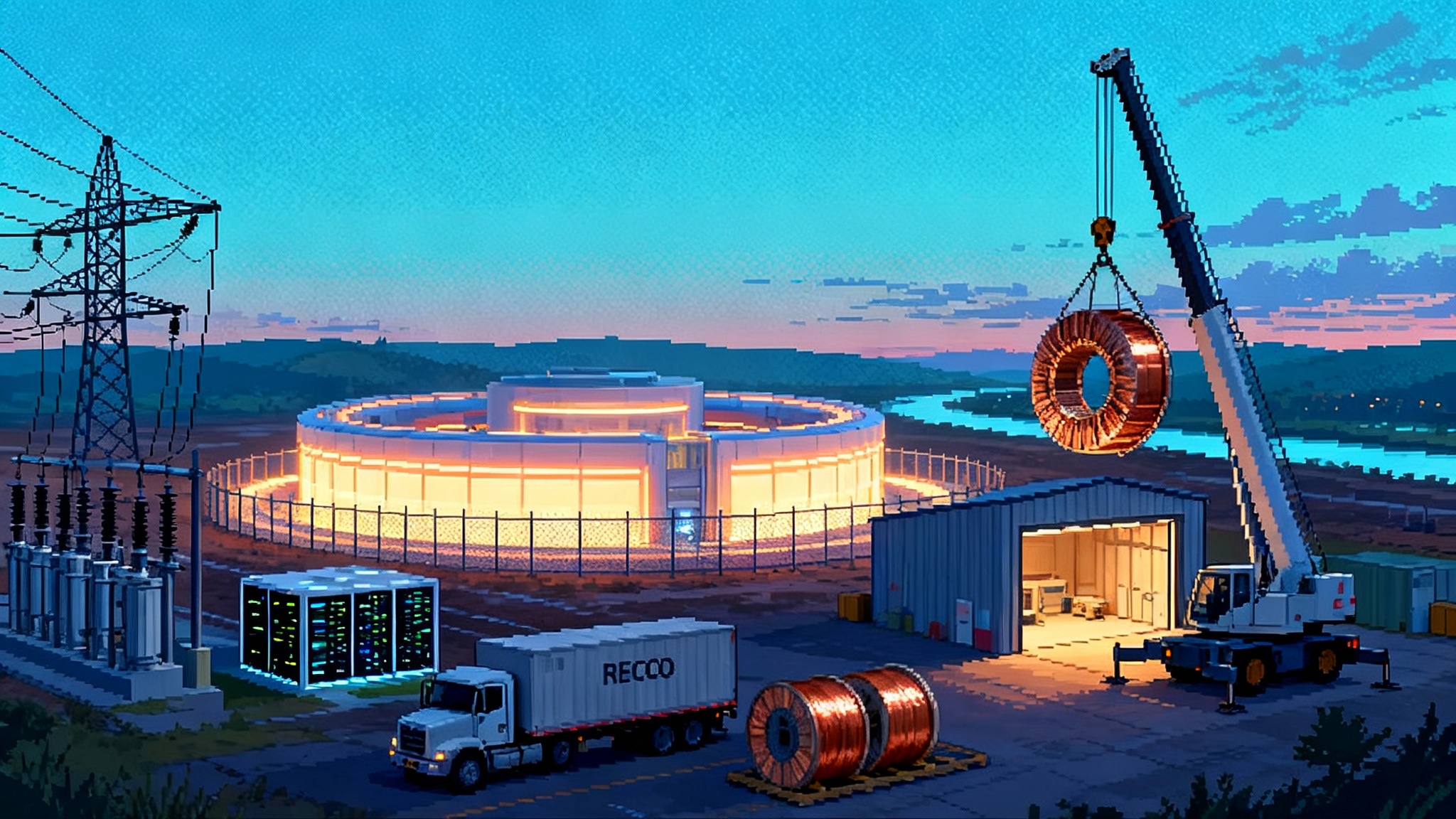

Transmission becomes a growth bottleneck and an opportunity: Deliverability rules force more local matching, which raises the value of transmission that can prove real transfers. Expect transmission developers to market lines not only for congestion relief but also as compliance enablers. New lines that connect wind-rich regions to industrial load pockets will unlock hydrogen clusters. For the policy mechanics behind new lines, see our take on state-led grid expansion.

-

Gas system interactions evolve: Blue hydrogen options that rely on natural gas with carbon capture must demonstrate low lifecycle emissions with verifiable storage of carbon dioxide. The rule’s anti-abuse provisions also limit circular uses like making power from hydrogen just to claim credits. That nudges blue projects toward integrated sites with real industrial offtake rather than stand-alone power-to-power loops.

The playbook by stakeholder

-

Developers: Pick grid regions with clear deliverability and multiple new clean resources. Design an 8760 supply stack from day one. Write PPAs that deliver qualifying EACs and step automatically to hourly in 2030. Buy or control on-site storage sized to your hourly shortfalls. Pre-negotiate replacement rules for missed hours and monitor lifecycle emissions monthly so year-end surprises do not erase credits.

-

Utilities and independent power producers: Package hourly compliant offerings. Offer combined wind plus solar plus storage blocks with hourly EAC schedules and performance guarantees. Develop green tariffs that integrate on-site batteries and operational curtailment rights so electrolyzers can respond to system needs without breaking compliance.

-

States: If you want hydrogen buildout, copy the policy combo that earned incrementality recognition. Pair a real emissions cap with clean power standards and implement granular tracking. Accelerate interconnection for hybrid projects that include storage and electrolyzers. Clarify how hourly certificates will be tracked in your registry so developers can write contracts with confidence.

-

Offtakers in steel, ammonia, and heavy transport: Write hydrogen contracts that specify hourly-compliant supply by 2030, not just price per kilogram. Ask for the PPA stack and storage plan behind the molecule. Consider take-or-pay with flex bands that reward producers for shaping to your operations, and provide minimum hours that match your process reliability needs.

-

Investors and lenders: Underwrite on the 2030 world, not just the 2025 transition. Require 8760 EAC schedules, storage rights, and a plan for registry participation. Put a sensitivity on hourly certificate prices and assume the fallback to grid-average emissions for missing hours is limited. Credit projects that bring their own storage and show interconnection headroom.

What it means for cost and timing

Credit value scales with how clean your hydrogen is. Below 0.45 kilograms of carbon dioxide equivalent per kilogram of hydrogen, and with labor rules met, the credit can reach 3 dollars per kilogram. The next tiers down step through 1.00, 0.75, and 0.60 dollars per kilogram as emissions rise. That math is unchanged from statute, but the route to those values is now concrete. The transition period through 2029 lets projects reach commercial operation and learn operations while registries and markets build hourly tracking. The flip to hourly in 2030 is firm, so plants that cannot shape their supply will see either lower capacity factors or lost credits.

The fast follows: storage and wires

Two markets will run in parallel with hydrogen because the rule makes them necessary.

-

Storage: Four-hour batteries become standard equipment for clean hydrogen plants. They shift low-cost solar into evening hours and cover short-term outages from wind. Longer duration storage will follow in windy winters and hydropower regions, where shifting across days and weeks is valuable. Expect developers like Fluence and Tesla to show up at hydrogen sites as core partners rather than accessories.

-

Transmission: The deliverability test raises the value of projects that can demonstrate real interregional flows. New lines that connect the Great Plains to Gulf Coast industrial loads, or reinforce West Coast interfaces, unlock larger EAC pools and reduce the cost of hourly matching. Hydrogen’s ability to act as a flexible load can also strengthen the case for lines by improving congestion relief economics.

A clear finish line and a new race

The 45V final rules do not make hydrogen easy. They make it explicit. The three pillars finally tell developers what to build and where to build it. The winners in 2025 to 2030 will treat electrons like ingredients in a recipe. They will pick regions with fresh supply, prove that power can reach the plant, and use storage to make every hour count once the clock strikes 2030. Do that and the credit tiers become bankable. Miss it and projects drift. The rulebook is in hand. The next advantage belongs to teams that can turn hourly proof into industrial molecules at scale.