Methane Showdown: U.S. Rollback vs Europe’s Clean-Gas Rules

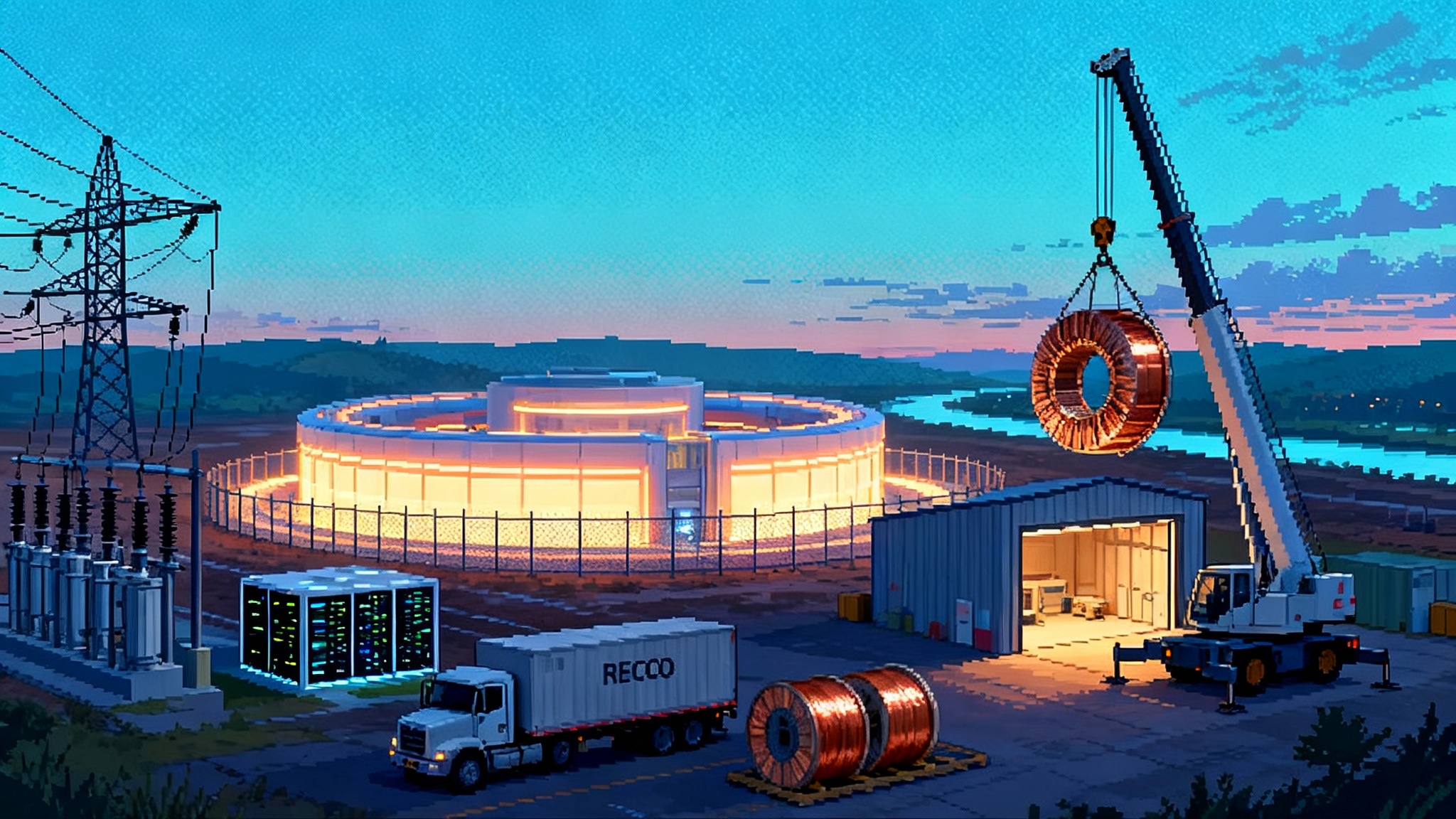

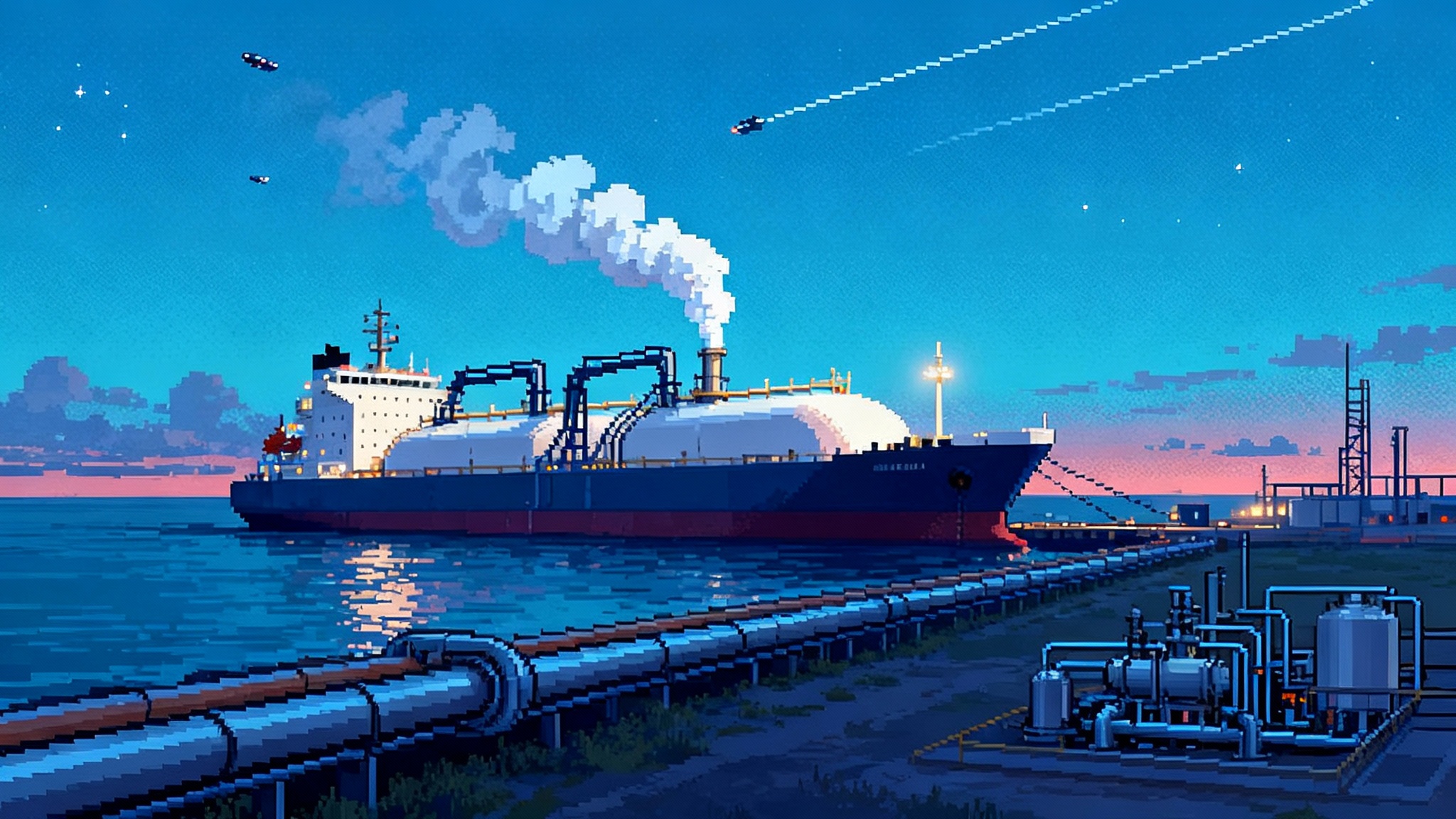

Washington is moving to unwind the methane fee and pare back federal reporting just as Europe locks in strict 2027 import rules. With MethaneSAT lost in July, U.S. LNG and oil now need measurement and verification that can withstand customs‑level scrutiny.

Breaking: Policy whiplash sets up a transatlantic methane clash

On March 14, 2025, the White House signed a Congressional Review Act resolution that voided the Environmental Protection Agency’s Waste Emissions Charge, the Inflation Reduction Act’s so‑called methane fee. If you want a primary source, see this Congressional Research Service brief on repeal. Six months later, on September 12, 2025, the Environmental Protection Agency also proposed to end much of the federal Greenhouse Gas Reporting Program, arguing that the nationwide reporting burden is not linked to a specific regulation.

Then came a blow from space. On July 1, 2025, MethaneSAT’s operators confirmed they had likely lost the satellite after contact was broken on June 20. That cut a high‑precision eye from the sky that many regulators, investors and buyers expected to use when comparing methane performance across basins and companies.

Put these three moves together and you get a strange picture. Inside the United States, compliance pressure on methane has eased at the federal level. Outside the United States, the world’s most prized market for gas and oil is asking for much more proof.

The European Union’s 2027 line in the sand

The European Union’s Methane Regulation sets a clear timeline for importers of oil, gas and coal. Starting January 1, 2027, importers must show that foreign producers apply monitoring, reporting and verification that is equivalent to European rules, or meet Oil and Gas Methane Partnership level 5 with verification. The official dates and requirements are laid out in the European Union methane import timeline.

This is not a label to print on a brochure. It is a gate. If you sell liquefied natural gas or crude into the European Union under contracts signed or renewed after August 4, 2024, you will need verifiable, measurement‑based proof by 2027. By August 2028, importers must report methane intensity. By 2030, imported fuels must fall below a limit that the European Commission will set.

What the rollback means for U.S. barrels and molecules

Repealing the methane fee removed a near‑term cost signal for emitters. Dialing back federal greenhouse gas reporting, if finalized, could thin out a common dataset that purchasers and financiers had learned to trust. Yet none of this changes what European buyers will demand. If you are a U.S. exporter targeting Europe, think of the European Union rules as a customs checkpoint that examines your emissions paperwork before it looks at your cargo.

This creates a two‑track world. Domestically, methane compliance can be a matter of state rules and company promises. Internationally, access to premium buyers is about external verification and traceable measurement. U.S. liquefied natural gas and crude sellers will not win that game with policy rhetoric. They will win it with data that survives someone else’s audit.

The pivot plan in three lanes

There are three practical ways U.S. producers and exporters can close the gap created by the federal rollback and the European Union’s import standards.

Lane 1: Private certification with chain of custody

Several certification systems already exist at scale. MiQ grades gas on methane intensity, detection coverage and operating practices. Equitable Origin’s EO100 focuses on a broader set of social and environmental standards. Major producers such as EQT and Chesapeake moved early to certify substantial volumes of gas, and buyers in Europe and North America have completed pilot trades that attach certificates to flows or retire them to match consumption.

Certification needs a chain of custody to matter at an import terminal. That means registries to prevent double counting, batch‑level tracking from wellhead to liquefaction or pipeline exit, and alignment between production and midstream segments. A certificate that starts at a well pad and disappears into a blender of anonymous molecules will not satisfy a European customs officer or a credit committee.

Liquefied natural gas sellers are already experimenting with this approach. Cheniere’s cargo emissions tags give buyers wellhead‑to‑delivery estimates on each cargo. Buyers care about these tags because they can write them into master sales agreements as representations, warranties and audit rights. Over time, the market will push these tags to reflect measurement rather than estimates and to cover a bigger share of the supply chain.

For oil, the certification ecosystem is younger, but the logic is the same. Traders and refiners need to know that a cargo’s origin field and gathering system have measurement‑based controls, that routine flaring is effectively prohibited and that methane leaks are found and fixed with documented timing. Expect crude certificates to evolve from corporate‑level statements to field‑level attestations tied to batch identifiers on bills of lading.

Lane 2: State rules as compliance scaffolding

Some states already impose requirements that mirror what the European Union wants to see. New Mexico requires operators to capture 98 percent of produced gas by the end of 2026 and restricts routine venting and flaring. Colorado has rigorous leak detection and repair schedules, pneumatic equipment replacements on a timeline and reporting that allows third parties to check progress. For a broader view of how state action is reshaping energy infrastructure, see how states reshape Corn Belt CCS.

For exporters, the smart move is to route European‑destined volumes from assets that sit under these stronger state regimes. In other words, treat state compliance as the backbone for a European equivalence argument, then layer on measurement and third‑party verification. When a buyer asks for proof, a seller can present a state permit, compliance records and independent measurement data as a package.

Lane 3: A sensing stack that survives scrutiny

The loss of MethaneSAT removed a high‑precision sensor, but the toolbox is larger than one satellite. Here is what a robust sensing stack looks like in practice:

- Continuous, on‑site sensors at priority facilities with automated alerts. These catch persistent leaks quickly and create a time‑stamped record of detection, response and repair.

- Regular aerial overflights using light detection and ranging or hyperspectral cameras. These sweep hundreds of sites to identify super‑emitters and quantify plumes. Vendors can process images within days.

- Independent satellite cross‑checks from providers that can see large plumes across basins. These do not replace site sensors but provide corroboration and identify events that field programs miss.

- Verification algorithms and workflows that reconcile source‑level measurements with site‑level readings and then with inventory models, which is exactly what European officials will look for when they say “equivalent monitoring, reporting and verification.”

Think of this as a layered security system for emissions claims. The point is not just to measure, but to produce an evidence trail that a buyer, a regulator or a lender can audit without calling your engineers.

How contracts and cargoes will change

Once import rules harden, contracts follow. Expect the following clauses to show up in liquefied natural gas sale and purchase agreements and in crude offtake contracts bound for Europe:

- Representations that the production feeding the cargo meets specified methane intensity thresholds and applies measurement‑based monitoring and leak repair standards.

- Warranties that the seller will maintain third‑party verification to a named standard, with audit rights upon notice and data‑sharing obligations that respect confidentiality but allow a buyer to prove compliance to a national authority.

- Adjustment mechanisms that add a premium for verified low methane intensity or discount a cargo that fails verification. Some agreements will go further and allow a buyer to reject a non‑compliant cargo without penalty if a European Union competent authority issues an enforcement notice.

- Transitional language for legacy contracts, since the European Union gives leeway for deals signed before August 4, 2024. Buyers will still want to show “all reasonable efforts” were made to meet equivalence and will push for best efforts obligations, annual reporting and corrective action plans.

This will not be academic. If European terminals begin random verification checks, traders will hedge not only price and weather but methane intensity and verification risk. That means portfolio managers will tag supply by verification quality and methane performance, and dispatch the cleanest and best‑documented barrels and cargoes to the strictest buyers.

Price premiums and penalties: a realistic range

Will the market pay for cleaner gas and oil, or will sellers absorb new costs as a price of entry? The answer will vary by season and by balance of supply and demand. Here are the mechanisms that will set the numbers:

- Supply scarcity of verifiably low‑methane volumes. If only a fraction of output is measured and verified to European standards, it fetches a premium when winter storage is tight.

- Compliance risk transfer. Buyers will pay a modest premium for the seller to assume the risk of a customs rejection, the same way they pay for reliability in shipping.

- Operational optionality. Sellers with measurement‑rich assets can reallocate compliant volume to Europe and send other flows to markets that have not yet set equivalence rules. That optionality is valuable and supports a premium during tight markets.

For another case where rules reshape pricing and market access, see how new clean fuels rules are changing producer incentives.

To see how this plays out, imagine two winter cargoes. Cargo A comes from wells with continuous monitoring, monthly aerial sweeps and a third‑party verification report tied to the specific batch. Cargo B has corporate‑level averages and a plan to improve. When a European utility faces a check from its national authority, Cargo A lowers the utility’s compliance risk. Cargo A will clear first and will usually clear higher.

Oil’s quiet convergence

The public debate focuses on gas, but the European Union import rules cover crude oil as well. That will push U.S. operators and traders to adapt quickly in areas that have received less attention:

- Tank‑level bookkeeping that preserves linkage between certified field output and a given cargo through gathering systems, pipelines and storage.

- Measurement programs for associated gas at oil wells to prove minimal flaring and rapid leak response.

- Audit‑ready documentation that a refiner can use to prove compliance to a national authority, especially for blends.

Expect early movers among Permian and Gulf Coast operators to pilot crude certificates that include methane intensity from the associated gas system, the rate of routine flaring and documented leak detection and repair. Traders that can assemble these pieces will have an edge with European refiners that are preparing for the same 2027 milestone.

The data problem after MethaneSAT

MethaneSAT’s loss matters because it narrowed a common reference many hoped to use to validate or challenge corporate claims. But the response should be to diversify, not to pause. Companies can treat third‑party data as a triangulation tool. For example, combine site sensors and overflights with satellite observations from multiple providers and then reconcile the numbers through a published method. This develops a body of evidence that converges, which is what regulators trust when equipment fails and datasets differ.

The upside of this approach is resilience. If a satellite goes offline or a sensor network drops data, the rest of the stack keeps the verification engine running. Investors also prefer diversified data sources because it reduces model risk and headline risk. In practical terms, resilience is the difference between moving a compliant cargo and waiting on the wrong side of a customs decision.

A playbook for U.S. exporters

If you sell U.S. gas or oil into Europe, the next 24 months are the runway to 2027. Here is a practical sequence that teams can follow.

-

Next 90 days

- Map every European‑exposed contract and mark which are signed after August 4, 2024. Identify any option volumes that might shift into Europe during a cold winter or a supply disruption.

- Assign a methane verification grade to each field, gathering system and supply path that feeds those contracts. Grade on what is measured, how often and who checks it.

- Start standardizing data rooms. Buyers and lenders will ask for the same documents. Build a repeatable package that includes permits, leak detection and repair logs, flare records and third‑party reports.

-

Next 12 months

- Expand continuous monitoring to top‑emitting sites and to the sites serving European contracts. Increase aerial coverage to capture super‑emitters and provide basin‑wide context.

- Pursue certification where it helps you consolidate gains. Certification does not replace measurement. It turns measurement into a product attribute.

- Rewrite sales contracts and tariffs to include verification language, audit rights and contingency plans for non‑compliance. Put a price on methane intensity so teams can manage it like any other risk.

-

Next 24 months

- Build a scheduling process that assigns verified‑clean supply to European destinations first, then allocates the rest by destination risk and price.

- Work with midstream partners. Pipelines and plants need to be part of the measurement and verification program. Without them, chain of custody breaks.

- Publish a methodology paper. Even a short one. Transparency lowers dispute risk and improves buyer trust, which supports better pricing.

The bigger implication

A quiet but decisive realignment is underway. At home, the federal government is stepping back from methane fees and from some reporting. Abroad, the European Union is stepping forward with a customs‑level test of what counts as clean gas and clean oil. Similar state‑centered dynamics are reshaping the grid, as explored in how states are in charge of grid expansion. The market will reconcile these directions through contracts, data and premiums, not slogans. Companies that invest now in measurement, verification and chain of custody will not just preserve European access. They will set the benchmark every other exporter has to meet.

That is the coming clash over clean. One side is pulling on rules. The other is pulling on markets. In the end, the pull that reaches a cargo manifest and a bill of lading is the one that wins.